Track Down Old 401 Plan Statements

The first thing you can do to find money held in forgotten 401 accounts is to go through old plan statements you may have. The statements could have come in the mail or you may have received them electronically through email.

Finding these statements makes it easier to know which employers you were at during the period when you had the 401 plan and can help you determine who to contact to access your account. You can also check with former co-workers who are still with the company to see who you should get in touch with.

How To Find Your 401 With Your Social Security Number

Knowing how to find your old 401s with your social security number can save a lot of time and headache. There are tools you can use to find your 401 and roll them over.

If you’re like most, you’ve changed jobs quite a bit during your career. According to a Department of Labor study, the average American will have had about 12 jobs during their career. All of that moving around is bound to cause some things to get lost in the shuffle. And if you’ve participated in any company-sponsored 401 plan, your retirement money may have been left behind. Luckily, there are ways to find your 401s using your social security number.

The sad fact is billions in retirement funds are left behind in 401 plans where the participant no longer works for that company.

401s that have been left behind with former employers can be cumbersome at best to find. However, it’s vital in building your retirement to locate your old funds and bring them back into your active portfolio.

The first step would be to contact your former employer’s human resources department. If you can get in touch with them, they should have the best route to getting a hold of your old 401s.

Next would be to reference your old 401s summary plan description. In that, you should be able to find your plan administrator’s contact information and what they do with former employees’ 401s.

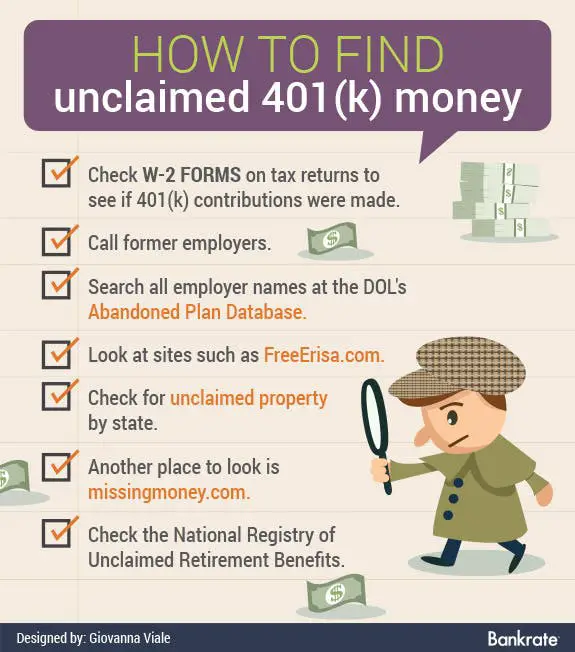

Search Databases For Unclaimed Assets

If you still cant find information on your lost 401 plans, you can also try searching one of the publicly available databases for unclaimed assets. The National Registry of Unclaimed Retirement Benefits is a good place to start. By entering your Social Security number, you can quickly see if there are any unclaimed retirement funds that belong to you. The money may still be held in the employers plan, or the company may have opened a special IRA account in your name to hold the funds.

You can also search using the National Association of Unclaimed Property Administrators site, which will help you track down unclaimed money you may be owed, not limited to retirement assets. Be sure to check in each state you have lived or worked. The site processes tens of millions of requests each year and has helped return more than $3 billion in unclaimed assets annually.

Recommended Reading: When Can You Pull Money From 401k

What Happens If I Leave My Job Before Im Fully Vested

If you leave your job before being fully vested, you forfeit any unvested portion of their 401. The amount of money youd lose depends on your vesting schedule, the amount of the contributions, and their performance. For example, if your employer uses cliff vesting after three years and you leave the company before then, you wont receive any of the money your employer has contributed to their plan.

If, on the other hand, your employer uses a graded vesting schedule, you will receive any portion of the employers contributions that have vested by the time they leave. For example, if you are 20% vested each year over the course of six years, and you leave the company shortly after year three, theyll keep 40% of the employers contributions.

Disadvantages Of Closing Your 401k

Whether you should cash out your 401k before turning 59 ½ is another story. The biggest disadvantage is the penalty the IRS applies on early withdrawals.

First, you must pay an immediate 10% penalty on the amount withdrawn. Later, you must include the amount withdrawn as income when you file taxes. Even further down the road, there is severe damage on the long-term earning potential of your 401k account.

So, lets say at age 40, you have $50,000 in your 401k and decide you want to cash out $25,000 of it. For starters, the 10% early withdrawal penalty of $2,500 means you only get $22,500.

Later, the $25,000 is added to your taxable income for that year. If you were single and making $75,000, you would be in the 22% tax bracket. Add $25,000 to that and now youre being taxed on $100,000 income, which means youre in the 24% tax bracket. That means youre paying an extra $6,000 in taxes.

So, youre net for early withdrawal is just $16,500. In other words, it cost you $8,500 to withdraw $25,000.

Beyond that, you reduced the earning potential of your 401k account by $25,000. Measured over 25 years, the cost to your bottom line would be around $100,000. That is an even bigger disadvantage.

Recommended Reading: What To Do With 401k When You Retire

Federal Insurance For Private Pensions

If your company runs into financial problems, youre likely to still get your pension.

-

Insures most private-sector defined-benefit pensions. These are plans that typically pay a certain amount each month after you retire.

-

Covers most cash-balance plans. Those are defined-benefit pensions that allow you to take a lump-sum distribution.

-

Does not cover government and military pensions, 401k plans, IRAs, and certain others.

What Is A 401 Account

A 401 plan, named for the section of tax code that governs it, is a retirement plan sponsored by an employer, allowing employees to save a portion of their paycheck for retirement.

The advantage to employees of saving with a 401 plan is they are able to save funds they have earned, before taxes are deducted from a paycheck.

Many employers offer a company match meaning whatever the employee contributes, the company matches.

Although 401 plans were originally born as a supplement to pension plans, they are now often the sole retirement plans offered at companies.

Read Also: What Should I Invest In 401k

Ways To Dig Up An Old 401 Account

Before we play lost and found with your old 401 plan, know that even though you cant find your 401 account , your plan money is federally protected.

Thats right. By law, nobody can access, steal or otherwise make off with your 401 funds while theyve gone missing.

With Uncle Sam at your back, use these tips and strategies to find a lost 401 account.

Average 401 Balance By Age

Retirement savings grow with compound interest, which means account balances increase with time. Like other types of retirement accounts, money saved in a 401 grows like a snowball, with interest earning interest on itself. The older you are, the more time youve had to build up your savings.

Note: In 2022, employees can contribute up to $20,500 in their 401. Employees over 50 can contribute an additional catch-up contribution of $6,500.

With compounding interest, the earlier money is put into an account, the more opportunity it has to grow, and the greater the possible returns. In retirement accounts like 401s, building retirement savings early means a greater opportunity for growth.

Heres the average amount people have saved for retirement by age group, according to Vanguards data.

|

$107,147 |

$29,095 |

While a large disparity in savings exists, women often need greater retirement savings than men to retire comfortably. Women tend to live longer and could therefore need more long-term care than men, which could require greater spending in retirement.

Read Also: How Can I Save For Retirement Without 401k

Other Forgotten Funds And Where To Find Them

Retirement funds arent the only assets that may be lost or forgotten. Others include insurance accounts or annuities unpaid wages pensions from former employers FHA-insurance refunds tax refunds savings bonds accounts from bank or credit union failures. In addition, heirs may easily overlook one or more accounts, if the estate plan failed to list all of them.

The National Association of Unclaimed Property Administrators reports that about 1 in 10 Americans have unclaimed property, and more than $3 billion is returned to owners each year.

Brokerage firms and other financial institutions must report unclaimed or abandoned accounts once they have made a diligent effort to locate the owner. Should they be unsuccessful, they must report it to the state agency that handles such matters. The agency then claims it through a process known as escheatment so that the owners can find it.

Websites you can use to find lost funds include your states unclaimed property site NAUPAs missingmoney.com the U.S. Department of Labor database for back wages or the Pension Benefit Guaranty Corp to claim your pension funds. To find accounts at failed banks, try the Federal Deposit Insurance Corp. For credit unions, go to the National Credit Union Administration.

A final note: Claiming your assets is free. Beware of anyone who wants to charge you for doing so.

Also of Interest

Reference An Old Statement

Because companies reorganize, merge, get acquired, or go out of business every day, its possible that your former employer is no longer around. In that case, try to locate a lost 401k plan statement and look for contact information for the plan administrator. If you dont have an old statement, reach out to former coworkers and ask if they have an old statement.

Recommended Reading: Can I Rollover A 401k To An Existing Ira

Why Does The Calculator Ask About My Highest Level Of Education

All questions in the calculator help us make more informed predictions about your future. Knowing your level of education lets us determine a more realistic estimate of how much youll earn in the future and in turn provide an estimate of what you may need in retirement. And although this information helps us provide you with a more personalized calculation, it is optional.

Search The Abandoned Plan Database

If you cant find your lost money by contacting your old employer, searching the National Registry of Unclaimed Retirement Benefits, or the FreeERISA website, you have one last place to check, the Abandoned Plan Database offered by the U.S. Department of Labor.

Searching is simple, you can search their database by Plan Name or Employer name, and locate the Qualified Termination Administrator responsible for directing the shutdown of the plan.

Recommended Reading: What To Do With Your 401k After Leaving A Job

How To Find Out If I Have A 401

The best way to make sure you donât lose track of your 401 is to periodically keep tabs on it. Although, checking your retirement accounts too frequently can lead to overkill and alarm if the market takes a dive. Aim for quarterly or semi-annual checks of your funds to make sure everything is in order.

Actively managing your 401 is a good habit to get into. Making sure your retirement accounts are being properly funded and youâre on track to meet your retirement goals should be etched into your overall personal finance plan.

However, if youâve let it slip for the past couple of years, no need to worry. Contact your human resources department to get information on how you can monitor your account.

You may be given access to an online portal for you to log in and manage your account.

Verify your statements are being sent to the correct address. Bookmark the account information so you always know where to log into your account from. Also, consider updating your login and password to make sure your account is more secure.

When Can I Start Withdrawing From My 401

You can withdraw from your traditional 401 after age 59½. You will incur early withdrawal penalties if you take money earlier unless you qualify for an exception.

You can withdraw your contributions from your Roth 401 at any time with no penalty. But you must pay taxes and potential penalties on earnings if you withdraw them early.

Read Also: How Does 401k Show On Paycheck

Also Check: What’s The Max I Can Put In My 401k

Picking The Best Option

Figuring out what to do can be difficult, as there may be complex tax and investment return implications for each decision.

In many cases, unless youre ready to retire, moving the funds into a new retirement account is often a good option. If your funds are in an IRA that was opened in your name, the IRA provider may be charging high fees. And, unless the old employer offers a much better plan than your current options, consolidating your money within a few accounts can make it easier to track your investments and help you qualify for discounts or benefits from plan administrators.

The easiest way to do this is with a direct transfer, where the money never touches your hands. Otherwise, 20 percent of the money has to be withheld for taxes, and you only have 60 days to deposit the funds into the new retirement account or the withdrawal will be treated as a cash out.

Fair warning, there can still be a lot of paperwork involved with a direct transfer. However, the company that youre sending the money to will often be able to help you with the process.

No matter what option you choose, if youve got old retirement accounts floating out there its in your best interests to track that money down sooner than later. The more you know about your retirement funds, the more options you may have the next time youre faced with a major financial setback. At the very least, youll understand where you stand as you prepare for retirement.

Deferral Limits For 401 Plans

The limit on employee elective deferrals is:

- $20,500 in 2022 , subject to cost-of-living adjustments

Generally, you aggregate all elective deferrals you made to all plans in which you participate to determine if you have exceeded these limits. If a plan participants elective deferrals are more than the annual limit, find out how you can correct this plan mistake.

Also Check: Can I Move My 401k From One Company To Another

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

What Is A Defined Contribution Plan

A defined contribution plan is any retirement plan to which an employee or employer regularly contributes some amount. Often, the employee chooses to send a fixed percentage of monthly income to the account, and these contributions are automatically withdrawn, directly from her paycheck – no effort required. The money that doesn’t go to the employee’s take-home pay gradually accumulates, the balance earns interest from investments, and by the time retirement rolls around, its grown into a substantial nest egg for the retiree. Thats the idea.

In a defined contribution plan , there are no guarantees about the income youll receive in retirement. That doesnt mean such plans cant be just as effective, however, and employers often sweeten the deal by making contributions of their own, straight into your account.

Don’t Miss: Can You Convert A Traditional 401k To A Roth Ira

You’ve Found Your Old 401s Now What

Once you’ve located your old 401s, you have a few options. Some come with penalties, some require taxes to be paid, and some don’t require either.

You have the option to cash out all of the funds in your old 401s. However, the IRS will charge you a 10% early withdrawal penalty. In very few cases, can this penalty be waived, so it’s best to leave it saved until you’re at least 59½.

Secondly, you can rollover your old 401s into your current employer-sponsored plan. This comes with no penalty or taxes. Because you are rolling it over into another retirement account, you won’t incur any additional costs in doing so.

Lastly, you can consolidate your 401s into an IRA. Like a 401, an IRA is a retirement account, so it’s free from any penalties and taxes. These are held outside of your employer’s 401 plan, but they’re easy to set up and come with many more investment options.

Cherish Your Valuable Pension

All three individuals with pensions above are millionaires due to their long-term dedication and pensions. Even if you were only receiving a $15,000 a year pension, its still worth more than $500,000 a year using a 2.55% divisor and 90% payout probability.

Given the median net worth in America is around $100,000, we can conclude that anybody with a pension is considered very well off. Less than 20% of Americans have pensions in the new decade.

Theres one key variable that I havent discussed, and thats a pension owners lifespan. Unfortunately, the foreign service officer with a pension worth $2,833,333 cant sell his pension to anybody for that amount. Nor does the pension keep paying out after death. Although, in some cases, a pension can keep paying out to a surviving spouse. The reality is ones pension value fades as the owner inches closer towards the end.

Therefore, it behooves every pension owner to live as long and healthy of a life as possible to maintain the value of his/her pension. The same logic goes for anybody with passive income, including social security. The richer you are, the healthier you should try to be!

The value of your pension is subjective. You could even multiply your annual pension amount by the average P/E multiple of the S& P 500 to come up with its value. There are many variables and variable amounts to consider.

You May Like: How Do I Get My 401k From A Previous Employer