Leave It In Your Current 401 Plan

The pros: If your former employer allows it, you can leave your money where it is. Your savings have the potential for growth that is tax-deferred, youll pay no taxes until you start making withdrawals, and youll retain the right to roll over or withdraw the funds at any point in the future.

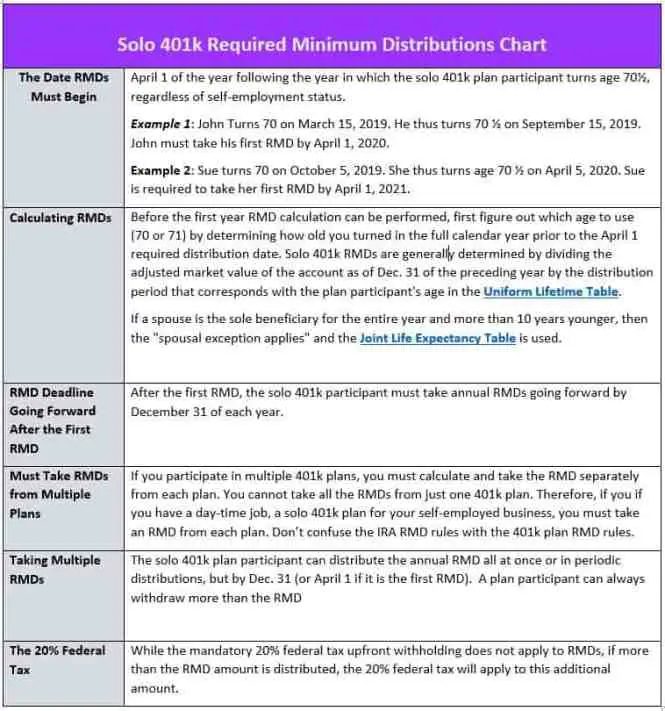

The cons: Youll no longer be able to contribute to the plan, and the plan provider may charge additional fees because youre no longer an employee. Managing multiple tax-deferred accounts can also prove complicated. The IRS mandates required minimum distributions annually from all such accounts beginning at age 72 . Fail to calculate the correct amount across multiple accounts, and the IRS will slap you with a 50% penalty on the shortfall.

Do I Have To Pay Taxes When Rolling Over A 401

Whether you owe taxes on a rollover depends on whether youre changing account types . Generally, if you move a traditional 401 account to a Roth IRA, you could create a tax liability. Here are a few scenarios:

- If youre rolling over money from a traditional 401 to another traditional 401 or traditional IRA, you wont create a tax liability.

- If youre rolling over a Roth 401 to another Roth 401 or Roth IRA, you wont create a tax liability.

- However, if youre rolling a traditional 401 into a Roth IRA, you could create a tax liability.

Its also important to know that if you have a Roth 401 that has any employer matching funds in it, those matching funds are categorized as a traditional 401 contribution. So if you transfer a Roth 401 with matching funds into an IRA, youll need to create two IRA accounts a traditional IRA and a Roth IRA to avoid any tax issues during the rollover.

Of course, youll still need to abide by the 60-day rule on rollovers. That is, you have 60 days from the date you receive a retirement plan distribution to roll it over into another plan, according to the IRS. Taxes generally arent withheld from the transfer amount, and this may be processed with a check made payable to your new qualified plan or IRA account.

How Long Does It Take To Rollover A 401

There is no one-size-fits-all answer when rolling over a 401. The amount of time it will take to complete the rollover process will depend on several factors, including the type of 401 you have, the financial institution where your 401 is held, and the financial institution where you want to roll over your 401.

If you have a traditional 401, you will likely be able to complete the rollover process within a few weeks. However, if you have a Roth 401, the rollover process may take a bit longer, as special rules apply to Roth 401s.

Finally, its important to note that you may be subject to taxes and penalties if you do not complete the rollover process within 60 days. Therefore, its essential to work with a financial advisor or tax professional to ensure that you complete the rollover process correctly and promptly.

Read Also: Is A 401k A Defined Benefit Plan

Avoiding Taxes With Indirect Rollovers

However, there is a tax complication. When your 401 plan administrator or your IRA custodian writes you a check, by law they have to automatically withhold a certain amount in taxes, usually 20% of the total. So you wont get as much as you may have figured on.

To add insult to injury, you need to make up the amount withheldthe funds you didnt actually getwhen you redeposit the money if you want to avoid paying taxes.

What Are The Disadvantages Of Waiting To Roll Over Your 401

If your previous employer had a 401 plan with expensive investment options or otherwise high fees, youll want to look into moving the money to an IRA or your new 401 plan as soon as you reasonably can. The longer you leave the money there, the more the fees are working to eat away your hard-earned investment returns.

Next, leaving the account at your old employer can sometimes lead to it being forgotten. At the same time, a financial life with scattered accounts is much more difficult to manage. Its smart to consolidate to the extent possible and be proactive about optimizing the number of accounts you have.

There usually isnt a lot of upside associated with waiting, so its a good idea to create a plan and consolidate as soon as is practical for you. If you do decide not to roll over your old 401, make sure that its an active choice. So whatever you decide to do, be sure to give it some thought first.

Recommended Reading: What Happens To 401k When You Leave Company

Pros And Cons: 401 Vs Ira

401 Pros |

|

|---|---|

|

|

|

|

Direct Vs Indirect Rollovers

A direct rollover is when your money is transferred electronically from one account to another, or the plan administrator may cut you a check made out to your account, which you deposit. The direct rollover is the best approach.

In an indirect rollover, the funds come to you to re-deposit. If you take the money in cash instead of transferring it directly to the new account, you have only 60 days to deposit the funds into a new plan. If you miss the deadline, you will be subject to withholding taxes and penalties. Some people do an indirect rollover if they want to take a 60-day loan from their retirement account.

Because of this deadline, direct rollovers are strongly recommended. In many cases, you can shift assets directly from one custodian to another, without selling anything. This is known as a trustee-to-trustee or in-kind transfer.

Otherwise, the IRS makes your previous employer withhold 20% of your funds if you receive a check made out to you. It’s important to note that if you have the check made out directly to you, taxes will be withheld, and you’ll need to come up with other funds to roll over the full amount of your distribution within 60 days.

To learn more about the safest ways to do IRA rollovers and transfers, download IRS publications 575 and 590-A and 590-B.

Read Also: How To Combine Fidelity 401k Accounts

How Do I Transfer My 401k To An Ira

When you leave your job for any reason, you have the option to roll over a 401 to an IRA. This involves opening an account with a broker or other financial institution and completing the paperwork with your 401 administrator to move your funds over. Usually, any investments in your 401 will be sold.

How To Rollover 401k To Crypto Ira

Are you one of the many people who want to roll over your traditional 401k account into a cryptocurrency-based IRA? The great news is that its a relatively easy process because of new federal tax rules. Essentially, you move the funds directly from the 401k and place them into a special kind of IRA called a SDIRA .

SDIRAs can legally hold cryptocurrency and many other kinds of non-traditional assets. If you attempt to set up a SDIRA on your own, the process can be kind of a hassle. But, if you find a licensed custodian who regularly works with IRA transfers, the whole transfer can happen in about an hour or less.

In short, three actions take place at the same time. One, you transfer your 401k assets into a SDIRA. Only a self-directed IRA can hold cryptocurrency, aka alt-coins. So, if you want to move those 401k assets into a SDIRA, youll have to create a SDIRA first.

Next, you need to use the funds in the 401k to buy the various cryptocurrencies to fund the SDIRA. This is a simple but vital step, which involves converting the assets in the 401k into alt-coin assets that will go directly into the self-directed IRA you have just created.

Last and most important of all, its up to you to choose an account custodian. This person keeps the account records and sends regular reports to you. Of course, there are more details to the process than that, so here is a summary of what the entire rollover process is like.

Also Check: Who Do I Call To Cash Out My 401k

Protection From Market Downturns

You will not lose money due to market downturns in a fixed annuity or fixed index annuity. If the markets have a down year, you earn zero interest. In exchange for this protection, you are limited on the upside you can get each year, unlike an individual stock through a mutual fund.

A variable annuity will provide unlimited upside potential without protection from volatile market conditions. However, adding a Guaranteed Lifetime Withdrawal Benefit can protect the annuitant from running out of money due to a stock market crash.

Where Should You Save Your 401 Statements

Where you save your old 401 statements is just as important as why. You shouldnât simply shove them in the back of your desk drawer and never look at them again. Ideally, youâll want to save a few copies of them in case something happens to one.

If you have the means to securely save physical copies of your 401 statements, make sure they are kept in a fireproof safe or filing cabinet. Also, youâll want to make sure in the case your home is ever broken into thieves canât easily find your documents. Your 401 statements in the wrong hands could lead to someone having access to your retirement funds that shouldnât.

In addition to physical copies, itâs a smart idea to keep digital copies of your 401 statements. Be sure to save a couple of copies of each statement in case a hard drive crashes, or you lose access to your cloud storage. Keeping digital copies of your 401 statements is ideal because you donât have to worry about managing stacks of physical paperwork, and you can organize your financial documents more efficiently.

Read Also: Can I Roll My 401k Into A Roth Ira

Recommended Reading: How To Calculate Max 401k Contribution

Take Caution With Indirect Rollovers

Rollovers may be done as direct or indirect, but they are not managed the same.

Direct A direct rollover is where the funds are transferred directly from one retirement account to another as the owner you never touch the funds. Doing a direct rollover avoids this negative consequence that may come with an indirect rollover.

Indirect â As the owner you can receive a distribution of your account balance from the plan instead of arranging for a direct rollover. This might not be the best idea. If you take a distribution, the plan administrator typically withholds 20% of the distributable amount for federal income taxes. The 20% is returned in the form of a tax credit in the year the rollover process was completed. When you do this indirect rollover, you can increase the rollover amount, from your own funds, equal to the 20% withholding amount. If you roll over the amount of the check you receive without adding that 20% back, then the amount withheld will be treated as a taxable distribution. You will generally have to pay income taxes on that amount as well as a 10% penalty tax if you are younger than 59 1/2. Also, when you take the cash directly, the IRS only allows you 60 days from the date of receipt of the funds to rollover the funds to another plan or IRA.

Additional rollover caveats

What’s The Difference Between A Rollover And An Asset Transfer

The main difference between a rollover and an asset transfer is where the money is held before it’s moved to Vanguard. If you’re moving money to Vanguard from:

- An employer-sponsored plan, such as a 401 or 403, you can initiate a rollovertypically, when you change jobs or retire. When you roll over retirement plan assets, you’re moving them from a group plan into an IRA .

- An IRA at another financial institution, you can initiate an asset transfer, tax-free. You can also transfer securities held in a brokerage IRA at another financial institution into a Vanguard Brokerage IRA.

You May Like: How To Start A Solo 401k

Can I Move My 401k To A Roth Ira

Yes, you can move a traditional 401 to a Roth IRA, but this is usually a two-step process. First, youll roll over your traditional 401 to a traditional IRA. Then, youll convert your traditional IRA into a Roth IRA. When you do this, the amount converted is considered taxable income. Many people convert only a portion of their IRA balance each year to avoid going into a higher tax bracket.

If You Have Company Stock

Some retirement savers hold company stock in their 401 alongside other investments. In that situation, if you roll over all those assets to an IRA, you lose the potential to get a more favorable tax treatment on any growth those shares had while in your 401.

It gets a bit confusing, but the idea is that if the company stock has unrealized gains, you transfer it to a brokerage account instead of rolling it over to the IRA along with your other 401 assets. Upon transferring, you are taxed on the cost basis .

However, when you then sell the shares from your brokerage account whether immediately or down the road any growth the stock experienced inside the 401 would be taxed at long-term capital gains rates . This could be less than the ordinary-income tax treatment youd face if the stock went into a rollover IRA and then were withdrawn.

Heres an example: If the cost basis of your company stock is $10,000 and the gains on it were $20,000, you would pay ordinary taxes on the $10,000 when you transfer the shares to a brokerage account.

The $20,000 in gains, however, would be taxed at long-term rates once the stock is sold. Any further growth from the point of transfer to sale would be taxed as either short- or long-term gains, depending on how long you held it before selling.

Its a complex transaction, and if done incorrectly, the strategy loses its tax advantage, said CFP Melissa Brennan, a financial planner with ARS Private Wealth in Houston.

Read Also: Can I Move My 401k To Roth Ira

Move Your Old 401 Assets Into A New Employers Plan

You have the option to avoid paying taxes by completing a direct, or “trustee-to-trustee,” transfer from your old plan to your new employer’s plan, if the employer’s plan allows it.

It can be easy to pay less attention to your old retirement accounts, since you can no longer contribute. So, transferring old 401 assets to your new plan could make it easier to track your retirement savings.

You also have borrowing power if your new retirement plan lets participants borrow from their plan assets. The interest rate is often low. You may even repay the interest to yourself. If you roll your old plan into your new plan, youll have a bigger base of assets against which to borrow. One common borrowing limit is 50% of your vested balance, up to $50,000. Each plan sets its own rules.

Here are a few important steps to take to successfully move assets to your new employers retirement plan so as not to trigger a tax penalty:

Step 1: Find out whether your new employer has a defined contribution plan, such as a 401 or 403, that allows rollovers from other plans. Evaluate the new plan’s investment options to see whether they fit your investment style. If your new employer doesn’t have a retirement plan, or if the portfolio options aren’t appealing, consider staying in your old employer’s plan. You could also set up a new rollover IRA at a credit union, bank, or brokerage firm of your choice.

The instructions you get should ask for this type of information:

Rollovers: The Complete Guide

A 401 rollover is the process by which you move the funds in your 401 to another retirement account usually either an IRA or another 401. A 401 rollover typically happens when you leave your employer, either to retire or to start a new job. There are certain regulations you need to follow when rolling over your assets, most notably the 60-day rule. And you will also need to choose a new financial institution to house your account when you roll over your money into an IRA. If youre considering a 401, a financial advisor can help you set up a retirement plan for your nest egg. Lets break down everything you need to know about 401 rollovers.

Read Also: How Can I Borrow Money From My 401k