Pros And Cons Of Rolling Over 401k To Ira

Learn the pluses and the minuses of getting all of your IRA and 401k ducks in a row.

According to the Bureau of Labor Statistics, on average, individuals between the ages of 18 and 52 may change jobs as frequently as 12 times. Some of those jobs probably came with some type of employer sponsored retirement plan such as 401k or an IRA account . When switching jobs, many people choose to rollover any accounts to their new employer’s plan rather than taking them as a withdrawal. When you roll over a retirement plan distribution, penalties and tax are generally deferred. So let’s look at a few of the pros and cons of consolidating them into one IRA with one institution.

Roll Over Your 401 To A Traditional Ira

If you’re switching jobs or retiring, rolling over your 401 to a Traditional IRA may give you more flexibility in managing your savings. Traditional IRAs are tax-deferred1 retirement accounts.

- Pros

-

- Your money can continue to grow tax-deferred.1

- You may have access to investment choices that are not available in your former employer’s 401 or a new employer’s plan.

- You may be able to consolidate several retirement accounts into a single IRA to simplify management.

- Your IRA provider may offer additional services, such as investing tools and guidance.

- Cons

-

- You can’t borrow against an IRA as you can with a 401.

- Depending on the IRA provider you choose, you may pay annual fees or other fees for maintaining your IRA, or you may face higher investing fees, pricing, and expenses than you would with a 401.

- Some investments that are offered in a 401 plan may not be offered in an IRA.

- Your IRA assets are generally protected from creditors only in the case of bankruptcy.

- Rolling over company stock may have negative tax implications.

- Whether or not you’re still working at age 72 RMDs are required from Traditional IRAs.

How Do 401s And Iras Work

A 401 is an employer-sponsored retirement savings plan that allows employees to save pre-tax money from their paychecks, often with a partial match from their employers. Money deposited into 401 accounts is not taxed until it is withdrawn. It gets its name from the section of the tax code that covers it.

An IRA is an individual retirement account in which the saver directly deposits pre-tax funds. Often, individuals who leave companies where they had 401 plans will roll the funds into IRAs.

Regardless of whether you own a 401k or an IRA, once a distribution is taken, it is taxable as ordinary income. Additionally, if you are withdrawing money prior to the age of 59 and a half, then the IRS levies an additional 10% penalty tax. The same rules of taxation apply when you roll a 401 plan or an IRA into an annuity.

Don’t Miss: How To Withdraw Your 401k From Fidelity

Roth Ira Vs : Whats The Difference

Roth IRAs can help you save for retirement and enjoy tax-free growth. However, 401s can help you reduce your tax liability for the current tax year. So, which is better?

It depends on factors like your income level and employment situation. Learn more about each by utilizing online tools and resources, which allow you to compare and contrast easily.

In order to determine which to choose, youll need to understand the difference between each. Heres a closer look at both Roth IRAs and 401s to help you decide if one or both can provide the best solution for your retirement savings.

Direct And Indirect Rollovers

Annuity rollover rules are also affected based on whether you do a direct rollover or an indirect rollover.

Direct rollovers occur when you transfer your retirement account funds within annuity rollover rules directly into an annuity. Under these circumstances, direct transfers are tax free. Direct transfers are commonly done by mailing or wiring funds directly to the new plan provider, but on some occasions, the old plan provider may mail the check directly to you, payable to the new plan provider. This still counts as a tax-free direct transfer.

Indirect rollovers, however, are more complicated and have significant tax consequences if not executed correctly. Indirect rollovers involve withdrawing your funds from a retirement account typically when you change jobs or other reason allowed under the tax laws prior to retirement. To remain tax-free, the funds must be rolled over within 60 days of distribution. Otherwise, the distribution is income taxable and may also be subject to the penalty for withdrawing funds prior to age 59 and a half.

Indirect rollovers have other consequences as well. Distributions made from qualified retirement plans, such as 403 annuities and 457 plans, are subject to automatic withholding tax in the amount of 20%. Internal Revenue Code considers the withholding of a distribution unless it is added to the 80% received and reallocated during the 60-day limit.

The advice here is simple: whenever possible use direct transfers.

Read Also: Why Transfer 401k To Ira

What Happens If You Cash Out Your 401

If you take your 401 money before you reach age 59 ½, you might have to pay taxes at your regular tax rate, on top of a penalty from the IRS, on any money that hasnt been taxed before. You may be able to avoid any penalties for certain life events or purchases, but youll still probably owe taxes on any previously untaxed money.

Roll Over Your Money To A New 401 Plan If This Option Is Available

If you’re starting a new job, moving your retirement savings to your new employer’s plan could be an option. A new 401 plan may offer benefits similar to those in your former employer’s plan. Depending on your circumstances, if you roll over your money from your old 401 to a new one, you’ll be able to keep your retirement savings all in one place. Doing this can make sense if you prefer your new plan’s features, costs, and investment options.

- Pros

-

- Any earnings accrue tax-deferred.1

- You may be able to borrow against the new 401 account if plan loans are available.

- Under federal law, assets in a 401 are typically protected from claims by creditors.

- You may have access to investment choices, loans, distribution options, and other services and features in your new 401 that are not available in your former employer’s 401 or an IRA.

- The new 401 may have lower administrative and/or investment fees and expenses than your former employer’s 401 or an IRA.

- Required minimum distributions may be delayed beyond age 72 if you’re still working.

- Cons

-

- You may have a limited range of investment choices in the new 401.

- Fees and expenses could be higher than they were for your former employer’s 401 or an IRA.

- Rolling over company stock may have negative tax implications.

Recommended Reading: How To Roll 401k Into Another 401k

Reasons You May Want To Wait To Roll Over Your 401

- Temporary ban on contributions. Some plan sponsors impose a temporary ban on further 401 contributions for employees who withdraw funds before leaving the company. You’ll want to determine if the gap in contributions will significantly impact your retirement savings.

- Early retirement. Most 401s allow penalty-free withdrawals after age 55 for early retirees. With an IRA, you must wait until 59 ½ to avoid paying a 10% penalty.

- Increased fees. IRA investors may pay more fees than they would in employer-sponsored plans. One reason: The range of more sophisticated investment options you may choose can be more expensive than 401 investments. Your advisor can help identify what extra cost a rollover may incur and if the benefits of the rollover justify those additional costs.

- Can take loans out. Your 401 may permit you to take out a loan from the account, but this is typically only for active employees. And you may have to pay in full any outstanding loan balances when you leave the company. You cannot take loans from IRAs.

Reasons You May Want To Roll Over Now

- Diversification. Investment options in your 401 can be limited and are selected by the plan sponsor. Rolling your funds over into an IRA can often broaden your choice of investments. More choices can mean more diversification in your retirement portfolio and the opportunity to invest in a wider range of asset classes including individual stocks and bonds, managed accounts, REITs and annuities.

- Beneficiary flexibility. With some IRAs, you may be able to name multiple and contingent beneficiaries or name a trust as the beneficiary. Other IRAs may allow you to impose restrictions on beneficiaries. These options aren’t usually available with 401s. But, keep in mind, not all IRA custodians have the same rules about beneficiaries so be sure to check carefully.

- Ownership control. You are the owner and have access rights with an IRA. The assets in your IRA are also not subject to blackout periods. With a 401 plan, the qualified plan trustee owns the assets and assets may be subject to blackout periods in which account access is limited.

- Distribution options. If your IRA is set up as a Roth IRA, there is not a set age when the owner is required to take minimum distributions. With 401 plans and traditional IRAs, the owner will have to take required minimum distributions by April 1 of the year after they turn age 72.

Also Check: Are There Penalties For Withdrawing From 401k

How To Report The Rollover On Your Tax Return

- You must report any transaction when you submit your annual tax return for both direct and indirect rollovers.

- Your IRA brokerage will send you a Form 1099-R that will show how much money you took out of your IRA.

- On your 1040 tax return, report the amount on the line labeled IRA Distributions. The Taxable Amount you record should be $0. Select rollover.

How Long Do I Have To Roll Over My 401 From My Old Job

If you have money sitting in a 401 with your last employer and you decide to leave the money in there, theres no time limit. You can roll those funds into an IRA or your new employers retirement plan whenever you want to.

However, if you have your old 401 money sent directly to you from your retirement plan , the IRS says you have just 60 days from the date you receive a retirement plan distribution to roll it over into another plan or an IRA. Otherwise, you will get hit with taxes and an early withdrawal penalty.

You May Like: Where Do You Check Your 401k

Choose Investments In Your Ira

Once the money is consolidated into one account, you can choose what types of investments belong in that account. Make an investment plan, and make sure the investments you choose will match up with the expected withdrawals you will need to take.

For example, if you know you will need to take $20,000 out next year, you don’t want that $20,000 invested in something aggressive, risky, or volatile such as a stock fund. You want it in something safe so you you won’t have to worry about that part of your account being worth less than $20,000 when you need it.

The Balance does not provide tax, investment, or financial services or advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors. Investing involves risk, including the possible loss of principal.

Keep Your 401 With Your Previous Employer

In this instance, you wont change a thing. Just make sure that you actively monitor your investments in the plan for performance and remain aware of any significant changes that occur.

If you really like your current investment options and are paying low fees on the investments, this might be the right choice for you.

Also Check: How To Borrow From 401k To Buy A House

Decide What Kind Of Account You Want

Your first decision is what kind of account youre rolling over your money to, and that decision depends a lot on the options available to you and whether you want to invest yourself.

When youre thinking about a rollover, you have two big options: move it to your current 401 or move it into an IRA. As youre trying to decide, ask yourself the following questions:

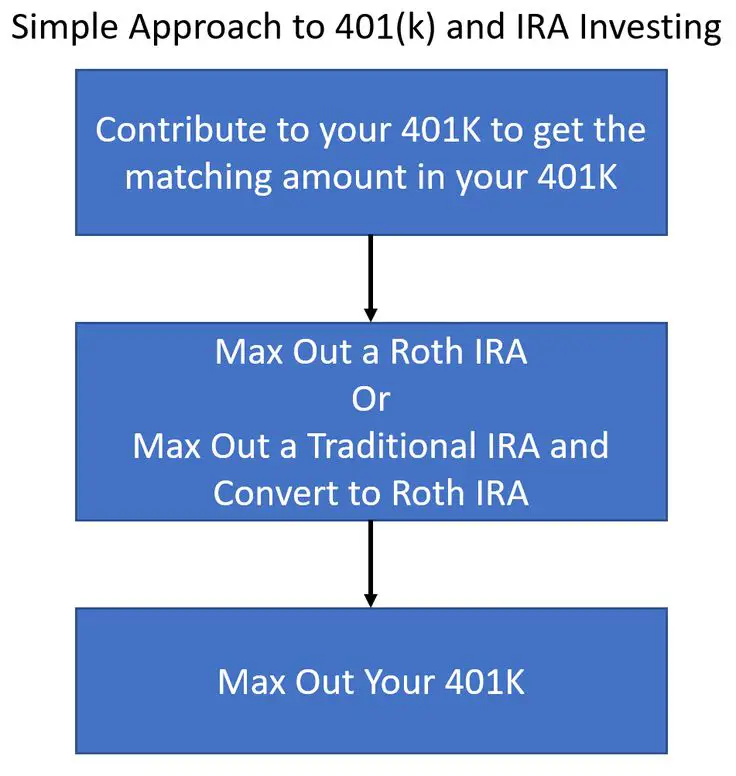

- Do you want to invest the money yourself or would you rather have someone do it for you? If you want to do it yourself, an IRA may be a good option. But even if you want someone to do it for you, you may want to check out an IRA at a robo-advisor, which can design a portfolio for your needs. But do-it-for-me investors may also prefer to make a rollover into your current employers 401 plan.

- Does your old 401 have low-cost investment options with potentially attractive returns, and does your current 401 offer similar or better options? If youre thinking about a rollover to your current 401 plan, youll want to ensure its a better fit than your old plan. If its not, then a rollover into an IRA could make a lot of sense, since youll be able to invest in anything that trades in the market. Otherwise, maybe it makes sense to keep your old 401.

- Does your current 401 plan offer access to financial planners to help you invest? If so, it could make sense to roll your old 401 into your new 401. If you move money to an IRA, youll have to manage it completely and pick investments or hire someone to do so.

What Is An In

Unlike the traditional rollover, an in-service rollover is probably something youve never heard of and for good reason. First, not all company retirement plans allow for it, and second, even for those that do, the details can be confusing to employees. The bottom line: An in-service rollover allows an employee to be able to roll their 401k to an IRA while still employed with the company. The employee is also still able to contribute to the plan, even after the rollover is complete. Most plans allow this type of rollover once per year, but depending on the plan, you could potentially complete the rollover more often for different contribution types.

Recommended Reading: What Age Is Retirement For 401k

Also Check: Can You Withdraw Your 401k When You Leave A Company

Why Roll Over Your 401 Into An Ira

Moving your funds from a 401 to an IRA offers various benefits that you are unlikely to find in a 401 plan. While 401 are limited to a few investment choices like stocks and bonds, IRAs have a wider pool of investments ranging from EFTs, REITs, Certificates of Deposits, stocks, and bonds. This can help you create a diversified portfolio and have multiple income streams.

Also, IRA tends to be less expensive than 401 plans. Due to the limited investment choices in 401, you will have to incur higher costs in administrative fees, fund expense ratios, and management fees, which can reduce your overall return. While IRAs are not free of fees, the higher number of investment choices means you can pick investments with the lowest fees and exercise more control over how you invest.

Tags

Are There Tax Implications Of Ira Rollovers

Depending on how you move your money, there might be tax implications. If you move your money into an account with the same tax treatment as your old account, there shouldnt be issues as long as you deposit any checks you receive from your 401 into a tax-advantaged retirement account within 60 days. However, if you move a traditional 401 into a Roth IRA, you could end up with a tax bill. Check with a tax professional to find out how you may be affected.

Recommended Reading: Can I Cash Out My 401k After Leaving My Employer

Do I Have To Pay Taxes When Rolling Over A 401

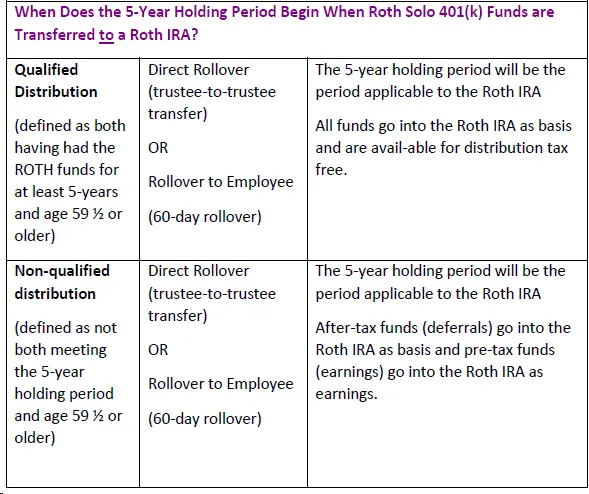

Whether you owe taxes on a rollover depends on whether youre changing account types . Generally, if you move a traditional 401 account to a Roth IRA, you could create a tax liability. Here are a few scenarios:

- If youre rolling over money from a traditional 401 to another traditional 401 or traditional IRA, you wont create a tax liability.

- If youre rolling over a Roth 401 to another Roth 401 or Roth IRA, you wont create a tax liability.

- However, if youre rolling a traditional 401 into a Roth IRA, you could create a tax liability.

Its also important to know that if you have a Roth 401 that has any employer matching funds in it, those matching funds are categorized as a traditional 401 contribution. So if you transfer a Roth 401 with matching funds into an IRA, youll need to create two IRA accounts a traditional IRA and a Roth IRA to avoid any tax issues during the rollover.

Of course, youll still need to abide by the 60-day rule on rollovers. That is, you have 60 days from the date you receive a retirement plan distribution to roll it over into another plan, according to the IRS. Taxes generally arent withheld from the transfer amount, and this may be processed with a check made payable to your new qualified plan or IRA account.

Rolling Your Annuity Into A 401

Can you roll your annuity over into your 401? It depends.

First, your annuity would need to already be an IRA annuity. Second, your 401 plan would have to allow you to roll money from other tax-deferred retirement plans into it.

You can run into tax implications when rolling an annuity into a traditional 401. Thats because traditional 401 contributions are tax deductible but annuity contributions outside of a retirement account are not.

The IRS will not allow you to mix and match deductible and nondeductible contributions into the same account.

One solution may be to carry out a tax-free exchange of one annuity with another annuity. This is permitted under Section 1035 of the tax code.

The exchange will prevent you from having to pay income taxes or capital gains taxes on the exchange. But be aware of possible surrender charges that you may have to pay.

You should check with the person in charge of your employers plan. You should also check with your annuity provider and review the contract to make sure youre able to take the funds from the annuity.

Recommended Reading: Is 401k Required By Law In California