How To Start A 401

Setting up a 401 plan can be as simple or as complicated as you like. Most people outsource at least some portion of the process. In particular, they use a template legal document to establish the 401 plan, which is substantially less expensive than hiring attorneys to draft original documents. Unless your retirement plan is especially complicated or youre trying to get fancy , youll probably use preconfigured programs from 401 vendors. These programs are often called volume submitter or prototype plans, and theyre an excellent choice for most companies and nonprofits.

Here are the crucial pieces of any 401 plan. While this list seems extensive, in some cases, a single company provides several of these services.

Ive used Solo 401 providers for my own business, and I helped my wife with this as well. I suggest keeping things as simple as possible . Thats based on our experience, plus the dozens of larger employers Ive worked with. When you go beyond essential plan features, its easier to make mistakes and waste time.

The plan document is a legal document that details the rules of your 401 plan. It defines specific terms, and provides a roadmap for any questions that come up when administering the plan. The plan document is a long legal document that most people never see. Instead, employees receive a shorter version of the document, known as the Summary Plan Description , when they enroll in the plan. For reference, heres a sample of a plan document.

How Much Does It Cost To Open A Solo 401

There is no cost to open a 401 account but watch out for those fees later on. While you’re researching your options, check for account maintenance fees, transaction fees, commissions, mutual fund expense ratios, and sales loads.

A fractionally higher fee can mean a big hit to a retirement portfolio. If you make the right choices you can minimize the fees you pay.

Can I Manage My Own 401k

David Bolton

Managing your own 401 account can be beneficial or disastrous depending on how you choose to invest, but it gives you complete control over your future.

Some 401 plans have more investment options than others, but most have a pretty limited selection of investment opportunities. That is why more and more people are starting to wonder whether they can manage their own 401 instead of being limited to the few available options. Although you can manage your 401 in some cases, youâll soon learn about whether or not you really should.

If your employer offers a self-directed 401 option, then yes you can manage your own 401 account. If they donât you will need to choose from the available investment options and rely on a fund manager or market index funds to manage your account.

Over years, weâve seen all different kinds of 401 plans as well as the different investment avenues that employers have offered along the way. Weâve dealt with actively managed 401 plans, passively managed plans, and also of course self-directed accounts. Everything you read here is from hands-on experience in the industry, so letâs dive right in!

Don’t Miss: How To Use 401k For Home Purchase

Managing Your Retirement Funds

Make no mistake, you need to start saving for retirement as soon as you start earning income, even if you cant afford much at the beginning. The sooner you start, the more youll accumulate, thanks to the miracle of compounding.

Letâs say you save $40 per month and invest that money at a 3.69% rate of return, which is what the Vanguard Total Bond Market Index Fund earned across a 10-year period ending in December 2020. Using an online savings calculator, an initial amount of $40 plus $40 per month for 30 years adds up to just under $26,500. Raise the rate to 13.66%, the average yield of the Vanguard Total Stock Market Index Fund over the same period, and the number rises to more than $207,000.

As your savings build, you may want to get the help of a financial advisor to determine the best way to apportion your funds. Some companies even offer free or low-cost retirement planning advice to clients. Robo-advisors such as Betterment and Wealthfront provide automated planning and portfolio building as a low-cost alternative to human financial advisors.

Keep Your Money Where It Is

Keep your savings invested in your former employer’s retirement plan.

- Your savings stay invested, with the same tax advantages

- You continue with the plan’s investment options

- You can’t make additional contributions

- Your past employer may decide to make changes to the plan that impact your account

- Loans aren’t allowed, but you may be able to withdraw money before you retire under certain circumstances

Recommended Reading: How Much Invest In 401k

How Do Employer 401 Matching Contributions Work

Some employers offer to match their employees 401 contributions, up to a certain percentage of their salary.

One common approach involves an employer matching employee contributions dollar-for-dollar up to a total amount equal to 3 percent of their salary. Another popular formula is a $0.50 employer match for every dollar an employee contributes, up to a total of 5 percent of their salary.

Continuing our example from above, consider the impact on your 401 savings of a dollar-for-dollar employer match, up to 3 percent of your salary. If you contribute 5 percent of your annual pay and receive $2,000 every pay period, with each paycheck you would be contributing $100 and your employer would contribute $60.

When starting a new job, find out whether your employer provides matching 401 contributions, and how much you need to contribute to maximize the match. If they do, you should at a minimum set your 401 contribution level to obtain the full match, otherwise youre leaving free money on the table.

What Can You Do If Your Employer Doesnt Offer A 401 Match

Some employers encourage employee participation in their retirement plans by offering to match a portion of the funds. For example, many companies will add 50 cents of every dollar up to 6% of an employees 401 contributions.

But what if your employers retirement plan offers a 401 without a match? Is there any way you can still beef up your retirement a little more? Here are some ideas:

Recommended Reading: Can I Transfer Funds From My 401k To An Ira

Matching Contributions For Student Debtors

Some employers provide a matching contribution on the amount you save in your 401 or workplace retirement account they might match every dollar you contribute, for example, up to 4 percent of your salary. But people with student loans may delay saving for retirement while they focus on whittling down their debt, which means they stand to lose years of free money from their employer.

Starting in 2024, student loan payments would count as retirement contributions in 401, 403 and SIMPLE I.R.A.s for the purposes of qualifying for a matching contribution in a workplace retirement plan. The same goes for governmental employers who make matching contributions in 457 and related plans.

Can I Manage My Own 401

Since 401 plans are employer-sponsored, it will typically be up to your employer whether you can manage your own 401 account or not. In recent years, employers have become more and more willing to allow their employees to do this and started offering what is known as a self-directed 401. Also known as a brokerage window, a self-directed 401 plan allows employees to buy and sell investment securities however they see fit.

As of now, about 20% of companies around the country have adopted this option and added it to their 401 plans. That of course then means that about 80% of companies do not offer this option to their employees. So more often than not, you will not be able to manage your 401, unless you work for one of the companies that provide you with that option.

But if youâre hoping that it will become an option in the future, keep your hopes up. This is becoming more common and in the relatively near future, most companies will likely start offering this to their employees. This will not only potentially benefit employees like yourself, but also the employers as youâll learn about shortly.

Don’t Miss: How To Find My Fidelity 401k Account Number

What Are The Advantages Of 401 Matching

While businesses arent required to offer a 401 contribution match for employees, its still a good idea. Robertson said matching contributions can boost employee morale and, because they are deductible, drive down a businesss tax liability.

If you want to offer a matching program but youre afraid some employees will just take the money and run, consider a vesting schedule. With this arrangement, employees cant take the employers contributions until the employees have participated in the retirement plan for a certain length of time.

For example, employer matching contributions might not fully vest for three years. If an employee leaves for another job before those three years are up, they arent entitled to all of the contributions the employer has made on their behalf. Of course, they do get to take all of the money they have personally contributed.

Some companies opt for profit-sharing contributions to employees 401 accounts when business is good. As mentioned above, these contributions are also tax deductible.

The typical 401 match is called a safe harbor nonelective match of 3% of salary, Pyle said. This means the employees get 3%, whether or not they participate in their employers 401 plan. Other match types are 100% on the first 3% of salary deferred and 50% on the next 2% of salary deferred.

Did you know?: Some of the best payroll software providers, such as ADP and Paychex, offer 401 plan services as part of their packages.

What Options Do 401 Plans Have

While some 401 plans do allow you to manage your own account â more on that later â the majority of them do not. And most 401 plans between companies all around the country have similar investment options for their employees to choose from. While there will of course be some differences from company to company, it is common for many of the same investment options to pop up no matter who youâre working for.

In most 401 plans, youâll have the option of investing into five main asset categories. These categories include U.S. large cap, U.S. small cap, international markets, emerging markets, and bond allocations. Large and small cap funds refer to the market capitalization of the companies within. For example, the S& P 500 Index comprises the 500 largest companies in the United States. So a fund that mimics the S& P 500 would be an example of a large cap fund.

While these options are good for most average investors, there isnât a whole lot of variety in what you can invest in. And you wonât really have any chance of beating the overall market as you work towards retirement. So before we get into managing your own account, letâs learn about how 401 accounts are usually managed.

Don’t Miss: Can I Have A 401k Without An Employer

Safe Harbor 401 Plans

A safe harbor 401 plan is similar to a traditional 401 plan, but, among other things, it must provide for employer contributions that are fully vested when made. These contributions may be employer matching contributions, limited to employees who defer, or employer contributions made on behalf of all eligible employees, regardless of whether they make elective deferrals. The safe harbor 401 plan is not subject to the complex annual nondiscrimination tests that apply to traditional 401 plans.

Safe harbor 401 plans that do not provide any additional contributions in a year are exempted from the top-heavy rules of section 416 of the Internal Revenue Code.

Employers sponsoring safe harbor 401 plans must satisfy certain notice requirements. The notice requirements are satisfied if each eligible employee for the plan year is given written notice of the employee’s rights and obligations under the plan and the notice satisfies the content and timing requirements.

In order to satisfy the content requirement, the notice must describe the safe harbor method in use, how eligible employees make elections, any other plans involved, etc. Income Tax Regulations section 1.401-3 , contains information on satisfying the content requirement using electronic media and referencing the plan’s Summary Plan Description.

Both the traditional and safe harbor plans are for employers of any size and can be combined with other retirement plans.

What Is A Qualified Domestic Relations Order

A qualified domestic relations order is a judicial order entered as part of a property division in a divorce or legal separation. Specifically, the QDRO divides retirement and pension plans such as 401, 403, and 457 as well as federal and state civil service plans and IRAs. Further, the QDRO formally recognizes an alternate payees right to receive, or assigns to an alternate payee the right to receive, all or a portion of the benefits payable with respect to a participant under a retirement plan.

Donât Miss: Can I Buy 401k Myself

You May Like: How Do You Get A Loan From Your 401k

Do Employers Have To Offer A 401

Currently, theres no federal legislation requiring any employer to offer a retirement plan. However, since 2012, 46 states have either implemented a state-based retirement savings program, studied program options, or considered legislation in order to encourage people to save for their future. Additionally, there are a handful of states that have passed legislation requiring businesses to offer a state retirement plan to their employees if they do not offer another retirement plan such as a 401.

Providing comprehensive benefits such as a 401 plan can be critical to building a people-first culture. According to a Human Interest study, a 401 is the most-wanted benefit after health insurance.

No Taxes On Social Security Benefits Or Retirement Plans

The fact that the state has no income tax means it doesnt have state taxes on Social Security benefits, which are considered income. In addition, there are also no taxes on retirement income, such as 401 plans and IRAs.

This is a considerable advantage for all retirees thinking of Florida, even though most arent working full-time jobs, said Melissa Terry, CFA at VEM Tooling. The fewer taxes from your allotted pension distributions or passive income checks are the only money available in your budget. Floridas state-level income tax laws apply to every form of income, including your Social Security benefits.

Read Also: What To Ask 401k Advisor

Crank Up The Investments Available

- Contribute more Put a higher percentage of your income into your existing retirement plan. Since it lowers your taxable income, it may be cheaper than you think.

- Try other tax-deferred options Consider opening an individual retirement account if youve reached the maximum contribution level in your employer-sponsored plan.

- Consider getting taxed up front Money placed in a Roth IRA is taxed now, but qualified Roth earnings are never taxed. This can save you more money in the long run.

Focus On Running Your Business Not Your 401 Plan

-

Recruit & retain top talent. A Human Interest study found that a retirement plan is the most-wanted benefit, after health insurance.3

-

Easy to start, easy to use. Admin dashboards provide insight into plan participation, reporting, and more.

-

Reduce manual work. In-house recordkeeping and complianceplus depending on your plan.

Recommended Reading: How To Locate Lost 401k

Ira 401k And Us Investments For Canadians

We meet with a lot of clients who are looking for some guidance on how to handle their US investment accounts. Whether they have moved from the US or inherited US assets from family members these individuals often have the same questions, concerns and tax planning issues.

Outlined below are some of the frequently asked questions by clients with US investments accounts:

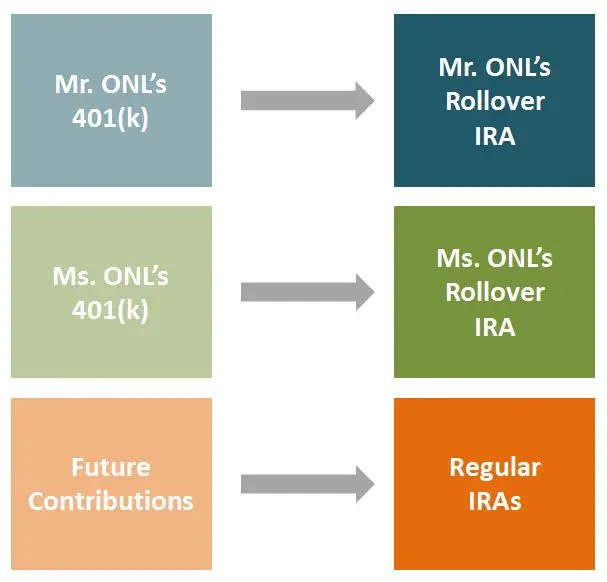

Read Also: Should I Move 401k To Ira

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our reporters and editors focus on the points consumers care about most how to save for retirement, understanding the types of accounts, how to choose investments and more so you can feel confident when planning for your future.

You May Like: Can I Transfer Money From One 401k To Another

Drawbacks To A Solo 401

A solo 401 may not be right for small businesses that plan to expand and hire employees in the near-term, since doing so would likely result in plan ineligibility. In addition, calculating profit-sharing contributions for sole proprietorships and partnerships tends to be complex because it requires modified net profits. The formula for this calculation is available in IRS Publication 560.

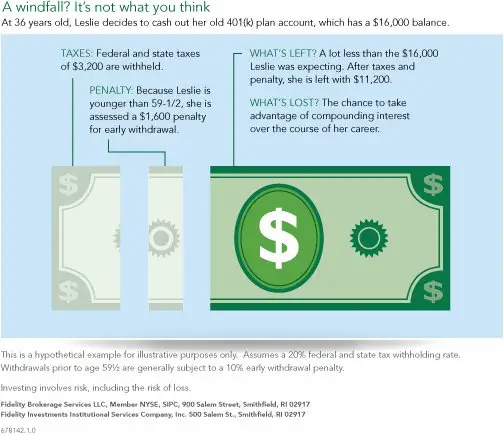

How To Avoid 401 Early Withdrawal Penalties

There are certain exceptions that allow you to take early withdrawals from your 401 and avoid the 10% early withdrawal tax penalty if you arent yet age 59 ½. Some of these include:

- Medical expenses that exceed 10% of your adjusted gross income

- Permanent disability

- If you leave your employer at age 55 or older

- A Qualified Domestic Retirement Order issued as part of a divorce or court-approved separation

Even if you can escape the additional 10% tax penalty, you still have to pay taxes on your withdrawal from a traditional 401. owner owes no income tax and the recipient can defer taxes by rolling the distribution into an IRA.)

Also Check: Should I Open An Ira If I Have A 401k