Should I Stop Contributing To My 401

Research has shown that consistent investing pays off over time. For instance, Charles Schwab looked at five different investing styles, ranging from trying to time the market to keeping everything in cash. The best performing strategy was the investor who managed to perfectly time the market an impossibility for most investors, as noted above.

After that, the most effective strategy was one where an investor socked away money at the start of the year, followed by an approach called dollar-cost averaging, or investing a set amount of money on a regular basis, such as monthly or with each paycheck. In other words, how most people invest in their 401s.

The worst performer? The investor who stuck with cash, Schwab found.

I am a big believer in the adage that time in the market is more important than timing the market, and that means that any time you can set aside money to invest is a good time, Richardson noted. If you have the ability to put more toward your 401 or other retirement accounts, this is as good a time as any.

Read Also: How Do You Open An Investment Account

Investments Managed According To Your Goals

Your 401 plan may also offer stand-alone investment options that are managed professionally based on your expected retirement date or on your account growth objectives and your tolerance for risk. The most common stand-alone option is target-date funds . Theyre called target date because theyre invested based on the date you expect to retire. TDFs are:

- Made up of multiple underlying investments

- Broadly diversified and professionally managed

- Invested with a risk and reward profile based on years until retirement

- Named according to the year of expected retirement

Generally, you choose the TDF with the year that most closely matches the year you plan to retire. The funds inside the TDF are invested according to how much time is remaining before your expected retirement year, gradually adjusting automatically to balance asset growth with principal preservation objectives as you get older.

Other stand-alone investment options include balanced funds and target-risk funds. These funds are also diversified, but they dont change as you get older. Rather, you choose them according to your ability to tolerate risk and your need for investment growth. In theory, a stand-alone optionwhether TDF, balanced, or target riskis designed to be your sole 401 investment.

Scale Up Contributions Over Time

Once you’ve picked your investments, the best thing you can do is leave your account alone and let the contributions build.

In addition to low costs and diversity, consistently investing over time i.e., every paycheck will make the biggest difference in the size of your savings. Low-cost funds are only effective if you continuously invest in them and don’t try to time the market, or pull money out when it starts to drop, a recent report from Morningstar says.

Experts also advise increasing your contributions each time you get a raise or bonus by a percentage point or two, helping you reach your goals faster.

Finally, remember that while the stock market has historically increased around 10% per year, that’s not guaranteed, and there will be periods when it falls. Experts also expect returns to be lower, around 4%, over the next decade than they have been the previous 10 years.

Still, no one knows what will happen, except that the best course of action is typically to invest in low-cost index funds consistently, over many decades. Do that, and you’ll be on the path to building real wealth.

Also Check: How To Get 401k From Old Employer

Convert Old 401s To Roth Iras

Lets pretend that youve changed jobs at least once in your career, and you still have a 401 from a former employer. If you have enough cash on hand, you can convert that 401 into a Roth IRA. Since the money in that 401 wasnt taxed when you first put it into the account, youll pay taxes on that money when you convert it to a Roth IRA. Doing that rollover is not complicated. Youll have to make some phone calls and fill out some paperwork.

Why would you want to convert that old 401 into a Roth IRA? There are a couple of reasons.

Remember this: converting is an option only if you have the cash on hand to pay the taxes. If you dont have enough, try Door #3.

Recommended Reading: Best Long Term Investment Accounts

What To Consider Before Investing

You dont have to pick just one fund. Instead, you could spread your money over several funds. How you divvy up your moneyor your asset allocationis your decision. However, there are some things you should consider before you invest:

- Your risk tolerance

- How much you need

The first consideration is highly personal, your so-called risk tolerance. Only you are qualified to say whether you love the idea of taking a flier or whether you prefer to play it safe.

Read Also: Can I Create My Own 401k

Anything Else I Should Know

Yep. A few things, actually.

Once you contribute to a 401, you should consider that money locked up for retirement. In general, distributions prior to age 59½ will be hit with a 10% penalty and income taxes.

If you leave a job, you can roll your 401 into a new 401 or an IRA at an online brokerage or robo-advisor. The IRA can give you more control over your account and allow you to access a larger investment selection.

401s typically force you to begin taking distributions called required minimum distributions, or RMDs at age 72 or when you retire, whichever is later. You may be able to roll a Roth 401 into a Roth IRA to avoid RMDs.

How To Manage Your 401 In A Bear Market

When a bear market sets in, the worst thing you can do is hit the panic button on your 401. While it may be disheartening to see your account value decreasing as stock prices drop, thats not necessarily a reason to overhaul your asset allocation.

Instead, look at which investments are continuing to perform well, if any. And consider how much of a decline youre seeing in your investments overall. Look closely at how much of your 401 you have invested in your own companys stock, as this could be a potential trouble spot if your company takes a financial hit as the result of a downturn.

Continue making contributions to your 401, at least at the minimum level to receive your employers full company match. If you can afford to do so, you may also consider increasing your contribution rate. This could allow you to max out your annual contribution limit while purchasing new investments at a discount when the market is down. Rebalance your investments in your 401 as needed to stay aligned with your financial goals, risk tolerance and timeline for retiring.

Recommended Reading: Does Borrowing From 401k Affect Credit Score

Read Also: What Is A Robs 401k

Why Put Gold In Your Ira

Individual Retirement Accounts protect your retirement as well as your familys financial security. These special accounts allow you to set aside tax protected savings that you can use in the future.

With these long term accounts its important to allocate a significant portion to assets that are solid and reliable, so you have a secure future.

You can have cash in an IRA, but that is devaluing at a rapid pace and inflation is out of control.

You need an asset thats reliable, retains its value, and even increases in value over time, and there is no better asset for this than gold.

With the worlds economy struggling through lockdowns, shortages, wars, and inflation, uncertainty has never been higher and investors are protecting themselves by placing physical gold in IRAs.

A gold IRA investment prospers from these crisis that negatively affect most other assets.

Risk is knowing the economic dangers and doing nothing to protect yourself and your family.

Safety is knowing the economic dangers and taking action to ensure your financial future, and this is easy to do with a Gold IRA.

How Do I Create A 401 Plan

Creating a 401 plan for a companyeven a small oneis a complex process. The following is a basic overview of the steps for getting approval and starting the plan:

- Write a plan with the help of a plan adviser and send it to the IRS for a determination letter .

- Find a trustee to help you decide how to invest contributions and manage individual employee accounts.

- Begin making employer contributions, if offered, and allowing employee contributions through your payroll system.

Recommended Reading: Do You Lose Your 401k If You Quit

What Is Employer Matching

With an employer match, a company matches what an individual employee contributes to their 401 up to a certain amount. Most companies that offer an employer match determine how much it contributes based on a percentage of what an employee contributes.

For instance, a company may contribute 50% of the first 6% that an employee contributes. So, if your annual salary is $60,000 and you choose to contribute 6% to your 401 each year, you will contribute $3,600 and your company will contribute 50% of that, or $1,800. You can choose to contribute more of your salary, but your companys match will be capped at $1,800.

What Kind Of Investments Are In A 401

A 401 plan will typically offer a range of investments, but any single plan may not offer all possible types of investments. The most common investment options include:

- Stock mutual funds: These funds invest in stocks and may have specific themes, such as value stocks or dividend stocks. One popular option here is an S& P 500 index fund, which includes the largest American companies and forms the backbone of many 401 portfolios.

- Bond mutual funds: These funds invest exclusively in bonds and may feature specific kinds of bonds, such as short- or intermediate-term, as well as bonds from certain issuers such as the U.S. government or corporations.

- Target-date mutual funds: These funds will invest in stocks and bonds, and theyll shift their allocations to each based on a specific target date or when you want to retire.

- Stable value funds: These funds invest in low-yield but very safe assets, such as medium-term government bonds, and the returns and principal are insured against loss. These funds are more appropriate for investors near retirement than for younger investors.

Some 401 plans may also allow you to buy individual stocks, bonds, ETFs or other mutual funds. These plans give you the option of managing the portfolio yourself, an option that may be valuable to advanced investors who have a good understanding of the market.

Also Check: Can I Roll Over A 403b To A 401k

Can I Roll My 401k Into Gold

Fortunately, it is possible to entirely convert an existing 401 into gold or another precious metal. However, this does not give you a get-out-of-jail-free card. You will still have to pay your taxes without any further deductions.

In addition, you will need to leave your present job before moving your 401k to a self-directed IRA account. You can purchase gold and silver products with the money youve transferred from your 401 to your new IRA.

Recommended Reading: Should I Roll My Ira Into My 401k

How To Buy Gold With Your 401

Kirsten Rohrs Schmitt is an accomplished professional editor, writer, proofreader, and fact-checker. She has expertise in finance, investing, real estate, and world history. Throughout her career, she has written and edited content for numerous consumer magazines and websites, crafted resumes and social media content for business owners, and created collateral for academia and nonprofits. Kirsten is also the founder and director of Your Best Edit find her on LinkedIn and Facebook.

For many investors, the allure of precious metals is hard to resist most notably, gold. It is one of the most sought-after and popular investments in the world because it can offer lucrative returns in any investment portfolio. Gold is generally considered to be a safe investment and a hedge against inflation because the price of the metal goes up when the U.S. dollar goes down.

One thing investors need to consider is that most 401 retirement plans do not allow for the direct ownership of physical gold or gold derivatives such as futures or options contracts. However, there are some indirect ways to get your hands on some gold in your 401.

Also Check: Can I Rollover My 401k To A Money Market Account

K Withdrawal / Investment Rules

Withdrawals from a 401k come in many forms, and since we just talked about the Solo 401k, let’s discuss the investment rules here. What’s important to understand is that:

- You’re borrowing money from the 401k plan.

Yes, you technically own the money come retirement, but until then, you really don’t own the money. When you take money out for alternative investments, you’re doing so with the understanding that the money is borrowed.

Using the example above, letâs say that you borrowed $50,000 to invest into a property.

If you borrowed this sum of money, you would be using a participant loan option. Under the terms of this loan option, you must:

- Pay back the 401k on a regular schedule

- Repay the 401k over a five-year period

- Pay interest rates

The interest rate is the current prime lending rate plus 1%. Ultimately, the money is yours when you retire, yet to ensure that you don’t dip into the retirement fund due to its tax-free, penalty-free basis, you’re forced to pay the loan back.

Investment rules for a 401k are defined under the Internal Revenue Code . What this code does is dictate what is not allowed to be invested in under 401k terms. What the Code, specifically Section 408 and 4975, does is disqualify persons from certain types of transactions. These persons are defined as Disqualified Persons.

These rules are not to limit an investor’s investments.

Instead, the rules are there to stop anyone in control of a 401k from taking advantage of their power.

Fully Legal And Irs Compliant

In 1974, Congress enacted the Employee Retirement Income Security Act to shift the burden of building retirement assets from the employer to the employee. ERISA, when paired with specific sections of the Internal Revenue Code, makes it legal to tap into your eligible retirement accounts without an early withdrawal fee or a tax penalty.

Donât Miss: How To Do Your Own 401k

Recommended Reading: When To Rollover Your 401k

Your Plan May Allow You To But That Doesn’t Mean You Should

One of the biggest disadvantages of 401s is that you’re usually limited to a few investment options that have been selected by your employer and may or may not fit your needs. Historically, most workers had no other choice if they wanted to contribute to their 401s, but the rising popularity of 401 self-directed brokerage accounts is changing this.

More options aren’t always better, though, especially if you’re new to investing and are unsure what to choose. Below, I explain 401 brokerage accounts in more detail, along with who may want to consider them and who is better off staying away.

Image source: Getty Images.

How To Transfer A 401k

People have to evaluate all the options they have when theyre near retirement age. A gold IRA rollover might be possible in some cases, which means that they must assess their alternatives from early on.

Fortunately, clients can transfer their 401 k into a gold IRA, and it doesnt cost them any fees. However, the process is often challenging, so having expert help is the best way to go. First of all, the person should understand the difference between a 401 k rollover and a transfer.

A 401 k rollover happens when the client takes the funds from one account and puts them into another. Thus, they might get their 401 k and deposit the money into an IRA account.

Alternatively, transfers occur when a custodian deposits the money where it needs to be. Consequently, clients never really see it. Transferring is not expensive, but the person must have a trustee or custodian to be able to do it. Moreover, they should get expert help to make sure the process is straightforward.

Read Also: Financing Commercial Real Estate Investments

Recommended Reading: How Can I Rollover My 401k To Roth Ira

When Can I Withdraw From My 401 Plan

You can start to withdraw your savings penalty-free when you reach age 59 ½. Taking out your savings before that time could cost you an extra 10% on top of what youd normally pay in state and federal taxes.

When its time to start using your savings, be sure to consider the tax implications. In addition, once you turn 72, you typically have to withdraw a minimum amount annually to comply with distribution requirements

401 plans can be very useful tools in saving for retirement, particularly if you take advantage of features that your plan may offer to help maximize your savings. And the sooner you start saving in your 401 plan, the longer any investment earnings have to produce earnings of their own.

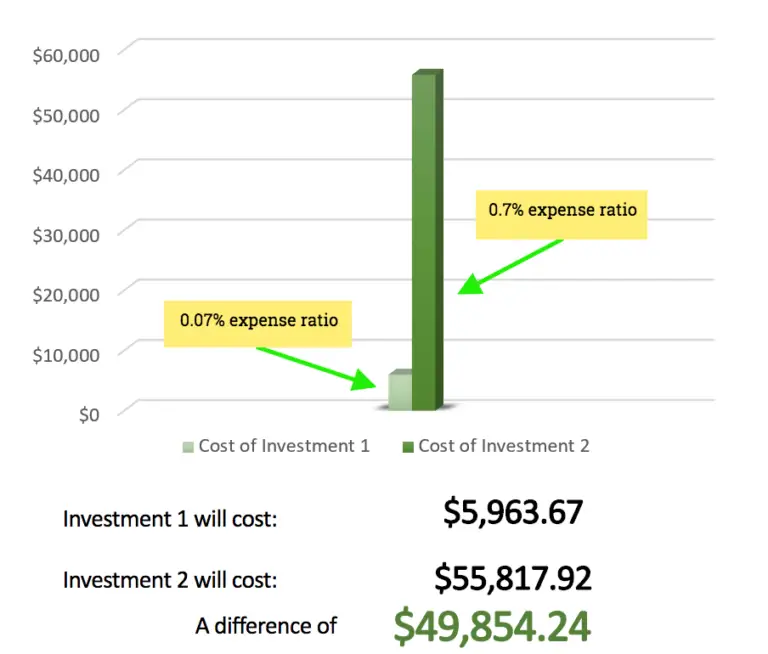

Be Aware Of The Fees Associated With Your Plan

The goal of investing in a 401 plan is to grow your money over time through investments. Because its an active investment , there are fees included. Your plan negotiates these fees on your behalf. They can include amounts needed to cover administrative costs and management expenses. While you dont have complete control over the fees in your 401 plan, its important to be aware of what youre paying. If youre choosing your own investments, look at fees and returns to ensure that you get what you pay for.

Recommended Reading: What Is The Contribution Limit For 401k