A High Bar For Maxing Retirement

In 2021, if your adjusted gross income exceeds $125,000 and youâre single , you wonât be able to contribute the full amount directly to your Roth IRA.

As an alternative, these savers can consider using a strategy known as the âbackdoor Roth,â where they make a non-deductible contribution with after-tax dollars to a traditional IRA and then convert it to a Roth.

They could also direct money to a Roth 401 plan at work, provided their employer offers it.

Thereâs a tax benefit to sprinkling some of your cash across Roth, tax-deferred accounts and taxable brokerage accounts: Youâre diversifying your tax treatment, which can help you manage your tax bill in retirement.

âMost people would simply save some money in both the tax-deferred and tax-free accounts,â Stolz said. âWe donât know what the future tax brackets will be, but youâre adding some opportunity to get tax favorable treatment across your portfolio.â

Read Also: How Much Money Should I Put In My 401k

Roth 401 Contribution Limits

The contribution limit for Roth 401s is much higher than those for Roth IRAs. However, Roth 401 contribution limits are the same as those for traditional 401s.

Individual Roth 401 contributions limit is $19,500 for 2021. Total contributions made by employees and employer matches to a Roth 401 are limited to $58,000.

Traditional 401s Vs Roth 401s

A 401 works best for someone who anticipates being in a lower income tax bracketin retirement compared with the one theyre in now. For example, someone currently in the 32% or 35% tax bracket may be able to retire in the 24% bracket.

Employers have been increasing tax diversification in their retirement plans by adding Roth 401s. These accounts combine features of Roth IRAs and 401s. Contributions go into a Roth 401 after you have paid taxes on the money. You can withdraw contributions and earnings tax- and penalty-free if youre at least age 59 1/2 and have owned the account for five years or more. Youll also be required to take minimum distributions from a Roth 401 once you turn age 72. However, you might be able to avoid RMDs if you can move the money from a Roth 401 into a Roth IRA, which has no required minimum distributions.

and a Roth 401, the total amount of money you can contribute to both accounts cant exceed the annual limit for your age, either $20,500 or $27,000 for 2022. If you do exceed it, the IRS might hit you with a 6% excessive-contribution penalty.)

Recommended Reading: How To Cash Out 401k Without Penalty

Read Also: Can I Borrow Against My 401k To Buy A House

What Is A Good 401 Contribution

Your ideal 401 contribution depends on several factors. If your employer offers a match, your first priority should be to contribute enough to get the full match. From there, you may want to max out a tax-free retirement account such as a Roth IRA before you finish maxing out your 401. If youre able to do all three of these, it can help you get the most out of your investments.

Dont Miss: How Much Will My 401k Pay Me Per Month

What Is An Ira

IRAs are tax-advantaged retirement savings accounts. There are several types of accounts, each with its own eligibility rules and contribution limits. Some contributions are tax deductible. Some withdrawals may be tax-free.

IRAs are unique compared with traditional savings vehicles because they have market exposure. You can own stocks, mutual funds, exchange-traded funds and other securities in an IRA, which can help your account value compound quickly compared to savings accounts, CDs and money market accounts.

The history of the IRA goes back to the 1960s and early 70s. According to Forbes, companies like Studebaker were struggling to pay pensions to thousands of workers. In 1974, the crisis led Congress to enact the Employee Retirement Income Security Act. This law created new regulations for pensions and retirement plans like the IRA. A new era of how people funded retirement was soon underway. Saving for retirement became the responsibility of individuals, not employers. Few companies continued to offer pensions.

See: 6 Things You Must Do When Planning For Retirement

You May Like: What Is The Benefit Of A Roth Ira Vs 401k

Can I Contribute To A 401 After Year End

A common question is whether you can contribute to your retirement savings plan after December 31. The answer is that because 401 contributions are made through payroll deductions, December 31 is the deadline.

However, if you have an IRA, you can contribute to that account up until the 2022 tax year filing deadline, which is April 18, 2023. The IRA contribution limit is $6,000 and the $1,000 catch-up contributionif you are 50 or oldertakes the total maximum contribution to $7,000.

How To Claim Your Retirement Savings

Normally, getting at your money can be difficult, and the rules are often imposed by the plan design rather than regulations.

For instance, regulations allow you to access the money without a bonus penalty by:

- Getting a hardship withdrawal before age 59 ½.

- Waiting until age 59 ½.

- Leaving your employer in the year you turn age 55 or after.

While most plans do have loan provisions, many dont allow hardship withdrawals, and some plans require that a person be terminated before accessing their money, even if they are 59 ½ or older.

Due to COVID-19, the Coronavirus Aid, Relief, and Economic Security Act, or CARES Act, made it easier to get at your money up to $100,000 in loans or distributions, if the plan allowed it. These withdrawals had to be taken before the end of 2020. If you took a hardship loan in 2020, you could avoid paying the 10 percent penalty on the money, as well as take the option to repay the loan tax-free over the next three years.

Unless youre really in a bind, Brewer advises against taking a distribution or a loan. Theres no replacing time in the market, she points out, and consistent saving over time is one of the best ways to build wealth for the future.

Don’t Miss: Can You Roll 401k Into Another 401k

Change In Business Name Affect On Contributions Question:

You can still setup the solo 401k in 2021 under your sole proprietor business. Next year in 2022, we can update the plan to list the new self-employed business. All else would remain the same . The 2022 annual solo 401k contributions would be based on your new self-employment income and you would have until 2023 to make those contributions.

How Much You Should Contribute With The New Contribution Limits

The IRS determines whether or not to increase its contribution limits based on an annual basis. Sometimes changes in the Consumer Price Index have been very small, like on the order of 2% per year. Congress prefers to increase contributions in increments of at least $500, which they did this year.

With the ability to increase your contributions by $500 in 2020, you may be wondering if you should. My answer is a resounding yes.

If you divide that amount into monthly contributions, youre making only slightly smaller payments which will benefit you in the long run. Continuing to max out your 401k at this level is an ideal strategy,

You May Like: Should I Open A 401k

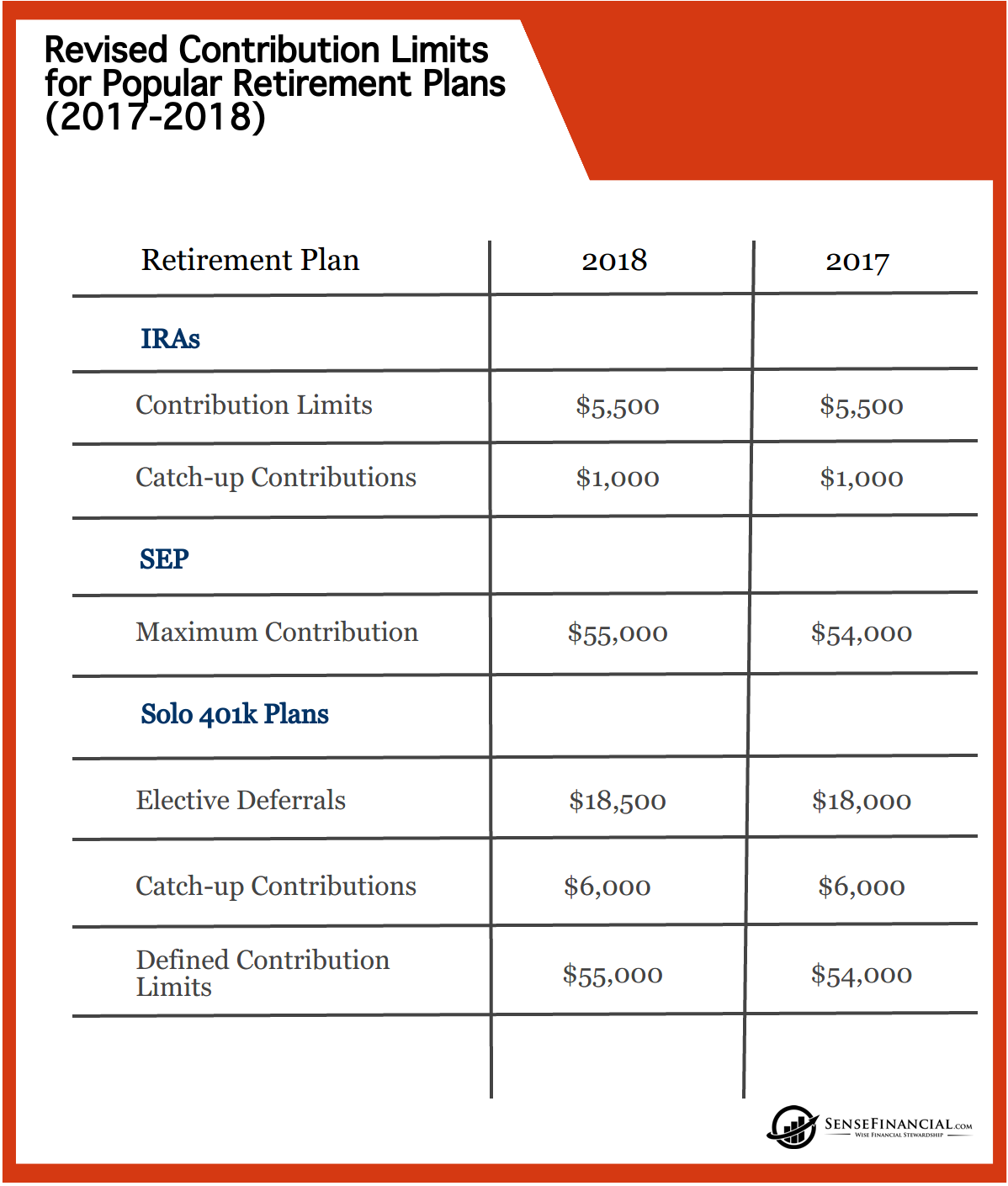

Annual Retirement Plan Limits

The IRS has announced changes to retirement plan limits for 2023

Each year the Internal Revenue Service announces the cost-of-living adjustments applicable for all types of qualified retirement plans and IRAs. The various annual contribution limitations and other important indexes which govern all plans either remain unchanged year-over-year or may rise depending on whether the Consumer Price Index meets a threshold level dictating an increase.

For 2023, highlights include:

- The contribution limit for employees who participate in 401, 403, most 457 plans, and the federal governments Thrift Savings Plan is increased to $22,500, up from $20,500

- The limit on annual contributions to an IRA increased to $6,500, up from $6,000

- The amount individuals can contribute to their SIMPLE retirement accounts is increased to $15,500, up from $14,000.

- The Annual Compensation Limit increased to $330,000, up from $305,000 .

The Retirement Plan Company is pleased to present this table for your convenience. Contact Us for more assistance.

Annual Compensation and Contribution Limits for Qualified Retirement Plans

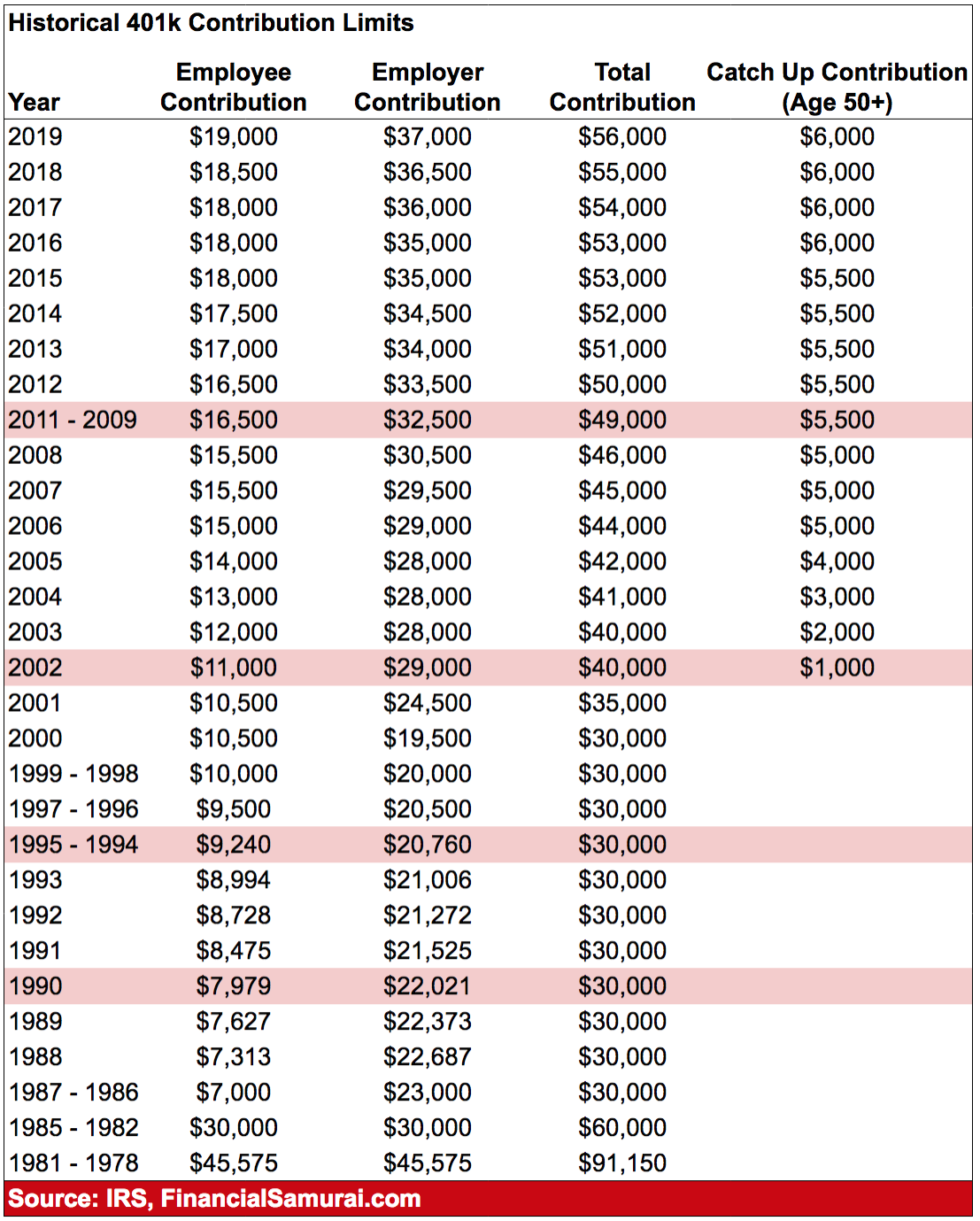

Contribution Limits For 2021 And 2022

When most people think of 401 contribution limits, they are thinking of the elective deferral limit, which is $19,500 in 2021 and $20,500 for 2022. This is the maximum amount you are allowed to voluntarily defer to your 401 for the year. Adults 50 and older are also allowed $6,500 in catch-up contributions, which are additional elective deferrals, in 2021 and 2022. This brings the maximum amount they can contribute to their 401s to $26,000 in 2021 or $27,000 in 2022.

The IRS also imposes a limit on all 401 contributions made during the year. In 2021, it rises to $58,000 and $64,500, respectively. In 2022, it rises to $61,000 and $67,500, respectively. This includes all your personal contributions and any money your employer contributes to your 401 on your behalf.

Highly paid employees have some additional limitations to keep in mind. Companies can elect to stop a participant’s salary deferrals once that person has earned $290,000 in 2021 or $305,000 in 2022, and companies use only that first amount to calculate employer matching contributions.

For example, say your company matches up to 6% of your salary and you earn $300,000 in 2021. Six percent of $300,000 is $18,000 however, your company can only match you up to 6% of $290,000, the maximum employee compensation limit for 2021. So rather than up to $18,000, you’d get up to $17,400 as an employer match.

Here’s a useful reference chart to help you remember these important limits and thresholds:

| Type of Contribution |

|---|

Read Also: When Can You Start Your 401k

Tools To Help Manage Your 401 Plan

There are several online tools to help you get the most out of your defined-contribution plans such as the 401, 401, 403, 457 and Thrift Savings Plan.

Personal Capital is one option. You can learn more in our Personal Capital Review, or visit their site for more information.

Blooom is another online 401 robo-advisor. Blooom oversees your 401 account and analyzes investing opportunities that you may not be aware of.

Blooom can help investors analyze their investment fees improve their diversification and find the right mix of stocks, bonds and other investments.

More About Robo-Advisors: Robo-advisors are automated platforms that use algorithms to guide your investment choices or manage your portfolio on your behalf. Learn more about them in our article, Best Robo-Advisors for Military Members.

How Much Salary Can You Defer If Youre Eligible For More Than One Retirement Plan

The amount of salary deferrals you can contribute to retirement plans is your individual limit each calendar year no matter how many plans you’re in. This limit must be aggregated for these plan types:

- SIMPLE plans plans)

If youre in a 457 plan, you have a separate limit that includes both employee and employer contributions.

Make sure you dont exceed your individual limit. If you do and the excess isnt returned by April 15 of the next year, you could be subject to double taxation:

- once in the year you deferred your salary, and

- again when you receive a distribution.

Read Also: Where To Invest 401k Money Now

Are There Income Limits For 401s

While there’s not a universal income limit on 401 contributions, in some cases the IRS does impose contribution limits on “highly compensated employees” when a company encounters disproportionate contribution levels among its workers. The IRS has a test that helps employers who sponsor 401 plans assess whether employees are participating in their plan at levels proportionate to their compensation.

If the test determines that people across compensation levels aren’t participating in a manner the IRS deems proportionate, employee contribution levels for highly compensated employees can be lowered. In these cases, your employer may need to return some of your excess contributions.

The IRS defines a highly compensated employee in one of two ways:

An individual who either owned more than 5% of the interest in a business at any time during the year or the preceding year, no matter how much they were paid.

An individual who received over $135,000 from the business in the preceding year in 2022, and, if the employer ranks employees by compensation, was in the top 20%.

How To Maximize Your 401 Retirement Savings

A workplace 401 account can be a powerful tool to help build your retirement savings. To maximize your 401 benefits, follow these tips:

1. Set your contribution level to take full advantage of your employers 401 match. If your company matches a certain percentage of your contributions, set your contribution level to take maximum advantage of the match. Otherwise, youre leaving money on the table.

2. Start contributing to your 401 immediately.

3. Take advantage of target-date funds. If youre overwhelmed by the investment options offered by your 401 plan, choose a target-date fund aligned with your anticipated year of retirement. Target date funds are optimized for your retirement timeline, making them great options for beginners or more hands-off investors.

4. Increase your 401 contribution percentage regularly. Each year, increase your 401 contribution rate by at least one additional percentage point. Gradual small increases have a minor impact on your take-home pay and a major impact on your retirement nest egg over time. In addition, if you receive any raises or bonuses, dedicate at least a portion of them to your savings.

Read Also: How To See My 401k Balance

Should You Be Maximizing Your 401 And Ira Contributions

With the annual 401 contribution limit rising, you might feel pressure to put more money into retirement savings. However, most people aren’t contributing up to the 401 limit anyways: a recent Vanguard report found that only 14% of people with Vanguard 401 accounts were contributing the maximum amount allowed. The majority of those people were making more than $150,000 annually.

And even having access to a 401 puts you in a better position than many in , 72% of public and private employees had access to some type of employer-sponsored retirement plan like a 401 or pension plan.

So if you’re wondering whether you need to contribute more money to your 401 or IRA now, it really depends on your individual finances. If your employer offers to match a percentage of your contributions, your first priority should be contributing enough to earn the match. By not taking advantage of the match, you’re essentially losing out on free money.

From there, if you have more money to invest, you’ll want to consider possibly opening up a Roth IRA to take advantage of the tax benefits it offers. You can contribute to both a 401 and Roth IRA at the same time, as long as you meet the income requirements of a Roth IRA. With a Roth IRA, contributions are taxed up front, so you don’t have to pay taxes on your investments or investment gains when you take distributions in retirement.

-

Offers informational articles to help users improve their understanding of investment strategies and market trends

Youre Our First Priorityevery Time

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

You May Like: How Can I Track My 401k Check

How To Get Started

Some brokers charge annual fees and commissions for your account, while others may have $0 annual fees and charge zero commission for purchases of securities like stocks, exchange-traded funds or mutual funds. Others may offer certain promotions and bonuses, such as a $200 cash bonus if you deposit $20,000 or some variation thereof. Do your research to decide which type of IRA is right for you and to find the best broker for you.

Does Employer 401k Match Count Towards The Annual Limit

Do you want to take advantage of a max contribution to a 401k? Do you know if your employers 401k match counts towards the maximum limit? The answer is yes, but does it count as a contribution from the individual, or does it count as an employer contribution? These two factors can make a huge difference.

Recommended Reading: How Do I Know If I Had A 401k

Where Should You Invest First Ira Or 401

Should you contribute to your 401 plan at the expense of contributing to a Roth or traditional IRA? I covered this topic in a previous article, Where Should You Invest First IRA or 401/TSP?

First, make sure youre contributing enough to your 401 or Thrift Savings Plan to maximize employer-matching contributions. Then, try to max out a Roth IRA if you are eligible to contribute to one.

This ensures you take advantage of the free money through your employers matching contributions while providing you the best of both worlds regarding current and future taxes. Tax flexibility is an important retirement planning tool.

If your company doesnt offer 401 matching contributions, you may consider contributing to a Roth IRA first, and then contributing to your 401.