Taking Withdrawals From A 401

Once money goes into a 401, it is difficult to withdraw it without paying taxes on the withdrawal amounts.

“Make sure that you still save enough on the outside for emergencies and expenses you may have before retirement,” says Dan Stewart, CFA®, president of Revere Asset Management Inc., in Dallas.”Do not put all of your savings into your 401 where you cannot easily access it, if necessary.”

The earnings in a 401 account are tax-deferred in the case of traditional 401s and tax-free in the case of Roths. When the traditional 401 owner makes withdrawals, that money will be taxed as ordinary income. Roth account owners have already paid income tax on the money they contributed to the plan and will owe no tax on their withdrawals as long as they satisfy certain requirements.

Both traditional and Roth 401 owners must be at least age 59½or meet other criteria spelled out by the IRS, such as being totally and permanently disabledwhen they start to make withdrawals.

Otherwise, they usually will face an additional 10% early distribution penalty tax on top of any other tax they owe.

Some employers allow employees to take out a loan against their contributions to a 401 plan. The employee is essentially borrowing from themselves. If you take out a 401 loan, please consider that if you leave the job before the loan is repaid, you’ll have to repay it in a lump sum or face the 10% penalty for an early withdrawal.

Account Minimums & Maintenance Fees

Note: many custodians have account minimums for Donor Advised Fund charitable accounts. However, for the purposes of this article, we will ignore those accounts.

Schwab, Fidelity, and TD Ameritrade have no minimum account balance or maintenance fees for investment accounts.

Vanguard has no minimum account balance or maintenance fees if you sign up for e-delivery services. However, if you receive paper statements, then they charge an annual maintenance fee. For most account types, this fee is $20 for each account where the total Vanguard assets you have in the account are less than $10,000.

Unfortunately, E-Trade does not clearly advertise if there is a minimum account balance for their retirement accounts, but they do advertise that there is no minimum account balance for brokerage accounts.

How Are They Different

| Employers provide a 401 to employees as a benefit | An IRA is an individual retirement account, so it belongs to you individually |

| Lowers your taxable income because most 401 contributions are made before taxes are taken out | Your traditional IRA contributions are made from your taxable earnings, you are then permitted to deduct the contributions from your income in certain situations |

| The employer selects the investment options offered in the plan | Typically offers a wider range of investment options than a 401 |

| The employer may match up to a certain percentage of your contribution | Isnt tied to your employer, so you dont get a match on your contributionhowever, you have more control and flexibility when and how you contribute |

| You may be able to roll over an old 401 from a previous job into the 401 at your current job | You can roll multiple outside accounts like old 401s or other IRAs into one IRA to simplify your savings |

Also Check: Where Should I Put My 401k Money After Retirement

Best For Active Traders: Td Ameritrade

TD Ameritrade

Most retirement-focused investors would do well to stick with a passive investment style. However, if youre into active investing, TD Ameritrade offers industry-leading platform options and tools.

-

Choose between multiple web, mobile, and desktop platforms

-

Access the advanced thinkorswim trading platform with no added costs

-

Roth contributions and 401 loans are supported

-

Accounts will move to Charles Schwab in the future

-

Advanced platforms may be overwhelming for newer traders

TD Ameritrade is another renowned discount brokerage and our choice as best for active traders. It offers an individual 401 account with no recurring fees and commission-free stock and ETF trades. Its solo 401 also supports Roth contributions and 401 loans, although you might want to check with the company if loans are still available. Its standout feature for active traders, though, is the thinkorswim active trading platform, which is available on desktop, mobile, and the web.

Before diving into other details, its important to note that this brokerage has been acquired by Charles Schwab. TD Ameritrade accounts will become Schwab accounts at some point in the future. However, as you can see from its review on this list, were fans of Schwab as well and look forward to seeing the combined capabilities once the integration is complete.

Read our full TD Ameritrade review.

How To Open A 401k Without An Employer

How do you open a 401 account without an employer plan? Many companies donât offer a 401. But there are many alternatives to save for retirement.

The 401 retirement plan is the most common way in which Americans save for retirement. However, according to a study by the US Census Bureau, only 14% of US employers offer a 401 through their company. That still results in over 70% of Americans contributing to a 401 plan. But if you find yourself working for a company that doesn’t offer a 401 plan, you might not know how to open a 401 without an employer plan.

If your company doesnât offer a 401 plan or you are self-employed, youâll need to join a separate financial institution. There youâll be able to open a 401, IRA, or any other retirement plan you choose.

In addition to these alternatives to 401s, you’ll want to rollover your old 401s to these accounts. Consolidating your 401s will help keep your retirement properly managed and accounted for.

Read Also: Is Fidelity A 401k Plan Administrator

Managing Your Retirement Funds

It’s important to start saving for retirement as soon as you begin earning income, even if you can’t afford to save that much at the beginning. The sooner you begin, the more you’ll accumulate, thanks to the miracle of compounding.

As your savings build, you may want to get the help of a financial advisor to determine the best way to apportion your funds. Some companies even offer free or low-cost retirement planning advice to clients. Robo-advisors such as Betterment and Wealthfront provide automated planning and portfolio building as a low-cost alternative to human financial advisors.

Is It A Good Idea To Take Early Withdrawals From Your 401

There are few advantages to taking an early withdrawal from a 401 plan. If you take withdrawals before age 59½, you will face an additional 10% penalty in addition to any taxes you owe. However, some employers allow hardship withdrawals for sudden financial needs, such as medical costs, funeral costs, or buying a home. This can help you skip the early withdrawal penalty but you will still have to pay taxes on the withdrawal.

Read Also: Where Can I Rollover My 401k To An Ira

Deadline To Set Up And Fund

- For taxable years 2020 and beyond, individual 401 plans may be set up by tax filing deadlines plus extensions. Note: It can take 30 or more days to establish a plan.

- Salary deferral portion of the contribution must be deducted from a paycheck prior to year end, with some exceptions for certain business structures.

- Business owner contribution may be made up through the business tax filing due date plus extensions.

Read Also: Can I Transfer Money From 401k To Ira

How Do Small Business Owners Choose The Best 401 For Their Needs

To find the right 401 for their small business, employers generally look for plan providers that:

- Charge reasonable plan and investment fees and have no hidden costs

- Provide real-time integration between the 401 recordkeeping and payroll systems to eliminate manual data entry and reduce errors

- Offer a simplified compliance process

- Make administrative fiduciary oversight available

- Offer ERISA bond and corporate trustee services

- Help with investment fiduciary services and plan investment responsibilities

- Make investment advisory services available for employees

You May Like: How To Find Your 401k

How A Simple Ira Works

The SIMPLE IRA follows the same investment, rollover, and distribution rules as a traditional or SEP IRA, except for its lower contribution thresholds. You can put all your net earnings from self-employment in the plan, up to a maximum of $14,000 in 2022, plus an additional $3,000 if you are 50 or older.

Employees can contribute along with employers in the same annual amounts. As the employer, however, you are required to contribute dollar for dollar up to 3% of each participating employee’s income to the plan each year or a fixed 2% contribution to every eligible employee’s income whether they contribute or not.

Like a 401 plan, the SIMPLE IRA is funded by taxdeductible employer contributions and pretax employee contributions. In a way, the employer’s obligation is less. That’s because employees make contributions even though there is that mandated matching. And the amount you can contribute for yourself is subject to the same contribution limit as the employees.

Early withdrawal penalties are hefty at 25% within the first two years of the plan.

Use Assessed Value Of Property For In

No. The taxes owed on the in-kind distribution of the land will be based on the fair market value of the land. As such, it would not necessarily be appropriate to use the assessed value . The most conservative approach would be to obtain a third party valuation such as an appraisal or at least an assessment from a professional such as an experienced realtor based on comps, etc. Ultimately, the governments concern is the underpayment of taxes especially from the distribution of property owned inside a solo 401k plan or a self-directed IRA.

You May Like: How To Take A Loan Against Your 401k

Is The Year To Take Your Maximum Tax Savings

Setting up a Solo 401k is a powerful tax planning tool. Solo 401ks are fully compliant with the IRS rules. With Nabers Group, the Solo 401k setup process is simple and straightforward.

Although it is the end of the tax year, as soon as you setup your Solo 401k, you will be entitled to make full employee and employer contributions up until your tax return date in 2022, plus extension dates.

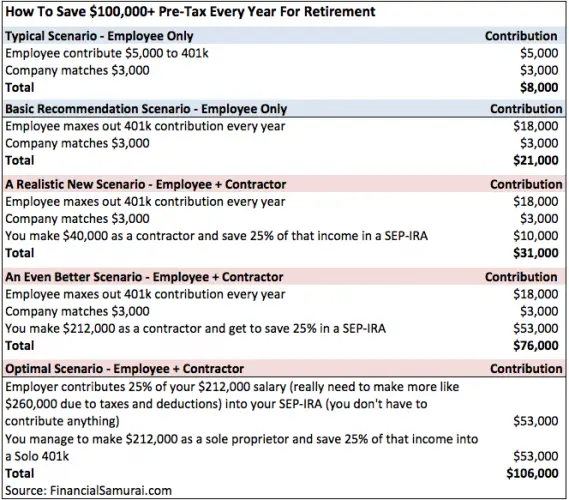

Contribution limits to a Solo 401k are remarkably high. For 2021, the max is $58,000 and $64,500 if you are 50 years old or older. This is up from $57,000 and $63,500 in 2020. This limit is per participant. If your spouse is also earning money from your small business that means they can also contribute up to the same amount into the Solo 401k. If you are both 50 years old or older, your joint contributions could be up to $129,000 per year!

Solo 401k contributions are much higher than all other retirement plans. Traditional and Roth IRA limits are just $6,000. The catch-up contribution is $1,000 more if you are 50 years old or older. The IRS increases contribution limits frequently as a cost of living to keep up with inflation. Therefore, its a good bet youll see Solo 401k contribution limits continue going up over time .

Also Check: How Many 100 Watt Solar Panels Do I Need

Choose An Account Type

Traditional 401s are standard at workplaces, but more employers are adding the Roth 401 option, too.

As with Roth IRAs versus traditional IRAs, the main difference between the two types of plans is when you get your tax break:

-

The regular 401 offers it upfront since the money is automatically taken out of your paycheck before the IRS takes its cut . Youll pay income taxes down the road when you start making withdrawals in retirement.

-

Contributions to a Roth 401 are made with post-tax dollars , but qualified withdrawals are tax-free

-

Investment earnings within both types of 401s are not taxed

Another upside to the Roth 401 is that, unlike a Roth IRA, there are no income restrictions to limit how much you can contribute.

The IRS allows you to stash savings in both a traditional 401 and Roth 401, which can add tax diversification to your portfolio, as long as you dont exceed the annual maximum contribution limits of $20,500 in 2022 .

You May Like: How To Do A Hardship Withdrawal 401k

Research Retirement Options For Your Business

It’s important to do your due diligence in researching firms that provide recordkeeping and third-party administration services for 401 plans. As you assemble your list, include a range of established, reputable mutual fund companies, brokerage firms, and insurance companies. Focus on providers that can serve you and your employees long-term with extensive resources and excellent customer service.

You may also want to hear from owners of businesses that are similar to yours, as they may be able to offer insights from their own experiences selecting 401 plan service providers.

Rules Change Regarding Offering Solo 401k Plan To Par

QUESTION 5: Have the rules changed for 2020 regarding whether I can still fund my solo 401k if I have two part-time employees that work less than 1000 hrs/year, but more than 500 hrs/year? Would I have to open up retirement accounts for them?

ANSWER: In short yes resulting from the SECURE Act, but it would be for those part-time employees who satisfy the new rule by 2024. Effective for tax year 2021 , solo 401k plans will need to be offered to part-time employees who have three consecutive 12-month periods of 500 hours of service and who satisfy the plans minimum age requirement. Hours of service during 12-month periods beginning before January 1, 2021, are not taken into account for this rule. We are waiting for the IRS to release more guidance on this new rule in 2020. See Section 112 of the ACT for more information.

Last Weeks Most Popular Solo 401k FAQs

You May Like: When Can You Access 401k

You May Like: Can You Open Up Your Own 401k

How Much Money Do You Need To Retire

According to the Department of Labor, experts say most people need around 70% to 90% of their pre-retirement income to maintain the same standard of living after they stop working full time.

But ultimately, the amount youâll need to have saved depends on a variety of factors, including what your annual contributions to retirement savings plans are, what other sources of savings and income you have, and the lifestyle you want after you stop working.

How To Invest Your 401

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandheres how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks or securities.

Nothing is more central to your retirement plan than your 401. It represents the largest chunk of most retirement nest eggs.

Finding the money to save in the account is just step one. Step two is investing it, and thats one place where people get tripped up: According to a 2014 Charles Schwab survey, more than half of 401 plan owners wish it were easier to choose the right investments.

Heres what you need to know about investing your 401.

Also Check: How Can You Take Out Your 401k

Read Also: What Is The Interest Rate For Borrowing From 401k

If You And Your Spouse Are Each Opening A Schwab Account

If you and your spouse are each opening the new investment-only account with Schwab to get into traditional equities, then youll open the Company Retirement Account Master Account as well as participant sub-accounts .

Each participant will keep his money separate in his own Schwab participant account under the master account for the Company retirement account. Youll each have a distinct login and keep the Schwab funds separate.

Complete the Company Retirement plan application:

Include the first 4 pages of your Adoption Agreement and your trust document. These documents can be found in your 401k documents, located on your 401k dashboard.

Complete one Participant application per spouse:

You May Like: How To Find Out How Much Is In My 401k

How To Open A Td Ameritrade Account For The Solo 401k

Each brokerage house is different in how they classify their investment-only accounts and applications can update at any time. We have made our best efforts to provide you the most up to date applications here, but please check with TD Ameritrade to ensure you have the right application to open an investment-only brokerage account under your Solo 401k plan and trust.

Its important to remember youre not opening a TD Ameritrade 401k. Rather, your 401k plan and trust are opening an investment-only account with TD Ameritrade.

TD Ameritrade calls these types of accounts Trust accounts and they are designed to work with your Solo 401k.

Read Also: How To Borrow Against 401k Fidelity

Also Check: How To Roll Roth 401k To Roth Ira

To Mail Contributions To Fidelity

Fidelity InvestmentsCincinnati, OH 45277-0003

Types Of Retirement Accounts

There are many different types of retirement accounts, and each one has rules and regulations for things like contributions and withdrawals.

Here are some basics about four common types of retirement savings plans.

401 Plans

A 401 is an employer-sponsored retirement plan. With a traditional 401, you can automatically contribute a percentage of your paycheck before itâs taxed. And you wonât have to pay taxes on contributions or earnings until you withdraw funds from the account.

A Roth 401, on the other hand, is funded with money thatâs already been taxed. So qualified withdrawals are tax-free.

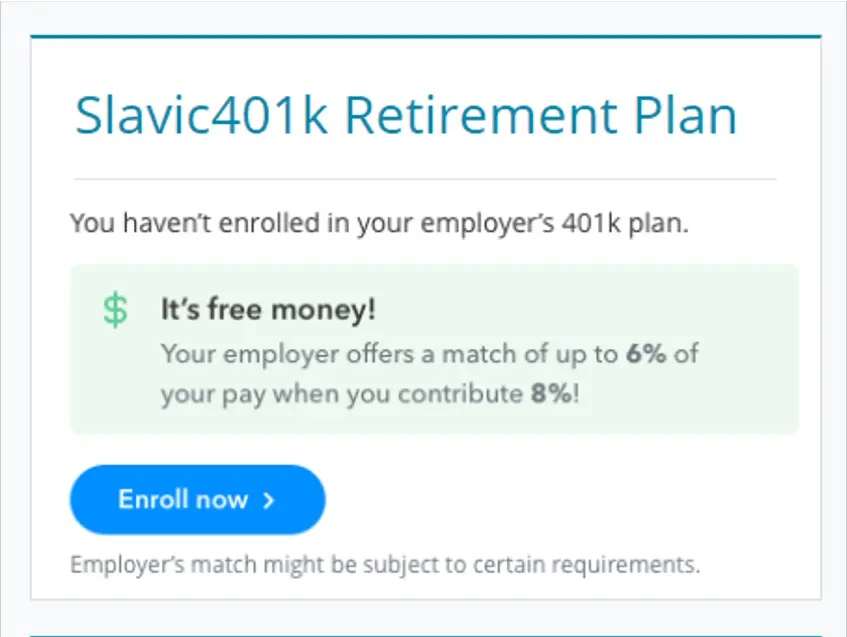

In some cases, your employer may match your 401 contributions up to a certain limit. That can help you increase your savings potential. But there might be a vesting period before you can access the employer-matched funds.

You also get to choose how your 401 is invested. Depending on the provider, you may have a menu of investment options to pick from. And you may even have access to free financial guidance through your provider. But all plans and providers are different.

401 plans also have some requirements and limitations that you should be aware of, including:

403 Plans

403 plans are a lot like 401 plans. For one, theyâre also employer-sponsored. But theyâre offered by public schools and certain tax-exempt organizations. You may have heard 403 plans referred to as tax-sheltered annuity plans or tax-deferred annuity plans.

Traditional IRAs

Roth IRAs

Read Also: How Much Should You Be Contributing To Your 401k