The Maximum You Can Put Into A 401 In 2022

-

If youre under age 50, your maximum 401 contribution is $20,500 in 2022.

-

If youre 50 or older, your maximum 401 contribution is $27,000 in 2022, because you’re allowed $6,500 in catch-up contributions.

For 2022, your total 401 contributions from yourself and your employer cannot exceed $61,000 or 100% of your compensation, whichever is less.

Employers who match employees’ 401 contributions often do so between 3% and 6% of the employee’s salary. So if you make $50,000, and contribute 5% of your salary , and your employer matches that full 5%, you’ll add $5,000 to your balance each year.

Traditional Vs Roth 401k Contribution Limits

Some employers offer both a traditional 401k and a Roth 401k, but whats the difference between each? Lets walk through the differences between both account types so you can decide which type works best for your needs.

- Roth 401k: A Roth 401k refers to an employer-sponsored savings plan that gives you in which you can invest after-tax dollars for retirement. The perk to investing in a Roth 401k: You pay taxes on your money ahead of time, which means that you wont pay any taxes on your contributions after you take withdrawals after you reach age 59 ½ as long as the account has been funded for at least five years. All of your accumulated contributions and earnings come out tax free.

- Traditional 401k: A traditional 401k refers to an employer-sponsored plan that gives you the option to defer paying income tax on the amount you contribute for retirement. For example, lets say you earn $50,000 and max out your retirement plan at $19,500. Assuming you have no other deductions, your taxable earnings will reduce from $50,000 to $30,500. .

Wondering whether you should invest in both? You might want to take a tax-diversified approach because it could allow you to invest in many types of assets and allow you to diversify your savings. You can contribute to both a Roth and a traditional 401k plan as long as your total contribution doesnt go over $19,500 in 2021 and $20,500 in 2022.

Key Employee Contribution Limits That Remain Unchanged

The limit on annual contributions to an IRA remains unchanged at $6,000. The IRA catch-up contribution limit for individuals aged 50 and over is not subject to an annual cost-of-living adjustment and remains $1,000.

The catch-up contribution limit for employees aged 50 and over who participate in 401, 403, most 457 plans, and the federal government’s Thrift Savings Plan remains unchanged at $6,500. Therefore, participants in 401, 403, most 457 plans, and the federal government’s Thrift Savings Plan who are 50 and older can contribute up to $27,000, starting in 2022. The catch-up contribution limit for employees aged 50 and over who participate in SIMPLE plans remains unchanged at $3,000.

Details on these and other retirement-related cost-of-living adjustments for 2022 are in Notice 2021-61PDF, available on IRS.gov.

Also Check: What Is The Tax Rate On A 401k

What Are The 401 Contribution Limits For 2021 And 2022

8 Min Read | Dec 17, 2021

What if you had access to the same type of investing account millionaires use to build their wealth? Youd jump on the chance, right? Well, you do! Believe it or not, millionaires dont roll the dice on flashy investment trends. Nope! More than anything else, they invest money in their humble, unflashy 401 plan at work.

Thats right! According to The National Study of Millionaires, eight out of 10 millionaires invested in their companys 401 plan. They put money into their accounts month after month, year after year, until one day they looked up and their net worth was in the seven figures. And if they can do it, you can too!

Your 401 is an easy and effective way to put thousands of dollars away each year for retirement. So if youre one of the millions of Americans with access to a 401, dont take it for granted!

But just how much can you put into your 401 in 2021 and 2022? Lets take a look.

401 Contribution Limits For 2021

|

The 401 contribution limit is $19,500. |

|

The 401 catch-up contribution limit for those age 50 and older is $6,500. |

|

The limit for employer and employee contributions combined is $58,000. |

|

The 401 compensation limit is $290,000.1 |

401 Contribution Limits For 2022

|

The 401 contribution limit is $20,500. |

|

The 401 catch-up contribution limit for those age 50 and older is $6,500. |

|

The limit for employer and employee contributions combined is $61,000. |

|

The 401 compensation limit is $305,000.2 |

Plans Are An Important Retirement Tool That Employees Can Use To Contribute To Their Retirement Savings This Article Will Inform You About The 401 Plan Changes

The 401 contribution limit is the maximum amount employees can contribute to their retirement plan each year. The IRS has released new limits for retirement accounts in the United States. The new limits are based on the cost of living increases and will take effect in 2023. A few changes will impact 401 accounts.

As a worker, you may be wondering if the 401 contribution limit increases for 2023 will apply to you. The limit increases for this plan year will apply to participants aged 50 and up.

Don’t Miss: What Can You Do With A 401k

How Solo 401 Contribution Limits Work

If youre a self-employed individual, you must calculate the maximum amount of elective deferrals and nonelective contributions you can make. When figuring out your contribution, your compensation is your earned income, or, your net earnings from self-employment after deducting both:

-

Contributions for yourself

-

One-half of your self-employment tax

Keep in mind that self-employed individuals must often pay the employer costs associated with 401 plans, typically including a one-time start-up fee, as well as a monthly account maintenance fee. You must also pay fees on the specific stocks and bonds you purchase with your 401 investments .

For more information, refer to the IRS table and worksheets found in Publication 560, Retirement Plans for Small Business.

Maximum 401 Contribution Limits

Many employers offer 401 matching contributions as part of their benefits package. With a 401 match, your employer agrees to duplicate a portion of your contributions, up to a certain percentage of your salary. In addition to matching contributions, some employers may share a percentage of their profits with employees in the form of non-matching 401 contributions.

While an employers 401 match and non-matching contributions dont count toward your $19,500 employee deductible contribution limit , they are capped by total contribution limits.

Total 401 plan contributions by both an employee and an employer cannot exceed $58,000 in 2021 or $61,000 in 2022. Catch-up contributions for employees 50 or older bump the 2021 maximum to $64,500, or a total of $67,500 in 2022. Total contributions cannot exceed 100% of an employees annual compensation.

Also Check: What Is The Best Place To Rollover A 401k

Employer Match And You

Employer match programs are a way for employers to keep employees happy and cared for. Theyre also a way to retain employees. Thats because many matching programs come with a vesting schedule. This means that you dont have access to the full matching funds until youve been with the company for a certain period of time. The prospect of losing out on that money may keep an employee around longer.

In almost all cases, it makes sense to max out your employers matching offer. This is effectively free money, and all you have to do to get it is to be a responsible saver.

With that said, you shouldnt contribute more than you can actually afford. Saving for retirement is crucial, yes, but you shouldnt max out your contributions by overpaying your mortgage or building an emergency fund. Thats especially true if you dont think youll stay with the company long enough to have it fully vest. After all, this would reduce the benefit of matching. Still, if its financially feasible for you to max out your matching, do it.

Limits For Highly Paid Employees

If you earn a very high salary, you may be considered a highly compensated employee , subject to more stringent contribution limits. To prevent wealthier employees from benefiting unfairly from the tax benefits of 401 plans, the IRS uses the actual deferral percentage test to ensure that employees of all compensation levels participate proportionately in their companies’ plans.

If non-highly compensated employees do not participate in the company plan, the amount that HCEs can contribute may be restricted.

Read Also: Where To Invest Your 401k

Compensation Limit For Contributions

Remember that annual contributions to all of your accounts maintained by one employer – this includes elective deferrals, employee contributions, employer matching and discretionary contributions and allocations of forfeitures, to your accounts, but not including catch-up contributions – may not exceed the lesser of 100% of your compensation or $61,000 for 2022 . This limit increases to $67,500 for 2022 $64,500 for 2021 $63,500 for 2020 if you include catch-up contributions. In addition, the amount of your compensation that can be taken into account when determining employer and employee contributions is limited to $305,000 for 2022 $290,000 in 2021 .

Higher 401 Contribution Limits Mean Little To Many Workers

While Americans can stash away gobs more money in their retirement accounts next year, a huge swath of workers wont benefit from the huge increase in the annual contribution limit for 401s and similar workplace retirement plans.

Thats because 45% of American households dont have these types of retirement accounts, according to Federal Reserve data, while a quarter of those surveyed have no retirement savings or pension at all. Even those who do have access to these plans dont sock away nearly enough to come close to the maximum contribution.

That means the generously higher limit won’t help close the shortfall in retirement savings of many millions of Americans, who will likely rely more heavily on Social Security to make ends meet in old age.

The system is benefiting the wealthy, Joanna Ain, associate director of policy at Prosperity Now, told Yahoo Money. It’s terrific that were increasing these amounts for tax-deferred retirement account savings, but these are not the households I stay awake at night worrying about. We have so many low-income families and households that are not at the point where they’re even starting to think about retirement.

Last month, the Internal Revenue Service announced record high maximum annual contributions to 401 and similar retirement accounts. Workers who have a 401, 403, most 457 plans, and the federal government’s Thrift Savings Plan can contribute up to $22,500 next year, up 9.7% from the limit of $20,500 this year.

Also Check: How Can You Check Your 401k

What Happens If You Contribute Too Much To Your 401

If your 401 contributions exceed the limits above, you may end up being taxed twice on your excess contributions: once as part of your taxable income for the year that you contribute and a second time when you withdraw from your plan. Earnings still grow tax-deferred until you withdraw them.

If you realize you contributed too much to your 401, notify your HR department or payroll department and plan administrator right away. During a normal year, you have until your tax filing deadlineusually April 15to fix the problem and get the money paid back to you.

Excess deferrals to a 401 plan will have to be withdrawn and returned to you. Your human resources or payroll department will have to adjust your W-2 to include the excess deferrals as part of your taxable income. If the excess deferrals had any earnings, you will receive another tax form that you must file the following tax year.

Access to thousands of financial advisors.

Expertise ranging from retirement to estate planning.

Match with a pre-screened financial advisor that is right for you.

Answer 20 questions and get matched today.

Connect with your match for a free, no-obligation call.

Why Are There Limits On 401k Contributions

You might be wondering why there are 401k limits in the first place, and youre not wrong to question this stipulation. Youre contributing your own money after all, right?

Since 401k contributions have certain tax advantages, the IRS places a limit on how much you can put in your account to limit taxpayer payout and prevent wealthier employees from benefitting more than the average worker.

As we discussed before, the contribution limits can vary depending on the kind of retirement plan, age, and whether an individual is considered a highly compensated employee.

Also Check: How Much 401k Should I Have At 40

Where Should You Invest First Ira Or 401

Should you contribute to your 401 plan at the expense of contributing to a Roth or traditional IRA? I covered this topic in a previous article, Where Should You Invest First IRA or 401/TSP?

First, make sure youre contributing enough to your 401 or Thrift Savings Plan to maximize employer-matching contributions. Then, try to max out a Roth IRA if you are eligible to contribute to one.

This ensures you take advantage of the free money through your employers matching contributions while providing you the best of both worlds regarding current and future taxes. Tax flexibility is an important retirement planning tool.

If your company doesnt offer 401 matching contributions, you may consider contributing to a Roth IRA first, and then contributing to your 401.

Can I Contribute 100 Percent Of My Salary To A 401

If your earnings are below $20,500, then the most you can contribute is the amount you earn. It should also be noted that a 401 plan document governs each particular plan and may limit the amount that you can contribute. This applies especially to highly compensated employees, which in 2022 is defined as those earning $135,000 or more or who own more than 5 percent of the business.

Sponsors of large company plans must abide by certain discrimination testing rules to make sure highly compensated employees dont get a lopsided benefit compared to the rank and file. Generally, highly compensated employees cannot contribute higher than 2 percentage points of their pay more than employees who earn less, on average, even though they likely can afford to stash away more. The goal is to encourage everyone to participate in the plan rather than favor one group over another.

There is a way around this for companies that want to avoid discrimination testing rules. They can give everyone 3 percent of pay regardless of how much their employees contribute, or they can give everyone a 4 percent matching contribution.

Also Check: Can You Buy Gold With 401k

Employer And Employee 401k Contribution Limits

You cannot go over a specified limit for 401k contributions, which applies to the sum of elective deferrals , employer matching contributions, employer nonelective contributions and allocations of forfeitures. Well define all of these below.

- Elective deferrals: Elective deferrals refer to amounts of money you elect to transfer from your pay and into your employers retirement plan.

- Employer matching contributions: Employer matching contributions refer to contributions your employer makes to your retirement plan account if you contribute to the plan from your salary. Heres an example of a common 401k match plan formula: 50 cents on the dollar up to 6% of the employees pay. Not taking advantage of the match means you dont get free money, so its always advantageous for you to get the match!

- Employer nonelective contributions: When an employer makes a contribution to an employee in an employer-sponsored retirement plan , these are employer nonelective contributions.

- Forfeitures: Forfeitures hold employer contribution amounts that accrue when you leave the plan and youre not fully vested in the plan. Vesting means that you own the money in your plan. If youre not fully vested and you leave your job, your company can take the money in your plan.

She calls Personal Capitals blend of technology and personal advice more 21st century. She added, I dont need a company with walnut-paneled offices. Its a modern, intelligent approach.

Working With Your Financial And Tax Professionals

A 401 plan can become the cornerstone of a personal retirement savings program, providing the foundation for future financial security. Consult your financial and tax professionals to help you determine how your employer’s 401 and other savings and investment plans could help make your financial future more secure.

Important NoteEquitable believes that education is a key step toward addressing your financial goals, and we’ve designed this material to serve simply as an informational and educational resource. Accordingly, this article does not offer or constitute investment advice and makes no direct or indirect recommendation of any particular product or of the appropriateness of any particular investment-related option. Your needs, goals and circumstances are unique, and they require the individualized attention of your financial professional. But for now, take some time just to learn more.

Please be advised that this material is not intended as legal or tax advice. Accordingly, any tax information provided in this material is not intended or written to be used, and cannot be used, by any taxpayer for the purpose of avoiding penalties that may be imposed on the taxpayer. The tax information was written to support the promotion or marketing of the transactions or matter addressed and you should seek advice based on your particular circumstances from an independent advisor.

What’s the next step for you?

A financial professional can help you decide. Let’s talk.

Also Check: How Do You Withdraw From Your 401k

Contribution Limits For Highly Compensated Employees

Some 401 plans have extra contribution limits on employees who are highly compensated. plan and you are a high earner, these limits may not apply to you.)

Highly compensated employees can contribute no more than 2% more of their salary to their 401 than the average non-highly compensated employee contribution. That means if the average non-HCE employee is contributing 5% of their salary, an HCE can contribute a maximum of 7% of their salary. In addition to the federal limit, your company may have specific caps established to remain compliant.

The IRS determines you are a HCE if:

Either you owned 5% or more of a company last year and are participating in its 401 plan this year.

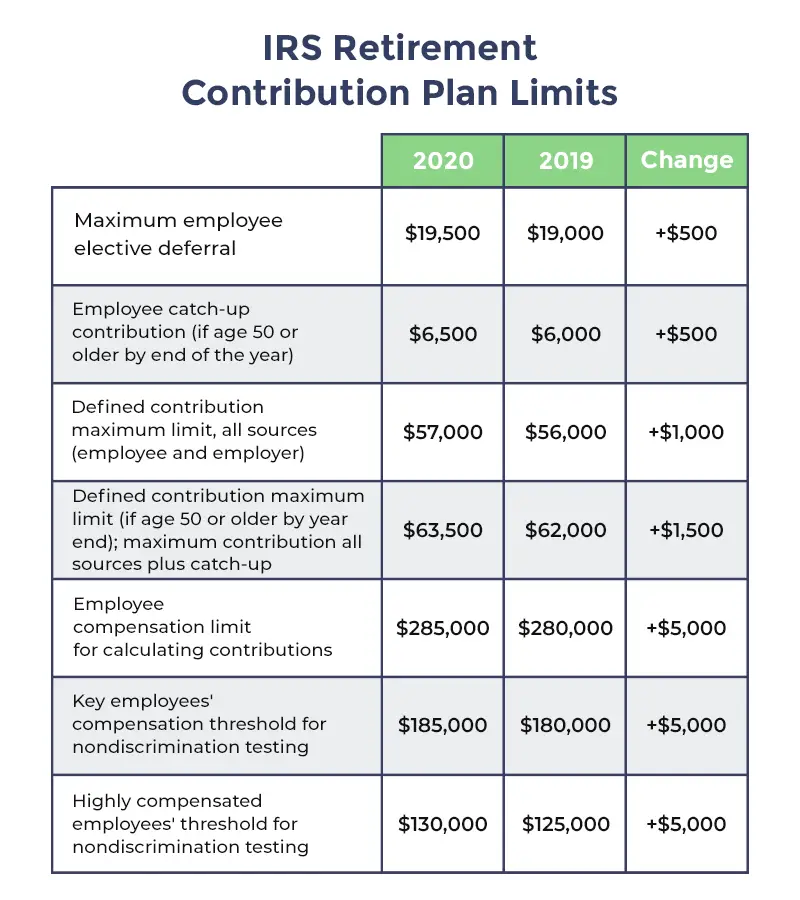

Or you earned $130,000 or more in 2020 from a company with a 401 plan youre participating in this year.

Unlike most other 401 limit guidelines, HCE classifications are based on your status from the previous year. For the 2022 plan year, the employee compensation threshold is $135,000.

If HCE contribution rates exceed non-HCE contribution rates by more than 2%, companies workplace retirement plans may lose their tax-advantaged status. As a HCE, you may be prevented from contributing to your 401 to the employee contribution max due to low 401 participation rates. You should still be able to make catch-up contributions on top of your HCE cap if you are eligible, though.

Related:Find A Financial Advisor In 3 minutes