The Retirement Projection Section Of Your 401 Statement

As you look at your account balance, you may be wondering how it translates to monthly income in retirement. The Retirement Projection section of your 401 statement should outline a projected account balance at age 65 and an estimated monthly income over the course of 25 years.

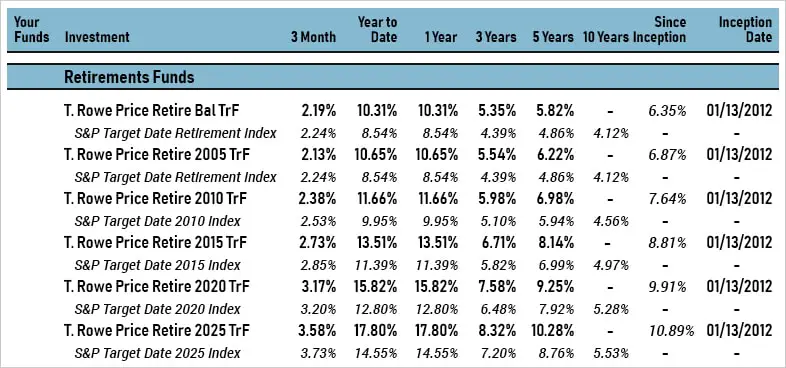

Keep in mind, this projection is only an estimate and is based on several assumptions, such as that you will make the same deferral and match percentages, you wont make early withdrawals, and you will earn a projected 6% annual rate of return.

What Is A 401

A 401 is an employer-sponsored retirement plan enabling workers to save money in a tax-deferred way. Often employers will match contributions up to a percentage of salary. Its just like any other retirement plan in the sense that youre trying to save money and reduce taxes as you do it. Like an IRA, you will pay taxes once you start taking withdrawals in retirement.

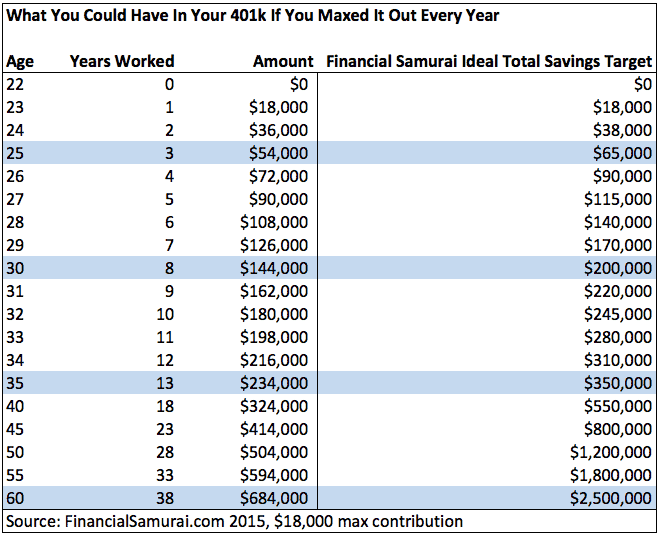

If you opted for it when you were hired, every paycheck a percentage of your salary is taken out and put into a 401 retirement account. Your employer may add some more money, maybe even the same amount, on top of that. That money is usually invested, and has been accumulating. How much is in there?

There are different types of 401s. A Roth 401 operates much in the same fashion as a Roth IRA. While still employer-sponsored, it uses after-tax income to fund itself, so you pay the taxes now, and not later in retirement. While one can deliberate the merits of which to use, the general consensus is that a Roth format is useful if one believes they will be in an higher tax bracket later in life when withdrawing from their retirement accounts.

Conversely, a traditional 401 advocate might argue that the ability to put more money into an account in the beginning and through time, allows the saver to make the most of compound interest.

Read more about how a 401 works in this article from TheStreet.

How Do I Receive Money From Moneygram To My Bank Account

MoneyGram allows you to send money directly to a bank account or mobile wallet in select countries. To find out if you can send money to your receivers bank account or mobile wallet, start sending money or estimate fees from the homepage, and select Direct to Bank Account or Account Deposit as your receive option.

You May Like: How Do You Withdraw From 401k

Read Also: Can You Rollover Partial 401k To Ira

Can I Add Or Remove Accounts From The Report I’m Viewing

Yes. You can customize the statement you’re currently viewing to include other accounts by clicking the Add or Remove Accounts link near the top of the statement. The accounts must share the same statement start and end date. You must select at least one eligible account to view a statement.

Adding or removing accounts this way changes the set of accounts that appears on your statement for the current viewing only. You can also permanently group the accounts that appear on your statements.

Note: this option is not currently available for your annuity accounts.

How To Measure Twice & Keep Finance Personal

To fully understand your employers 401 plan, ask your plan administrator for a copy of the Summary Plan Description . This document details your plans eligibility requirements, contributions/rollovers, vesting, and in-service distribution rules .

Ask your plan administrator if there is a dedicated investment advisor to help you align your risk tolerance with your risk capacity when choosing your funds. The plan administrator and investment advisor have a fiduciary responsibility to act in the best interest of the plan participants, so do not hesitate to ask questions or request more information about your retirement plan.

Review your retirement accounts individually but also together as a total portfolio, ensuring that each account is playing a different role but collaboratively aligned with your familys unique objectives and desired outcomes.

Recommended Reading: When Do You Have To Take Money Out Of 401k

What Is Lifetime Income And Why Is It Important

These new illustrations were supposedly designed to help you address the nagging doubts you have about your money and retirement.

Research has shown that almost everyone is worried about having enough for retirement. But, very few people understand how their lump sum of savings translates into a monthly retirement paycheck.

The math is especially complicated when trying to account for unknowns like rates of return, inflation, and how long you are going to live.

NOTE: The NewRetirement Planner provides you with this analysis. The Planner puts financial wellness into your own hands with comprehensive inputs and beautiful detailed analyses, including various charts that help you to understand a complete view of your retirement income and how well it meets your spending needs.

What If You Are The Beneficiary Of A 401 Plan

If you are the beneficiary of a 401 plan, youll have a little bit different set of rules that apply to taking money out of the 401 plan. Your choices will depend on whether you were the spouse or non-spouse of the 401 plan participant and whether the 401 plan participant had reached age 70 1/2the age for required minimum distributions .

If you or your spouse turned 70 1/2 before Jan. 1, 2020, the age for RMDs is still 70 1/2. If you or your spouse turned 70 1/2 on or after Jan. 1, 2020, the age for RMDs is 72.

Recommended Reading: How Do I Get Access To My 401k

Don’t Miss: Where Do You Check Your 401k

Withdrawing Funds Between Ages 55 And 59 1/2

Most 401 plans allow for penalty-free withdrawals starting at age 55. You must have left your job no earlier than the year in which you turn age 55 to use this option. You must leave your funds in the 401 plan to access them penalty-free. But there are a few exceptions to this rule. This option makes funds accessible as early as age 50 for many police officers, firefighters, and EMTs.

Make sure to understand the rules around the age requirement for penalty-free withdrawals. For example, the age 55 rule wont apply if you retire in the year before you reach age 55, and your withdrawal would be subject to a 10% early withdrawal penalty tax in this case.

The age 55 and up retirement rule wont apply if you roll your 401 plan over to an IRA. The earliest age to withdraw funds from a traditional IRA account without a penalty tax is 59. 1/2.

You might retire at age 54, thinking that you can access funds penalty-free in one year. It doesnt work that way. You must wait one more year to retire for this age rule to take effect.

Also Check: What Is A 401k Annuity

Where Is My 401

When you leave your employer you have three options for the money youâve accumulated in your old 401 account. You can either:

- Leave it alone and keep it in the same account

- Roll over the funds to your new employerâs 401 plan or

- Roll over the funds to an IRA.

Most people leave their 401âs alone, either from neglect or they donât bother with facilitating the transfer.

You can rollover your old 401 funds to an IRA as soon as youâd like. If your IRA is already set up then it can accept the funds immediately.

However, if your new employer implements a waiting period before you can participate in their 401 program, then you have no choice but to leave it alone until youâre eligible.

This is where things fall through the cracks. Unattended 401âs can end up in a few different places: the old account you have with your former employers, an automatic safe harbor rollover account set up by your plan, the unclaimed property department in the state, or your old 401s could have been cashed out already if the balance was less than $5,000 when you left the job.

Read Also: Can I Get A 401k

Search For Unclaimed Retirement Benefits

When all else fails, search for yourself in the National Registry of Unclaimed Retirement Benefits. Not all employers participate in this service, but many do because it provides benefits that help them meet their legal requirements. It’s a free service, and it only requires your Social Security number.

Merrill Lynch Walmart 401k Terms Of Withdrawal

The merging of the former employers 401k is very simple. The IRA for the renewal of Wrath is the choice you want to get an IRA, and then just contact them to combine with an IRA rollover. The main reason why the IRA rollover is very simple to set up is because financial organizations really need your organization. The IRS knows this, and in the end, the end of age will be exactly the same, so what is the purpose of wasting time and money on this problem.The plan will create another account for alternative beneficiaries and will provide alternative beneficiaries with the right investment opportunities available to the various participants. Or search for your online business plan in BrightScope. The plan may be that it meets your definition of difficulty, such as funds to prevent expulsion or confiscation in your principal residence.

Also Check: When Can You Take Out Your 401k Without Penalty

How Long To Keep 401k Statements

Keeping your 401 statements is a good idea to help keep track of your retirement savings. It also can help keep your retirement funds in your hands.

Given the tax-deferred nature of 401s, itâs possible the contributions you make to a 401 and its balance could be subject to review by the IRS. Although highly unlikely, itâs important to be prepared for such cases. To ensure youâre able to navigate any IRS audits or to simply keep track of your 401âs performance, itâs essential to hold onto copies of your 401 statements. But how long do you need to keep your 401 statements?

How long you keep your 401 statements is up to you. For tax purposes, youâll want to hang onto your 401 statements for at least seven years. However, itâs a good idea to keep your 401 statements for as long as you have money in the account. Once youâve withdrawn all of the funds out of a 401 or have closed the account and rolled over the funds to another retirement account, youâll be fine to discard your old 401 statements.

Thereâs more to saving your 401 statements than just filing away the documents you receive in the mail. Your 401 plan will send you different statements, and knowing the best place to keep them will ensure you donât lose them or donât end up in the wrong hands.

Disadvantages Of Closing Your 401k

Whether you should cash out your 401k before turning 59 ½ is another story. The biggest disadvantage is the penalty the IRS applies on early withdrawals.

First, you must pay an immediate 10% penalty on the amount withdrawn. Later, you must include the amount withdrawn as income when you file taxes. Even further down the road, there is severe damage on the long-term earning potential of your 401k account.

So, lets say at age 40, you have $50,000 in your 401k and decide you want to cash out $25,000 of it. For starters, the 10% early withdrawal penalty of $2,500 means you only get $22,500.

Later, the $25,000 is added to your taxable income for that year. If you were single and making $75,000, you would be in the 22% tax bracket. Add $25,000 to that and now youre being taxed on $100,000 income, which means youre in the 24% tax bracket. That means youre paying an extra $6,000 in taxes.

So, youre net for early withdrawal is just $16,500. In other words, it cost you $8,500 to withdraw $25,000.

Beyond that, you reduced the earning potential of your 401k account by $25,000. Measured over 25 years, the cost to your bottom line would be around $100,000. That is an even bigger disadvantage.

Also Check: Is Spouse Entitled To 401k In Divorce In Ny

Option : Move The Money To Your New 401

If you have a new job with a new 401, your current employer may permit you to roll over your old 401 funds into your new account. However, not all plans allow this, so check with your company’s HR department or plan administrator to see if it’s an option for you.

If it is and you decide it’s your best move, you must choose between a direct and an indirect rollover. Direct rollovers are the better choice because you don’t handle the money at all. You just fill out a form telling your old plan administrator where to send the funds and they take care of it for you.

With an indirect rollover, the plan administrator cuts you a check for the funds in your account and you place that money into your new account. But if you fail to do this within 60 days of cashing out your old account, the government considers it a distribution and taxes you on that money for the year.

Before you decide to move your money to your new 401, make sure you like your investment options and are comfortable with the fees your new 401 charges. Many employers don’t allow you to transfer money out of your 401 if you’re a current employee, so once you transfer your old 401 funds to your new account, they could be stuck there, at least until you leave your current job.

How Do I Consolidate My Statements So I Only Receive One Statement Per Month Or Quarter

If you have multiple accounts and receive multiple statements, individual statements appear separately online. In some cases, Fidelity may automatically consolidate some of your eligible statements. You can also consolidate your eligible statements by completing the Consolidate Accounts into a Household Relationship form. This allows you to specify which accounts you would like to see on one statement. You can find this form under Related Links on the Statements page .

Note: your annuity accounts are not available for consolidation with your other personal investing accounts.

Also Check: What Is My Fidelity 401k Account Number

What Is A 401 Account

A 401 plan, named for the section of tax code that governs it, is a retirement plan sponsored by an employer, allowing employees to save a portion of their paycheck for retirement.

The advantage to employees of saving with a 401 plan is they are able to save funds they have earned, before taxes are deducted from a paycheck.

Many employers offer a company match meaning whatever the employee contributes, the company matches.

Although 401 plans were originally born as a supplement to pension plans, they are now often the sole retirement plans offered at companies.

Option : Leave It Where It Is

You don’t have to move the money out of your old 401 if you don’t want to. You won’t ever lose the funds — provided you don’t lose track of your old account again. But this option is usually the least desirable.

For one, it’s more difficult to manage your retirement savings when they’re spread out over many accounts. You also get stuck paying whatever your old 401’s fees were, and these can be higher than what you’d pay if you moved your money to an individual retirement account, for example.

But if you like your plan’s investment options and the fees aren’t too high, you could consider leaving your old 401 funds where they are. Just make careful note of how to access them again so you don’t forget.

Recommended Reading: Where Is My 401k Money Invested

Follow The Paper Trail

If you think you may have money in a company-sponsored retirement plan floating around somewhere, you should take all necessary measures to track it down. You worked hard for those dollars, and you want to make sure theyre working as hard as possible for you and your future.

The Find a Financial Advisor links contained in this article will direct you to webpages devoted to MagnifyMoney Advisor . After completing a brief questionnaire, you will be matched with certain financial advisers who participate in MMAs referral program, which may or may not include the investment advisers discussed.

How Long Will It Take To Process Your Application

We begin to process your application once we receive your completed application form. It will take:

- 7 to 14 days for online applications

- normally within 120 days for applications delivered at a Service Canada Centre

- normally within 120 days for applications sent by mail

It could take longer to process your application if Service Canada does not have a complete application.

You May Like: Can I Liquidate My 401k

Retirement Funds Are Different

They are not turned over to the state, which means, its possible that nothing will happen to your money until something happens with your company ).

A common scenario is when you leave a company and move, perhaps you even change your email address.

Perhaps months or even years have gone by, or youve moved to the other side of the country. Then something happens with your employer and they need to contact you for instructions of what to do with your account.

Locate An Old 401 Statement

If youâre having trouble getting a hold of your former employerâs HR department, refer to an account statement of your old 401.

If youâre still living at the same address, you should have yearly or quarterly statements mailed to you. Check your statement for information on where your account is held and any contact information.

The information on your statements will come in handy in identifying how much money youâll be transferring over to make sure nothing is left behind.

Read Also: How Can I Find My Lost 401k