Leverage The National Registry

The National Registry, run by Pen Check, a retirement plan distribution firm, is a nationwide, secure database listing of retirement plan account balances that have been left unclaimed by former participants of retirement plans.

The site offers an easy, free-of-charge way to locate lost or forgotten employee retirement accounts. You can conduct as many searches as you want, using just your Social Security number. The site is safe, encrypting any information you input on a secure server.

What Happens To Old 401s

401 administrators have different procedures for what to do with left behind accounts. Depending on the amount, they could be distributed directly to you, transferred to an IRA on your behalf, or sent to a separate holding account until you claim them.

Unwilling to bear the burden of maintaining vast amounts of accounts from former employees, 401 plans prefer to unload them any way possible. This can make it challenging to find your old 401s.

Check With The Department Of Labor

The U.S. Department of Labor operates the Employee Benefits Security Administration. Its a federal organization that can help you find lost 401 or pension benefits.

You can search for your old employers Form 5500 here. Certain retirement plan administrators are required to file that form, which gives details on companies defined benefit plans.

Recommended Reading: What Should I Do With My 401k After Retirement

What If Your Employer Goes Out Of Business

Under federal law, your employer must keep your 401 funds separate from their business assets.

This means that even if your employer abruptly shuts their doors overnight, your money is protected. It cannot be used to pay off your companys loans, cover employee payroll, or for any other purpose.

If your company shut down abruptly, it is possible that a portion of money will be at risk. If your money has been withheld, but has not yet been sent to the 401 plan to be invested, the company could in theory, access those funds.

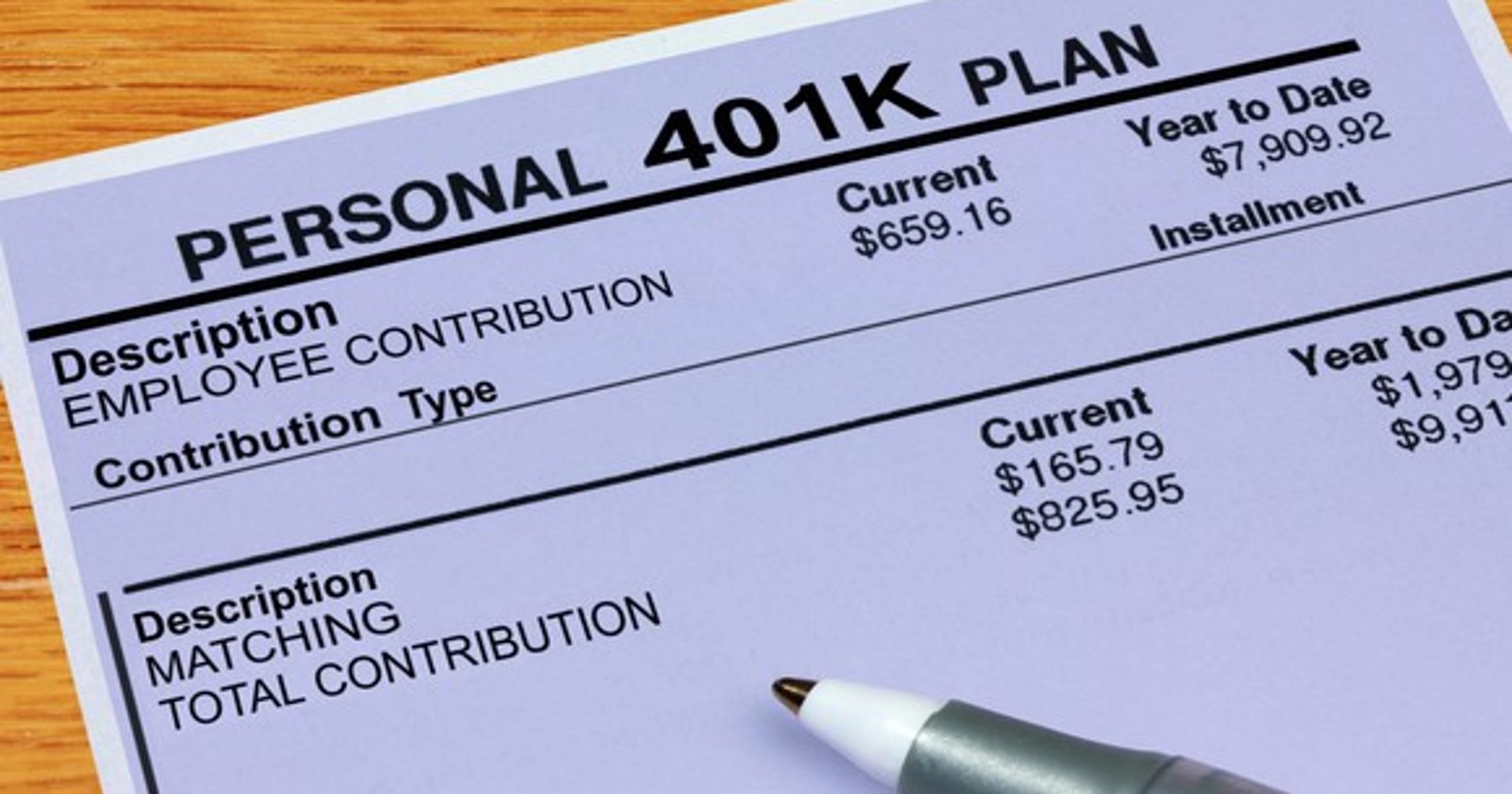

What Is A 401 Account

A 401 plan, named for the section of tax code that governs it, is a retirement plan sponsored by an employer, allowing employees to save a portion of their paycheck for retirement.

The advantage to employees of saving with a 401 plan is they are able to save funds they have earned, before taxes are deducted from a paycheck.

Many employers offer a company match meaning whatever the employee contributes, the company matches.

Although 401 plans were originally born as a supplement to pension plans, they are now often the sole retirement plans offered at companies.

You May Like: When Do I Have To Draw From My 401k

Finding Old Retirement Accounts

You may want to start by contacting your former employers and the plan administrators, the companies that ran the retirement plan. Sometimes, youll find that your retirement account is still there and chugging along as is, hopefully growing in value over time. If you want, you may be able to leave it there, although update the company with your current contact information so it can let you know about any important changes.

However, its not always that easy. If your account had less than $5,000 in it when you left, the plan administrator can transfer the funds to an individual retirement account that was set up in your name. If it had less than $1,000, the company may have tried to send you a check for the amount to the address it had on file. You may also have trouble tracking down the account if the company went bankrupt or switched plan administrators, leaving it up to you to figure out who is holding onto the money now.

One thing is certainother companies dont get to keep your money. If a company cant figure out how to contact you, it has to turn unclaimed funds over to state agencies. You can start searching for your unclaimed funds in these databases:

Once you find your account or money, youll still need to decide what to do with it.

How Do You Start A 401

The simplest way to start a 401 plan is through your employer. Many companies offer 401 plans and some will match part of an employee’s contributions. In this case, your 401 paperwork and payments will be handled by the company during onboarding. If you are self-employed or run a small business with your spouse, you may be eligible for a solo 401 plan, also known as an independent 401.

These retirement plans allow freelancers and independent contractors to fund their own retirement, even though they are not employed by another company. A solo 401 can be created through most online brokers.

Read Also: Can I Use My 401k To Buy A Second Home

You’ve Found Your Old 401s Now What

Once you’ve located your old 401s, you have a few options. Some come with penalties, some require taxes to be paid, and some don’t require either.

You have the option to cash out all of the funds in your old 401s. However, the IRS will charge you a 10% early withdrawal penalty. In very few cases, can this penalty be waived, so it’s best to leave it saved until you’re at least 59½.

Secondly, you can rollover your old 401s into your current employer-sponsored plan. This comes with no penalty or taxes. Because you are rolling it over into another retirement account, you won’t incur any additional costs in doing so.

Lastly, you can consolidate your 401s into an IRA. Like a 401, an IRA is a retirement account, so it’s free from any penalties and taxes. These are held outside of your employer’s 401 plan, but they’re easy to set up and come with many more investment options.

Which Version Of Quicken Can I Use

The Quicken Discontinuation Policy established by Intuit® restricts online services to only the three most current versions of Quicken. Due to this limitation in the Quicken software, T. Rowe Price cannot support older versions of these products or help troubleshoot problems that may occur. Clients may continue to use earlier versions of Quicken by manually entering accounts and transactions. For more information regarding the Quicken Discontinuation Policy, please refer to this Quicken web page.

Read Also: Can I Invest 401k In Stocks

What Are Your Options For Old Retirement Plans

You generally have four options for dealing with money thats in an employer-sponsored retirement account when youre no longer working at the company:

- Leave the money where it is: Although you might not be able to contribute to the account any longer, you may be able to leave the money in your former employers plan. Sometimes, you may need to meet a minimum account balance to qualify, such as $200 for a TSP or $5,000 for some 401s.

- Transfer funds to a new employer-sponsored plan: If you have a new job with a company that sponsors a retirement plan, you may be able to roll over the money into your new employers plan. When this is an option, compare the previous and new plans fees, terms, and investment options to see which is best.

- Roll over to an individual retirement account: You can also move the money into an individual retirement account . An IRA may give you more control as you can choose where to open the account and invest in a wider range of funds. Its also fairly easy to move from one IRA to another as the account isnt tied to your employer. However, IRAs could have more fees, especially if you dont have a lot of assets and dont qualify for lower-cost investment funds.

- Cash out: You can also take the money out of retirement accounts completely. But unless youre 59½ or older , you may need to pay a 10 percent early withdrawal penalty in addition to income taxes on the money.

What Is A 401

A 401 is an employer-sponsored retirement plan enabling workers to save money in a tax-deferred way. Often employers will match contributions up to a percentage of salary. Its just like any other retirement plan in the sense that youre trying to save money and reduce taxes as you do it. Like an IRA, you will pay taxes once you start taking withdrawals in retirement.

If you opted for it when you were hired, every paycheck a percentage of your salary is taken out and put into a 401 retirement account. Your employer may add some more money, maybe even the same amount, on top of that. That money is usually invested, and has been accumulating. How much is in there?

There are different types of 401s. A Roth 401 operates much in the same fashion as a Roth IRA. While still employer-sponsored, it uses after-tax income to fund itself, so you pay the taxes now, and not later in retirement. While one can deliberate the merits of which to use, the general consensus is that a Roth format is useful if one believes they will be in an higher tax bracket later in life when withdrawing from their retirement accounts.

Conversely, a traditional 401 advocate might argue that the ability to put more money into an account in the beginning and through time, allows the saver to make the most of compound interest.

Read more about how a 401 works in this article from TheStreet.

Recommended Reading: What Is 401k Plan Mean

How To Find An Old : 7 Ways

People prone to leaving things behind usually don’t lose a 401 account, but it happens more often than you think – especially if you don’t have a great deal of cash stashed away in a 401.

Data from Plan Sponsor Council of America shows that 58% of 401 transfer balances are between $1,000 and $5,000 when a career professional leaves an employer. That’s not an insignificant range of money, but it’s money you could have working for you, if you could only find it.

Additionally, the U.S. Government Accountability Office states that over 25 million Americans with cash in a 401 or other employer retirement plan left that money behind when they moved on to greener career pastures.

People leave old 401 accounts behind for many reasons. The account holder may have engaged in a string of job-hopping experiences and lost an old retirement account in the shuffle. Or, the 401 account holder’s company merged with another firm, was bought out, or went bankrupt.

You might even automatically have been enrolled in an old 401 company by a firm you only spent a year or so working at, didn’t realize it, and completely missed bringing the 401 account along with you to your next job.

If that sounds vaguely familiar, how do you find the money you lost in an old 401 account and what do you do with it when you get it back?

There are plenty of ways to get the job done. Let’s take a closer look.

How Does Money Get Left Behind

Very few people stay at one employer the entire length of their career.

But unlike your bank account which you may have from job to job, a 401 account is linked to your employer. It is up to you to do something about it.

When you leave your employer, the money may stay in the account for an indefinite amount of time.

However, if the company closes the 401 plan, files for bankruptcy, goes out of business or is acquired by another company, you may be forced to decide, within a short period of time.

Its possible that years will go by after you parted ways with your old job, and then youll get a letter notifying you that you need to move your 401 account, or take a distribution.

If this happens, youre much better off rolling the money into an IRA account, or transferring the money into your current companys 401 plan.

Recommended Reading: How Much 401k Do You Need To Retire

Ways Of Finding My Old 401ks Including Using Ssn

If youâve ever left a job and wondered âWhere is my 401?â, youâre not alone. Locating 401âs is complicated. Thus, billions of dollars are left behind each year. Beagle can help track down your money.

Contributing to an employer-sponsored 401 plan is a great way to build wealth for retirement especially if youâre receiving a match from your company. The problem is they are tied to an individual employer. We forget about them, leave that company, and one day we realize âOh yeah! Where is my 401?â

A 401 can be in a few different places. Most commonly it could be with your previous employers, an IRA they transferred your funds to after you left, or mailed to the address they had on file.

Believe it or not, Americans unknowingly abandoned $100 billion worth of unclaimed 401 accounts. According to a US Labor Department study, the average worker will have had about 12 different jobs before they turn 40. So itâs easy to see how we can lose track of so much 401 money.

To find your old 401s, you can contact your former employers, locate an old 401 statement, search unclaimed asset database in different states, query 401 providers using your social security number or better yet, get some help to find your 401 accounts from companies like Beagle.

Youre Our First Priorityevery Time

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Don’t Miss: How To Invest Money From 401k

What Is The Main Benefit Of A 401

A 401 plan lets you reduce your tax burden while saving for retirement. Not only are the gains tax-free but it’s also hassle-free since contributions are automatically subtracted from your paycheck. In addition, many employers will match part of their employee’s 401 contributions, effectively giving them a free boost to their retirement savings.

Option : Move The Money To Your New 401

If you have a new job with a new 401, your current employer may permit you to roll over your old 401 funds into your new account. However, not all plans allow this, so check with your company’s HR department or plan administrator to see if it’s an option for you.

If it is and you decide it’s your best move, you must choose between a direct and an indirect rollover. Direct rollovers are the better choice because you don’t handle the money at all. You just fill out a form telling your old plan administrator where to send the funds and they take care of it for you.

With an indirect rollover, the plan administrator cuts you a check for the funds in your account and you place that money into your new account. But if you fail to do this within 60 days of cashing out your old account, the government considers it a distribution and taxes you on that money for the year.

Before you decide to move your money to your new 401, make sure you like your investment options and are comfortable with the fees your new 401 charges. Many employers don’t allow you to transfer money out of your 401 if you’re a current employee, so once you transfer your old 401 funds to your new account, they could be stuck there, at least until you leave your current job.

Also Check: Can You Transfer 401k To Roth Ira

Check The National Registry Of Unclaimed Retirement Benefits

The National Registry is a nationwide, secure database listing of retirement plan account balances that have been left unclaimed by former participants of retirement plans.

It is essentially a search engine of lost 401 plans.

The only thing you need to search the database is your social security number. No additional information is needed, and there is no cost to search the database.

Don’t Leave Your 401 Behind Here’s How To Reclaim Your Hard

Switching jobs pulls your mind in several directions at once, and it’s easy for your old 401 to get lost in the shuffle. But you can’t afford to forget about it for good. Building a nest egg to sustain you for decades is tough, so you can’t afford to leave any old retirement accounts behind. If you’ve lost track of your old 401, take these steps to find it and put that money to good use.

Don’t Miss: Can You Put 401k Into Roth Ira

Option : Leave It Where It Is

You don’t have to move the money out of your old 401 if you don’t want to. You won’t ever lose the funds — provided you don’t lose track of your old account again. But this option is usually the least desirable.

For one, it’s more difficult to manage your retirement savings when they’re spread out over many accounts. You also get stuck paying whatever your old 401’s fees were, and these can be higher than what you’d pay if you moved your money to an individual retirement account, for example.

But if you like your plan’s investment options and the fees aren’t too high, you could consider leaving your old 401 funds where they are. Just make careful note of how to access them again so you don’t forget.