Leave Your Money In The Plan

You may want to keep the balance in your old plan, especially if:

- you like the plans investment options,

- the plan has low fees, or

- you want to move the balance to a new employers plan later.

If your account balance is less than $5,000, your employer may require you to move it. In this case, consider rolling it over to your new employers plan or to an IRA.

Contact The 401 Plan Administrator

If your employer is no longer around, try getting in touch with the plan administrator, which may be listed on an old statement.

If youre unable to find an old statement, you still may be able to find the administrator by searching for the retirement plans tax return, known as Form 5500.

You can find a 5500s by the searching the name of your former employer at www.efast.dol.gov.

If you locate a Form 5500 for an old plan, it should have the contact information on it.

Level One Bancorp Announces Quarterly Preferred Stock Cash Dividend

Your best bet is to visit FreeERISA.com, which can help you track down your old 401 using the following website tools:

- Code search: Find employee benefit and retirement plan filings by location.

- Dynamic name search: Find 5500s even if the plan sponsors name changed.

- Instant View: See benefit filings right in your browser instantly.

You May Like: Does A 401k Rollover Count As A Contribution

Read Also: What Is The Difference Between 401k And 403b

How To Find Old 401 Accounts

E. NapoletanoEditorial Note: The content of this article is based on the authors opinions and recommendations alone and is not intended to be a source of investment advice. It may not have not been reviewed, commissioned or otherwise endorsed by any of our network partners or the Investment company.

Billions of dollars are left behind in forgotten 401 plans in the United States. Thats a massive amount of unclaimed property just waiting to be returned to its right fully owners. So if youre looking to find old 401 accounts, youve come to the right place. Well help you track them down in four different ways.

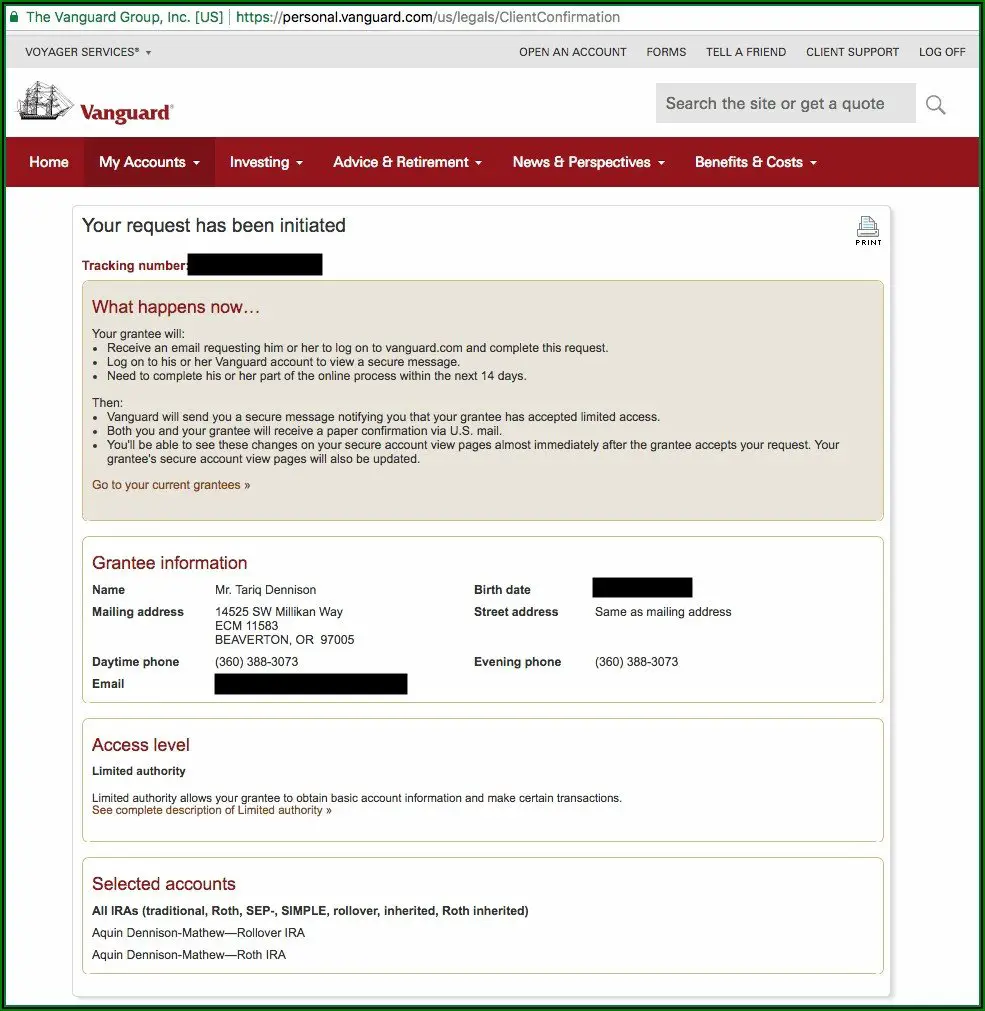

Option : Roll It Into An Ira

If your new employer doesnt offer a 401 or you dont like their option, you can roll your 401 into an IRA.

Rolling over accounts is easier than it sounds. You may need to open an IRA at a brokerage company and sign a few papers that allow the brokerage to transfer the money into your new account. This option will help keep your balance growing tax deferred and you can continue to make tax-deferred contributions.

Also Check: What Happens With 401k When You Quit

What Are The Best Retirement Plans For You

-

If you have a 401 or other workplace retirement plan: First you may want to contribute enough to get any free money offered by your employer via the company match. For more on the pros and cons of these plans, jump to our section on employer-sponsored retirement plans, including 401s, 403s, 457s, defined benefit plans and TSPs.

-

If youve maxed out your 401 or you dont have a retirement plan at work: Consider an IRA. Jump to our section on the pros and cons of four types of IRAs, including traditional and Roth IRAs. If you already know you want an IRA, check out our round-up of the best IRA providers.

-

If youre self-employed or the owner of a small business: Jump to our section about retirement accounts designed specifically for you, including the , Solo 401, SIMPLE IRA and profit sharing.

Weâll walk you through the various types of retirement plans below. Bear in mind, these are the retirement plans or accounts available to you depending on your situation. For more information on which investments to choose inside your retirement account, connect to our guide on retirement investments here.

Can I Keep 401k With Old Employers

If youâve changed jobs recently, find out if you can keep 401 with old employer, and the alternative options you might have.

When you switch jobs, you have several options with your 401. You can decide to leave it where it is, rollover to a new employer, or transfer the money to an individual retirement account . Each of these options has different tax implications, and you should understand the particulars of each option before deciding the option to take.

You can leave your 401 in your former employerâs plan if you meet the minimum balance requirement. Employers require employees to have at least $5,000 in 401 savings if they decide to leave their money behind indefinitely. This option does not require any action on the employees part, and you can leave your job without doing anything to your 401 money. The employer will continue managing the 401 funds, but you wont be able to make contributions to the retirement account once you leave.

You May Like: How To Invest In 401k Without Employer

Option : Keep Your Savings With Your Previous Employers Plan

If your previous employers 401 allows you to maintain your account and you are happy with the plans investment options, you can leave it. This might be the most convenient choice, but you should still evaluate your options. Each year, American workers manage to lose track of billions of dollars in old retirement savings accounts, so you should make sure to track your account regularly, review your investments as part of your overall portfolio and keep the beneficiaries up to date.

Some things to think about if youre considering keeping your money in your previous employers plan:

Taking The Cash Distribution May Cost You

Avoiding cash distributions can save you from taxes and penalties, because any amount you fail to roll over will be treated as a taxable distribution. As a result, it would also be subject to the 10% penalty if you are under age 59 1/2.

Since the taxable portion of a distribution will be added to any other taxable income you have during the year, you could move into a higher tax bracket.

Using the previous example, if a single taxpayer with $50,000 of taxable income were to decide not to roll over any portion of the $100,000 distribution, they would report $150,000 of taxable income for the year. That would put them in a higher tax bracket. They also would have to report $10,000 in additional penalty tax, if they were under the age of 59 1/2.

Only use cash distributions as a last resort. That means extreme cases of financial hardship. These hardships may include facing foreclosure, eviction, or repossession. If you have to go this route, only take out funds needed to cover the hardship, plus any taxes and penalties you will owe.

The CARES Act, enacted on March 27, 2020, provided some relief for those who need to make withdrawals from a retirement plan. It lifted penalties for withdrawals made through December 2020 and provides three years to pay back any early withdrawals.

Recommended Reading: Can You Use Your 401k To Pay Off Debt

Recommended Reading: How Much Should I Put In My 401k

Determine If Your 401 Account Was Rolled Over To A Default Ira Or Missing Participant Ira

One possibility is your employer rolled the funds over into a Default IRA.

If your employer tried to contact you for instructions as to what to do with your account balance, and you fail to respond, you may be deemed a non-responsive participant.

If they are unable to locate you altogether, you may be deemed a Missing Participant.

In either scenario, if the plan is being terminated, your employer may have put the funds in a Missing Participant Auto Rollover IRA.

This is an IRA account set up on your behalf to preserve your retirement assets until they are claimed by you or your beneficiaries under Department of Labor regulations.

To qualify for a Missing Participant or Default IRA, the account balance must be greater than $100 but less than $5,000 unless the funds are coming from a terminated plan, then the $5,000 ceiling is waived.

Finding a Missing Participant IRA

If your money has been transferred to a Missing Participant IRA, you should be able to find it by searching the FreeERISA website.

This search is slightly more time consuming than the national registry. Registration is required to search the database, which contains 2.6 million ERISA form 5500s, covering 1.3 million plans and 1 million plan sponsors.

If you know your money has been transferred to one of these default accounts, you should get it out into a standard IRA account.

Typically, these accounts must be interest-bearing, bear a reasonable rate of return, and be FDIC insured.

Here’s the bad part:

What Should I Do With My Lost Retirement Account

Once youve tracked down your lost retirement funds, you have some decisions you need to make. You can, of course, withdraw the funds and spend them, but there are a few reasons that might be a bad idea. If youre withdrawing funds from a forgotten 401 or other savings plan, take some time to research the taxes or penalties youll have to pay on any money you take out. Unless you put after-tax funds in, youll be taxed on the funds as you would with any type of income.

If youre 72 years old, though, youll need to pay attention to the Required Minimum Distributions to avoid a penalty. The amount youre required to take each year is based on a calculation that divides your account balance by your life expectancy factor. You can use the IRS Required Minimum Distribution Worksheet to help with that.

For the remainder of the amount, you may choose to leave it alone, withdraw it, or roll it into an IRA. You may find you can save on fees by rolling the amount over, but after retirement, the fees involved in doing that may eat into any cost savings. Weigh your options, including calculating the income taxes youll owe on any amount you withdraw, before making any decisions.

Recommended Reading: Can I Invest In A 401k On My Own

Ways To Manage Old Employer

If youre like most Americans, youve changed employers a few times throughout your working career. In fact, the average person switches jobs 12 times during his or her lifetime!

While job-hopping can get you a variety of experience, it can also create some complexity managing your finances specifically when it comes to the money youve saved in employer-sponsored retirement plans such as a 401 or profit-sharing plan.

Every time you leave a job where you contributed money to an employer-sponsored retirement plan, you are faced with the dilemma of determining how to handle those old plans. Naturally, each time you must ask yourself: what should I do with this account?

Generally, you have four options.

Use A 401 Lookup Database

The Capitalize team has created a database and search tool to help locate a missing 401 account. Simply input your company name below to get started.

Usually, we can locate the account instantly. If we cant, our in-house team will track it down for you and help you move into an account of your choice.

Other databases also enable you to look for unclaimed property, like the Employee Benefits Security Administrations Abandoned Plan Search and the National Registry of Unclaimed Retirement Benefits. One of these databases may be able to reveal the location of your old 401.

Read Also: Can I Roll My Ira Into My 401k

K And Your Tax Burden

One of the best things about a 401 k is that the money in these accounts is not subject to tax. With an IRA, you can save and invest money without having to worry about the tax burden. However, this only applies while the money remains in your IRA. It is also not uncommon to have more than one IRA, so it may help to learn how many IRA you can have and how it affects your 401k. If you remove the money or roll it into another account, it becomes part of your taxable estate. This is why its important that you make decisions regarding your 401 k wisely and dont rush into anything.

Its crucial that you educate your beneficiaries on how your 401 k works, too. If you pass away before youve retired, the company you work for ensures that your beneficiary gets access to your 401 k. However, you have to make sure that your beneficiary understands how this works. Your 401 k money may be subject to income tax if its removed from your IRA. If the balance in your account is substantial, a lump distribution could result in substantial income taxes for your beneficiary.

If your beneficiary wants to avoid paying tax on all of your 401 k at once, its important that they take this into consideration. You have to make sure they understand all of the options that are available. Its not necessary to transfer all of the money in an IRA at once, for example. Distribution can be spread out into multiple distributions over an extended period.

What Happens If I Cash Out My 401

If you simply cash out your 401 account, youll owe income tax on the money. In addition, youll generally owe a 10% early withdrawal penalty if youre under the age of 59½. It is possible to avoid the penalty, however, if you qualify for one of the exceptions that the IRS lists on its website. Those include using the money for qualified education expenses or up to $10,000 to buy a first home.

You May Like: How Do You Move Your 401k When You Change Jobs

How To Find A Locked

Every defined benefit pension plan and locked-in retirement account is regulated according to either a provincial or a federal pension standard regulator. In Sandras case, she worked in Ontario and the pension plan was regulated by the Ontario regulator.

The Financial Services Commission of Ontario is the government body that looks after pensions in Ontario. They have records of every pension regulated by Ontario, even if the pension plan no longer exists, as was the case with Sandras. If you have any information about the original company, they should be able to tell you who was responsible for that pension plan and can provide contact information for the pension administrator or custodian.

I called the FSCO at 1-800-668-0128 and asked if they knew who the pension administrators for Company A were. They were able to tell me the company name of the current administrators of the pension and gave me the name and phone number of the administrator.

I called the pension administrators number and left a message which was returned the same day. The pension administrator I talked to was able to confirm that Sandra was in their system and gave me the name and phone number of the financial institution where her LIRA was being held.

I gave the financial institution information to Sandra and she was able to call and regain access to the retirement account which had a value of approximately $24,000.

Read Also: How To Save For Retirement

How 401 Rollovers Work

If you decide to roll over an old account, contact the 401 administrator at your new company for a new account address, such as ABC 401 Plan FBO Your Name, provide this to your old employer, and the money will be transferred directly from your old plan to the new or sent by check to you , which you will give to your new companys 401 administrator. This is called a direct rollover. Its simple and transfers the entire balance without taxes or penalty.

Another, even simpler option is to perform a direct trustee-to-trustee transfer. The majority of the process is completed electronically between plan administrators, taking much of the burden off of your shoulders.

A somewhat riskier method is the indirect or 60-day rollover in which you request from your old employer that a check be sent to you made out to your name. This manual method has the drawback of a mandatory tax withholdingthe company assumes you are cashing out the account and is required to withhold 20% of the funds for federal taxes. This means that a $100,000 401 nest egg becomes a check for just $80,000 even if your clear intent is to move the money into another plan.

Don’t Miss: How To Stop Your 401k

Tax Implications Of Cashing Out A 401 After Leaving A Job

The following are some tax rules regarding your old 401:

-

When you leave your 401 account with your old employer, you wont need to pay taxes until you choose to withdraw the funds.

-

Even when you roll over your old 401 account to your new employer, you need not pay any taxes.

-

At the time of your 401 distributions, you will be liable to pay income tax at the prevailing rates applicable for such distribution.

-

If you havent reached the age of 59 ½ years at the time of distribution, you may be liable to pay a premature withdrawal penalty of 10%, subject to certain exceptions.

-

Distributions from a designated Roth account are tax-free after you reach the age of 59 ½ years, provided your account is at least five years old.

Although legally, you have every right to liquidate your old 401 account and cash out the entire funds, doing so would reduce your savings for the retired life. Additionally, the distributions will add up to your annual taxable income.

Article By

The Human Interest Team

We believe that everyone deserves access to a secure financial future, which is why we make it easy to provide a 401 to your employees. Human Interest offers a low-cost 401 with automated administration, built-in investment education, and integration with leading payroll providers.