Fidelity And/or Vanguard To Tiaa

Transfer funds from Fidelity and/or Vanguard fund into a TIAA fund

Plan Your Retirement With Your 401 K

If you havent already, its crucial that you start to plan your retirement as soon as possible. Financial security is a vital part of having a healthy and happy retirement. The aim of having a 401 k in the first place is that it gives you freedom from work and acts as a nest egg. You might be working hard now, but you want to be able to truly enjoy your golden years. Having the proper retirement plans in place is the easiest way to ensure this. If you start planning to retire well before the time comes, you should be in a very strong position financially.

Take the time to come up with plans for your retirement while you still have a job. These plans dont have to be concrete. All you have to do is get an idea of how your retirement may look financially. Then you can plan distributions from your 401 k, as well as any investments you may want to investigate.

Read Also: How To Transfer 401k From Fidelity To Vanguard

Substantially Equal Periodic Payments

Substantially equal periodic payments are another option for withdrawing funds without paying the early distribution penalty if the funds are in an Individual Retirement Account rather than a company-sponsored 401 account.

SEPP withdrawals are not permitted under a qualified retirement plan if you are still working for your employer. However, if the funds are coming from an IRA, you may start SEPP withdrawals at any time.

There is an exception to this rule for taxpayers who die or become permanently disabled.

SEPP must be calculated using one of three methods approved by the Internal Revenue Service : fixed amortization, fixed annuitization, or required minimum distribution . Each method will calculate different withdrawal amounts, so choose the one that is best for your financial needs.

Don’t Miss: Can You Contribute To 401k After Leaving Job

How Do I Close Out A 401k Account

Closing a 401 account can take a significant bite out of the balance.

If you leave an employer where you have a 401 plan, you might want to close out that 401 account. Sometimes you can let the money stay in that old 401, but people often want to completely cut their ties with the company and consolidate financial accounts for easier record keeping. You can reduce your liability for taxes and penalties by rolling these accounts into new tax-deferred accounts.

Understanding Early Withdrawal From A 401

Withdrawing money early from your 401 can carry serious financial penalties, so the decision should not be made lightly. It really should be a last resort.

Not every employer allows early 401 withdrawals, so the first thing you need to do is check with your human resources department to see if the option is available to you.

As of 2021, if you are under the age of 59½, a withdrawal from a 401 is subject to a 10% early withdrawal penalty. You will also be required to pay regular income taxes on the withdrawn funds.

For a $10,000 withdrawal, when all taxes and penalties are paid, you will only receive approximately $6,300.

You May Like: How Do I Know I Have A 401k

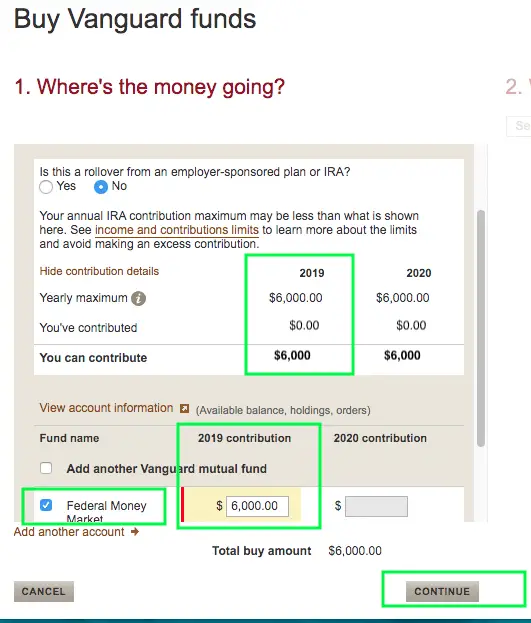

Direct Dividends And Capital Gains To Your Money Market

As you were building your savings, you probably used your earnings to buy more shares of your investmentsthat’s how you benefit from compounding.

But now that you’re spending money from your accounts, consider having your earnings sent to your money market fund rather than reinvested, at least in your taxable accounts.

Here’s why: You’ll incur taxes on these gains when they’re paid out. If you reinvest them and then turn around and withdraw them in a few months, you’ll likely have to pay taxes on them again.

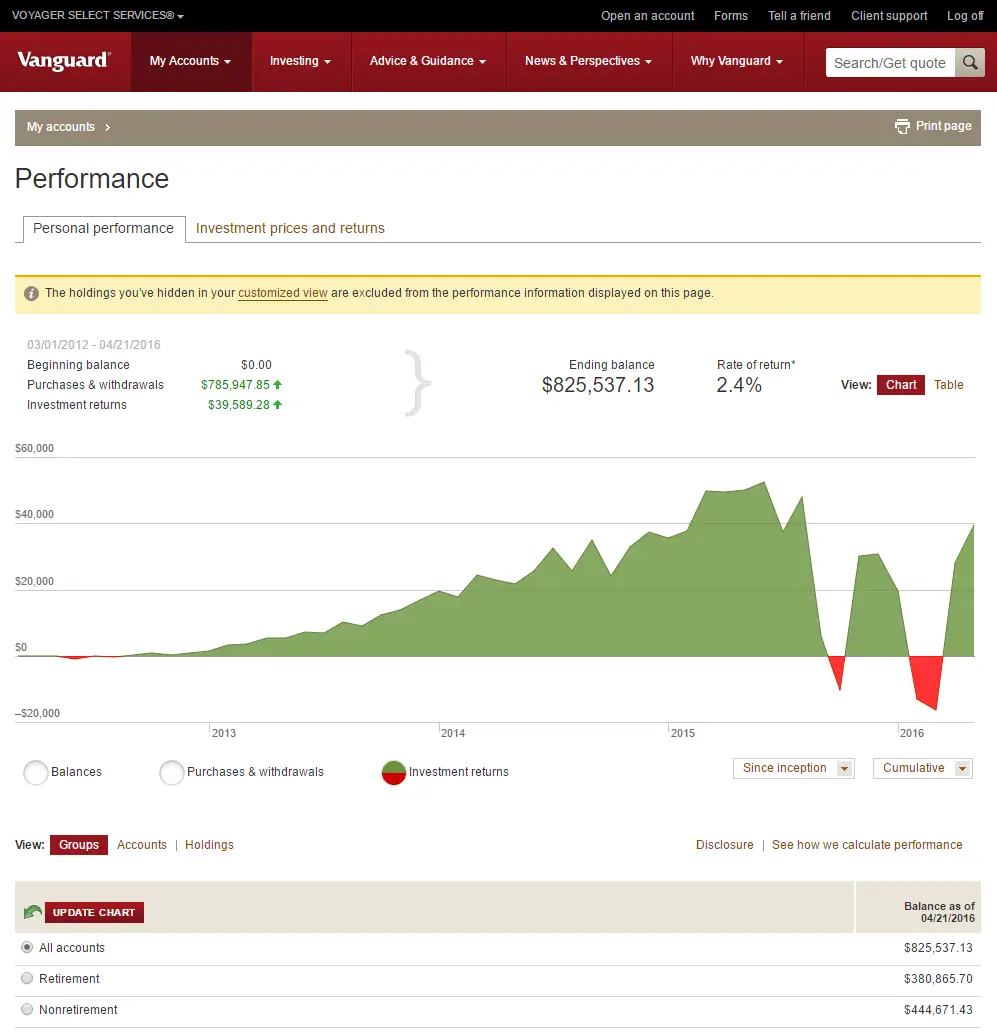

The investment returns you accumulate on the savings in your account.

This Is What Happens To Your 401 When You Quit

When you quit your job, you have five options for your 401:

If youre considering quitting or transitioning jobs, you may be wondering what to do with your 401. Each of the options above has benefits and drawbacks, and you should carefully consider whats best for you.

Before you decide what to do with your 401, make sure you dont have a loan on your 401. 401 loans are appealing because they dont affect your debt-to-income ratio however, if you cant repay it by the tax due date after leaving your job, youll be taxed on the balance and charged an early withdrawal fee. Some companies offer special options here, so you should always check with your 401 administrator and plan documents.

Youll also want to keep in mind the fact that some account types only allow one rollover per year so if youre changing jobs frequently, this is something to be aware of. Refer to this chart from the IRS to learn more about account rollovers.

With this in mind, you have the following options for your 401 when quitting your job:

Read Also: How To Take Money Out Of 401k Without Penalty

Read Also: How To Open A 401k With An Employer

Loan Or 401 Withdrawal

While similar, a 401 loan and 401 withdrawal arent interchangeable and have a few key differences. While you can use either to access up to $100,000 of your retirement funds penalty- and tax-free as part of the Consolidated Appropriations Act, they each have their own rules.

As part of a 401 withdrawal:

- Repayment isnt required.

- Theres no withdrawal penalty.

- Distribution will be taxed as income, but you can pay it back within three years and claim a refund.

As part of a 401 loan:

- You must repay the loan within a specified time frame .

- The loan amount isnt taxed initially, and theres no penalty. If you cant pay it back within the specified time frame, the outstanding balance is taxed and youll also be assessed a 10 percent early withdrawal penalty, if you are under age 59 1/2.

- If you leave your job, you have until mid-October of the following year to offset the outstanding loan amount. Otherwise, you could owe 401 early withdrawal taxes and penalties.

Work with your plan sponsor to learn more about the pros and cons of a 401 withdrawal vs. 401 loan.

You Asked We Answer: How Long Can A Company Hold Your 401k After You Leave

Having a strong 401 k plan is a priority for most Americans. In the USA, a 401 k plan or IRA is the basis of your retirement savings. The absence of a universal welfare plan means that these accounts are the responsibility of your employer. However, some jobs dont work out. You might end up resigning before you reach retirement age. When this happens, it can affect your 401 k plan. If you resign early, you may need to figure out what to do with your old 401 k account.

Depending on the amount in your 401 k and your age at retirement, you may have full access to the funds. Otherwise, you might need to wait a certain period of time. You might also be required to transfer the 401 k funds to a new account from the old account. Withdrawing the money before youre old enough can mean you face penalties. This article discusses your options when you leave your job before youve reached retirement age.

You May Like: How Do I Draw Money Out Of My 401k

Can You Make An Early Withdrawal From Your 401 Plan

Yes, you can make an early withdrawal but just because you can, it doesnt mean that you should. Cashing out from your 401 plan early can come with several financial consequences such as loss of interest growth or penalties. This is why its not recommended to cash out the 401 until you are at least 59 years old.

How To Handle Your 401 When Leaving A Job

When you leave a job, youre probably focused on cleaning out your desk and saying good-bye to work friends. But taking care of your 401 retirement plan at the soon-to-be-former employer should also be high on your to-do list so that you can handle that money responsibly and avoid unnecessary taxes and penalties.

If you take a 401 loan from a job, you generally must repay the outstanding balance in full when you leave. Otherwise, the loan may be treated as a distribution and subject you to early withdrawal penalties.

Assuming you dont have any outstanding 401 loans, heres a look at your options.

1. Cash it out. Tempting as might be to cash out a 401 from a previous employer, this should be your last resort. If you cash out a 401 before age 59.5, youll be subject to taxes and early withdrawal penalties. In addition, youll also lose out on money that could have grown and supported you during retirement. If you have less than $5,000 in your 401, the plan administrator may automatically distribute funds to you, triggering a taxable distribution, so ask them about this before you leave. If you need money to help you through a career transition, explore other options first such as a home equity line of credit or a personal loan, which are typically cheaper ways to access money.

Also Check: How To Borrow From 401k For Home Purchase

Read Also: When You Quit Your Job What Happens To Your 401k

Rolling 401k Into Ira

When you leave an employer, you have several options for what to do with your 401k, including rolling it over into an IRA account.

Its possible to do the same thing while still working for an employer, but only if the rules governing your workplace 401k allow for it.

The negative for rolling the money into an IRA is that you cant borrow from a traditional IRA account.

Another option when you leave an employer is to simply leave the 401k account where it is until you are ready to retire. You also could transfer your old 401k into your new employers retirement account.

If you are at least 59 ½ years old, you could take a lump-sum distribution without penalty, but there would be income tax consequences.

You May Like: When Can I Set Up A Solo 401k

Withdrawals Are An Alternative To 401 Loans

A 401 loan is generally preferable to a 401 withdrawal if you must use the funds in your retirement accounts to meet your immediate needs. A loan is a better alternative because:

- You avoid the 10% early withdrawal penalty that applies if you take money out of your 401 before age 59 1/2.

- Youll repay the money to your 401 so it will not permanently lose out on all of the investment gains it could have earned between the time of the withdrawal and the time you retire.

Before considering a 401 withdrawal and incurring both the penalties and losing gains for the remainder of the time until retirement, you should seriously think about taking out a loan instead if your plan allows it.

Recommended Reading: How Can I Pull My 401k Money Out

Cashing Out A 401 Is Popular But Not So Smart

Intellectually, consumers know that cashing out retirement accounts isnt a smart move. But plenty of people do it anyway. As discussed, you may be forced out of your former plan based on your account balance, but that doesnt mean you should cash the check and use it for non-retirement related purposes. In the long run, your financial future will be better served by rolling the money over into an IRA or if applicable, your new employers 401 plan.

A 2020 survey by Alight, a leading provider of human capital and business solutions, found that 4 out of 10 people cashed out their balances after termination between 2008 and 2017. About 80 percent of those who had an account balance of less than $1,000 cashed out, while 62 percent who had balances between $1,000 and $5,000 did the same.

Based on historical rates of return, a $3,000 cash out at age 24 leads to a $23,000 difference , in your projected account balance at age 67, so even a small amount of money invested into a retirement vehicle today can make a big difference in the long run.

Eligibility For Cashing A 401 Plan

In the event that you are still under the employment of the company that is paying for your 401, you wont be eligible for cashing out your 401 plan. The only exceptions to this would be if the plan, in particular, allows for a 401 loan, an in-service withdrawal, or a hardship withdrawal.

One piece of advice would be to avoid taking out a 401 loan as much as you can. The cash you have in your 401 needs to be given as much time as you can in order to grow. The loan is also required to be paid back with interest, so youll just end up losing money in the long run.

If you are no longer under the employment of the companies that sponsor your 401 plan, then you are indeed eligible to get the money. You can either cash it out, or you may roll it over through an IRA.

If you choose the rollover instead of the cash-out, then you will not have to pay any penalty or income taxes. Rollovers arent taxable transactions not if you do it correctly. If you roll your 401 plan over into another plan, then the IRS does not see this as cashing out.

Read Also: What Is My Fidelity 401k Account Number

Contact Your Old 401 Provider

First, identify the provider of your old 401. If you arenât sure who your old 401 provider is, the name should be on your account statements. If you have trouble finding this information, call your former employer.

Is your old 401 with Fidelity? If so, you can do the entire rollover through your NetBenefits®. account. You donât need any additional paperwork, and the money can be directly transferred.

Is your old 401 with a different provider? If so, they will need to start the rollover process, so youâll need to either call them or initiate the process online. They may need some paperwork, such as a Letter of Acceptance from Fidelity, or their own paperwork completed and signed by you or a Fidelity representative. If you have multiple accounts or employers, you may need more than one LOA.

Here are some questions to ask when you contact them. If youâd like to have a Fidelity rollover specialist on the line with you when you call, call us first at 800-343-3548.

Covington, KY 41015-0037

Do you own company stock?

If you have shares of company stock, itâs easiest to give us a call at 800-343-3548 and one of our rollover specialists can help you understand your options and take action.

October 22, 2019Keywords: 401k, Fidelity, IRA, rollover, Schwab

You need to find out from the receiving IRA custodian how they want the check made out to. I was rolling over to an IRA at Fidelity. Fidelity says on their website:

Say No To Management Fees

Need Money From Your Retirement Fund Vanguard Advises Taking Loans Instead Of Withdrawals

Need some emergency money? With more than 36 million Americans unemployed in the wake of the pandemic, you are not alone.

- May 18, 2020

Need to take emergency money out of your retirement fund?

With more than 36 million Americans unemployed in the wake of the pandemic, you are not alone. Thats the largest rise in claims since the U.S. Department of Labor started tracking the data in 1967.

As a result, the federal government changed the rules surrounding retirement accounts so we can take our money out more easily. The changes were part of the massive $2 trillion economic stimulus plan called the CARES Act.

However, Vanguard is advising investors that taking money out of our retirement accounts comes at a cost. Borrowing from your retirement plan may be a better strategy than withdrawing money. Heres why, according to Vanguard: When you borrow from your 401 or other IRA or retirement plan, you generally begin to repay the loan with every paycheck.

The automatic nature of repayment makes it more likely that the borrowed money will be returned to your long-term savings. Yes, you can repay a withdrawal from the plan for up to three years under the new law, but it can take more discipline and foresight to do so, the mutual fund giant said in a note to clients.

The biggest risk of any retirement plan loan is that you wont be able to pay the money back.

If your plan usually charges a loan origination fee, it will be waived.

You May Like: Which 401k Investment Option Is Best

Don’t Miss: How To Withdraw Your 401k From Fidelity

What If You Are The Beneficiary Of A 401 Plan

If you are the beneficiary of a 401 plan, youll have a little bit different set of rules that apply to taking money out of the 401 plan. Your choices will depend on whether you were the spouse or non-spouse of the 401 plan participant and whether the 401 plan participant had reached age 70 1/2the age for required minimum distributions .

If you or your spouse turned 70 1/2 before Jan. 1, 2020, the age for RMDs is still 70 1/2. If you or your spouse turned 70 1/2 on or after Jan. 1, 2020, the age for RMDs is 72.

You May Like: Can You Get Your 401k If You Quit Your Job