Deposit Your Money Into Your Fidelity Account

You can have the money sent directly to us to deposit into your account, or deposit it yourself.

Important: The check should be made payable to Fidelity Management Trust Company , FBO . Be sure to ask your former plan administrator to include your IRA account number on the check.

Please note: When a rollover check is made payable directly to you, you must deposit the money into your IRA within 60 days of receiving the check to avoid income taxes and a possible early withdrawal penalty.

|

Covington, KY 41015-0037 |

Benefits Of Rolling Into A New Plan

Rolling your money into a new employers plan gives your retirement assets the opportunity to continue growing tax-deferred. Its also convenient to have your assets all in one place. Your new plan may provide additional benefits, such as:

-

Automatic investing. If your new plan allows employee deferrals, you can take advantage of payroll deductions to regularly contribute to your retirement account. You may be able to contribute up to $20,500 for 2022.

-

Extra contributions. If youre age 50 or older and your plan allows employee deferrals, the plan may also allow you to make additional catch-up contributions beyond the annual limit up to $6,500 for 2022, for a total of $27,000.

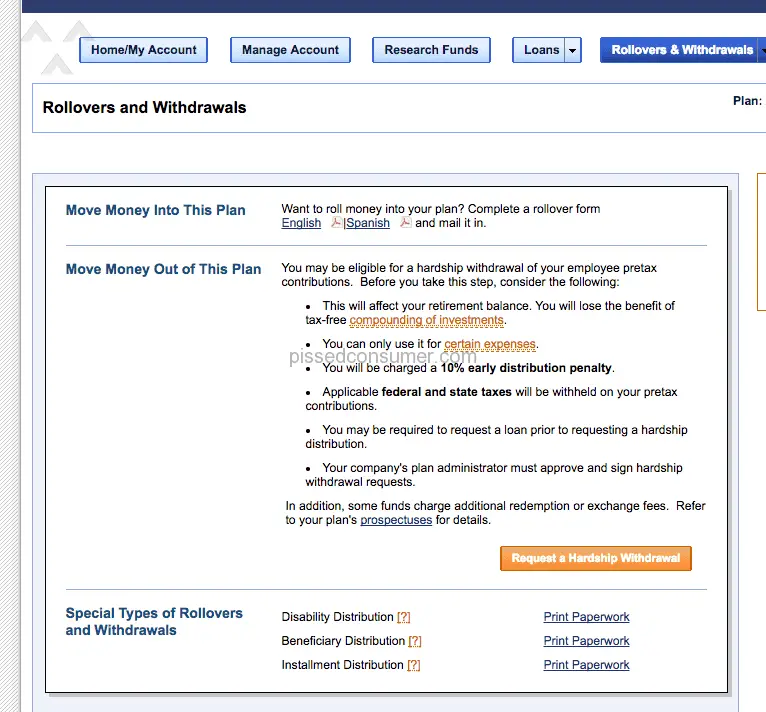

The 10% Early Distribution Penalty

Ive mentioned this penalty a couple of times, so lets discuss it in some detail. Under IRS rules, retirement funds are eligible for distribution beginning at age 59 ½. If you take distributions before reaching that age, which can certainly happen in the case of a distribution or an unsuccessfully completed rollover, youll pay a penalty equal to 10% of the amount of the distribution, over and above the ordinary income tax owed.

Recommended Reading: Can You Start Your Own 401k

Confirm A Few Key Details About Your 401 Plan

First, get together any information you have on your old 401. Its okay if you dont have a ton, but any details like an old account statement or an offboarding e-mail from your former HR team can help. 401 paperwork can be confusing, so just focus on identifying the following three items:

STEP 2

Look Out For Your Check In The Mail And Deposit Into Your New Account

ADP will only distribute your 401 funds directly to you, using the mailing address they have on file for your account. Once you get the check, its then up to you to deposit that check with your new IRA provider.

There are a few ways you can deposit your check depending on the provider:

- Mobile deposit the easiest option is to check your providers mobile app to see if they have a mobile deposit option. Not all providers provide this option but its worth checking. Mobile deposits are the quickest option and typically take 3-5 business days to show up in your account.

- Deposit in person at a local branch if your provider has a physical branch near by, you can also deposit the check in person. Checks deposited in person typically take 3-5 business days to show up in your account.

- Send the check by mail you can also send the check by mail to the provider using the address you previously looked up. Funds that are mailed can take up to 15 business days to show up in your account.

Read Also: When Can I Start A 401k

How To Transfer Money From 401 To Bank Account

Learn how to transfer money from 401 to bank, and the duration it takes to receive the money in your bank account.

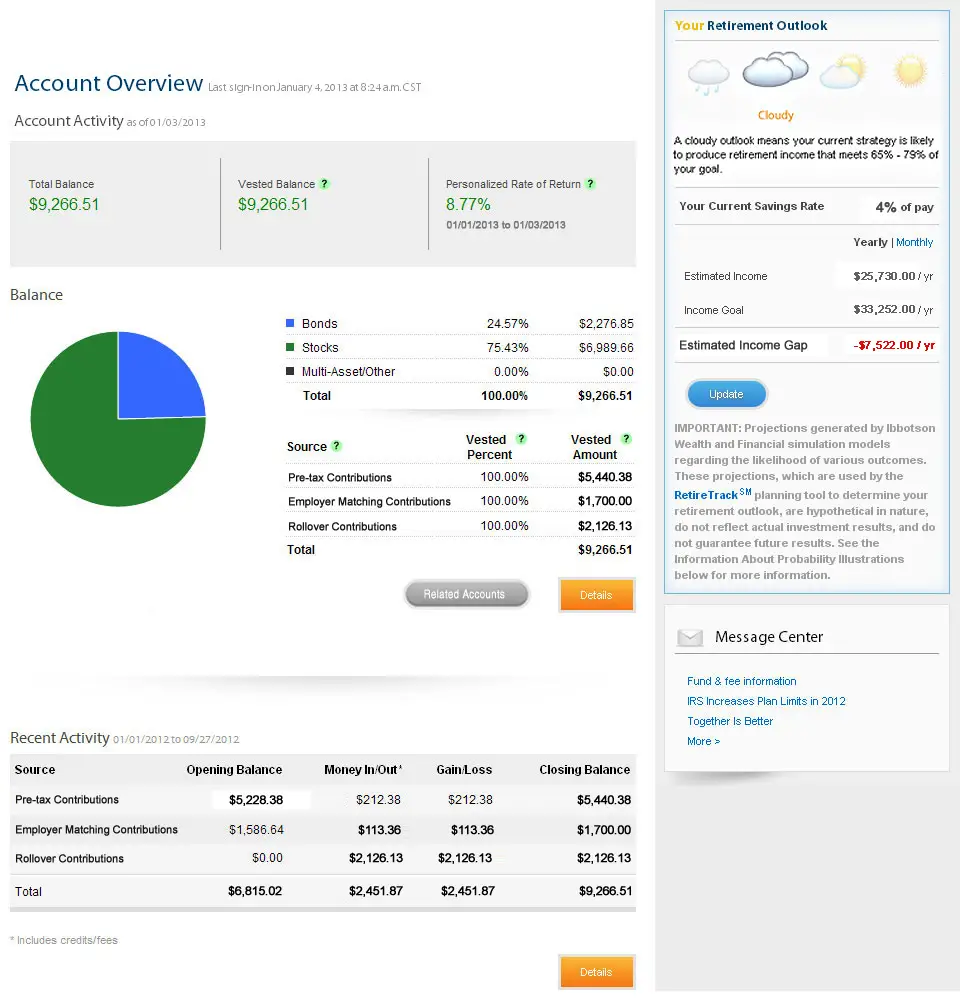

When you quit your job or retire, you have to choose what to do with your accumulated 401 retirement savings. Usually, you can leave your retirement money with the former employer, rollover to an IRA, or transfer the money to your bank account. While it is a smart move to keep retirement money in a retirement account, you can cash out if you need money urgently.

To transfer money from a 401 to a bank account, you should send a withdrawal request to the 401 plan administrator. It can take up to seven business days for the withdrawal to be processed, and you can expect to receive your funds shortly thereafter. Usually, direct deposits take a shorter duration to arrive than paper checks.

Donât Miss: How To Move Your 401k To An Ira

Option : Keep Your Savings With Your Previous Employers Plan

If your previous employers 401 allows you to maintain your account and you are happy with the plans investment options, you can leave it. This might be the most convenient choice, but you should still evaluate your options. Each year, American workers manage to lose track of billions of dollars in old retirement savings accounts, so you should make sure to track your account regularly, review your investments as part of your overall portfolio and keep the beneficiaries up to date.

Some things to think about if youre considering keeping your money in your previous employers plan:

Also Check: Can I Convert My 401k To An Ira

View Important Information About Our Online Equity Trades And Satisfaction Guarantee

- View important information about our online equity trades and Satisfaction Guarantee

-

1. Standard online $0 commission does not apply to over-the-counter equities, transaction-fee mutual funds, futures, fixed-income investments, or trades placed directly on a foreign exchange or in the Canadian market. Options trades will be subject to the standard $0.65 per-contract fee. Service charges apply for trades placed through a broker or by automated phone . Exchange process, ADR, and Stock Borrow fees still apply. See the Charles Schwab Pricing Guide for Individual Investors for full fee and commission schedules.

2. If you are not completely satisfied for any reason, at your request Charles Schwab & Co., Inc. , Charles Schwab Bank, SSB , or another Schwab affiliate, as applicable, will refund any eligible fee related to your concern. No other charges or expenses, and no market losses will be refunded. Refund requests must be received within 90 days of the date the fee was charged. Schwab reserves the right to change or terminate the guarantee at any time. Go to schwab.com/satisfaction to learn whats included and how it works.

Look Out For Your Check In The Mail And Deposit It Into Your New Ira

ADP will only distribute your 401 funds directly to you, using the mailing address they have on file for your account. Once you get the check, its then up to you to deposit that check with your new IRA provider.

There are a few ways you can deposit your check depending on the provider:

- Mobile deposit the easiest option is to check your providers mobile app to see if they have a mobile deposit option. Not all providers provide this option but its worth checking. Mobile deposits are the quickest option and typically take 3-5 business days to show up in your account.

- Deposit in person at a local branch if your provider has a physical branch near by, you can also deposit the check in person. Checks deposited in person typically take 3-5 business days to show up in your account.

- Send the check by mail you can also send the check by mail to the provider using the address you previously looked up. Funds that are mailed can take up to 15 business days to show up in your account.

STEP 5

Also Check: How Much 401k Do You Need To Retire

How Old Are You

If your client is 59½ or younger, theres typically a 10% early withdrawal penalty for both IRAs and 401s . Fortunately, CRA allows the 10% penalty to be claimed as a FTC on the Canadian return in addition to the 15% withholding. On a $100,000 plan, thats $75,000 net the client would also need to owe at least $25,000 in Canadian tax for the transfer to be tax-neutral.

If your client is 70½ or older, she must start withdrawing from the U.S. plan by April 1 of the year following the year the client reached that age. If youre comfortable with where the money is and how its being invested, its probably better to leave it tax-deferred as long as you can, says Altro. You can even withdraw the IRA at a slower pace than a RRIF the minimums are lower than they are in Canada.

If your client is 71 or older, she must convert her RRSP to a RRIF, and its no longer possible to contribute to the RRIF.

Here Are Sample Phone Instructions When You Speak With Voya Financial:

Read Also: Can I Rollover From 401k To Roth Ira

Next Steps To Consider

This information is intended to be educational and is not tailored to the investment needs of any specific investor.

Recently enacted legislation made a number of changes to the rules regarding defined contribution, defined benefit, and/or individual retirement plans and 529 plans. Information herein may refer to or be based on certain rules in effect prior to this legislation and current rules may differ. As always, before making any decisions about your retirement planning or withdrawals, you should consult with your personal tax advisor.

Fidelity does not provide legal or tax advice. The information herein is general and educational in nature and should not be considered legal or tax advice. Tax laws and regulations are complex and subject to change, which can materially impact investment results. Fidelity cannot guarantee that the information herein is accurate, complete, or timely. Fidelity makes no warranties with regard to such information or results obtained by its use, and disclaims any liability arising out of your use of, or any tax position taken in reliance on, such information. Consult an attorney or tax professional regarding your specific situation.

Be sure to consider all your available options and the applicable fees and features of each before moving your retirement assets.

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917

A Rollover Or Transfer Ira May Be Right For You If You Want

Streamlined account management

Access your accountswhenever you need to, however you want. Whatever your preferences, you can securely manage and monitor your accountsalmost anytime, anywhere.

A centralized view of your investments

Whether youre saving for future education, saving for a major life event, or simply want to build your wealth over time, you can invest all your goals in one place.

Ongoing tax-deferred growth potential

Choose an option that allows you to continue to benefit from your savings tax-advantaged status and increase the growth potential of your wealth.

Additional select client benefits

As your assets with us increase, so will your benefits. All our clients enjoy a competitive list of benefits aligned to your investment tier.

Read Also: How To Withdraw From Fidelity 401k

How To Transfer A Former Employer 401k At Voya Financial To A Self

While some financial institutions require forms filled out in order to process a transfer of a former employer 401k plan, Voya Financial will accept over the phone instructions to request the full or partial direct rollover of a former employer plan including a 401k plan to a self-directed solo 401k.

Top Reasons To Consider A Fidelity Ira

There are several benefits to opening your rollover IRA at Fidelity.

Fidelity investments offer some of the widest range of investment options in its commission-free lineup. Any US stock and ETF can be bought or sold for no transaction fee, and index funds have no internal expenses.

Having plenty of investment options is incredibly valuable. Weve had several clients come to us with heavily concentrated positions of their own company stock in a 401. Weve been able to help them diversify and protect their savings by rolling it into an IRA at Fidelity. One client, in particular, stood to lose nearly half of their savings in a concentrated company stock position!

With over $10 trillion in assets, Fidelity brokerage services LLC has enough depth and stability for you to be comfortable that your money is secure.

Fidelitys interface is incredibly user-friendly too. When you log in, you can easily view your Fidelity account balances and positions, or place trades to rebalance your portfolio. Head on over to fidelity.com to see for yourself. Its straightforward to integrate your Rollover IRA at Fidelity into the rest of your financial plan to maintain the consistency you need to meet your goals.

We can help you as well.

Contact us for a free consultation.

Disclosures:

Read Also: How Often Can I Rollover 401k To Ira

Also Check: How To Find My Fidelity 401k Account Number

Warning: Watch Out For 401 Loans

No discussion of 401 plan rollovers would be complete without considering the implications of IRS 401 loan provisions.

Millions of people have loans through their 401 plans. You can borrow up to 50% of the value of your plan, up to a maximum of $50,000. The loan must generally be repaid within five years. However, if your employment ends and you still have a 401 loan outstanding, there may be tax consequences.

Under a typical 401 plan loan provision, the employer may allow you up to 60 days from termination to repay the loan, though some may extend that to 90 days. But if you fail to make repayment within the required timeframe, the plan administrator will declare the unpaid loan balance to be a distribution.

Once again, the distribution that will be added to your regular income, subject to ordinary income tax, plus the 10% early distribution penalty if youre under 59 ½.

You May Like: How To Use 401k To Pay Off Debt

Open Your Fidelity Account

Already have an IRA open at Fidelity? Great skip this step

In order to move the money out of your 401 account, youll need to have an account opened for that money to move into. If youve decided to move your funds to Fidelity, you have two main options:

Weve written a full guide on the five key differences between 401s and IRAs if youre trying to understand all of the differences.

Ultimately, most people who roll over an old 401 do so into an IRA for a few key reasons:

Think of your IRA as helping you do two key tasks:

The good news? Opening an IRA at Fidelity can be done online and should take you less than 10 minutes, if you dont already have one.

Recommended Reading: What Happens To My 401k When I Leave A Company

Rolling Over To A New 401

The first step in transferring an old 401 to a new employer’s qualified retirement plan is to speak with the new plan sponsor, custodian, or human resources manager who assists employees with enrolling in the 401 plan. Because not every employer-sponsored plan accepts transfers from an outside 401, it is imperative for a new employee to ask if the option is available from the new employer. If the plan does not accept 401 transfers, the employee needs to select one of the three other options for the 401 account balance.

If the new employer plan accepts 401 transfers from other companies, there is often a substantial amount of paperwork that must be completed by the employee. The paperwork is provided by the new plan sponsor or human resources contact and requires the name, date of birth, address, Social Security number, and other employee identifying information.

In addition, the 401 transfer form must provide details of the old employer plan, including total amount to be transferred, investment selections held in the account, date contributions started and stopped, and contribution type, such as pre-tax or Roth. A new plan sponsor may also require an employee to establish new investment instructions for the account being transferred on the form. Once the transfer form is complete, it can be returned to the plan sponsor for processing.

A transfer from one 401 to another is a tax-free transaction, and no early withdrawal penalties are assessed.