How To Retire On $400000 Comfortably

Can I Retire at 62 with $400,000 in a 401k? This guide will show you how to retire on $400,000, step-by-step. Well provide estimates on your retirement income at different age brackets.

If you are close to transitioning to retirement, check our Retirement Planning Guide.

If you are not close to transitioning to retirement, check out our Guaranteed Retirement Income Guide.

Use an annuity calculator to get a better idea of the retirement income generated.

This guide will answer the following questions:

- Can I retire at 62?

- Should I buy an annuity with my 401k?

- How long will $400k last in retirement?

Average 401 Returns Dont Tell The Whole Story

Vanguards 2022 How America Saves report says the average 401 balance for Vanguard participants in 2021 was $141,542, up 10% from the 2020 level. However, this number cant really tell you much. Every 401 plan is different. Some people contribute a minuscule 1% of their income, while others contribute 401s up to the limit every year. Meanwhile, some investments perform drastically better than others.

To grasp what you can expect from your 401 plan, you need to understand some key points. Well examine these below.

What Do Average 401 Balances Tell Us

According to Mike Shamrell, vice president of thought leadership at Fidelity Investments, the latest data shows that despite economic uncertainty, retirement savers stayed the course and didnt make significant changes to their retirement savings habits.

Shamrell said that the total savings rate across all Fidelity managed 401 plans, including contributions from both employees and employers, reached a record 14% in the first quarter of 2022.

Individuals did not make significant changes to their asset allocation, he says. Only 5.6% of 401 savers made a change to the asset allocation within their account, and of those people that made a change, more than 80% made only one.

This trend aligns with expert advice that long-term investors should always resist the temptation to let market conditions impact their investing strategy. Instead, they should focus on the things they can control, such as their individual contribution rate.

Don’t Miss: How To Avoid Taxes On 401k

How Long Do You Want To Plan For

Obviously you don’t know exactly how long you’ll live, and it’s not a question that many people want to ponder too deeply. But to get a general idea, you should carefully consider your health and life expectancy, using data from the Social Security Administration and your family history. Also consider your tolerance for managing the risk of outliving your assets, access to other resources if you draw down your portfolio , and other factors. This online calculator can help you determine your planning horizon.

What Is The Average Return On A 401k

What is the average rate of return on 401K in 2021?Savers helped drive their returns last year by setting aside more of their pay for their retirement plans. Employee contributions to 401 plans averaged 9.4% by the end of 2021, up from an average of 9.1% a year earlier and an average of 8.9% at the end of 2019, Fidelity said.

What is a good average return on 401k?

5% to 8%Many retirement planners suggest the typical 401 portfolio generates an average annual return of 5% to 8% based on market conditions. But your 401 return depends on different factors like your contributions, investment selection and fees.

What return can I expect on my 401k?

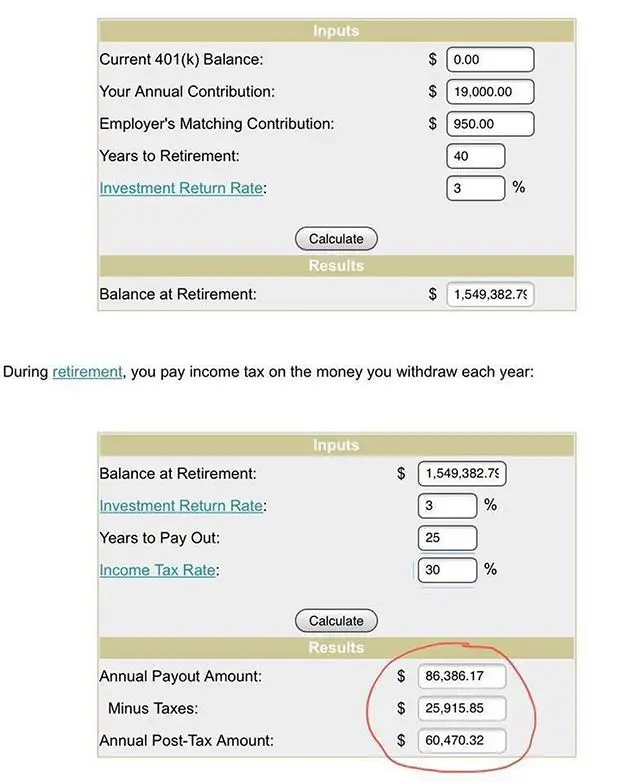

That being said, although each 401 plan is different, contributions accumulated within your plan, which are diversified among stock, bond, and cash investments, can provide an average annual return ranging from 3% to 8%, depending how you allocate your funds to each of those investment options.

What is the average annual return on 401K?

The average rate of return on 401s from 2015 to 2020 was 9.5%, according to data from retirement and financial service provider, Mid Atlantic Capital Group. Keep in mind, returns will vary depending on the individual investor’s portfolio, and 9.5% is a general benchmark.

Also Check: How Do I Locate My Old 401k

Putting It All Together

After you’ve answered the above questions, you have a few options.

The table below shows our calculations, to give you an estimate of a sustainable initial withdrawal rate. Note that the table shows what you’d withdraw from your portfolio thisyear only. You would increase the amount by inflation each year thereafteror ideally, re-review your spending plan based on the performance of your portfolio.

We assume that investors want the highest reasonable withdrawal rate, but not so high that your retirement savings will run short. In the table, we’ve highlighted the maximum and minimum suggested first-year sustainable withdrawal rates based on different time horizons. Then, we matched those time horizons with a general suggested asset allocation mix for that time period. For example, if you are planning on needing retirement withdrawals for 20 years, we suggest a moderately conservative asset allocation and a withdrawal rate between 4.9% and 5.4%.

The table is based on projections using future 10-year projected portfolio returns and volatility, updated annually by Charles Schwab Investment Advisor, Inc. . The same annually updated projected returns are used in retirement saving and spending planning tools and calculators at Schwab.

Average 401 Returns Often Lower

A key factor to the low returns on a 401 is the percentage of fees associated with the plan. Yes, the number of fees attached to your plan your be what is causing such a dismal performance.

It might sound crazy, but the fees associated with your 401 can have a tremendous impact on your future.

In a recent SEC report, an example with a portfolio of $100,000 and a difference in fees of only .75% caused a gap of $30,000 over the course of a 20 year investment period. $30,000 could impact your retirement date significantly!

Now think about the fact that you might have a larger investment portfolio, a larger time frame to invest, or an even larger percentage of fees!

You could be missing out on thousands of dollars or even hundreds of thousands of dollars that should be safe in your retirement account.

In fact, just a 1% fee reduction could help to add 10 additional years to your retirement income! It is worth paying attention to the hidden fees! Simply making an effort to reduce your fees could significantly increase the growth of your 401 accounts.

Don’t Miss: Is An Annuity A 401k

The Importance Of Financial Literacy

Financial literacy cannot be understated. The more you know the more effective you will be when it comes to planning a solid financial future.

You may think that learning about personal finance will not help you out in the end, but education has proven to help improve 401 performance.

A 2010 study showed that individuals with financial literacy had a higher average return on their 401 plans than less financially literate individuals.

Financially literate individuals received an average return of over 1% higher. As we showed with the fees, 1% can make a huge difference in your retirement savings!

You will be saving for retirement over the course of 25 or 30 years, imagine the amount of money you can save with the combined efforts of fee slashing and a basic knowledge about your finances.

The difference could make a huge impact on your life! It is worth investing the time and energy to accumulate knowledge and create a strong financial future for yourself and your family.

Recommended Reading: Can I Borrow From My 401k To Start A Business

Inflation Will Force 25% Of Americans To Delay Retirement: Survey

If I was retiring tomorrow I would be worried, but its the long game an investor in her 40s told The Post.

Younger investors say they try not to think about where their portfolio will be in 40 or so years.

Contributing to my 401 is the most adult thing I am doing these days. If it doesnt pay off, I will be screwed, an investor in her 20s said.

Analysts at Fidelity say its not necessarily the market selloff thats to blame for dwindling retirement accounts.

The averages fluctuate for a variety of reasons: Market performance is certainly one, as well as other factors, such as contribution levels, whether folks are taking withdrawals from their accounts, and also, the coming/going of participants, a Fidelity spokesman told The Post.

And personal finance experts say anyone who invests must understand there are ebbs and flows in the market cycle.

The downturn in the stock market is not atypical what was atypical was last year in 2021 where the market was up 28% with almost no downside volatility, Greg McBride, chief financial officer for personal finance website Bankrate, told The Post.

That was the anomaly. Over time, the market has had at least one correction every year or so, McBride adds.

Even as savings are down this quarter, the numbers are a dramatic increase from a decade ago. In the first quarter of 2012, the average 401 was $74,900, the average IRA was $75,300, and the average 403 was $58,000.

Also Check: How To Borrow Money From 401k To Buy A House

Save Early Often And Aggressively

Yes, saving is hard. Its hard when you are young and not making a large salary, and its hard when youre older and big life expenses get in the way. However, the biggest threat to your retirement is inaction. Even if its uncomfortable to max out your 401k, do it if you can. If you get a salary raise, immediately put 50% of it towards savings if youre able. The earlier and more aggressively you can save, the better off you will be, and you may even surprise yourself with how much you are able to put away. Compounding can do wonders when there is a positive annual return as you can see from the high end of the potential savings chart, so the earlier you can save more, the farther your money will go.

Average Employee Contribution: $6940

The average annual employee 401 contribution was $6,940 during the 12 months ending March 2019, according to Fidelity, which is one of the largest retirement-account record keepers. The IRS sets the bar for contributions pretty high: The 401 contribution limit for employees is currently $19,000 per year, with those 50 or over allowed to save $25,000.

Recommended Reading: Can I Roll Money From 401k To Roth Ira

What Is The 401k Savings Potential By Age

The following chart depicts 401k savings potential by age, based on several assumptions. These numbers can seem high to many people, especially if you are older and started your retirement savings when the contribution limit was much lower. It can still be used as a guide for your target total retirement savings amounts, including your IRA, Roth IRA, and after-tax savings. While its designed for one person, it can also be used as a guide for a married couple if one spouse decides to no longer work.

The assumptions we used for this chart include:

- The numbers are more forward-looking vs. backward, since the average 401k contribution limits were lower in the past.

- You start full-time employment at age 22 at a company that provides a 401k, without a company match.

- You contribute $8,000 to your 401k after the first year, then from the second year onward, you contribute the maximum annual amount of $20,500.

- The No Growth column shows what you could potentially have in your 401k after so many years of a constant $20,500-per-year contribution and no growth.

- The 8% Growth* column shows what you could potentially have in your 401k after so many years of a constant $20,500-per year contribution compounded over the next 43 years.

- The difference between the two columns emphasizes the power of growth, compounding over time. By starting early and enjoying a historically average return on 401k, at age 65, an individual could turn $869,000 of contributions into over $6.4M dollars.

Average401 Return Vs The Market

It is generally knownthat 401k returns are not always high. Sometimes, they are barely enough as itis. Let’s talk about some numbers.

Around four years ago,it was calculated that the average rate of return on 401k plans was hangingaround -4% and lower. Even with how low this is, it was better than S& Preturns which were calculated at a dangerously low 7% and lower. Forclarification, S& P, which is also referred to as the Standard and Poor’s500, is an index tracking of the stock market. The index has 500 companies inthe US on its list with their progress being tracked. Due to its thoroughanalysis, it’s one of the most followed equity indices.

Let’s get back on track.S& P 500 made even lower in rate returns than 401k. When you look atinvestors, on the other hand, particularly the buy and hold ones, their returnswere calculated to be at the rate of 1.2%

Now, Motley Fool, overthe past five years, had an average 401k return of 7% perfect. Do you thinkthis is high? S& P made double with their returns faring as high as 15%.With this, it can be safely said that the average 401k plan made less than halfof an S& P 500 plan.

So, generally, it can beseen that the 401k returns rate is dangerously suffering in the US market. Youmight be wondering what a good 401k plan is or rather where a good 401k planshould start from. Finance experts have determined that a return rate of 5% isgood for planning your 401k.

You May Like: What Happens To 401k Money When You Quit

Average 401 Balances Dont Reflect All Retirement Savings

Theres another key fact to remember when looking at average 401 balances. They do not reflect total retirement savings, says David Stinnett, principal of Vanguard Strategic Retirement Consulting.

Participants may also have other savings accounts, such as individual retirement accounts , retirement accounts at previous employers or spousal accounts, not to mention additional retirement income sources like real estate, pensions and Social Security. All of these assets combined determine a persons retirement readiness.

Not All 401 Plans Are Created Equal

Of course, all of this assumes that your 401 plan is set up for you to take the utmost advantage of it… and unfortunately, not all 401 plans are the same. Thats another mistake most people make, in addition to assuming $20,500 is the absolute limit you can get into these plans: that every 401 plan looks exactly alike.

There are broad based rules created by the ERISA , which is a Federal law that sets minimum standards for retirement plans in the private sector. All retirement plans must follow these baselines. However, employers still have a lot of choice in what they allow or how they construct the plans offered to employees, and thats where you get a wide variation across companies.

If you want to power up your 401 and leverage it for all its worth, you first need to take a look under the hood and see what your plan provides and allows.

Don’t Miss: How To Set Up A Solo 401k For Myself

Median And Average 401 Plan Returns

With so many American invested in a 401 plan, we would hope that the average returns of a 401 plan were higher than the market average.

Unfortunately, this is not the case.

According to a study from Motley Fool, the average 401 return in 2015 was -.4%. That is an appallingly low number for those of us trying to work our way towards retirement.

You might be looking at these numbers and thinking How will I ever make it to retirement with returns like the -.4% in 2015?

Well, never fear: 2019 was a completely different story. With the help of the S& P seeing a 31.5% return in 2019, 401 balances rose by a record 17%.

And thats the thing about investing: one year can be extraordinarily low in returns, while another can be extraordinarily high in returns.

Taking that fact into account, Investopedia tells us that the average rate of return on a 401 hovers between 5% and 8%.

While a 5%-8%% rate of return is a much higher number than -.4%, the difference between those two numbers is startling. What kind of return should we expect over the course of our retirement saving years? Traditionally, retirement planners use an average growth rate of 5% each year for 401 plans.

Why are they using the low end of Investopedias ROI range?

What Is The Average Rate Of Return On A 401

Were here to help! First and foremost, SoFi Learn strives to be a beneficial resource to you as you navigate your financial journey.Read moreWe develop content that covers a variety of financial topics. Sometimes, that content may include information about products, features, or services that SoFi does not provide.We aim to break down complicated concepts, loop you in on the latest trends, and keep you up-to-date on the stuff you can use to help get your money right.Read less

If your employer offers a 401 plan, you may have wondered if its really where you want to put a portion of your hard-earned money every month.

Youve likely been told that the earlier you start saving for retirement, the better off youll be. But how can you know that the average rate of return on your 401 investments will be the same or more than other available options?

The average rate of return on 401s from 2015 to 2020 was 9.5%, according to data from retirement and financial service provider, Mid Atlantic Capital Group.

Keep in mind, returns will vary depending on the individual investors portfolio, and 9.5% is a general benchmark.

Heres what you should know to help you make an informed decision.

Recommended Reading: How To View My 401k Account

Don’t Miss: What Happens To My 401k When I Leave A Company