Youre Our First Priorityevery Time

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

What Happens If I Stop Contributing To My 401k

If you are considering stopping contributions to a 401k, you would be better served to merely suspend those contributions. A short-term suspension will slow the performance of your retirement fund, but it wont keep it from growing. It also will lessen the temptation to simply withdraw all the funds and wipe out retirement savings in the process.

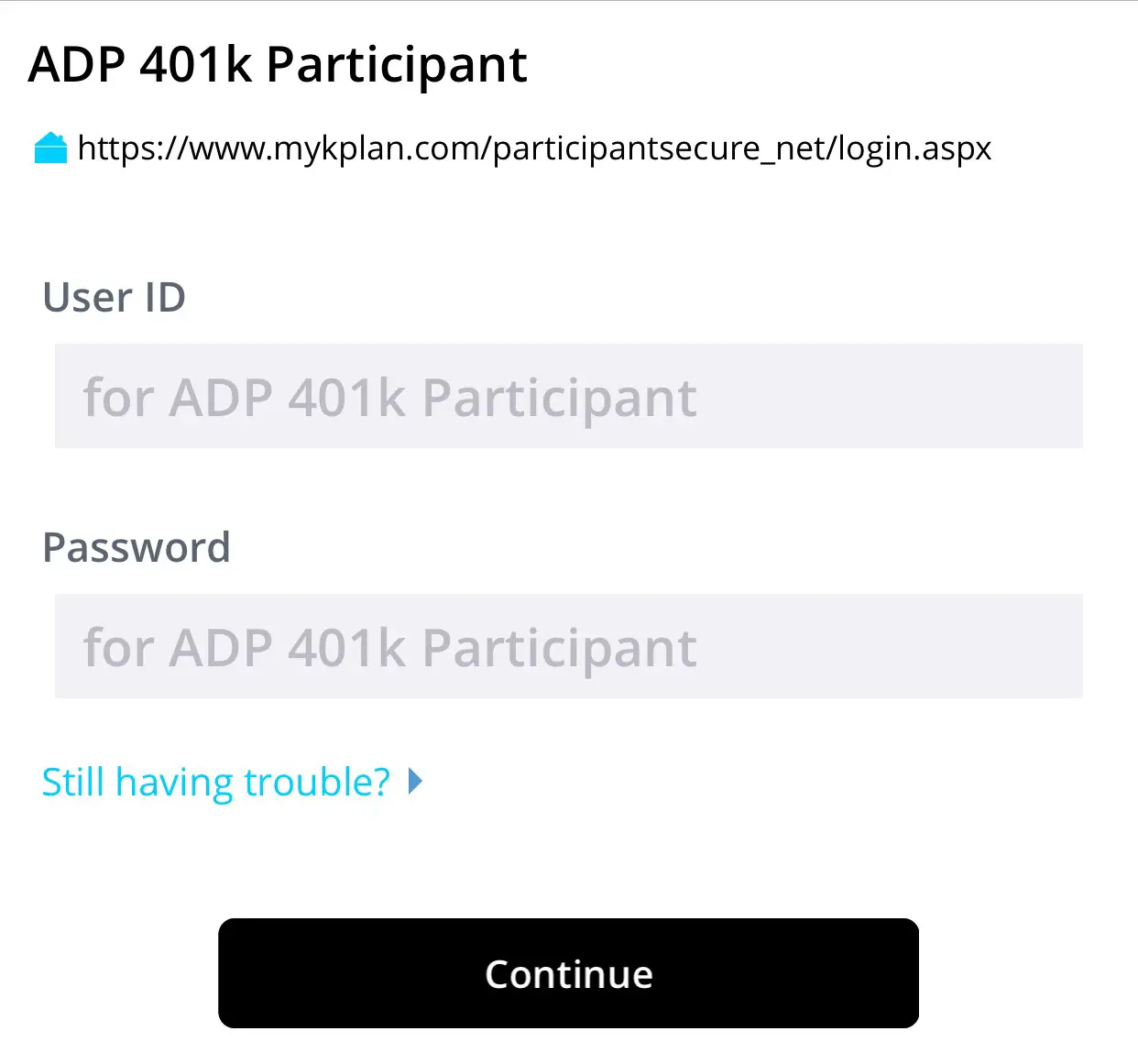

Give Participants Access To Their Account

Our online account dashboard, accessible via mobile device or online portal, gives you and your employees 24/7 access to 401 retirement accounts. Plan administrators can easily manage accounts, while plan participants can check retirement contribution amounts, re-balance accounts and maximize 401 contributions, review investment performance, and auto-enroll.

Don’t Miss: How To Use My 401k Money

How To Find My Fidelity Account Number

If you have forgotten your fidelity account number, this guide will provide you with all the information you need in order to retrieve it. It is easy for anyone to forget their account number, especially in cases where you have several bank accounts. There are several methods you can use to determine your identity account number as you can see below.

What Is Fidelitys Routing Number

Want to fund your Fidelity 401k or perhaps another Fidelity retirement account? Youll probably want to know which routing numbers to use. Always double-check to make sure youre taking down the right information. A single incorrect digit means the funds will go elsewhere, failing the transaction.

Routing numbers are usually well within your reach for a quick look-up. Aside from here, you can also find Fidelity routing numbers on the financial institutions website, with live chat support available. Or, if you have your Fidelity checks handy, just look for your routing number there.

Cash Back and No Annual Fees: Fidelity Rewards Visa Signature Review

Read Also: Can I Contribute To Both 401k And Ira

Contact Your Old Employer About Your Old 401

Employers will try to track down a departed employee who left money behind in an old 401, but their efforts are only as good as the information they have on file. Beyond providing 30 to 60 days notice of their intentions, there are no laws that say how hard they have to look or for how long.

If its been a while since youve heard from your former company, or if youve moved or misplaced the notices they sent, start by contacting your former companys human resources department or find an old 401 account statement and contact the plan administrator, the financial firm that held the account and sent you updates.

You may be allowed to leave your money in your old plan, but you might not want to.

If there was more than $5,000 in your retirement account when you left, theres a good chance that your money is still in your workplace account. You may be allowed to leave it there for as long as you like until youre age 72, when the IRS requires you to start taking distributions, but you might not want to. Heres how to decide whether to keep your money in an old 401.

The good news if a new IRA was opened for the rollover: Your money retains its tax-protected status. The bad: You have to find the new trustee.

Begin The Rollover Process

Youll have to fill out paperwork to conduct your rollover and it may require some back-and-forth conversations with your providers. You have several options to actually move the money from the old provider to the new one, but your best option is a direct rollover.

In a direct rollover, the funds are sent straight from your 401 into your new account without you touching the funds. Its important that you specify a direct rollover so that you dont have the check made payable to you. You could trigger a mandatory 20 percent withholding for taxes, and the IRS charges a 10 percent bonus penalty on withdrawals made before age 59 1/2.

Don’t Miss: Can I Rollover 401k To Ira Anytime

What Is The Account Number And Routing Number

While the routing number identifies the name of the financial institution, the account numberusually between eight and 12 digitsidentifies your individual account. If you hold two accounts at the same bank, the routing numbers will, in most cases, be the same, but your account numbers will be different.

You May Like: Is It A Good Idea To Borrow From Your 401k

How Do I Open A Fidelity Account

FESA FAQs: Download Here.

You May Like: How To Choose Fidelity 401k Investments

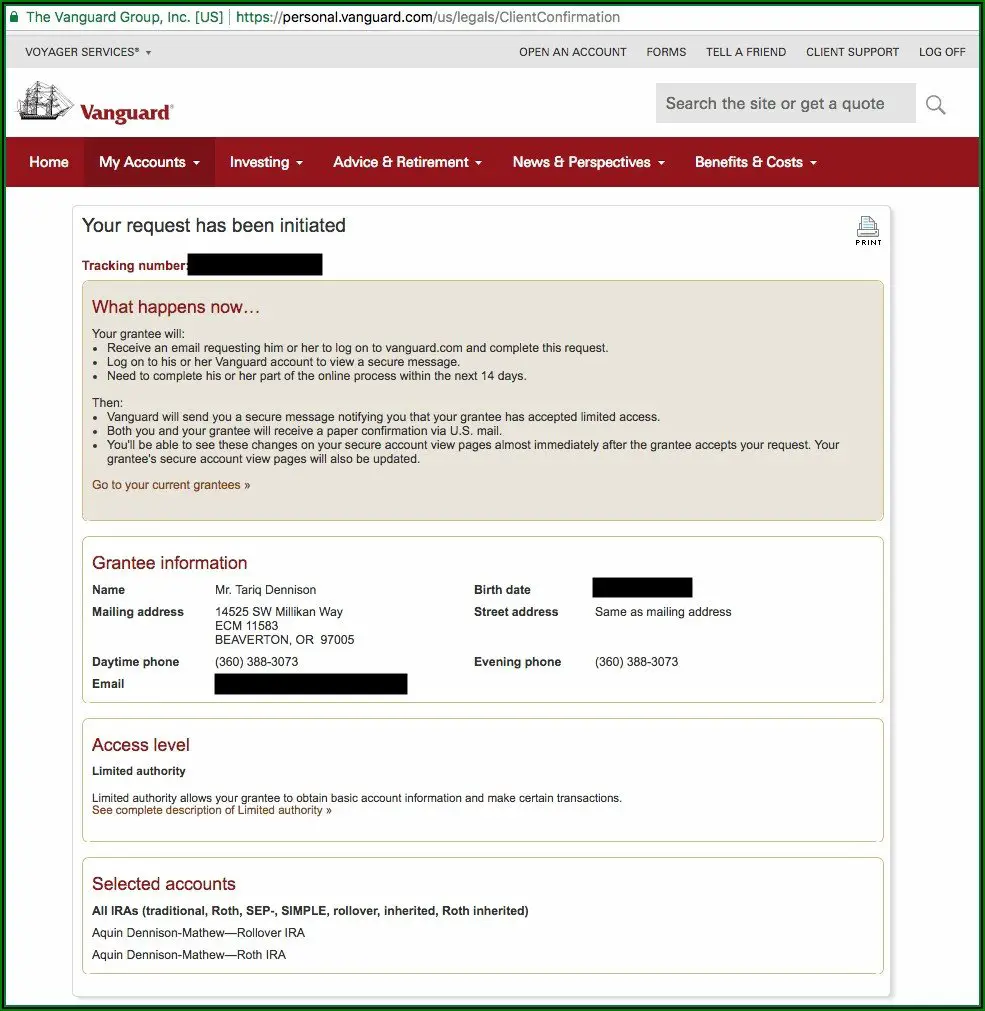

Transfer Funds To An Ira

Another way to protect your retirement funds is to transfer them into an individual retirement account . Like the process above, you can transfer funds from your 401 to an IRA via direct or indirect rollovers. If you dont already have an IRA, you can open one online or through the brokerage of your choice.

While 401s often offer higher permitted contributions and employer-matched contributions, IRAs typically offer more investment options.

Before opening a new account, check out our IRA guide to find out which type is best for you.

A Special Note For Pennsylvania Residents

If you live in Pennsylvania, you should start your search sooner rather than later.

In most states, lost or abandoned money, including checking and savings accounts, must be turned over to the states unclaimed property fund. Every state has unclaimed property programs that are meant to protect consumers by ensuring that money owed to them is returned to the consumer rather than remaining with financial institutions and other companies. Typically, retirement accounts have been excluded from unclaimed property laws.

However, Pennsylvania recently changed their laws to require that unclaimed IRAs and Roth IRAs be handed over to the states fund if the account has been dormant for three years or more.

If your account is liquidated and turned over to the state before the age of 59.5, you could only learn about the account when you receive a notice from the IRS saying you owe tax on a distribution!

Company 401k plans are excluded from the law unless theyve been converted to an IRA. If you know you have an account in Pennsylvania, be sure to log onto your account online periodically. You can also check the states website at patreasury.gov to see if you have any unclaimed property.

You May Like: How Do I Pull Money From My 401k

National Registry Of Unclaimed Retirement Benefits

The National Registry of Unclaimed Retirement Benefits helps employers connect with their former employees to returned unclaimed retirement accounts.

Using your social security number, they will search their database for any accounts associated with you. If one is found, they will provide you with the contact information for the plan’s administrator. Or if you’d like, they will contact your plan for you.

Then, you’ll receive information and a form to select how you want your 401 sent back to you.

This resource is only for unclaimed 401 reported by your former employers. If they havenât reported your 401, it will not show up in the database.

Balances Hit A New All

- Retirement account balances are at new highs, according to Fidelity Investments.

- Thanks to the markets recent run-up and increased savings, the number of 401 and IRA millionaires also hit all-time records in the second quarter of 2021.

Although many Americans continue to face financial uncertainty due to the pandemic, the outlook for retirement savers is only improving.

Retirement account balances, which took a sharp nosedive in 2020 when the coronavirus outbreak caused economic shock waves, are now at new highs, according to the latest data from Fidelity Investments, the nationâs largest provider of 401 savings plans.

The overall average 401 balance hit $129,300 as of June 30, up 24% from the same time last year, according to Fidelity.

Individual retirement account balances were also higher reaching $134,900, on average, in the second quarter, up 21% from a year ago.

Despite Covid case numbers rising in the U.S. and around the world, the yearâs market highs have been a boon for savers. In the second quarter, the S& P 500 ended up 8.2%, before retreating more recently.

Nearly 12% of workers increased their contributions during this time, while a record 37% of employers also automatically enrolled new workers in their 401 plans.

As a result, the number of 401 and IRA millionaires hit fresh highs, as well.

Together, the total number of retirement millionaires has nearly doubled from one year ago.

You May Like: When You Leave A Job Do You Get Your 401k

Recommended Reading: What Should I Do With My 401k After Retirement

Determining Your Fidelity Routing Number

You can identify your Fidelity account number first through your checks, where you will see a 13-digit number at the center bottom. However, if you do not have a check-writing feature on your account, find your 17-digit account number format. Heres a guide:

For brokerage accounts that start with X, Y, or Z:

Put your Fidelity Brokerage Account number after the Fidelity prefix, 39900000. If in case the one to use the figures cannot use letters in the number field, then they do the following substitution for direct deposits:

For the brokerage account number X01999999, the 17-digit account number format would be 39900000X01999999 or 39900000501999999 if the system cannot use letters.

Other brokerage accounts and 529 college savings accounts:

For this one, you need the Fidelity prefix 39900001. Then add your 9-character Fidelity brokerage or 529 plan account number.

Fidelity Routing Number for Fidelity accounts starting with 2 followed by two letters:

- Use the Fidelity prefix 392 first.

- Add the 5-digit Fidelity fund number of the mutual fund to which you want to deposit. If the fund number is less than five digits, then add zeros before the numbers.

- Next, add your 9-digit mutual fund account numb-ppp=][vfgrer.

Identifying 17-digit direct deposit account number if T account does not have check-writing:

If T789789789 is your direct deposit number and the fund is 055, then the 17-digit direct deposit number must be 39200055789789789.

What Happens After I Select And Save A Retirement Savings Plan

- Review the monthly amount to save toward retirement, as well as next steps and action items that will help you reach your retirement saving goal.

- of your plan to print or save to your computer.

- Access your plan online at any time by signing on at My Retirement Plan.

- VisitMy Retirement Plan Tips to learn how to make the most of your selected retirement savings plan.

Recommended Reading: Can I Start A 401k

California Company Makes Retirement Plan A Fixture

With California mandating certain-sized companies offer a retirement plan for their employees, Plumbing M.D. embraced the opportunity and turned to Paychex.

The business saw 100 percent participation in their Paychex 401 plan, and it’s many of the employees under the age of 30 who have been most enthusiastic.

Where Fidelity Go Falls Short

Tax strategy: The company does not offer tax-loss harvesting, one of the features that makes robo-advisors stand out for taxable accounts.

No human advisor guidance: Although Fidelity Go has investment advisors managing and rebalancing portfolios, these advisors do not give financial planning guidance or answer other investment questions.

Read Also: What Does Rollover Mean In 401k

Find 401 Plan Information Through The Labor Department

Another option is to find plan information through the Department of Labors website. By locating the companys Form 5500, an annual report required to be filed for employee benefit plans, you should be able to find contact information and who the plans administrator was during your employment.

You may also be able to find information on lost accounts through FreeERISA. You must register to use the site, but it is free to search once youve set up your account.

Net Unrealized Appreciation And Company Stock In A 401

If you have company stock in a 401, it could save you significant money on taxes to transfer those shares into a taxable brokerage account to take advantage of net unrealized appreciation, or NUA. NUA is the difference between what you paid for company stock in a 401 and its value now.

For example, if you paid $20,000 for company stock and its now worth $100,000, the NUA is $80,000.

The benefit of the NUA approach is that it helps you avoid paying ordinary income tax on these distributions of your own companys stock from your retirement account. That can be up to 37 percent, which is now the highest tax bracket, says Landsberg.

Instead, youll enjoy capital gains tax treatment, which even at the highest tax bracket is only 20 percent, on any appreciation. High earners, however, will be subject to a bonus 3.8 percent net investment income tax. And an NUA may be subject to a 10 percent early withdrawal tax if you move funds prior to age 59 1/2.

Landsberg says NUA makes the most sense when the difference in tax rates is higher.

Net unrealized appreciation is a very powerful tool, if used correctly, Landsberg says. So you can get creative and potentially have a pretty nice windfall if you use the NUA rules correctly.

You May Like: What Is A Pension Vs 401k

You May Like: How To Locate 401k Account

Pooled Employer Plan: The 401 Plan Designed For All Business Sizes

The Paychex Pooled Employer Plan makes it easier for businesses of any size to offer one of the most popular retirement plans for employees. While you reap the benefits of offering a retirement plan, we oversee plan setup, implementation, monitoring, enrollment, and other duties for 401 administration. Learn why a PEP could be a retirement game-changer for your small business.

Other Investment Accounts For Retirement

In addition to a Wells Fargo IRA and employee-sponsored retirement plans that Wells Fargo services, the financial services company also offers other investment options that you may be using to plan for retirement, including mutual funds, stocks and exchange-traded funds. By opening a WellsTrade® online and mobile brokerage account, youll not only be able to access your account online, but youll also be able to manage your own investment portfolio.

Visit the Wells Fargo online and mobile brokerage webpage and click Apply Online to set up your WellsTrade® account. After you set up your account, youll be able to plan for and manage your IRA by choosing the investments you want, entering self-directed online trades, transferring funds between your accounts and accessing this account information any time.

You May Like: When Can I Roll A 401k Into An Ira

You May Like: How Can I Get My 401k Without Penalty

How To Find And Claim Your Old Retirement Accounts

Whether you quit on your own accord, are fired, or laid off, leaving a job can be hectic. In the midst of the transition, dealing with a retirement account might get pushed pretty low on your to-do list.

While the money you contributed is yours forever, accounts can sometimes get forgotten about in the shuffle. And, in some cases, you may not have even realized youd had a retirement account if your employer automatically signed you up and withheld contributions.

Whether intentional or not, you can wind up with a handful of retirement accounts at different companies and lose track of some of them over time. Former employers and plan administrators may lose track of your current contact information.

Heres how to check and track down old accounts, and what you can do to get your finances organized.

How To Find Your Old 401 Accounts

1. Contact your former employer

You can start your search for your missing retirement savings by contacting your former employers human resources department. Simply tell them youre a former employee who wants to access a 401 plan you left behind. Then, theyll likely ask you for identifying information and dates of employment to help search their record.

If the HR department can locate your 401 account, theyll let you know what your options are for accessing the account. They can also give you steps to take to roll those assets over into your new employers 401 or to a rollover IRA account.

However, you might run into a hiccup if youre previous employer has been acquired by another company. In this case, you can search online for news about the acquisitions details, including the name and location of the purchasing company. If youre still in touch with former colleagues from that job, they may be able to provide you with the information as well.

2. National Registry of Unclaimed Retirement Benefits

If your online sleuthing doesnt turn up the information you need to find your old 401, dont despair. You can search the National Registry of Unclaimed Retirement Benefits, which helps employers connect with former employees who have left assets behind in a retirement plan.

3. U.S. Department of Labors Abandoned Plan Search

4. Use Beagle, the 401k super sleuths

Also Check: Is A 401k An Ira