Tips To Save For Retirement

That most Americans dont have nearly enough savings to sustain them through retirement is sad but true. How do you avoid that fate? Here are some steps that you can take, whether you’re early in your career or closer to your retirement.

Of course, start saving and investing as early as you possibly can. The longer you have, the better, especially where the power of compounding interest is concerned. Retirement may seem a long way off but when it comes to saving for it, the days can dwindle away quickly and any delay costs more in the long run.

What Are The Average Savings By Age

Unless youre an actuary, you probably have only a vague idea of how much money you should have saved for future expenses and retirement — and whether or not you are on the right track. The amount you should be saving each year is a complex calculation, economists say, so theres no right answer. Still, knowing Americans average retirement savings by age can help you gauge your progress.

The Economic Policy Institute , a non-profit, non-partisan think tank specializing in research on the economic situation of low- and middle-income workers, published a revealing 2019 report called The State of American Retirement Savings. Using data from the Federal Reserve Boards Survey of Consumer Finances, conducted every three years, the institute arranged the retirement savings statistics by six-year cohorts. The study looks at families headed by someone age 32 to 61 a 30-year period before the Social Security early eligibility age of 62 when most families should be saving for retirement.

See How Much You Can Save By Starting Now

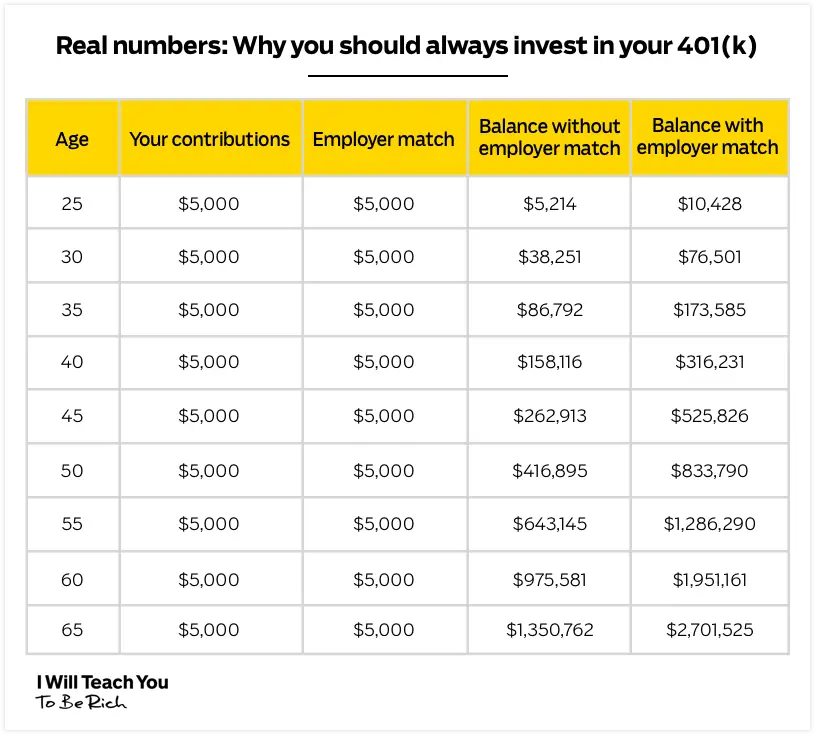

Contributing to a 401 can generate a large immediate rate of return on your investment. Letâs see how investing 10% of a $1,250 biweekly paycheck could affect your assets.

In other words, contributing 10% of your salary to a 401 would generate a whopping 140% immediate rate of return.

You can see the effect of contributing to a pre-tax account such as a 401 in the pie charts below.

Also Check: Can I Buy Individual Stocks In My 401k

Don’t Miss: How Much Should I Put In My 401k

Key Takeaways: Are You On Track To Retire

- 401 balances can average roughly $6,000 at the age of 24 to more than $255,000 at the age of 65.

- Knowing the average and median 401 savings by age can help you figure out where you stand and how you can be better prepared for the future.

- As soon as a 401 becomes available to you, its best to consider taking advantage of this benefit.

- There are various ways to prepare for retirement, such as:

- Improve your 401 balance

- Prioritize your retirement savings

- Learn from your 401 balance

Whats So Great About A 401 For Retirement Planning

Quite a few things. Having your contributions taken out regularly is more convenient than having to write a check to banks or investment firms every so often. That makes it more likely that you will continue to save, which makes it more likely youll have enough money to retire when the time comes.

But theres more. Your contributions arent counted as income for taxes, which reduces your annual tax bill. For example, if you earn $50,000 a year and contribute $5,000 of your salary to a 401, youll shelter $5,000 from state and federal income taxes that year. If youre in the 20 percent combined state and federal tax bracket, that will reduce your tax bill by $1,000.

Your earnings also wont be taxed until you withdraw them. In a regular brokerage account, youll owe taxes on income and capital gains the year in which you receive them. A 401 allows your earnings to grow tax-free for as long as you keep the money in your account.

The tax deduction also means that your paycheck wont be hit as much as it would without a 401. If you earn $50,000 a year, for example, you would need to save $417 a month before taxes to have $5,000 saved at the end of a year. If you saved that money in a 401, however, you would still contribute $417 a month, but your paycheck would be reduced by just $333 a month, because youve reduced your tax bill by more than $83 each month.

Read Also: Can I Withdraw From 401k To Buy A House

Depend On Nobody But Yourself

Contribute the maximum pre-tax income you can to your 401 for as long as you work. This is the absolute MINIMUM you can do to by on the right 401k savings by age path.

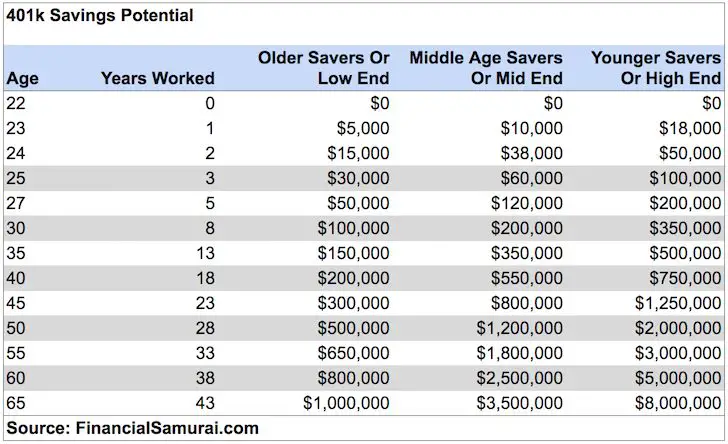

Below is a chart that shows what you could have in your 401 if you max it out each year starting in 2023. The right hand column shows what you would have in your 401 with 8% compound annual returns.

In other words, everybody who consistently maxes out their 401 each year will likely be a 401 millionaire by the time they turn 60.

After you contribute a maximum to your 401k every year, try and contribute at least 20% of your after-tax income after 401k contribution to your savings or retirement portfolio accounts.

This way, you will have potentially DOUBLE the amount in total retirement saving if your household income is $100,000 or more. If your household income is closer to $50,000, you should still see a nice 30% boost to your retirement savings if you consistently save 20% of your after tax income. Here is the recommended order to contribute to your retirement accounts.

Treat your 401k just like Social Security and write it off completely from your mind. Do not expect either accounts to be there for you when you retire. Its just like how you should never expect the government to ever help you when youre in need.

Two Favorite Real Estate Platforms

Fundrise: A way for accredited and non-accredited investors to diversify into real estate through private eFunds and eREITs. Fundrise has been around since 2012 and has consistently generated steady returns, no matter what the stock market is doing. For most investors, investing in a diversified portfolio is the best way to go. Fundrise manages over $3 billion in assets.

CrowdStreet: A way for accredited investors to invest in individual real estate opportunities mostly in 18-hour cities. 18-hour cities are secondary cities with lower valuations. They also have higher rental yields, and potentially higher growth due to job growth and demographic trends.

Both platforms are free to sign up and explore.

Ive personally invested $810,000 in real estate crowdfunding across 18 projects. My goal is to take advantage of lower valuations in the heartland of America. My real estate investments account for roughly 50% of my current passive income of ~$300,000.

Follow my 401k savings by age guide. But in the meantime, also build a passive income portfolio so you can live a better life today. Given you cannot withdraw from your 401k without penalty until 59.5, it is your passive investment portfolio that matters even more.

Read Also: How To Buy A House With 401k

Planning For Retirement By Age

The most important element of retirement saving is making and executing on your plan as early as possible. Over the years, your needs, priorities and preferences will shift. But setting a solid foundation and sticking closely to experts guidelines will give you the security of knowing youre on pace for a retirement you can look forward to. As you take action to plan out your retirement, its also important to keep an eye on your credit. A flush retirement account will open up opportunities for you in retirement, and robust credit can help you attain goals throughout your life.

Save Early And Often In Your 401k By 40

Contribute the maximum pre-tax income you can to your 401k for as long as you work. This is the absolute MINIMUM you can do to help ensure a comfortable retirement. After you have contributed a maximum to your 401k every year, try and contribute at least 20% of your after-tax income after 401k contribution to your savings or retirement portfolio accounts.

This way, you will have potentially DOUBLE the amount in total retirement saving if your household income is $100,000 or more. If your household income is closer to $50,000, you should still see a nice 30% boost to your retirement savings if you consistently save 20% of your after tax income.

At age 40, you should really have closer to $500,000 or more in your 401k. Challenge yourself to raise your after-tax and 401k contribution savings percent to possibly 50%. It wont be easy, but if you practice raising your savings rate by 1% a month until it hurts, youll find it easier than you think.

Once you maximize your 401k and save over 50% of your after-tax income for at least 10 years in a row, you will be financially free to do whatever you want.

Take it from me, someone who left the work force at the age of 34 after saving 50%+ for 13 years. Theres not a day that goes by where Im not thankful for working extra hard and making certain financial sacrifices to be free.

Don’t Miss: How To Sign Up For 401k

Why Am I Losing Money In My 401k

Several factors may be responsible for the loss of money in your 401. One possible cause is a general decline in the value of stocks. Another possible reason that your 401 is losing money is because you have invested in an individual company or industry that has faltered. Finally, losses may also be caused by fees charged by mutual fund companies and brokers.

K As A Retirement Vehicle By Age 60

The 401k is one of the most woefully light retirement instruments ever invented. Give me a pension that pays 70% of my last years salary for the rest of my life over a 401k or IRA any time! At least with the 401k, anybody can contribute.

The average 401k balance as of February 2022 is around $125,000 according to Fidelitys 12 million accounts, thanks to an incredible rise in the S& P 500 since 2009. Were at new record highs and the S& P 500 is now up close to 200% since the depths of the financial crisis.

Even so, $125,000 is an incredibly low amount given the median age of an American is 36.5. Further, the median 401k amount is closer to only $28,000. As an educated reader who is logical and believes saving for retirement is a must, Ive proposed a table that shows how much each person should have saved in their 401ks at age 25, 30, 35, 40, 45, 50, 55, 60, and 65.

We stop at 65 because you are allowed to start withdrawing penalty free from your 401k at age 59 1/2. Meanwhile, I pray to goodness you dont have to work much past 65 because youve had 40 years to save and investment already!

You May Like: Can You Roll Your Pension Into A 401k

What Is A 401k

Your 401k acts as a retirement investment account that is sponsored by your employer, where you can invest some of your earnings . Over time your contributions will likely grow, and you can start to withdraw money from it when you reach 59.5 years old.

Because it is sponsored by your employer, they will usually offer something called employer match. Take advantage of this as much as you can, because its free money! The percentage they will match varies among employers, but generally they will offer to match your contributions to a particular limit.

Always, always do what you need to do to get the employer match.

Another little perk to using a 401k because these are contributions you make before tax, you could be bumped to a lower tax bracket, depending on your income.

Aim To Invest As Much As Possible In Your 401 And Other Retirement Accounts

A 401 can be a convenient and simple way to save for retirement, although you have other options, including traditional IRAs and Roth IRAs.

You should be investing in these retirement plans throughout your career with the goal of amassing a nest egg large enough to meet your needs. If you aren’t hitting your investment targets, consider carefully reviewing your budget to find more opportunities to save. As you earn salary increases, you may also want to save those raises in your 401 rather than spending the extra income since this can make it easier to hit your savings targets.

You May Like: How To Figure Out 401k Contribution

Next Steps To Consider

This information is intended to be educational and is not tailored to the investment needs of any specific investor.

Diversification and asset allocation do not ensure a profit or guarantee against loss.

Investing involves risk, including risk of loss.

Target Date Funds are an asset mix of stocks, bonds and other investments that automatically becomes more conservative as the fund approaches its target retirement date and beyond. Principal invested is not guaranteed.

Fidelity does not provide legal or tax advice. The information herein is general in nature and should not be considered legal or tax advice. Consult an attorney or tax professional regarding your specific situation.

With respect to federal taxation only. Contributions, investment earnings, and distributions may or may not be subject to state taxation.

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917

How To Calculate Your Monthly 401 Contribution

In 2021, the 401 contribution limit is $19,500 for those under age 50 this increases to $20,500 for 2022. Workers age 50 or older can make an additional catch-up contribution of $6,500 in both 2021 and 2022. You and your employers combined contributions cant exceed $58,000 in 2021 or $61,000 in 2022, excluding catch-up contributions.

However, few people actually contribute these amounts. Only 12% of plan participants made the maximum contribution in 2020, when the limit was $19,500, according to Vanguard’s 2021 How America Saves report.

To determine how much you should be saving, you can use Social Securitys retirement estimator and see what monthly benefit you can expect from that fund. You also can use a retirement calculator to estimate how much youll need each month on top of Social Security. Choose a calculator that allows you to personalize as many factors as possible, including your current age and account balance, anticipated contributions, other sources of income, and expected rates of return.

Don’t Miss: How To Set Up 401k Contributions

I Wish Id Had The Courage To Live A Life True To Myself Not The Life Others Expected Of Me

This was the most common regret of all. When people realise that their life is almost over and look back clearly on it, it is easy to see how many dreams have gone unfulfilled. Most people had not honoured even a half of their dreams and had to die knowing that it was due to choices they had made, or not made. Health brings a freedom very few realise, until they no longer have it.

Are You Meeting Your Match

Weve said it before, and well say it again. At the very least, do what you can to contribute the minimum amount required to earn your employers match. Not doing so is equivalent to not earning your full salary. While this may reduce your take-home pay, consider the growth potential of your retirement account from compound interest over the long run.

Don’t Miss: Can I Put Money In A 401k And An Ira

I Wish I Had Stayed In Touch With My Friends

Often they would not truly realise the full benefits of old friends until their dying weeks and it was not always possible to track them down. Many had become so caught up in their own lives that they had let golden friendships slip by over the years. There were many deep regrets about not giving friendships the time and effort that they deserved. Everyone misses their friends when they are dying.

Prioritize Your Retirement Savings

Whether you started saving late or are frugal with your finances, there are several things you can do to increase the amount of money you put toward your 401.

Its advisable to add one year of gross salary saved every five years. So when youre 30, youll want to have saved one years worth of your salary at age 35, youll want to have saved two years worth of your salary and at 40, youll want to have saved three years worth of your salary.

Make compound interest work for you: Compound interest is a simple concept that can rapidly cause wealth to snowball. It happens when the interest that accrues on an amount of money, in turn, accrues interest itself. Do your research to see which 401 plans have the best interest-bearing options.

You May Like: What Are Terms Of Withdrawal 401k

What Percentage Of My Income Should I Contribute To My 401

You can use the 401 calculator to get straightforward, dollars-and-cents answers to many important questions about your retirement. When it comes to how much you ought to be saving, however, things arent quite so simple. It depends on your age, how many years you plan to work and, ultimately, on the kind of lifestyle you want to have after you retire.

Some advisors recommend saving 10-15% of your income as a general rule of thumb. If you save that much from the time you first start working in your 20s until you retire, that may be fine. If youre starting your retirement savings later in life, however, you will want to save more than that to try to catch up. While there are few hard and fast rules on exactly how much you should save, here are some general guidelines: