Is It Worth Taking A 401 Withdrawal To Buy A House

Taking a 401 withdrawal for a house can be a costly way to fund your home purchase. Youll pay income taxes on the distribution most likely at a higher rate than you would when withdrawing funds during your retirement years. And unless youre 59½ or older, youll pay an additional 10% penalty on the withdrawal.

Besides the immediate costs, using your 401 for a house down payment has long-term consequences. Youll be removing money from your nest egg money that may be harder to replace later on. And youll be unplugging a chunk of your money from future growth.

| Note: Withdrawing money from your 401 for a house down payment and other purchase costs qualifies as a hardship distribution as long as its for your primary residence. But the withdrawal will still be subject to income tax and, if youre under 59 ½, the 10% early withdrawal penalty. |

Getting Cash Out With A Mortgage Refinance

According to Bankrate.com, cash-out mortgage refinance rates are around 3.7% APR in 2020. So if you need to lower your rate, it might make sense for you to do a cash-out refinance. While this is an option for many borrowers, lending criteria are becoming more strict. All lenders are looking more closely to see if someone is already in forbearance and whether borrowers have jobs, says CD Davies, head of lending at Figure. In the past, he says, verification of employment happened shortly after application. Now borrowers can expect verification of employment within 48 hours of closing.Evaluating whether to do a cash-out refinance will depend on a few things:

Alternatives To Using A 401 To Buy A House

Again, cashing out a 401 to buy a house has significant implications and expenses both immediately and down the road. If thats your only way to fund a down payment, perhaps delaying the purchase can give you more time to save. But if youre looking to buy a home sooner rather than later, make sure you consider all your options before resorting to 401 withdrawals for a home purchase.

Don’t Miss: Can I Cash Out An Old 401k

What Happens If A Plan Loan Is Not Repaid According To Its Terms

A loan that is in default is generally treated as a taxable distribution from the plan of the entire outstanding balance of the loan . The plans terms will generally specify how the plan handles a default. A plan may provide that a loan does not become a deemed distribution until the end of the calendar quarter following the quarter in which the repayment was missed. For example, if the quarterly payments were due March 31, June 30, September 30 and December 31, and the participant made the March payment but missed the June payment, the loan would be in default as of the end of June, and the loan would be treated as a distribution at the end of September. -1, Q& A-10)

If your 401 plan or 403 plan has made loans that havent complied with plan terms about loans, find out how you can correct this mistake.

Take Out A Personal Loan

Typically, acceptance for personal loans is based on your income and . While every lender is different, in some circumstances, it’s possible to take out up to $100,000 to put toward a down payment.

However, it’s important to be aware that taking out a new loan can raise your debt-to-income ratio, which can hurt your ability to be approved for a mortgage. You’ll want to check with your lender to verify you’re able to take on more debt before taking out any new loans.

Read Also: How To Invest 401k Fidelity

Is There Any Way To Take An Early 401 Distribution Penalty

There are a few situations in which a penalty-free early distribution is allowed:

- You become disabled.

- You die and a payment is made to your beneficiary or estate.

- You pay for medical expenses exceeding 7.5 percent of your adjusted gross income.

- The distributions were required by a divorce decree or separation agreement .

As you can see, the IRS doesnt make it easy to take your 401 money early under any circumstances!

At a Glance : 401 Loans| Pluses |

|---|

Downside Of Using Your 401 To Buy A House

Tapping your retirement account for money for a house has drawbacks to consider, whether you take outright withdrawals or a loan. The main downside is that you diminish your retirement savings. Not only does your total retirement account balance drop, but even if you replace the funds, you have lost some potential for growth with the funds not being invested.

For example,if you have $20,000 in your account and take out $10,000 for a home, that remaining $10,000 could grow to $54,274 in 25 years with a 7% annualized return. But if you leave $20,000 in your 401 instead of using it for a home purchase, that $20,000 could grow to $108,548 in 25 years with the same 7% return.

With a Roth 401, you can withdraw the money youve contributed at any time tax- and penalty-free. However, if you withdraw earnings on your invested contributions before age 59½, you must pay taxes on them.

Don’t Miss: How Does 401k Work When You Quit

Retirement Plans Faqs Regarding Loans

Information on this page may be affected by coronavirus relief for retirement plans and IRAs.

These frequently asked questions and answers provide general information and should not be cited as any type of legal authority. They provide the user with information responsive to general inquiries. Because these answers do not apply to every situation, yours may require additional research.

Ira Rollover Bridge Loan

There is one final way to borrow from your 401k or IRA on a short-term basis. You can roll it over into a different IRA. You are allowed to do this once in a 12-month period. When you roll an account over, the money is not due into the new retirement account for 60 days. During that period, you can do whatever you want with the cash. However, if its not safely deposited in an IRA when time is up, the IRS will consider it an early distribution. You will be subject to penalties in the full amount. This is a risky move and is not generally recommended. However, if you want an interest-free bridge loan and are sure you can pay it back, its an option.

Read Also: How To Locate Old 401k

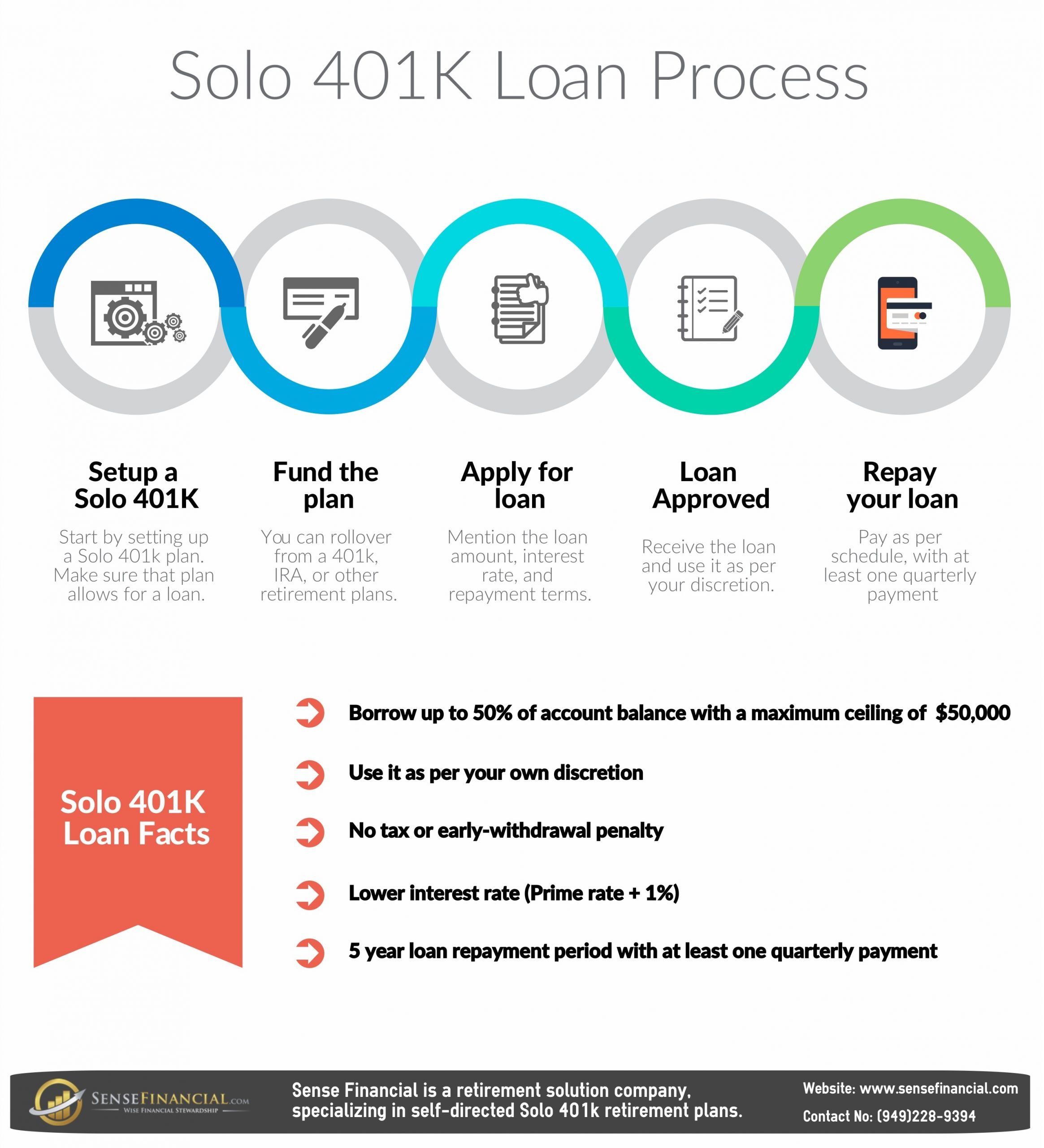

How To Borrow Against Your 401

You must apply for the 401 loan and meet certain requirements, which can depend on the plan’s administrator. Typically, a 401 borrower has to pay back the loan within five years. Most plans require payments at least quarterly, or every three months.

There are some exceptions again, it depends on the administrator. For instance, if you use the 401 loan to buy a home that will be your main residence, the five-year payback requirement can be waived.

If You Lose Your Job You May Have To Repay The Money By Tax Day Next Year

Leaving your job used to trigger a requirement that you repay your loan within 60 days. However, the rules changed in 2018 under the Tax Cuts and Jobs Act. Now you have until tax day for the year you took the withdrawal to pay what you owe.

So, if you borrow in 2021, you will need to repay the full balance by April 15, 2022, or by Oct. 17, 2022, if you apply for an extension. If you borrow in 2022, you’ll have to repay the full balance by April 17, 2023, because April 15 of that year falls on a Saturday, or by Oct. 16, 2022, since the 15th of October falls on a Sunday.

This longer deadline does slightly reduce the risks of borrowing. But, if you take out a loan now, spend the money, and then are faced with an unexpected job loss, it could be hard to repay your loan in full.

Don’t Miss: Where Can I Start A 401k

What Is A 401 Loan

A 401 loan is a loan you take out from your own 401 account. They work like normal loansyou pay origination fees and interestonly youre borrowing money from yourself. According to Vanguard, 78% of 401 plans permit participants to take out 401 loans, and about 13% of plan participants have an outstanding 401 loan.

If you need money, you might consider taking a loan from your 401 if:

You want a lower interest rate. 401 loans still charge interest. But the amount you pay may be less than on a loan you take out with someone else. 401 loan interest rates are based on the prime rate, an interest rate adapted from Federal Reserve loaning guidelines. 401 loans will normally be a percentage point or two above this rate, which may be lower than the rate you could get at a bank.

Youd prefer to pay interest to yourself. No one likes paying banks and credit card companies interest. While youre still on the hook for interest payments with a 401 loan, you get to pay it back to yourself instead of someone else.

You want looser credit requirements. If your credit score prevents you from getting the best rates on loans, you may opt for a 401 loan. Depending on your employer, you may not even need a credit check to borrow from your 401.

You might want to avoid a 401 loan if:

Borrow From Your 401k To Buy A Home

Saving up money for a down payment and closing costs to buy a house is one of the basic requirements in order to qualify for a home loan. It can be a tedious process, especially for first-time home buyers.

However, lenders do allow access to a retirement account as a legitimate source of cash from a 401k or an individual retirement account . But while those funds are available and are easily accessed by a borrower, should those accounts be used for a down payment and closing costs?

Read Also: Is A Solo 401k A Qualified Plan

Can You Borrow Money From Your 401

If you’ve got a decent amount invested in your 401 and need a short-term loan, you may be considering borrowing from the popular retirement vehicle.

There are many things to consider before you take out a loan from your 401, including potential penalties, taxes and the possibility of a smaller retirement nest egg.

Before you many any major financial decisions, it may be wise to consult with a financial adviser who can explain the impact.

How Much Can You Borrow From 401 To Buy A House

Generally, you can borrow up to half the value of your current balance or $50, 000 from your 401 to buy a house. The maximum amount that you can loan is the lower amount between the two.

For example, if you have $90, 000 as your current balance and you divide it by two you would have $45, 000. This means that you can borrow up to $45, 000 from your 401 plan, since it is the lesser amount. However, if you have $110, 000 as your current balance and you divide it by two you would have $55, 000. This means that you can borrow up to $50, 000 from your 401 plan, since $55, 000 would exceed the maximum loan amount which is $50, 000.

Recommended Reading: How To Find 401k From Former Employer

How Long Do You Have To Repay A 401 Loan

You generally have up to five years to repay your 401 loan, and you must make at least quarterly repayments. You may be able to get longer loans under special circumstances, like when you use a 401 loan for your primary residence. Your employer may set different terms for any of the above, so make sure to check with your plan administrator before you withdraw money from your 401.

Regardless of the requirements of your plan and company, you may choose to make more frequent repayments or to borrow money for a shorter amount of time. Paying off a 401 early minimizes the opportunity cost of having money not compound in your retirement accounts. It also helps protect you from the consequences of not repaying a 401 loan if you suddenly lose your job.

Remember: Your company determines when you must repay your 401 loan by if youre no longer employed. While your company may allow repayment up until you file taxes for the current year, you must repay your loan by then. Otherwise, you may owe taxes or an early withdrawal penalty on the amount you borrowed.

What Is A 401 And How Does It Work

Before diving into whether you should use your 401 to buy a house, its important to first have a firm grasp on how, exactly, a 401 retirement account works.

Your 401 account is an earmarked savings account created specifically to help you prepare for retirement. As defined by the Internal Revenue Code of the IRS, 401 holders can claim a tax deduction and will see their contributions to the account accrue tax-free interest over time. The trade-off is that access to the account is strictly limited.

Withdrawals from a 401 should not be made before the account holder turns 59½, or before they turn 55 and have left or lost their job. Early withdrawals incur a 10% early withdrawal penalty on the amount of money being taken out of the account. This amount also immediately becomes subject to income tax, since its no longer in the protected retirement savings account.

While these regulations may seem harsh, they are in place to incentivize account holders to set aside enough money to support a comfortable retirement. That being said, its not illegal to withdraw money from your 401 early, and those funds can certainly be put toward a down payment on a house.

Take the first step toward the right mortgage.

Apply online for expert recommendations with real interest rates and payments.

You May Like: How Much Can I Contribute To My Solo 401k

What To Do Before Withdrawing From Your 401

Even if you qualify for an early distribution, you should be wary of withdrawing from your 401.

So before borrowing from your 401, where should you look for money? The first and obvious place to look is liquid, cash savings, Levine says. Ideally, everyone would have an emergency fund for situations like this.

If you dont have enough saved up, then take a look at your current spending you may find areas where you can scale back to save money while times are tough.

Do you have a car payment or lease that you could reasonably get rid of by buying a cheaper or used car? Are you living in a rental that you could move out of and into something cheaper? Those are obviously serious steps, and just examples, but withdrawing from a 401 will permanently reduce your savings, says Renfro.

If you cant cut anything out of your budget, you could try to get discounts. Levine suggests calling providers, like your cable and insurance companies, and explaining that you need to cut back due to coronavirus-related cash flow issues. Theyll almost definitely offer a discount, he says.

You could also consider taking out a small loan, but be careful not to get yourself further behind with a high-interest debt payment, Renfro says.

When Borrowing From Your 401k Is A Bad Idea

Borrowing from your retirement plan for any reason is a risky proposition. There are several pitfalls to borrowing from your 401k or IRA account to buy a house.

If your debt-to-income ratio is high and youre already cutting your monthly budget pretty thin by getting a mortgage, then having a separate loan payment may make using your 401k to buy a house a terrible idea.

And even if you have plenty of money left over after paying your bills, tapping into your 401k should still be a last resort.

Your Retirement could be Harmed in the Long-Term

When borrowing from your 401k, you may not be able to contribute additional funds to your account while repaying the loan.

If your employer offers any retirement contribution matches, you will not be able to take full advantage of it.

When looking at your retirement savings in the long-term, the total amount will be less than it could because you cannot contribute for years.

Tax Penalties

When you withdraw funds from your retirement plan, you are subject to a 10% income tax penalty. The fund that money is in may also have an early-withdrawal fee.

The tax penalty is waived if you are getting a 401k loan and are repaying the amount borrowed.

However, if you leave your current employer for any reason, you may have to repay any loans within 60 days. If youre unable to repay within the window of time, you could face a 10% tax penalty.

You May Like: How To Rollover A 401k To Vanguard