What Is A 401 Early Withdrawal

First, lets recap: A 401 early withdrawal is any money you take out from your retirement account before youve reached federal retirement age, which is currently 59 ½. Youre generally charged a 10% penalty by the Internal Revenue Service on any withdrawals classified as earlyon top of any applicable income taxes.

If youre making an early withdrawal from a Roth 401, the penalty is usually just 10% of any investment growth withdrawncontributions are not part of the early withdrawal fee calculation for this type of account.

But the entire account balance counts for calculating the fee if youre making an early withdrawal from a traditional 401. These rules hold true for early distributions from a traditional IRA as well.

Reasons To Withdraw Penalty

There are a few reasons an account owner may want to withdraw retirement funds from an IRA or 401 account before reaching retirement age. In the following situations, those withdrawals may be free of penalties. Be aware that rules vary by account type.

In general, IRAs permit penalty-free withdrawals in more circumstances than 401s. However, 401s permit loans IRAs do notâmore on that below.

Other Options For Getting 401 Money

If you’re at least 59½, you’re permitted to withdraw funds from your 401 without penalty, whether you’re suffering from hardship or not. And account-holders of any age may, if their employer permits it, have the ability to loan money from a 401.

Most advisors do not recommend borrowing from your 401 either, in large part because such loans also threaten the nest egg you’ve accumulated for your retirement. But a loan might be worth considering in lieu of a withdrawal if you believe there’s a chance you’ll be able to repay the loan in a timely way s, that means within five years).

401 loans must be repaid with interest in order to avoid penalties.

Loans are generally permitted for the lesser of half your 401 balance or $50,000 and must be repaid with interest, although both the principal and interest payments are made to your own retirement account. It is also worth noting that the CARES Act raises the borrowing limit from $50,000 to $100,000. If you should default on the payments, the loan converts to a withdrawal, with most of the same consequences as if it had originated as one.

Also Check: Where To Invest 401k Now

When Does A 401k Early Withdrawal Make Sense

In certain cases, it actually might be strategic to move forward with 401k early withdrawal. For example, it could be smart to cash out some of your 401k to pay off a loan with a high-interest rate, like 1820 percent. You might be better off using alternative methods to pay off debt such as acquiring a 401k loan rather than actually withdrawing the money.

Always weigh the cost of interest against tax penalties before making your decision. Some 401k plans do allow for penalty-free early withdrawals due to a layoff, major medical expenses, home-related costs, college tuition, and more. Regardless of your strategy to withdraw with the least penalties, your retirement savings are still taking a significant hit.

Hardships Early Withdrawals And Loans

Generally, a retirement plan can distribute benefits only when certain events occur. Your summary plan description should clearly state when a distribution can be made. The plan document and summary description must also state whether the plan allows hardship distributions, early withdrawals or loans from your plan account.

You May Like: What Happens To Your 401k When You Die

Motivation To Not Withdraw Funds From A 401k

Every time youre tempted to borrow from your 401k, take a look at this chart below. It shows you when you will become a 401k millionaire based on various portfolio allocations and return assumptions.

Not only is paying a 10 percent penalty painful for a hardship withdrawal, so is losing out on years of compounding.

Understanding Early Withdrawal From A 401

A 401 is a retirement plan that allows you to make tax-deferred contributions into the plan and lets the investments grow tax-free until retirement age. Since this money is supposed to be for retirement, then it needs to remain in the account until you retire. Withdrawing money from your account should only be done in emergency situations. Removing the money early will result in payment of income taxes and a penalty.

Since a 401 is an employer sponsored plan, then your employer sets some of the rules regarding early withdrawal. Not every plan allows for early withdrawals. You should first check your plan documentation to determine whether an early withdrawal will be allowed from your plan. You can also view the details of what qualifies for an early withdrawal and any documentation that may be required.

You should think long and hard before taking any early withdrawals from your plan. You could consider other options such as a personal loan or borrowing from friends or family. Once you pay the income tax and early withdrawal penalty on your funds, you are likely to only be left with about 60% of the money that you removed from your account. This can put a huge dent in your account and set you way back in your retirement planning goals.

You May Like: How To Pull Money From Your 401k

Reasons To Proceed With Caution

Experts suggest moving slowly with any withdrawal. Here are three things to consider.

Hardship withdrawals are still subject to income taxes. Since your savings went into your retirement plan on a pretax basis, you’ll be paying income taxes on the contributions and earnings withdrawn.

“You get a three-year period to pay the taxes to Uncle Sam,” said Paul Porretta, partner at Pepper Hamilton LLP in New York.

Plan ahead to cover the tax bill and spread it over that period of time, perhaps out of your cash flow.

Know your 401 plan’s rules. Be aware that a workplace retirement plan may allow hardship distributions from participants’ savings, but it isn’t required to do so.

You’ll need to talk to your human resources department or your plan administrator before you proceed.

“A 401 plan or a 403 plan, even if it allows for hardship withdrawals, can require that the employee exhaust other sources of money before taking a withdrawal,” said Porretta.

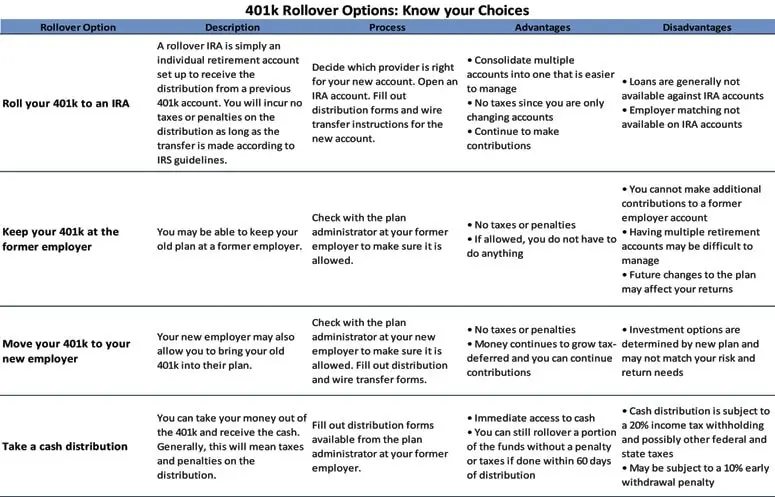

When You Leave A Job

When you leave a job, you generally have the option to:

- Leave your 401 with your current employer

- Roll over the funds to an IRA

- Roll over the funds to your new employer’s 401.

If you choose any of those options, you will not owe taxes or a 10% penalty. You can also take this money as a distribution, but this will trigger early withdrawal penalties if you are under 59 1/2 .

Read Also: How To Get My Walmart 401k

See If You Qualify For An Exception To The 10% Tax Penalty

Generally, the IRS will waive it if any of these situations apply to you:

-

You choose to receive substantially equal periodic payments. Basically, you agree to take a series of equal payments from your account. They begin after you stop working, continue for life and generally have to stay the same for at least five years or until you hit 59½ . A lot of rules apply to this option, so be sure to check with a qualified financial advisor first.

-

You leave your job. This works only if it happens in the year you turn 55 or later .

-

You have to divvy up a 401 in a divorce. If the courts qualified domestic relations order in your divorce requires cashing out a 401 to split with your ex, the withdrawal to do that might be penalty-free.

-

You need to pay for COVID-related issues. Section 2022 of the CARES Act says people can take up to $100,000 from their retirement plan, including a 401 penalty free as long as it’s for issues relating to COVID.

Other exceptions might get you out of the 10% penalty if you’re cashing out a 401 or making a 401 early withdrawal:

-

You become or are disabled.

-

You rolled the account over to another retirement plan .

-

Payments were made to your beneficiary or estate after you died.

-

You gave birth to a child or adopted a child during the year .

-

The money paid an IRS levy.

-

You were a victim of a disaster for which the IRS granted relief.

-

You overcontributed or were auto-enrolled in a 401 and want out .

-

You were a military reservist called to active duty.

How Long Does It Take To Cash Out A 401 After Leaving A Job

Depending on who administers your 401 account , it can take between three and 10 business days to receive a check after cashing out your 401. If you need money in a pinch, it may be time to make some quick cash or look into other financial crisis options before taking money out of a retirement account.

You May Like: How Long Do You Have To Roll Over Your 401k

How Early Retirement Plan Withdrawals Work Under Normal Circumstances

When there isnt a global pandemic impacting the livelihoods of the entire nation, withdrawing money early from a retirement plan is a serious decision. Thats because it carries with it some pretty serious consequences: namely, a 10% penalty paid on all of the money you withdraw, in addition to paying normal taxes. This, of course, assumes it is not a Roth plan, where the money has already been taxed.

Even if youre willing to pay the penalty, you have get approval from your plan beforehand. This is typically known as a hardship withdrawal. Some plan sponsors may not be willing to grant them, so make sure you check with your HR department before you plan on making one. Acceptable reasons for a hardship withdrawal include:

- Paying certain medical bills for you or family members

- Avoiding foreclosure on or to buy a primary residence

- Covering educational expenses for you or family members

- Paying for family funeral expenses

- Paying for some home repairs, such as those necessary after a natural disaster

Note that these reasons still carry the 10% penalties, in addition to taxes. There are a few instances where the penalty is waived:

What Is A 401

A 401, which can also be stylized as 401k, is an employer-sponsored retirement plan.

Depending on the 401k, you should be able to contribute a percentage of your annual salary to the plan as well. The average annual salary contribution to a 401k was 7% to 10%. That estimate can be doubled if your employer matches your salary contribution. The average salary contribution limit to a 401k plan is $19,500. If you are older than 50 your contribution limit is increased by $6,500. These are just average estimates your plan will vary.

Basically, your 401k is an employer sponsored retirement plan that will provide you with a supplemental income during your retirement.

You will only pay taxes on your 401k plan when you start withdrawing payments from it during retirement.

However, there are serious penalties for withdrawing from your 401k before the age of 59 ½.

Don’t Miss: Can I Transfer My 401k To Another Company

Understanding The Rules For 401 Withdrawal After 59 1/2

A 401 is a type of investment account thats sponsored by employers. It lets employees contribute a portion of their salary before the IRS withholds funds for taxes, which allows interest to accumulate faster to increase the employees retirement funds. Now, if you have a 401, you could pay a penalty if you cash out your investment account before you turn 59 ½.

Heres some more information about the rules you need to follow to maximize your 401 benefits after you turn 59 ½.

What Reasons Can You Withdraw From 401k Without Penalty

August 1, 2020 By Allen Francis

Everybody plays the fool on the stage of life there is no exception to the rule. The trick is to not make too many repeat performances. That is an amalgam of quotes culled from Shakespeare and 1970s soul group The Main Ingredient, but I think you get the gist. There are some foolish acts in life that bear more consequences than they are worth. Like early 401k withdrawals when you can withdraw from 401k without penalty.

I had a 401k plan that I converted into an annuity some years ago. It was the most foolish thing I could have ever done. I learned of so many other things I could have done after I did it.

Worse, I basically robbed myself of a small supplemental income in my retirement age.

But that is another story.

Usually, you must be 59 1/2 before you can even consider withdrawing from a retirement account without incurring tax or early withdrawal penalties.

What I have learned the hard way is that there are many conditions upon which you can withdraw from a 401k penalty-free.

Still, these early retirement withdrawal conditions are exacting and depend on the rules of your 401k plan.

First, lets breakdown what a 401k is.

Also Check: Can You Use 401k To Buy Investment Property

What Are The New Rules For 401k Withdrawals

New Retirement Account Rules in Response to Coronavirus

- Retirement account participants can withdraw up to $100,000 for coronavirus expenses.

- The income tax due on a retirement account withdrawal can be paid over three years.

- Savers have three years to put withdrawn funds back in a retirement account.

Most People Have Two Options:

- A 401 loan

- A withdrawal

Whether youre considering a loan or a withdrawal, a financial advisor can help you make an informed decision that considers the long-term impacts on your financial goals and retirement.

Here are some common questions and concerns about borrowing or withdrawing money from your 401 before retirement.

Recommended Reading: How Much Should I Put In My 401k Calculator

See If You Qualify For A Hardship Withdrawal

A hardship withdrawal is a withdrawal of funds from a retirement plan due to an immediate and heavy financial need. A hardship withdrawal usually isn’t subject to penalty.

Generally, these things qualify for a hardship withdrawal:

-

Medical bills for you, your spouse or dependents.

-

Money to buy a house .

-

College tuition, fees, and room and board for you, your spouse or your dependents.

-

Money to avoid foreclosure or eviction.

-

Funeral expenses.

-

Certain costs to repair damage to your home.

How to make a hardship withdrawal

Your employers plan administrator usually decides if you qualify for a hardship withdrawal. You may need to explain why you cant get the money elsewhere. You usually can withdraw your 401 contributions and maybe any matching contributions your employer has made, but not normally the gains on the contributions . You may have to pay income taxes on a hardship distribution, and you may be subject to the 10% penalty mentioned earlier.

Early Withdrawals During A Recession

A recession spells out bad times for all. Gross domestic product falls and industrial production slows down. Most noticeably of all, unemployment rates rise. You may find yourself on the wrong side of that trend with dwindling savings. You do have a nice amount of money that you set aside for a future version of yourself.

It’s a tempting idea that many people follow through on. A study from the IRS conducted in 2013 found that in 2004, prior to the Great Recession, 13.3% of people with some retirement plan experienced a taxable retirement account distribution essentially they did an early withdrawal. That percentage rose to 15.4% in 2010.

An early withdrawal should be a last resort. If you can afford not to withdraw early, do so. However, like many other issues within personal finance, recessions impact income levels differently. The same survey states that lower-income households have a higher propensity for an early withdrawal because they’re more deeply impacted by the economic shock.

Note: Retirement savings in a 401 might decline as a result of a recession-induced bear market, which might also drive people to withdraw. The Great Recession set 401s back by over $2 trillion. Yet, despite the volatile markets over the last few years, the average 401 balance has stayed relatively steady, according to Fidelity.

Don’t Miss: Should I Pay Someone To Manage My 401k

Taking Normal 401 Distributions

But first, a quick review of the rules. The IRS dictates you can withdraw funds from your 401 account without penalty only after you reach age 59½, become permanently disabled, or are otherwise unable to work. Depending on the terms of your employer’s plan, you may elect to take a series of regular distributions, such as monthly or annual payments, or receive a lump-sum amount upfront.

If you have a traditional 401, you will have to pay income tax on any distributions you take at your current ordinary tax rate . However, if you have a Roth 401 account, you’ve already paid tax on the money you put into it, so your withdrawals will be tax-free. That also includes any earnings on your Roth account.

After you reach age 72, you must generally take required minimum distributions from your 401 each year, using an IRS formula based on your age at the time. If you are still actively employed at the same workplace, some plans do allow you to postpone RMDs until the year you actually retire.

In general, any distribution you take from your 401 before you reach age 59½ is subject to an additional 10% tax penalty on top of the income tax you’ll owe.

Series Of Substantially Equal Payments

If none of the above exceptions fit your individual circumstances, you can begin taking distributions from your IRA or 401k without penalty at any age before 59 ½ by taking a 72t early distribution. This allows you to take a series of specified payments every year. The amount of these payments is based on a calculation involving your current age and the size of your retirement account.

The catch is that once you start, you have to continue taking the periodic payments for five years, or until you reach age 59 ½, whichever is longer. Also, you will not be allowed to take more or less than the calculated distribution, even if you no longer need the money. So be careful with this one!

Also Check: Can You Rollover Partial 401k To Ira