California Is A Community Property State

California is a community property state. This means that assets obtained during the marriage are divided in half upon divorce, including retirement savings and pension plans. In the case of a 401K or another type of plan, a spouse is entitled to 50% of the plans acquired value during the course of the marriage.

Any value accrued within a 401K or another plan a spouse possessed prior to marriage is that spouses separate property. It is not included in the calculation when dividing the marital portion.

There are instances where community property and separate property become mixed or commingled. When this happens, a forensic accountant may be necessary to separate community property value from a spouses separate property value.

What Happens To My 401k In A Divorce

Posted by | May 06, 2020 | 0 Comments

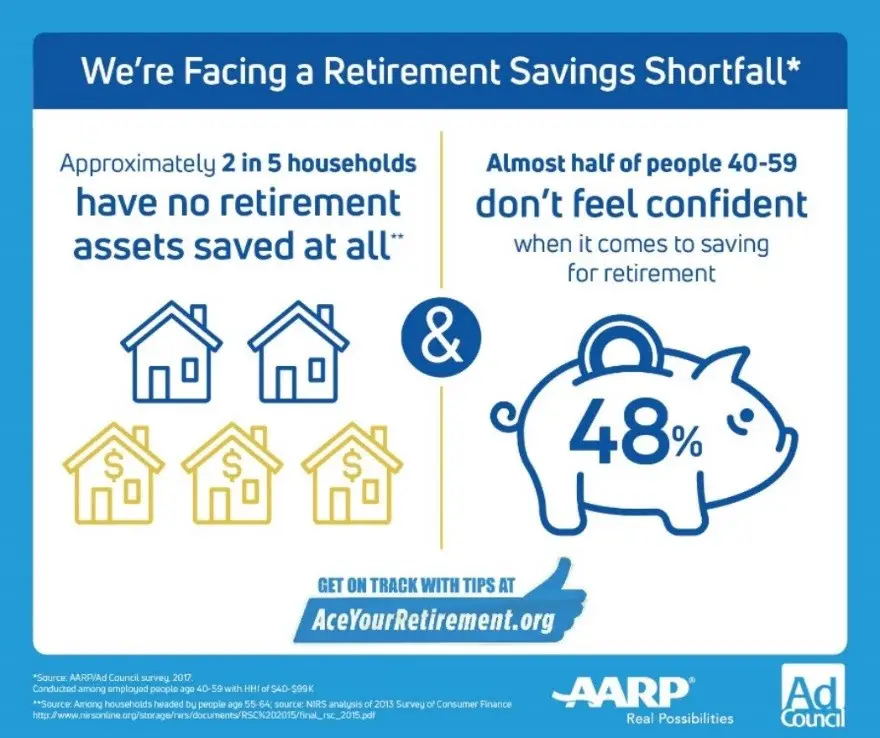

According to Fidelity Investments, the average balance of a 401 in March 2019 was $103,700. This number is based on more than 16 million 401 account holders in the U.S. The average amount in a 401 is generally tied to age. For 20 to 29 year olds, the average balance was $12,000. For 60 to 69 year olds, the average balance was $195,000.

Money issues are one of the most commonly cited causes of divorce. It is no surprise that in a contested divorce, each spouse may be fighting to get the most money they can, including their share of any retirement savings. How to divide up retirement savings, including a 401 in a divorce can be complicated and may require a separate procedure, known as a QDRO.

How Do We Transfer 401 Funds In A Divorce

The actual transferring of funds from a 401 is the easy part. A qualified domestic relations order enables you to take money from one 401 and put it in another without early withdrawal or tax penalties. The Employee Retirement Income Security Act permits these tax-free transfers specifically in the event of divorce.

Your attorney or your spouses attorney will prepare the QDRO in accordance with how your account is to be split, and then the QDRO will need to be approved by the court. After this is done, you can submit the QDRO to the account holders bank to have the funds transferred.

Read Also: How Much Can You Invest In 401k

Should You Cash Out A 401k In A Divorce

Am I suggesting that retirement plans are a good source of cash when going through a divorce? Let me be clear. No, I am not suggesting that at all. I simply want to share that if you have a cash need and it makes the most sense to take it from a retirement account, the IRS does allow you to take money from a 401K without penalty.

Keep in mind, though, if the funds are in a pre-tax account, they will still be taxable when withdrawn. The plan administrator will withhold taxes when the distribution is made. However, it may not be enough to cover your tax liability, depending on your marginal tax rate, so youll want to plan accordingly.

Dividing The Marital Portion Of A Qualified Retirement Account

Once the marital portion of a 401k or IRA has been determined and distinguished from any premarital portion, a particular financial instrument is then needed to transfer 50% of that marital portion to the other spouse. In the instance of a 401k, an instrument known as a Qualified Domestic Relations Order is needed to effectuate the transfer without incurring taxes or penalties. There are several companies that provide this service relatively inexpensively. It is important, however, that you retain an attorney and a QDRO expert familiar with the law on the subject to make sure both your settlement agreement and the QDRO are properly written.

With regard to IRAs, the marital portion can generally be divided more simply by the entry of transfer orders or similar orders from the court directing the institution holding the IRA to transfer 50% of the marital portion to the other spouse. Once again, it is essential to retain an attorney who has a command of the applicable law and will properly draft the necessary settlement agreement and transfer order.

In sum, the portion of retirement assets acquired prior to the marriage is generally exempt from equitable distribution, but proper techniques must then be employed to separate the premarital value of the retirement assets from their marital value upon equitable distribution. A skilled family law attorney is essential to ensuring that this process is undertaken correctly.

Don’t Miss: How To Start A 401k Account

What To Consider During A Divorce

Once you begin the divorce process, retirement account issues to consider include:

- Income taxes, tax-free income, and your tax bracket

- Rollover accounts

- Whether your state is a community property or marital property state

- Savings accounts and overall retirement funds

- Any specific terms you outlined in the divorce settlement

- Stocks or other payouts

These considerations will eventually lead to the final number your ex gets in the divorce.

Types Of Retirement Accounts

There are several types of retirement accounts, but they can be broken down into three main categories:

- Individual retirement accounts are available to some individuals who want to save for retirement and enjoy some tax benefits in the process. There are different kinds of IRAs, including traditional, Roth, and SEP IRAs. Each has its own rules on when people can contribute to these accounts, how much they can contribute each year, and the tax consequences.

- 401s and other defined contribution pension plans. These employment-based plans allow employees to contribute a percentage of their earnings to the plan. Sometimes, employers will make a matching contribution, usually up to a limit.

- Defined-benefit pension plans. These are also employment-based retirement plans. Unlike IRAs and 401s, however, the amount paid out after retirement doesn’t depend on individual investment returns. Rather, the retiree receives a set amount of benefits based a formula that includes things like length of employment and salary. Many government employees and members of certain unions qualify for pension plans.

Read Also: How Do I Get A Loan From My 401k

Tax Implications Of Dividing Retirement Assets

Tax implications for retirement assets differ depending on various factors, including the plan type. Most times, retirement transfers are tax-free. Sometimes, however, the plan defers the tax until the participant receives or withdraws the retirement funds. You should consult a Certified Public Accountant or tax attorney about the best way to deal with the specific retirement accounts in your divorce.

Normally, taking a distribution from your retirement account before reaching retirement age counts as an early distribution, which incurs a 10% penalty fee. However, if youre disbursing retirement funds after a divorce settlement, there is no early withdrawal fee, as long as you transfer the funds according to the divorce order.

Getting Legal Help

If you have questions about the property division in your case, you will need to contact an experienced family law attorney to find out your rights. An attorney can simplify the divorce process and help you understand how the court may divide your assets.

Also Check: How To Split A 401k In Divorce

State Laws For Pensions In A Divorce

A general rule of thumb when it comes to splitting pensions in divorce is that a spouse will receive half of what was earned during the marriage. However, this depends on each states laws governing this subject.

In equitable distribution states, assets are divided fairly but this doesnt necessarily mean 50/50. The vast majority of states are equitable distribution states. But there are also a few community property states, where all marital property is simply divided 50/50. There are only nine community property states Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas, Washington and Wisconsin, with Alaska as an opt-in so this arrangement is much less common.

Don’t Miss: How Long Will My 401k Money Last Calculator

Can I Empty My Bank Account Before Divorce

That means technically, either one can empty that account any time they wish. However, doing so just before or during a divorce is going to have consequences because the contents of that account will almost certainly be considered marital property. … Funds in separate accounts can still be considered marital property.

Can My Spouse Get My 401k In A Divorce

Over 46 million Americans currently have some type of retirement plan through work. These plans are governed by the rules of your particular employer, but also by federal laws. And rightfully so, as saving for retirement is a very important thing to do . In general, Federal law protects your 401 against judgments from creditors, even if you declare bankruptcy. Individual Retirement Accounts are not given the same protections. However, under the 2005 law, the Bankruptcy Abuse Prevention and Consumer Protection Act, up to $1 million in IRA assets are protected in the event of bankruptcy.

There are great protections in place for two types of retirement plans. But what happens to your 401k during separation and divorce proceedings? Can your spouse get your 401k in a divorce?

Also Check: Where Can I Get A 401k Plan

Gray Divorce Issues Include Weaving Through The Complications Of Splitting Pensions 401s And More Before The Process Is Complete

Getty Images

Divorce can look a bit different for older couples. They generally dont need to worry about child support or custody of young children. But splitting the retirement assets they jointly own and those that each spouse owns separately are another matter.

Along with the marital home, retirement accounts are often an older couples largest asset in a divorce proceeding. When both spouses have retirement accounts, the combined balances should be considered along with all other assets, says Laura Medigovich, certified financial planner and senior financial planner at Janney Montgomery Scott LLC in Purchase, N.Y.

The rules for splitting retirement assets differ depending on the type of accountIRA, 401 or a pensionand can be complicated. And transferring retirement funds to a former spouse can have unintended tax consequences if done incorrectly, so the stakes are high for getting it right. For one thing, you need a qualified domestic relations order to transfer a 401 account or pension rights in a divorce, but few divorcing couples may know this. The order, which is issued by a court or state agency, recognizes a divorcing spouses right to receive all or a portion of the account owners defined contribution plan or pension.

How Does Divorce Affect Social Security Benefits

If your marriage lasted 10 years or more, then you can receive benefits on your ex-spouses work record if the benefits you would receive based on your own work record are less. You may collect benefits as long as you remain unmarried, even if your ex-spouse has remarried. Your benefit as a divorced spouse is equal to 50% of your ex-spouses full retirement amount if you start receiving benefits at your full retirement age . If you continue to work while receiving these benefits, there are limits to how much you can earn.

Don’t Miss: How To Rollover Voya 401k

What Happens If Retirement Assets Were Held Prior To Marriage

Retirement assets held prior to marriage are the separate property of the spouse to whom they belong. Contributions made to the account during marriage are community property unless otherwise stated in a prenuptial or postnuptial agreement. Gains on those contributions would also be marital property.

What Typically Happens With 401s And Other Retirement Accounts During A Divorce

The division of retirement accounts are typically one of the most complex issues in divorce cases. There are tax implications and unique rules and laws that apply.

For example, a divorce is a rare time that allows you early access to your 401 or IRA without a tax penalty if your spouse is awarded part of your account.

Dividing retirement accounts during divorce is also tricky because investment accounts are tied to the stock market, so changes in the stock market directly affect your account’s value. That’s why very specific language has to be used in the divorce decree.

Read Also: Can You Use Your 401k For A House Down Payment

How Do I Divorce My Wife And Keep Everything

How To Keep Your Stuff Through Divorce

Are My 401 Retirement Assets Or Retirement Benefits Part Of Marital Property

Yes, unless there is a prenuptial agreement or other arrangement that protects your money from being marital property. If not, then anything earned or purchased after you filed your marriage certificate is likely going to be considered marital property and subject to division based on the laws in your state.

Read Also: Does 401k Get Split In Divorce

Questions About Dividing Up A 401 In A Texas Divorce Contact The Law Office Of Bryan Fagan

If you have any questions about the material that we discussed in today’s blog post, please do not hesitate to contact the Law Office of Bryan Fagan. Our licensed family law attorneys offer free of charge consultations six days a week where we can answer your questions and address the issues of your case head-on. We appreciate you spending part of your day with us here and hope that you will return tomorrow, as well.

Categories

- 7702 FM 1960 Rd E,Suite 212

- 900 Rockmead Dr. Suite 225Kingwood, TX77339

What Do Retirement Benefits Include

Retirement benefits include:

- Individual Retirement Accounts , and

- other retirement savings plans.

Visit the Pension Rights Center for general information about pensions and other types of retirement benefits.

Divorce and Retirement: How to Take Control of Retirement Benefits Divorce and Retirement is a guide about retirement for women going through divorce.

Read Also: How Much Income Will My 401k Generate

What Happens When Both Spouses Have 401 Plans And/or Iras

In this case, Hunady indicates it is possible to maintain your respective retirement accounts, however if one account value is higher than the other, the Qualified Domestic Relations Order or transfer to the other spouse could come into play. Or, if other financial assets exist, it’s possible to maintain your respective accounts and utilize these other assets to equalize the division, she says. Again, take into account any tax implications that may exist.

How Do You Get The Money Awarded To You In The Divorce From Your Spouse’s 401 Plan

This is an efficient question that needs to be asked in every divorce where retirement benefits are divided. The process of obtaining the money coming to you occurs at the end of a divorce but cannot be overlooked. It involves the submittal of a Qualified Domestic Relations Order first to the judge of your court to obtain their signature, then to the plan administrator for the 401. These steps can be complicated, and you need to follow a process to get this done correctly. It is advisable to have an attorney’s guidance in this area if for no other reason.

Recommended Reading: Does Borrowing From 401k Affect Credit Score

Determining The Value Of Your 401k

The easiest way to determine the value of your 401k is to contact your plan administrator or use your last yearly statement as a reference. From these documents a professional is able to determine exactly how much was earned before the marriage and the amount that was added from the day you got married until the divorce. While you can try to determine these amounts on your own, it is highly recommended to hire an expert that has experience with this and is an unbiased third party.

Hiring a talented actuary will give you the exact amounts of how much you and your spouse will receive and how much was solely yours to begin with having this coming from a third party professional will reduce the chances of your spouse contesting the fairness of the separation of the 401k.

An actuary will cost you between $250-1,000, but that cost is well worth it to be certain that you are not losing out on any money youve earned. The reason this calculation is so complicated is because return on investment needs to be taken out of the final calculations, along with any losses a talented actuary will know exactly which deductions to make.

If an actuary or attorney advises you to falsify the documents or use old statements, do not listen. Although it is enticing to find a way to hide the money from your spouse, if your spouse has an attorney they will likely subpoena all documents and potentially hire an investigator to look into the funds. Getting caught in this scheme is not worth it.

Do You Need To File Your Domestic Relations Order With Your Pension Plan

In most circumstances, you will need to take a certified copy of your domestic relations order and then fill it with your pension plan. This means that once the judge signs the order, your attorney should send the certified copy of the order to the pension plan offices along with a copy of your final decree of divorce.

The pension plan will then receive the certified copy of the domestic relations order and begin to review what has been submitted to them. They are looking for whether or not it meets all the criteria under state law and your specific pension plan guidelines. If you use the form provided to you by the pension plan, you should be in good shape. Once the review is complete, the pension plan will contact both you and your spouse in writing to let you all know if the order is accepted.

Don’t Miss: How To Increase 401k Contribution Fidelity