Keeping The Current 401 Plan

If your former employer allows you to keep your funds in its 401 after you leave, this may be a good option, but only in certain situations. The primary one is if your new employer doesnt offer a 401 or offers one thats less substantially less advantageous. For example, if the old plan has investment options you cant get through a new plan.

Additional advantages to keeping your 401 with your former employer include:

- Maintaining performance:If your 401 plan account has done well for you, substantially outperforming the markets over time, then stick with a winner. The funds are obviously doing something right.

- Special tax advantages: If you leave your job in or after the year you reach age 55 and think youll start withdrawing funds before turning 59½ the withdrawals will be penalty-free.

- Legal protection: In case of bankruptcy or lawsuits, 401s are subject to protection from creditors by federal law. IRAs are less well-shielded it depends on state laws.

You might want to stick to the old plan, too, if youre self-employed. Its certainly the path of least resistance. But bear in mind, your investment options with the 401 are more limited than in an IRA, cumbersome as it might be to set one up.

Some things to consider when leaving a 401 at a previous employer:

The Bankruptcy Abuse Prevention and Consumer Protection Act of 2005 does protect up to $1.25 million in traditional or Roth IRA assets against bankruptcy. But protection against other types of judgments varies.

How Much Money Do I Need To Open A Vanguard Ira

At Vanguard, you can open an account with a $0 balance. But there are a few minimums to keep in mind as you begin to invest.

- Vanguard ETFs: You only need enough money to cover the price of 1 share, which can generally range from $50 to a few hundred dollars.

- Vanguard mutual funds: Some Vanguard mutual funds have a $1,000 minimum . Most of our other Vanguard mutual funds have a $3,000 minimum.

What Happens If You Cash Out Your 401

If you take your 401 money before you reach age 59 ½, you might have to pay taxes at your regular tax rate, on top of a penalty from the IRS, on any money that hasnt been taxed before. You may be able to avoid any penalties for certain life events or purchases, but youll still probably owe taxes on any previously untaxed money.

Don’t Miss: Where Do I Go To Withdraw My 401k

How Do You Qualify For A Roth Ira

As a single taxpayer, you simply need to have a modified adjusted gross income under $129,000 to make the maximum contribution. The contribution amounts are reduced as your income nears $144,000, whereupon you no longer qualify for a Roth IRA. For married filing jointly taxpayers, the full contribution is available up to a MAGI of $204,000 with reductions to a complete phase out at $214,000.

Ways A Roth Ira Can Ruin Your Retirement

Theres been a lot of talk lately about converting traditional IRAs to Roth IRAs. This talk arises from the 2017 Tax Cuts and Jobs Act. The new tax law, commonly referred to as Trumps Tax Cut, created historically low tax rates.

Theres a quirk in the 2017 Tax Act that shouldnt be overlooked. Those historically low tax rates dont last forever. Unless Congress passes a new tax law, in 2026 the current low rates will increase automatically to the previous high rates.

Many fear the political pendulum will again swing towards acceptance of higher rates. They expect this low rate era to eventually come to an end, perhaps before they retire. This makes saving in a Roth IRA or a Roth 401 more attractive today.

You might also be wondering whether it makes sense to convert your existing traditional IRA to a Roth IRA. Doing so entails paying the taxes on the savings and growth youve accumulated in your pretax nest egg.

The rationale supporting this is quite obvious, its better to pay the low tax rates today than the high tax rates tomorrow .

This may sound like common sense, but dont be fooled. A Roth IRA can ruin your retirement. You may not have thought about it, but here are five ways that could happen.

When you save in a retirement plan, youre rolling the dice. You simply cannot predict where tax rates will be. And its not just where theyll be when you retire. Its how they will move throughout your retirement.

Read Also: Can You Invest 401k In Bitcoin

Make Sure You Understand These Rules Before Converting Your 401 Funds To A Roth Ira

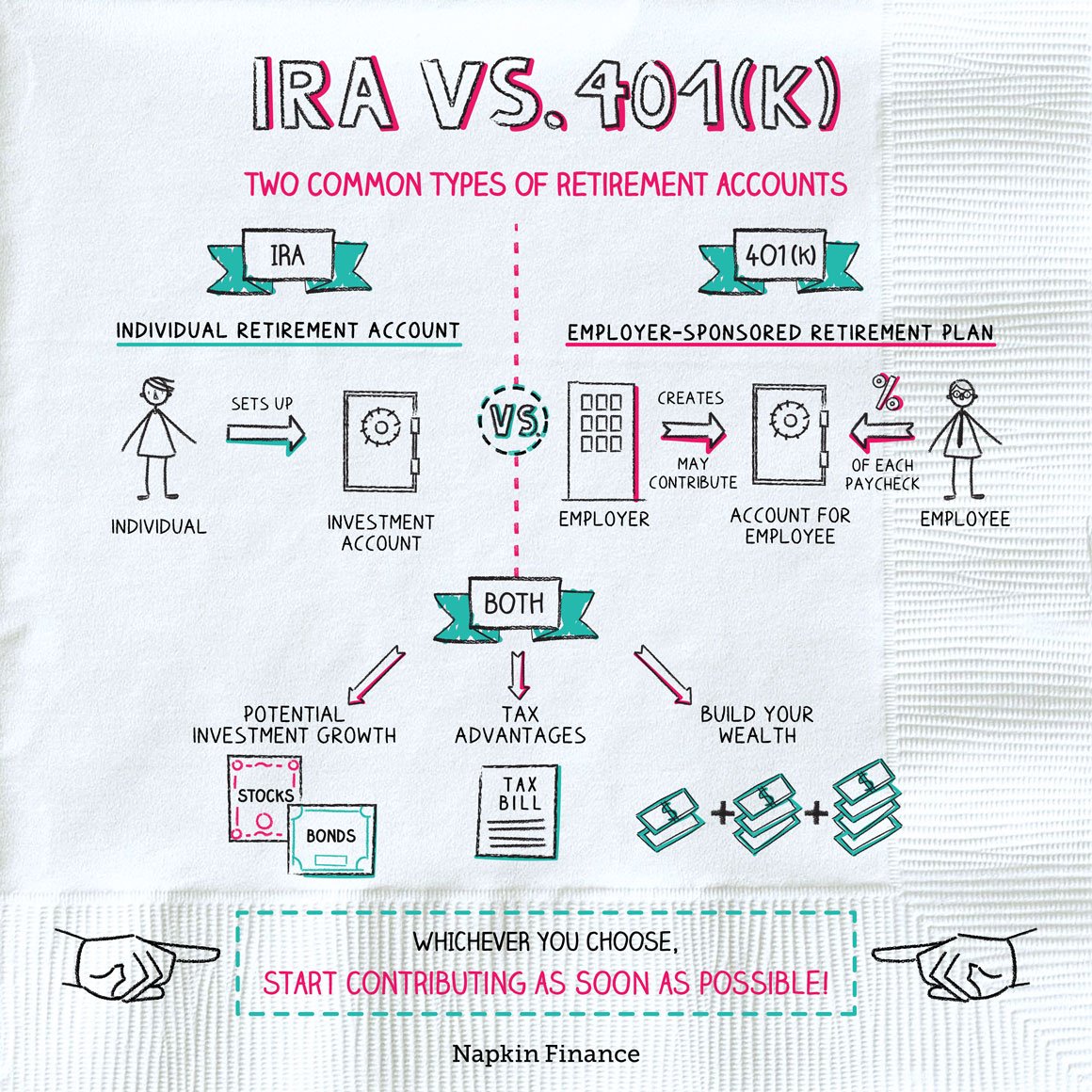

A 401 is a smart place to keep your retirement savings, especially if your company offers a matching contribution. But as some people look toward retirement, they find the Roth IRAs tax-free distributions more appealing. Contributing funds to a Roth IRA is always an option, but you could also do a 401 to Roth IRA conversion with your existing savings.

This lets you reclassify your 401 funds as Roth savings by paying taxes on the amount youd like to convert. Heres a closer look at how 401 to Roth IRA conversions work and how to decide if theyre right for you.

Why Might You Consider An In

When you have a 401, you dont have maximum control over the types of assets you can hold, such as mutual funds, stocks, and bonds. You typically have a limited menu of options.

Through an in-service rollover, transferring some or all of your 401 funds to a personal IRA can open up more options for your assets. For instance, you might be able to put money into alternative assets like precious metals . A bonus is that you usually can keep contributing to your employers 401 after youve moved funds to an IRA.

Furthermore, an in-service rollover enables your personal financial advisor to provide more hands-on help since at least some of your assets are in an IRA that you control and not in an employer-sponsored 401 that could come with strings attached.

Plus, some 401 plans have annual fees with their options that are way above average. If youre stuck in one of those, you can minimize your costs by rolling your 401 money into an IRA with a lower-cost fund company, explains Rick Salmeron, a certified financial planner.

On top of that, you might be permitted to make tax-free withdrawals from an IRA that you wouldnt be able to make from a 401.

With your funds in an IRA, you are the account owner and have more control over your assets, free from the restrictions your employer-sponsored plan can impose, Salmeron adds.

Read Also: How To Transfer 401k To Vanguard Ira

You Want Lower Fees And More Investment Options

Because a 401 account is tied to an employer, it likely has a limited number of investment options, especially if the plan is administered by a small company.

For example, you might have access to only a small group of mutual funds with relatively high expense ratios, or fees. Many discount brokerages, on the other hand, offer index funds with expense ratios close to zero within self-directed IRA accounts.

In a 401, a lot of people feel like theyre handcuffed in terms of what they can own, says Hernandez. In most cases, in an IRA you have a lot more flexibility in what you can own.

How Is The 5

When you roll over a distribution from a designated Roth account to a Roth IRA, the period that the rolled-over funds were in the designated Roth account does not count toward the 5-taxable-year period for determining qualified distributions from the Roth IRA. However, if you had contributed to any Roth IRA in a prior year, the 5-taxable-year period for determining qualified distributions from a Roth IRA is measured from the earlier contribution. So, if the earlier contribution was made more than 5 years ago and you are over 59 ½ a distribution of amounts attributable to a rollover contribution from a designated Roth account would be a qualified distribution from the Roth IRA.

Read Also: Can You Borrow From Your 401k Twice

Roth 401s As An Alternative

A Roth 401 combines the employer-sponsored nature of the traditional 401 with the tax structure of the Roth IRA. If your employer offers this type of plan, youll contribute after-tax money to your account and you wont owe taxes when you start receiving distributions. If your employer offers a match, though, that money is in a traditional 401 plan. So if you choose to convert it, you will owe taxes on it the year you do so.

If youre looking to do a rollover from a Roth 401 to a Roth IRA , the process is quite simple. All youll have to do is follow the same steps as if you were rolling over a traditional 401 to a traditional IRA. The tax structure is staying the same. If youre looking to convert your Roth 401 into a traditional IRA, youre out of luck. Unfortunately, this isnt possible, since you cant un-pay taxes on the money in your Roth 401.

Make An Investment Decision

The Financial Industry Regulatory Authority offers some great tips on what to look out for when making sound rollover decisions. Before you start making investment decisions, its important to choose the right firm. Consider:

- Fees: Check out what each prospective brokerage charges in fees, including annual fees, trading commissions, market data access fees, inactivity fees, account transfer fees, and account closing fees. Also, make sure that youre taking taxes into consideration. Youll need to pay taxes on your rollover.

- A diversity of investments: Does the brokerage offer a wide range of investments, such as stocks, bonds, ETFs, low-cost mutual funds, options, foreign-exchange trading?

- User-friendly platform: If this is your first foray into online investing, you need a brokerage that offers a super-easy platform to navigate and use. Also, look for plenty of videos and investor-education tools.

- Reporting and account management: Check out the type of reporting and account monitoring tools offered. Its always a good idea to open a practice account first before committing your Roth IRA savings to a specific brokerage account.

- Online/telephone help: Check out the brokerages helpline and customer support policies. You dont want to choose a broker that only provides support on weekdays from 9 a.m. to 5 p.m. and is off on weekends!

Don’t Miss: How Do I Withdraw Money From My Fidelity 401k

Converting A 401 To A Roth Ira

You can also convert traditional 401 balances to a Roth IRA. Generally, you’ll only be able to transfer a 401 to a Roth IRA once you’ve left the company that provided the 401 or once you reach the age of 59½, which is the age most plans allow for in-service withdrawals. That’s not always the case, however, so check the rules of your employer’s 401 plan.

Another option that may be available to you: an in-plan Roth conversion. If your employer offers a Roth 401 option, you may be able to convert your existing pre-tax and after-tax balances to a Roth account within the plan. Some employers even offer an auto-convert feature inside their plan. You can set it up so that any after-tax contributions are automatically converted to a Roth 401 at regular intervals.

Taxes on a 401 to Roth IRA conversion depend on the type of contributions involved:

Pre-tax contributions onlyIf your 401 account is composed entirely of pre-tax money , then you’ll be subject to current-year income tax on the entire amount converted to a Roth IRA.

After-tax contributions onlyIf the contributions made to your 401 account were made entirely in after-tax dollars, you can roll them directly into a Roth IRA, as long as any tax-deferred earnings associated with them are also distributed from your employer-sponsored plan at the same time to another eligible retirement plan.

Read Viewpoints on Fidelity.com: Rolling after-tax money in a 401 to a Roth IRA

Reasons You May Want To Roll Over Now

- Diversification. Investment options in your 401 can be limited and are selected by the plan sponsor. Rolling your funds over into an IRA can often broaden your choice of investments. More choices can mean more diversification in your retirement portfolio and the opportunity to invest in a wider range of asset classes including individual stocks and bonds, managed accounts, REITs and annuities.

- Beneficiary flexibility. With some IRAs, you may be able to name multiple and contingent beneficiaries or name a trust as the beneficiary. Other IRAs may allow you to impose restrictions on beneficiaries. These options arent usually available with 401s. But, keep in mind, not all IRA custodians have the same rules about beneficiaries so be sure to check carefully.

- Ownership control. You are the owner and have access rights with an IRA. The assets in your IRA are also not subject to blackout periods. With a 401 plan, the qualified plan trustee owns the assets and assets may be subject to blackout periods in which account access is limited.

- Distribution options. If your IRA is set up as a Roth IRA, there is not a set age when the owner is required to take minimum distributions. With 401 plans and traditional IRAs, the owner will have to take required minimum distributions by April 1 of the year after they turn age 72.

Also Check: Are There Penalties For Withdrawing From 401k

Read Also: How Do I Get My 401k From My Old Job

If You Have More Than One Ira: Ira Aggregation Rule And Pro Rata Rule

When it comes to conversions and distributions, the IRS views all of your traditional IRAs as one account. If you have 3 traditional IRAs and a rollover IRA spread across different financial institutions, the IRS would lump all of them together. It’s called the IRA aggregation rule and it can complicate your conversion to a Rothor make it more costly than you may have anticipated.

If you have existing IRAs, like a rollover, and also want to make nondeductible contributions and later convert them to a Roth, you won’t be able to convert only the after-tax balance. The conversion must be done pro rataor proportionally split between your after-tax and pre-tax balances, including contributions and earnings.

For instance, let’s say you have an existing traditional IRA worth $10,000. You’ve just made a nondeductible contribution to a new IRA in the amount of $5,000 and plan to convert it to a Roth IRA. You can convert $5,000 of your IRA dollars but you would have to pay taxes on about $3,333 of the money being converted.

Total IRA balance: $15,000 After-tax IRA balance: $5,000

$5,000 is one-third of your total IRA balance. That means that one-third of your conversion will be after-tax dollars and two-thirds will be pre-tax dollars.

What Amounts May I Roll Over In An In

If your plan allows it, you can roll over any vested plan balance, including earnings, to a designated Roth account, even if these amounts cant be distributed to you. You can make an in-plan Roth rollover of:

- elective deferrals,

- after-tax employee contributions and

- earnings on the above contributions.

The plan can specify which of these amounts are eligible for in-plan Roth rollovers and how often these rollovers can be done.

You May Like: What Time Does Fidelity Update 401k Accounts

How To Transfer Old 401s To An Ira

As you get near the point where you will need income from your retirement accounts, it is likely you will want to transfer old 401s to an IRA to simplify the process of managing your retirement money.

Many people are not aware that they can combine most of their retirement accounts into a single IRA.

If you have a 401 plan that you need to transfer to an IRA, here are the four steps to take.

If I Want To Keep A Specific Stock Or Asset In My Ira In My Portfolio For The Long Term Can I Keep That Asset And Convert It To A Roth Ira

Yes. If you are holding investments in a traditional IRAones you want to keep for a number of years and you think you may be in a lower tax bracket this year than you might be in the future, then a “focused conversion” may be a strategy to consider. With this strategy you move specific assets from a traditional IRA to a Roth IRA, rather than selling the assets first and then moving the resulting cash. In terms of the taxes, there is no difference between the 2 techniques.

Tip: To learn more, read Viewpoints on Fidelity.com: Focused conversion: A strategy for IRAs

You May Like: How To Withdraw 401k From Previous Employer

Can My Outstanding Plan Loan Be Part Of An In

Yes. If the plan allows, you may roll over your outstanding loan balance from the plans non-Roth account into the plans designated Roth account through a direct rollover as long as there is no change in the loans repayment schedule. The loans taxable amount when rolled over as an in-plan Roth direct rollover would be the balance of the loan at the time of the rollover.

Can You Be Required To Roll Over Your 401

Sometimes you have no choice in the matter. You might be required to roll over your 401 if:

⢠You donât meet a minimum balance requirement. For example, if you have less than $5,000 in your 401, your employer can require you to roll your 401 into a different account.

⢠Your old employer changes 401 providers. Depending on your company, your account may not be rolled over and your existing provider may not continue service. If your account is rolled over, the new provider might have requirements you canât meet, or they might not provide the services you want.

Also Check: How To Put 401k Into Ira