What If I Don’t Have Access To A 401

If you don’t work for a company that offers a 401, you can save for retirement using one or more of these other accounts:

- 403: A 403 is similar to a 401, but it’s available only to public school employees, select ministers, and employees of tax-exempt organizations.

- SIMPLE IRA: A SIMPLE IRA is designed for self-employed individuals and small business owners. It offers fairly high contribution limits and has mandatory contribution requirements for employers.

- : A SEP IRA is available to self-employed individuals with or without employees. Contribution limits depend in part on annual income.

- Solo 401: A solo 401 is simply a 401 that a self-employed person can open for themselves. Contribution limits are higher than for traditional 401s because you can make contributions as both employee and employer.

- IRA: Anyone can open and contribute to an IRA if they’re earning income throughout the year, but these accounts have more restricted contribution limits.

What Is A Simple Ira

A SIMPLE IRA is a retirement savings plan designed for small businesses, particularly those with less than 10 employees. As such, its typically low cost and easy to set up and administer. Employees who participate in a SIMPLE IRA can defer a percentage of their salary to their savings account and their employer is required to either match it or make non-elective contributions.

Distribution Rules Must Be Followed

Generally, distributions cannot be made until a “distributable event” occurs. A “distributable event” is an event that allows distribution of a participant’s plan benefit and includes the following situations:

- The employee dies, becomes disabled, or otherwise has a severance from employment.

- The plan ends and no other defined contribution plan is established or continued.

- The employee reaches age 59½ or suffers a financial hardship.

See When can a plan distribute benefits?

Benefit payment must begin when required. Unless the participant chooses otherwise, the payment of benefits to the participant must begin within 60 days after the close of the latest of the following periods:

- The plan year in which the participant reaches the earlier of age 65 or the normal retirement age specified in the plan.

- The plan year which includes the 10th anniversary of the year in which the participant began participating in the plan.

- The plan year in which the participant terminates service with the employer.

Loan secured by benefits. If survivor benefits are required for a spouse under a plan, the spouse must consent to a loan that uses the participant’s account balance as security.

Also Check: Do I Have A 401k Out There

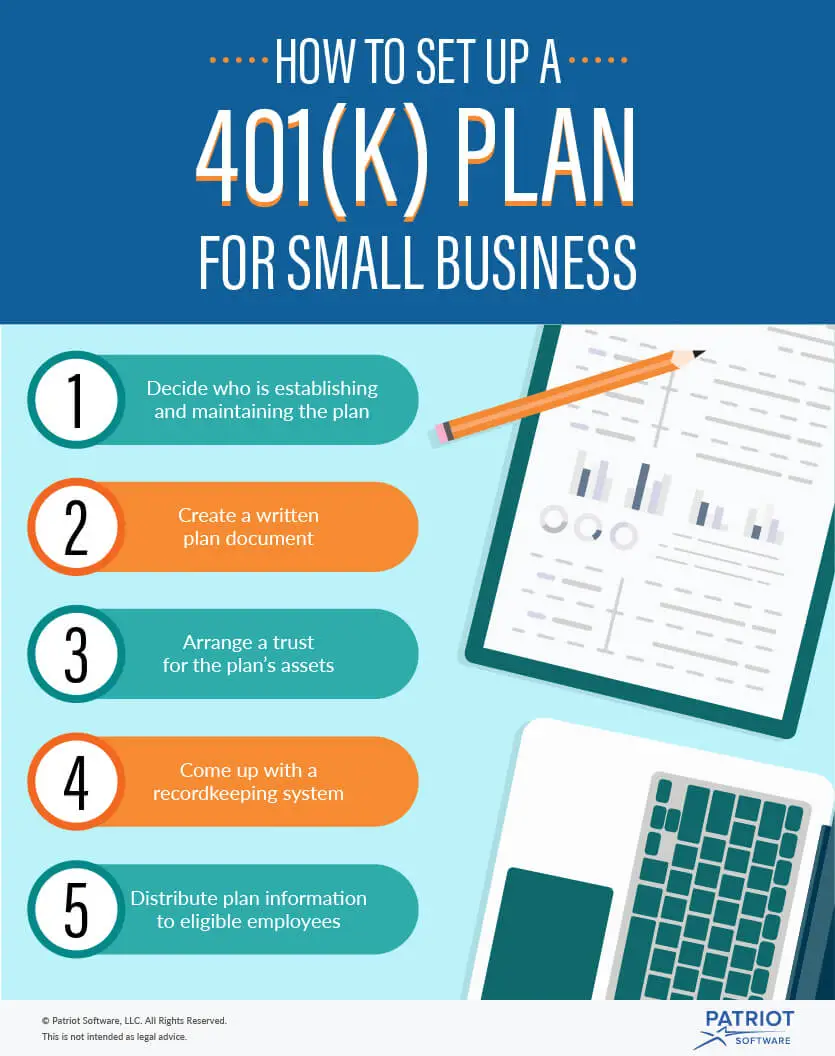

How To Set Up A 401k For A Business

The path to a successful retirement savings program starts with plan design. And while its true that employers can set up 401ks on their own, its generally recommended to seek the help of a professional or a financial institution. Theyll provide expert guidance throughout each of the following steps:

What Is A 401 Loan

A 401 loan is a loan you take out from your own 401 account. They work like normal loansâyou pay origination fees and interestâonly youâre borrowing money from yourself. According to Vanguard, 78% of 401 plans permit participants to take out 401 loans, and about 13% of plan participants have an outstanding 401 loan.

If you need money, you might consider taking a loan from your 401 if:

⢠You want a lower interest rate. 401 loans still charge interest. But the amount you pay may be less than on a loan you take out with someone else. 401 loan interest rates are based on the prime rate, an interest rate adapted from Federal Reserve loaning guidelines. 401 loans will normally be a percentage point or two above this rate, which may be lower than the rate you could get at a bank.

⢠Youâd prefer to pay interest to yourself. No one likes paying banks and credit card companies interest. While youâre still on the hook for interest payments with a 401 loan, you get to pay it back to yourself instead of someone else.

⢠You want looser credit requirements. If your credit score prevents you from getting the best rates on loans, you may opt for a 401 loan. Depending on your employer, you may not even need a credit check to borrow from your 401.

You might want to avoid a 401 loan if:

Recommended Reading: How Old Do You Have To Be To Start 401k

How Long Does It Take For A Small Business To Set Up A 401

Establishing a 401 can be a fairly straightforward process. However, without due diligence, that approach would be reckless and make your business vulnerable to expensive fees and risks associated with making hasty decisions regarding something as important as selecting a trustee. Depending on how much preliminary research you do, allow yourself ample time to create a plan document, establish a trust, notify employees, and launch your new benefit.

What Happens If You Contribute Too Much To Your 401

If your 401 contributions exceed the limits above, you may end up being taxed twice on your excess contributions: once as part of your taxable income for the year that you contribute and a second time when you withdraw from your plan. Earnings still grow tax-deferred until you withdraw them.

If you realize you contributed too much to your 401, notify your HR department or payroll department and plan administrator right away. During a normal year, you have until your tax filing deadlineusually April 15to fix the problem and get the money paid back to you.

Excess deferrals to a 401 plan will have to be withdrawn and returned to you. Your human resources or payroll department will have to adjust your W-2 to include the excess deferrals as part of your taxable income. If the excess deferrals had any earnings, you will receive another tax form that you must file the following tax year.

Access to thousands of financial advisors.

Expertise ranging from retirement to estate planning.

Match with a pre-screened financial advisor that is right for you.

Answer 20 questions and get matched today.

Connect with your match for a free, no-obligation call.

You May Like: Is It Better To Rollover 401k To Ira

Taking Withdrawals From A 401

Once money goes into a 401, it is difficult to withdraw it without paying taxes on the withdrawal amounts.

“Make sure that you still save enough on the outside for emergencies and expenses you may have before retirement,” says Dan Stewart, CFA®, president of Revere Asset Management Inc., in Dallas. “Do not put all of your savings into your 401 where you cannot easily access it, if necessary.”

The earnings in a 401 account are tax-deferred in the case of traditional 401s and tax-free in the case of Roths. When the traditional 401 owner makes withdrawals, that money will be taxed as ordinary income. Roth account owners have already paid income tax on the money they contributed to the plan and will owe no tax on their withdrawals as long as they satisfy certain requirements.

Both traditional and Roth 401 owners must be at least age 59½or meet other criteria spelled out by the IRS, such as being totally and permanently disabledwhen they start to make withdrawals.

Otherwise, they usually will face an additional 10% early distribution penalty tax on top of any other tax they owe.

Some employers allow employees to take out a loan against their contributions to a 401 plan. The employee is essentially borrowing from themselves. If you take out a 401 loan, please consider that if you leave the job before the loan is repaid, you’ll have to repay it in a lump sum or face the 10% penalty for an early withdrawal.

Youre Our First Priorityevery Time

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Also Check: How Much Can I Loan From My 401k

Minimum Vesting Standard Must Be Met

A 401 plan must satisfy certain requirements regarding when benefits vest. To “vest” means to acquire ownership. The vested percentage is the participant’s percentage of ownership in his or her account. All participants must be fully vested in their 401 elective deferrals. A traditional 401 plan may require completion of a specific number of years of service for vesting in employer discretionary or matching contributions. For example, a plan may require 2 years of service for a 20% vested interest in employer contributions and additional years of service for increases in the vested percentage. Matching contributions must vest at least as rapidly as a 6-year graded vesting schedule. A safe harbor and SIMPLE 401 plan must provide for 100% vesting in employer and employee contributions at all times.

Deadline To Set Up And Fund

- For taxable years 2020 and beyond, individual 401 plans may be set up by tax filing deadlines plus extensions. Note: It can take 30 or more days to establish a plan.

- Salary deferral portion of the contribution must be deducted from a paycheck prior to year end, with some exceptions for certain business structures.

- Business owner contributions may be made up through the business tax filing due date plus extensions.

Don’t Miss: Is Ira Safer Than 401k

What’s So Great About 401 Accounts

A 401 is a popular type of employer-sponsored retirement plan that’s available to all employees 21 or older who have completed at least one year of service with the employer, usually defined as 1,000 work hours in a plan year. Some employers enable new employees to join right away, even if they haven’t met this criterion yet.

In 2021 you’re allowed to contribute up to $19,500 to a 401 or up to $26,000 if you’re 50 or older. In 2020, those amounts rise to $20,500 and $27,000. These limits are much higher than what you find with IRAs, and they enable you to set aside a fairly large sum annually.

Most 401s are tax deferred, so your contributions reduce your taxable income each year. You must pay taxes on your distributions in retirement, but you may be in a lower tax bracket by then, in which case you would save money. Some employers also offer Roth 401s. You pay taxes on contributions to these accounts now, but you’ll get tax-free withdrawals in retirement.

Some employers also match a portion of their employees’ 401 contributions, which can make the task of saving for retirement a little easier. Each company has its own rules about matching, so consult with your HR department to learn how yours works.

Employer Benefits Of Offering A 401 To Employees

One reason companies offer 401 plans is to attract and retain top talent at every level of the organization. A 2022 survey commissioned by Human Interest and conducted by market research company OnePoll, found that retirement plans are the most-wanted benefit after health insurance. Human Interest internal data from March 2022 also found that offering a 401 plan may lead to lower turnover rates for small to medium-sized businesses.

A 401 is attractive to employees as it provides an easy, cost-effective way to save for retirement while deferring income tax on contributions until the future . But employees arent the only ones who receive tax benefits from a 401 plan. Employers can deduct match or profit sharing contributions made to employees 401 accounts .

Whats more, the government incentives qualified small businesses to start 401 plans. Eligible employers can take advantage of a startup costs tax credit of up to $5,500, per year for the first three years of the plan, to cover the the ordinary and necessary costs of starting a new 401 plan and by adding an automatic enrollment feature.

See how much a 401 would cost with SECURE Act tax credits applied.

Don’t Miss: How To Get My 401k From A Previous Employer

How To Apply For Canada Pension Plan Retirement Benefits

If you work in Canada, chances are you have noticed deductions for the Canada Pension Plan being deducted off of your pay cheque. Every individual who is employed or self-employed must contribute to this plan, which is the Canadian governments retirement income system.

- If you are employed by a company, your employer matches your contributions, which are withheld from your regular pay.

- If you are self-employed , you must make both the employee and employer contributions, and this is done each year when you file your personal T1 General tax return.

- CPP benefits do not start automatically. You must file an application with Service Canada to start your monthly pension.

What Is The Role Of The Employer In Administering 401k Plans

Under ERISA, plan fiduciaries, including the employer and any third parties who manage the plan and its assets, must act solely in the interest of the plan beneficiaries. Some of their responsibilities include:

- Managing the plan with the exclusive purpose of providing the plans retirement benefits to participants

- Ensuring that the investment menu offers a broad range of diversified investment alternatives

- Choosing and monitoring plan investment alternatives prudently

- Ensuring that the costs of plan administration and investment management are reasonable

- Filing reports, such as Form 5500 Annual Return/Report, with the federal government

These tasks should be taken seriously since fiduciaries can be held personally liable for plan losses or profits from improper use of plan assets that result from their actions.

You May Like: How Can I Find Out If I Have 401k Money

How Much Should An Employer Contribute To A 401k

With a traditional 401k, employers have the flexibility to alter how much they will contribute to their employees retirement savings accounts from year to year. Safe Harbor plans, on the other hand, are a bit more restrictive and require one of the following:

In total, employer contributions to any type of 401k, combined with employee salary deferrals, cannot exceed the lesser of 100% of employee compensation or the IRS limit for that year.

If You’re An Employer

If you already offer a 401 plan to your employees and would like to add a designated Roth 401 option to it, your plan’s service provider or custodian should be able to help. The IRS also has information for employers on its website, irs.gov, including Publication 4222, 401 Plans for Small Business and Publication 4530, andDesignated Roth Accounts Under 401, 403 or Governmental 457 Plans.

Don’t Miss: How To Rollover 401k To New Employer

How Do I Apply For Cpp Retirement Benefits

Next Steps

The standard age to start getting Canada Pension Plan retirement pension is 65 years old.

- a reduced pension if you apply as early as age 60, or

- an increased pension if you apply as late as age 70.

You can apply up to 12 months before you want to start getting your retirement benefits. suggests applying about 6 months before you want your CPP retirement benefits to start.

If you didn’t apply in time to get CPP retirement benefits at the standard age of 65, you can apply to get some or all the amount that you missed. To do this you have to be at least one month older than 65. The most you can get is 11 months’ worth of benefits. And you won’t get paid for any time earlier than the date you turned 65.

You can online or by using a paper application.

If I Am Eligible For A Reduced Immediate Pension Can I Resign And Wait Until I Am Eligible For An Unreduced Immediate Pension Before I Apply For My Public

Yes. You can defer the date of the first payment of your immediate pension. To do so, after having applied for your retirement pension, you will receive the Your Options document and you must indicate on the Reply-Form included that you want payment of your pension to begin on a date other than your retirement date. If the date on which you start receiving your immediate pension is closer to the date on which it would be payable without reduction, the reduction applicable to your pension will be less.

However, before making this decision, it is important to consider the consequences. Opting to receive a slightly higher pension at a later date could mean that you deprive yourself for several months of funds from which you could benefit as soon as you retire.

Recommended Reading: How Much Can You Put Into 401k Per Year