Can I Keep 401k With Old Employers

If youâve changed jobs recently, find out if you can keep 401 with old employer, and the alternative options you might have.

When you switch jobs, you have several options with your 401. You can decide to leave it where it is, rollover to a new employer, or transfer the money to an individual retirement account . Each of these options has different tax implications, and you should understand the particulars of each option before deciding the option to take.

You can leave your 401 in your former employerâs plan if you meet the minimum balance requirement. Employers require employees to have at least $5,000 in 401 savings if they decide to leave their money behind indefinitely. This option does not require any action on the employee’s part, and you can leave your job without doing anything to your 401 money. The employer will continue managing the 401 funds, but you won’t be able to make contributions to the retirement account once you leave.

How 401 Rollovers Work

If you decide to roll over an old account, contact the 401 administrator at your new company for a new account address, such as ABC 401 Plan FBO Your Name, provide this to your old employer, and the money will be transferred directly from your old plan to the new or sent by check to you , which you will give to your new companys 401 administrator. This is called a direct rollover. Its simple and transfers the entire balance without taxes or penalty.

Another, even simpler option is to perform a direct trustee-to-trustee transfer. The majority of the process is completed electronically between plan administrators, taking much of the burden off of your shoulders.

A somewhat riskier method is the indirect or 60-day rollover in which you request from your old employer that a check be sent to you made out to your name. This manual method has the drawback of a mandatory tax withholdingthe company assumes you are cashing out the account and is required to withhold 20% of the funds for federal taxes. This means that a $100,000 401 nest egg becomes a check for just $80,000 even if your clear intent is to move the money into another plan.

Why Not Just Leave The Money In The Old 401 Plan

When choosing between two 401 plans, I generally advise clients to favor rolling the old 401 over to the the new employers plan. This is solely for simplicity – because you dont want to have a dozen small retirement plans floating around when you retire.

But just because you should favor the new plan, does not mean it is the right choice. Check out the fees and investment options in the new plan to make sure you are not costing yourself money either through high fees or poor investment choices. If your new plan is undesirable with high fees or poor investment choices, you have another reason to consider rolling to an IRA .

Read Also: Can I Roll A Simple Ira Into A 401k

What Happens To Your 401k When You Leave A Job

Unfortunately, many people choose not to make a decision about what to do with their 401k funds. Instead, they simply leave the funds behind in their former employers 401k plan. Most plans allow former employees to leave funds in their account if the account contains more than $5,000. If theres less than $5,000 in the account, the plan sponsor may issue the former employee a check in order to close out the account.

While leaving money behind in a former employers 401k might be the easiest thing to do, its not always the best option. People often fail to monitor accounts held at former employers as closely as they should the money becomes out of sight, out of mind. This problem can worsen if an individual ends up leaving money behind in several different former employers 401ks.

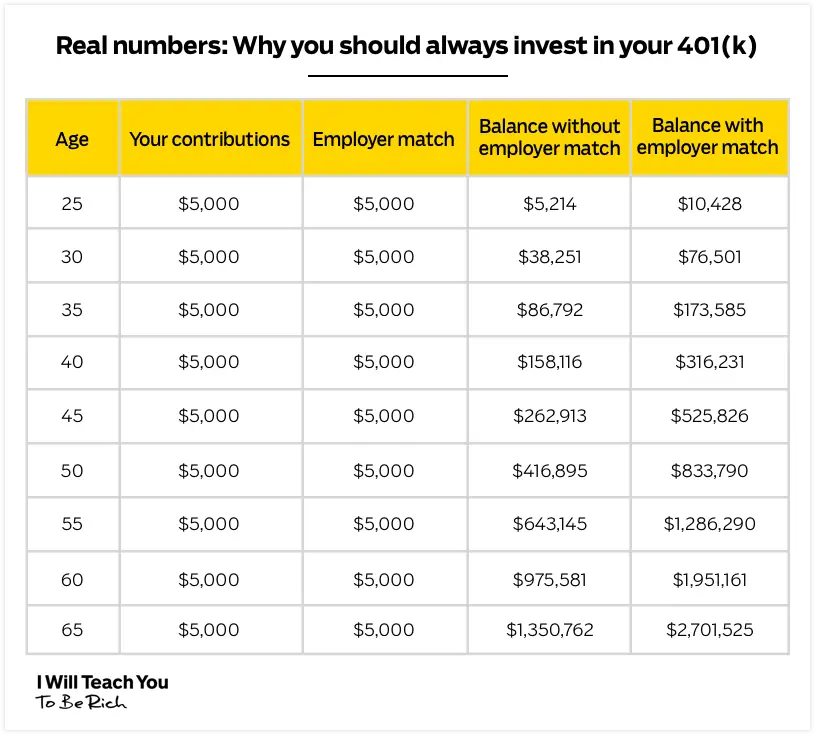

Also, the main benefit of a 401k plan is an employer match if the company offers one. Once you leave a job where you have a 401k, you no longer receive the match. And there are better investment vehicles out there 401k plans tend to have high fees, limited investment options, and strict withdrawal rules. So if youre no longer receiving the match, its usually best not to leave your assets languishing in an old 401k.

How To Locate A 401 From A Previous Job

If youre trying to locate an old 401 plan from a previous job, youre not alone. Not by a long shot. Roughly $850 million in plan assets owned by 33,000 employees are orphaned each year, held by a financial institution without an employer to oversee the plan . Thats a lot of money being left on the tableroughly two percent of all 401 plan assets.

The good news is that the Department of Labor has established rules for protecting money put into a 401, so the money isnt necessarily lostjust waiting for someone to claim it. However, that doesnt mean your old 401 account will always be easy to track down. It may take some digging, but there are a variety of ways you can find it.

Don’t Miss: How To Take A Loan Out On My 401k

Determine If Your 401 Account Was Rolled Over To A Default Ira Or Missing Participant Ira

One possibility is your employer rolled the funds over into a Default IRA.

If your employer tried to contact you for instructions as to what to do with your account balance, and you fail to respond, you may be deemed a non-responsive participant.

If they are unable to locate you altogether, you may be deemed a Missing Participant.

In either scenario, if the plan is being terminated, your employer may have put the funds in a Missing Participant Auto Rollover IRA.

This is an IRA account set up on your behalf to preserve your retirement assets until they are claimed by you or your beneficiaries under Department of Labor regulations.

To qualify for a Missing Participant or Default IRA, the account balance must be greater than $100 but less than $5,000 unless the funds are coming from a terminated plan, then the $5,000 ceiling is waived.

Finding a Missing Participant IRA

If your money has been transferred to a Missing Participant IRA, you should be able to find it by searching the FreeERISA website.

This search is slightly more time consuming than the national registry. Registration is required to search the database, which contains 2.6 million ERISA form 5500s, covering 1.3 million plans and 1 million plan sponsors.

If you know your money has been transferred to one of these default accounts, you should get it out into a standard IRA account.

Typically, these accounts must be interest-bearing, bear a reasonable rate of return, and be FDIC insured.

Here’s the bad part:

The Cons Of Leaving Your 401 Behind

Risk of Losing Track of Old 401s

Rolling over an old 401 or managing your savings during a job transition can be stressful and chaotic. Some people end up leaving behind an old account with the intention to revisit it later, only to forget about it or lose track of it as they are faced with other aspects of their job transition. This will make it difficult to put your savings to good use in a way that promotes your financial stability in the future.

As of now, if you have less than $5,000 in any old accounts, your previous employers will likely either cut you a check for the remaining balance or move the money into an IRA. Its up to you to find it, though.

Missing Out on Investment Opportunities

Do you know when you forget your old 401 accounts, you miss out on a chance for a solid investment plan? You were wise enough to set up a retirement plan to secure your financial freedom for the future. But, when you leave behind any amount of savings, it leads to loss of earning capacity.

Leaving behind money in an old retirement account also means that your savings dollars may not be invested in the most beneficial way possible for you. Staying on top of old accounts or rolling them over into your current plan can help you ensure you are investing every dollar with purpose, efficiency and your unique goals in mind.

Also Check: How To Access My Walmart 401k

What About My Current 401 Can I Access That Money At Any Time

You cannot take a cash 401 withdrawal while you are currently working for the employer that sponsors the 401 unless you have a major hardship. That being said, you can cash out your 401 before age 59 ½ without paying the 10% penalty if:

Additionally, you can cash out your 401 and pay the 10% penalty if you need funds for certain financial hardships and have no other source of funds. These hardships include:

Even if you meet these requirements, cashing out your 401 should always be seen as an absolute last resort.

Option : Roll It Into Your New 401

If your new employer offers a 401, you can possibly roll your old account into the new one. You may be required to be with the company for a certain amount of time before youre eligible to participate in their plan.

You can choose to do a Direct Rollover, whereby the administrator of your old plan transfers your account balance directly into the new plan. This only requires some paperwork.

Or, you can choose an Indirect Rollover. With this option, 20% of your account balance is withheld by the IRS as federal income tax in addition to any applicable state taxes. The balance of your old account is given to you as a check to deposit into your new 401 within 60 days. There is one catch, though. Youll need to deposit the entire amount of your old account into your new account, even the amount withheld for taxes. That means using personal cash to cover the difference and waiting until tax season to be reimbursed by the government.

You May Like: What Does It Mean To Roll Over Your 401k

What Are Your Options For Old Retirement Plans

You generally have four options for dealing with money thats in an employer-sponsored retirement account when youre no longer working at the company:

- Leave the money where it is: Although you might not be able to contribute to the account any longer, you may be able to leave the money in your former employers plan. Sometimes, you may need to meet a minimum account balance to qualify, such as $200 for a TSP or $5,000 for some 401s.

- Transfer funds to a new employer-sponsored plan: If you have a new job with a company that sponsors a retirement plan, you may be able to roll over the money into your new employers plan. When this is an option, compare the previous and new plans fees, terms, and investment options to see which is best.

- Roll over to an individual retirement account: You can also move the money into an individual retirement account . An IRA may give you more control as you can choose where to open the account and invest in a wider range of funds. Its also fairly easy to move from one IRA to another as the account isnt tied to your employer. However, IRAs could have more fees, especially if you dont have a lot of assets and dont qualify for lower-cost investment funds.

- Cash out: You can also take the money out of retirement accounts completely. But unless youre 59½ or older , you may need to pay a 10 percent early withdrawal penalty in addition to income taxes on the money.

Tracking Down A Lost 401

Its easy to understand why some workers might lose track of an old 401: Those born between 1957 and 1964 held an average of 12.4 jobs before the age of 54, according to the Bureau of Labor Statistics. The more accounts you acquire, the more challenging it is to keep track of them all.

Perhaps this is why there are some 24 million forgotten 401s holding assets in excess of $1.3 trillion.1 Left unattended too long, old accounts can be converted to cashand even transferred to the state as unclaimed propertyforgoing their future growth potential.

If youre among those with misplaced savings, heres how to locate and retrieve them:

Don’t Miss: Can I Use 401k To Invest In Real Estate

How To Explain To An Employer Why You Quit Your Job

Rehearse your answer to the question, Why did you leave your job? to make sure youre padding the negatives with positivity. If you take the time to create an answer and practice it, you will be able to answer the question with confidence and ease. My boss and I were both committed to the success of the company, but

Also Check: How Do I Find My Old 401k

My Former Employer Sent Me A Check For My 401 Balance Now What

I left a job recently and I had just started participating in the 401 there. My employer sent me a check for what I had in my 401 account. Can they do that?! What do I do now?

Robert

Hey Robert,

Based on what youve shared and what Im assuming the situation is, yeah, they absolutely can do that. Let me explain.

When you leave a job youve got a few options on what to do with your 401 account. In no particular order they are:

- Leave the money in the 401 plan

- Roll the money over to an IRA

- Roll the money over to a new 401

- Take a distribution

Each of those options could possibly be reasonable, but they all have something in common. You decide what youre doing with the money. In this particular example, you didnt sign up for it or maybe even know it was happening. Your old employer was the decision maker and now youre left wondering what happened.

This situation is predicated on one thing, Robert. Your account balance. If your account balance falls within a certain amount, the employer has options available to them. For example, if your account balance is under $1,000, they can cut you a check for the balance of the account. If this is the case , youve got 60 days to get that money into an IRA or it will be considered a taxable distribution. If youre not over age 59 ½, youll also be looking at a penalty. Yikes. Dont let that happen.

Don’t Miss: Where To Invest 401k Now

What To Do With Your Leftover 401 Funds

Moving from one job to another and dealing with the surprises of life can be overwhelming, right? It is easy to forget or lose track of your previous 401 plan as you start focusing on your current retirement savings account and settle into your new job.

To maintain ease of access to your savings and make the most of your leftover 401s, there are several options to choose from when deciding what to do with your old 401s.

First, you can leave the money in the old 401 if you are sure you will not forget about it. The advantage of this option is your account maintaining a tax-deferred status. The downside is, if you have less than $5,000 your past employer can send a check to you or to an IRA, which can attract some fees.

Rolling over your past 401 accounts into an individual retirement account ensures that you maintain good record-keeping of the funds, as they are all saved in one place. Even better, you will accrue more benefits, such as having more control over factors, such as account fees and access to a broader range of investments.

You can also choose to roll over your old 401 into your current employers plan, as long as the plan allows it. This ensures you protect your savings in a tax-deferred account and have access to profitable investment options. Just ensure you understand the rules set in the new plan.

What Happens If I Cash Out My 401

If you simply cash out your 401 account, youll owe income tax on the money. In addition, youll generally owe a 10% early withdrawal penalty if youre under the age of 59½. It is possible to avoid the penalty, however, if you qualify for one of the exceptions that the IRS lists on its website. Those include using the money for qualified education expenses or up to $10,000 to buy a first home.

Read Also: What Is The Max 401k Contribution