How To Convert Your 401 To Roth Ira

LAST REVIEWED Dec 13 20199 MIN READ

When you leave your job, one of the options regarding your 401 account is to transfer your 401 funds into a Roth IRA . It might not be the first thing that comes to mind, as contributions to a Roth IRA are from post-tax earnings while those to a 401 account are from pre-tax earnings. To qualify for a 401 rollover to a Roth IRA, you must meet the Internal Revenue Services income limits.

S For Rolling Over A 401 Into A Roth Ira

Once youve done the research, consulted a professional, and decided that a 401 conversion to a Roth IRA is right for you, theres a few things youll have to do.

First, youll need to open a Roth IRA account. NextAdvisor recommends these 5 online brokerages, which generally have low fees and good customer service.

Next, call that brokerage and tell them youd like to roll over a 401. This will likely be more effective than calling the institution that holds your 401 money after all, that company is not incentivized to help you move it out. As a general rule, its usually a lot easier to get money into a financial institution than it is to get money out of one, says Hernandez.

Depending on the institutions involved, the next steps may involve a paper check being mailed to your home, so youll need to make sure that both institutions have your most updated personal information on file. Make sure youre keeping track of the transactions for tax purposes. The 401 institution should provide you with a 1099-R form, which you can provide to your tax preparer.

Try not to get overwhelmed by the paperwork, says Stanley. Break the task into steps and give yourself time to get it done. You dont even need to do it all at once, she says. Whether you get it done in days or weeks, youll have taken a great step toward your financial goals.

Converting Roth 401 To Roth Ira

A Roth 401 plan is similar to a Roth IRA in that the contributions are made from post-tax money in both the cases. Hence, it is easier to convert a Roth 401 account into Roth IRA when compared to traditional 401-to-Roth IRA conversions.

However, taxes may be due on matching contributions from your employer, since such contributions are normally made from pre-tax money and kept in an accompanying regular 401 account. You can set up a new Roth IRA and roll over your 401 funds to it.

Also Check: How To Claim Your 401k

Rolling Over A 401 To A Roth Ira: Should You Convert To A Roth

What are your 401 rollover options? You may consider rolling over an old 401 to a Roth IRA, which is properly described as a Roth conversion. Converting your old 401 or 403 to a Roth IRA is worth considering. A Roth IRA offers unique benefits unavailable in other types of retirement accounts: no RMDs, tax-deferred growth and tax-free withdrawals. But a 401 to Roth IRA conversion doesnt make sense in every situation. For high-earners, it may not make sense to pay tax on your retirement savings now.

Alternatives To Roth Conversion

There are also alternatives to a 401 conversion to consider. For example, you can leave your traditional 401 alone and start putting money from your paycheck into a new Roth 401 instead. That way, you dont have to worry about taking a hit paying taxes now and still take advantage of the Roths tax-free growth later.

Heres the deal: We want you to be careful as you think about transferring your retirement savings into a Roth 401. It might make sense for you if you can pay cash for the taxes without taking money out of your 401 and if youre still several years away from retirement. If those scenarios dont apply to you, you probably want to think about a different option.

But before you do anything, make sure you talk with an investing professional. They can help you understand the tax impact of a 401 conversion and weigh the pros and cons of each option.

Read Also: Can I Max Out My 401k And Roth Ira

Roth 401 Vs Traditional 401

Most people are familiar with how traditional 401 retirement plans work: An employee contributes pre-tax dollars and can choose from a variety of investment options. Then, contributions and potential earnings grow tax-deferred until they’re withdrawn, usually in retirement.

With a Roth 401, the main difference is when the IRS takes its cut. You make Roth 401 contributions with money that has already been taxedjust as you would with a Roth individual retirement account . Any earnings then grow tax-free, and you pay no taxes when you start taking withdrawals in retirement.1

Another difference is that if you withdraw money from a traditional 401 plan before you turn 59½, you pay taxes and may potentially owe a 10% penalty on the entire distribution.2 With a Roth 401, your non-qualified withdrawals are a pro-rata amount of your contributions and earnings, and you may potentially be subject to the 10% early withdrawal penalty on funds that are considered gross income.3

One similarity between Roth and traditional 401s is that you must start taking required minimum distributions once you reach age 72 to avoid facing a penalty. However, you can get around this requirement when you retire by rolling your Roth 401 into a Roth IRA, which has no RMDs.4 This way, your assets have the opportunity to grow tax-free, and if you pass down your IRA to your heirs, they won’t have to pay taxes on distributions either.

Should You Convert To A Roth 401

If your company allows conversions to a Roth 401, you’ll want to consider two factors before making a decision:

Recommended Reading: Can You Invest 401k In Bitcoin

Should I Move My 401k After Retirement

If your 401 plan has a cost-effective investment option, there may be little reason to move your money. If they work for a large company, the company, because of economies of scale, can usually negotiate fees and expenses for a very low 401 plan for participants in the plan, says M.

How long do you have to move your 401k after retirement?

How long do you have to roll over a 401? If the distribution is made directly to you from your retirement plan, you have 60 days from the date you receive the retirement plan distribution to roll it into another plan or IRA, according to the IRS.

Can I move my 401k after I retire?

When you retire or leave your job for any reason, you have the right to transfer your 401 assets to an IRA. You have a number of immediate rollover options: Roll out your traditional 401 to a traditional IRA. You can roll up your traditional 401 assets into a new or existing traditional IRA.

The Ins And Outs Of Opening And Contributing To A Roth Ira

The easy answer to your second question is again, yes, you can potentially contribute to a Roth IRA even if you contribute the yearly maximum to a 401. In fact, it’s an ideal retirement savings scenario to contribute the maximum to both. And it’s something I highly recommend if you can afford it.

For 2022, you can contribute up to $20,500 to a 401 with a $6,500 catch up if you’re 50 or over. You can contribute up to $6,000 to a Roth IRA with a $1,000 catch up . Together, that’s a sizeable savings.

So on the surface, it would appear you’re good to go. However, although there are no income limits for contributing to a Roth 401, there are yearly income limits for contributing to a Roth IRA, and that could throw a wrench in your plan. For 2022, if your adjusted gross income is $144,000 or over for single filers you wont be eligible to make a Roth IRA contribution.

Recommended Reading: Should I Do A Roth Ira Or 401k

Can I Switch From 401k To Roth

Not every company allows employees to convert an existing 401 balance to a Roth 401. If you can’t convert, consider making your future 401 contributions to a Roth account rather than a traditional one. You are allowed to have both types. As mentioned, you’ll owe income tax on the amount you convert.

Times A Roth 401k Conversion Is A Good Idea

Roth IRAs have become one of the most popular ways to build retirement savings over the years. In fact, theyre so popular that thousands of people clamor every tax season to convert their traditional IRAs to Roth IRAs.

This conversion is one of the most popular financial planning moves, since it can reduce your tax burden and eliminates required minimum distributions .

More recently, a new form of Roth account has emerged: Roth 401k plans. Roth 401k plans are essentially the same alternative to traditional 401k plans that Roth IRAs are to traditional IRAs. Contributions are made after tax, and gains and withdrawals are tax free.

And with Roth 401k plans on the scene, many sponsors are starting to allow their participants to convert their traditional, pretax 401k balances into Roth, after tax balances. This transition is known as a Roth 401k conversion.

Roth 401k conversions are not unlike Roth IRA conversions. The transition will create taxable income, but your assets will never leave your employers 401k plan.

Heres how one might work:

Conversions can be appealing. You pay taxes on the account now, rather than in the future when you might be in a higher bracket. But the decision is not always so cut and dry. And since this is a question I get in my practice from time to time, I thought itd help to share 5 circumstances where a Roth 401k conversion is a good idea.

Also Check: How To Find 401k Account Number

Benefits Of A Roth 401 Conversion

A recent study by Willis Towers Watson revealed a new trend among employer sponsored retirement benefits Roth 401s. In fact, seven out of ten employers now offer Roth 401s to their employees. If you already invest in a traditional 401, theres no need to worry. You can convert your existing 401 to a Roth and reap the benefits!

What is a Roth 401?

The Roth 401 is a workplace retirement savings account that combines the benefits of a 401 and Roth IRA. In a traditional 401 all contributions are made pre-tax. This means you arent taxed for income invested in your 401. Those taxes will be deferred until you take withdrawals in retirement. With a Roth 401 though, contributions are made after tax. This means you pay income tax on the money before investing it, but you wont have to pay any taxes during retirement. Like a traditional 401, Roth 401s can be matched by an employer and carry the same contribution limits. Its worth nothing that only your contributions to a Roth 401 are made after tax, so any company matching funds in your account will be subject to taxation in retirement.

Benefits of a Conversion

Who Should do a Roth 401 Conversion?

How to Convert

Here is a step-by-step guide to convert a traditional 401 to a Roth 401:

Speak with a Marietta Wealth financial professional to determine if a Roth 401 conversion is the right move for you.

Transfer To Your New Employers 401 Plan

If your new employer allows it, you can move the funds from your old plan into your new one. It can be easier to manage your investments when they are all in one place, which makes this a good option for some. Keep in mind, you still may be limiting yourself regarding investment choices and expenses could be higher too.

There is no one-size-fits-all approach to retirement planning or investing, which is important to keep in mind as Roth conversion strategies gain popularity. Roth conversions may play a large part in maximizing future wealth for some investors. Consider your next steps carefully and find a strategy that is consistent with your retirement planning goals and wealth management objectives.

For a more complete discussion on the various options for an old 401, please see this article.

Recommended Reading: Can I Roll A Simple Ira Into A 401k

Is Now A Good Time To Convert 401k To Roth Ira

Historically low tax rates make 2021 a great time to convert your traditional IRA to a Roth account. … “Between now and 2025, the last year of tax reform, taxes are on sale.” When you convert to a Roth IRA you pay the taxes now at your current tax rate so you don’t have to pay a higher tax rate in retirement.

Reasons Not To Convert From 401 To Roth Ira

Unlike her dad, 27-year-old Samantha Morgan doesnt benefit from a lot of tax deductions. Shes single, with no dependents and renting a one-bedroom apartment. After years of struggling as a low-paid medical resident with lots of student loans, she is finally debt-free and earning a doctors salary, which puts her firmly in the 35 percent tax bracket.

One of the big reasons Joe Morgan decided to convert to a Roth IRA was because he expected to be in a higher tax bracket when he retired. Samantha, on the other hand, has good reason to expect to be earning considerably less, and paying less in taxes, after she retires. For that reason, it makes more sense for Samantha to make tax-free contributions to a 401, because she will pay a lower tax rate when she withdraws the 401 funds after retirement.

The other benefit of Samanthas 401 is that her employer, St. Judes Hospital, matches a percentage of Samanthas 401 contributions. Thats free money! The standard arrangement is to match 50 percent of employee 401 contributions every pay period up to the first 6 percent of salary . But if Samantha wants to maximize the match, she needs to pace herself.

The best advice is to talk to your tax professional about whether a 401 to Roth IRA conversion is right for you. For lots more information, check out the related HowStuffWorks links on the next page.

You May Like: How To Find Out If I Have An Old 401k

But Which Calculator Can You Trust

Please pay close attention because you could lose $100,000 or more with the wrong Roth Conversion Calculator.

There are over a hundred free ones online, and thats about what they are worth.

So many are simplistic and chintzy its as if some teenager threw one together for a school project.

Many of these online calculators cut corners. They dont ask enough questions about your personal situation to give meaningful results.

So the one-size-fits-all approach wont do when your lifes savings is on the line.

Even worse: more than two out of three calculators gave wrong answers, according to the prestigious CPA Journal.

And most of the calculators require you to enter your private financial information in an online form. NEVER do that.

There are good, expensive IRA conversion calculators that tax professionals use for their clients.

You get what you pay for.

But I practically give away the one I use for my clients.

Now, my Roth conversion calculator is one of the most powerful available today.

Yet its easy to use

With a click of your mouse, youll open the Excel spreadsheet. On the front page, you will quickly:

Just click the mouse and youll see everything unfold before your eyes.

Its that easy.

Check out what the pros say:

Even though its worth every penny of that $1,000 value and because I have a multi-year waiting list for new clients

I feel an obligation to nearly give away my Roth IRA conversion calculator spreadsheet.

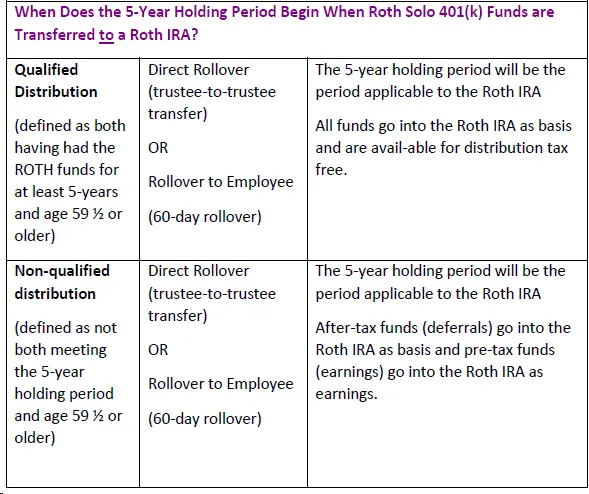

Since A Qualified Distribution From A Designated Roth Account Is Not Subject To Taxation Must The Distribution Be Reported

Yes, a distribution from a designated Roth account must be reported on Form 1099R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc.PDF.

For direct rollovers, the plan administrator is required to provide the plan administrator of the plan accepting an eligible rollover distribution, with a statement indicating either the first year of the 5-taxable-year period for the employee and the portion of the distribution attributable to basis, or, that the distribution is a qualified distribution.

For other distributions, the plan administrator must provide to the employee, upon request, the portion of the distribution attributable to basis or that the distribution is a qualified distribution. The statement is required to be provided within a reasonable period following the employee request, but in no event later than 30 days following the employee request.

Don’t Miss: How To Invest In 401k Fidelity

Rolling Over From A Traditional 401

If you currently have a traditional 401 and want to convert it to a Roth 401, you also may have the option to do that. But it’s important to understand the tax implications of this type of rollover.

You contribute to a traditional 401 with pre-tax funds and are taxed on withdrawals as ordinary income after age 59 1/2 . When you contribute to a Roth 401, however, you contribute with after-tax dollars but can take tax-free withdrawals.

Because of the different tax rules, rolling over money from a traditional to a Roth 401 has tax consequences, with converted funds classified as taxable income. This can increase the amount of income taxes you owe the IRS in the year the conversion takes place.

However, while you may get a large IRS tax bill, this can make sense in some situations. You may wish to convert a traditional 401 to a Roth 401 under the following circumstances:

- You’re in a lower tax bracket now than you expect to be in retirement: If this is the case, you’ll owe less tax on the converted funds at your current low tax rate than you’d otherwise pay when taking taxable distributions from a traditional 401 as a retiree.

- You want to minimize taxes on Social Security: Distributions from a Roth 401 aren’t considered “countable” income when you’re determining if a portion of your Social Security benefits will be taxed.

Converting a traditional 401 to a Roth 401 is simple — you’ll just need to complete some paperwork to request the transfer of funds.