Making Your 401 And Ira Work Together

The goal of all this is to give you the greatest opportunity to save, with the greatest flexibility. So my thought would be to first contribute enough to your 401 to capture the maximum company match. Then, if you’re eligible contribute to a tax-advantaged Health Savings Account . If your 401 has limited investment options consider opening either a traditional or a Roth IRA and contribute the annual maximum. Next, if you can, put more money in your company plan until you max it out. And if you get to the point where you can save even more , put that money in a taxable brokerage account.

The bottom line is you can’t really save too much, only too little. So use all the savings and investing vehicles available to you, including both an IRA and your 401, to save as much as you can, as early as you canand, at the same time, get the maximum tax break. You won’t regret it.

Have a personal finance question? Email us at [email protected]. Carrie cannot respond to questions directly, but your topic may be considered for a future article. For Schwab account questions and general inquiries, contact Schwab.

Can I Contribute To A Traditional Or Roth Ira If Im Covered By A Retirement Plan At Work

Yes, you can contribute to a traditional and/or Roth IRA even if you participate in an employer-sponsored retirement plan . See the discussion of IRA Contribution Limits. If you or your spouse is covered by an employer-sponsored retirement plan and your income exceeds certain levels, you may not be able to deduct your entire contribution. See the discussion of IRA deduction limits.

What Is The Difference Between An Ira Vs Sep Ira

A SEP is a true profit-sharing arrangement in that the employer can contribute the lesser of 25% of business revenue, or $58,000 for 2021 to themselves and any eligible employee. To be eligible, the employee must be 21, worked for the employer 3 of the past 5 years and receive at least $650 in paid compensation. If the business has eligible employees, then they must set up accounts for each employee and contribute to their accounts every time the owner contributes to their own account.

This is usually not an issue, because the accounts are easy to set up and can be established any time before the business files their tax returns . Many business owners will work with their CPAs and wrap up the entire years taxes and determine how much the employer should contribute to each account. That flexibility and ease is one of the reasons why practice owners choose to stay with a SEP.

One thing to note is only the employer contributes money to the SEP employee contributions are not allowed.

You can still fund a Traditional or Roth IRA, in addition to the SEP. However, the Backdoor Roth IRA is not allowed, as a you cant have any pre-tax IRA money and still do the Backdoor Roth, and a SEP is considered an IRA.

Anyone can fund a Traditional IRA or Roth IRA, as long as they have earned income . These are completely separate from any employer retirement plans.

You May Like: What Is The Max You Can Put In A 401k

You May Like: Can I Roll A 401k Into An Existing Ira

Contributing To A Simple Ira

The “Simple” in Simple IRA is actually an acronym that stands for Savings Incentive Match Plan for Employees. Like a 401 plan, a Simple IRA helps you and your employer save for your retirement. Unlike a 401 plan, however, Simple IRAs are only available to small employers with less than 100 employees. Additionally, unlike a 401 plan, an employer is required to contribute a certain percentage to the Simple IRA each year. The percentage the employer is required to contribute depends on whether you also choose to make a contribution to your Simple IRA.

Whats The Max You Can Contribute To A Self Directed 401k

If you are offered the option of a self-directed 401 by an employer, the custodian would be the plan administrator. The same contribution limits apply as for regular IRA and 401 plans. In 2019, the maximum IRA contribution is $6,000, plus a $1,000 catch-up for those age 50 or above.

Who is the custodian of a self directed 401k?

If you are offered the option of a self-directed 401 by an employer, the custodian would be the plan administrator. The same contribution limits apply as for regular IRA and 401 plans.

Do you have to pay taxes on self directed IRA?

The investor who has a strong interest in precious metals can invest pre-tax money long-term in a traditional IRA, and pay the taxes due only after retiring. The self-directed aspect may appeal to the independent investor, but its not completely self-directed.

Don’t Miss: Can You Borrow Money Against Your 401k

How Do I Recharacterize A Regular Ira Contribution

To recharacterize a regular IRA contribution, you tell the trustee of the financial institution holding your IRA to transfer the amount of the contribution plus earnings to a different type of IRA in a trustee-to-trustee transfer or to a different type of IRA with the same trustee. If this is done by the due date for filing your tax return , you can treat the contribution as made to the second IRA for that year .

Ira Tax Deduction Limit

Although there is no overall limit for contributing to a traditional IRA, there are income limits on tax-deductible contributions.

In other words, if you want to claim a tax deduction equaling the amount of your contribution in the year you invest the funds in your traditional IRA, your income must be below a certain threshold. The table below shows the limit for making tax-deductible IRA contributions in 202 and 2022 if you are covered by a workplace retirement plan such as a 401.

Data source: IRS.You May Like: How To Find Your Old 401k Account

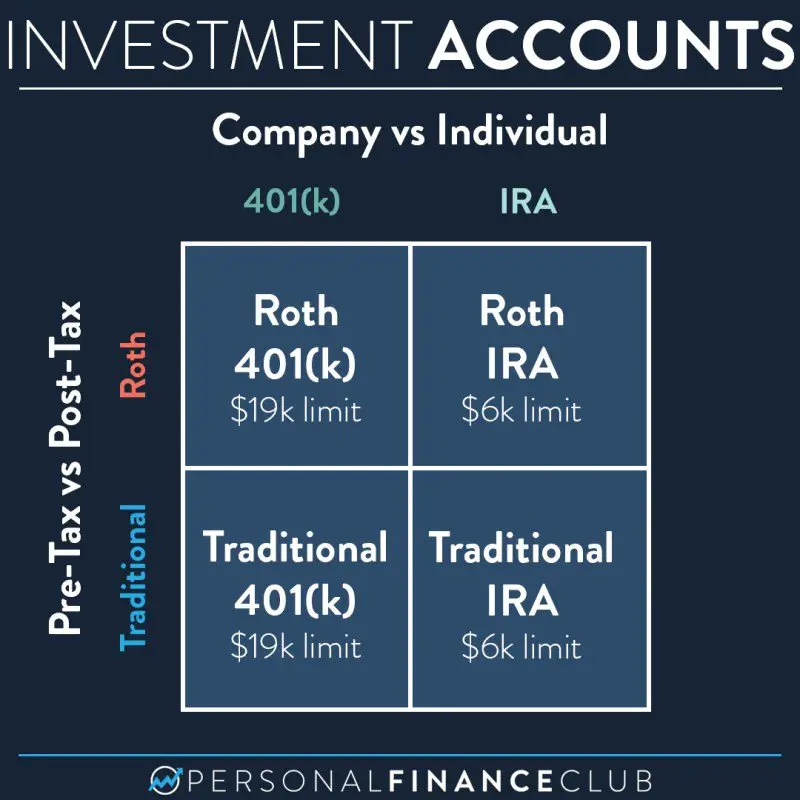

Can You Have Both A 401 And An Ira

Can you contribute to 401 and IRA plans simultaneously to save for retirement? Its a legitimate question to ask if youre just getting started on your retirement planning journey. For example, if youre already contributing to a plan at work, you may be wondering if you can also save money in an IRA.

Or maybe you opened an IRA in college but now youre starting your career and have access to a 401 for the first time. You may be unsure whether it makes sense to keep making contributions if youll soon be enrolled in your employers retirement plan.

Having a basic understanding of 401s and IRAs can help you make the most of these accounts when planning your retirement strategy, and answer the pressing questions: Can you have a 401 and a Roth IRA, and/or can you have a 401 and an IRA thats traditional?

What Happens If I Take A Distribution From My Designated Roth Account Before The End Of The 5

If you take a distribution from your designated Roth account before the end of the 5-taxable-year period, it is a nonqualified distribution. You must include the earnings portion of the nonqualified distribution in gross income. However, the basis portion of the nonqualified distribution is not included in gross income. The basis portion of the distribution is determined by multiplying the amount of the nonqualified distribution by the ratio of designated Roth contributions to the total designated Roth account balance. For example, if a nonqualified distribution of $5,000 is made from your designated Roth account when the account consists of $9,400 of designated Roth contributions and $600 of earnings, the distribution consists of $4,700 of designated Roth contributions and $300 of earnings .

See Q& As regarding Rollovers of Designated Roth Contributions, for additional rules for rolling over both qualified and nonqualified distributions from designated Roth accounts.

Read Also: How Do You Borrow Money From Your 401k

The Benefits Of Diversifying Your Retirement Accounts

We’ve touched on the difference between traditional and Roth retirement accounts. It’s important to consider each in regards to your current financial situation and your retirement goals.

Matching contributions by an employer are a great incentive to contribute towards a 401. Additionally, the tax-free retirement distributions of Roth IRAs and Roth 401s are something to consider as well.

Moreover, the investment options provided by a 401 plan are significantly limited to the options provided in an IRA. By spreading out your retirement savings between 401s and IRAs, you can take advantage of your employer’s 401 match and invest in a broader array of investments in an IRA.

Backdoor Roth Ira Contribution Limit

The IRA contribution limit for 202122 is $6,000 per person, or $7,000 if the account owner is 50 or older. So if you want to open an account and then use the backdoor IRA method to convert the account to a Roth IRA, that’s the maximum you can contribute for those tax years.

It’s worth noting that you can make IRA contributions until the tax deadline, so if you make your contribution after New Year’s Day, you can effectively make two years’ worth of contributions at once.

Also Check: What 401k Funds Should I Invest In

What Does A Good Combination Retirement Strategy Look Like

The earlier you can start saving for retirement, the better, but when you start, saving a lot of money in both a 401 and a Roth IRA might not be feasible.

Start by maxing out a Roth IRA while you are in your 20s, and if there is a company 401 as well, contribute just up to the amount you need to get your employers match, Whitney says.

As your income rises, saving on income taxes might become more important to many households. At that point, contributing more aggressively to a 401 account should become more attractive.

Planning your strategy this way allows you to end up with both types of accounts in retirement that have been growing for years.

Tap Into A Wide Range Of Investment Options

Every 401 or IRA is generally managed by an investment professional. They choose a subgroup of investments based on the funds objectives. Having both a 401 and an IRA may enable you to widen the investment offerings you are able to save in, Poorman says, giving you both control and flexibility. Its really opening up your choices, he says.

Don’t Miss: How Do I Take My Money Out Of My 401k

What Amounts May I Roll Over In An In

If your plan allows it, you can roll over any vested plan balance, including earnings, to a designated Roth account, even if these amounts cant be distributed to you. You can make an in-plan Roth rollover of:

- elective deferrals,

- after-tax employee contributions and

- earnings on the above contributions.

The plan can specify which of these amounts are eligible for in-plan Roth rollovers and how often these rollovers can be done.

Filing Status And Income

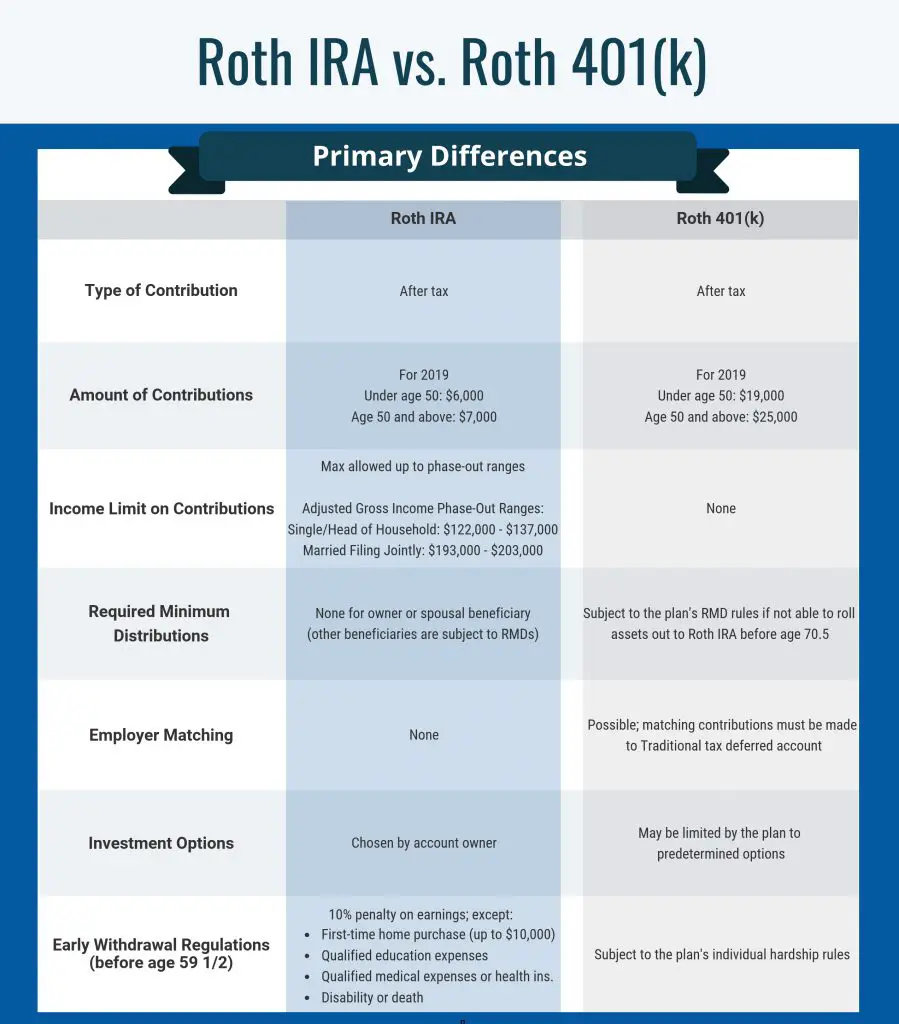

As for contribution limits, not everyone can contribute to a Roth IRA because of phase-outs due to income caps. In contrast, there are no income caps on contributions to a traditional tax-deferred IRA.

The most P.H.s daughter can contribute will depend on her modified adjusted gross income . Assuming she is single, she can contribute up to the limit for a Roth IRA if her MAGI is less than $129,000 in 2022. If her MAGI is higher than that but less than $144,000, she can still contribute, but the amount is reduced.

When MAGI is $144,000 and above, no Roth IRA contribution is permissible. However, there is no comparable MAGI limit for traditional IRAs. That is, someone who cannot contribute to a Roth IRAdue to earnings limits can contribute to a traditional IRA. Further, there is no MAGI limit on who can convert from a traditional IRA to a Roth IRA. If you decide to contribute to a traditional IRA and convertto a Roth IRA, be sure to review your plan with your tax adviser before taking action.

As to IRS resources, the Roth IRA chart for 2022 on IRS.gov covers limits for other filings statuses, including couples. There also are details about how to calculate a reduced Roth IRA contribution amount if your MAGI is higher than permitted under current limits.

Recommended Reading: Does It Make Sense To Rollover 401k

Retirement Plans For Self

If youre self-employed or own a small business, you have some further options for creating your own retirement plan. Three of the most popular options are a solo 401, a SIMPLE IRA and a SEP IRA, and these offer a number of benefits to participants:

- Higher contribution limits: Plans such as the solo 401 and SEP IRA give participants much higher contribution limits than a typical 401 plan.

- The ability to profit share: These plans may allow you to contribute to the employee limit and then add in an extra helping of profits as an employer contribution.

- Less regulation: These retirement plans typically reduce the amount of regulation required versus a standard plan, meaning its easier to administer them.

- Investible in higher-return assets: These plans can be invested in higher-return assets such as stocks or stock funds.

- Varied investment options: Unlike a typical company-administered retirement plan, these plans may allow you to invest in a wider array of assets.

So those are some of the key benefits of retirement plans for the self-employed or small business owners.

Can I Keep The Same Funds I Have In My Retirement Plan

This depends on your plan. First, you’ll want to reach out to your provider to determine if moving the assets over “in-kind” or “as is” could be an option for you.

If it is an option, then you’ll want to contact us at 877-662-7447 . One of our rollover specialists can help determine if we can hold your current investments here at Vanguard.

If it isn’t an option, don’t worrywe can still help you choose new investments once your assets have arrived here at Vanguard.

Don’t Miss: Can You Withdraw Money From 401k

How Much Money Do I Need To Open A Vanguard Ira

At Vanguard, you can open an account with a $0 balance. But there are a few minimums to keep in mind as you begin to invest.

- Vanguard ETFs: You only need enough money to cover the price of 1 share, which can generally range from $50 to a few hundred dollars.

- Vanguard mutual funds: Some Vanguard mutual funds have a $1,000 minimum . Most of our other Vanguard mutual funds have a $3,000 minimum.

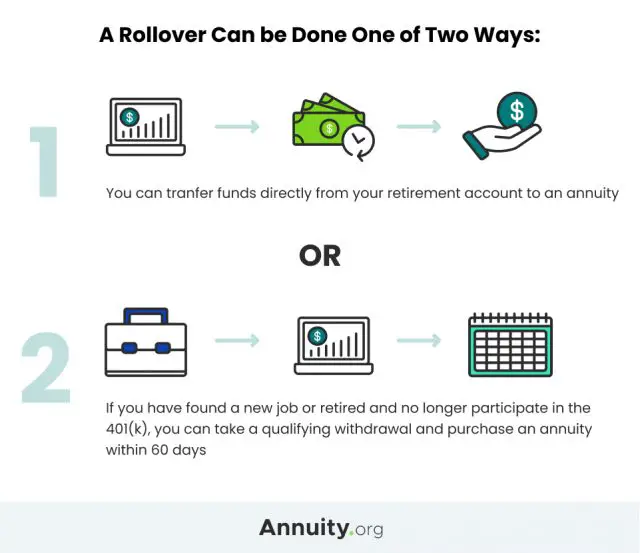

Can I Roll Over Distributions From A Designated Roth Account To Another Employer’s Designated Roth Account Or Into A Roth Ira

Yes. However, because a distribution from a designated Roth account consists of both pre-tax money and basis , it must be rolled over into a designated Roth account in another plan through a direct rollover. If the distribution is made directly to you and then rolled over within 60 days, the basis portion cannot be rolled over to another designated Roth account, but can be rolled over into a Roth IRA.

If only a portion of the distribution is rolled over, the rolled over portion is treated as consisting first of the amount of the distribution that is includible in gross income. Alternatively, you may roll over the taxable portion of the distribution to another plans designated Roth account within 60 days of receipt. However, your period of participation under the distributing plan is not carried over to the recipient plan for purposes of measuring the 5-taxable-year period under the recipient plan.

The IRS may waive the 60-day rollover requirement in certain situations if you missed the deadline because of circumstances beyond your control. See FAQs: Waivers of the 60-Day Rollover Requirement.

Read Also: How Does Retirement Work With 401k

Yes But The Tax Breaks You Receive May Be Limited By Your Income

The quick answer is yes, you can have both a 401 and an individual retirement account at the same time. Actually, it is quite common to have both types of accounts. These plans share similarities in that they offer the opportunity for tax-deferred savings or Roth IRA, tax-free earnings). However, depending on your individual situation, you may or may not be eligible for tax-advantaged contributions to both of them in any given tax year.

If you have a retirement plan at work, your tax deduction for a traditional IRA may be limitedor you may not be eligible for a deduction, depending on your modified adjusted gross income .

You can, however, still make nondeductible contributions. And if your income exceeds certain thresholds, you may not be eligible to contribute to a Roth IRA at all.

If My Only Participation In A Retirement Plan Is Through Non

You can contribute to a traditional IRA regardless of whether or not you are an active participant in a plan. However, when determining whether you can deduct a contribution to a traditional IRA, the active participant rules under IRC Section 219 apply. You are an active participant if you make designated Roth contributions to a designated Roth account. As such, your ability to deduct contributions made to a traditional IRA depends on your modified adjusted gross income.

Recommended Reading: What Happens When You Rollover A 401k To An Ira

Is There A Limit On How Much I May Contribute To My Designated Roth Account

Yes, the combined amount contributed to all designated Roth accounts and traditional, pre-tax accounts in any one year for any individual is limited ). The limit is $20,500 in 2022 , plus an additional $6,500 in 2020, 2021 and 2022 if you are age 50 or older at the end of the year. These limits may be increased in later years to reflect cost-of-living adjustments.