Can You Contribute To A Roth Ira And A 401

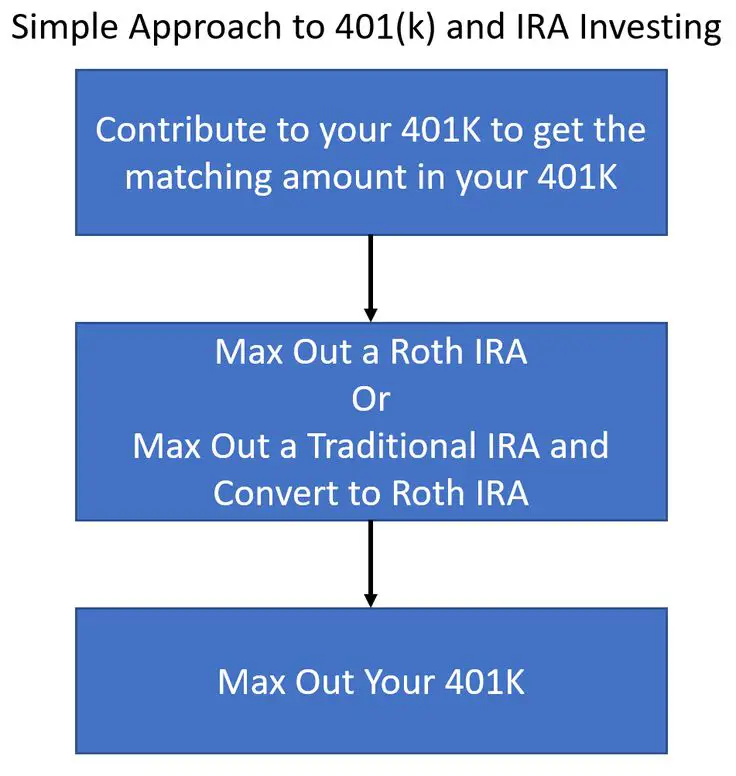

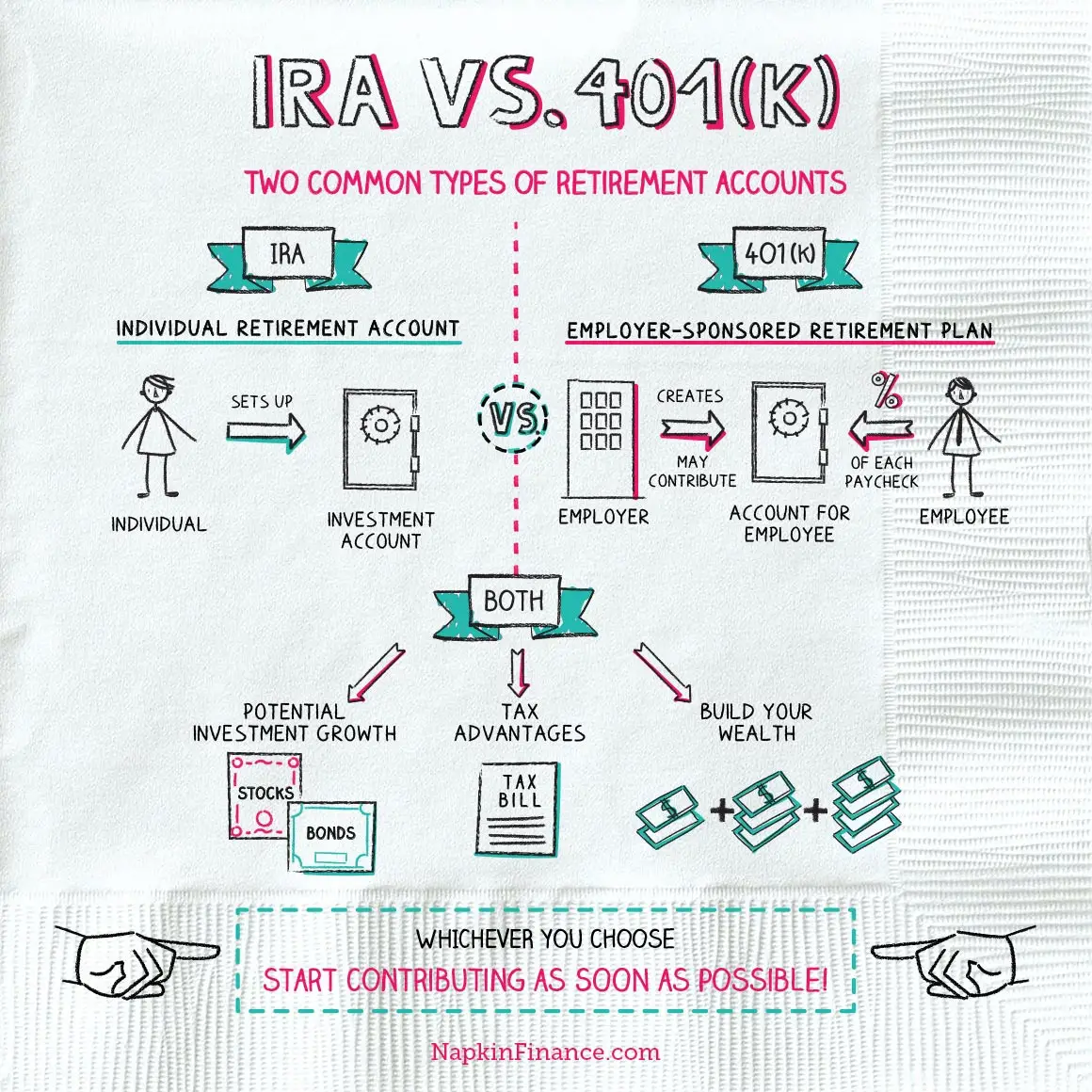

Many, if not most, retirement investors can contribute to both a Roth IRA and a 401 at the same time.

You can and should have both a Roth IRA and a 401, says Gregory W. Lawrence, a certified financial planner and founder of retirement planning firm Lawrence Legacy Group. Future tax rates are heading higher, possibly much higher, so maxing out both a Roth IRA and a 401 will give you more net after-tax dollars in retirement.

If your employer offers a 401 plan, you can choose to contribute to either a traditional 401 account or a Roth 401 account . The difference is when you pay income taxes: Upon making withdrawals in retirement with the former, or when youre making contributions in the present with the former.

Meanwhile, contributions to a Roth IRA are always made after you pay income taxesand qualified withdrawals in retirement are always tax-free. Heres the catch: You can only contribute to a Roth IRA if your annual income is below certain thresholds:

When You Should Consider Converting A 401 To A Roth Ira

If you anticipate your tax bracket being higher in retirement due to required minimum distributions or other sources of income, then it may make sense to pay income tax now while you are in a lower tax bracket.

Another reason to convert to a Roth is when you have a sizable pool of tax-free Roth assets relative to your tax-deferred retirement accounts. The tax benefits of a Roth IRA are most significant in this case. If your Roth IRA savings are only 5% or 10% of your entire retirement savings, it may not be enough to justify the loss of tax deferral.

Keep this in mind as an isolated conversion of relatively small dollar value may not make a material impact on your overall wealth. A financial plan can help you weigh whether maintaining tax-deferred growth is a better strategy to maximize your wealth.

What Are The Benefits Of A Roth Individual Retirement Account

A major benefit of a Roth individual retirement account is that, unlike traditional IRAs, withdrawals are tax-free when you reach age 59½. You can also withdraw any contributions, but not earnings, at any time regardless of your age.

In addition, IRAs typically offer a much wider variety of investment options than most 401 plans. Also, with a Roth IRA, you dont have to take required minimum distributions when you reach age 72.

You May Like: How To Cash In My 401k Early

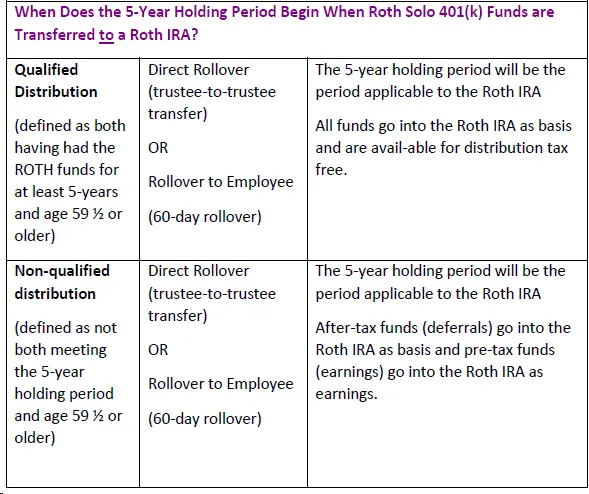

How Long Do You Have To Roll Over A 401

If a distribution is made directly to you from your retirement plan, you have 60 days from the date you receive a retirement plan distribution to roll it over into another plan or an IRA, according to the IRS.

But if you have more than $5,000 in a 401 at your previous employer and youre not rolling it over to your new employers plan or to an IRA there generally isnt a time limit on making this decision.

Read Also: What Is The Difference Between An Annuity And A 401k

Understand How Taxes Work Before You Make A Move

The main difference between traditional retirement accounts and Roth IRAs are when taxes are paid. For example, a traditional IRA typically allows you to take an up-front tax deduction and pay your tax bill during retirement. However, if you convert your traditional IRA to a Roth IRA and you already received a tax deduction, youâll have to pay income taxes for the year.

There are ways around a hefty tax bill, but it can be tricky if you contribute to other traditional IRA assets like a . You should seek the help of a professional to determine if a backdoor Roth IRA is the best strategy for you before making a move.

Recommended Reading: What Is An Ira Account Vs 401k

Don’t Miss: Can You Borrow From 401k To Buy A House

Converting A Traditional Ira To A Roth Ira

Converting a traditional IRA to a Roth IRA lets you transfer all or a portion of your traditional accounts into a Roth IRA. But it comes with a tax bill. Because contributions to a traditional IRA may be tax-deductible, income taxes are typically due on distributions from the accountand that includes conversions. You would have to pay income taxes on all of the pre-tax contributions and tax-deferred investment earnings transferred to the Roth account.

You can also make nondeductible contributions to an IRA and then convert them to a Roth.

S For Rolling Over A 401 Into A Roth Ira

Once youve done the research, consulted a professional, and decided that a 401 conversion to a Roth IRA is right for you, theres a few things youll have to do.

First, youll need to open a Roth IRA account. NextAdvisor recommends these 5 online brokerages, which generally have low fees and good customer service.

Next, call that brokerage and tell them youd like to roll over a 401. This will likely be more effective than calling the institution that holds your 401 money after all, that company is not incentivized to help you move it out. As a general rule, its usually a lot easier to get money into a financial institution than it is to get money out of one, says Hernandez.

Depending on the institutions involved, the next steps may involve a paper check being mailed to your home, so youll need to make sure that both institutions have your most updated personal information on file. Make sure youre keeping track of the transactions for tax purposes. The 401 institution should provide you with a 1099-R form, which you can provide to your tax preparer.

Try not to get overwhelmed by the paperwork, says Stanley. Break the task into steps and give yourself time to get it done. You dont even need to do it all at once, she says. Whether you get it done in days or weeks, youll have taken a great step toward your financial goals.

You May Like: How To Find A 401k From An Old Employer

A Tax Loophole Lets High Earners Contribute Indirectly To A Roth Ira

InvestopediaForbes AdvisorThe Motley Fool, CredibleInsider

High-income earners cant contribute directly to a Roth IRA. But thanks to a tax loophole, they can still make contributions indirectly. If you take advantage and maximize your retirement savings, you can save tens or even hundreds of thousands of dollars on taxes over the years. Let’s delve deeper into this loophole and the benefits of setting up a backdoor Roth IRA.

Tips For Managing Your Retirement Accounts

- Taking care of your retirement plans on your own is harder than it might seem. Luckily, finding the right financial advisor that fits your needs doesnt have to be hard. Finding a qualified financial advisor doesnt have to be hard. SmartAssets free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- Check your 401 contributions each year to make sure youre taking full advantage of your employers plan when it comes to matching contributions. Run the numbers through our 401 calculator annually to make sure youre contributing enough to reach your target retirement savings goal.

Read Also: Are There Penalties For Withdrawing From 401k

What Is A Roth 401

The Roth 401 is a workplace retirement savings account that combines the convenience of a traditional 401 with all the benefits of a Roth IRAplus a few more. Its the best of both worlds!

A traditional 401 and a Roth 401 are similar. You can get your company match by contributing to either type of account, and both have a $20,500 contribution limit for 2022.2 But thats where the similarities end.

The biggest difference between a traditional 401 and a Roth 401 is how your contributions are taxed. When you put money into a traditional 401, youre using pretax dollars. That means the money goes into your 401 before you pay taxes on it. Those taxes are then deferred until you make withdrawals from your 401 in retirement.

On the other hand, your contributions to a Roth 401 are made with after-tax dollars, meaning you invest that money in your Roth 401 after you pay taxes on it. Its a little more expensive on the front end, but its worth it. Why? Because you get the benefit of tax-free growth on your contributions. So when you start withdrawing money in retirement, you wont have to pay a single penny in taxes.

Whenever you can make tax-free growth part of your investment strategy, do it!

Do I Have To Convert The Entire Amount In My Traditional Ira Or Qrp

No. You may convert just a portion of your assets, and there is no limit to the number of conversions. To help manage the taxes due on each conversion, you may convert smaller amounts over several years. Keep in mind, if you want to take a distribution, each conversion has its own five-year waiting period to avoid the 10% additional tax if you are under age 59 1/2.

Dont Miss: Should I Do 401k Or Roth Ira

Also Check: Do I Need A Financial Advisor For My 401k

Make Sure You Understand These Rules Before Converting Your Retirement Savings

A 401 is a smart place to keep your retirement savings, especially if your company offers a matching contribution. But as some people look toward retirement, they find the Roth IRA’s tax-free distributions more appealing. Contributing funds to a Roth IRA is always an option, but you could also do a 401 to Roth IRA conversion with your existing savings.

This lets you reclassify your 401 funds as Roth savings by paying taxes on the amount you’d like to convert. Here’s a closer look at how 401 to Roth IRA conversions work and how to decide if they’re right for you.

You Expect To Earn More Money In The Future

If you plan to earn lots of money in the future or earn a high income now you should consider rolling your funds into a Roth IRA instead of a traditional IRA. For single filers in 2016, the maximum income allowable for contributions to a Roth IRA starts at $117,000 and ends at $133,000. Learn more about Roth IRA rules and contribution limits here. For married filers, on the other hand, the ability to contribute to a Roth IRA begins phasing out at $184,000 and halts completely at $194,000 for 2016. The more you earn in the future, the harder it will become to contribute to a Roth IRA and secure the benefits that come with it.

Read Also: How Does 401k Work In Divorce

Also Check: How Does A 401k Work When You Change Jobs

How To Contribute To A Roth Ira

You open and contribute to a Roth IRA independently of any particular job or employer. There is a much lower IRA contribution limit: $6,000 in 2022, or $7,000 if you are age 50 or older.

IRAs are not eligible for any sort of matching contributions. However, they typically offer a much broader range of investment options than the limited menu of funds offered by the average 401 plan.

But its the freedom from paying income tax on withdrawals that is the Roth IRAs biggest superpower. In addition, there are no mandatory withdrawals once you turn 72so-called required minimum distributions .

The beauty of being able to contribute to a Roth IRA is that a portion of your retirement savings are not subject to ordinary income tax upon withdrawal, and you are never mandated to start withdrawing, says Whitney.

Transfer To Your New Employers 401 Plan

If your new employer allows it, you can move the funds from your old plan into your new one. It can be easier to manage your investments when they are all in one place, which makes this a good option for some. Keep in mind, you still may be limiting yourself regarding investment choices and expenses could be higher too.

There is no one-size-fits-all approach to retirement planning or investing, which is important to keep in mind as Roth conversion strategies gain popularity. Roth conversions may play a large part in maximizing future wealth for some investors. Consider your next steps carefully and find a strategy that is consistent with your retirement planning goals and wealth management objectives.

For a more complete discussion on the various options for an old 401, please see this article.

Don’t Miss: Can I Transfer Part Of My 401k To An Ira

You Want To Avoid Required Minimum Distributions

Heres another rule that applies to a 401 but not a Roth IRA: required minimum distributions, or RMDs.

The IRS requires all 401 owners to withdraw a minimum amount from their accounts each year beginning in the year they turn 72. The exact amount depends on your balance, your age, and a life-expectancy variable determined by the IRS.

With a Roth IRA, that money has already been taxed, so RMDs are not required.

Where Should I Put My Retirement Money After I Retire

Roll over to an IRA. This option can also retain the tax-deferred advantage of a lump-sum distribution while offering a range of investment options. Alternatively, you can invest part or all of the lump-sum rollover in an annuity. It can provide you with a guaranteed income stream throughout your retirement.

What is the safest retirement fund?

No investment is completely safe, but there are five that are considered the safest investments you can have. Bank savings accounts and CDs are usually FDIC insured. Treasury securities are government-backed notes.

Where should a retiree put their money?

You can mix and match these investments to suit your income needs and risk tolerance.

- Immediate Fixed Annuity.

- Real Estate Investment Trusts

Don’t Miss: How To Track Down Old 401k Accounts

What Happens If You Cash Out Your 401

If you take your 401 money before you reach age 59 ½, you might have to pay taxes at your regular tax rate, on top of a penalty from the IRS, on any money that hasnt been taxed before. You may be able to avoid any penalties for certain life events or purchases, but youll still probably owe taxes on any previously untaxed money.

How To Transfer A Traditional Ira Into A 401

If youve weighed the choices and decided youd like to combine retirement plan balances inside your 401 and your 401 plan provider is ready and willing to take those IRA assets there are steps you need to take to do it right.

First, know that you cant roll a Roth IRA into a 401 not even into a Roth 401. Were specifically talking about pretax money in a traditional IRA here.

As with a 401 rollover, the easiest way to roll a traditional IRA into a 401 is to request a direct transfer, which moves the money from your IRA into your 401 without it ever touching your hands. Contact your 401 plan administrator for instructions on how to do this following its guidance will allow you to avoid taxes and penalties.

About the author:Arielle O’Shea is a NerdWallet authority on retirement and investing, with appearances on the “Today” Show, “NBC Nightly News” and other national media. Read more

Recommended Reading: How To Pull Out Of Your 401k

What Is A Roth Ira

A Roth IRA is a tax-exempt, independent retirement account. The key term here is tax-exempt you contribute money on an after-tax basis, and the money can grow free from taxation into and through retirement. Whats more, you wont pay any tax on principal or earnings when you withdraw the money in retirement, assuming the account has been opened for at least five years.

Owning and funding a Roth IRA is not only a mathematically smart idea. Its also psychologically easing: any money contributed to a Roth IRA has the potential to compound and earn dividends for the rest of your life and youll still incur no tax liability. To know that you have a tax-free fund to cover your spending in retirement is truly a magnificent benefit.

The Roth IRA does come with some points of caution, however. First, contributions are limited to $6,000 annually, though the IRS will allow an additional catch-up contribution of $1,000 for those over 50.

Second, to contribute fully and directly to a Roth IRA, youll need to fall within certain income limits. For single people, this limit is $125,000, and for married couples, its $198,000. Beyond these thresholds, youll be restricted in your ability to contribute and may not even be able to contribute at all.

Should You Convert Your Traditional 401 Into A Roth 401

8 Min Read | Jun 9, 2022

A few years back, the Roth 401 was the new kid on the block when it came to company-sponsored retirement accounts.

But now, 86% of employers offer a Roth 401 option to their employees.1 If the Roth 401 is on the table at your workplace, thats great news for you!

But if your company is offering a Roth 401 option, youre probably wondering what to do with your existing traditional 401. Is converting a traditional 401 to a Roth the way to go? Or should you just leave it alone?

There are some things to keep in mind before you make this decision, so lets dive in.

Read Also: Can I Transfer 401k To Roth Ira