Low Down Payment Alternatives To Using A 401

In the 1980s and 1990s, first-time home buyers used 401 plans to help buy homes because low- and no-downpayment mortgages were scarce.

Using a 401 to buy a home is not necessary today.

The government backs multiple low- and no-downpayment mortgage loans for first-time buyers, and the typical first-time home buyer doesnt put twenty percent down.

Here are some popular alternatives to using withdrawing money from a 401 to help buy a home.

Alternatives To Using Your 401k

While using your 401K may seem like an easy solution, you can pay steep penaltiesnot to mention the fact that youll be depleting your retirement savings.

- If you keep $34,375 in your 401K account, it could grow significantly over the course of the next few years.

- If you withdraw it to put $25,000 towards your home, youll experience an immediate loss plus a loss of potential future dividends.

There are other good options for covering your down payment and closing costs. These include:

- Making an IRA withdrawal You may be eligible to withdraw up to $10,000 from your Roth IRA to put toward a first home. You can make this withdrawal without paying a penalty or being taxed.

- Researching grants Some states, cities, and counties offer grant incentives for qualifying first-time home buyers. Depending on the nature of the grant, you may be able to use it for your down payment or closing costs.

- Taking out a loan from another source Other government-sponsored programs can help you take out a loan to cover a portion of your closing costs or down payment. Some offer loans that are forgiven after a certain time period or repayable only after the sale of the home. Others carry interest rates as low as 0%.

Thoroughly research your local resources to see if youre eligible for programs that could prevent the need for a 401K withdrawal.

Using A 401 Withdrawal To Buy A House

401 withdrawals are generally not recommended as a means to buy a house because theyre subject to steep fees and penalties that dont apply to 401 loans.

If you take a 401 withdrawal before age 59½, youll have to pay:

- A 10% early withdrawal penalty on the funds removed

- Income tax on the amount withdrawn

For example, say you withdraw $20,000 from your 401 to cover your down payment and closing costs.

- Youll be charged a $2,000 early withdrawal penalty

- And youll have to pay income tax on the $20K, which likely comes out to around $4,000-$6,000

Thats up to $8,000 gone from your retirement savings, on top of the initial withdrawal.

The standard rules for 401 withdrawals are as follows:

- Most 401 plans allow withdrawals only in cases of financial hardship

- However, using the money to buy a primary residence often qualifies as a financial hardship withdrawal

- You can withdraw only the money required to cover your immediate need

- The money does not have to be repaid

Since the IRS considers 401 withdrawals as ordinary income, withdrawing 401 money could bump some home buyers into a higher tax bracket. This could add even more to the cost of the early withdrawal.

Coronavirus update:

The CARES Act provision allowing for tax-free withdrawals from a 401 expired on Dec. 31, 2020. The IRSs normal 10% penalty is being enforced on hardship withdrawals in 2022.

Recommended Reading: When Do You Have To Take 401k Distributions

Can You Use Your 401 To Buy A House

Retirement accounts are just that: money thats being set aside for you to use in your golden years. And if youve been carefully saving, you might be wondering if its OK to tap those funds to use for something right now, like a home purchase, given that its an investment in its own right.

One of the most common types of retirement plans is the 401, which is often offered by companies to their workers. It provides an easy way to earmark some of your salary for retirement savings, along with the tax benefits that a 401 brings. Youll be setting aside money without paying taxes right now and then will pay the taxes when you withdraw it, which ideally will be when youre in a lower tax bracket than youre in now. In many cases, companies also match up to part of your personal savings, which is another reason that 401 accounts are so popular, since thats essentially free money.

But those funds have been set aside specifically for your retirement savings, which means that if your plan allows you to withdraw it earlier, youll pay a penalty, along with the taxes you owe given your current tax bracket. Theres usually the potential to borrow from it, though, which may be a better option.

So, while you can use your 401 for a first-time home purchase in most cases, the question is whether you should.

Donât Miss: How To Choose 401k Investment Options

What Is A 401

The Internal Revenue Code of the IRS allows 401 retirement plan contributions as tax deductions to help people prepare for retirement:

- The retirement plan accrues tax-free interest over time

- However, the IRS limits accessing the funds until the account holder turns 59½ years old or 55 if they lost or left their job and

- Early funds withdrawals incur a 10% penalty with the funds subject to income taxes.

The purpose of these limits and penalties is to make account holders accumulate enough money for a comfortable retirement.

You May Like: How Is My 401k Doing

Using A 401 Loan To Buy A House

A 401 loan to buy a house is permitted by the IRS, provided it is permitted by the plan.

Such a loan allows an employee to withdraw the lesser of:

- 50% of their 401 accountâs vested balance or a minimum of $10,000, whichever is greater

So, if an employee has $120,000 vested in a 401 plan, they would only be able to take a loan of up to $50,000 from the account. However, if their vested account balance was just $15,000, they could take out a loan of up to $10,000.

A 401 plan loan often needs to be repaid, allowing the employee to stay on track toward their retirement savings goals. While most 401 loans must be repaid over five years, loans taken to purchase a primary residence can be repaid over a longer period of time.

When a 401 loan is repaid, it avoids classification as a distribution. This means that a loan isnât subject to early withdrawal penalties or income taxes on the funds. However, if the loan is not repaid according to the plan rules, it may be considered a distribution and would then be subject to both taxes and any applicable penalties.

Loans from 401 plans are to be repaid with interest. This means that the loan will cost the employee extra money out of pocket, but that interest is also added to their own retirement plan .

Buy A House The Right Way

Well give it to you straight: You should never, ever take money out of your 401 to buy a house. Period. If you dont have enough money saved for a down payment, youre not ready to own a house. Because homeownership comes with all kinds of other costs that could sink you if youre not financially prepared .

Leave the money in your 401 alone until youre actually ready to retire. Better yet, work with a SmartVestor Pro to make sure your investments are on track to meet your retirement goals.

The only time its okay to consider taking money out of your 401 early is to avoid bankruptcy or foreclosure. But thats a catastrophic financial situation. Wanting to get into a house faster is not the same thing.

So, if youve got the house fever, cool off, take a cold shower, and take a real, honest look at where you are financially. Theres plenty of time and better ways to save up for a down payment. Like we said before, 20% down is ideal because you wont have to pay private mortgage insurance as part of your monthly mortgage payment. PMI is insurance that protects the lendernot youin case you stop making your monthly payments. Lenders require it for all home buyers who put less than 20% down.

However, a 510% down payment will also workespecially if youre a first-time home buyer. Just be prepared for those PMI payments. And remember, the more you put down, the less you have to borrowand the faster you can pay that mortgage off and be completely debt-free!

About the author

Don’t Miss: How To Build Your 401k

Considering Life After Retirement

Lastly, you need to consider the loss of retirement income, since thats what a 401k is supposed to be. During the recession, a lot of people saw their accounts shrink down to nothing. Many of these people later kicked themselves for not withdrawing the money. This adds another variable into the mix the safety and security factor. You can see why its not a question I can answer for you. There are just too many it depends scenarios to think about. But hopefully, after reading this article, youll know exactly what to research and consider.

Heres some recommended reading I want to leave you with. Theres an article on Bankrate.com called 10 Ways to Come Up With a Down Payment. Its worth reading. It provides a short overview of different strategies you can use, along with the pros and cons of each.

This article deals with the question: Can I use my 401k to buy a house in 2010? If you have additional questions about the home buying process, mortgage loans, or related topics, you can do a search at the top of this page.

How To Participate In The Home Buyers Plan

The Home Buyers Plan is a program that allows you to withdraw funds from your Registered Retirement Savings Plans to buy or build a qualifying home for yourself or for a related person with a disability. The HBP allows you to pay back the withdrawn funds within a 15-year period.

You can withdraw funds from more than one RRSP as long as you are the owner of each RRSP account. Your RRSP issuer will not withhold tax on withdrawn amounts of $35,000 or less. Some RRSPs, such as locked-in or group RRSPs, do not allow you to withdraw funds from them.

Certain conditions must be met in order to be eligible to participate in the HBP, including the following:

Don’t Miss: Can You Take A Loan From 401k For Home Purchase

How Much Can You Withdraw From 401k For Home

In most cases, you can borrow the lesser of up to 50% of your vested balance or $50,000. This means that if you have $200,000 vested in your 401k, you can only borrow up to $50,000. If you have $60,000 vested, you can borrow up to $30,000.

Your vested balance is the amount of money youd be able to keep if you left your current employer. Any money youve personally contributed is automatically vested. The money your employer contributes is usually only vested once youve stayed with the company for a certain amount of time.

Do You Qualify For A Mortgage Without 401 Funds

With such a wide range of mortgageoptions and down payment assistance on the market, most people simply dontneed to tap their 401 in order to purchase a home.

On top of that, todays lowmortgage rates increase your home buying power by reducing monthly payments.Its easier to afford a home than ever before.

Before taking money out ofretirement, find out whether you qualify for a mortgage based on your currentsavings. You might be surprised.

Popular Articles

Don’t Miss: How To Use 401k For Business

Alternatives To Using Your 401 To Buy A House

Even if youre short on cash and facing hardship, there are other options you might want to consider before tapping into your 401 account to cover the down payment on a house.

IRA Account

If you have an IRA, you should look there for extra funds before considering an early withdrawal from your 401. IRAs are built with special provisions for first-time home buyers, which the IRS defines as anyone who hasnt owned a primary residence within the previous 2 years.

Under these provisions, first-time home buyers are allowed to withdraw up to $10,000 without incurring the 10% penalty. However, that $10,000 is still subject to state and federal income taxes. If your withdrawal exceeds $10,000, then the 10% penalty is applied to the additional distribution.

A Roth IRA is an even better option, if you have one. Some plans allow you to make a hardship withdrawal, and up to $10,000 can be withdrawn tax-free for the express purpose of a first-time home purchase.

FHA Loan

A Federal Housing Administration loan is a government-backed mortgage with looser requirements designed to make it easier for first-time home buyers to purchase a property. This includes low down-payment options and lower credit score requirements. For this reason, an FHA loan may be a better option than making a withdrawal from your 401.

- Size of your down payment

Accessing And Repaying 401 Funds

Funds can be obtained, as you may expect, from a loan. Its often called a 401 loan, and when you take one out, you will have to repay it with interest no surprise there. The interest rate is typically set up as a formula, such as “prime rate plus one or two percentage points. The prime rate is published daily, and it is based on surveys of 30 banks’ lending rates.

More often than not your loan term will be a maximum of five years, and your payment will be taken directly from your payroll.

Also Check: Can A Spouse Get Your 401k In Divorce

How Much Can You Withdraw From Your 401k For A Home Purchase

The maximum withdrawal amount varies depending on the method you use. Start with a 401 loan because it is the financially responsible choice. You can cover any remaining fees with a 401 withdrawal because of the 401s stricter loan requirements.

Due to a recent congress ruling, if your employer allows it, you are allowed to withdraw both your employers 401 contributions and any investment earnings as well as your contributions.

Also Check: Is An Annuity A 401k

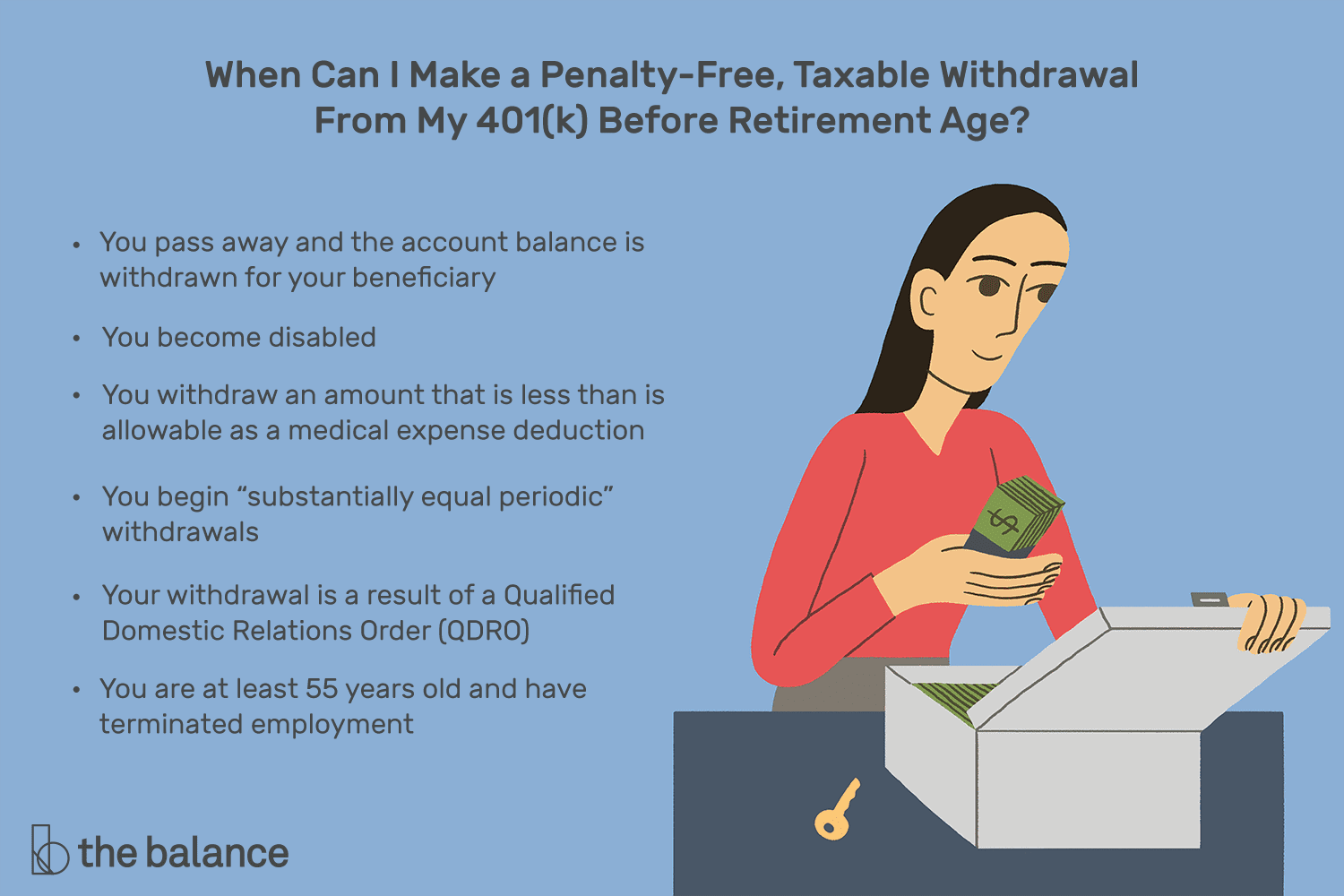

How Much Can You Take Out Without Penalty

With a few exceptions, account holders will be expected to pay an additional 10% early withdrawal tax on early or premature distributions . In addition to the 10% penalty, the money taken out will be taxed as income for the year its withdrawn. Therefore, no money can be taken out before the age of retirement without penalty, unless the reason correlates to the exceptions above.

Recommended Reading: Is It Best To Rollover A 401k To An Ira

Can I Use My 401k Or Ira To Buy A House

The most difficult part of buying a house is coming up with the down payment. This leads to the question, “Can I access cash in my retirement accounts to help toward the down payment on my house?”. The short answer is in most cases, “Yes”. The next important questions is “Is it a good idea to take a withdrawal from my retirement account for the down payment given all of the taxes and penalties that I would have to pay?” This article aims to answer both of those questions and provide you with withdrawal strategies to help you avoid big tax consequences and early withdrawal penalties.

Should You Use Your 401k As A First

Were here to help! First and foremost, SoFi Learn strives to be a beneficial resource to you as you navigate your financial journey.Read moreWe develop content that covers a variety of financial topics. Sometimes, that content may include information about products, features, or services that SoFi does not provide.We aim to break down complicated concepts, loop you in on the latest trends, and keep you up-to-date on the stuff you can use to help get your money right.Read less

Withdrawing money from a 401 to buy a house may be allowed by your company-sponsored plan, but this tactic is not always advisable, especially for first-time home buyers.

When it comes to using money from a 401, first-time home buyers need to keep in mind a few things, including the rules and penalties around early withdrawals from a 401 account as well as the potential loss of retirement savings.

Before you consider using a 401k to buy a house, consider alternatives like withdrawing funds from a Roth IRA, seeking help from a Down Payment Assistance Program , or seeing if you qualify for other types of home loans.

Lets take a look at the pros, cons, and important considerations that can help prospective homebuyers make a more informed decision about using funds from a 401 to buy a home.

You May Like: Can 401k Be Transferred To Another Company

You May Like: How Do You Find An Old 401k

Why Would Someone Want To Use Their 401 To Buy A Home

There are several reasons a first time home buyer may consider using 401 funds to pay for a new home. Typically, its done to meet an immediate cash need in order to make the down payment on a home for instance, when a first-time home buyer doesnt have savings for a down payment but wants to take advantage of low mortgage interest rates.

Home buyers might be attracted to the low interest rate on 401 loans vs. other down payment loan options. Many first time home buyers are also young, so a hit to their retirement savings may not feel like such a big deal.

But the truth is that even when youre young, removing funds from your retirement account can significantly hurt your growth potential and lower the total amount youll save for retirement in the end.

Almost any financial advisor will tell you that it should never be your first option, and many will tell you not to do it under any circumstances.