What Happens If I Dont Make Any Election Regarding My Retirement Plan Distribution

The plan administrator must give you a written explanation of your rollover options for the distribution, including your right to have the distribution transferred directly to another retirement plan or to an IRA.

If youre no longer employed by the employer maintaining your retirement plan and your plan account is between $1,000 and $5,000, the plan administrator may deposit the money into an IRA in your name if you dont elect to receive the money or roll it over. If your plan account is $1,000 or less, the plan administrator may pay it to you, less, in most cases, 20% income tax withholding, without your consent. You can still roll over the distribution within 60 days.

How Do 401s And Iras Work

A 401 is an employer-sponsored retirement savings plan that allows employees to save pre-tax money from their paychecks, often with a partial match from their employers. Money deposited into 401 accounts is not taxed until it is withdrawn. It gets its name from the section of the tax code that covers it.

An IRA is an individual retirement account in which the saver directly deposits pre-tax funds. Often, individuals who leave companies where they had 401 plans will roll the funds from them into IRAs.

Regardless of whether you own a 401k or an IRA, once a distribution is taken, it is taxable as ordinary income. Additionally, if you are withdrawing money prior to the age of 59½, then the IRS levies an additional 10 percent penalty tax. The same rules of taxation apply when you roll a 401 plan or an IRA into an annuity.

Next Steps To Consider

A qualified distribution from a Roth IRA is tax-free and penalty-free. To be considered a qualified distribution, the 5-year aging requirement has to be satisfied and you must be age 59½ or older or meet one of several exemptions .

Fidelity does not provide legal or tax advice. The information herein is general and educational in nature and should not be considered legal or tax advice. Tax laws and regulations are complex and subject to change, which can materially impact investment results. Fidelity cannot guarantee that the information herein is accurate, complete, or timely. Fidelity makes no warranties with regard to such information or results obtained by its use, and disclaims any liability arising out of your use of, or any tax position taken in reliance on, such information. Consult an attorney or tax professional regarding your specific situation.

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917

Also Check: How To Protect 401k From Identity Theft

A Roth Ira Can Be A Great Way To Save For Retirement Since The Accounts Have No Required Minimum Distributions And You Withdraw The Money Tax

Tax-free income is a dream of every taxpayer. And if you save in a Roth account, its a reality. Roths are the youngsters of the retirement savings world. The Roth IRA, named after the late Delaware Sen. William Roth, became a savings option in 1998, followed by the Roth 401 in 2006. Creating a tax-free stream of income is a powerful retirement tool. These accounts offer big benefits, but the rules for Roths can be complex.

Here are 11 things you must know about utilizing a Roth IRA as part of your retirement planning.

Background Of The One

Under the basic rollover rule, you dont have to include in your gross income any amount distributed to you from an IRA if you deposit the amount into another eligible plan within 60 days ) also see FAQs: Waivers of the 60-Day Rollover Requirement). Internal Revenue Code Section 408 limits taxpayers to one IRA-to-IRA rollover in any 12-month period. Proposed Treasury Regulation Section 1.408-4, published in 1981, and IRS Publication 590-A, Contributions to Individual Retirement Arrangements interpreted this limitation as applying on an IRA-by-IRA basis, meaning a rollover from one IRA to another would not affect a rollover involving other IRAs of the same individual. However, the Tax Court held in 2014 that you cant make a non-taxable rollover from one IRA to another if you have already made a rollover from any of your IRAs in the preceding 1-year period .

Recommended Reading: How Do I Transfer My 401k To A New Job

Are There Any Required Minimum Distributions I Must Take From The Ira Accounts After Retirement

Let’s go back to Jim’s example once again. At age 72, Jim must start taking distributions from his Traditional IRA holdings as per amounts mandated by the IRS, based on Jim’s life expectancy and balance remaining.

Jim has no obligation to distribute his Roth IRA holdings. He can continue to choose the best investments to grow his money tax-free.

At Age 72:| Tax-free withdrawal of original contribution and any growth amount.

No mandatory withdrawals. |

Use This Strategy For Tax

Want to retire early? A Roth IRA conversion ladder could help you tap your tax-sheltered retirement accounts before age 59½without the usual 10% penalty.

With a Roth conversion ladder, you shift money from a tax-deferred retirement accountsuch as a traditional IRA or 401into a Roth IRA. But unlike a standard Roth IRA conversion, you do it multiple times over several years. If done correctly, you can withdraw the converted funds with no tax or penalty long before your 59th birthday.

Dont Miss: Who Does Walmart Use For 401k

Recommended Reading: Can You Rollover A 401k Into An Annuity

How Long Do You Have To Roll Over A 401

If a distribution is made directly to you from your retirement plan, you have 60 days from the date you receive a retirement plan distribution to roll it over into another plan or an IRA, according to the IRS.

But if you have more than $5,000 in a 401 at your previous employer and youre not rolling it over to your new employers plan or to an IRA there generally isnt a time limit on making this decision.

How To Roll Over Your 401 To An Ira

The easiest and safest way to roll over your 401 into an IRA is with a direct rollover from the financial institution that manages your 401 plan to the one that will be holding your IRA. Note there are three key types of rollovers from a 401 to an IRA:

Your plan administrator can guide you through the process, and the financial institution where your money is going will usually be more than happy to assist. In many cases, your plan administrator will give you a check made out to your new IRA custodian for you to deposit there. Thus, open your new IRA first, then contract the plan administrator for of your former employer.

Read Also: How Do I Look Up My 401k

Can I Rollover My 401k To An Ira Without Leaving My Job

Most people roll over 401 savings into an IRA when they change jobs or retire. But, the majority of 401 plans allow employees to roll over funds while they are still working. A 401 rollover into an IRA may offer the opportunity for more control, more diversified investments and flexible beneficiary options.

What To Know About Roth Iras And Roth Conversions

A Roth individual retirement account offers advantages a traditional IRA does notlike the potential for your savings to grow tax-free and not having to take required minimum distributions.

Well help you understand the benefits Roth IRAs offer, your options for including a Roth IRA in your retirement savings strategy and what to consider when evaluating your needs.

Read Also: How Do I Look At My 401k

Advantages Of Rolling Over Your 401

1. You can consolidate your 401 accounts

Especially if you change jobs often, you might find yourself with many 401 accounts scattered around. The more accounts you have, the harder it may be to actively make decisions. By having your retirement funds all in one place, you may be able to manage them more carefully.

2. Youll have more investment choices in an IRA

With your 401, you are restricted to the investment and account options that are offered in that plan. An IRA can give you a more diverse option of items to invest in. In an IRA you may be able to invest in individual stocks, bonds or other vehicles that may not be available in your 401.

You cant add to the 401 at your previous employer. But if you roll this money over into a traditional IRA, you can add to that traditional IRA over time, up to the annual maximum. Youll have to follow the IRA contribution guidelines.

3. Youll have the choice to bring the account anywhere youd like

With an IRA, you can take your money with you to any advisor, if you already have a financial advisor or financial planner that you work with, for example. Or maybe you already have a brokerage where some of your money is being managed, and you want all your funds there.

How Much Will I Lose If I Cash Out My 401k

If you withdraw money from your 401 account before age 59 1/2, you will need to pay a 10% early withdrawal penalty, in addition to income tax, on the distribution. For someone in the 24% tax bracket, an early withdrawal of $ 5,000 from a 401 plan will cost you $ 1,700 in taxes and penalties.

Can you withdraw your 401k right now without penalty? The CARES Act gave Americans financially affected by the pandemic the opportunity to retire without penalty, but that exception ended in 2020. But while withdrawing funds from a 401 , IRA, or any other retirement account has no penalties for now. Financial planners say that raiding that account should be the last resort.

Also Check: How To Sign Up For 401k On Adp

Invest Your Newly Deposited Funds

You’ll have to choose investments in your new IRA so your money can grow. Make sure to maintain an appropriate asset allocation given your age, and consider your risk tolerance.

Finally, when your new IRA has been opened, be sure to read up on common IRA mistakes to avoid, such as forgetting required minimum distributions, not designating beneficiaries, and trading too often in the account.

Why Might You Consider An In

When you have a 401, you dont have maximum control over the types of assets you can hold, such as mutual funds, stocks, and bonds. You typically have a limited menu of options.

Through an in-service rollover, transferring some or all of your 401 funds to a personal IRA can open up more options for your assets. For instance, you might be able to put money into alternative assets like precious metals . A bonus is that you usually can keep contributing to your employers 401 after youve moved funds to an IRA.

Furthermore, an in-service rollover enables your personal financial advisor to provide more hands-on help since at least some of your assets are in an IRA that you control and not in an employer-sponsored 401 that could come with strings attached.

Plus, some 401 plans have annual fees with their options that are way above average. If youre stuck in one of those, you can minimize your costs by rolling your 401 money into an IRA with a lower-cost fund company, explains Rick Salmeron, a certified financial planner.

On top of that, you might be permitted to make tax-free withdrawals from an IRA that you wouldnt be able to make from a 401.

With your funds in an IRA, you are the account owner and have more control over your assets, free from the restrictions your employer-sponsored plan can impose, Salmeron adds.

You May Like: Should I Get A 401k

Should You Roll Over Your 401

To start, its worth knowing that you dont have to make a 401-to-IRA rollover, even if you do leave your job. You have the option of leaving the money youve invested in the plan at your old company. You cant keep contributing to it, but it will stay invested and if your investments go up, youll continue to see your account grow. This is called an orphan account.

Do you like the way your money is invested currently? If so, you may want to consider keeping your money in the existing plan. If you currently arent working but anticipate taking a new job soon, you could leave your money at your old plan temporarily and put it into your new companys plan once you have access to it.

For those who dont think theyll end up in another 401 plan but still want to save more for retirement, it might make sense to do a 401-to-IRA rollover. Remember, even though you still have your account at your old companys 401, you wont have the ability to make more contributions.

Option : Move The Money To Your New Employer’s 401 Plan

Moving money to your new employers 401 may be an option, depending on whether your current employer has a 401 plan and the terms of the plan. Like your former employer’s plan, many factors ultimately depend on the terms of your plan, but you should keep the following mind:

- Ability to add money: You’ll generally be able to add money to your new employer’s plan as long as you meet the plan’s requirements. This option also allows you to consolidate your retirement accounts, which may make it easier to monitor your investments and simplify your account information at tax time.

- Investment choices: 401 plans typically have a more limited number of investment options compared to an IRA, but they may include investments you can’t get through an IRA.

- Available services: Some plans may offer educational materials, planning tools, telephone help lines and workshops. Your plan may or may not provide access to a financial advisor.

- Fees and expenses: 401 fees and expenses often include administrative fees, investment-related expenses and distribution fees. These fees and expenses may be lower than the fees and expenses of an IRA.

- Penalty-free distributions: Generally, you can take money from your plan without tax penalties at age 55, if you leave your employer in the calendar year you turn 55 or older.

- Required minimum distributions: Generally, you must take minimum distributions from your plan beginning at age 72, unless you are still working at the company.

Read Also: Can I Roll Over A 403b To A 401k

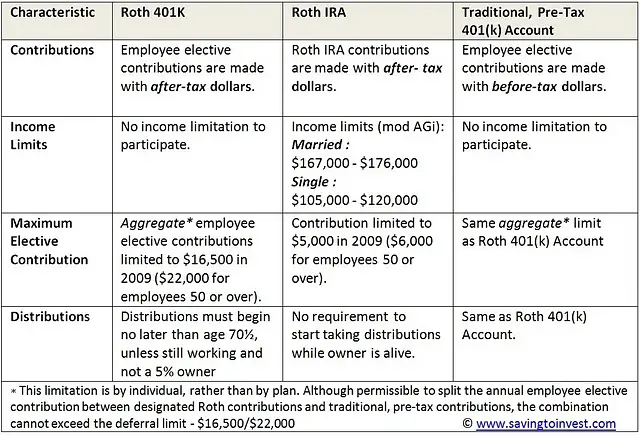

Converting A Traditional 401 To A Roth Ira

Youll owe some taxes in the year when you make the rollover because of the crucial differences between a traditional 401 and a Roth IRA:

- A traditional 401 is funded with the salary from your pretax income. It comes right off the top of your gross income. You pay no taxes on the money that you contribute or the profit that it earns until you withdraw the money, presumably after you retire. You will then owe taxes on withdrawals.

- A Roth IRA is funded with post-tax dollars. You pay the income taxes upfront before it is deposited in your account. You wont owe taxes on that money or on the profit that it earns when you withdraw it.

So, when you roll over a traditional 401 to a Roth IRA, youll owe income taxes on that money in the year when you make the switch.

The total amount transferred will be taxed at your ordinary income rate, just like your salary. Tax brackets for 2022 range from 10% to 37%, which are the same as those from 2021.

Disadvantages Of An Ira Rollover

A rollover is not for everyone. A few cons to rolling over your accounts include:

- . You may have credit and bankruptcy protections by leaving funds in a 401k as protection from creditors vary by state under IRA rules.

- Loan options are not available. The funds may be less accessible. You may be able to get a loan from an employer-sponsored 401k account, but never from an IRA.

- Minimum distribution requirements. You can generally withdraw funds without a 10% early withdrawal penalty from a 401k if you leave your employer at age 55 or older. With an IRA you generally have to wait until you are age 59 1/2 to withdraw funds in order to avoid a 10% early withdrawal penalty. The Internal Revenue Service offers more information on tax scenarios as well as a rollover chart.

- More fees. You may be responsible for higher account fees as compared to a 401k which has access to lower-cost institutional investment funds because of group buying power.

- Tax rules on withdrawals. You may be eligible for favorable tax treatment on withdrawals if your 401K is invested in company stock.

Neither State Farm nor its agents provide tax or legal advice.

Start a Quote

Recommended Reading: How To Open Up A 401k

Rolling Over Your 401 Into An Ira Account Comes With Many Benefits

When you change jobs, you generally have four options for your 401 plan. One of the best options is doing a 401 rollover to an individual retirement account . The other options include cashing it outand pay taxes and a withdrawal penalty, leave it where it isif your ex-employer allows this, or transfer it into your new employer’s 401 planif one exists. For most people, rolling over a 401 for those in the public or nonprofit sector) is the best choice. This article explains why and how to go about it.