Work With A Financial Advisor

Whether you have questions about your 401 investment options or want to open up a Roth IRA, working with a trusted and qualified financial advisor can go a long way. They can help answer all your investing questions and give you the guidance you need to start investing for retirement and building wealth.

Dont have an advisor? We can help with that! Our SmartVestor program can connect you with up to five financial advisors who are ready to help you take the next step toward the retirement youve always dreamed about.

Ready to get started? Find your SmartVestor Pro today!

About the author

Ramsey Solutions

Ramsey Solutions has been committed to helping people regain control of their money, build wealth, grow their leadership skills, and enhance their lives through personal development since 1992. Millions of people have used our financial advice through 22 books published by Ramsey Press, as well as two syndicated radio shows and 10 podcasts, which have over 17 million weekly listeners.Learn More.

Provisions For Changing Jobs

Most 401 plans permit the employee who terminates employment the options of receiving the 401 balance in a lump sum or to receive periodic payments or to roll over the proceeds to an IRA or other employer-sponsored retirement plan. Additionally, some 401 plans permit the terminated employee to retain their 401 balance in their former employer’s plan. Amounts that are retained in a former employer’s 401 plan or transferred to another employer’s plan or IRA postpone the taxation until amounts are subsequently distributed from the plan or IRA the money was rolled into.

When receiving funds from a 401 with the intention to roll the amount to an IRA:

- The rollover must be completed in 60 days.

- Employers must withhold 20% of the proceeds as a withholding tax. It is up to the participant to make up this 20%, or it will be treated as a distribution. The money withheld will be used as a credit against any income tax liability.

- Neither the 60-day rule nor the 20% withholding apply to amounts directly transferred to an IRA or other qualified plan.

Contribution Limits For Governmental 457 Plans

| 2021 |

| Double limit catch-up contributions 10 | $19,500 | $20,500 |

9. The limit is the lesser of the dollar amount shown, or 100% of your includible compensation for the taxable year. This limit includes contributions to all 457 plans at all employers during your taxable year, including any employer contributions that vest during the year. Contributions to non-457 plans and 403 plans) are disregarded. Roth contributions cannot be made to a nongovernmental 457 plan.

10. Eligibility occurs during the three taxable years ending before the employee attains ânormal retirement ageâ as defined by the plan. Eligibility requires the availability of an âunderutilized amountâ based on plan contributions in preceding years. Roth contributions cannot be made to a nongovernmental 457 plan.

Recommended Reading: Can I Access My 401k If I Lose My Job

You May Like: How To Pull From 401k

Maximum 401 Company Match Limits

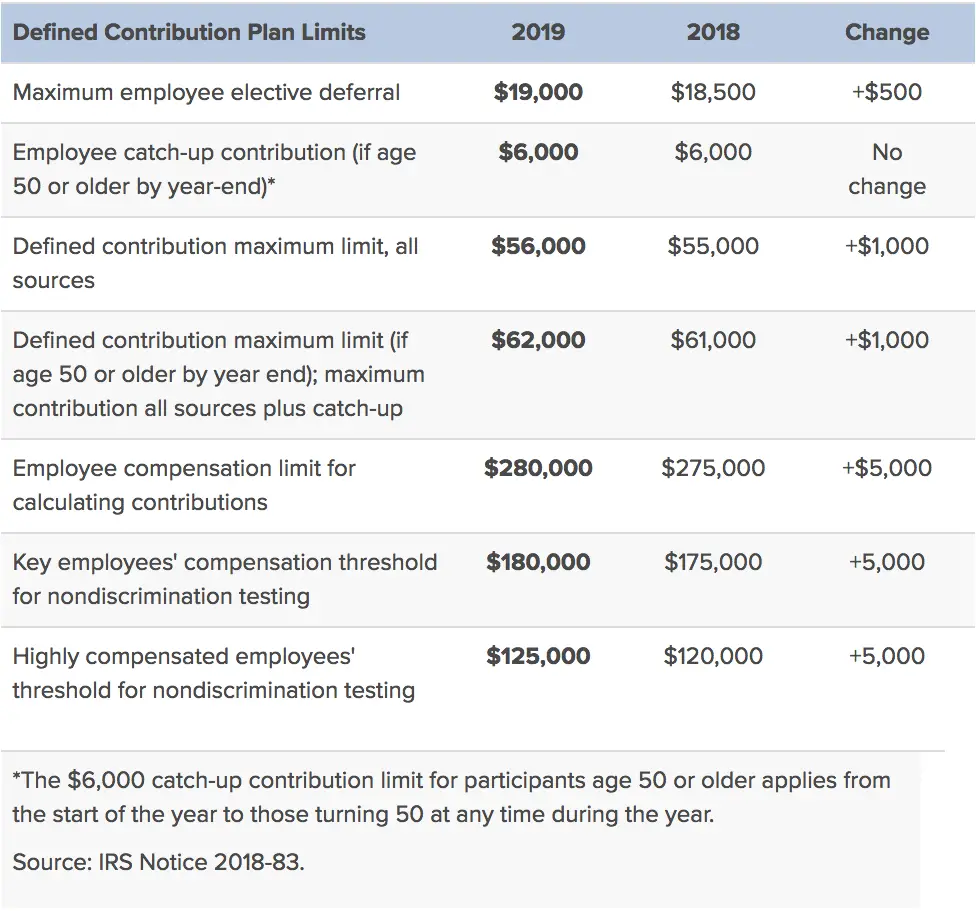

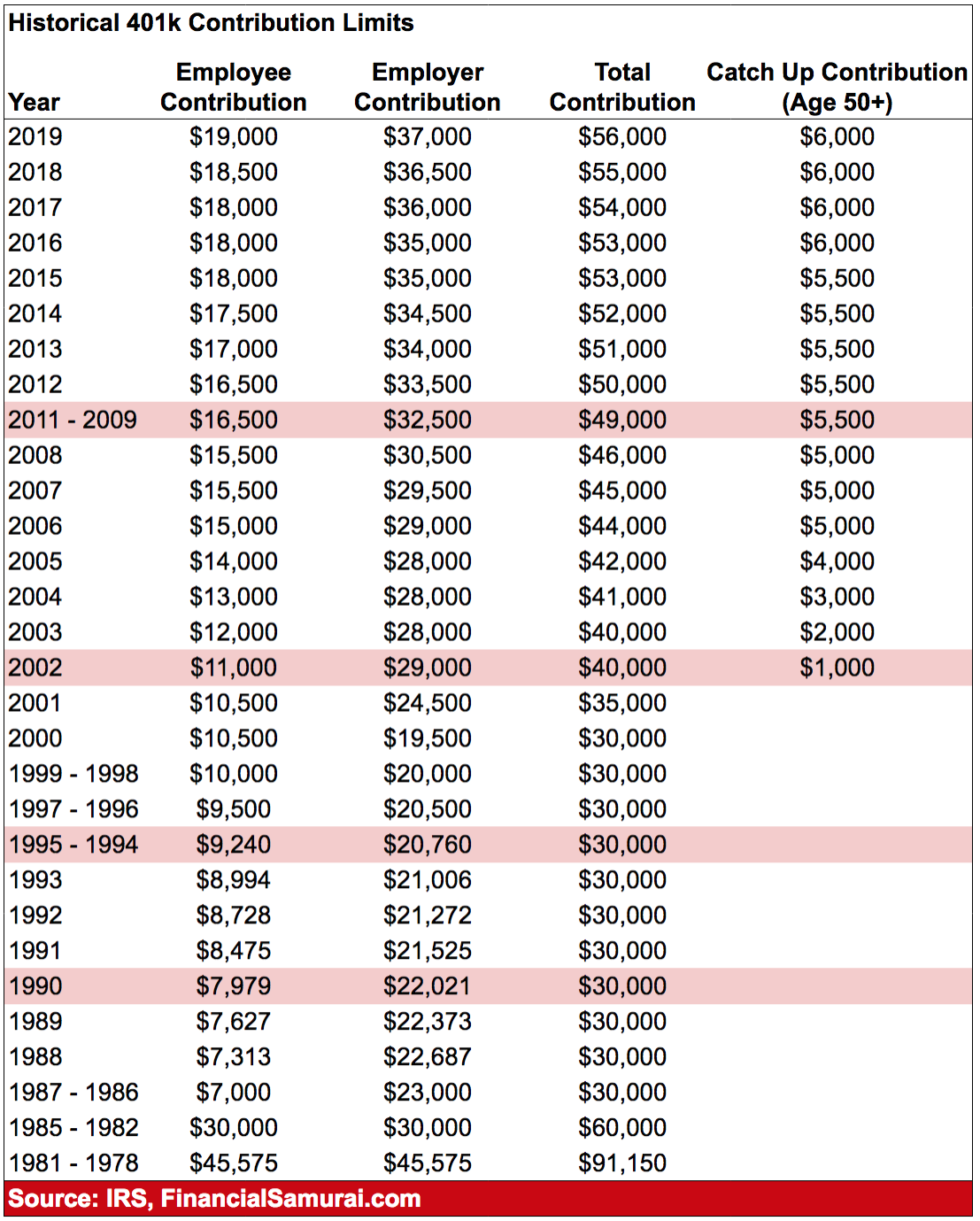

The employee and employer match limits for 401s fluctuate each year to account for inflation. Since inflation is projected to rise, the 401 max contribution is increasing as well.

According to the IRS, the employee contribution amount 401 limits per year include:

Therefore, in 2022, an employee can contribute up to $20,500 toward their 401. The employer can match the employee contribution, as long as it doesnt exceed the separate $61,000 employer-employee matching limit.

Since matching $20,500 in full would only total $41,000, most employees dont have to worry about this dilemma. This problem typically arises for individuals who are contributing to more than one employer-matched 401 plan or have switched or are switching to a new employer within the year. Employers should continue to communicate limits with employees each year to avoid misunderstandings.

If you have employees who are aged 50 or older, they may be eligible for additional contributions to their 401 accounts, also known as catch-up contributions. Catch-up contributions remained the same in both 2021 and 2022.

The key employees compensation threshold increased from 2021 to 2022, from $185,000 to $200,000. Known as the nondiscrimination testingthreshold, these limits apply to specific individuals within a company to ensure they remain within specific 401 contribution limits.

Key employees are defined as any employee who:

Irs Announces 401 Limit Increases To $20500

IR-2021-216, November 4, 2021

WASHINGTON The Internal Revenue Service announced today that the amount individuals can contribute to their 401 plans in 2022 has increased to $20,500, up from $19,500 for 2021 and 2020. The IRS today also issued technical guidance regarding all of the costofliving adjustments affecting dollar limitations for pension plans and other retirement-related items for tax year 2022 in Notice 2021-61PDF, posted today on IRS.gov.

Don’t Miss: Can A Spouse Get Your 401k In Divorce

Not All 401 Plans Are Created Equal

Of course, all of this assumes that your 401 plan is set up for you to take the utmost advantage of it… and unfortunately, not all 401 plans are the same. Thats another mistake most people make, in addition to assuming $20,500 is the absolute limit you can get into these plans: that every 401 plan looks exactly alike.

There are broad based rules created by the ERISA , which is a Federal law that sets minimum standards for retirement plans in the private sector. All retirement plans must follow these baselines. However, employers still have a lot of choice in what they allow or how they construct the plans offered to employees, and thats where you get a wide variation across companies.

If you want to power up your 401 and leverage it for all its worth, you first need to take a look under the hood and see what your plan provides and allows.

What Is A Solo 401k

According to the IRSs own website, a Solo 401k is simply a one participant 401k plan. It is no different than any other 401k, except that it only covers the owner and maybe also, his or her spouse. Its key that the sponsoring business compensates the spouse. These plans follow all of the same rules as any other 401k plan. Except no full time W2 employees are allowed in a Solo 401k.

Solo 401ks, just like other 401k plans are designed to help you save for retirement. In a Solo 401k, you play multiple roles, including, employee and employer. As such, you get additional benefits and control compared to a large group 401k plan. In the Solo 401k you have very high contribution limits and multiple ways to contribute. With certain Solo 401k providers, you also have full control over your retirement assets and investments. This means you can invest in stocks, bonds, gold & silver, ETFs, private companies, mortgage notes, and bitcoin. All inside your Solo 401k plan.

Also Check: How Much In 401k To Retire

You May Like: How To Check For 401k

How Much You Can Afford To Contribute

Despite contribution limits, often times employees will contribute what they can afford to set aside for retirement. Financial experts generally recommend that everyone contribute 10% of their paycheck to a 401, but this may not be doable for all. Plus, often times we think about other ways we’ll need to use that money now.

Your life expenses can play a role in how much of your paycheck you feel comfortable contributing to your 401. If you tend to have high monthly costs or someone who relies on your financial support, you may feel like contributing a higher percentage to your 401 may mean having less in your paycheck to meet your monthly expenses.

If attempting to max out your 401 means putting yourself in a financially stressful situation, it’s okay to just contribute what you feel comfortable with.

In this case, a good rule of thumb that still has a profound positive impact on your retirement savings is to contribute just enough to receive the full employer match. So if your employer will match up to 7% of your contributions, only contribute 7% so you can take full advantage of that extra money. Your employer match is essentially “free money” so you don’t want to leave any sitting on the table.

Roth Ira And Traditional Ira Maximum Annual Contribution Limits

| 2021 |

| Less than $10,000 | Less than $10,000 |

11. The limit is generally the lesser of the dollar amount shown, or your taxable compensation for the year. For more information about IRA contributions, please see IRS Publication 590-A or consult your tax advisor.

12. If you will have attained at least age 50 during the tax year, you can contribute an additional amount to your IRA each year.

13. Married can use the limits for single individuals if they have not lived with their spouse at any time during the year.

14. As of 2010, there is no income limit for taxpayers who wish to convert a traditional IRA to a Roth IRA.

You May Like: How To Borrow Against 401k Fidelity

Don’t Miss: How To Build Your 401k

Treatment Of Excess Deferrals

You have an excess deferral if the total of your elective deferrals to all plans is more than the deferral limit for the year. Notify your plan administrator before April 15 of the following year that you would like the excess deferral amount, adjusted for earnings, to be distributed to you from the plan. The April 15 date is not tied to the due date for your return.

Excess withdrawn by April 15. If you exceed the deferral limit for 2020, you must distribute the excess deferrals by April 15, 2021.

- Excess deferrals for 2020 that are withdrawn by April 15, 2021, are includable in your gross income for 2020.

- Earnings on the excess deferrals are taxed in the year distributed.

The distribution is not subject to the additional 10% tax on early distributions.

Excess not withdrawn by April 15. If you don’t take out the excess deferral by April 15, 2021, the excess, though taxable in 2020, is not included in your cost basis in figuring the taxable amount of any eventual distributions from the plan. In effect, an excess deferral left in the plan is taxed twice, once when contributed and again when distributed. Also, if the entire deferral is allowed to stay in the plan, the plan may not be a qualified plan.

Reporting corrective distributions on Form 1099-R. Corrective distributions of excess deferrals are reported to you by the plan on Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc.

Contribution Limits In 2021

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandheres how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks or securities.

401 plans are an excellent way to save for retirement, but because 401s are tax-advantaged, the IRS sets a contribution limit on how much you and your employer can put into your 401 per year.

Don’t Miss: How To Make A 401k

Income Limits Don’t Have To Limit You

401 income limits are meant to apply to highly compensated employees. If you don’t make more than $305,000 a year, you don’t have to stress about how these limits will slow down your retirement savings. Contributing to a 401 can be a great way for youand your employerto save money on your taxes now and save toward your retirement down the line.

Saving In A Personal Annuity

If you want an additional way to save for retirement outside of your employer plan, consider a personal annuityOpens dialog. A personal annuity, also called an after-tax annuity, can help you build additional retirement savings. It offers options that can provide a steady stream of income when you retire.4

Also Check: Is Having A 401k Worth It

What Are The Tax Benefits To The Employer For Offering A 401 Matching Plan

Employers can use the contributions to employee 401 accounts as tax deductions on their federal corporate income tax returns. These contributions may also be exempt from state and payroll taxes. As a result, the employer keeps their employees happy, sees reduced turnover and benefits financially with tax deductions.

Roth 401 Vs Traditional 401

Although the contribution limits are the same for traditional 401 plans and their Roth counterparts, a designated Roth 401 account is technically a separate account within your traditional 401 that allows for the contribution of after-tax dollars. The elected amount is deducted from your paycheck after income, Social Security, and other applicable taxes are assessed. The contribution doesn’t garner you a tax break in the year you make it.

The big advantage of a Roth 401 is that no income tax is due on these funds or their earnings when they’re withdrawn after you retire. A traditional 401 works in the opposite way. That is, savers make their contributions on a pretax basis and pay income tax on the amounts withdrawn when they retire. Neither of these 401 accounts imposes income limitations for participation.

When available, savers may use a combination of the Roth 401 and the traditional 401 to plan for retirement. Splitting your retirement contributions between both kinds of 401s, if you have the option, can help you ease your tax burden in retirement.

Don’t Miss: What To Ask 401k Advisor

Employer Match And You

Employer match programs are a way for employers to keep employees happy and cared for. Theyre also a way to retain employees. Thats because many matching programs come with a vesting schedule. This means that you dont have access to the full matching funds until youve been with the company for a certain period of time. The prospect of losing out on that money may keep an employee around longer.

In almost all cases, it makes sense to max out your employers matching offer. This is effectively free money, and all you have to do to get it is to be a responsible saver.

With that said, you shouldnt contribute more than you can actually afford. Saving for retirement is crucial, yes, but you shouldnt max out your contributions by overpaying your mortgage or building an emergency fund. Thats especially true if you dont think youll stay with the company long enough to have it fully vest. After all, this would reduce the benefit of matching. Still, if its financially feasible for you to max out your matching, do it.

Contribute To Solo 401k And Day

Your wifes ability to contribute to a solo 401 depends on the self employment income that she receives from the partnership. Specifically, in order to determine how much she could contribute to the solo 401 she would take the amount reported on line 14 of her K-1 and reduce it by one half of the self-employment tax. Of that number, she could contribute for 2021: up to $26,000 as an employee contribution plan sponsored by her daytime employer) and a profit-sharing contribution to the solo 401 equal to 20% of that same number provided that her overall contribution to the solo 401 cannot exceed $64,500 for 2021. For 2022, the overall limit is $67,500.

Recommended Reading: How Can I Save For Retirement Without 401k

Youre Our First Priorityevery Time

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

You’re Still Likely Ahead Of The Pack

If you’re in the running to max out your 401, congratulations! You’re well ahead of the average retirement saver.

As a next step, make sure those high contributions are delivering the right results. That may require optimizing your investment strategy, trimming the fat from your lifestyle, or investing in an HSA or taxable brokerage account. Make those moves and you’ll have a bright retirement future ahead.

The Motley Fool has a disclosure policy.

Read Also: Can You Transfer 401k To Td Ameritrade

What Happens If You Exceed The 401 Contribution Limit

If you go over the maximum 401 contribution for a given tax year, this is called an “excess deferral.” Excess contributions are subject to double-taxation if you do not disburse them by April 15 of the year following the tax year in question. If you discover you made an excess contribution, reach out to your plan administrator immediately to correct the issue.