Don’t Leave Your 401 Behind Here’s How To Reclaim Your Hard

Switching jobs pulls your mind in several directions at once, and it’s easy for your old 401 to get lost in the shuffle. But you can’t afford to forget about it for good. Building a nest egg to sustain you for decades is tough, so you can’t afford to leave any old retirement accounts behind. If you’ve lost track of your old 401, take these steps to find it and put that money to good use.

Have A Realistic Understanding Of When You Want To Retire

Having clearly defined goals will help you determine how much you should have saved based on your personal goals. Your savings objectives will be different if you plan to retire at 50 than if you plan to continue working past 70. Additionally, its important to determine as accurately as you can what your cost of living will be in retirement. How much do you need to spend per year to maintain the lifestyle that you want for the rest of your life? Have a good sense of what your costs will be so you can factor that into your overall retirement strategy. Really evaluate how long you want to continue working, and what retirement age is realistic for you based on your income and your current level of savings.

How Many Lost 401ks And Other Retirement Accounts Are Forgotten

Think lost and forgotten retirement accounts amount to chump change? Although no one keeps data on how much retirement money gets lost or forgotten, in an interview with Bloomberg, Terry Dunne of Millennium Trust Co., made an educated guess based on government and industry data that more than 900,000 workers lose track of 401k-style, defined-contribution plans each year.

That figure doesnt include pensions. According to the Pension Benefit Guaranty Corporation, an independent agency of the U.S. government tasked with protecting pension benefits in private-sector defined benefit plans, there are more than 38,000 people in the U.S. who havent claimed pension benefits they are owed. Those unclaimed pensions total over $300 million dollars, with one individual being owed almost $1 million dollars!

Could that money belong to you?

Don’t Miss: How Can I Apply For 401k

What To Do If Youve Lost A Pension

If your search for unclaimed retirement benefits is specific to a pension rather than a 401, the U.S. Department of Labors Employee Benefits Security Administration can help. The site has an Abandoned Plans section that details plans that have been neglected by the employers who sponsored them. This often happens when an employer filed bankruptcy or the plan sponsor is no longer around to administer it.

Another resource for tracking down a lost pension is the U.S. Department of Labors Form 5500 Search. Employers are required to report their retirement details using this form, so a search can help you track down the information you need to get in touch with your plan administrator.

If your pension was governmental, you should go through the government website specific to your city, county, or state. State and local government pensions can be tracked down through the personnel office. Military pensions are administered through the U.S. Department of Veterans Affairs, and information on federal government pensions is available through the Federal Employees Retirement System .

Whatever search you use to ask, Do I have retirement money somewhere? these databases are solely designed to identify those funds. Youll still have to contact the plan administrator or former employer to get your money. It will at least give you the information youll need to get started, though.

Leverage The National Registry

The National Registry, run by Pen Check, a retirement plan distribution firm, is a nationwide, secure database listing of retirement plan account balances that have been left unclaimed by former participants of retirement plans.

The site offers an easy, free-of-charge way to locate lost or forgotten employee retirement accounts. You can conduct as many searches as you want, using just your Social Security number. The site is safe, encrypting any information you input on a secure server.

Don’t Miss: How To Take Out 401k Without Penalty

How To Find An Old : 7 Ways

People prone to leaving things behind usually don’t lose a 401 account, but it happens more often than you think – especially if you don’t have a great deal of cash stashed away in a 401.

Data from Plan Sponsor Council of America shows that 58% of 401 transfer balances are between $1,000 and $5,000 when a career professional leaves an employer. That’s not an insignificant range of money, but it’s money you could have working for you, if you could only find it.

Additionally, the U.S. Government Accountability Office states that over 25 million Americans with cash in a 401 or other employer retirement plan left that money behind when they moved on to greener career pastures.

People leave old 401 accounts behind for many reasons. The account holder may have engaged in a string of job-hopping experiences and lost an old retirement account in the shuffle. Or, the 401 account holder’s company merged with another firm, was bought out, or went bankrupt.

You might even automatically have been enrolled in an old 401 company by a firm you only spent a year or so working at, didn’t realize it, and completely missed bringing the 401 account along with you to your next job.

If that sounds vaguely familiar, how do you find the money you lost in an old 401 account and what do you do with it when you get it back?

There are plenty of ways to get the job done. Let’s take a closer look.

Option : Transfer The Money From Your Old 401 Plan Into Your New Employers Plan

Moving your old 401 into your new employers qualified retirement plan is also an option when you change jobs. The new plan may have lower fees or investment options that better support your financial goals. Rolling over your old 401 into your new companys plan can also make it easier to track your retirement savings, since youll have everything in one place. Its worthwhile to talk with an Ameriprise advisor who will compare the investments and features of both plans.

Some things to think about if youre considering rolling over a 401 into a new employers plan:

Don’t Miss: What Are The Best Investments For My 401k

Is It A Good Idea To Take Early Withdrawals From Your 401

There are few advantages to taking an early withdrawal from a 401 plan. If you take withdrawals before age 59½, you will face an additional 10% penalty in addition to any taxes you owe. However, some employers allow hardship withdrawals for sudden financial needs, such as medical costs, funeral costs, or buying a home. This can help you skip the early withdrawal penalty but you will still have to pay taxes on the withdrawal.

Use An Outside Company Like Beagle

If your search in the above databases doesnât provide any results, utilizing an outside company to find your old 401s and do the difficult work of consolidating them is a great option.

Beagle is the first company of its kind that will do the difficult work for you. We will track down your old 401s and find any hidden fees in your current 401 plan.

Then, they will provide you with options on how best to rollover your 401s into one convenient, low-cost investment option.

This is a great option for anyone who is not sure where to start or even where to begin looking.

Also Check: What Is My Fidelity 401k Account Number

Locate An Old 401 Statement

If youâre having trouble getting a hold of your former employerâs HR department, refer to an account statement of your old 401.

If youâre still living at the same address, you should have yearly or quarterly statements mailed to you. Check your statement for information on where your account is held and any contact information.

The information on your statements will come in handy in identifying how much money youâll be transferring over to make sure nothing is left behind.

What To Do When You Find Your Old 401 Plan

If find your lost 401, congratulations! However, its not time to celebrate by blowing it all on a fancy vacation or a shopping spree. You invested that money to build a retirement nest egg and thats exactly where those funds should stay.

To invest your old 401, you can do whats known as a rollover to avoid early withdrawal penalties. You can roll over the funds into an individual retirement account or into another retirement plan, such as your current employers 401.

In both cases, you can avoid withholding taxes if you roll over the funds directly via the plan administrator. If a distribution is made directly to you, you have 60 days to deposit it into your new retirement account in order to avoid taxes and penalties.

Don’t Miss: How To Move A 401k To A Roth Ira

Find 401 Plan Information Through The Labor Department

Another option is to find plan information through the Department of Labors website. By locating the companys Form 5500, an annual report required to be filed for employee benefit plans, you should be able to find contact information and who the plans administrator was during your employment.

You may also be able to find information on lost accounts through FreeERISA. You must register to use the site, but it is free to search once youve set up your account.

Us Department Of Labor

Even if your former employer abandoned its retirement plan, your money isnt lost forever. The U.S. Department of Labor maintains records for plans that have been abandoned or are in the process of being terminated. Search their database to find the Qualified Termination Administrator responsible for directing the shutdown of the plan.

Don’t Miss: How Do You Take Money Out Of 401k

What Is A 401 Account

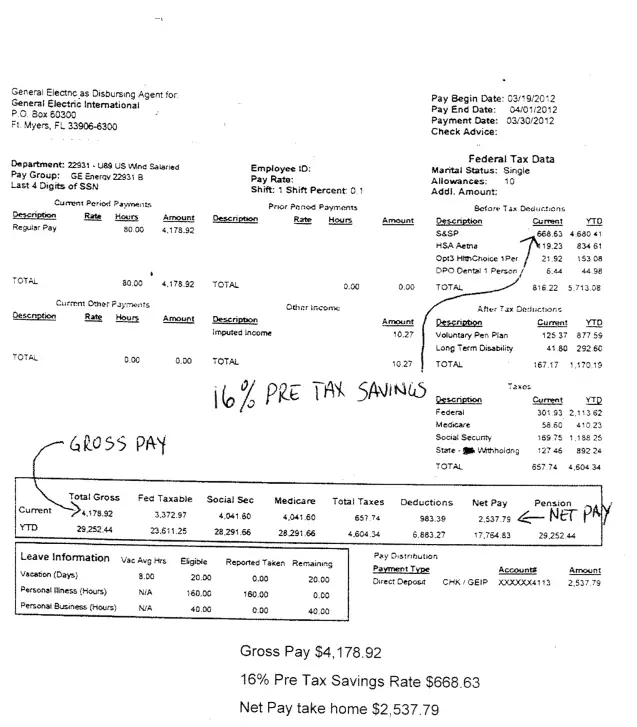

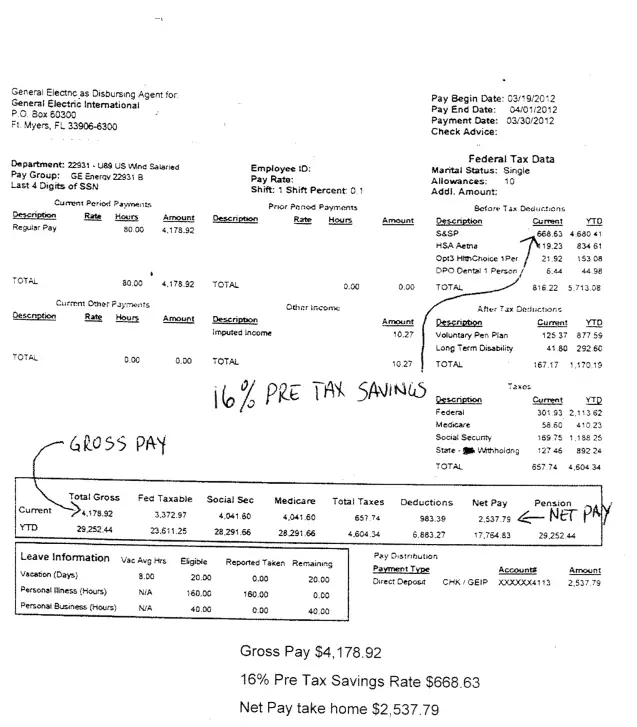

A 401 plan, named for the section of tax code that governs it, is a retirement plan sponsored by an employer, allowing employees to save a portion of their paycheck for retirement.

The advantage to employees of saving with a 401 plan is they are able to save funds they have earned, before taxes are deducted from a paycheck.

Many employers offer a company match meaning whatever the employee contributes, the company matches.

Although 401 plans were originally born as a supplement to pension plans, they are now often the sole retirement plans offered at companies.

Option : Leave It Where It Is

You don’t have to move the money out of your old 401 if you don’t want to. You won’t ever lose the funds — provided you don’t lose track of your old account again. But this option is usually the least desirable.

For one, it’s more difficult to manage your retirement savings when they’re spread out over many accounts. You also get stuck paying whatever your old 401’s fees were, and these can be higher than what you’d pay if you moved your money to an individual retirement account, for example.

But if you like your plan’s investment options and the fees aren’t too high, you could consider leaving your old 401 funds where they are. Just make careful note of how to access them again so you don’t forget.

Also Check: What Is The Difference In A 401k And An Ira

Contributing To A 401 Plan

A 401 is a defined contribution plan. The employee and employer can make contributions to the account up to the dollar limits set by the Internal Revenue Service .

A defined contribution plan is an alternative to the traditional pension, known in IRS lingo as a defined-benefit plan. With a pension, the employer is committed to providing a specific amount of money to the employee for life during retirement.

In recent decades, 401 plans have become more common, and traditional pensions have become rare as employers shifted the responsibility and risk of saving for retirement to their employees.

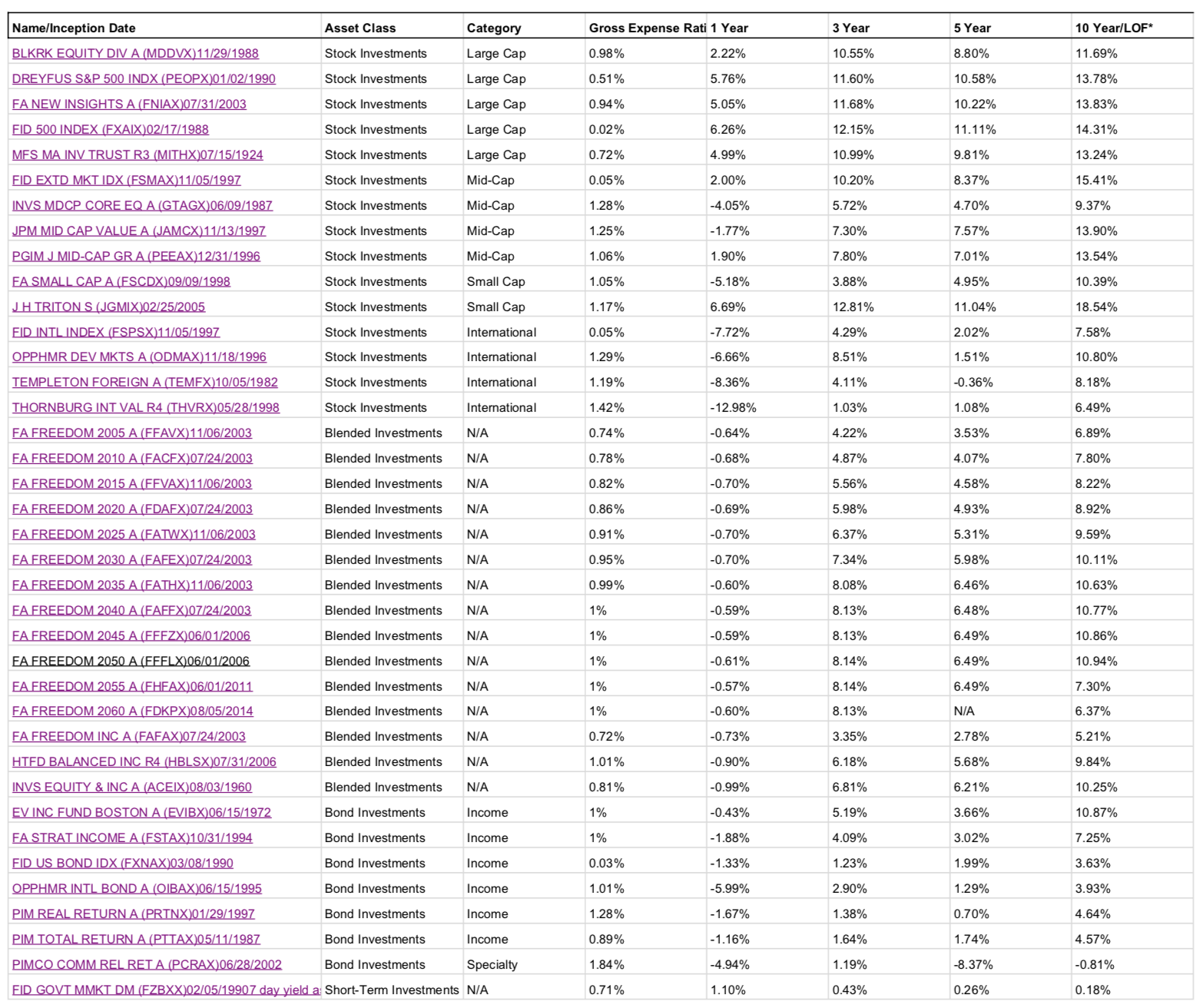

Employees also are responsible for choosing the specific investments within their 401 accounts from a selection their employer offers. Those offerings typically include an assortment of stock and bond mutual funds and target-date funds designed to reduce the risk of investment losses as the employee approaches retirement.

They may also include guaranteed investment contracts issued by insurance companies and sometimes the employer’s own stock.

Tracking Down Your Plan

If you think youve lost track of a savings plan, search your files for old retirement account statements. These should provide some key data to help your search, such as your account number and contact information for the plan administrator. If you dont have any statements, contact your former employers human resources department.

If your employer filed for bankruptcy, your 401 balance is protected from creditors and is likely still held at the investment company that administered your plan. In the case of a pension, it was either taken over by an insurance company or the federal Pension Benefit Guaranty Corp., which protects traditional pensions. You can track down your pension at pbgc.gov/search-all.

Its also possible that your employer turned over your 401 balance to your states unclaimed property fund. Your states treasury department should offer an online service that lets you search for your money. You can also check the National Registry of Unclaimed Retirement Benefits.

Recommended Reading: How To Find Out If I Have Any 401k

Use A 401 Lookup Database

The Capitalize team has created a database and search tool to help locate a missing 401 account. Simply input your company name below to get started.

Usually, we can locate the account instantly. If we cant, our in-house team will track it down for you and help you move into an account of your choice.

Other databases also enable you to look for unclaimed property, like the Employee Benefits Security Administrations Abandoned Plan Search and the National Registry of Unclaimed Retirement Benefits. One of these databases may be able to reveal the location of your old 401.

Follow These Steps With Help If You Need It

At the same time, finding your old accounts may be challenging for several reasons. In the first year of the pandemic, for example, hundreds of thousands of U.S. businesses closed permanently. In addition, says Zigo, you may have moved, or changed your email address, so your previous employer cant find you. Your old 401 plan may have changed sponsors. One of my clients has tried 10 times to reach a previous sponsor. It can be a frustrating process. And the bigger the hurdle, the less likely we are to try, she says. But help is available. A qualified financial planner can guide you through the following steps.

1. Take stock of your accounts

First, make a list that includes every employer where you contributed to a 401, suggests Charles Sachs, a CFP at Kaufman Rossin Wealth LLC in Miami, Florida. Next, call each one to see if they still have an account in your name, and update your contact information, if needed. Reaching out to them is the only way to find out where you stand, Sachs says. Its common for our clients to discover one or two old plans where they still have funds.

2. If a company has closed, check these websites

You can search for your money, which may be considered unclaimed property, at databases such as unclaimed.org and missingmoney.com. Both have links to state treasurers, comptrollers or other officials who update their lists of unclaimed assets regularly.

3. Rollover the money directly to avoid expensive withholding

Also Check: How To Rollover 401k From Principal

Taking Withdrawals From A 401

Once money goes into a 401, it is difficult to withdraw it without paying taxes on the withdrawal amounts.

“Make sure that you still save enough on the outside for emergencies and expenses you may have before retirement,” says Dan Stewart, CFA®, president of Revere Asset Management Inc., in Dallas.”Do not put all of your savings into your 401 where you cannot easily access it, if necessary.”

The earnings in a 401 account are tax-deferred in the case of traditional 401s and tax-free in the case of Roths. When the traditional 401 owner makes withdrawals, that money will be taxed as ordinary income. Roth account owners have already paid income tax on the money they contributed to the plan and will owe no tax on their withdrawals as long as they satisfy certain requirements.

Both traditional and Roth 401 owners must be at least age 59½or meet other criteria spelled out by the IRS, such as being totally and permanently disabledwhen they start to make withdrawals.

Otherwise, they usually will face an additional 10% early distribution penalty tax on top of any other tax they owe.

Some employers allow employees to take out a loan against their contributions to a 401 plan. The employee is essentially borrowing from themselves. If you take out a 401 loan, please consider that if you leave the job before the loan is repaid, you’ll have to repay it in a lump sum or face the 10% penalty for an early withdrawal.

Average 401k Balance At Age 65+ $458563 Median $132101

The most common age to retire in the U.S. is 62, so its not surprising to see the average and median 401k balance figures start to decline after age 65. Once you reach age 65, there are still several considerations for your retirement, even if you are no longer working and accumulating wealth. Some of these include making decisions about Medicare, creating a plan around withdrawing money from your retirement accounts, and evaluating any additional insurance needs.

Recommended Reading: Can You Move A 401k Into A Roth Ira