Think Of Medical Needs Later In Life

Annette Hammortree, CLTC, RICP, and Owner of Hammortree Financial Services

When taking a look at your employers retirement plan, I suggest that you start by contributing 15 percent of your income. The 401 specifically should be for at least the full matching contributions offered by your employer. The next step depends on your goals and objectives.

Once you have committed to matching the 401 contribution, the next step would be to utilize a Health Savings Account, since you can tap into this for medical needs during retirement, as well as starting a Roth IRA. The Roth is important since it provides another bucket to generate income during retirement. The power is in the rate of savings not the rate of return.

I also recommend taking a bucketing approach for different savings objectives, short , intermediate , long term and retirement.

How Much Should I Have In My 401k At 30

Again, the average 401 amount is more than twice as high as the median 401 balance. This indicates that high-wage earners and those who are committed to making the most of their 401 plan have a greater capacity for savings.

If youre falling behind, throughout your 30s you should consider bumping up the amount you contribute by a few percentage points when you have the opportunity. When you schedule the increase with any increases or bonuses you obtain, this becomes an incredibly simple task to do. In this method, you wont see any reduction in your discretionary money. In point of fact, if you live within rather than over your means, it will be easier for you to maintain control over your spending habits.

Contributing To Your 401

You can contribute a portion of your earnings to a 401 account tax-free each pay period, subject to annual limits set by the Internal Revenue Service . Some employers even offer matching programs, where they contribute an equal amount to help grow your fund. Its clear to see how it makes sense to put in as much as possible and maximize your 401.

But there may be reasons to hold back. Your financial situation should play a role in how much you decide to put in an employer-sponsored retirement plan. So should the specifics of the plan. Consider whether your companys 401 is high in quality with solid growth rates and company matching. Make sure your own money base is solid, ensuring that you can afford to put some of your earnings away.

Maxing out your contributions probably isnt your best choice if youre struggling to pay bills each month, still working on other aspects of your finances, or if your 401 options arent great.

There are many key financial goals to meet as you get older and plan for retirement. Think about paying off high-interest debt, building an emergency fund, and securing overall financial wellness.

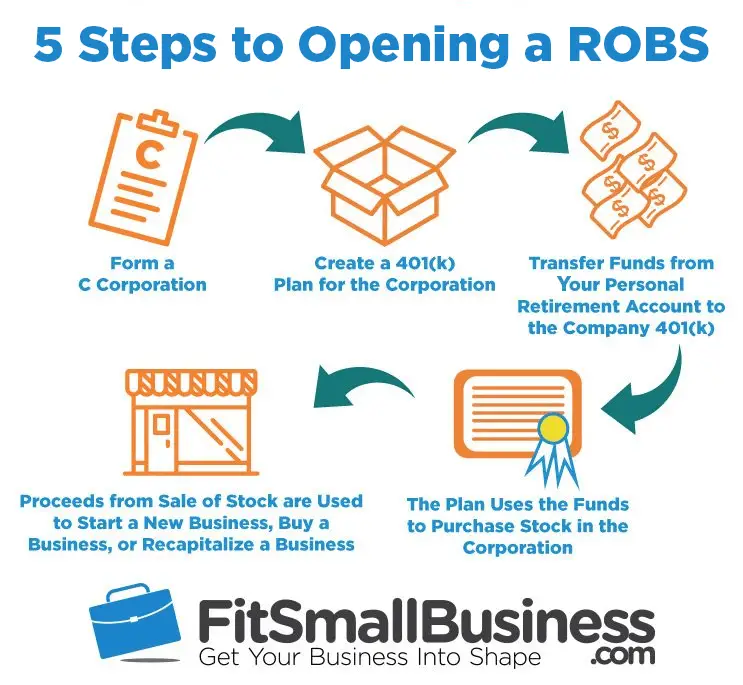

Also Check: Should I Use My 401k To Start A Business

Average 401 Plan Balances By Age

According to Fidelity Investments, the financial services firm that administers more than $11.8 trillion in assets and has 34.7 million workplace participant accounts, the average 401 plan balance decreased to $121,700 in the first quarter of 2022.

However, the savings rate contributions), was about 14%. This percentage almost met Fidelity’s suggested savings rate of 15%.

How does workplace plan saving break down by age? Here’s how Fidelity crunches the numbers.

Factors That Can Affect The True Value Of Your Retirement Savings

Remember, the average retirement savings in a 401k is only one aspect of a balanced retirement plan. There are plenty of other factors that go well beyond the average account balance of your 401k to help you enjoy a comfortable retirement.

Retirement savings can include a 401k, a traditional or Roth IRA, an emergency fund to protect you from having to take out high-interest loans, a pension plan, your own private brokerage account, and more.

So before you decide whether or not youre happy with the savings in your 401k, take stock of the 9 factors below in evaluating your retirement plan more holistically.

You May Like: How To Find All My 401k

How Much Does The Average 65 Year Old Have In Retirement Savings

Those who had retirement accounts did not have enough money in them. According to our research, 56- to 61-year-olds have an average of $163,577. Those aged 65 to 74 have even less. If you turned that money into an annuity for life, it would only be a few hundred dollars a month.

How much money does the average 65 year old retire with?

Data from the U.S. Census Bureau shows that the average retirement income for retirees age 65 and older was $46,360 in 2020. The poverty rate for people age 65 and older remained at 9.0 percent in 2020 .

What is the average 401k balance for a 65 year old?

| Old age |

|---|

| 87,725 dollars |

Save More As You Earn More

Even if you’re not making the big bucks now, the best thing you can do to make sure your savings rate increases with time is to start planning today for when you make more money. Keep your expenses low and determine what’s most important to you.

As your income increases, it’s OK if your expenses rise, too. Your costs just need to increase at a slower pace than your income. Set a goal of saving a certain and increasing percentage of your pay with every raise you get. If you can live below your means and avoid lifestyle inflation, then you are well-positioned to make your savings balance soar.

Read Also: What Is The Difference Between Roth And 401k

Contribute The Maximum Amount Your Employer Matches

Robert Johnson, Ph.d., CFA, CAIA, and Professor of Finance at Creighton University

Perhaps the worst financial mistake anyone can make is turning down free money. If one doesnt contribute enough in a 401 plan that has a company match to earn that match, one is basically turning down free money. Contributing the max to your 401 also reduces your tax bill. Investors should do whatever it takes to participate in your companys 401 plan to the level to get your full employer match.

Company matching requirements vary considerably by company. For instance, some firms will match contributions dollar for dollar up to a certain maximum. On the other hand, some plans require the employee to invest a certain minimum percentage of salary before the firm will contribute any employer match.

Leverage All The Resources At Your Disposal

There are many tools available to help you understand your financial life in more detail, and when these tools are so readily available, not leveraging them can result in a huge blind spot when it comes to your finances. Simply having this information will help you understand if you are on the right track, and how to accelerate your progress on your retirement goals. If working with a financial advisor is an option for you, this can be an invaluable resource, especially as you get closer to retirement. A financial advisor who has your best interest in mind can help you strategize and address potential gaps in your savings and retirement income plans.

Read More: 7 Essential Steps for Retirement Planning

Also Check: What Is The Best 401k Match

What Kind Of Investments Are In A 401

401 accounts often offer a small, curated selection of mutual funds. Thats a good thing and a bad thing: On the plus side, you may have access to lower-cost versions of those specific funds, especially at very large companies that qualify for reduced pricing.

The negative is that even with discounted costs, that small selection narrows your investment options, and some of the funds offered may still have higher expense ratios than what youd pay if you could shop among a longer list of options. That can make it harder to build a low-cost, diversified portfolio.

Some plans also charge administrative fees on top of fund expenses, which can add up. If your 401 is expensive, contribute enough to earn your company match, and then direct any additional retirement savings contributions for the year into an IRA.

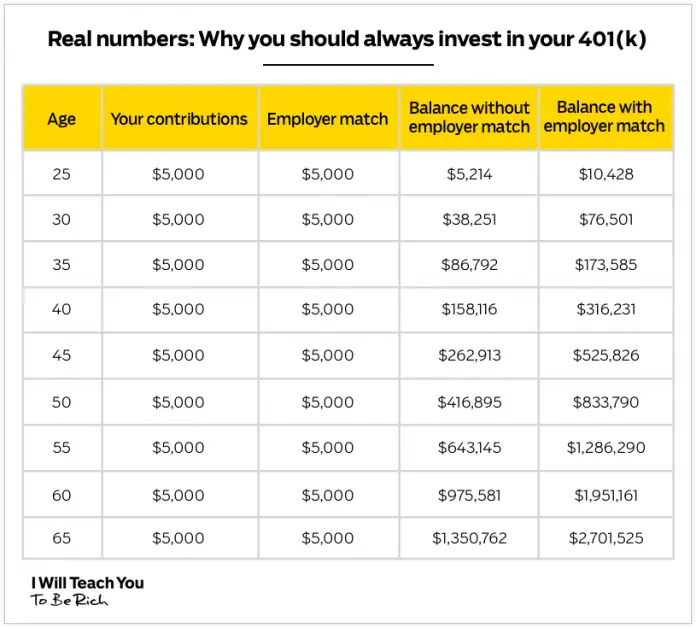

How Contributing To A 401 In Your 20s Compounds

Lets compare the effects of the two employer-matching plans. Lets say you are 25 years old, will earn $40,000 per year without a raise until you turn 65, and earn a steady 6% on your savings while contributing 5% of your salary to the 401 annually. How much will you have saved under each matching arrangement?

- With a 50% match, your savings would grow to $464,286.

- With a 100% match, your savings would grow to $619,048.

Thats a difference of $154,762nearly four years’ worth of your salary. Thinking of it in those terms should make it seem like a much bigger deal than an extra $1,000 per year. But if starting early is so important, how would waiting affect your savings? Under each plan, if you wait until you are 35 to start saving, youd have the following:

- With a 50% match, your savings would grow to $237,175.

- With a 100% match, your savings would grow to $316,233.

By waiting 10 years to start matching your contributions, youd be losing about half of what you could have gained in retirement savings. Thats the difference of saving a mere $2,000 per year for 10 years, for a total of $20,000.

In other words, starting early and contributing to your 401 in your 20s allows you to take advantage of the employer match, which is free money. However, contributing early when you’re young also allows you to maximize the power of compounding, which is the interest earned on your interest over the years.

Recommended Reading: How To Keep 401k After Leaving A Job

But Why Would I Max Out My Roth Ira Before My 401k If Its So Good

Theres a lot of nerdy debate in the personal finance sphere about this very question, but our position is based on taxes and policy.

Assuming your career goes well, youll be in a higher tax bracket when you retire, meaning that youd have to pay more taxes with a 401k. Also, tax rates will likely increase in the future.

The Ladder of Personal Finance is pretty handy when considering what to prioritize when it comes to your investments, but it is just a tool. For more about the Ladder of Personal Finance and how to make it work for you, check out THIS video where I explain it.

PRO TIP: The video is less than three minutes long. It is worth your time.

When Should You Start A 401k

As soon as you start working, you should start your 401k. Youre only limited by the minimum age limit for employment in the United States, which is 14 employees can make contributions to their 401k plans from this age onwards.

However, its worth noting that employers are not legally required to include employees in their 401k programs until the age of 21, so keep this in mind.

Recommended Reading: How To Transfer 401k From Previous Employer

Lets Start With Retirement

A comfortable, secure retirement is the biggest financial challenge most of us will ever face, so its smart to put it at the top of your priorities.

The following guidelines are not absolute, but they can give you a reasonable estimate of what it takes to prepare for retirement. As you can see, the earlier you start, the smaller the bite:

- If you’re getting started in your 20s, save 10-15 percent of your pre-tax income.

- If youre getting started in your 30s, save 15-20 percent of your pre-tax income.

- If you’re starting to save in your early 40s, save 25-35 percent of your pre-tax incomea pretty meaningful chunk of your income.

- If you start later, the percentages add up quickly. So save as much as possible, and consider other strategies, such as retiring later, to manage retirement.

The real beauty of these guidelines is that the percentages won’t change as you get older. If you’re 30 and can save 15-20 percent of your income for retirement, you probably won’t need to save more than 15-20 percent as you age. Starting early is a huge advantage, provided that you remain consistent throughout your working life.

Dont get me wrong. I understand that saving 15 percent of your pre-tax income when you’re 25, or 20 percent of your income when youre 30, is toughespecially when youre trying to pay off student loans or manage other financial obligations. But the numbers don’t lieretirement is a hugely expensive challenge, and the earlier you start preparing for it, the better.

How Much Should You Really Have In Your 401

Saving for a financially secure retirement is a long-term project with a sometimes indistinct final objective, especially when people are just starting in their careers. Retirement is far in the future at that point and key concerns such as career earnings, investment returns and post-retirement living expenses seem remote. One rule of thumb is that by age 30 people should have approximately a years salary in a 401 or other retirement account. Other benchmarks suggest more or less may be appropriate. If youd like some help planning for retirement you can find a financial advisor who serves your area with our free online matching tool.

401 Basics

One of the most common retirement savings vehicles is a 401 plan. These plans offer tax advantages and flexibility in investment choices. Employees contribute to these plans through payroll deductions. And many employers will match savers contributions. Combined with tax-deferred investment gains, these features allow 401 owners to build sizable balances over time.

Whether a given balance will be adequate depends on a number of factors, including age at retirement, annual income, local cost of living, healthcare needs and projected expenses in retirement. To find out more on how a 401 can perform over time, you can use the SmartAsset 401 calculator.

What 30-Year-Olds Actually Save

Retirement Savings Benchmarks

Additional Retirement Saving Insights

Bottom Line

Tips on Saving for Retirement

Don’t Miss: How To Find Out If You Have A Lost 401k

Diversify Plans If Possible

Matthew Yu, Loan Originator for Socotra Capital

Some employers have small matches, but some match dollar for dollar on your first 3-5 percent. Thats 100 percent ROI at the end of each year for your 3-5 percent contribution!

For those with less generous employee matches and limited investment funds, you should carefully gauge your companys 401 plan to see if you could get better returns investing in a Self-Directed IRA. The amount you put into the 401 is just as important as the type of investment that your 401 is invested in.

For best diversification, I would recommend those new to the workforce to split up their retirement savings into their 401 and Roth IRAs. Set aside an investment budget that stings, but isnt too painful. Your 401 will be automatically withdrawn every month. Money that doesnt hit your pocket is much easier to invest than the money that comes out of it. Investing early pays dividends.

How Much Should I Have In My 401k

Laurie BlankSome of the links included in this article are from our advertisers. Read our Advertiser Disclosure.

If youre wondering how much money you should have in your 401k, your wait is over. Retirement savings is much of the talk in todays personal finance world.

You want to make sure youre saving enough to meet your retirement goals. Otherwise, you may have to find ways to save more or possibly delay retiring.

While each person has a different financial situation, these insights can improve your retirement plan.

In This Article

You May Like: How Much Does A 401k Audit Cost

Make Savings A Priority

Keep your eye on your dreams. Do the best you can to get to at least 15%. Of course, it may not be possible to hit that target every year. You may have more pressing financial demandschildren, parents, a leaky roof, a lost job, or other needs. But try not to forget about your futuremake your retirement a priority too.

How Do I Figure Out How Much To Save For Retirement

Retirement experts offer different thumb rules about how much you need to save: somewhere around $ 1 million, 80% to 90% of your annual income before retirement, 12 times your salary before retirement.

How much do I need to retire at $ 100000 a year? If you hope to retire in 50 years with an annual income of $ 100,000, you need a whopping $ 1,747,180!

Read Also: How To Make A 401k Account

The Importance Of The 401k For Retirement

The 401k is one of the most woefully light retirement instruments ever invented. The maximum amount you can contribute for 2021 is $19,500. It should go up by $500 every 2 4 years based on history.

Give me a pension that pays 70% of my last years salary for the rest of my life over a 401k or IRA any time! At least with the 401k, anybody can contribute.

The average 401k balance as of 2022 is around $120,000 according to Fidelitys 12 million accounts. The bull market since 2009 has significantly helped boost the average 401k balance. Who knew the S& P 500 would rise by 16% in 2020, and 27% in 2021 as the coronavirus pandemic froze global economies.

$120,000 sounds like a lot of money. However, it is an incredibly low amount given the median age of an American is 36.5. Further, the median 401k amount is closer to only $28,000.

As an educated reader who is logical and believes saving for retirement is a must, Ive proposed a table that shows how much each person should have saved in their 401ks at age 25, 30, 35, 40, 45, 50, 55, 60, and 65.

We stop at 65 because you are allowed to start withdrawing penalty free from your 401k at age 59 1/2. Meanwhile, I pray to goodness you dont have to work much past 65 because youve had 40 years to save and investment already!