Roth 401k Or Traditional 401k

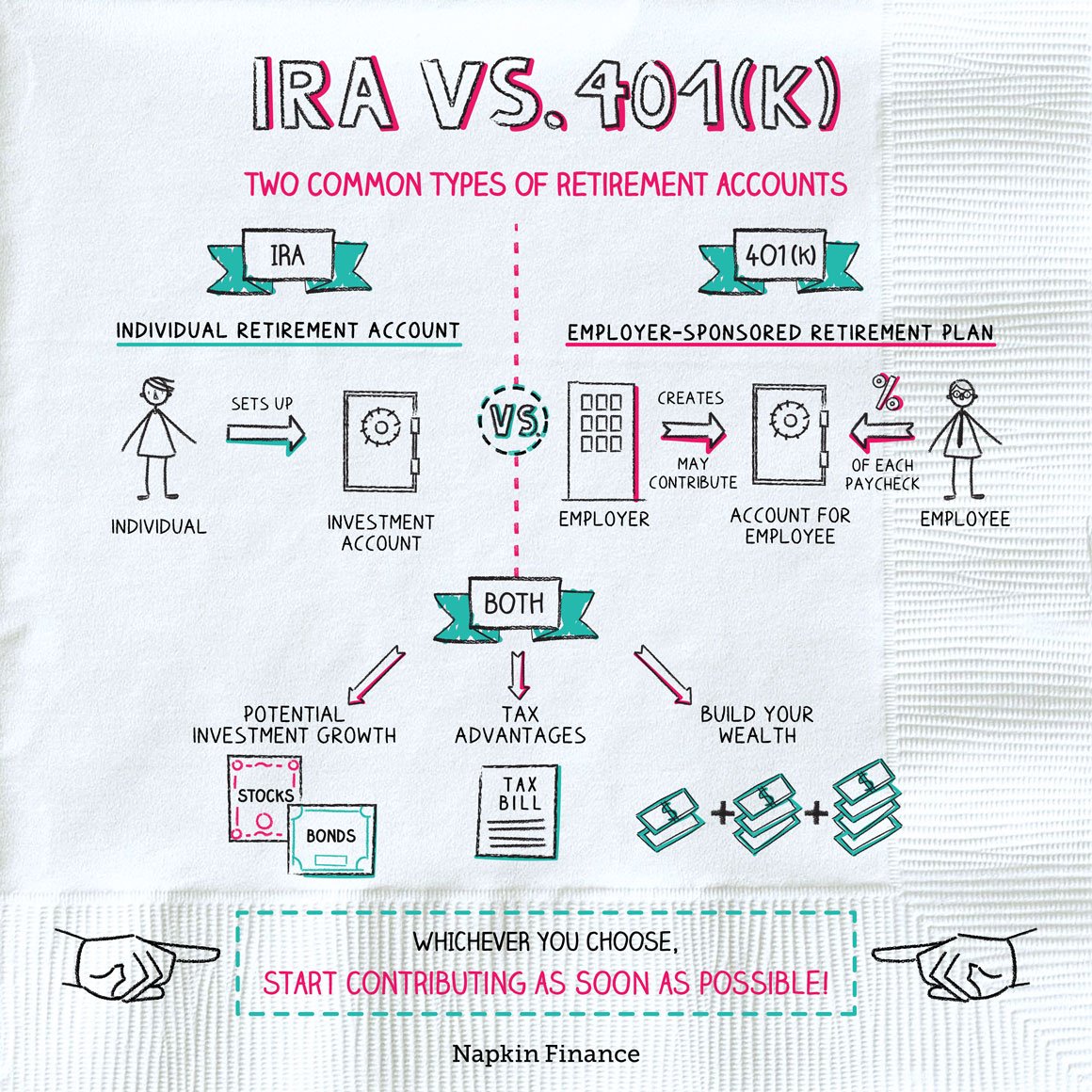

The 401k plan is the cornerstone to retirement. Gone are the days of big company and school district annual pensions and generous social security benefits. Its now up to the individual to plan and save for their entire retirement. In addition to all the expenses that go with it. Luckily, a Roth 401k or Traditional 401k is a fantastic tool. One of the best that you can use to save for your retirement and goals. However, there is a lot to understand about how they work and how to use the 401k for your best outcome.

Both The Roth 401 And The Roth Ira Can Help You Reach Your Retirement Goals Each Has Its Advantages And Disadvantages

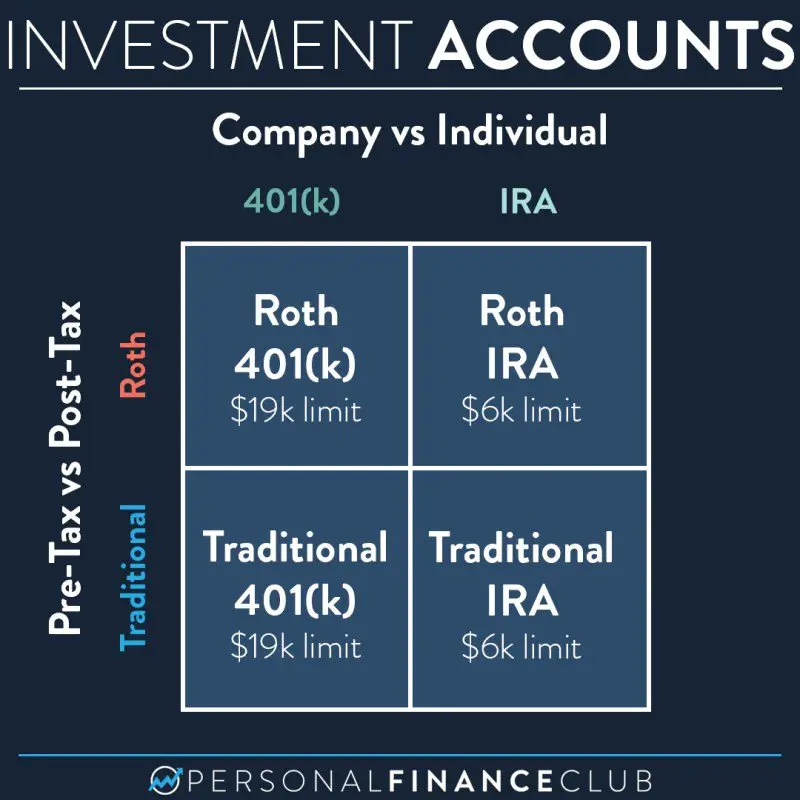

Roth 401s and Roth IRAs are retirement savings accounts that allow you to contribute with after-tax dollars and take tax-free withdrawals in retirement. They are an alternative to traditional 401s and traditional IRAs, both of which allow pre-tax contributions but require you to pay tax on withdrawals.

While both Roth accounts make it possible to defer taxes until retirement, there are some important differences between a Roth 401 and a Roth IRA:

- Required minimum distributions: Roth 401s require you to begin taking money out at age 72, while Roth IRAs do not have required minimum distributions .

- Eligibility: Because of income limits, higher earners cannot contribute to Roth IRAs.

- Individual/employer accounts: Roth 401s are administered by employers, while Roth IRAs are opened by individuals.

- Contribution limits: Roth 401s have higher contribution limits than Roth IRAs.

Can You Have A Roth Ira And A Roth 401

It is possible to have both a Roth IRA and a Roth 401 at the same time. However, keep in mind that a Roth 401 must be offered by your employer in order to participate. Meanwhile, anyone with earned income can open an IRA, given the stated income limits.

If you dont have enough money to max out contributions to both accounts, experts recommend maxing out the Roth 401 first to receive the benefit of a full employer match.

Don’t Miss: How To Invest My Fidelity 401k

Roth 401 Vs Traditional : Which Plan Is Best For You

The most important question to ask yourself when comparing Roth and traditional 401 plans is “Do I expect my tax bracket to be higher or lower after I retire?”

If the answer is “lower,” then a traditional 401 would make more sense. But if you expect to have a higher tax rate in retirement, a Roth 401 could be the better choice.

Two main factors could affect your tax rate after you’ve stopped working. The first is your target annual retirement income. If this figure is significantly less than your income during your earning years, that could strengthen the case for the traditional 401. But the opposite would be true if you think you might actually be enjoying a greater income in retirement.

The second factor to consider is future changes in income tax rates. Of course, that’s out of your control, and in the hands of the IRS and the political powers-that-be. But, as Rob Williams, managing director of the Schwab Center for Financial Research says, current “tax rates are close to historical lows.” Some economists and financial analysts predict that they are destined to rise in ensuing years.

So it might be better to invest via a Roth 401 and take the tax hit now especially if your retirement days are decades away. By going the Roth route, you know exactly what your tax liability will be now instead of hoping they stay low in the years to come.

Choosing The Right Account For You

Each individuals circumstance is completely different. If you are making decisions on which type of account is better for your current financial situation and retirement goals, be sure to contact one of our financial advisors. Many important aspects of your current income or savings could be overlooked when non-professionals attempt to make this decision on their own. Your retirement is extremely important, youve been working toward it for a long time. When it comes time to enjoy the fruits of your labor, you will be happy that you made the best decision for your circumstances. Whether your goal is to utilize the money youve saved for so long by traveling, or youre hoping to pass along some amount of wealth to your children, retirement is an exciting time that with proper planning can be lived out in the exact way you have planned out in your mind.

Read Also: Can I Get Money From My 401k

Roth 401k Vs Roth Ira: How Are They Similar

Before we look at the differences between Roth IRAs and Roth 401ks, lets look at the similarities. Heres the big one: with both of these accounts, your investments grow without the burden of taxation. This can mean a larger nest egg when you decide youre ready to retire.

Also, in most circumstances, you can withdraw money from both a Roth IRA and a Roth 401k income tax-free after you turn 59 1/2. Practically, this means favorable tax treatment in retirement, since you wont have to pay taxes on the distributions you take after you hit 59 ½.

With a Roth IRA, you can withdraw contributions penalty-free, but earnings will generally be taxed and penalties assessed on any withdrawals made before age 59½, with a few exceptions. With Roth 401ks, withdrawals before age 59½ are usually taxed and assessed a penalty, but there are ways to avoid this .

Read More:When Can I Withdraw From My 401k or IRA Penalty-Free?

No Loans Without Rollover

Unlike Roth 401s, Roth IRAs dont allow loans. However, there is a way around this: Initiate a Roth IRA rollover. During this period, you have 60 days to move your money from one account to another. As long as you return that money to it or another Roth IRA in that time frame, you are effectively getting a 0% interest loan for 60 days.

Don’t Miss: Does Max Contribution To 401k Include Employer Match

Disadvantages Of A Roth Ira

The Roth IRA sounds pretty awesome, doesnt it? Unfortunately, the Roth IRA does have some limitations that you need to be aware of:

- Lower contribution limits. You can only invest up to $6,000 in a Roth IRA each year or $7,000 if youre age 50 or older.3 When you compare that with the contribution limits for a 401, you might be thinking, Thats it? Thats why 401s and Roth IRAs work better together.

- Income limits. As amazing as the Roth IRA is, theres a chance you might not even be eligible to put money into one. Gasp! If your modified adjusted gross income is higher than $144,000 as a single person or more than $214,000 as a married couple filing jointly, then you wont be able to contribute to a Roth IRA in 2022.4 But dont worry, the traditional IRA is still an optionits better than nothing!

- The five-year rule. This wont be an issue for most folks, but the five-year rule says you cant take money out of your Roth IRA until its been at least five years since you first contributed to the account. Youll get hit with taxes and penalties if you break that rule . And remember: Just like the 401, youll be penalized for taking money out of a Roth IRA before age 59 1/2 .

What Is The Difference Between A Roth 401k And A Traditional 401k

With a Roth 401, your money goes after taxes. That means you pay taxes now and take home a little less than your paycheck. When you contribute to a traditional 401, your contribution is pretax. They are taken from the top of your gross income before your paycheck is taxed.

What is the benefit of a Roth 401 K over traditional?

With a Roth 401 youll be contributing with after-tax money, so you wont be enjoying todays tax breaks. In exchange, the money you withdraw in retirement will be tax-free. In a Roth 401, you will not only enjoy tax-free growth of your investment profits, but also tax-free withdrawals.

What are the pros and cons of a Roth 401k?

Pros and Cons of a Roth 401

- More than Personal Finance Cheat Sheets:

How does a Roth 401k work?

With a Roth 401, the main difference is when the IRS makes the withholding. You make a Roth 401 contribution with taxable money . Your income then grows tax-free, and you pay no taxes when you start taking withdrawals in retirement.

Also Check: Can I Borrow Money From My 401k

Years Of Investing Can Overcome A Higher Tax Bracket

When choosing between 401s, Natalie Pine, CFP® professional at Briaud Financial Advisors, says, “We typically recommend that younger clients use Roth instead of traditional because their money grows tax-free for such a long time.”

This is her recommendation even for a younger person who is currently in a high tax bracket. Why? “Because,” she explains, “the tax-free growth usually overcomes the higher tax bracket over a long enough period of time.”

Contributions Taken Directly From Paycheck

Contributions are made on a pre-tax basis, meaning that they are deducted from your paycheck before taxes are taken out. This lowers your taxable income and therefore lowers the amount of taxes you will pay each year. The money in your 401K account grows tax deferred until you withdraw it during retirement. You can even use a handy calculator online to determine how much you should be contributing.

Read Also: How Many Loans Can You Take From Your 401k

When The Roth 401 Is Better

Heres when the Roth is probably a better option:

Youre young and in a low tax bracket

I recommend making Roth contributions when someone is in a low bracket and expecting to later be in a higher tax bracket, says Mark Wilson, CFP and founder of MILE Wealth Management in Irvine, California. If you can pay taxes today at 12 percent to avoid paying taxes in the future at 25 percent, this is a good deal.

Wilson defines a low bracket as being taxed at the federal level of 12 percent or less. There are cases where Roths can make sense for folks in higher brackets as long as they are expecting even higher incomes in the future, says Wilson.

Youth is also a big advantage, allowing money to grow tax-free even longer.

The younger a person is, the more advantage a Roth can have for them, because they have a longer time for the money to grow, says Edward J. Snyder, CFP and founder of Oaktree Financial Advisors in Carmel, Indiana. The younger person is also more likely to be in a lower tax bracket than someone who is mid- to late-career.

You expect tax rates to rise

Even if you dont expect to earn more, you might expect tax rates across the country to increase, and such a rise could make the Roth 401 more attractive today.

Of course, theres always uncertainty in any projections, especially predicting the political winds.

You already have a traditional 401

RMDs can have an impact on the taxation of Social Security benefits and Medicare surcharges, says Greenman.

Roth 401 Meet Roth Iras More Versatile Big Brother

While you may have heard of the Roth IRA, thereâs a bigger and stronger retirement feature available in many 401 plans called the Roth 401. It can be a great way to protect your future savings against tax rate increases and/or climbing into a higher tax bracket in retirement.

Contrary to popular belief, the Roth 401 isnât a new plan â itâs simply a feature available in a 401, and it can help you save more retirement dollars than its little brother, the Roth IRA. You can choose to put some, none or all your contributions after-tax into your Roth 401, saving up to $20,500 in 2022, or $27,000 if you are 50 years of age or older. Compare this to the Roth IRA, which only allows a maximum contribution up to $6,000 in 2022 .

Roth 401 vs. Roth IRA

| Attributes | |

|---|---|

| None | $144,000* |

Roth tax rules are the exact opposite of how traditional tax-deferred 401 contributions work. Your tax-deferred contributions will be taxed when you withdraw the money at retirement however, you receive no tax deduction on Roth contributions. The benefit is that your Roth withdrawals can be taken tax-free when you reach retirement.

Itâs important to note that any employer match or profit sharing into your 401 will always be on a tax-deferred basis as required by law.

If you donât have the Roth option in your company 401 plan, itâs a great idea to request it. This typically requires an amendment to the plan thatâs a minor cost to the business owner.

Also Check: How To Use Your 401k To Buy A Business

You May Like: How Much Is The Max You Can Contribute To 401k

At What Age Does A Roth Ira Make Sense

A Roth IRA makes sense at any ageearly or even late in your careerso consider your retirement savings options and, if appropriate for your income and financial goals, open one as soon as possible. Think about whether you want to pay taxes when you’re no longer working and may need all the income you can get.

You Can Switch To A Roth 401

Finally, “another advantage of a traditional 401 is that you can convert it into a Roth,” says R.J Weiss, CFP® professional and founder of The Ways to Wealth.

This is an important benefit that is unique to traditional 401 contributions. You can’t make a Roth contribution this year and then decide five years down the road to convert the contributions back to a pre-tax traditional 401.

But you can convert traditional 401 contributions to a Roth 401 at any time down the road, providing that you can pay the income taxes that will be due at the time.

It’s something to keep in mind if you think your tax strategy and financial situation might change. With this flexibility, you could wait to pay taxes on your 401 contributions until a below-average income year or after completing a move from a high income-tax state to one with lower tax rates.

Recommended Reading: How Do I Get A Loan From My Fidelity 401k

Weighing The Pros And Cons

Roth IRAs and Roth 401ks are both good options for retirement savers. The answer to which account is the better option will really depend on your unique situation. Its always a good idea to talk to your financial advisor to weigh the pros and cons and come up with what the best choice is for your situation.

Read More:What is a Fiduciary? Heres Why It Matters in Money Management

More Money Now Vs Later

It can be hard to turn your back on those attributes, but is a Roth 401 suitable for you? Here are the factors to consider.

-

It may cost you more on the front end to use a Roth 401. Contributions to a Roth 401 can hit your budget harder today because an after-tax contribution takes a bigger bite out of your paycheck than a pretax contribution to a traditional 401.

-

The Roth account can be more valuable in retirement. Thats because when you pull a dollar out of that account, you get to put that entire dollar in your pocket. When you pull a dollar out of a traditional 401, you can keep only the balance after paying taxes on the distribution.

When you pull a dollar out of a Roth 401, you get to put that entire dollar in your pocket.

-

Contributing the maximum to either account each year yields the same pot of money in retirement. The traditional 401 balance would then be reduced by your tax rate in retirement, whereas the Roth 401 balance would remain whole.

Read Also: How Do I See How Much Is In My 401k

How To Make A 401 And Roth Ira Work Together

OK, so now weve arrived at the moment of truth: Should you put your money in a 401 or a Roth IRA? The answer is . . . yes!

If youre eligible for a 401 and a Roth IRA, the best-case scenario is that you invest in both accounts . That way, youre taking advantage of your employer match and getting the tax benefits of a Roth IRA.

The best way to remember where to start is with this rule: Match beats Roth beats Traditional. An employer match is free money, and you simply dont leave free money on the tableso thats where you start!

After that, you take the tax advantages of Roth accounts like a Roth IRA over traditional IRAs and their tax-deferred growth every time. It pays off more in the long run!

Heres how that works in three simple steps: Lets say you make $60,000 a year and youre under 50. Once youre debt-free and have a fully funded emergency fund, your goal is to invest 15%$9,000 in this casein retirement.

- You start by investing in your 401 up to the match your company offers. Lets say, in this case, that its 3% of your gross income . You invest $1,800 in your 401 to reach the employer match. This leaves you with $7,200 more to invest.

- Then, you max out your Roth IRA. You can only contribute $6,000 in 2022, so that leaves you with $1,200.

- Return to your 401 and invest the remaining $1,200.

You Need To Make Withdrawals Within 5 Years Of Opening Your 401

Unlike a Roth IRA, a Roth 401 is actually less flexible when it comes to the timing of withdrawals than its traditional 401 counterpart.

You can begin making withdrawals from a traditional 401 penalty-free at age 59 ½. However, with a Roth 401, you’ll need to wait at least five years from opening your account, regardless of how old you are, to avoid taxes and penalties . So if you open the account at age 58, you won’t be able to make tax-free withdrawals until you reach age 63.

For twenty- and thirty-something workers, this won’t be a concern. But if you’re getting a late start on retirement savings or you’ve started working for a new employer near age 59½, you may want to stick with a traditional 401 to avoid this 5-year rule.

Also Check: How To Calculate 401k Contribution