Option : Leave It Where It Is

You dont have to move the money out of your old 401 if you dont want to. You wont ever lose the funds provided you dont lose track of your old account again. But this option is usually the least desirable.

For one, its more difficult to manage your retirement savings when theyre spread out over many accounts. You also get stuck paying whatever your old 401s fees were, and these can be higher than what youd pay if you moved your money to an individual retirement account, for example.

But if you like your plans investment options and the fees arent too high, you could consider leaving your old 401 funds where they are. Just make careful note of how to access them again so you dont forget.

Also Check: What Is The Difference In A 401k And An Ira

Look Through Your Documents

Your first step should be to look through your documents, either in paper or electronic form. Old 401 statements contain information that can help you locate the account. Look for the account number, as well as the name and contact information of the plan administrator that runs the 401 you participated in.

What To Do If Youve Lost A Pension

If your search for unclaimed retirement benefits is specific to a pension rather than a 401, the U.S. Department of Labors Employee Benefits Security Administration can help. The site has an Abandoned Plans section that details plans that have been neglected by the employers who sponsored them. This often happens when an employer filed bankruptcy or the plan sponsor is no longer around to administer it.

Another resource for tracking down a lost pension is the U.S. Department of Labors Form 5500 Search. Employers are required to report their retirement details using this form, so a search can help you track down the information you need to get in touch with your plan administrator.

If your pension was governmental, you should go through the government website specific to your city, county, or state. State and local government pensions can be tracked down through the personnel office. Military pensions are administered through the U.S. Department of Veterans Affairs, and information on federal government pensions is available through the Federal Employees Retirement System .

Whatever search you use to ask, Do I have retirement money somewhere? these databases are solely designed to identify those funds. Youll still have to contact the plan administrator or former employer to get your money. It will at least give you the information youll need to get started, though.

Also Check: How To Rollover 401k Into Fidelity

Call Your Old Employer

If you suspect you have missing 401 funds or even if you’re not sure, it’s still a good idea to contact old employers and ask them to check if they’re holding your old account. Your former company will have records of you actually participating in a 401 plan.

You’ll either need to provide or confirm your Social Security number and the dates of your employment, but if you can, you’ll have found the fastest way to dig up a missing 401.

Leverage The National Registry

The National Registry, run by Pen Check, a retirement plan distribution firm, is a nationwide, secure database listing of retirement plan account balances that have been left unclaimed by former participants of retirement plans.

The site offers an easy, free-of-charge way to locate lost or forgotten employee retirement accounts. You can conduct as many searches as you want, using just your Social Security number. The site is safe, encrypting any information you input on a secure server.

Dont Miss: How To Take Out 401k Without Penalty

Recommended Reading: How To Find Out Whats In Your 401k

Look For Contact Information

If you don’t know how to contact your former employer — perhaps the company no longer exists or it was acquired or merged with another company — see if you have any old 401 statements. These should have contact information to help put you in touch with the plan administrator.

If you don’t have an old 401 statement handy or yours doesn’t tell you what you need to know, visit the U.S. Department of Labor website and look up your employer. There you should find your old retirement account’s tax return, known as Form 5500. That will most likely have contact information for your 401’s plan administrator.

Search The Abandoned Plan Database

If you cant find your lost money by contacting your old employer, searching the National Registry of Unclaimed Retirement Benefits, or the FreeERISA website, you have one last place to check, the Abandoned Plan Database offered by the U.S. Department of Labor.

Searching is simple, you can search their database by Plan Name or Employer name, and locate the Qualified Termination Administrator responsible for directing the shutdown of the plan.

Recommended Reading: What To Do With Your 401k After Leaving A Job

You May Like: How To Pay Off 401k Loan

Use Additional Government Document Recovery Tools

Lots of folks say the federal government is beholden to excessive paperwork and, in many ways, those people are right. But your hunt for an old 401 isn’t a good example of that mindset.

Exhibit “A” is the U.S. Department of Labor’s Abandoned Plan Database. The database can tell you if your company’s old 401 plan is still up and running, has been deep-sixed, or is being held by an outside administrator who can steer you to your old 401 account.

When using the website, the more information you can provide, the better. Your best bets include using the plan’s name, the name of your old employer, the city and state where the company resided, and the appropriate zip code.

Roll It Over Into Your Current Employer’s 401

Another option is rolling the old 401 into your current employer’s 401. This can make it easier to keep track of your retirement accounts and might open up broader investment choices. But be sure you’re aware of how your current employer’s 401 works before transferring money from your old 401 into it.

You May Like: Can I Rollover 401k To Another 401 K

How Does Money Get Left Behind

Very few people stay at one employer the entire length of their career.

But unlike your bank account which you may have from job to job, a 401 account is linked to your employer. It is up to you to do something about it.

When you leave your employer, the money may stay in the account for an indefinite amount of time.

However, if the company closes the 401 plan, files for bankruptcy, goes out of business or is acquired by another company, you may be forced to decide, within a short period of time.

Its possible that years will go by after you parted ways with your old job, and then youll get a letter notifying you that you need to move your 401 account, or take a distribution.

If this happens, youre much better off rolling the money into an IRA account, or transferring the money into your current companys 401 plan.

How To Find Your 401 With Your Social Security Number

Knowing how to find your old 401s with your social security number can save a lot of time and headache. There are tools you can use to find your 401 and roll them over.

If youre like most, youve changed jobs quite a bit during your career. According to a Department of Labor study, the average American will have had about 12 jobs during their career. All of that moving around is bound to cause some things to get lost in the shuffle. And if youve participated in any company-sponsored 401 plan, your retirement money may have been left behind. Luckily, there are ways to find your 401s using your social security number.

The sad fact is billions in retirement funds are left behind in 401 plans where the participant no longer works for that company.

401s that have been left behind with former employers can be cumbersome at best to find. However, its vital in building your retirement to locate your old funds and bring them back into your active portfolio.

The first step would be to contact your former employers human resources department. If you can get in touch with them, they should have the best route to getting a hold of your old 401s.

Next would be to reference your old 401s summary plan description. In that, you should be able to find your plan administrators contact information and what they do with former employees 401s.

Recommended Reading: How Can I Use My 401k

Contributing To A 401 Plan

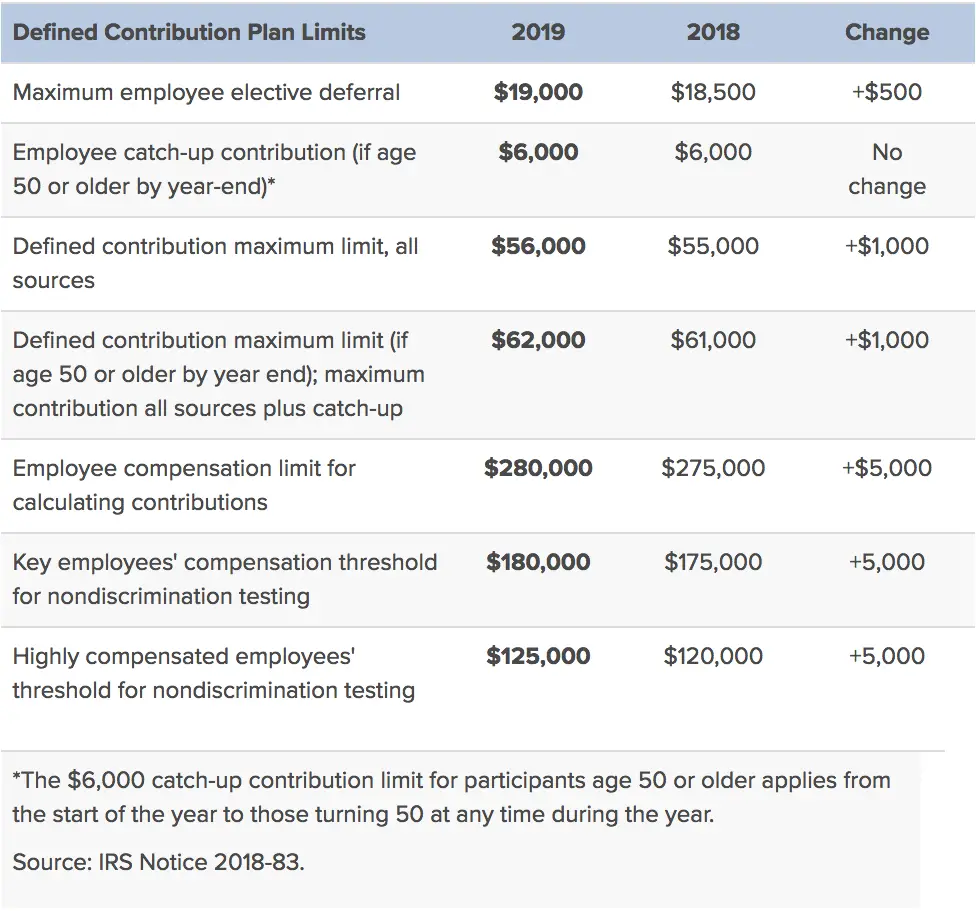

A 401 is a defined contribution plan. The employee and employer can make contributions to the account up to the dollar limits set by the Internal Revenue Service .

A defined contribution plan is an alternative to the traditional pension, known in IRS lingo as a defined-benefit plan. With a pension, the employer is committed to providing a specific amount of money to the employee for life during retirement.

In recent decades, 401 plans have become more common, and traditional pensions have become rare as employers shifted the responsibility and risk of saving for retirement to their employees.

Employees also are responsible for choosing the specific investments within their 401 accounts from a selection their employer offers. Those offerings typically include an assortment of stock and bond mutual funds and target-date funds designed to reduce the risk of investment losses as the employee approaches retirement.

They may also include guaranteed investment contracts issued by insurance companies and sometimes the employers own stock.

Are There Other 401 Options

Withdrawal is not the only way to access 401 funds for a down payment.

Your benefits provider may also offer 401 loan options. If available, this option not only helps you avoid the early withdrawal penalty fee, but also paying income tax on your withdrawal.

401 loans let you borrow up to 50% of your vested account balance Taking out this type of loan puts your 401 account on hold for the duration of the loan you wont be able to make additional contributions until the money is paid back.

But how can you calculate whether the 401 loan is a smart financial decision? As with any lending scenario, the price you pay to borrow the money has a big impact on determining whether the loan is worth it. You can typically expect a 1%-2% spike above the prime rate for these types of loans. Another factor to consider has to do with your employment. If youre unable to pay back the loan on time or before leaving/losing your job, you may be subject to the same financial penalties that come with a withdrawal.

Read Also: How To Calculate 401k Employer Match

Contact Your Former Employer’s Hr Department

Another way to locate an old 401 is to contact your former employer’s HR department. The department should be able to tell you the name of the plan administrator along with the contact information.

If that ends up reuniting you with the old 401, you can leave the account with your former employer, roll it over into an individual retirement account , roll it over into your current employer’s 401 or cash out the account.

So, what if your former employer is no longer in business or you aren’t able to track them down? The money should be somewhere. You just need to hunt for it. One place to look is the federal government’s Abandoned Plan database.

Deferral Limits For 401 Plans

The limit on employee elective deferrals is:

- $20,500 in 2022 , subject to cost-of-living adjustments

Generally, you aggregate all elective deferrals you made to all plans in which you participate to determine if you have exceeded these limits. If a plan participants elective deferrals are more than the annual limit, find out how you can correct this plan mistake.

Also Check: Can I Move My 401k From One Company To Another

Don’t Miss: Do 401k Loans Affect Mortgage Applications

How To Find And Claim Your Old Retirement Accounts

Whether you quit on your own accord, are fired, or laid off, leaving a job can be hectic. In the midst of the transition, dealing with a retirement account might get pushed pretty low on your to-do list.

While the money you contributed is yours forever, accounts can sometimes get forgotten about in the shuffle. And, in some cases, you may not have even realized youd had a retirement account if your employer automatically signed you up and withheld contributions.

Whether intentional or not, you can wind up with a handful of retirement accounts at different companies and lose track of some of them over time. Former employers and plan administrators may lose track of your current contact information.

Heres how to check and track down old accounts, and what you can do to get your finances organized.

Discover Where Your Funds May Have Been Transferred

If your former employer does not have your old 401, you can search on the Department of Labors abandoned plan database. You will be able to search for your plan using the information you already have, including your name, your employers name and more. If you had a traditional pension plan and it no longer exists, you can search the U.S. Pension Guaranty Corp. database to find your unclaimed pension.

Finally, you may want to search the National Registry of Unclaimed Retirement Benefits. This service is available nationwide and has records of account balances unclaimed by former retirement plan participants.

Read Also: Can You Use Your 401k As Collateral For A Loan

What Should I Do With My Lost Retirement Account

Once youve tracked down your lost retirement funds, you have some decisions you need to make. You can, of course, withdraw the funds and spend them, but there are a few reasons that might be a bad idea. If youre withdrawing funds from a forgotten 401 or other savings plan, take some time to research the taxes or penalties youll have to pay on any money you take out. Unless you put after-tax funds in, youll be taxed on the funds as you would with any type of income.

If youre 72 years old, though, youll need to pay attention to the Required Minimum Distributions to avoid a penalty. The amount youre required to take each year is based on a calculation that divides your account balance by your life expectancy factor. You can use the IRS Required Minimum Distribution Worksheet to help with that.

For the remainder of the amount, you may choose to leave it alone, withdraw it, or roll it into an IRA. You may find you can save on fees by rolling the amount over, but after retirement, the fees involved in doing that may eat into any cost savings. Weigh your options, including calculating the income taxes youll owe on any amount you withdraw, before making any decisions.

Too Complicated Get Some Help

If this process seems like a lot of work, youâre not alone. Locating your old 401 accounts and finding the proper place to transfer them to can get confusing.

Fortunately, Beagle can do all of the difficult work for you. The tasks of finding your accounts and facilitating their transfers are all done for you. Getting started is easy.

Also Check: Can You Roll Your Pension Into A 401k

Can I Withdraw That Money

Access to funds in your retirement account depends on your situation.

After You Leave Your Job

Once you quit, retire, or get fired, you should have access to your vested balance. You can withdraw those funds and reinvest in a retirement accountor cash out, although there may be tax consequences and other reasons to avoid doing so.

While Still Employed

While youre still employed, you typically have limited access to money in a retirement planeven your fully vested balance. Rules may require that you meet specific criteria and that your plan allows you to access your money. There are several potential ways to withdraw money before you leave your employer:

Other Situations

You might become fully vested in all of your balances if your employer terminates or shuts down the retirement plan, enabling you to transfer the funds elsewhere. Likewise, death or disability can trigger 100% vesting. Check with your employers plan administrator to learn about all of the plans rules.

Roll It Over To Your New Employer

If youve switched jobs, see if your new employer offers a 401, when you are eligible to participate, and if it allows rollovers. Many employers require new employees to put in a certain number of days of service before they can enroll in a retirement savings plan. Make sure that your new 401 account is active and ready to receive contributions before you roll over your old account.

Once you are enrolled in a plan with your new employer, its simple to roll over your old 401. You can elect to have the administrator of the old plan deposit the balance of your account directly into the new plan by simply filling out some paperwork. This is called a direct transfer, made from custodian to custodian, and it saves you any risk of owing taxes or missing a deadline.

Alternatively, you can elect to have the balance of your old account distributed to you in the form of a check, which is called an indirect rollover. You must deposit the funds into your new 401 within 60 days to avoid paying income tax on the entire balance and an additional 10% penalty for early withdrawal if youre younger than age 59½. A major drawback of an indirect rollover is that your old employer is required to withhold 20% of it for federal income tax purposesand possibly state taxes as well.

Don’t Miss: How Do I Access My 401k Funds