How The Rollover Is Done Is Important Too

Whether you pick an IRA for your rollover or choose to go with your new employer’s plan, consider a direct rolloverthats when one financial institution sends a check directly to the other financial institution. The check would be made out to the new financial institution with instructions to roll the money into your IRA or 401.

The alternative, having a check made payable to you, is not a good option in this case. If the check is made payable directly to you, your plan administrator is required by the IRS to withhold 20% for taxes. As if that wouldn’t be bad enoughyou only have 60 days from the time of a withdrawal to put the money back into a tax-advantaged account like a 401 or IRA. That means if you want the full value of your former account to stay in the tax-advantaged confines of a retirement account, you’d have to come up with the 20% that was withheld and put it into your new account.

If you’re not able to make up the 20%, not only will you lose the potential tax-free or tax-deferred growth on that money but you may also owe a 10% penalty if you’re under age 59½ because the IRS would consider the tax withholding an early withdrawal from your account. So, to make a long story short, do pay attention to the details when rolling over your 401.

Modify Your Investment Elections

Note: Any contributions to your account made after the effective date of this change will be directed into the investments you select.

Your 401k Plan Provider

If your 401k plan provider offers advisory services, you can try this route as well. You keep the investing decisions in-house.

For example, Vanguard 401k plans offer a managed service called Vanguard Managed Account Program. This service automatically rebalances your portfolio to own a diversified basket of funds that match your investing goals.

Why You Might Use Your 401k Plan Provider

- Prefer to keep your management in-house

- Trust your 401k provider to make the right portfolio decisions

Don’t Miss: How Much Money Should I Put In My 401k

Early Withdrawals At Age 55

If you retireor lose your jobwhen you are age 55 but not yet 59½, you can avoid the 10% early withdrawal penalty for taking money out of your 401. However, this only applies to the 401 from the employer that you just left. Money that is still in an earlier employers plan is not eligible for this exceptionnor is money in an IRA.

Should I Pay Someone To Manage My 401

Here are some situations when having a financial advisor manage your 401 may make sense and when … to consider managing the account yourself.

getty

Investors can save over three times as much in a 401 compared to an IRA, without even including employer contributions. So, it’s little surprise that most Americans rely on employer plans to save for retirement. Given the reliance on 401 or 403 savings, investors may wonder: should I pay someone to manage my 401?

As with nearly everything in personal finance, the answer is: it depends. Here are some situations when having a financial advisor manage your 401 may make sense and when to consider managing the account yourself.

Also Check: How To Find Your 401k Balance

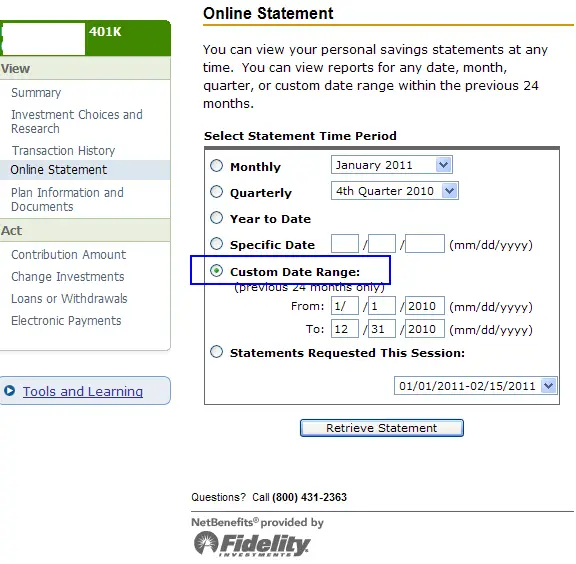

How To Find & Calculate Fidelity 401 Fees

To understand how much youre paying for your Fidelity plan, I recommend you sum their administration and investment expenses into a single all-in fee. Expressing this as both a percentage of plan assets, as well as hard dollars per-participant, will ultimately make it easier for you to compare the cost of your Fidelity plan to competing 401 providers and/or industry averages.

To make this easy on you, weve created a spreadsheet you can use with all the columns and formulas youll need. All you need to do is find the information for your plan, then copy it into the spreadsheet.

Doing this for Fidelity can be a bit of a pain, but not to worry well show you everything you need to do in 4 simple steps.

Step 1 Gather All the Necessary Documents

To calculate your Fidelity 401 fees, the only document youll need is their 408 fee disclosure – what Fidelity has named a Statement of Services and Compensation.

Fidelity is obligated by Department of Labor regulations to provide employers with a 408. This document contains plan-level information about their administration fees. This information is intended to help employers evaluate the reasonableness of these fees. This document can be found on the Fidelity employer website.

If you hired an outside financial advisor for your plan, youll need to factor their pricing into your Fidelity fee calculation. This information can usually be found in a services agreement or invoice.

Step 2 Locate Fidelitys Direct 401 Fees

Rollover Of Former Employer 401k Plan Held At Fidelity Investments After Participant Loan Payoff Question:

For my existing 401k account with Fidelity from my previous employer, I am ready to do the rollover after the 401k participant loan payment I had on the account and been paid off. I want to check if I should wait for the new Fidelity brokerage account for the solo 401k plan that I opened with your company before I request the direct-rollover of the former employer 401k , or I can request the direct-rollover check now?

Also Check: Is It Best To Rollover A 401k To An Ira

Compare Other Advisors Online

Investment advice, services, and costs vary widely among online brokerages, and its important to find the right combination of features and fees for you. Your best online broker depends on what type of investor you are:

- Very active trader desiring efficient execution and low commissions

- Small investor looking for affordable fees and no minimum balances

- DIY investor desiring abundant research resources

- Mobile investor wanting a great interface

At MoneyRates, its easy to compare and choose among the best online brokers.

Why Solo 401k Loan Not On Fidelity Statement Question:

Looking at my solo 401k brokerage account and Im confused on how the account is showing up. I wrote a check for the solo 401k participant loan proceeds , and it looks like the account is showing the actual balance has decreased. Is this just how Fidelity is accounting it or did this actually come from the balance as a withdrawal? Where can I see the actual loan balance/ information?

You May Like: How To Contact My 401k

How To Get A Managed 401k Plan

You have two different ways to have a managed 401k plan.

These options all take a different management approach and charge different management fees. Below is a brief summary of your three different options and you can choose which one is best for you.

What’s great about these three options is that you can switch plans at any time. If you want a more hands-on approach you can notch up to another provider. Or, you can adopt a more laissez-faire management strategy too!

Processing Solo 401k Loan Question:

I received the rollover check from John Hancock for my former employer 401k and will go into the local Fidelity Investments office tomorrow to deposit the check into the new brokerage account that you helped me set up for the self-directed solo 401k that you provide. I would like to make sure I understand the process to create a solo 401k participant loan against the balance. I think you all create the paperwork. Whats the method to move the loan amount from the fidelity account into my personal checking account. Do I just use the fidelity transfer functionality, get a check drafted or ?

Also, I will be rolling over an IRA account as well. Am I limited to 1 loan or can I take out a second loan against the additional amount?

You May Like: Can I Convert My 401k To An Ira

Convert Existing Fidelity Solo 401k And Take A 401k Participant Loan Question:

I was looking for a 401k alternative to Fidelity and stumbled on your site and wanted to send an email with a few questions. I am in the process of buying a new house and was hoping to take a loan out from my solo / self employed 401k plan at fidelity however to my surprise they said that my 401k plan doesnt have the loan feature because it is a self employed / small business type. Needless to say I am looking for a new 401k provider where I can transfer my and my wifes 401k monies from fidelity and shortly after take a loan for the down payment. Does this sound like something you folks would be able to help me with? If this sounds doable, please give me a call when you have some time to go over next steps.

Tips For Finding A Financial Advisor

- Finding the right financial advisor that fits your needs doesnt have to be hard. SmartAssets free tool matches you with financial advisors who serves your area in five minutes. If youre ready to be matched with local advisors that will help you achieve your financial goals, get started here.

- In order to find a financial advisor who’s right for you, you’ll want to think carefully about your needs and long-term goals before starting the search process. Advisors often specialize in serving certain types of clients and in providing particular services. For instance, if you want a comprehensive financial plan, you might want to work with a certified financial planner. If it’s tax planning help you’re after, a certified public accountant might be a good fit.

Read Also: How To Invest 401k In Stocks

Roth Ira Statement From Fidelity Representative: Question:

Can you confirm whether this statement is true or not . The IRS does not allow for Roth IRA money to be rolled into any 401k plan. That is only allowed on pre-tax IRA and retirement accounts. I was hoping to roll over a Roth IRA into my solo 401k roth account. Is this allowed?

The Fidelity representative is correct that a Roth IRA cannot be transferred to a Roth solo 401k. This is a Roth IRA rule. Visit here for more on this rule. I suspect this rule was put in place because the distribution rules are different for a Roth IRA vs a Roth solo 401k.

Where Can I Find My Fidelity 401k Fees

Whether due to my own ineptitude, or through deliberate camouflaging on Fidelitys part, I could not for the life of me figure out what these additional fees were. The info that I sought is information that your 401 provider must supply youyet I could not locate and account for these mysterious fees. A few days after giving up on Fidelitys website, I happened to receive an email with Fidelitys annual prospectus disclosure and viola, a CTRL F later and I finally uncovered the fees that were eating up nearly one percent of my account on an annual basis. You can find this required disclosure information under the Plan Information and Documents tab on your account.

Assuming Im not the only one who sucks at navigating an unfamiliar financial services website, I wanted to spell out those fees in somewhat plain English. For those who dont have a 401k plan through Fidelity, this information should still prove somewhat valuable, as it allows you to compare the fees in your own plan to another provider. I had a next-to-impossible time finding my own 401k providers fees, never mind search for those of competing plans.

Now, lets take a look at the Fidelity 401k fees that Im paying.

Don’t Miss: How To Sell 401k Plans

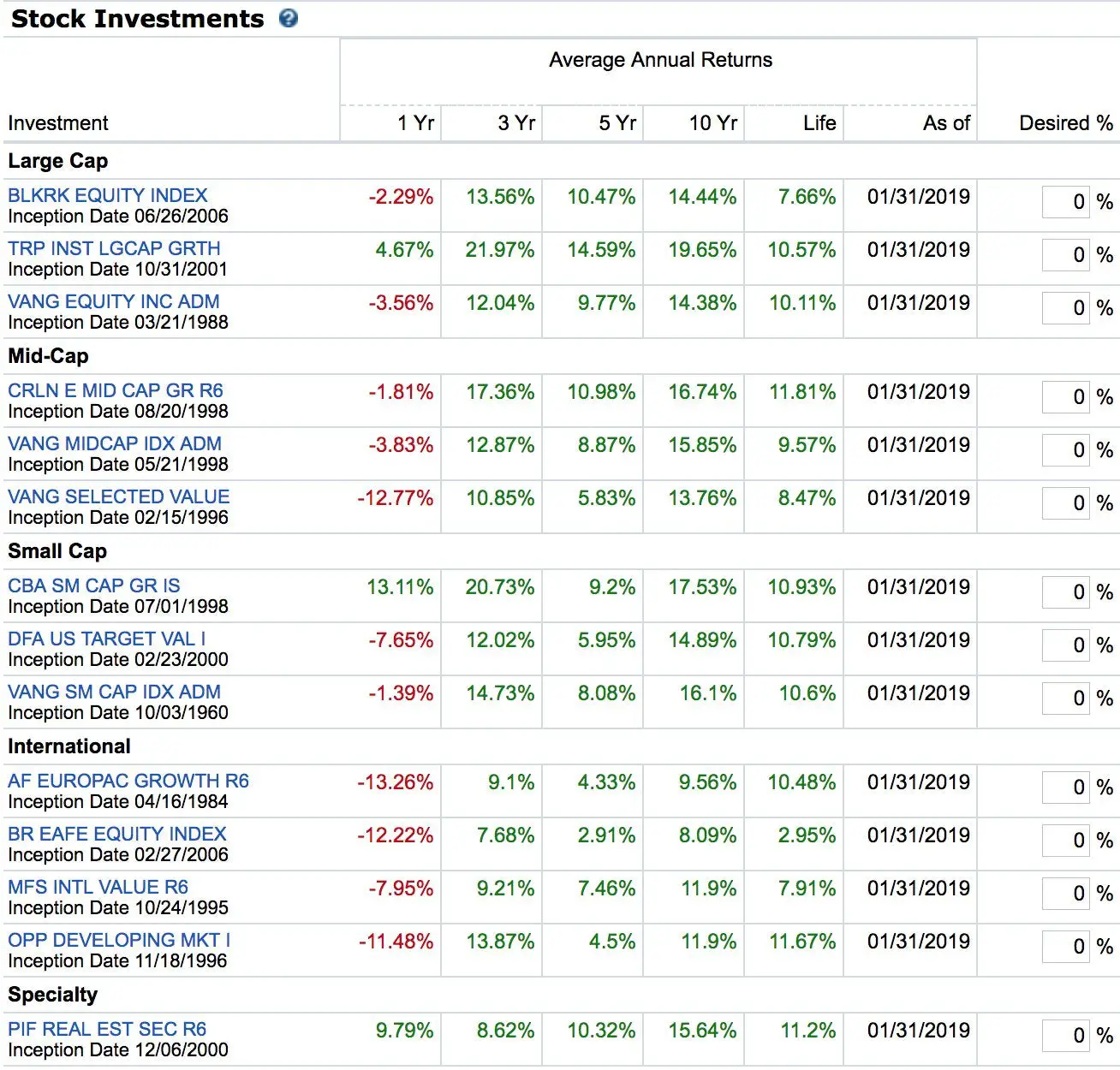

Should You Use Fidelitys Brokeragelink Option

- Bryan Zschiesche

If you are one of the 22 million investors with a retirement plan at Fidelity, you may have access to an option within your plan that could dramatically improve the success of your 401k. Fidelitys BrokerageLink® option is a self-directed brokerage account within the 401k or 403b plan. In this article, youll learn what the BrokerageLink® option is and when it may make sense to take advantage of it.

Most retirement plans provide a short list of investment choices across stock and bond categories along with one stop shopping in target date retirement funds. It is usually possible to craft a fairly well-diversified portfolio using the standard options offered by most plans. Interestingly, most investors dont undertake the effort. As of Q1 2019, 52% of individuals with a Fidelity 401k had all of their retirement savings in a target date fund.1

For investors who want more control over their asset allocation, BrokerageLink® may be the way to go. For purposes of our discussion today, well focus on Fidelitys offering, but many retirement plans administered by other institutions such as Charles Schwab, Alight, Ascensus, Vanguard, and Merrill Lynch offer similar brokerage window options.

What is BrokerageLink®?

Benefits of BrokerageLink®

Additional Considerations

The following are some additional considerations to make before opening a BrokerageLink® account:

1 Fidelity Q1 2019 Retirement Analysis

Bryan Zschiesche

Recent Posts

Modify Your 403 Contribution

Note: All contribution amounts must be in whole percentages and changes will become effective with the current or next pay period, or as soon as administratively possible.

You May Like: How To Find A 401k From Previous Employer

What You Can Find At Fidelity

| Offering | |

| 75,000 new issue and secondary market bonds including corporate and municipal bonds | |

| Robo advisor | Automated portfolio built with mutual funds. It charges no annual advisory fee on balances under $10,000. The annual fee is $3 for balances of $10,000$49,999, and 0.35% for balances of $50,000+ |

How Do You Start Investing For Retirement

One of the best strategies to invest for your retirement future is setting up automatic, ongoing contributions into a retirement plan. You can keep the investment strategy simple yet effective by investing in low-cost index funds. Once you have these factors in place, consider increasing your deposits as youre able over time to set even more money aside for retirement.

Read Also: Can I Start My Own 401k Plan

Be Wary Of Target Date Funds

Think hard before you simply invest your 401 in a target-date fund. The idea of these funds is that they’re geared to evolve as you move closer to retirement. If youre planning to retire in 2035, for example, you would invest in a target-date fund that matures in that year. The funds managers will continually re-balance the fund to maintain an appropriate allocation as the target date gets closer.

Here’s why this type of fund may not be the best choice. For starters, funds use different allocation strategies, which may or may not be a good match with your goals. As experts point out, a target date funds performance is largely based on the fund managers. Since you probably dont know the good managers from the bad, picking a fund is difficult.

Equally important, fees for these funds are often high, and novice investors dont understand the golden rule of target-date funds. If you invest in one, you shouldnt mix it with other investments. Most financial advisors agree that its close to an all-or-nothing investment. Investing your 401 in other funds as well throws off the allocation.

One-stop shopping is appealing, but just because these vehicles are a simple way to invest doesnt mean that they’re easy to understand or the right place to park your retirement funds.

Should I Manage My Own Retirement Account

There are pros and cons to having a professional investment advisor manage your 401. And for some, it may not make sense. After all, not everyone needs a financial advisor. When it comes to making decisions about your finances, focus on the intersection of what matters and what you can control. Using that lens, here’s when to consider managing your own retirement plan and when to ask for help.

Don’t Miss: How To Calculate How Much To Contribute To 401k

Your Money Deserves More Than Thoughts And Prayers

Whether you manage your 401 yourself or with an advisor, take advantage of the controllable aspects, like your asset allocation. When the account becomes a big part of your retirement strategy or if you realize you need financial guidance beyond what you can do yourself, it’s likely worth acting on. The benefits of working with a financial advisor often go beyond money management. Google is great, but there’s still no substitute for a real person giving personalized advice.

Is Fidelity Go Right For You

If youve been wanting to test the robo-advisor waters but you feel more comfortable with an established broker, Fidelity Go has a lot to offer. The fees are competitive, and the portfolios are well-diversified and closely monitored by real live humans. Theres also a low account minimum to help you get in the door, especially compared with other broker-owned online advisors.

Investors with taxable accounts, however, will miss the tax-loss harvesting offered by other robo-advisors. Although use of municipal bonds in taxable accounts can help reduce your tax burden.

Read Also: What Percent To Put In 401k