Personal Capital Average 401k Balance By Age

| AGE | |

|---|---|

| $458,563 | $132,101 |

*Note: Averages are rounded up to the nearest dollar. Numbers are based on aggregated and anonymous data from the Personal Capital Dashboard. Accounts included are the following: 401k, former employer, Roth 401k. Excludes test and invalid accounts. Excludes any account value greater than $100,000,000 or less than -$100,000,000. Excludes spouse accounts. Snapshotted balance as of 9/7/2022.

You Get A Tax Break For Contributing To A 401

The core of the 401s appeal is a tax break: The funds for it come from your salary, but before tax is levied. This lowers your taxable income and cuts your tax bill now. The term youll often see used is pre-tax dollars.

Say you make $8,000 a month and put $1,000 aside in your 401. Only $7,000 of your earnings will be subject to tax. Plus, while inside the account, the money grows free from taxes, which can boost your savings.

Yes, you will have to pay taxes someday. Thats why a 401 is a type of tax-deferred account, not tax-free. Well get back to that.

The Rules You Need To Knowplus A Pitfall You’ll Want To Avoid

You can still contribute to a Roth IRA and/or traditional IRA even if you participate in a 401 plan at workas long as you meet the IRA’s eligibility requirements. You might not be able to take a tax deduction for your traditional IRA contributions if you also have a 401, but that will not affect the amount you are allowed to contribute. which is up to $6,000, or $7,000 with a catch-up contribution for those 50 and over, for 2021 and 2022.

It usually makes sense to contribute enough to your 401 account to get the maximum matching contribution from your employer. But adding an IRA to your retirement mix after that can provide you with more investment options and possibly lower fees than your 401 charges. A Roth IRA will also give you a source of tax-free income in retirement. Here are the rules you’ll need to know.

Also Check: Can I Use Money From 401k To Buy A House

Employers Have A Higher Contribution Ceiling

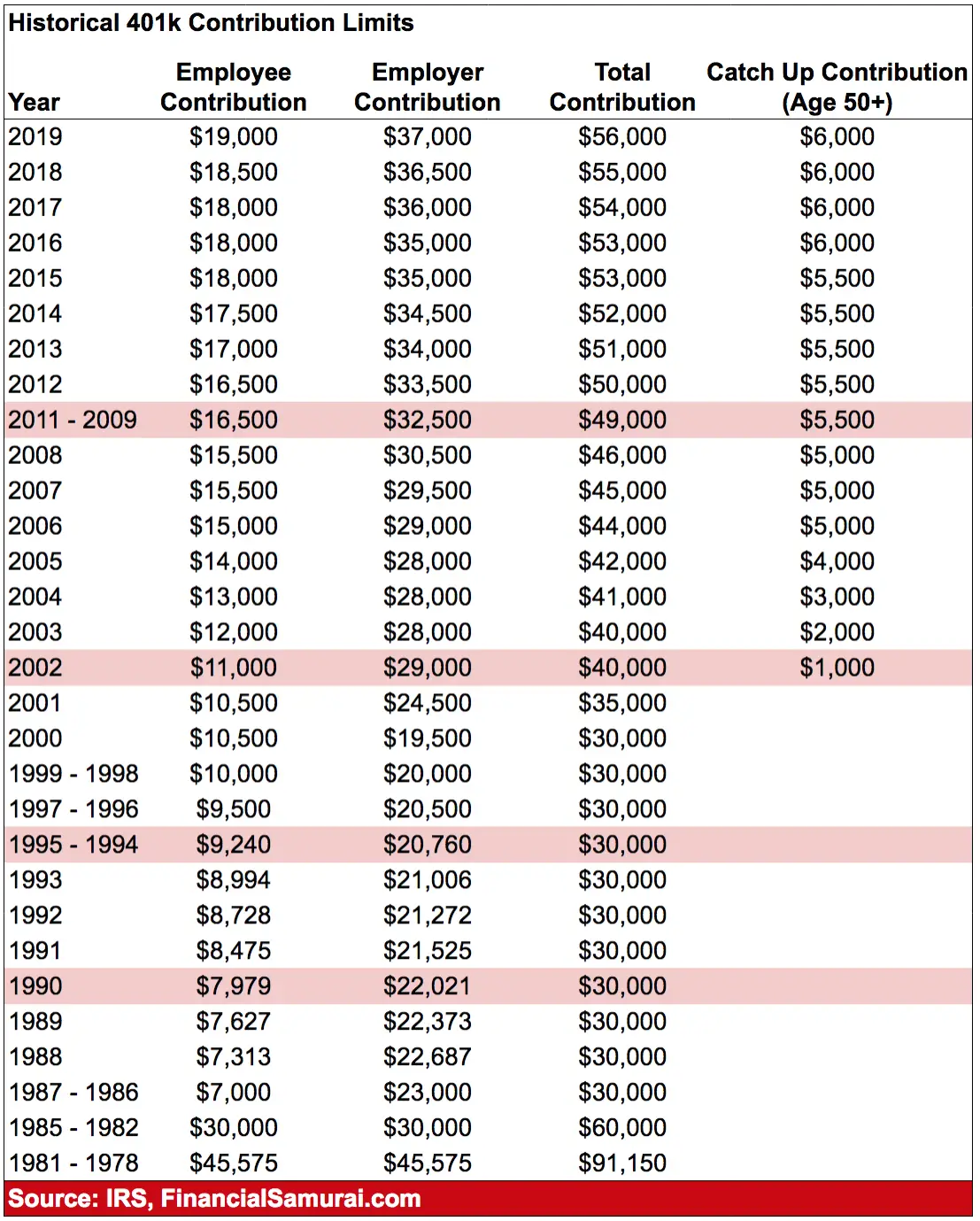

The employers 401 maximum contribution limit is much more liberal. Altogether, the most that can be contributed to your 401 plan between both you and your employer is $61,000 in 2022, up from $58,000 in 2021. That means an employer can potentially contribute much more than you do to your plan, though this is not the norm.

The salary cap for determining employer and employee contributions for all tax-qualified plans is $305,000. Even at that level, the employer would have to contribute a hefty amount to reach the $61,000 limit.

How To Find Out How Much Your 401 Is Charging You

You can find the details of your 401 plan fees in your plans Summary Annual Report . Plan administrators are required to provide this report once each year, and it should be distributed to you by your employer.

Unfortunately, these fees arent usually listed in a straightforward manner, so youll have to calculate them yourself. First, youll want to calculate your plans administrative fees using the following process.

To find your investment fees, which likely make up the bulk of what youre paying for your 401 plan, youll want to look for the expense ratio. You can usually find this by logging onto your plans account and navigating to the fund details page. This fee is assessed annually as a percentage of your total investments and subtracted from your returns. A typical 401 expense ratio is 1%, which means if your plan earned 10% in returns last year, you only saw 9%.

Recommended Reading: How Do I Cash Out My 401k From Walmart

Choosing Health Insurance Bills Or Your 401

If you cant afford to pay your monthly bills, you cant afford to make 401 contributions. If there are unexpected expenses or loss of income, you may even need to withdraw retirement money early. If possible, focus on putting in the minimum to get your employers match, then use the additional money to pay off any high-interest debt, like credit cards.

One option, if youre struggling to afford your 401 contributions, is to choose a cheaper health insurance plan. People who overpay for health insurance are 23% more likely to forgo their employers retirement match, a TIAA Institute study found.

A health savings account can help you reduce health costs and save for retirement at the same time. You can only fund one if you have a high-deductible health plan, which often leads to higher out-of-pocket costs. You fund an HSA with pre-tax money. When you spend it on Internal Revenue Service -approved qualified medical expenses, your distributions for those are also tax-free and penalty-free.

An HSA is a good supplement to your 401 contributions because if you have unused money in the account when you turn 65, you can withdraw it without penalty for any purpose, though youll owe income taxes for distributions made for non-qualified medical expenses.

Youre Our First Priorityevery Time

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

You May Like: Do You Pay Taxes On 401k Rollover To Roth Ira

Can I Max Out 401k And Ira In 2022

A 401 plan has a higher contribution limit than a traditional or Roth IRA$20,500 vs. $6,000 in 2022. You can contribute more if youre 50 or older and there are special rules if youre eligible for both types of retirement. join plans.

What is the max 401k and Roth contribution for 2022?

After-tax vs. For 2022, employees under the age of 50 can set aside up to $20,500 of their salary into their regular pretax or Roth 401 account. However, you can make additional after-tax contributions to your traditional 401, allowing you to save more than the $20,500 cap.

Can I max out a 401k and an IRA in the same year?

The limits for 401 plan contributions and IRA contributions do not overlap. As a result, you can fully contribute to both types of plans in the same year as long as you meet the different eligibility requirements.

Your Employers Contribution Limit

Some employers may have a set limit for the percentage you can contribute toward your 401 each paycheck and, depending on how much you get paid, maxing out your employers limit may still not be enough for you to max out the federal contribution limit.

For example, a company may allow employees to contribute up to 50% of their paycheck to their 401 account . Or, they may allow up to a 20% contribution per paycheck. It depends on your company, so be sure to double check.

If youre maxing out your employers contribution limit but you still worry that its not enough to help you reach your retirement goals, you can also contribute your post-tax income to a Roth IRA account.

A Roth IRA is another type of retirement account but with slightly different rules s which differ from a Roth IRA). You must open the account on your own is). And instead of contributing pre-tax dollars that youre taxed on when you make withdrawals in retirement, you contribute after-tax dollars and wont pay taxes on withdrawals later on.

Also, the contribution limits for an IRA are different from that of a 401 you can contribute up to $6,000 per year to a Roth IRA if youre under age 50, and $7,000 per year if youre age 50 or older.

You May Like: How Much Can We Contribute To 401k

Recommended Reading: Can You Leave Money In 401k At Your Old Job

Are There Separate Limits For Roth 401s

No. Roth 401s have the same contribution limit as regular 401s. For 2022, that limit is $20,500. You can contribute to both a traditional 401 and a Roth 401 account in the same year, as long as your total contributions dont exceed that amount. If youre choosing between the two, learn about the differences between a Roth and traditional 401.

|

no account fees to open a Fidelity retail IRA |

||

Account minimum |

||

|

when you invest in a new Merrill Edge® Self-Directed account. |

Promotioncareer counseling plus loan discounts with qualifying deposit |

PromotionGet $100 when you open a new, eligible Fidelity account with $50 or more. Use code FIDELITY100. Limited time offer. Terms apply. |

How Often Should I Contribute To My Roth Ira

For many people, contributing the maximum annual to their IRA at once is difficult. The best thing is to set up automatic payments that transfer money from your bank account to your brokerage account on a regular basis, such as every two weeks or once a month. Setting a periodic contribution also has other benefits.

Should I fund my Roth IRA all at once?

But there is nothing in the law that prevents you from using both. In fact, financial planners often recommend funding a Roth IRA once youve contributed enough to your 401 to get your employers full-matching contributions.

When should you contribute to a Roth IRA?

Her verdict: The best time to fund an IRA is January 1 of the tax year. If the money sits in an interest bearing tax account, you will lose some of your earnings into taxes. If instead, you put money into interest-bearing, IRA it will earn the same tax-deferred interest.

Read Also: How To Use Your 401k To Start A Business

How Much Can I Contribute To My 401k And Roth Ira In 2021

For 2021 and 2022, you can contribute up to $ 6,000 to a Roth or traditional IRA. If you are 50 or older, the limit is $ 7,000. The most you can contribute to a 401 in 2021 is $ 19,500, or $ 26,000 if you are 50 or older.

Can I max out 401k and Roth IRA in same year?

Contribution Limits Contributions for Roth IRAs and 401 plans are not cumulative, which means that you can max out both plans as long as you qualify to contribute to each.

Can you contribute to a Roth IRA and a 401k at the same time?

You can contribute to both a Roth IRA and an employer -sponsored retirement plan, such as a 401 , SEP, or SIMPLE IRA, subject to income limits. Contributions to Roth IRAs and employer -sponsored retirement plans can allow for saving as much in a tax -beneficial retirement account as is permitted by law.

How much can I contribute to both a 401k and Roth IRA?

You can contribute up to $ 19,500 in 2020 to a 401 plan. If you are 50 or older, the maximum annual contribution jumps to $ 26,000. You can also donate up to $ 6,000 to the Roth IRA in 2020. That jumps to $ 7,000 if youre 50 or older.

How To Calculate Your Monthly 401 Contribution

In 2021, the 401 contribution limit is $19,500 for those under age 50 this increases to $20,500 for 2022. Workers age 50 or older can make an additional catch-up contribution of $6,500 in both 2021 and 2022. You and your employers combined contributions cant exceed $58,000 in 2021 or $61,000 in 2022, excluding catch-up contributions.

However, few people actually contribute these amounts. Only 12% of plan participants made the maximum contribution in 2020, when the limit was $19,500, according to Vanguard’s 2021 How America Saves report.

To determine how much you should be saving, you can use Social Securitys retirement estimator and see what monthly benefit you can expect from that fund. You also can use a retirement calculator to estimate how much youll need each month on top of Social Security. Choose a calculator that allows you to personalize as many factors as possible, including your current age and account balance, anticipated contributions, other sources of income, and expected rates of return.

Also Check: How Do I Get My 401k Out

When Can I Contribute To A Roth Ira For 2021

You can make IRA contributions for a specified year anytime between January 1 and the following years tax filing deadline . The IRS has extended the 2020 tax filing and IRA contribution deadline to Monday, May 17, 2021.

What is the last day to contribute to an IRA for 2021?

As a general rule, you have until tax day to make IRA contributions for the year in advance. In 2021, that means you can contribute to your 2020 tax year limit of $ 6,000 until May 17th. And from January 1, 2021, you can also contribute to your 2021 tax year limit until tax day in 2022.

Can I open an IRA in 2021 and contribute for last year?

Make Sure You Choose The Right Tax Year. If you open an IRA before the tax deadline, you can make contributions for the previous or current year. For 2021, the maximum IRA contribution is $ 6,000. People age 50 and older can make an additional $ 1,000 in holding contributions, totaling $ 7,000.

How much can I put in a Roth IRA 2021?

More On Retirement Plans Note: For other retirement plan contribution limits, see the Topic Retirement â Contribution Limits. For 2022, 2021, 2020 and 2019, the total contributions you make each year to all of your traditional IRAs and Roth IRAs cannot be more than: $ 6,000 , or.

Working With Your Financial And Tax Professionals

A 401 plan can become the cornerstone of a personal retirement savings program, providing the foundation for future financial security. Consult your financial and tax professionals to help you determine how your employer’s 401 and other savings and investment plans could help make your financial future more secure.

Important NoteEquitable believes that education is a key step toward addressing your financial goals, and we’ve designed this material to serve simply as an informational and educational resource. Accordingly, this article does not offer or constitute investment advice and makes no direct or indirect recommendation of any particular product or of the appropriateness of any particular investment-related option. Your needs, goals and circumstances are unique, and they require the individualized attention of your financial professional. But for now, take some time just to learn more.

Please be advised that this material is not intended as legal or tax advice. Accordingly, any tax information provided in this material is not intended or written to be used, and cannot be used, by any taxpayer for the purpose of avoiding penalties that may be imposed on the taxpayer. The tax information was written to support the promotion or marketing of the transactions or matter addressed and you should seek advice based on your particular circumstances from an independent advisor.

What’s the next step for you?

A financial professional can help you decide. Let’s talk.

Read Also: What To Know About 401k

Tips For Contributing To Your 401

- If youre struggling to get started or stay on track, consider working with a financial advisor. Finding a qualified financial advisor doesnt have to be hard. SmartAssets free tool matches you with up to three financial advisors in your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- If you switch jobs, you can no longer contribute to a previous employers 401 plan. You dont want to lose the hard work you did to save that money, so you should look to make a direct 401 rollover to your new employers plan.

- A traditional IRA and a 401 offer similar tax benefits. You might wonder whether one is a better option for you. Heres an article to help you think about an IRA vs. a 401.

- You should always avoid early withdrawals from your 401. Not only will you have to pay the income tax, youll have to a pay 10% penalty. There are a couple of ways you could avoid that big penalty though. If you really think you need to withdraw money early, heres more information on 401 withdrawals.

What Is A Good 401 Contribution

Your ideal 401 contribution depends on several factors. If your employer offers a match, your first priority should be to contribute enough to get the full match. From there, you may want to max out a tax-free retirement account such as a Roth IRA before you finish maxing out your 401. If you’re able to do all three of these, it can help you get the most out of your investments.

Also Check: Can You Merge 401k Accounts