Next Steps To Consider

Keep in mind that investing involves risk. The value of your investment will fluctuate over time, and you may gain or lose money.

The change in the RMD age requirement from 70½ to 72 only applies to individuals who turn 70½ on or after January 1, 2020. Please speak with your tax advisor regarding the impact of this change on future RMDs.

Fidelity does not provide legal or tax advice. The information herein is general and educational in nature and should not be considered legal or tax advice. Tax laws and regulations are complex and subject to change, which can materially impact investment results. Fidelity cannot guarantee that the information herein is accurate, complete, or timely. Fidelity makes no warranties with regard to such information or results obtained by its use, and disclaims any liability arising out of your use of, or any tax position taken in reliance on, such information. Consult an attorney or tax professional regarding your specific situation.

This information is intended to be educational and is not tailored to the investment needs of any specific investor.

Administering A Solo 401 Plan

Once your Solo 401 plan exceeds $250,000 in assets at the end of the year, the IRS requires you file an annual Form 5500 EZ. Or if you ever terminate the plan, you must also file a Form 5500 EZ.

Unlike Traditional 401 plans, there are no compliance testing requirements to ensure Solo 401 plans do not favor highly compensated employees and are non-discriminatory, as long as you have no employees participating in the plan.

These plans can be called Self-Directed 401, Individual 401, Individual Roth 401, Self-Employed 401, Personal 401 or One-Participant 401 depending upon the vendor offering the plan services.

You May Like: How Do I Get My 401k

What Is A Self

Most workers are at the whim of their employer when it comes to retirement accounts. But when you’re self-employed, you have control. You can choose which retirement accounts are right for your goals and how to best utilize them.

There are several accounts you can choose from, including a solo 401. These are similar to a 401 you might get at a salaried position, though they actually allow you to save significantly more annually.

You can explore your retirement options, including IRAs, by reviewing top providers online now.

Don’t Miss: What Is The Difference Between Annuity And 401k

How Much Does It Cost To Open A Solo 401

There is no cost to open a 401 account but watch out for those fees later on. While you’re researching your options, check for account maintenance fees, transaction fees, commissions, mutual fund expense ratios, and sales loads.

A fractionally higher fee can mean a big hit to a retirement portfolio. If you make the right choices you can minimize the fees you pay.

How Do I Set Up A Solo 401 For My Business

To open a solo 401, you simply need to find a solo 401 provider. When you open a solo 401, the provider will usually create a solo 401 plan document for you. There are several solo 401 providers you can choose from. If youre a fan of Vanguard, you can create a Vanguard solo 401. You can also create a Fidelity 401 or ETrade solo 401.One downside with a Vanguard solo 401 is it does not allow you to roll over an existing IRA into your Vanguard solo 401. One downside with a Fidelity solo 401 is it does not have a Roth 401 option. Do your research on the various solo 401 providers out there, and they will assist you in helping to set up the plan. It is actually quite simple once you choose a provider.

Also Check: When Can I Borrow From My 401k

Plan Establishment And Contribution Deadlines

Solo 401 plans must be established by December 31 of the first plan year for which they are effective. For example, in order to make contributions to a solo 401 plan for 2022, the plan must be established by December 31, 2022.

The contributions themselves, however, dont need to be made until the individual tax filing deadline of April 15, or October 15 with a six-month extension.

Do You Get A Pension If You Are Self Employed

Most self-employed people use a personal pension for their pension savings. With a personal pension you choose where you want your contributions to be invested from a range of funds offered by the provider. The provider will claim tax relief at the basic rate of tax on your behalf and add it to your pension savings.

Read Also: How To Direct Transfer 401k To 403b

Recommended Reading: How Can I Pull My 401k Money Out

Looking For A Financial Advisor

Get In Touch With A Pre-screened Financial Advisor In 3 Minutes

That may be just as well because many financial advisors feel its a good idea to hedge your bets for any tax scenario by investing in a mix of pre-tax and after-tax retirement accounts. room for strategy in the future, says Shon Anderson, a certified financial planner in Dayton, Ohio. Ultimately, the choice of whether to invest your money in a traditional solo 401 versus a Roth solo 401 is a matter of age, income, location and preference.

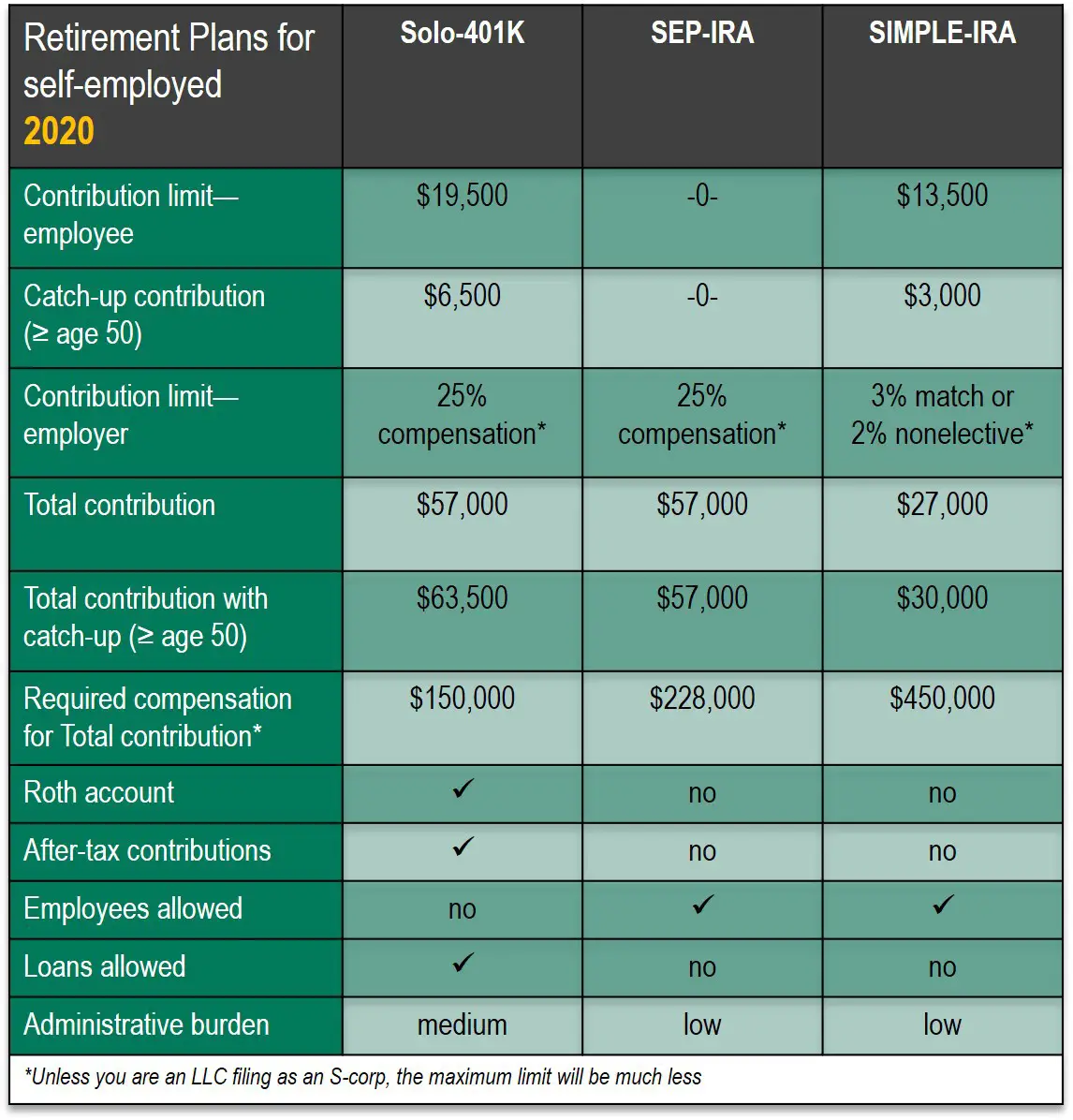

How Much Can I Contribute To A Solo 401

There are two types of contributions that can be made:

It is important to consult your accountant to calculate the profit-sharing contribution if you plan to open and contribute to a Solo 401.

Read Also: How To Set Up A 401k Account

Don’t Miss: What Does A 401k Do

Do I Need A 401kk Solo Plan

A solo 401 is an excellent way to save for retirement if you’re a small business owner. If you hire employees at some time during your business’s lifetime, you’ll have to adjust the plan to include them equally or create criteria to define benefit-eligible employees and create retirement plans for them.

Solo 401k Plan For A Sole Proprietor

QUESTION 2: Can a sole proprietor open a solo 401k plan?

ANSWER: Yes a sole proprietorship can also sponsor a solo 401k plan. A sole proprietor files a Schedule C to report the self-employment activity. We would list your name as the self-employed business on the solo 401k plan documents, and your contributions to the solo 401k plan would be based on line 31 of the Schedule C.

You May Like: When Retiring What To Do With 401k

Whats The Max You Can Contribute To A Self Directed 401k

If you are offered the option of a self-directed 401 by an employer, the custodian would be the plan administrator. The same contribution limits apply as for regular IRA and 401 plans. In 2019, the maximum IRA contribution is $6,000, plus a $1,000 catch-up for those age 50 or above.

Who is the custodian of a self directed 401k?

If you are offered the option of a self-directed 401 by an employer, the custodian would be the plan administrator. The same contribution limits apply as for regular IRA and 401 plans.

Do you have to pay taxes on self directed IRA?

The investor who has a strong interest in precious metals can invest pre-tax money long-term in a traditional IRA, and pay the taxes due only after retiring. The self-directed aspect may appeal to the independent investor, but its not completely self-directed.

Other Financial Benefits Of A Solo 401

The solo 401 can be an excellent choice for those with a side gig as well, especially if theyre already able to live comfortably on their main salary. With the solo 401 you can go above the usual limits of a 401.

While you may contribute to multiple 401 accounts, your total employee contribution to all types of 401s may not exceed the annual maximum contribution, that is, $20,500 in 2022.

But the solo 401 can be valuable even if you already have a 401 plan and even if youve maxed out that other plan for a given year. Thats because you can still make an employer contribution, allowing you to exceed the smaller employee-only contribution amount. So the solo 401 allows you to save more with the employer contribution, reducing your business taxes.

Another benefit of the solo 401 is that it doesnt prevent you from taking advantage of other retirement plans such as the IRA. You can still contribute up to the annual maximum there. If youre an individual looking to set up a traditional IRA or Roth IRA, then youll want to look at the benefits of those plans.

Like the typical 401 plan, the solo 401 also allows you to take out a loan against your account. loan.)

While I generally encourage clients to avoid that strategy, it can come in handy at times, Conroy says.

Recommended Reading: Should I Roll My Ira Into My 401k

Excess Contribution Not Withdrawn By April 15

So what happens if you dont notice that youve over-contributed to one or more 401k plans until after April 15? In this situation, the excess contribution is taxed twice, once in the year when contributed and again when distributed .

Also, the earnings from the excess contribution will be taxable income for the following year. If the mistake is not corrected, then the IRS may disqualify the entire 401k plan retroactive to the beginning of year 1. This results in the employees entire 401k account balance to become income to the employee which would have massive adverse tax consequences.

But the main reason why you want to be more conservative in your self-employed 401k contribution is not the fine. Th main reason is the stress of getting an IRS audit letter in the mail. It will also take time to amend your tax returns. This process can take hours.

Id much rather miss out on contributing an extra $1,000 in my self-employd 401k than go through the torture of dealing with the IRS.

Remember, when in doubt, round down your self-employed 401k contribution amount.

Can I Contribute To A Sep Ira And 401 Simultaneously

Question: If I have self-employment income from a separate business and also am employed by an employer that offers a 401 plan, can I participate in the 401 plan and still contribute to my SEP IRA?

Answer: Yes As long as the SEP IRA plan and the 401 plan are offered by separate companies. If you dont own the company that pays you a W-2, you can participate in both plans. Even if you participate in an employers retirement plan at a second job, you are allowed to set up an SEP plan if you have self-employment income through a business. You can learn more via the IRS Frequently Asked Questions for SEP plans. However, your contributions are still subject to some limitations.

You May Like: Can You Get A Loan Using Your 401k As Collateral

Iras: Easy For Getting Started

An IRA is probably the easiest type of account to use. If you plan to save less than the annual limitand your income allows you do to what you wantyou might not need to look any further.

IRAs are not tied to your business, so the paperwork required to establish and maintain the account is minimal. You dont need to provide corporate documents, and theres no annual administration needed on your part. Technically, these arrangements are individual accounts, so theyre in your name as an individual taxpayer.

Contribution limits: IRAs have relatively low contribution limits, but you might not have the cash flow or desire to contribute above those limits. For 2023, the maximum IRA contribution is $6,500. For those over age 50, an additional $1,000 catch-up contribution is available.

Any saving is better than no saving at all, but to reach your retirement goals, you may eventually have to save more than an IRA allows.

Pre-tax and post-tax: IRAs can be established for pre-tax savings and after-tax savings . However, youll need to ensure that your income doesnt disqualify you from using those options. If you have a job with a retirement plan, that could also complicate matters.

The Drawbacks For The Self

While often the best choice if you qualify, there are a few things that make an individual Roth 401 slightly less than perfect:

- Establishing an individual Roth 401 plan can be a lot of initial paperwork.

- An individual Roth 401, unlike a Roth IRA, requires mandatory distributions once you reach age 72. However, you might be able to roll over your Individual Roth 401 assets to your Roth IRA once youre no longer employed, effectively getting around this rule.

- Not all brokerage houses offer individual Roth 401 products.

- You cant change your mind about Roth 401 contributions, rolling them over to your traditional 401 and taking the tax deduction later. Once its done its done. Its a better deal in the long run, anyway.

Anyone who can take advantage of these tax shelters probably should. At the very minimum, it warrants a meeting with your qualified tax adviser to seriously discuss the topic. The consequences in terms of real-world dollars and cents are profound.

Read Also: Can I Transfer My 401k To My Spouse

Dont Make These Common Self

1) Only contributing up to the maximum by the employee. Dont forget the profit sharing portion in #2 if you have leftover operating profits.

2) Calculating the profit sharing contribution based off gross income before operating expenses instead of operating profits. Otherwise, you will over contribute.

3) Not deducting from operating income the 1/2 SE tax deduction, which also leads to over contributing.

Why Choose Roth Over A Traditional Ira

Like we talked about earlier, since you pay taxes on the money you put in your Roth IRA when you invest it, youll be able to use your savings in retirement tax-free. That means if you contribute the maximum amount each year, you could potentially have a nest egg worth almost $1.5 million after 30 years! Weve got your attention now, right? And you wont have to pay a penny in income taxes when you withdraw that money in retirement.

Its also important to remember that you have no idea what tax rates will be when you reach retirement, especially if you move up in tax brackets throughout your career .

With a Roth IRA, youre paying the current income taxes within your bracket as you contribute. So, when you finally settle down to enjoy that nest egg, you know exactly how much money is yours versus Uncle Sams.

Recommended Reading: What Is A 401k Annuity

Don’t Miss: Can You Use 401k For Investment Property

Round #3 When Is The Contribution Deadline For Solo 401 And Sep Ira

For 2020, the contribution deadline for the Solo 401 as well as the contribution deadline for the SEP IRA has been extended to May 17, 2021. This deadline is specifically for the employer contributions.

If youre setting up a solo 401 just now for the tax year 2020, you cannot contribute as an employee, unfortunately. But you can do so for the tax year 2021. The takeaway is you still have time to create and put in money to either a solo 401 or a SEP IRA, as the Employer. Make sure you do this before the deadline. Take a break from uploading your TikTok video for a day!

Round 3 Winner: Its a tie. The Solo 401 contribution deadline and SEP IRA contribution deadline are the same.

How Do I Maximize Individual 401 Contributions

The Individual 401 plan allows participants under 50 years old to defer through salary withholding $18,500 in 2018 per person. Participants 50 years old and over can contribute an additional $6,000. Employers can contribute up to 25% of each employees compensation to the Individual 401 plan, up to a combined maximum of $55,000. This maximum increases to $61,000 for participants over 50 years old . More details and guidelines can be found on the IRS website at .

Individual 401 plans do not need to file a 5500 IRS tax form unless their total plan assets are over $250,000. Many Solo 401 plans do not hire a third party administrator until theyre required to file the Form 5500. The complexities of these small 401 plans are much smaller with only one or two participants, which reduce the need to have a TPA until youre required to file the Form 5500. Its a good idea to discuss the tax implications with your CPA or financial advisor.

Recently Individual 401 plans have become popular with oil and gas consultants. There are other tax deductions and retirement strategies to take advantage of beyond an Individual 401 plan. We can help if youre looking to set up an Individual 401 / Solo 401, or if you have a 401 from a previous employer that youd like to rollover to an IRA! Colorado Financial Management has been assisting clients with retirement and 401 solutions for over 20 years.

Read Also: Can I Have 2 401k Plans

You May Like: Is A 401k Rollover To Ira Taxable

Deadline To Set Up And Fund

- For taxable years 2020 and beyond, individual 401 plans may be set up by tax filing deadlines plus extensions. Note: It can take 30 or more days to establish a plan.

- Salary deferral portion of the contribution must be deducted from a paycheck prior to year end, with some exceptions for certain business structures.

- Business owner contributions may be made up through the business tax filing due date plus extensions.