Withdrawing Funds From A 401 Before 55

If you are younger than 55, you may still qualify to withdraw money without quitting your current job. You can take a hardship withdrawal if you have a qualified expense. For example, you can take a hardship withdrawal to pay qualified educational fees, medical expenses, alimony and child support, repair of damage to your residence or to purchase your principal residence. You will owe income tax on the amount you take out from your retirement savings as a hardship withdrawal.

How Much Can I Earn While On Social Security

Many people receiving Social Security retirement benefits choose to continue working or return to work. Some enjoy the social aspect of working, while others have a financial need. However, working past your retirement can affect your monthly benefit from the Social Security Administration.

Just how much can you earn while receiving Social Security? The answer depends on whether or not you have reached full retirement age. Working can potentially decrease your monthly benefit payment and cause your Social Security benefits to become taxable. Keep reading as we tell you how much you can earn while on Social Security without affecting your benefits!

What Is A Roth 401

Some 401s allow you to make Roth contributions. A Roth 401 contribution has a different tax structure than your standard 401 deposit. While the traditional 401 contribution is tax-deductible up front and taxable when you withdraw funds, the Roth contribution is the opposite. You get no tax deduction for a Roth contribution, but your withdrawals in retirement are tax-free.

You May Like: How Can I Find My 401k Balance

How Are 401 Withdrawals Taxed

If a rollover-eligible withdrawal is made to you in cash, the taxable amount will be reduced by 20% Federal income tax withholding. Non-rollover eligible withdrawals are subject to 10% withholding unless you elect a lower amount. State tax withholding may also apply depending upon your state of residence.

However, your ultimate tax liability on a 401 withdrawal will be based on your Federal income and state tax rates. That means you will receive a tax refund if your actual tax rate is lower than the withholding rate or owe more taxes if its higher.

If a 401 withdrawal is made to you before you reach age 59½, the taxable amount will be subject to a 10% premature withdrawal penalty unless an exception applies. This penalty is meant to discourage you from withdrawing your 401 savings before you need it for retirement. You can avoid the 10% penalty under the following circumstances:

- You terminate service with your employer during or after the calendar year in which you reach age 55

- You are the beneficiary of the death distribution

- You have a qualifying disability

- You are the beneficiary of a Qualified Domestic Relations Order

- Your distribution is due to a plan testing failure

A full list of the exceptions to the 10% premature distribution penalty can be found on the IRS website.

Understanding The Rules For 401 Withdrawal After 59 1/2

LAST REVIEWED Apr 15 20219 MIN READ

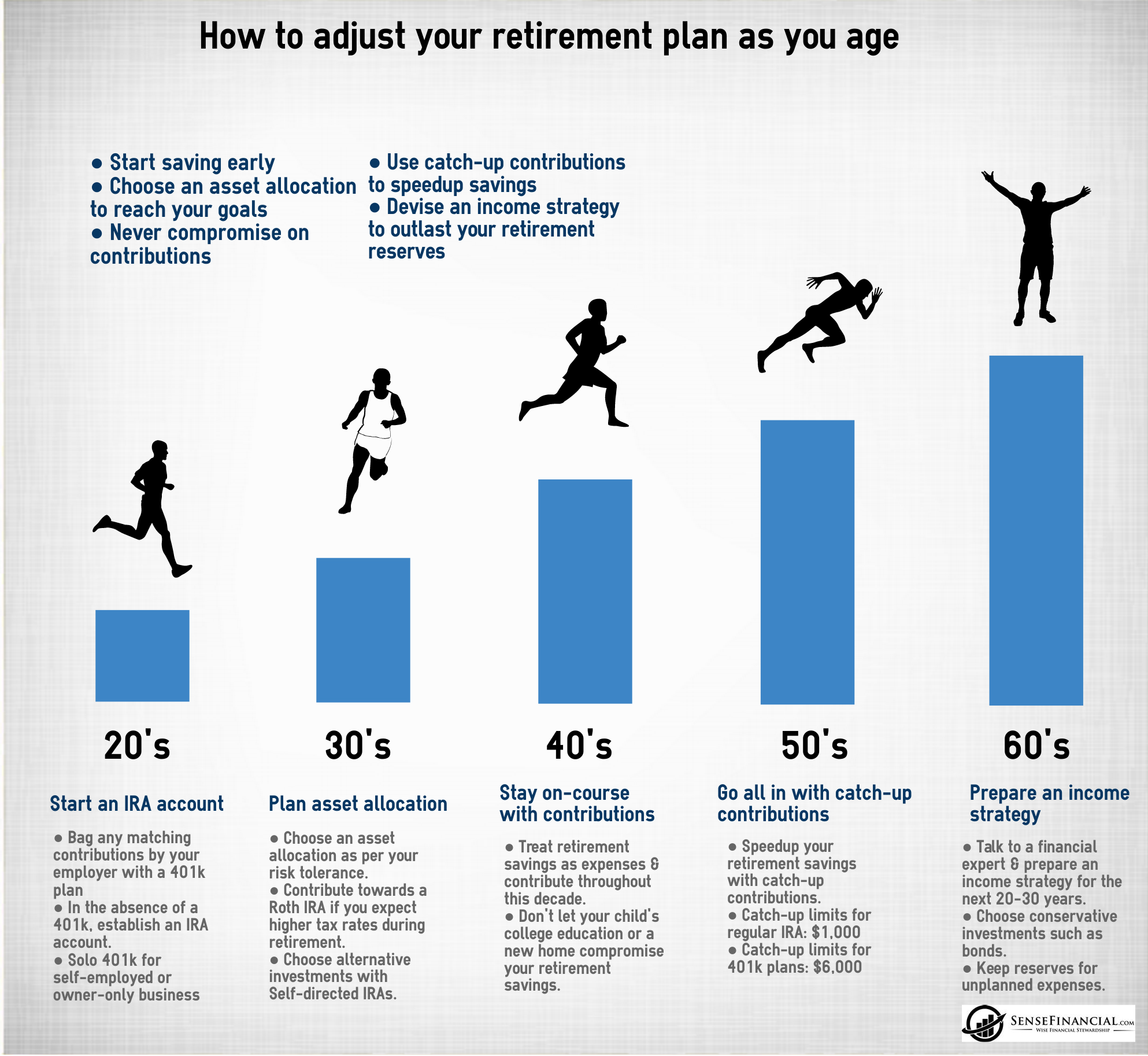

A 401 is a type of investment account thats sponsored by employers. It lets employees contribute a portion of their salary before the IRS withholds funds for taxes, which allows interest to accumulate faster to increase the employees retirement funds. Now, if you have a 401, you could pay a penalty if you cash out your investment account before you turn 59 ½.

Heres some more information about the rules you need to follow to maximize your 401 benefits after you turn 59 ½.

Also Check: How Much You Should Contribute To 401k

Social Security Payments For December: When Is Your Money Coming

Social Security payments for December started going out this week. See when your payment will arrive.

Katie Teague

Writer

Katie is a writer covering all things how-to at CNET, with a focus on Social Security and notable events. When she’s not writing, she enjoys playing in golf scrambles, practicing yoga and spending time on the lake.

The Social Security Administration this week started disbursing December payments. In , you’ll get your first increased benefit amount. For those who receive Supplemental Security Income, you’ll get your first increase in December. We’ll explain why below and how the timing of Social Security payments works.

This month, keep an eye out for a letter in the mail about your Social Security benefits increase for 2023. It’ll have details about your individual benefit rate increase for next year — or you can also check your benefits online using your My Social Security account.

Read more: Stimulus Checks: 18 States Are Sending Tax Rebates to Residents

Withdrawing Funds Between Ages 55 And 59

Most 401 plans allow for penalty-free withdrawals starting at age 55. You must have left your job no earlier than the year in which you turn age 55 to use this option. You must leave your funds in the 401 plan after leaving your job in order to access them penalty-free, but there are a few exceptions to this rule. This option makes funds accessible as early as age 50 for many police officers, firefighters, and EMTs.

Make sure you understand the rules around the age requirement for penalty-free withdrawals. The age 55 rule won’t apply if you retire in the year before you reach age 55, and your withdrawal would be subject to a 10% early withdrawal penalty tax in this case.

The age-55-and-up retirement rule won’t apply if you roll your 401 plan over to an IRA. The earliest age to withdraw funds from a traditional IRA account without a penalty tax is 59½.

Read Also: Can I Take Money From 401k To Buy A House

What Types Of Retirement Plans Require Minimum Distributions

The RMD rules apply to all employer sponsored retirement plans, including

profit-sharing plans, 401 plans, 403 plans, and 457 plans. The RMD rules also apply to traditional IRAs and IRA-based plans such as SEPs, SARSEPs, and SIMPLE IRAs.

The RMD rules also apply to Roth 401 accounts. However, the RMD rules do not apply to Roth IRAs while the owner is alive.

The Costs Of Early 401k Withdrawals

Early withdrawals from an IRA or 401k account can be expensive.

Generally, if you take a distribution from an IRA or 401k before age 59 ½, you will likely owe:

- federal income tax

- 10% penalty on the amount that you withdraw

- relevant state income tax

Calculate It:401k Withdrawals Before Retirement

The 401k can be a boon to your retirement plan. It gives you flexibility to change jobs without losing your savings. But that all starts to fall apart if you use it like a bank account in the years preceding retirement. Your best bet is usually to consciously avoid tapping any retirement money until youve at least reached the age of 59 ½.

If youre not sure you should take a withdrawal, use this calculator to determine how much other people your age have saved.

Recommended Reading: How Do You Set Up A 401k

Converting A 401 To An Ira

You cannot contribute to a 401 after you leave your job, so if you want to continue adding money to your retirement funds, youll need to roll over your account into an IRA. Previously, you could contribute to a Roth IRA indefinitely but could not contribute to a traditional IRA after age 70½. However, under the new Setting Every Community Up for Retirement Enhancement Act, you can now contribute to a traditional IRA for as long as you like.

Keep in mind that you can only contribute earned income, not gross income, to either type of IRA, so this strategy will only work if you have not retired completely and still earn taxable compensation, such as wages, salaries, commissions, tips, bonuses, or net income from self-employment, as the IRS puts it. You cant contribute money earned from either investments or your Social Security check, though certain types of alimony payments may qualify.

To execute a rollover of your 401, you can ask your plan administrator to distribute your savings directly to a new or existing IRA. Alternatively, you can elect to take the distribution yourself. However, in this case, you must deposit the funds into your IRA within 60 days to avoid paying taxes on the income.

Traditional 401 accounts can be rolled over into either a traditional IRA or a Roth IRA, whereas designated Roth 401 accounts must be rolled over into a Roth IRA.

How To Use The Rule Of 55 To Retire Early

Many companies have retirement plans that allow employees to take advantage of the rule of 55, but your company may not offer the option.

401 and 403 plans are not required to provide for rule of 55 withdrawals, so dont be surprised if your plan does not allow this, says Paul Porretta, a compensation & benefits attorney at Troutman Pepper, a law firm based in New York City.

Many companies see the rule as an incentive for employees to resign in order to get a penalty-free distribution, with the unintended consequence of prematurely depleting their retirement savings, he says.

Here are the conditions that must be met and other things to consider before taking a rule of 55 withdrawal.

However, as with any financial decision, be sure to check with a trusted advisor or tax professional first to avoid any unforeseen consequences.

Don’t Miss: How To Use 401k To Buy Stock

Are You Still Working

You can access funds from an old 401 plan after you reach age 59½ even if you haven’t yet retired. The best idea for old 401 accounts is to roll them over when you leave a job. You won’t be hit with penalties if you withdraw from your old accounts if you’re at least age 59½. But you should check with your human resource department about the rules for withdrawing from your current 401 if you’re still in the workplace.

If I Participate In A Sep Plan Can I Contribute To A Roth Ira In Addition To Receiving Contributions Under The Sep Plan

A SEP-IRA is a traditional IRA that holds contributions made by an employer under a SEP plan. You can both receive employer contributions to a SEP-IRA and make regular, annual contributions to a traditional or Roth IRA. Employer contributions made under a SEP plan do not affect the amount you can contribute to an IRA on your own behalf.

Because a SEP-IRA is a traditional IRA, you may be able to make regular, annual IRA contributions to this IRA, rather than opening a separate IRA account. However, any dollars you contribute to the SEP-IRA will reduce the amount you can contribute to other IRAs, including Roth IRAs, for the year.

Example 1: Nancys employer, JJ Handyman, contributes $5,000 to Nancys SEP-IRA at ABC Investment Co. based on the terms of the JJ Handyman SEP plan. Nancy, age 45, is permitted to make traditional IRA contributions to her SEP-IRA account at ABC Investment Co., and she contributes $3,000 in 2019. If Nancy also wants to contribute to her Roth IRA at XYZ Investment Co. for 2019, she can contribute $3,000 by April 15, 2020.

Don’t Miss: How To Take Out A Loan Against 401k

How Are Withdrawals Of Roth 401 Deferrals Taxed

Because Roth 401 deferrals are contributed to your account on an after-tax basis, they are never taxable upon withdrawal. Their earnings can also be withdrawn tax-free when theyre part of a qualified withdrawal. A qualified withdrawal is one that occurs 1) at least five years after the year you made your first Roth deferral and 2) after the date you:

- Become disabled

If you withdraw Roth 401 deferrals as part of a non-qualified withdrawal, their earnings are taxable at applicable Federal and state rates and may be subject to the 10% premature withdrawal penalty.

Additional answers to Roth questions can be found in our Roth FAQ.

How Much Can I Withdraw Using The Rule Of 55

Under the rule of 55, you can take penalty-free distributions from your most recent employer-sponsored 401 or 403 if you’re age 55 or older and were laid off, fired, or quit your job. The amount you can withdraw will depend on the amount of money in your 401 or 403 account, and it is limited to your compensation multiplied by the number set for that tax year .

You May Like: How Much Do I Put In My 401k

What Are The Pros And Cons Of Withdrawal Vs A 401k Loan

| Pros and Cons of 401k Withdrawal vs. 401k Loan | ||

|---|---|---|

| 401k Withdrawal | ||

|

|

|

| Cons |

|

|

You Must Begin Taking Distributions At Age 72

Even if you donât need the money, youâll have to start taking required minimum distributions from your 401 beginning at age 72. The same goes for any other tax-deferred retirement accounts you may have. , you can get around this by converting these funds to a Roth IRA. However, you wonât owe any taxes on the money in a Roth 401, and itâs distributed proportionately.)

The amount youâre required to withdraw depends on your retirement account balances and your life expectancy. While these IRS worksheets can help you do the math, a financial advisor can help you think about how to be effective with your distributions.

Also Check: How To Avoid Penalty On 401k Withdrawal

Withdrawals After Age 59

Tax-advantaged retirement accounts, such as 401s, exist to ensure that you have enough income when you get old, finish working, and no longer receive a regular salary. From time to time, you may be eager to tap into your funds before you retire. However, if you succumb to those temptations, you will likely have to pay a hefty priceincluding early withdrawal penalties and taxes such as federal income tax, a 10% penalty on the amount that you withdraw, and relevant state income tax.

Most Americans retire in their mid-60s. Theres a little more flexibility offered with retirement savings plans, though, including the company-sponsored 401. The Internal Revenue Service allows you to begin taking distributions from your 401 without a 10% early withdrawal penalty as soon as you are 59½ years old.

If you retireor lose your jobwhen you are age 55 but not yet 59½, you can avoid the 10% early withdrawal penalty for taking money out of your 401. However, this only applies to the 401 from the employer that you just left. Money that is still in an earlier employers plan is not eligible for this exceptionnor is money in an IRA.

How Does A 401 Work When You Retire

Over the course of your working years, you diligently contribute to your 401 in preparation for retirement. But what happens once you actually get there? In short, itâs time to switch from saving your money to generating income with your savings.

So how does a 401 work when you retire? For starters, it can be an essential source of income when you exit the workforce. But before you start withdrawing money from your 401, itâs a good idea to build a plan to create your retirement income. Hereâs what you can expect from your 401 when you retire.

Also Check: What Is A 401k Vs Roth Ira

Take Caution If You Are Not 55 Yet

Do not retire earlier than age 55, thinking you can access your 401 funds penalty-free once you turn 55. For example, if you retire at 54, believing in one year you can access funds penalty-free, youll have missed the mark. To avoid the penalty from 55 59 ½, you needed to leave your employer no earlier than the year you attained the age of 55. When you leave your employer before age 55, the earliest you can access funds penalty-free will be age 59 ½.

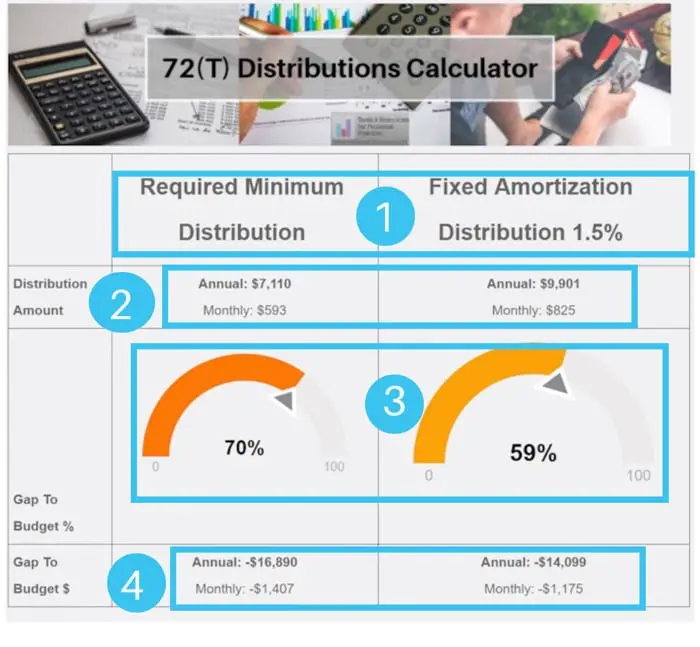

If you roll your previous 401 into a new employers 401 or to an IRA, you void the early access rule! Once its rolled over, you cannot withdraw money until youre 59½ without penalties unless you qualify for an exception or use an odd tax code provision called 72 payments.

What Age Can You Withdraw Money From A 401 Without A Penalty

The 401 is a retirement savings plan sponsored by an employer. It is a way for employees to save for retirement on a tax-deferred basis. This means that the money you contribute to your 401 account grows tax-free until you retire and start withdrawing it.

You can start withdrawing money from your 401 without paying the penalty at 59 ½. This is the age that the IRS has designated as the age of retirement. However, you will be penalized if you withdraw money from your 401 before this age. The penalty for early withdrawal is ten percent of the amount withdrawn.

So, if you want to avoid paying the penalty, you need to wait until you are at least 59 ½ years old before you start withdrawing money from your 401.

Recommended Reading: How To Open A 401k Account