What Happens If You Leave A Company Before You Are Vested

4.3/5Leaving before youvestedYouyouryou when you leave a jobyoukeep youryou are vestedread here

Some employees are allowed to exercise options before they vest, known as early exercising. If any of the option shares you exercised are still unvested when you leave your job, the company has to pay to repurchase those shares from you.

Additionally, what does it mean when your vested? Vesting in a retirement plan means ownership. This means that each employee will vest, or own, a certain percentage of their account in the plan each year. An employee who is 100% vested in his or her account balance owns 100% of it and the employer cannot forfeit, or take it back, for any reason.

Keeping this in view, can vested options be taken away?

After your options vest, you canexercise them that is, pay for the stock and own it. It may be couched in language such as company repurchase rights,redemption or forfeiture. But what it means is that the company canclaw back your vested stock options before they become valuable.

What happens to 401k money that is not vested?

If you leave a company that matched 401k contributions before the vesting schedule is complete, the nonvested money is returned to the employer. If your contributions have vested 80% upon your departure, the employer is returned 20%.

Employee Stock Option

Also Check: How Much Will Be In My 401k When I Retire

K Plan Based On Company Size

While 401 becomes a promising motivation for employees and appealing addition to the job postings to attract more talent, businesses must consider the best strategies to reap the benefits of this benefit. Below are some of the best practices and the types of 401 plan that is ideal whether you are operating for a small, medium, or large enterprise:

Small to Medium Enterprise

Small to mid-sized businesses, aiming to expand their operations and company size will benefit from offering 401 to their employees and business partners. But to better manage your organizationsâ 401, the Department of Labor has given the following steps when establishing this retirement plan:

Adopt a written plan documentâ

This documents a day-to-day plan for your businessâ 401 plan. You may seek help from financial institutions or retirement plan professionals to draft a plan that best works for you.

Arrange a trust for the planâs assets

âSetting up a trust ensures that the planâs assets will be allocated solely for this benefit. It must have at least one trustee to handle the contributions, investments, and distributions on the plan.

Develop a recordkeeping systemâ

How To Ease 401 Plan Implementation For Your Business

Since theres a lot to stay on top of when you decide to start a 401 at your company, you may decide to outsource administration of your plan to a TPA. If you do, then Complete Payroll Solutions may be a good fit for you if you want a TPA that:

- Offers creative plan design by using safe harbor, new comparability and age-weighted formulas.

- Can help you avoid the year-end data crunch. We maintain all the necessary data on our platform to file Form 5500 and complete the compliance testing for the plan, minimizing the data collection work on your end.

- Offers great value with our administration and recordkeeping services bundled together.

- Provides added benefits that make administration even more seamless for you like uploading 401 contributions to your product provider.

To learn more about what we can offer you, read our next article on our 401 services. If you want to find out the top factors you should consider when selecting a 401 provider, read our checklist.

Recommended Reading: What Happens To My 401k From My Old Job

What Is A 401k Retirement Plan

A 401k retirement plan is a retirement savings plan or fund sponsored by a business. Typically, an employer will withhold a certain amount of an employees pay, add to it, and then transfer it into a 401k in the employees name.

Many companies offer a 401K retirement plan as part of their overall benefits package. This is designed to attract top talent and to keep them. Lets give an example of how this could work.

Jimmys Juice, located in a suburb of Chicago, is a fruit juice manufacturer. Although not a huge company, profits have been steadily increasing since it opened for business three years earlier. Back then, Jimmy Johnson, the companys owner, could not offer much for his employees in the way of benefits except what was mandated by law. Recently he introduced a 401k plan for his employees.

Sarah Thompson works for Jimmy. Her salary is $60,000 per year. She contributes a certain percentage of her paycheck to this new 401k plan. The payroll department at Jimmys company routes this money directly into an account theyve opened in Sarahs name, meaning deposits into it will never actually pass through Sarahs hands.

Sarahs contributions equal $8,000 over the course of the year. The IRS now looks at Sarahs gross income for the year as $52,000, not $60,000. For this reason, less tax has been taken off her regular biweekly paycheck.

RELATED ARTICLES

Setting Up A 401 Plan For Your Small Business In Five Steps

This guide reviews the ins and outs of starting a 401 plan. To help, weve broken things down into five sections:

Choosing the type of retirement plan you want to offer

Determining the design of your 401 plan

Selecting your 401 plan provider

Making your 401 plan official

Maintaining your 401 plan

Weve also included some FAQs, should you need any specific questions answered during the process. But before we dive too deep, lets dig a little deeper into some of the benefits of a 401 plan.

Don’t Miss: How To Choose A 401k Provider

Common Questions Plan Participants May Ask Employers About A New 401 Plan:

- What other plans were considered? How does this choice compare?

- When can I start contributing?

- What affect will this have on my taxes?

- Does the company match contributions? How does that work? What is the limit?

- What are the investment options? Can I manage my own investments?

- How often can I change my investment and contribution options?

- Can I access my plan online?

- When can I withdraw money? Can I make an emergency withdrawal from my plan?

Roll The Money Into Your New 401

If youâve been offered a new job and it comes with a 401, you may be able to just move your money out of your old retirement plan and into a new one. The benefit of going this route, assuming you plan to participate in your new employerâs 401, is that youâll have all of your retirement funds in a single account. That should, in turn, make your money easier to manage and make your savings progress easier to track.

That said, youâll want to do whatâs known as a direct rollover into your new 401. That way, the money will move from your old plan right into your new one, as opposed to you getting a check and having to make that transfer.

If you donât do a direct rollover, but instead get a check for your old 401 balance, itâll be on you shoulders to transfer it into your new plan in a timely fashion. Otherwise, you may face tax-related consequences. Plus, you may not get your entire 401 balance, as your employer may be required to withhold some of it for tax purposes, even if your intent is to transfer your entire balance over to another 401. Thatâs a hassle youâre better off avoiding.

Also Check: How To Start Withdrawing From 401k

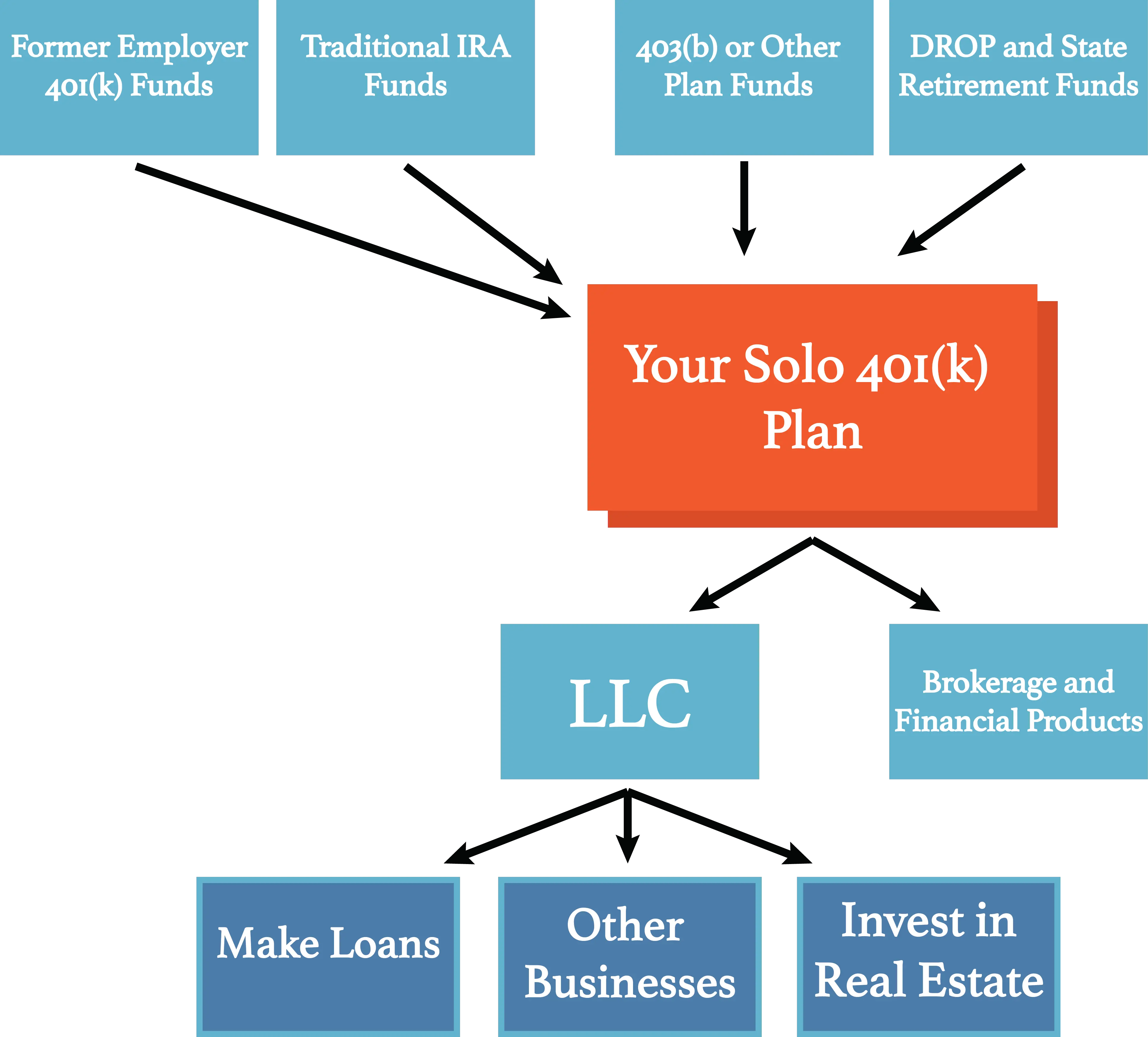

How The Solo 401 Works

Solo 401s are a retirement savings option for small businesses whose only eligible participants in the plan are the business owners . It can be a smart way for someone who is a sole proprietor or an independent contractor to set aside a decent-sized nest egg for retirement.

Not content with the federal acronym, various financial institutions have their own names for the solo 401 plan. The independent 401 is one of the most generic. Other examples include:

- One-Participant k

- Self-Employed 401

If you are not sure which name your financial service provider uses, ask about the 401 plan for small business owners. The IRS provides a handy primer on such plans.

To Do Right By Their Employees

According to the National Institute on Retirement Security, over 38 million working age households have zero retirement savings. With life expectancy getting longer and longer, its crucial that your employees have enough saved for a comfortable retirement.

Given that saving for retirement is the #1 source of financial stress for Americans, a 401 optimized for employee savings could have a big impact on their quality of life. Studies show reducing financial stress may even make them more productive at work.

In addition to all the aforementioned benefits, 401s can also earn your small business some major tax credits!

Once youre clear on your reasons for starting a 401 and what you need it to accomplish, youre ready to move on to step 2.

Don’t Miss: Should You Use 401k To Pay Off Debt

Operating Your 401k Plan

Once you have established your 401k plan, it is essential to have a system for operating and maintaining it. By establishing the plan, you have assumed the responsibilities that come with plan administration. Suppose you have opted to hire a professional. In that case, they may take over some or all of the duties associated with operating the plan.

As a plan administrator, you are liable for ensuring that everything is running smoothly and that your employee portfolios perform at the highest level. This process can also be referred to as 401k Benchmarking. If you breach your fiduciary responsibilities, the portfolios under your care may experience loss. In the event of this kind of error, you may be held personally liable.

At Benchmark My Plan, we offer peace of mind by providing benchmarking at no cost. Benchmarking will enable you as the employee fiduciary to have confidence knowing that your employees retirement accounts are taken care of, and you are ERISA compliant.

Our extensive network of financial advisors is ready to help you benchmark your 401k at a moments notice. Reaching out to us is quick and easy. Give us a call at , and we can connect you with an advisor that is right for your case.

What Are The Advantages Of 401 Matching

While businesses arent required to offer a 401 contribution match for employees, its still a good idea. Robertson said matching contributions can boost employee morale and, because they are deductible, drive down a businesss tax liability.

If you want to offer a matching program but youre afraid some employees will just take the money and run, consider a vesting schedule. With this arrangement, employees cant take the employers contributions until the employees have participated in the retirement plan for a certain length of time.

For example, employer matching contributions might not fully vest for three years. If an employee leaves for another job before those three years are up, they arent entitled to all of the contributions the employer has made on their behalf. Of course, they do get to take all of the money they have personally contributed.

Some companies opt for profit-sharing contributions to employees 401 accounts when business is good. As mentioned above, these contributions are also tax deductible.

The typical 401 match is called a safe harbor nonelective match of 3% of salary, Pyle said. This means the employees get 3%, whether or not they participate in their employers 401 plan. Other match types are 100% on the first 3% of salary deferred and 50% on the next 2% of salary deferred.

Did you know?: Some of the best payroll software providers, such as ADP and Paychex, offer 401 plan services as part of their packages.

Don’t Miss: How To Find Out Your 401k Balance

Solo 401 Eligibility Requirements

Setting the wrong eligibility requirements could result in you being excluded from the plan or non-owner employees being eligible to participate in the plan.

For example, say you elect zero years of service as a requirement to participate, but you have five seasonal employees who work fewer than 1,000 hours each year. These employees would be eligible to participate in the plan because they meet the age and service requirements. Consequently, their eligibility would disqualify your business from being suitable to adopt the solo 401 plan. Instead, you could adopt a regular 401 plan.

Some solo 401 products, by definition, require further exclusions. Before you decide to establish a solo 401 plan, be sure to check with your financial services provider regarding its provisions.

What Are The Benefits Of Offering A 401 To Employees

When it comes to 401 plans, there are often common misconceptions around the time, resources, and costs it takes to establish and set up a plan. Business owners may believe that a 401 plan isn’t right for them, are unclear of the benefits, or believe the administrative responsibilities are too cumbersome. In truth, there are some significant advantages in offering a 401 plan to employees:

- A 401 can help make your business more competitive in attracting and retaining top talent.

- Employers can take advantage of an annual tax credit of up to $5,000 for the first three years of the plan.

- Plan expenses are tax-deductible, along with employer contributions such as an employee match or profit-sharing.

- Advances in payroll integration and recordkeeping make the implementation and maintenance of offering a retirement plan more affordable than ever.

Read Also: Can I Pull From My 401k

Youre Our First Priorityevery Time

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Learn More About The Everyday 401 By Jp Morgan

You can sign up for an Everyday 401 by J.P. Morgan plan online. Get started today.

Everyday 401 by J.P. Morgan is not an offering of JPMorgan Chase Bank, NA clients will be directed to J.P. Morgan Asset Management, an affiliate.

This is a general communication being provided for informational purposes only. It is educational in nature and not designed to be a recommendation for any specific investment product, strategy, plan feature or other purposes. By receiving this communication you agree with the intended purpose described above. Any examples used in this material are generic, hypothetical and for illustration purposes only. None of J.P. Morgan Asset Management, its affiliates or representatives is suggesting that the recipient or any other person take a specific course of action or any action at all. Communications such as this are not impartial and are provided in connection with the advertising and marketing of products and services. JPMorgan Chase & Co. and its affiliates do not provide tax, legal or accounting advice. This material is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your personal tax, legal and accounting advisors for advice before engaging in any transaction.

If you are a person with a disability and need additional support in viewing the material, please call 1-800-343-1113 for assistance.

JPMorgan Chase Bank, N.A. Member FDIC. Equal Opportunity Lender, ©2022 JPMorgan Chase & Co

Recommended Reading: Can I Contribute To Both 401k And Ira

What Is The Cost When Starting A 401

When you decide to start a 401 plan at your company, youll likely have a one-time initial fee to set it up. This will cover activities like setting up the new plan and educating your employees about the plan.

For these services, you can expect to pay anywhere between $500 to $2,000. Keep in mind that theres a tax credit for start-up costs for small businesses with less than 100 employees, which the SECURE Act increased to up to $5,000 annually for the first three years.

At Complete Payroll Solutions, we charge a one-time $500 set-up fee.

Once your plan is up and running, youll have ongoing fees as well. These are broken down into employer costs and employee expenses.

- Employer: To maintain your plan, youll pay administrative fees annually. The more complicated the plan design, the higher the fees may be, but you will generally see costs ranging from $750 a year to $3,000. On top of these costs, youll pay whats known as a per-participant fee that will be somewhere in the range of $15 to $60 a year for each person enrolled. At Complete Payroll Solutions, we charge a quarterly plan administration fee of $275 plus $8 per participant.

- Employee: Your employees may see expenses deducted from their accounts or from the performance of the investments for three categories of fees. Specifically, they may be responsible for recordkeeping fees, mutual fund management fees, and investment advisory fees. All of these are based on a percentage of plan assets.