What To Look For In A Solo 401k

Going through the process of shopping around for a solo 401k provider, I’ve learned a lot about what to look for. There are a lot of options and nuances that you should look for when shopping for a 401k. Many of the “free” providers offer simple generic plans , and if those don’t work for you, you can have a third party provider create a custom 401k plan for your business, which you can then take to a brokerage .

Whoa, that sounds confusing, and it can be. So let’s look at the major options that you need to consider when selecting a solo 401k provider.

- Does the 401k provider offer both Roth and Traditional contributions?

- Does the 401k provider offer after-tax contributions to do a mega backdoor Roth IRA.

- Does the 401k provider offer loans from the plan?

- What types of investment options are allowed in the plan ?

- Does the provider allow rollovers into the plan and rollovers out of the plan?

- The costs to maintain the plan

- The costs to invest within the plan

Based on your wants and needs, there are a lot of things to compare when shopping for a solo 401k provider. Let’s compare some of the main firms that offer solo 401ks.

Is Exercising An Employee Stock Option Taxable

Employee stock options allow employees to buy their employer’s stock at a discount. The option alone doesn’t typically give the employee an ownership interest in the company, but exercising the option to buy the stock does.

There are two main types of stock options, each with its own tax results.

- Statutory stock options. Statutory stock options are granted under an employee stock purchase plan or an incentive stock option plan. Receiving a statutory stock option doesn’t result in a taxable transaction, but exercising your option and selling the stock does. Simply exercising the option without a sale typically doesn’t have any tax consequences either, although you’ll have to use Form 6251 to determine whether you owe the Alternative Minimum Tax .

- Nonstatutory stock options. Nonstatutory stock options are granted without one of these plans. When you exercise a nonstatutory stock option, you owe tax on the difference between the price you paid for the stock and its fair market value on the date you exercise the option.

When you use TurboTax to prepare your tax return, you just need to answer some simple questions about your options. The software will do the calculations and fill in all of the right tax forms for you.

How To Get Started With A 401

After opening your 401 via your employer, its time to start choosing your investments.Ultimately, its a matter of choosing which type of investment youd be most comfortable with. Youll have a choice of stock funds, blended funds, , target-date funds . With target-date funds, the investments become more conservative the closer you get to retirement. The other investment option is a bond.

Remember to weigh the pros and cons of each option before investing, and make sure youre clear on any fees that apply.

You May Like: Can I Take My Money Out Of My 401k

Liquidate Funds And Transfer To Your Bank

Once you have moved your tokens to a new platform like Coinbase or Binance, then you are ready to initiate a withdrawal to your bank.

First, you will need to sell the crypto. Second, you will withdraw the funds to your linked bank account.

If you choose to use Coinbase or Binance, you can learn more about those platforms and transferring from Trust Wallet by clicking on the respective links.

When you sell the cryptocurrency, it can trigger a taxable event. In the case of capital gains, you would be responsible for taxes. For instance, suppose you purchased $100 worth of Dogecoin when it was selling for $0.10. If you sold it at $0.12, then you would be selling for a gain. Thus, you would be responsible for taxes on the profit.

Td Ameritrade Solo 401k

TD Ameritrade is another low cost brokerage that offers a prototype free solo 401k plan. Their plan is the hardest to dissect, however, after discussing their plan with them, here is what we found.

The TD Ameritrade solo 401k plan only allows traditional contributions after July 2022 .

As such, TD Ameritrade will also discontinue allowing loans from their solo 401k, and existing loans will need to be repaid.

Looking at their plan document, they only allow rollovers from 401, 401, 403, 403, 408, and 457 accounts.

They also offer a lot of investment choices within their 401k plan. For example, they offer Vanguard ETFs commission free.

There are no setup fees or annual account fees with TD Ameritrade’s plan. All regular trades within the 401k are subject to their standard commission which is $0 per stock, ETF, and option trade. However, even beyond the Vanguard ETFs, they offer other ETFs commission free as well.

Note: If you currently have a plan with TD Ameritrade, and you have a Roth Solo 401k, you’re going to need to rollover your plan to another provider by July 2022 . This is a little bit of a hassle, but very do-able. It could also be a good time to consider using a third-party firm to setup a non-prototype plan and give you more options for investing.

Learn more about in our TD Ameritrade Review.

You May Like: When Do You Have To Draw From 401k

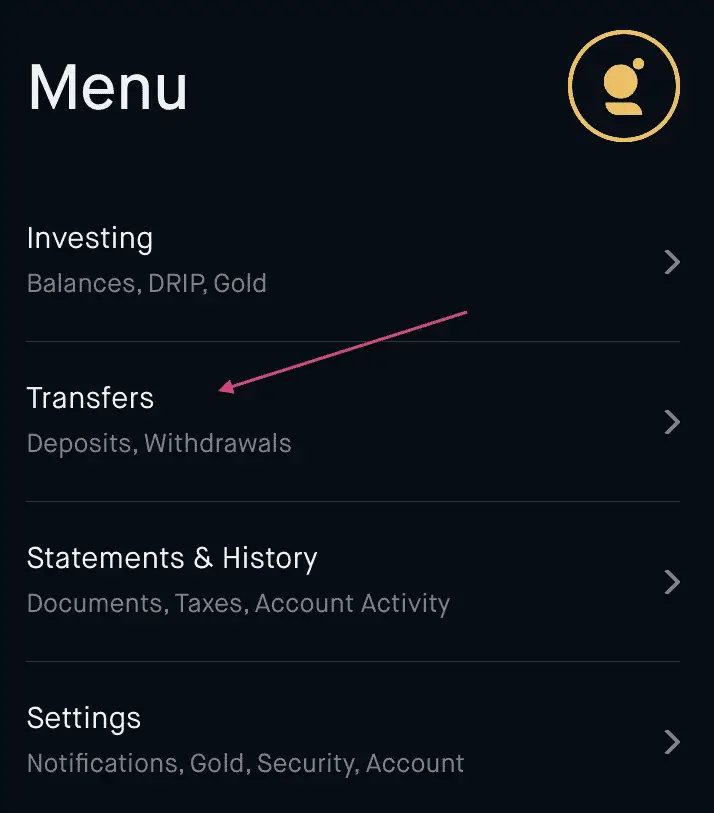

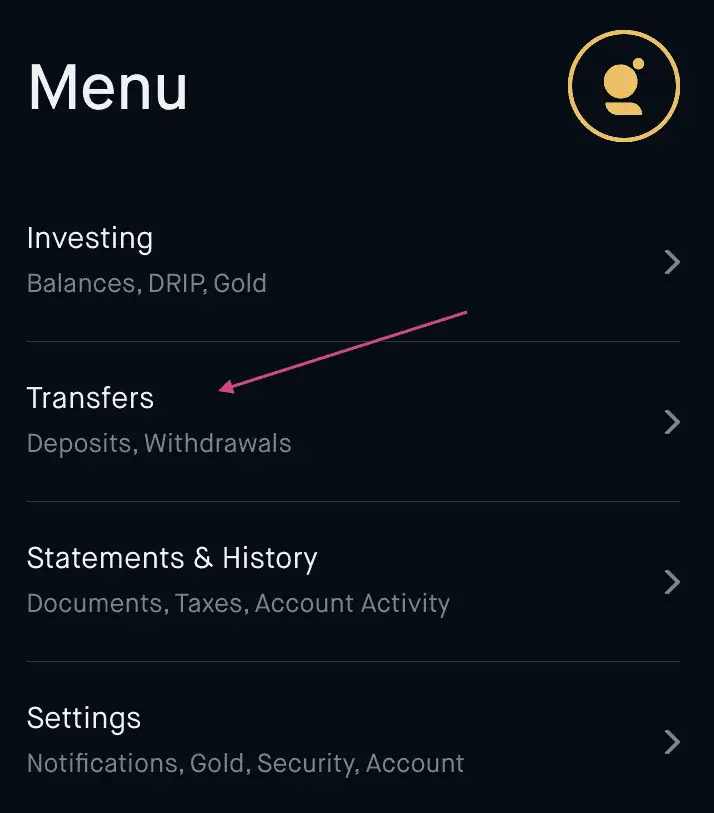

Accessible Investing With The Robinhood App From Robinhood Markets

Even if you’re not actively involved in the stock market, you probably own stocks. If you have a retirement plan at work, if you have a 401, or an IRA, you are probably invested in stocks, even if it’s via mutual funds. Perhaps today, perhaps tomorrow, or perhaps not until after you have retired, at some point you will need and want to take more control over your personal investments. Or maybe you’d just like to buy a few shares of Apple, because you enjoy using its products, or purchase a share or two of Disney to give to your child or grandchild.

With today’s spread of online discount brokers, dipping your toes into the investment waters is certainly much easier than ever. Most of these brokerages have gone a long way toward making their Web interfaces accessible with screen readers and magnification, but until now there have still been costs, primarily in the form of commissions, that limited the novice, very small investor.

AccessWorld has published many articles on accessible personal finance. In this article, we’re going to look at a new online brokerage that goes a long way toward resolving the issues of both expense and accessibility.

Accessible No-Commission Trading with Robinhood

Getting Started

Exploring the Robinhood Interface

Audible Charts

Making Trades with Robinhood

You can open a Robinhood account with no money, but you need sufficient funds to make trades. For this review I started out with $100, though I have subsequently added funds.

The Long and Short

Transferring Your Betterment Ira To A 401 Or Another Employer

Note that Roth IRAs cannot be transferred into 401s, even if its a Roth 401, due to IRS rules.

If your IRA is part of a Tax-Coordinated Portfolio, transferring your IRA will likely lead to rebalancing in any taxable accounts that are part of the Tax-Coordinated Portfolio and remain at Betterment. Rebalancing may result in the realization of taxable gains.

Lastly, if you request that an outbound transfer request be placed on hold, we will maintain the request for 30 days, at which point it will be canceled if you do not take further steps to complete the transfer.

Heres what we need to transfer your Traditional IRA to your Traditional 401:

- An acceptance letter from your new provider.

- A copy of a Betterment account statement, which you can find in Documents.

- A signed letter from you authorizing the rollover. This should reference the words, I authorize the transfer of assets from my Betterment Traditional IRA account into my 401/employer sponsored plan.

- If you are transferring out more than $250,000, the signed authorization letter will need to be medallion signature guaranteed.

All outgoing transfer paperwork must be mailed to:

Standard Mail

Irving TX 75063

Read Also: How To Check If You Have A 401k

Who Manages A 401

The employer and a nominated administrator are the two main entities involved in the management of a 401. Examples of some of the most widely used administrators include Charles Schwab, Paychex, Fidelity Investments, and American Funds.

Your company will choose an administrator. The administrator will be responsible for a range of tasks like ensuring your 401 plan is in keeping with legislative changes, reviewing and monitoring the 401s performance, compliance, and designing the plan itself.

If you are self-employed, you can set up a solo 401, which is managed through an administrator of your choosing.

Aside from the administrator, there are multiple other roles involved that ensure the smooth running of the 401. This includes financial advisors, auditors, and regulators that all work with the same purpose in mind.

However, you do have some control over your 401 plan. At a minimum, you can change investments quarterly, and likely much more often with resitrctions.

If your employer doesnt run their 401 plan under the US Department of Labors guidelines, your employer can decide how often you can change your investments.

Answers To Your Questions

To grow wealth, you need to invest. As a first-time investor, you may have a lot of questions about buying and selling stocks. Fortunately, easy-to-use investing platforms like Robinhood, Acorns, SoFi, and others provide an affordable alternative to picking stocks or mutual funds on your own or paying a wealth manager to invest your money for you.

There’s a lot you may want to know about selecting investments, what to do with your Acorns or Robinhood tax forms, and how your investment gains and losses are taxed. Here are answers to common questions for people who are new to investing.

Read Also: How Do You Rollover Your 401k To A New Employer

How Do I Transfer Shares Held By A Transfer Agent

Contact your transfer agent and obtain a current account statement, then submit your account statement to TD Ameritrade along with a completed TD Ameritrade Transfer Form. Be sure to indicate how you would like your shares transferred by making a selection in Section 3-D of the form.

Please note: The registration on your account with the transfer agent must match the registration on your TD Ameritrade account.

Should You Manage Your Own Portfolio Use An App

Most investment companies help you create a portfolio based that is managed by a robo-advisor. Sounds easy enough to do it yourself, right? While you can build and manage your own portfolio, investment companies like Robinhood, Acorns, and Schwab offer new investors a few helpful features.

- Help in selecting investments. Robo-advisors, such as Betterment, typically have you complete a questionnaire to provide information on your investment goals, time horizon and risk tolerance. Based on that information, the app creates your portfolio.

- Automatic rebalancing. Over time, investment gains and losses can cause your portfolio to be out of balance. A robo-advisor will periodically buy or sell assets within your portfolio to ensure itâs still in line with your financial goals.

- Low upfront investment minimums. Many mutual funds have hefty initial investment minimums anywhere from $1,000 to $3,000 or more. Many beginning investors canât afford to invest thousands of dollars right out of the gate. Robinhood and some other investment companies have low or no account minimums they may also require a more hands-on approach.

If you donât have a lot of money to invest right now or much time to spend researching investments and managing your portfolio, an app is a good place to start.

Don’t Miss: How Much You Should Have In 401k By Age

What Are Your Choices For A Rollover

In general, once you leave a job you have three choices for how to deal with your employer-sponsored retirement plan:

- Leave it with your old employers 401 plan: This approach requires the least amount of work, but may require you to have a minimum amount if you plan to maintain the account there.

- Roll it over into your new employers 401 plan: This approach will require you to file some paperwork, but youll have all your 401 money in one place. This choice can make sense if you like your new employers plan.

- Roll it over into an IRA: This move will require you to file some paperwork, but then youll have the complete freedom to invest the money as you see fit. If you liked the investment options you held in a previous plan, you may still be able to access those via an IRA.

, thats another option for a rollover. But this option is not typical for most individuals.)

If you roll over your 401 into an IRA, youll also want to consider the kind of rollover you need.

- With a Roth 401, youll likely be more interested in a Roth IRA, so that you can maintain the substantial advantages of that plan.

- If you have a traditional 401, then youll probably opt for a traditional IRA.

Read Also: Is 401k The Best Way To Save For Retirement

What Are The Advantages Of Rolling Over A 401 To An Ira

Doing a 401 rollover to an IRA offers perks that can include more diverse investment selections than a typical 401 plan, perhaps cheaper investments and lower account fees. Its also a way to keep your retirement funds organized and ensure you have easy access to them. And while some 401 plans pass account management fees along to the employees, many IRAs charge no account fees.

In summary, its a good way to save money, stay organized and make your money work harder.

Whether or not you can roll funds from a 401 or an individual retirement account into a more liquid investment fund depends on a few factors. You may be able to change your investments in an IRA, but doing so within a 401 is a different matter, as these plans typically have limited options from which to choose.

Speaking in general terms, IRA and 401 assets that are distributed and not rolled over to another IRA or eligible retirement plan will be subject to income tax. They may also be subject to an early-withdrawal penalty of 10% if you are under age 59½.

Also Check: How Much Should I Put In My 401k Calculator

What Are Capital Gains And How Are They Taxed

When you sell an investment, you often pay taxes on the profit you make from the sale. This profit is called a capital gain.

To calculate your capital gains and losses, you need four pieces of information:

The amount of tax you’ll pay on the capital gain typically depends on how much you made from the sale and how long you owned the asset.

- Short-term. If you owned the investment for one year or less, the sale is a short-term capital gain or loss. Short-term capital gains are taxed at the same rate as your ordinary income, such as wages from a job. Ordinary income tax rates for the 2022 tax year range from 10% to 37%. You can figure out which tax bracket you’re in using our Tax Bracket Calculator.

- Long-term. If you owned the investment for longer than one year, the sale is a long-term capital gain or loss. Long-term capital gains are typically taxed at special long-term capital gains rates, ranging from 0% to 20%.

For most people, the long-term capital gains tax rate is lower than their ordinary income tax rate, so it can be advantageous to hold investments that have increased in value for longer than one year before selling them.

Comparing The 5 Most Popular Solo 401k Providers

Now that we’ve covered the five major “free” solo 401k providers, let’s compare them in a chart side-by-side to see how their offerings compare to each other.

Sorry, the chart doesn’t display on mobile.

|

Comparing The Most Popular Solo 401k Providers |

|

|---|---|

|

E-Trade |

|

|

$0/trade |

$0/trade |

Notes: Vanguard’s annual fees can be waived over $50,000 in assets. Also, all of these companies offer commission-free ETFs, so you could potentially invest for free within your Solo 401k. Vanguard also have a very odd pricing schedule. While they do offer their own products commission free, if you want to buy other stocks or ETFs, you’ll pay anywhere from $2-$7 depending on how much in assets you have.

Now you can see why the choice of solo 401k providers is so difficult. Each firm has strengths and weaknesses, and the selection depends really on what matters to you. However, E*TRADE does stand out as having the most robust options.

And if none of these really excite you, you can always create your own solo 401k with a third party provider.

Read Also: Should I Transfer My 401k To A Roth Ira

Who Should Choose Robinhood

Robinhood makes investing about as easy as possible. The mobile app is quick to download, set up and fund, allowing you to start making trades almost immediately. In fact, this is a common criticism of Robinhood: It makes investing so easy it feels more like a game than a serious activity.

Still, its hard to beat the convenience of the Robinhood app. If you want to invest through your mobile device and dont need extensive research tools like screeners, you should get what you need from Robinhood. The company offers commission-free trades for all their investments, including cryptocurrency.

The reason Robinhood offers commission-free trades is that it acceptspayment for order flow, meaning they process trades through brokers who give them the highest fee, not necessarily the best rate for your investment. As a result, you could be paying more to buy and getting less when you sell investments.

Robinhood is missing several of the investment accounts and trading options found with Fidelity and is also lacking in terms of customer service. You can only request calls, and in-person branches arent accessible like Fidelity. Last, Robinhood doesnt provide as many educational materials as the best online brokers for beginners.

These drawbacks havent hurt Robinhoods popularity, though, especially with the younger smartphone generation. For many investors, the ease of use is worth it.