Can I Lose Money In A 401 Plan

401 plans are designed to be long-term investment plans. Therefore, over long time horizons, the likelihood of you losing money, especially a significant amount of money, in a 401 plan is considered to be low. That said, due to typical market fluctuations, it is common to see the value of your account drop from time to time. Furthermore, the performance of a 401 will be dictated by the risk level and type of securities one invests in. A well-diversified portfolio following a passive indexing strategy is generally recommended.

Mega Backdoor Roth Solo 401k Ban Question:

Since the Build Back Better bill did not pass in 2021, yes the solo 401k participant can still make voluntary after-tax solo 401k contributions for both 2021 and 2022 and subsequently convert the contributions to the Roth IRA or the Roth solo 401k. Since congress was not able to pass the BBB in 2021 which would have banned both the backdoor and the mega backdoor starting in 2022, if the bill is passed in 2022 it would be effective at the earliest starting in 2023 as this is how retirement regulation generally works .

How Much Should I Have Saved For Retirement By Age 50

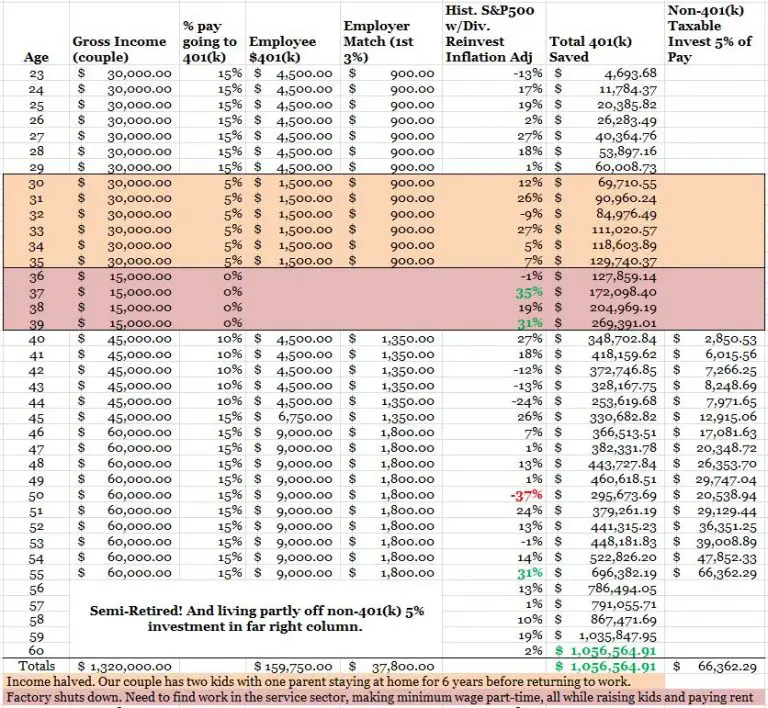

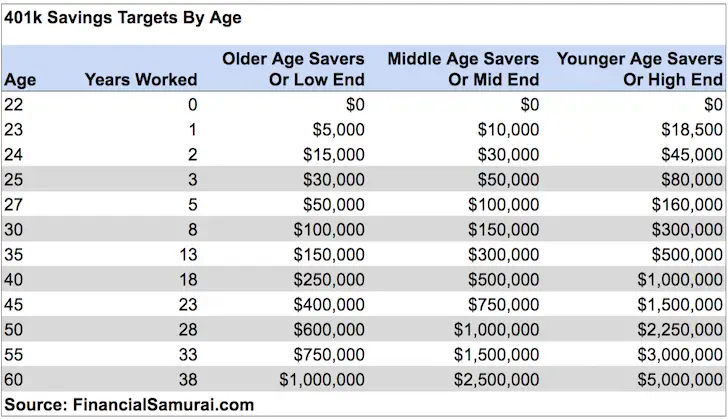

One suggestion is to have saved five or six times your annual salary by age 50 in order to retire in your mid-60s. For example, if you make $60,000 a year, that would mean having $300,000 to $360,000 in your retirement account. It’s important to understand that this is a broad, ballpark, recommended figure.

Don’t Miss: How To Rollover Your 401k To A Roth Ira

How Long Does It Take For A Small Business To Set Up A 401

Establishing a 401 can be a fairly straightforward process. However, without due diligence, that approach would be reckless and make your business vulnerable to expensive fees and risks associated with making hasty decisions regarding something as important as selecting a trustee. Depending on how much preliminary research you do, allow yourself ample time to create a plan document, establish a trust, notify employees, and launch your new benefit.

Total 401 Employer And Employee Annual Contribution Limits

| 2022 Limit | ||

|---|---|---|

|

Total with Catch-Up Contributions for those 50 or Older |

$67,500 |

$73,500 |

Many employers offer 401 matching contributions as part of their job benefits package. That means they agree to duplicate a portion of your contributions up to a set percentage of your salary. In addition, some employers may also share a percentage of their profits with employees in the form of non-matching contributions.

While an employers 401 matching and non-matching contributions dont count toward your annual employee deductible contribution limits, they are capped by total contribution limits.

Vanguard data from 2021 show that among 401 plans the firm administered, 95% of employers provided matching or non-matching contributions to their employees. Approximately 85% of employers provided a 401 match to their employees. Approximately 10% of employers provided non-matching 401 contributions, with no requirement that employees also contribute.

While the annual limits for individual contributions are cumulative across 401 plans, employer contribution limits are per plan. If you were to participate in multiple 401 plans in one calendar year , each of your employers could max out their contributions.

Also Check: How To Convert Traditional 401k To Roth Ira

How Much Can An Employer Contribute To A Solo 401

If you contribute to your solo 401 as an employee, you can contribute up to $20,500 for 2022. The total solo 401 contribution limit, if youre 50 or older, is $27,000.

Nonelective contributions to a solo 401 made as an employer, are generally limited to 25% of compensation, according to the IRS. If youre self-employed, your total contributions cant exceed your earned income for the 2022 tax year.

Theres also an overall contribution limit of $61,000 for 2022. So, total contributions to a participant’s account , cannot exceed that amount.

Who Qualifies For The Savers Credit

Depending on your income, you may qualify for the savers credit, which is a tax break designed to encourage lower-and middle-income taxpayers to save for retirement. For 2022, if your modified adjusted gross income is $34,000 or less, you may be eligible to claim the up to $1,000 savers credit. If youre married filing jointly, your modified adjusted gross income must be $68,000 or less, to claim the up to $2,000 savers credit.

The savers credit is based on a percentage of the first $2,000 or $4,000 that you contribute to your 401, IRA, or Roth IRA retirement account. But rollover contributions wont count toward the savers credit calculation.

Also Check: How To Invest Without A 401k

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

How is this page expert verified?

At Bankrate, we take the accuracy of our content seriously.

Expert verified means that our Financial Review Board thoroughly evaluated the article for accuracy and clarity. The Review Board comprises a panel of financial experts whose objective is to ensure that our content is always objective and balanced.

Their reviews hold us accountable for publishing high-quality and trustworthy content.

Arrow Right Arrow Right Arrow Right Arrow Right

At Bankrate we strive to help you make smarter financial decisions. While we adhere to stricteditorial integrity,this post may contain references to products from our partners. Here’s an explanation for how we make money

What Does The Irs Consider A Permanent Disability

A person is permanently and totally disabled if both of the following apply: He or she cannot engage in any substantial gainful activity because of a physical or mental condition, and. A doctor determines that the condition has lasted or can be expected to last continuously for at least a year or can lead to death.

Also Check: Can I Access My 401k If I Quit My Job

The Secure 20 Act And Your Retirement Savings: Expect To See These Big Changes

Congress passed the long-awaited SECURE 2.0 Act of 2022 that promises to restructure most Americans’ 401 plans and change retirement contribution and withdrawal rules to help Americans grow and preserve their nest eggs.

The SECURE 2.0 Act came as part of the $1.7 trillion omnibus spending bill Congress passed before closing for the Christmas holiday, and President Biden intends to sign it into law.

So what’s included in this retirement legislation? And how will it affect your money? We’ll talk you through the details of the SECURE 2.0 Act below. Keep in mind that new laws can be complex. A financial advisor can explain the intricacies of the SECURE 2.0 Act and how it directly affects you and your financial situation.

What Is the SECURE 2.0 Act?

The SECURE 2.0 Act puts in motion provisions to make retirement savings more straightforward and accessible to a wider range of people.

Beginning in December 2019, the original SECURE Act was created to re-introduce the topic of retirement probing onto the congressional agenda. There has been an evident and growing concern about retirement savings being cast aside that was in much need of attention.

From then to now, new provisions have been added to accomplish several tasks in the final bill being executed:

Keep in mind this is not an exhaustive list. For the full scope here is the government release of the SECURE 2.0 Act provisions.

Mandatory Retirement Auto-Enrollment

Increase Annual Catch-up Limits

Roth Matching

The Bottom Line

The 401 Contribution Deadline

While individual retirement accounts allow adding cash up until the annual tax filing deadline in April, 401 contributions do not fall under that same guideline. Contributions must be made by the close of the calendar yearmeaning by December 31. The same deadline applies to Roth 401 plans and even to the 403 plans offered by nonprofit organizations and government employees.

The reasoning for the year-end deadline is that these retirement plan contributions are made via payroll deductions, says Julie Virta, a certified financial planner and senior financial adviser with Vanguard Personal Advisor Services.

In other words, because contributions are made through payroll, account holders cannot simply take any money they may have available and add it to a 401 fund.

You May Like: Does Employee Match Count Towards 401k Limit

Benefits Must Not Be Assigned Or Alienated

The plan must provide that its benefits cannot be assigned or alienated. A loan from the plan to a participant or beneficiary is not treated as an assignment or alienation if the loan is secured by the participant’s account balance and is exempt from the tax on prohibited transactions under IRC 4975 or would be exempt if the participant were a disqualified person. See Publication 560 for additional information on prohibited transactions. A loan is exempt from the tax on prohibited transactions under IRC section 4975 if it:

- Is available to all such participants or beneficiaries on a reasonably equivalent basis,

- Is not made available to highly compensated employees ) in an amount greater than the amount made available to other employees,

- Is made in accordance with specific provisions regarding such loans set forth in the plan,

- Bears a reasonable rate of interest, and

- Is adequately secured.

Also, compliance with a qualified domestic relations order , does not result in a prohibited assignment or alienation of benefits.

Please Note: This Article May Contain Outdated Information About Rmds And Retirement Accounts Due To The Secure Act 20 A Law Governing Retirement Savings From Their Retirement Account Will Change From 72 To 73 Beginning January 1 2023 For More Information About The Secure Act 20 Please Read This Article Or Speak With Your Financial Consultant

Note: Due to the Coronavirus Aid, Relief, and Economic Security Act, required minimum distributions for IRAs were waived for 2020. Learn about the RMD waiver >

Dear Carrie,

I turn 70 this year and am working part-time. I don’t necessarily need the income but I like my work and it gives me money to spend on a few “extras.” I have a few dollars left over each month and recently read that I can still contribute to an IRA. With required minimum distributions around the corner and tax season here, I’m wondering if this is a good idea?

A Reader

Dear Reader,

According to a recent GALLUP survey, 63% of Americans plan on working part-time in retirement. And I think that makes a lot of sense. After all, working part-time not only provides some extra income, it’s also a way to stay active and engaged. To my mind, it’s an ideal scenario.

As you point out, the new SECURE Act has changed how you can treat your savings after age 70. Another change is the start date for required minimum distributions . Let’s review the RMD rules first, then take a look at the various accounts you can use for savings, beginning with IRAs, and then also look at employer plans and taxable accounts.

You May Like: How Do I Pull Money From My 401k

Solo 401 Establishment Deadline:

For 2021, in order to make employee contributions for 2021, the self-employed business owner had to establish the solo 401k plan by December 31, 2021. However, if the plan was established on January 1, 2022 or after by your business tax return due date including the business tax return extension, then you cam make employer profit sharing contributions for 2021 but cannot make employee contributions. For example, an employer operating the plan on a calendar-year basis had to complete the solo 401k plan documentation no later than .

For makin 2021 solo 401k plan contributions, the solo 401k has to be adopted by December 31, 2021 for self-employed businesses operating the plan on a calendar-year basis in order to preserve the right to make both employee and employer contributions in 2022 for 2021 by the business tax return including business tax return extensions. Otherwise, if the solo 401k plan is adopted on January 1, 2022 or after but by your business tax return due date including extensions, you will only be allowed to make employer contributions not employee contributions to the solo 401k plan. To learn more about the December 31, 2021 plan adoption/establishment deadline VISIT HERE.

Profit Sharing Contribution Question:

Yes, provided you each spouse separately has the necessary net self-employment income to satisfy said contribution amounts, as solo 401k contributions are based on each participants separate net self-employment income. For example, if the self-employed business is an LLC that is taxed as as sole proprietorship, both spouses will need to file a separate Schedule C and their solo 401k contributions will be based on their respective Schedule C net self-employment income figure, so line 31 of the Schedule C.

You May Like: How To Find Your 401k Account Number

Can I Contribute To A 401 After Year End

A common question is whether you can contribute to your retirement savings plan after December 31. The answer is that because 401 contributions are made through payroll deductions, December 31 is the deadline.

However, if you have an IRA, you can contribute to that account up until the 2022 tax year filing deadline, which is April 18, 2023. The IRA contribution limit is $6,000 and the $1,000 catch-up contributionif you are 50 or oldertakes the total maximum contribution to $7,000.

Deadlines: The Bottom Line

Both employers and employees receive tax benefits for contributing to a 401 plan. Employees can build their nest eggs tax-free, while employers enjoy tax credits and write-offs, lower employee turnover, and a more productive workforce. If youre a small business, a low-fee retirement program can benefit your employees and your bottom line.

Looking for a 401 provider that will help make sure youre covered on all of these deadlines? Human Interest provides support for compliance for 401 and 403 plans. to find out more about Human Interest.

Read Also: How To Find Out If Someone Has A 401k

Time For Depositing Elective Deferrals

Employers must deposit employee contributions to the retirement plans trust or individual accounts as soon as they can reasonably be segregated from the employers general assets. The Department of Labor provides a 7-business-day safe harbor rule for employee contributions to plans with fewer than 100 participants.

If you havent deposited employees elective deferrals as soon as you could have, find out how you can correct this mistake.

What Are The 401 Contribution Limits

There are two relevant 401 contribution limits you need to know.

The first is the individual contribution limit. This contribution limit is a limitation that applies to all 401s. In 2022, that limit is $20,500.

A 50/50 split means each 401 would support up to $10,250 and not a penny more. So, if you have one 401, you can contribute up to $20,500 to it. If you have two 401s, you can contribute up to $20,500 to all accounts combined.

The distribution can vary. If you want to put $20,000 in one 401 and $500 in the other, you can do so. It would be best if you simply made sure neither employer over-funds your accounts through automatic contributions. If you over-contribute, you may be subject to additional taxes on the excess, and youll be required to remove the extra contributions, paying the 10% early withdrawal penalty. In general, over-contributing is penalized and isnt worth trying to do.

Theres a second contribution limit, though, and its the most exciting. Its the employer contribution limit. This limit, as of 2022, is $61,000.

Theres one quirk, however. This limitation is calculated per employer rather than per employee.

In other words, both of your employers can potentially contribute up to $61,000 to your 401s. If you work two jobs and have two employers, and all three of you max out your contributions, thats $20,500 + $61,000 + $61,000.

Imagine a scenario such as this:

You have three relevant values here:

Also Check: When Can I Collect My 401k

Can I Contribute To A 401k While On Long

If you have a private IRA or 401k, your retirement benefits will have no affect on SSDI eligibility or payment amounts, as long as you paid taxes on your contributions. Retirement plan income however can stop you from receiving SSI or may reduce the amount of your monthly SSI payments.

Ira Deduction Limits For 2022

If you save with both a 401 and a traditional IRA, you may also face some limits on your ability to deduct your contributions depending on your income. Contributions to a Roth are never deductible.

For instance, if you are covered by a retirement plan at work:

- You can deduct up to the contribution limit, if youre single and your Modified Adjusted Gross Income is $68,000 or less for 2022. You can take a partial deduction if your income is between $68,000 and $78,000 in 2022. Theres no deduction for people who earn more than $78,000 in 2022.

- If youre married and filing jointly, you can deduct the full amount if your MAGI is $109,000 or less in 2022. You can take a partial deduction if your income is between $109,000 and $129,000 in 2022. Theres no deduction if you earn more than $129,000 in 2022.

Making pre-tax IRA contributions is a great way to save on taxes and invest for retirement. If your MAGI is above the threshold, your contribution would be considered nondeductible. There may be alternative and potentially better strategies to explore instead of making nondeductible contributions. Some other avenues to consider would be a Roth IRA and a taxable brokerage account.

Also Check: When Can You Start Your 401k