What Is A 401

A 401 plan is a retirement savings plan that allows workers to make pre-tax contributions from their paychecks and invest them, without having to pay taxes on the money they set aside until its withdrawn. Many plans also offer a Roth contribution option that allows employees to make contributions from money thats already been taxed so they dont pay taxes upon withdrawal.

Unlike pension plans, you dont have to manage the funds. Instead, employees control how their money is invested. But there are still costs to you for running a 401.

Take Note Older Savers

If you start saving later in life, especially when you’re in your 50s, you may need to increase your contribution amount to make up for lost time.

Luckily, late savers are generally in their peak earning years. And, from age 50, they have a greater opportunity to save. As noted above, the 2023 limit on catch-up contributions is $7,500 for individuals who are age 50 or older on any day of that calendar year.

If you turn 50 on or before Dec. 31, 2022, for example, you can contribute an additional $7,500 above the $22,500 401 contribution limit for the year for a total of $30,000 including catch-ups.

“As far as an ‘ideal’ contribution is concerned, that depends on many variables,” says Dave Rowan, a financial advisor with Rowan Financial in Bethlehem, PA. Perhaps the biggest is your age. If you begin saving in your 20s, then 10% is generally sufficient to fund a decent retirement. However, if you’re in your 50s and just getting started, you’ll likely need to save more than that.”

The amount your employer matches does not count toward your annual maximum contribution.

Contribute To A Roth Ira

The Roth IRA is the peanut butter to the 401s jellythey just go better together! The beautiful thing about the Roth IRA, which stands for individual retirement account, is that it lets you enjoy tax-free growth and tax-free withdrawals in retirement. Tax-free . . . dont you just love the sound of that?

In 2021, you can put up to $6,000 into a Roth IRA .6 Sticking with our example above, maxing out your Roth IRA and investing $6,000 into your account brings your total retirement savings for the year to $9,750 . . . just a little bit short of your retirement savings goal.

So what are we going to do with the remaining $1,500? Its time to send you back . . . back to the 401!

Also Check: How To Transfer A 401k Account

Also Check: How Much Can I Put In A Solo 401k

Who Is Responsible For Monitoring 401 Costs

The plans fiduciaries must monitor fees to ensure theyre reasonable. The Employee Retirement Income Security Act of 1974 includes a set of standards or “duties”often referred to as ERISA fiduciary dutieswhich include running the plan in the interest of participants and beneficiaries, and for the exclusive purpose of providing benefits and paying plan expenses.

All 401 plans must have a Named Fiduciary who has ultimate . Plan documents will identify the Named Fiduciary. If a plan sponsor wishes to share its fiduciary responsibility, it can choose to hire a service provider to perform several administrative functions, including those that fall under Internal Revenue Code sections , 3, and 3.

Personal Capital Average 401k Balance By Age

| AGE | |

|---|---|

| $458,563 | $132,101 |

*Note: Averages are rounded up to the nearest dollar. Numbers are based on aggregated and anonymous data from the Personal Capital Dashboard. Accounts included are the following: 401k, former employer, Roth 401k. Excludes test and invalid accounts. Excludes any account value greater than $100,000,000 or less than -$100,000,000. Excludes spouse accounts. Snapshotted balance as of 9/7/2022.

Recommended Reading: How To Find Out Who Your 401k Is With

What Is The 401k Savings Potential By Age

The following chart depicts 401k savings potential by age, based on several assumptions. These numbers can seem high to many people, especially if you are older and started your retirement savings when the contribution limit was much lower. It can still be used as a guide for your target total retirement savings amounts, including your IRA, Roth IRA, and after-tax savings. While its designed for one person, it can also be used as a guide for a married couple if one spouse decides to no longer work.

The assumptions we used for this chart include:

- The numbers are more forward-looking vs. backward, since the average 401k contribution limits were lower in the past.

- You start full-time employment at age 22 at a company that provides a 401k, without a company match.

- You contribute $8,000 to your 401k after the first year, then from the second year onward, you contribute the maximum annual amount of $20,500.

- The No Growth column shows what you could potentially have in your 401k after so many years of a constant $20,500-per-year contribution and no growth.

- The 8% Growth* column shows what you could potentially have in your 401k after so many years of a constant $20,500-per year contribution compounded over the next 43 years.

- The difference between the two columns emphasizes the power of growth, compounding over time. By starting early and enjoying a historically average return on 401k, at age 65, an individual could turn $869,000 of contributions into over $6.4M dollars.

Working With Your Financial And Tax Professionals

A 401 plan can become the cornerstone of a personal retirement savings program, providing the foundation for future financial security. Consult your financial and tax professionals to help you determine how your employer’s 401 and other savings and investment plans could help make your financial future more secure.

Important NoteEquitable believes that education is a key step toward addressing your financial goals, and we’ve designed this material to serve simply as an informational and educational resource. Accordingly, this article does not offer or constitute investment advice and makes no direct or indirect recommendation of any particular product or of the appropriateness of any particular investment-related option. Your needs, goals and circumstances are unique, and they require the individualized attention of your financial professional. But for now, take some time just to learn more.

Please be advised that this material is not intended as legal or tax advice. Accordingly, any tax information provided in this material is not intended or written to be used, and cannot be used, by any taxpayer for the purpose of avoiding penalties that may be imposed on the taxpayer. The tax information was written to support the promotion or marketing of the transactions or matter addressed and you should seek advice based on your particular circumstances from an independent advisor.

What’s the next step for you?

A financial professional can help you decide. Let’s talk.

Also Check: Can You Move A 401k To A Roth Ira

Setting Retirement Savings Goals By Age

Depending on what stage of life you’re in, how much you want to save for retirement can vary. For example, someone in their early 20s may be on a tighter budget and have decades to make progress on their savings goals. They wouldn’t need to have as much saved yet as someone who is in their 50s and may be thinking about retiring in the next decade.

Saving for retirement can feel overwhelming, so it can be helpful to set smaller

- In your 60s: Have seven to eight times your annual salary in a retirement account.

Once you know what your savings goals are, you can choose a percentage of your salary to contribute to your 401 each year to help reach those goals. First, look at how much money you already have saved. Then, figure out how much more money you would need to save each year to meet your next goal. Based on that, you can determine how much money from each paycheck you need to put toward your retirement contributions.

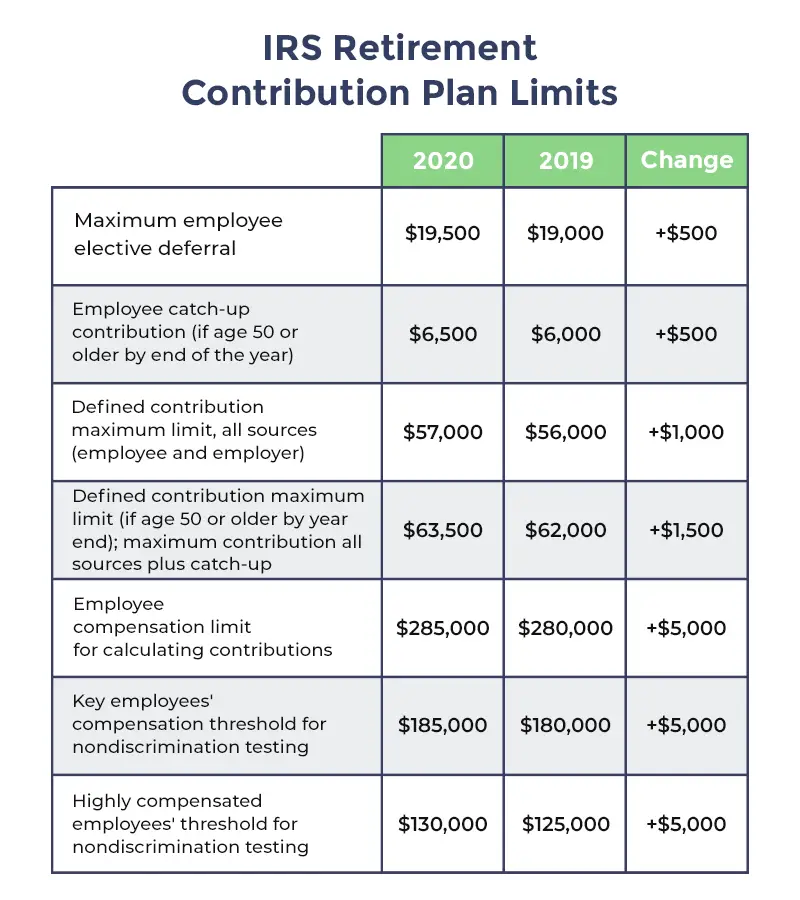

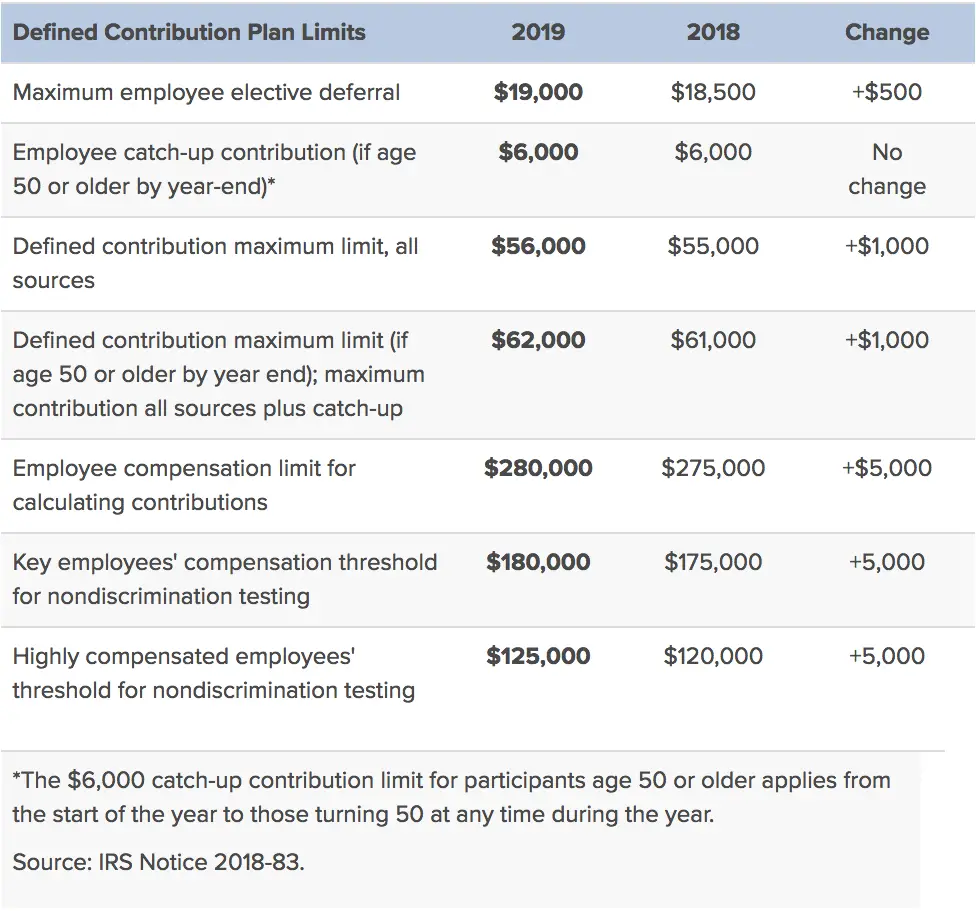

Irs Announces 401 Limit Increases To $20500

IR-2021-216, November 4, 2021

WASHINGTON The Internal Revenue Service announced today that the amount individuals can contribute to their 401 plans in 2022 has increased to $20,500, up from $19,500 for 2021 and 2020. The IRS today also issued technical guidance regarding all of the costofliving adjustments affecting dollar limitations for pension plans and other retirement-related items for tax year 2022 in Notice 2021-61PDF, posted today on IRS.gov.

You May Like: How To Transfer Voya 401k To Fidelity

What Kind Of Investments Are In A 401

401 accounts often offer a small, curated selection of mutual funds. Thats a good thing and a bad thing: On the plus side, you may have access to lower-cost versions of those specific funds, especially at very large companies that qualify for reduced pricing.

The negative is that even with discounted costs, that small selection narrows your investment options, and some of the funds offered may still have higher expense ratios than what youd pay if you could shop among a longer list of options. That can make it harder to build a low-cost, diversified portfolio.

Some plans also charge administrative fees on top of fund expenses, which can add up. If your 401 is expensive, contribute enough to earn your company match, and then direct any additional retirement savings contributions for the year into an IRA.

Why Should I Use One

Matching dollars, for one thing. Over 90% of employers that offer a 401 plan also kick in a company match, which means as you contribute, your employer will, too. Commonly, that match will be worth 50% to 100% of your contributions, up to a limit that typically falls between 3% and 6% of your annual salary. If your employer offers up this free money, a good rule of thumb is to do everything you can to contribute enough to take advantage of it.

The other huge benefit of the 401 is that it allows you to put a lot of money away for retirement in a tax-advantaged way. The annual 401 contribution limit is $20,500 for tax year 2022, with an extra $6,500 allowed as a catch-up contribution every year for participants age 50 or older. For 2023, you can contribute $22,500 and those ages 50 and up can contribute an extra $7,500.

Don’t Miss: How To Get Money From 401k To Buy A House

How Much Money Should You Have In Your 401k

At IWT, we talk about 401ks a lot.

And, thats with good reason. If you want to be rich, the 401k is one of the most powerful investment tools at your disposal, especially for retirement planning. It is also one of the most misunderstood money-maximizing vehicles, starting with how much you should have in your 401k.

That is a solid question, but it doesnt have a simple answer. To answer that burning question How much should I have in my 401k? we need more details. How much to invest in 401k investments will depend on your age and a few other considerations.

Lets start at the beginning.

You May Like: What Happens To My 401k After I Leave My Job

What Is The Main Benefit Of A 401

A 401 plan lets you reduce your tax burden while saving for retirement. Not only do you get tax-deferred gains but it’s also hassle-free since contributions are automatically subtracted from your paycheck. In addition, many employers will match part of their employee’s 401 contributions, effectively giving them a free boost to their retirement savings.

Recommended Reading: How Do You Take Money Out Of 401k

Is The Matched Amount Mine To Take With Me If I Leave My Employer

It depends on your employers plan. Some employers may opt to include a vesting requirement, which may delay when you will have full access to your employers match. Just like the match formula can vary from plan to plan, so can the vesting schedule.

There are three types of vesting schedules:

- Immediate vesting: In this case, there is no term of employment required to earn your employers match.

- Cliff vesting: After a predetermined amount of time, you unlock the full amount of your employer’s match. For example, iIf you have a 2-year cliff, you unlock the full amount of your employers match after your 2 year anniversary with the company.

- Graded vesting: Theres a bit more flexibility on the employers part here and can differ by plan. Generally, you gradually unlock a portion each year you are employed by your employer. Its always good to familiarize yourself with your plans vesting schedule. Using the same 2-years as an example, if you have a 2-year graded vesting with equal vesting each year, you unlock the 50% of your employers match after your 1st year with the company, and 100% of your match after 2 years with the company.

When Can You Withdraw From A 401

You can withdraw funds from a 401 at any point but until you turn 59.5, the money will be taxed like regular income and subject to an additional 10% tax. These rules are in place to discourage people from depleting funds that are supposed to support them once they retire.

There are exceptions to the additional 10% tax for certain early withdrawals. For instance, you can use your 401 money to pay for health insurance while you’re unemployed without facing that tax.

Once you turn 72 you have to start taking a required minimum distribution withdrawal annually. You can calculate what your required minimum distribution would be through the following Internal Revenue Service worksheet.

How much can you contribute to a 401?

The IRS recently announced that the contribution limit for 401 plans will increase by $2,000 to $22,500 for 2023 because of inflation. That doesn’t include any employer matches.

You May Like: How Much Percentage Should I Contribute To My 401k

Are You Maxing Out On Your 401 Contributions

First things first if you have a match, maxing out too early in the year can lead to missing out on a portion of your employers match. Once you max out and are no longer able to contribute for that tax year, your employers match will stop as well. In your Guideline accounts contribution setting page, well alert you if the amount youve elected to contribute will push you into this territory so you can adjust your deferral amount and get the most value from your Guideline 401 each year.

Now, if you are already contributing the maximum allowable amount to your 401 and looking to save more with a dedicated retirement account, consider contributing to an IRA.¹ IRAs offer similar advantages to a 401 and allow you to contribute an additional $6,000 in 2022. The limit on IRAs increased to $6,500 for 2023 . In addition to this uppermost limit, there are contribution limits and considerations based on your income, which are covered here.

Takeaways:

¹ Subject to IRS cost-of-living adjustments

The information provided herein is general in nature and is for informational purposes only. It should not be used as a substitute for specific tax advice that considers all relevant facts and circumstances. Guideline makes no representations or guarantees with regard to investment performance as investing involves risk and investments may lose value. Clients should consult a qualified investment or tax professional to determine the appropriate strategy for them.

Contributions In Excess Of 2021 Limits

Evaluating your estimated contributions for the year ahead and analyzing your contributions at the end of a calendar year can be very important. If you find that you have contributions in excess of the 2021 limits, the IRS requires notification by March 1 and excess deferrals should be returned to you by April 15.

Don’t Miss: Should You Convert Your 401k To An Ira

Using Ubiquitys 401 Calculator

The Ubiquity 401 calculator paints a picture of what your retirement savings will look like when youre ready to stop working. Start by entering your age, household income, and any current savings.

Enter the amount you currently save towards your 401 each month, the amount you expect to spend each month when you retire, and the age you plan to retire. Then, Ubiquitys 401 calculator will show you what to expect, and if there is a deficit. Unlike other 401 calculators, you might find online, the Ubiquity 401 calculator also accounts for hidden fees associated with your retirement savings that you may not be aware of.

You will see:

- The monthly income you can expect to need when you retire

- The amount you will actually receive from your retirement based on your current savings and monthly contributions

- How close you are to achieving your retirement goalswhether youre on the right track, ahead of the game, or need to beef up your savings

How You Can Increase Your 401 Savings

Its been a challenging few months for anyone contributing to a 401. Your account balance has probably decreased as the value of both stocks and bonds has decreased. Younger investors should not overreact. Even if you havent seen one before, extended down markets are unavoidable. The good news is that they allow you to purchase more shares at a discount.

But regardless of your age, now is an excellent moment to reassess your 401 strategy if youre experiencing anxiety. This is crucial if your contribution amount has not changed since you enrolled in the plan or were enrolled automatically.

This article outlines the steps you can take to increase your 401 savings.

Recommended Reading: Can I Use 401k To Start A Business

Is A 401 An Ira

While 401s and individual retirement accounts both enable you to invest money tax-free for retirement, they have important differences.

IRAs are available to people who have access to a 401 through their employer and those who don’t. Like a 401 you’ll face penalties if you withdraw money before you turn 59.5. But unlike a 401, you can only contribute up to $6,500 a year starting in 2023. And the money you contribute will have already been taxed, unlike with 401 where it is taken out of your paycheck before it gets taxed.

There are two different kinds of IRAs: traditional and Roth. Traditional IRAs function a lot like 401s except you could be eligible for tax deductions for making contributions to an IRA. When you withdraw money from a traditional IRA after you turn 59½ it’ll be taxed like ordinary income.

But with a Roth IRA, there is no immediate tax benefit when you contribute post-tax dollars. The major advantage of a Roth IRA is once you withdraw funds after you turn 59½, you won’t have to pay any taxes.