Too Complicated Get Some Help

If this process seems like a lot of work, youâre not alone. Locating your old 401 accounts and finding the proper place to transfer them to can get confusing.

Fortunately, Beagle can do all of the difficult work for you. The tasks of finding your accounts and facilitating their transfers are all done for you. Getting started is free and only takes a few minutes.

Also Check: Can I Rollover My 401k To An Existing Ira

Signs It Makes Sense To Roll Your 401 Into A Roth Ira

If youre thinking of rolling your 401 into a Roth IRA instead of a traditional IRA, you have plenty of reasons to do so. Not only do Roth IRAs let you invest your dollars in the same investments as traditional IRAs, but they offer additional perks that can help you save money down the line. Here are four signs that a Roth IRA might actually be your best bet.

Tips For Saving For Retirement

- Having trouble figuring out how taxes fit into your retirement plan? It may be smart to work with a financial advisor on such decisions. Finding a qualified financial advisor doesnt have to be hard. SmartAssets free tool matches you with up to three financial advisors in your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- As you plan for your retirement income, you should also consider how Social Security benefits fit into the equation. Our Social Security calculator can help in this regard. Fill in your age, income and target retirement date and well calculate what you can expect in annual benefits.

You May Like: How To Cash In Your 401k

Rolling Over A : What Are Your Options

Lets say youre starting a new job and youre wondering what to do with the money in a 401 you had at an old job. You have four options:

- Option 1: Cash out your 401.

- Option 2: Do nothing and leave the money in your old 401.

- Option 3: Roll over the money into your new employers plan.

- Option 4: Roll over the funds into an IRA.

Well walk you through the pros and cons of each one:

Guaranteed Retirement Income For Life

You can choose to annuitize your annuity to receive annuity payments over a period of time or for life or add an optional income rider to generate a paycheck you can never outlive. Sometimes the insurance company will provide a paycheck that increases to help with inflation and the cost of living. Annuities automate withdrawing from a 401k or IRA.

Recommended Reading: What Reasons Can You Withdraw From 401k Without Penalty

Retirement: New Rules Are Coming For 401 And Ira Accounts Here’s What To Know

Retirement plans are getting a shake-up, thanks to new regulations added to the $1.7 trillion federal spending bill.

Retirement accounts like 401 plans, IRAs and Roth IRAs will soon be under a new set of regulations, now that the Senate and House approved a $1.7 trillion federal spending bill that includes new regulations for retirement plans.

Following in the path of the original SECURE Act of 2019, the SECURE 2.0 Act of 2022 incentivizes retirement plans for employers and gives investors more options.

The federal spending bill now heads to President Joe Biden, who is expected to sign it by the Dec. 30 deadline.

The biggest changes for most Americans with retirement accounts would be the extension of the age for required minimum distributions and increased “catch-up” limits for people over 60. But there are more than 90 different retirement changes overall in the bipartisan bill.

Some retirement account changes would take effect immediately after the passage of the bill, while others would start in 2024 or beyond.

Transferring Your 401 To Your Bank Account

You can also skip the IRA and just transfer your 401 savings to a bank account. For example, you might prefer to move funds directly to a checking or savings account with your bank or credit union. Thats typically an option when you stop working, but be aware that moving money to your checking or savings account may be considered a taxable distribution. As a result, you could owe income taxes, additional penalty taxes, and other complications could arise.

IRA first? If you need to spend all of the money soon, transferring from your 401 to a bank account could make sense. But theres another option: Move the funds to an IRA, and then transfer only what you need to your bank account. The transfer to an IRA is generally not a taxable event, and banks often offer IRAs, although the investment options may be limited. If you only need to spend a portion of your savings, you can leave the rest of your retirement money in the IRA, and you only pay taxes on the amount you distribute .

Again, moving funds directly to a checking or savings account typically means you pay 20% mandatory tax withholding. That might be more than you need or want. Most IRAs, even if theyre not at your bank, allow you to establish an electronic link and transfer funds to your bank easily.

Don’t Miss: How To Move 401k To Vanguard

Advantages Of Silver Individual Retirement Account

Silver was typically used as a value store and in valuable transactions. Many banks and financial firms support their financial investments by purchasing and investing in precious metals, making it more difficult for the price of silver or various other precious metals to disintegrate entirely. Because of this, precious metal investments and silver will certainly never be zero. Stocks, however, can lose all of their value overnight. Because of this, silver is one of the safest financial investment alternatives available.

Are 529 Plans Already Flexible Enough

Some education savings experts think 529 accounts have adequate flexibility so as not to deter families from using them.

For example, owners with leftover account funds can change beneficiaries to another qualifying family member thereby helping avoid a tax penalty for non-qualified withdrawals. Aside from a kid or grandkid, that family member might be you a spouse a son, daughter, brother, sister, father or mother-in-law sibling or step-sibling first cousin or their spouse a niece, nephew or their spouse or aunt and uncle, among others.

Owners can also keep funds in an account for a beneficiary’s graduate schooling or the education of a future grandchild, according to Savingforcollege.com. Funds can also be used to make up to $10,000 of student loan payments.

The tax penalty may also not be quite as bad as some think, according to education expert Mark Kantrowitz. For example, taxes are assessed at the beneficiary’s income-tax rate, which is generally lower than the parent’s tax rate by at least 10 percentage points.

In that case, the parent “is no worse off than they would have been had they saved in a taxable account,” depending on their tax rates on long-term capital gains, he said.

Recommended Reading: How To Withdraw From Fidelity 401k

Are There Tax Consequences To A Rollover Tsp To Ira

Your TSP balance would likely be tax-exempt if you contributed to your TSP while serving in a combat zone. You will never pay taxes on these funds, and you must be careful not to roll these funds into a traditional IRA unintentionally.

A box will appear on the TSP withdrawal wizard when you select the box stating: Check this box if tax-exempt balances are accepted for the account.

- You do not check this box if you are transferring from a traditional TSP to a traditional IRA.

- Check this box to convert a conventional TSP to a Roth IRA rollover.

As soon as you separate and complete a total withdrawal from your TSP, you can pocket those tax-exempt funds.

You gain a double tax benefit if you contribute to a Roth IRA:

1) You dont pay taxes on the initial contribution

2) When you withdraw the earnings, you dont have to pay taxes.

The Cons Of Rolling Over Your 401 Into A Roth Ira:

- Unlike 401, you can’t borrow against a Roth IRA.

- Any traditional 401 assets are subject to taxes upon being rolled into a Roth IRA at the time of conversion.

- At some companies, maintaining your Roth IRA may have annual fees or other fees to pay, or more than what you did with your 401 plans, you may face higher investment fees, pricing, and expenses.

- Some 401 investments may not be provided in a Roth IRA.

- Generally, your IRA assets are protected only in the case of bankruptcy from creditors.

- Negative tax implications may present in rolling over a company stock.

Recommended Reading: How Much Can I Take From 401k For Home Purchase

How To Report The Rollover On Your Tax Return

- You must report any transaction when you submit your annual tax return for both direct and indirect rollovers.

- Your IRA brokerage will send you a Form 1099-R that will show how much money you took out of your IRA.

- On your 1040 tax return, report the amount on the line labeled IRA Distributions. The Taxable Amount you record should be $0. Select rollover.

Decide Which Type Of Conversion You Want

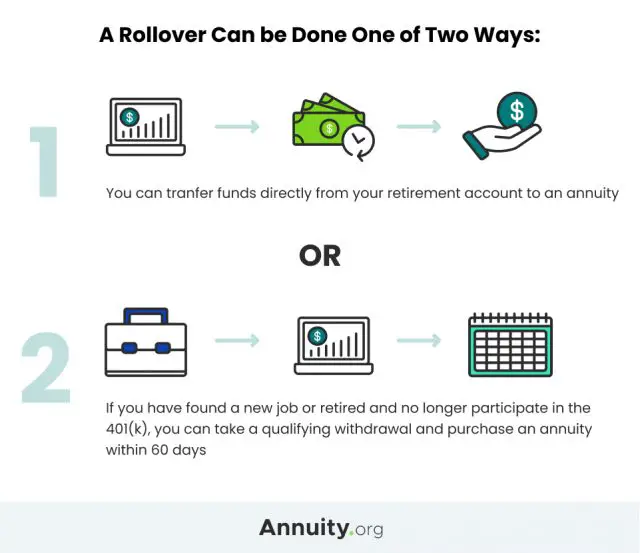

There are two types of rollovers you can make before retirement: a direct or indirect rollover.

For a direct rollover, your old 401 plan administrator will be able to deposit your 401 money directly into your new Roth IRA account once it is opened.

If a direct rollover is not an option, or if you want an indirect rollover, this means the 401 plan administrator will have a check made out to you.

With an indirect rollover, taxes will be automatically withheld and be counted toward taxes paid for that year. You will have to use other funds you have on hand to replace the tax amount lost. If you do not replace the money that was sent to the IRS, it will be considered taxable income on which you will pay regular income taxes plus an additional 10% tax penalty.

You May Like: How Do I Access My 401k From A Previous Employer

Reasons You May Want To Roll Over Now

- Diversification. Investment options in your 401 can be limited and are selected by the plan sponsor. Rolling your funds over into an IRA can often broaden your choice of investments. More choices can mean more diversification in your retirement portfolio and the opportunity to invest in a wider range of asset classes including individual stocks and bonds, managed accounts, REITs and annuities.

- Beneficiary flexibility. With some IRAs, you may be able to name multiple and contingent beneficiaries or name a trust as the beneficiary. Other IRAs may allow you to impose restrictions on beneficiaries. These options aren’t usually available with 401s. But, keep in mind, not all IRA custodians have the same rules about beneficiaries so be sure to check carefully.

- Ownership control. You are the owner and have access rights with an IRA. The assets in your IRA are also not subject to blackout periods. With a 401 plan, the qualified plan trustee owns the assets and assets may be subject to blackout periods in which account access is limited.

- Distribution options. If your IRA is set up as a Roth IRA, there is not a set age when the owner is required to take minimum distributions. With 401 plans and traditional IRAs, the owner will have to take required minimum distributions by April 1 of the year after they turn age 72.

A Possible Backdoor Solution

There is a possible solution in what’s called a “backdoor Roth.” Currently, it’s possible to convert a traditional IRA to a Roth IRA even if you’re above the income limits . Basically, you first open a traditional IRA and make a contribution. There are no income limits for making a contribution to a traditional IRA, but you may not be able to deduct the amount.

You then convert that IRA to a Roth. You’d have to pay income taxes on any deductible contributions and earnings converted to the Roth, but from then on, you’d enjoy the tax-free benefits. This works well if you’ve never had a traditional IRA before. However, if you have an existing IRA, the distribution rules get more complicated.

If this is something you think might work for you, I recommend talking to a financial or tax advisor before taking action.

You May Like: How To Start A 401k For Myself

Be Sure To Understand The Tax Consequences Before Making The Change

If you are considering leaving a job and have a 401 plan, then you need to stay on top of the various rollover options for your workplace retirement account. One of those options is rolling over a traditional 401 into a Roth individual retirement account . This can be a very attractive option, especially if your future earnings will be high enough to knock into the ceiling placed on Roth account contributions by the Internal Revenue Service .

Regardless of the size of your earnings, you need to do the rollover strictly by the rules to avoid an unexpected tax burden. Since you havent paid income taxes on that money in your traditional 401 account, you will owe taxes on the money for the year when you roll it over into a Roth IRA. Read on to see how it works and how you can minimize the tax bite.

Option : Roll Over The Money Into Your New Employers Plan

Rolling your money over to your new 401 plan has some benefits. It simplifies your investments by putting them in one place. And you also have higher contribution limits with a 401 than you would with an IRAwhich means you can save more!

But there are lots of rules and restrictions for rolling money over into your new employers plan, so its usually not your best bet. Plus, your new 401 plan probably only has a handful of investing options to choose from too. And if youre feeling iffy about those options, why put all your retirement savings there? Which brings us to . . .

Read Also: Where To Transfer My 401k

How Much Money Do I Need To Open A Vanguard Ira

At Vanguard, you can open an account with a $0 balance. But there are a few minimums to keep in mind as you begin to invest.

- Vanguard ETFs: You only need enough money to cover the price of 1 share, which can generally range from $50 to a few hundred dollars.

- Vanguard mutual funds: Some Vanguard mutual funds have a $1,000 minimum . Most of our other Vanguard mutual funds have a $3,000 minimum.

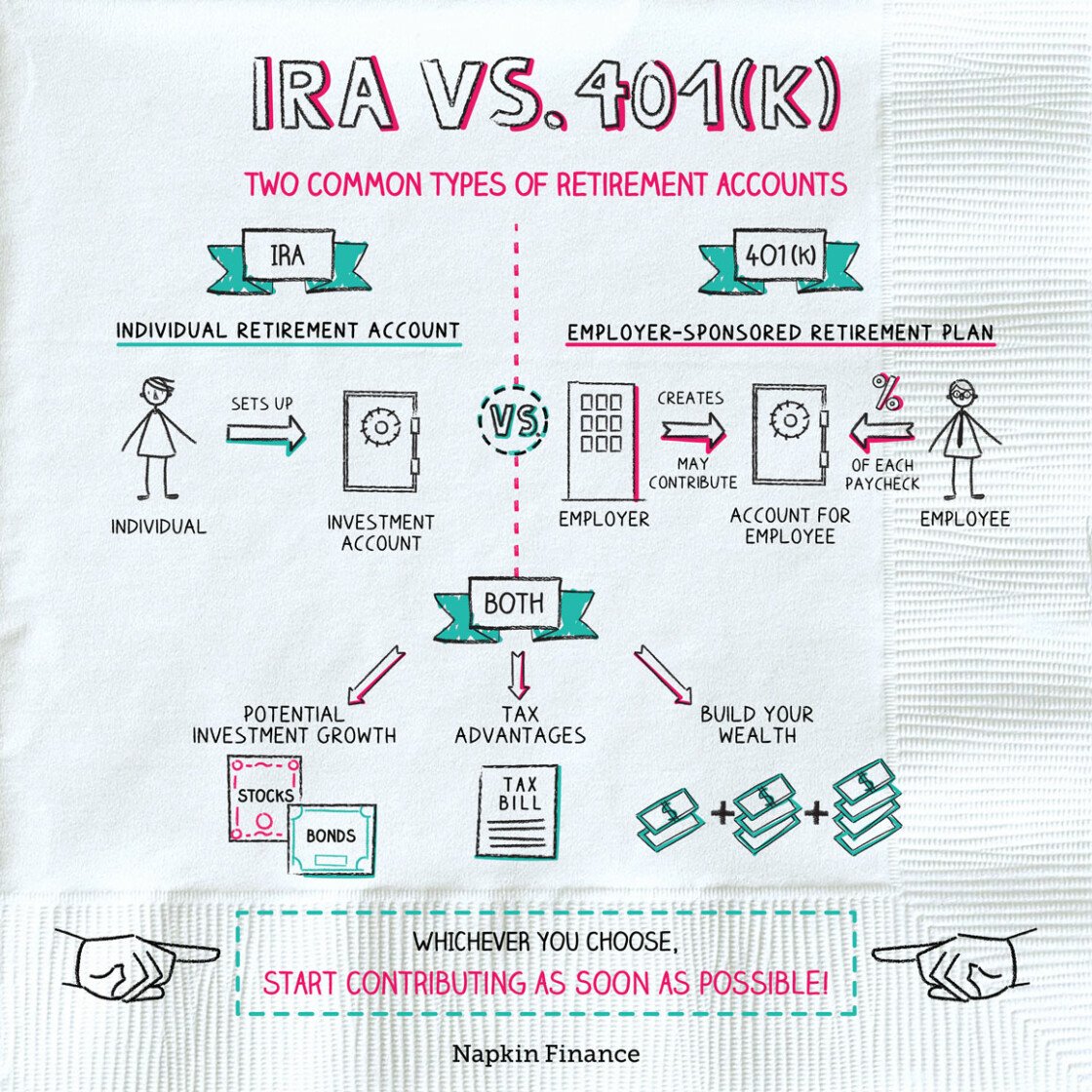

What Is A Roth Ira

A Roth individual retirement account is an after-tax retirement savings account. Why after tax? You create and add to a Roth IRA with money thats already been taxed. But that means that both growth and withdrawals when you take a qualified distribution are not taxed.1 If you think you might be in a higher tax bracket in retirement, saving in a Roth IRA now may be extra advantageous.

While tax-free withdrawals and growth are great, Roth IRAs offer several other benefits. Those include:

- access to a range of potential investment options,

- ability to consolidate other retirement savings accounts into a Roth IRA,

- a flexible withdrawal strategy in retirement, and

- tax-free withdrawals for heirs if a Roth IRA is part of an estate plan.

In addition, if youre married and your spouse isnt employed or doesnt make enough to set up a Roth IRA, you can set up a spousal Roth IRA for them.

Recommended Reading: Can You Rollover A 401k Into A 403b

You Expect To Earn More Money In The Future

If you plan to earn lots of money in the future or earn a high income now you should consider rolling your funds into a Roth IRA instead of a traditional IRA. For single filers in 2016, the maximum income allowable for contributions to a Roth IRA starts at $117,000 and ends at $133,000. Learn more about Roth IRA rules and contribution limits here. For married filers, on the other hand, the ability to contribute to a Roth IRA begins phasing out at $184,000 and halts completely at $194,000 for 2016. The more you earn in the future, the harder it will become to contribute to a Roth IRA and secure the benefits that come with it.

Contact Your Former Employers 401 Plan

This is something that can be done in one of two ways. In certain cases, you can simply call your new Roth IRA provider and have them do most of the work some will be able to contact your former employers 401 plan for you, but theres also a chance youll be responsible for coordinating. If youd like assistance with this process, Capitalize is here to assist.

In the event that you do need to proactively reach out to your previous employer, read on for instructions.

You should be able to find contact information in the document packet you received when you left your job, or, alternatively, you can find the phone number to reach 401 support on your previous employers HR website.

Youll want to call them and request a direct transfer of your Roth 401 plan to the Roth IRA mentioned in the previous step.

The important part here is to ensure that the transfer of assets is a direct transfer or a trustee-to-trustee transfer. This ensures that you dont receive plan assets directly, and they are instead sent to the provider that handles your Roth IRA. In an ideal rollover process, you shouldnt receive a check, and the money should simply transfer electronically from your previous employers Roth 401 plan to your Roth IRA.

Remember to ensure that the entire amount of your Roth 401 must find its way to your new Roth IRA within 60 days if youve received a check made out to you!

Also Check: How To Transfer A 401k To Another 401 K