How Much Tax Will I Pay On A Roth Conversion

How Much Tax Will You Pay on a Convertible Roth IRA? Lets say you are in the 22% tax bracket and converting $20,000. Your income for the tax year will increase by $20,000. Assuming that this doesnt push you to a higher tax bracket, youll owe $4,400 in taxes on the conversion.

What is the downside of Roth conversion?

Paying income tax at the time of conversion, which can be substantial, is the main disadvantage of converting to a Roth IRA. If you anticipate lower income tax rates in the future, there may not be any tax benefit to converting a Roth IRA.

How do I avoid taxes on a Roth IRA conversion?

Reduce adjusted gross income If youre planning a Roth conversion, you might consider reducing your adjusted gross income by contributing more to your pre-tax 401 plan, suggests Lawrence. You can also take advantage of what is called tax-loss harvesting, offsetting gains with losses, in a taxable account.

Can I Convert To A Roth Ira Even If I Earn Too Much To Contribute

Yes, there are no income limits on conversion. Also, if you and/or your spouse have high income levels and are not eligible to contribute directly to a Roth IRA, and you do not already have a traditional IRA, you may want to consider opening a traditional IRA and making a nondeductible contribution, then converting it to a Roth IRA. This strategy is sometimes called a back-door Roth contribution.

Roth 401 Required Minimum Distributions

A common misconception about Roth 401s is that they do not require minimum distributions like Roth IRAs. While Roth IRAs donât require distributions be taken out, Roth 401s must begin taking distributions once the account holder turns 72.

A required minimum amount must be distributed from a Roth 401 each year to avoid penalties charged by the IRS.

To calculate the required minimum distribution amount from your Roth 401, divide your 401 balance as of December 31 of the previous year by your life expectancy factor.

Your life expectancy factor is taken from the IRS Uniform Lifetime Table.

An exception to this requirement is that if your spouse is the only primary beneficiary and is ten years younger than you, use the IRS Joint Life Expectancy Table instead.

Failure to withdraw the required minimum distribution and the amount that is left in the Roth 401 will be subject to a 50% penalty. Meaning if you were required to withdraw $10,000 the previous and donât, you could lose $5,000 automatically.

The IRS does allow some exceptions to RMDs. If youâre 72 and older and still working for the company that sponsors your 401 plan and donât more than 5% of that company, you can delay your mandatory withdrawals.

However, if you leave that company, you will be required to begin taking mandatory withdrawals from that 401 plan.

Also Check: Can You Use Your 401k To Pay Off Your House

Find Out If Youll Be Able To Convert Your 401

According to the IRS, in order to be eligible for a 401 conversion, the money must be vested .6 All the money you put into your 401 is immediately vested, but your employers contributions might be vested over timemeaning the money isnt yours until its been in your account for a while. Depending on the vesting schedule set up by the company and how long youve been there, your existing 401 might not be fully vested yet.

Companies sometimes have their own additional restrictions on who can convert their 401, so ask your employer if youre eligible.

Influential Yet Often Overlooked Roth 401 Plan Design Features

In 2001, Roth 401 benefits came into existence.1 Since then, this option has become a trendy, low-cost, and easy to implement plan design feature, available in over 80% of available retirement plans.2

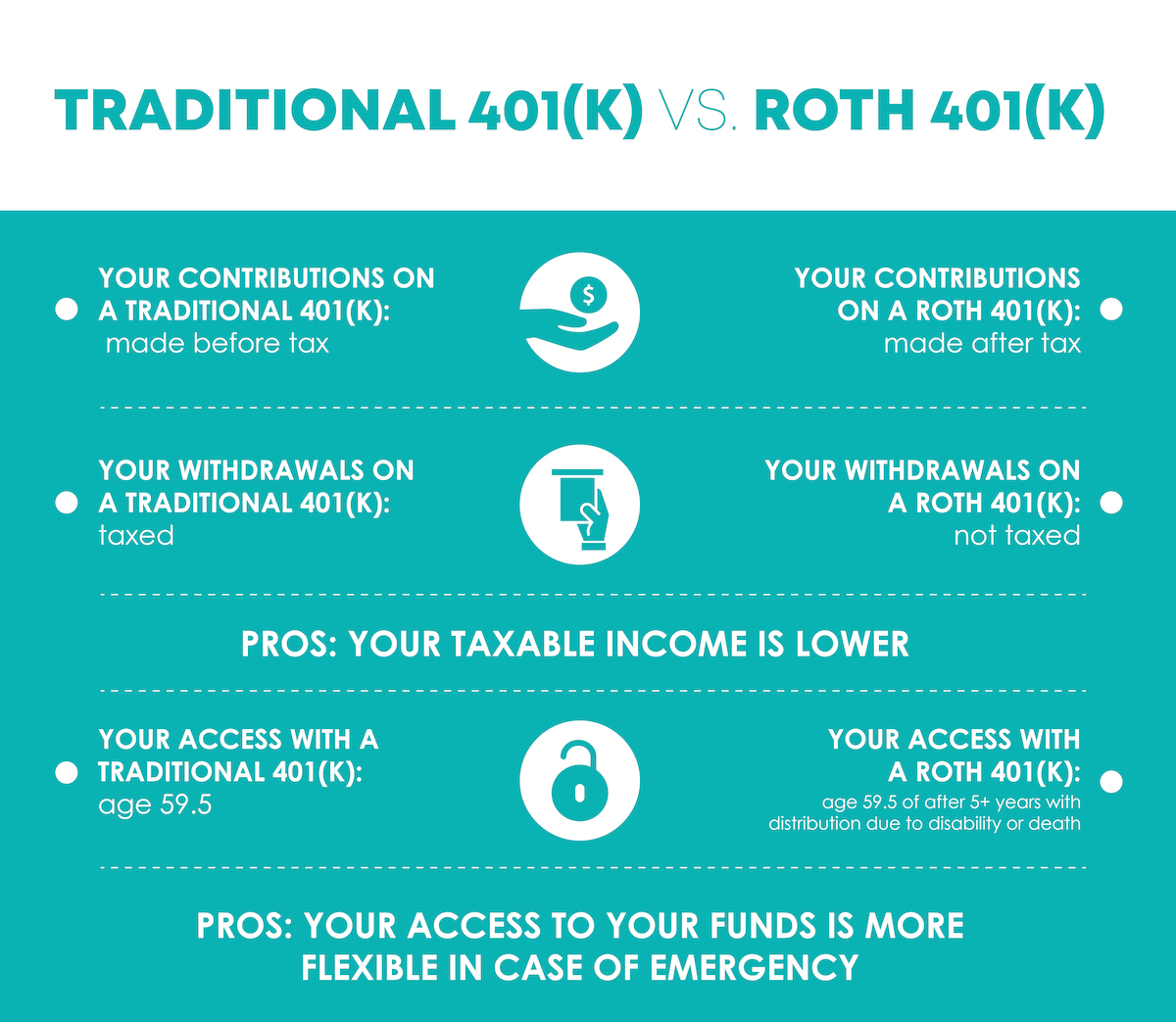

As opposed to a traditional 401, which is pre-tax, a Roth 401 offers an after-tax contribution option with tax-free withdrawals provided they are qualified distributions made after a 5-taxable-year period of participation and are either made on or after the date participants attain age 59½, made after death, or attributable to a participant being disabled. For plan sponsors, a Roth option opens another design feature that allows participants to take advantage of an additional, often overlooked, tax strategy – the In-plan Roth Conversion. Lets take a deeper dive into Roth 401 plans and their benefits.

Read Also: Are Employers Required To Contribute To 401k

Looking Back At The Third Quarter

Every asset class return in our framework except cash was negative in the quarter. Investors moving into safe-haven assets such as the U.S. dollar pushed the value of the greenback to historically high levels. This was a drag on international performance for U.S. investors. Inflation and monetary policy continue to top investors concerns. Markets are now broadly pricing in a contraction in economic growth.

The Fed continues its aggressive policy cycle

The Federal Reserve is expected to hike rates to 4.25% by year-end and keep rates elevated throughout 2023 to combat historically high inflation. High policy rates and softening global economic growth forecasts were a headwind to equity markets, which saw risk asset sell-offs and lower valuations.

Strengthening dollar a drag on international investments

The dollar strengthened to historically high levels for a variety of reasons, including the introduction of the UK minibudget, fears of escalation in the Russia-Ukraine war, and souring investor sentiment. The strong dollar meant international equity investments were the worst performers in the quarter, while domestic equities outperformed for U.S. investors. Of the international asset classes in our framework, emerging markets and international small- and mid-cap stocks were the worst performers.

Equity markets reach new lows

Roth 401 With A Match

Theres one important thing to remember about the Roth 401: Only your contributions grow tax-free. If your company offers a match, youll have to pay taxes on retirement income from the match side of the account.

Still, the Roth 401 is an amazing deal. It could literally save you hundreds of thousands of dollars in retirement. And yet, only 26% of workers are making contributions to their company plans Roth option.5

If youre just starting out with a company and they give you this option, take the ball and run with it!

But if you still have debt to pay off and dont have a fully funded emergency fund, pump the brakes. You need to get your financial house in order before you start saving for retirement.

If youd like a specific, step-by-step plan to becoming a millionaire by the time you retire, weve got one. Theres a whole group of millionaires called Baby Steps Millionaires whove followed Ramseys 7 Baby Steps to hit the million-dollar mark. By following the Baby Steps, they were able to pay off all their debt and reach a million-dollar net worth in about 20 years.

Don’t Miss: What To Do With Your 401k

Should You Convert To A Roth Ira

If you chose not to pay income tax as you earn and are waiting until retirement, you might not have considered changing your mind. For many, this makes sense. Targeting a percentage of your pre-retirement income to live on throughout retirement is a very common strategy, after all. If your retirement income is less than your income while earning, you can pay a lower tax rate. However, that relies on the tax rate of your retirement income remaining lower than the rate you would pay as youre earning. And as any shrewd investor knows, nobody can predict the future.

Thats not to say that there are no factors that are well within your control that are useful in making this decision. In fact, most Roth IRA conversions are the result of changes to ones personal financial situation, not a reaction to a potential change in the overall financial landscape.

Some of the reasons you might choose to convert to a Roth IRA are:

Similarly, there are also reasons to avoid a Roth IRA conversion. It might not be your best option if:

Rolling Your Old 401 Over To A New Employer

To keep your money in one place, you may want to transfer assets from your old 401 to your new employers 401 plan. Doing this will make it easier to see how your assets are performing and make it easier to communicate with your employer about your retirement account.

To roll over from one 401 to another, contact the plan administrator at your old job and ask them if they can do a direct rollover. These two words “direct rollover” are important: They mean the 401 plan cuts a check directly to your new 401 account, not to you personally.

Generally, there aren’t any tax penalties associated with a 401 rollover, as long as the money goes straight from the old account to the new account.

Although this route may help you stay organized with fewer accounts to keep track of, make sure your new 401 has investment options that are right for you and that you aren’t incurring higher account fees.

Read Also: Can You Move A 401k Into A Roth Ira

What Types Of Distributions Cannot Be Qualified Distributions And Must Be Included In Gross Income

You cannot treat the following types of distributions from a designated Roth account as qualified distributions and must include any earnings paid out in gross income:

-

Corrective distributions of elective deferrals in excess of the IRC Section 415 limits or 100% of earnings).

-

Corrective distributions of excess deferrals under Section 402 .

- Corrective distributions of excess contributions or excess aggregate contributions.

- Deemed distributions under IRC Section 72 .

S For Rolling Over A 401 Into A Roth Ira

Once youve done the research, consulted a professional, and decided that a 401 conversion to a Roth IRA is right for you, theres a few things youll have to do.

First, youll need to open a Roth IRA account. NextAdvisor recommends these 5 online brokerages, which generally have low fees and good customer service.

Next, call that brokerage and tell them youd like to roll over a 401. This will likely be more effective than calling the institution that holds your 401 money after all, that company is not incentivized to help you move it out. As a general rule, its usually a lot easier to get money into a financial institution than it is to get money out of one, says Hernandez.

Depending on the institutions involved, the next steps may involve a paper check being mailed to your home, so youll need to make sure that both institutions have your most updated personal information on file. Make sure youre keeping track of the transactions for tax purposes. The 401 institution should provide you with a 1099-R form, which you can provide to your tax preparer.

Try not to get overwhelmed by the paperwork, says Stanley. Break the task into steps and give yourself time to get it done. You dont even need to do it all at once, she says. Whether you get it done in days or weeks, youll have taken a great step toward your financial goals.

Don’t Miss: How Do I Get My 401k Money From Walmart

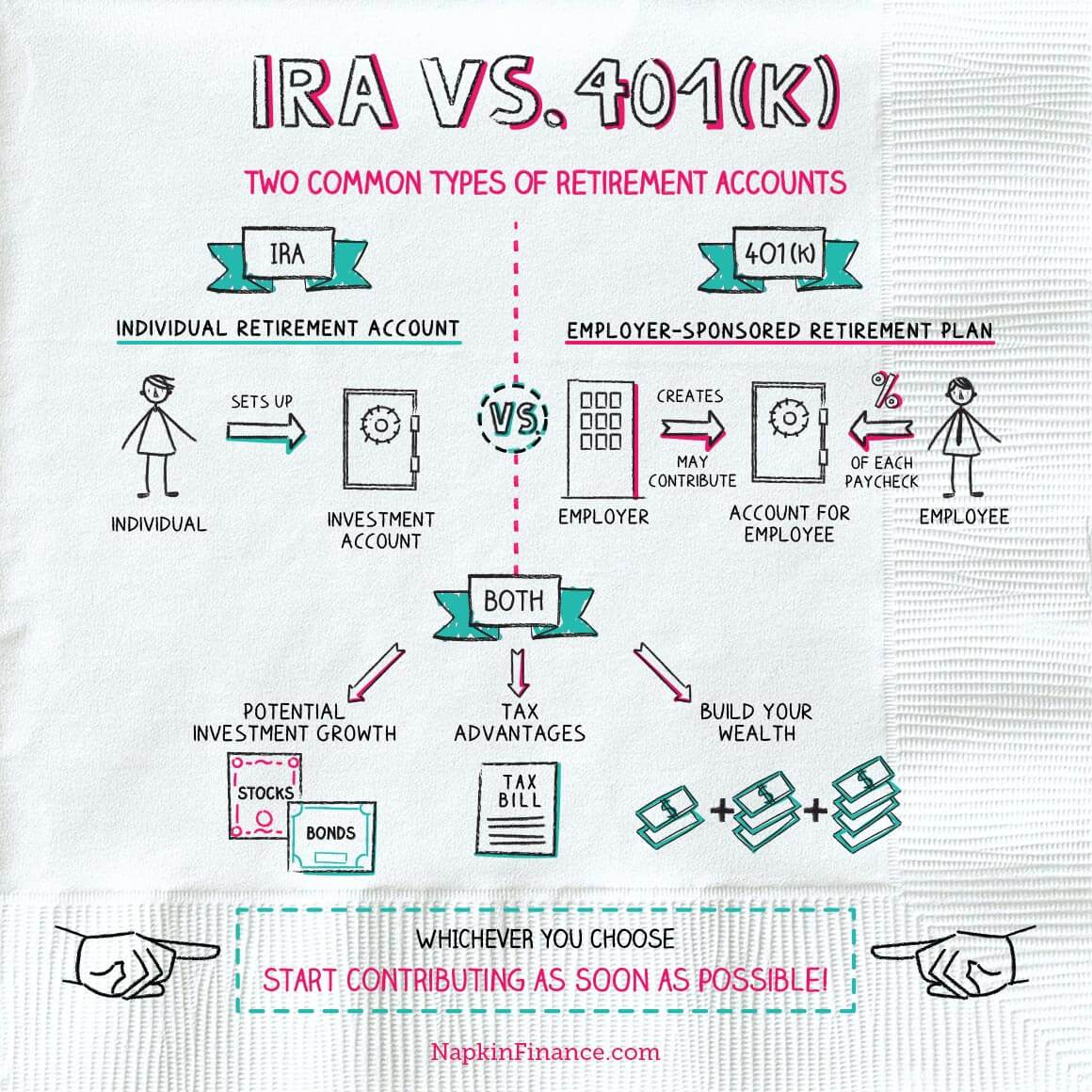

Iras And Roth Iras The Differences

As mentioned, generally, IRAs are taxed upon withdrawal including both contributions and earnings. In the contribution year, deposits are generally deducted from the Adjusted Gross Income on income tax returns. Roth IRAs are not deductible.

Tip: Considerable attention should be paid to the effect of an increased AGI with Roth conversions and contributions. AGI is used with several government programs such as Medicare, the Affordable Care Act , and College Financial Aid and having a higher AGI may affect your eligibility with these programs or their health care premium amounts. Medicare has a 2-year look back period in determining premiums. Completing your Roth conversion at least two years prior to your Medicare enrollment may be beneficial.

- Contribution Limits: Both IRAs and Roth IRAs have contribution limits.

- IRA contribution limits are equal to earned income with the deduction phasing out at $68,000 and eliminated at $78,000 for single filers and at $109,000 and $129,000 respectively for joint filers. Non-deductible contributions above these amounts are reported on IRS Form 8606.

- Roth IRA contributions limits are imposed based on modified AGI and are phased out starting at $129,000 and eliminated at $144,000 for single filers and at $204,000 and $214,000 respectively for joint filers.

Paying Taxes On Your 401 To Roth Ira Conversion

Roth retirement accounts are funded with after-tax dollars, while traditional 401s are funded with pre-tax dollars, so you must pay taxes on your 401 to Roth IRA conversions. In most cases, the funds you’re converting count toward your taxable income, but you must complete your conversion by Dec. 31 if you want it to go on this year’s tax bill.

The effect on your tax bill depends on how much you’re converting and how much other taxable income you’ve earned during the year. If you’re not careful, your 401 to Roth IRA conversion could push you into a higher tax bracket, meaning you’ll lose a higher percentage of your income to the government. You can avoid this by staying mindful of your tax bracket throughout the year and striving to keep your total taxable income, including conversions, under your bracket’s upper limit.

You may not owe taxes on the full amount of your 401 to Roth IRA conversion if you’ve made nondeductible 401 contributions in the past. But that’s where things get a little hairy. Nondeductible 401 contributions are funds you contribute to a traditional 401 but don’t get an immediate tax break for. You pay taxes on your contributions, but earnings grow tax deferred until you withdraw them.

Recommended Reading: How Can I Take Money From My 401k

Can I Get A Distribution While I Am Still An Employee And Roll Over That Distribution As An In

Your plan may limit in-plan Roth rollovers to distributable amounts. If so, your plan may allow an in-service distribution of vested amounts in your plan accounts that you may be able to roll over to a designated Roth account in the same plan. Your plan must state the rules for when you may obtain an in-service distribution.

May Be Worth A Second Look

There are many aspects of a Roth 401 benefit that make the option worth a second look for many participants.

As your employees come to you and ask questions about their retirement planning needs, understanding the differences could help you to financially empower your workforce.

If you have questions, feel free to reach out to your Morgan Stanley Financial Advisor to discuss your options. You should also consult with your legal and tax advisor.

Also Check: Can I Have A 401k And An Ira

Age 50 And Over Catch Up Contribution Question:

The short answers is no.

- The maximum amount of voluntary after-tax contributions that you can make to a solo 401k plan for 2021 is $58,000 even if you are 50 or older .

- Assuming that you are 50 or older, you have not already made employee contributions to another 401k plan and that you have sufficient self-employment income, you can make an additional $6,500 catch up contribution for 2021. This would be made as either a pre-tax or Roth employee contribution and would also not be counted in determining the amount of voluntary after-tax contributions that you can make.

You Expect To Pay Higher Taxes In The Future

Since Roth IRAs use after-tax dollars, youll have to pay taxes upfront on any funds you roll over. However, you wont have to pay taxes on your distributions, which could be extremely beneficial if youre taxed at a higher rate when you reach retirement. Youll pay taxes either way now or later. But with a Roth IRA, you can rest assured your withdrawals will be tax-free.

Also Check: How To Claim Your 401k

How Do I Rollover If I Receive The Check

If you receive a distribution check from your 401 rollover to a Roth IRA, then chances are good they will hold around 20% for taxes. If you want a direct 401 rollover to a Roth IRA, you may want to send that check back to your employer 401 provider and ask to be sent all of your eligible retirement distribution directly to your new Rollover IRA account .

You have 60 days upon receiving the check to get the money into the Roth IRA- no exceptions! So dont procrastinate on this one.

Roth Ira Conversion Ladder

A Roth IRA conversion ladder is a series of Roth IRA conversions made year after year. It’s a way for people to tap their retirement savings early without penalty. The government lets you withdraw your Roth IRA conversions tax- and penalty-free after they’ve been in your account for five years, and Roth IRA conversion ladders leverage this to get around the government’s 10% early withdrawal penalty on tax-deferred savings for those under 59 1/2.

You start by converting the sum you expect to spend in your first year of retirement from your 401 or other tax-deferred account to a Roth IRA at least five years beforehand so you can access it penalty-free when you retire. Then, four years before you’re ready to retire, you convert another sum you can use in your second year of retirement. You continue doing this until you have enough to last you until you’re 59 1/2, at which point you can use all your savings penalty-free.

It requires a lot of retirement savings to pull off, and it could result in a larger tax bill, but it’s a strategy worth considering if you plan to retire before you’re 59 1/2.

There are quite a few rules to keep in mind when you’re doing a 401 to Roth IRA conversion, but as long as you check your plan’s restrictions and prepare yourself for the accompanying tax bill, you shouldn’t run into any problems.

You May Like: Can I Roll A 401k Into A Roth Ira