Your Money Your Choice

Generally, experts do not recommend using your 401 to pay off a mortgage.

But everyone has their own unique financial circumstances. So theres no one-size-fits-all answer.

If youre determined to use your retirement savings, consider the move carefully first. It might not hurt to seek the advice of a financial adviser, either.

This person can assess the impact this step will have on your personal finances and make a well-informed recommendation about what to do.

If a 401 withdrawal doesnt seem like the right move, consider one of the many other ways you can pay off your mortgage early.

Chances are, theres a way you can cut your repayment time and save on interest without the help of your 401 funds. Especially at todays low mortgage rates.

How To Pay Off Your Mortgage Early

If paying off your mortgage early is right for you, here are some strategies to do it:

- Make biweekly payments. One way to get started with making extra mortgage payments is to set up a biweekly schedule. This amounts to making a full extra monthly payment each year and can reduce the time spent with a mortgage. Starting with biweekly payments can help you get ahead on your mortgage while allowing you to keep working toward other financial goals.

- Make extra mortgage payments each year. Similar to making biweekly payments, you can simply make an extra mortgage payment once a year, or pay an additional amount each month on top of what you already pay. Be sure to coordinate with your lender so that these extra funds are allocated to the principal.

- Refinance to a mortgage with a shorter term. If you stand to get a lower interest rate, refinancing to a 15-year mortgage means youll pay off the loan sooner. Keep in mind that even with a lower rate, you could be paying more each month, since your payments are now spread out over a shorter period of time.

If You Need Cash Borrowing From Your 401 Can Be A Low

Provided your 401 plan permits loans, borrowing from your 401 may help you pay bills, fund a big purchase or make a down payment on a home.

But youll need to pay interest if you want to tap your retirement account. There are also rules you need to follow so that you arent taxed on the amount you borrow. And there are possible drawbacks like missing out on potential investment growth to consider before deciding to take out a 401 loan.

You May Like: How Do I Offer 401k To My Employees

What Are The Rules For 401 Withdrawal

Tax-deferred retirement accounts, such as 401 plans and 403 plans, were designed to encourage workers to save for retirement. So the rules arent super friendly when it comes to withdrawals before age 59 ½.

Depending on your financial situation, however, you may be able to request what the IRS calls a hardship distribution. Employer retirement plans arent required to provide hardship distribution options to employees, but many do. Check with your HR department or plan administrator for details on what your plan allows.

According to the IRS, to qualify as a hardship, a 401 distribution must be made because of an immediate and heavy financial need, and the amount must be only what is necessary to satisfy this financial need. Expenses the IRS will automatically accept include:

Certain medical costs.

Costs related to buying a principal residence.

Tuition and related educational fees and expenses.

Payments necessary to avoid eviction or foreclosure.

Burial or funeral expenses.

Certain expenses to repair casualty losses to a principal residence .

You still may not qualify for a hardship withdrawal, however, if you have other assets to draw on or insurance that could cover your needs. And your employer may require documentation to back up your request.

Recommended: How Does a 401 Hardship Withdrawal Work?

Is It A Good Idea To Use 401k To Pay Off House

Utilizing 401 funds to pay off a mortgage early results in less total interest paid to the lender over time. However, this advantage is strongest if you’re barely into your mortgage term. If you’re instead deep into paying the mortgage off, you’ve likely already paid the bulk of the interest you owe.

You May Like: How To Pull Money Out Of 401k Without Penalty

Will Other Investments Beat Paying Off A Mortgage Early

Is it better to pay off your mortgage or invest? Ultimately, its a personal decision, but investing could be more sensible.

Sadly, the math tells us its almost always better to invest in other places than in your mortgage, says Richard Bowen, CPA and owner of Bowen Accounting in Bakersfield, California.

Mortgage rates are lower than theyve been in recent years, so if paying off your mortgage early leads to a return equal to your interest rate, that return would likely be lackluster compared to the annualized return for the S& P 500 roughly 10 percent over the last 90 years.

A potentially better use of the funds might be to take the cash youd use to pay off your mortgage and leverage it into buying a cash flow-positive property like multi-family real estate or single-family homes that have the potential to offer higher long-term returns, Bowen points out.

Any choice poses a risk, however. Even after paying off your mortgage early, real estate prices could plunge, leaving you with a potential loss. Carefully consider which risks youre willing to take. Ultimately, you might be better off not paying your mortgage off early.

The thing is, no one can give you a guarantee on an investment, Bowen cautions. You can put your money in the stock market and lose it. You can put your money in real estate and it doesnt perform as well as you expected it to.

Loans You Behind Financially While Pmi Does Not

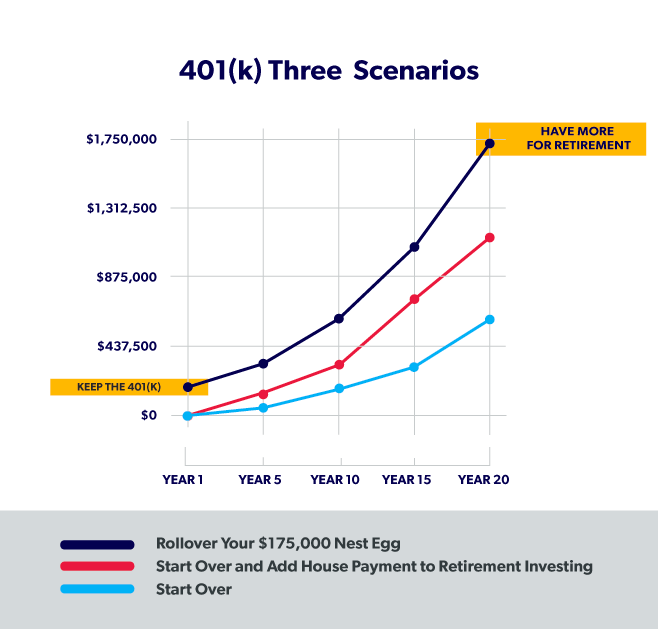

In the example in a previous section, we showed how removing just $10,000 from a retirement account could result in a $50,000 lower balance at retirement.

Now imagine you remove $20,000 or even $30,000 to reach the 20% down payment mark to avoid PMI. The future losses are going to be way more impactful than the $200 per month outlay now. Dont sacrifice your retirement savings because youre averse to PMI. Look at the long-term, broader view.

Don’t Miss: Is An Annuity Better Than A 401k

Irs Late Fees Are Onerous

- If you dont file your return, you will owe an additional 5% each month of any tax amount that is due, up to 25%.

- If you dont pay what you owe, the IRS will levy an extra 0.5% each month of your due tax amount to your overall IRS debt.

- If you dont file or pay, the 0.5% failure-to-pay penalty will accrue, up to 25% of what you owe, until the tax is paid.

- That means the total penalty for failure to file and pay could amount to a whopping 47.5% of your tax bill!

- On top of all that, youll owe interest on the overdue amount. Determined quarterly, the interest rate is the federal short-term rate plus 3%, compounded daily.

- Other penalties may apply.

I frequently see questions from people who are getting ready to retire and want to take money out of their retirement account to pay off their mortgage. It is a good idea to meet with a tax professional before making these decisions so you understand the ramifications of taking out large sums from retirement accounts at one time. Even though you were not subject to the additional 10% tax, you still had to report the income. They can help you figure out whether it is best to take your distribution amounts over several years in order to minimize the tax burden. Keep in mind that once you pay off the mortgage, there is no longer any interest deduction.

Thanks for the great question and all the best to you and your wife in your retirement years.

Transfer Balances To A Low

If high-interest payments are diminishing your budget, transfer them to a low-interest account. Compare your current debt interest rates to other competitors. Sift through their fine print to spot any red flags. Credit card companies may hide variable interest rates or fees that drive up the cost. Find a transfer card that works for you, contact the company to apply, and transfer over your balances.

Read Also: How To Roll Over 401k To New Job

Assess Your Current Financial Situation

Sit down and create a list of your savings, assets, and debts. How much debt do you have? Are you able to allocate different funds towards debts? If you have $2,500 in credit card debt and a steady source of income, you may be able to pay off debt by adjusting your existing habits. Cutting the cord with your TV, cable, or streaming services could be a great money saver.

However, if youre on the verge of foreclosure or bankruptcy, living with a strict budget may not be enough. When looking into more serious debt payoff options, your 401k may be the best route.

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Don’t Miss: What Is The Tax Rate On 401k After 65

Why Do People Get 401 Loans

As long as a plan allows it, participants generally can borrow from their 401 for any reason that they deem necessary. Some plans may only allow loans for specific reasons, so be sure to check your plans rules before trying to borrow.

Since youre borrowing your own money, and no credit check is involved, it may be easier to get approved for a 401 loan as long as you meet the plans requirements for borrowing. In some cases, a requirement may be getting approval from your spouse , because your spouse may be entitled to half of your retirement assets if you divorce.

Here are some potential uses for a 401 loan.

- Paying household bills and expenses

- Funding a down payment on a house

- Paying off high-interest debt

- Paying back taxes, or money owed to the IRS

- Funding necessary home repairs

- Paying education expenses

But that doesnt mean 401 loans are always a good idea. In fact, there are some major risks that come with borrowing from your retirement savings. Here are two.

How Does Repayment Work On A 401 Loan

Typically, you have five years to repay a 401 loan. However, if youre using the loan to purchase a primary residence, that time frame may be extended. The exact time frame youll have for repayment will depend on your plan, but in some cases, it can last up to 25 years.

In either case, you must make payments on the loan at least quarterly and each payment must be of a similar size.

Don’t Miss: Do I Have To Rollover My 401k When I Retire

Can A 401 Help You Make A Down Payment

The short answer is yes. The longer answer is yes, but

First things first your 401 is your money to use at your discretion. While it doesnt function the same way as a standard deposit account, you still have the right to access it if you choose to do so. If youre like many, your 401 is your largest financial account, and it can certainly be tempting to use these funds as the source of your down payment. However, there are some distinct drawbacks to this strategy, including penalties, taxes, and potential repayment requirements.

Typically, those who decide to use their 401 as a down payment source are first-time homebuyers who likely dont have the savings or assets to make a down payment otherwise.

If youve weighed the pros and cons and believe using the funds in your 401 is the best choice for you, you have two options for accessing your money.

- 401 Loan: In this scenario, you are simply borrowing from yourself. All funds you withdraw will have to be repaid with interest .

- 401 Withdrawal: By withdrawing money, you avoid any repayment requirements. However, you will incur a 10% penalty and be required to pay income tax on the amount withdrawn.

Lets take a deeper look into each of these options.

What Are The Costs Associated With 401 Loans

You may be able to avoid paying an early withdrawal penalty and taxes if you borrow from your 401 instead of taking the money as a distribution. But 401 loans have their own set of rules and costs, so you should be sure you know what youre getting into.

There are some appealing advantages to borrowing from a 401. For starters, if your plan offers loans , you might qualify based only on your participation in the plan. There wont be a credit check or any impact to your credit score even if you miss a payment. And borrowers generally have five years to pay back a 401 loan.

Another plus: Although youll have to pay interest , the interest will go back into your own 401 account not to a lender as it would with a typical loan.

You may have to pay an application fee and/or maintenance fee, however, which will reduce your account balance.

Of course, a potentially more impactful cost to consider is how borrowing a large sum from your 401 now could affect your lifestyle in retirement. Even though your outstanding balance will be earning interest, youll be the one paying that interest.

Until you pay the money back, youll lose out on any market gains you might have had and youll miss out on increasing your savings with the power of compound interest. If you reduce your 401 contributions while youre making loan payments, youll further diminish your accounts potential growth.

Recommended: Pros & Cons of Using Retirement Funds to Pay for College

Also Check: Can I Move My 401k To An Ira

Should You Use A 401 To Pay Off Debt

In some cases, it could be beneficial to cash out a portion of your 401 to pay off a loan with high rates. For debts with lower interest rates, such as a home mortgage or student loan, taking a 401 withdrawal, and paying both income taxes and a possible 10% penalty on it, would make little financial sense.

Thats especially true when you consider that youd be sacrificing $45,000 in retirement savings, plus future earnings on that money.

Fortunately, there are some alternatives:

- Negotiate your interest rate: If you have good credit, then you may be able to get your interest rate lowered by several percentage points just by negotiating with your credit card company.

- Balance transfer: You can also transfer credit card balances to lower-interest credit cards. Many balance transfer credit cards have promotional periods during which they charge 0% interest, but watch out for transfer fees.

- Consolidation: If you have private student loans, consider consolidating them into a loan with a lower interest rate if your credit has improved since you first borrowed.

Who Gets The Interest Payments From A 401 Loan

You get the interest you pay on the 401 loans, since you are essentially lending money to yourself. Keep in mind that the interest payments are made with after-tax dollars. That’s a downside to 401 loans, because those after-tax dollars will be taxed again when they’re taken out as a 401 withdrawal in retirement.

Read Also: Can I Roll My Old 401k Into A Roth Ira

Are 401 Withdrawals Subject To Taxes And Penalties

Even if you can qualify for a hardship distribution, plan on paying taxes on the distribution . Unless you meet specific criteria to qualify for a waiver, youll also pay a 10% early withdrawal penalty if youre younger than 59 ½.

Now lets assume youre 33 years old, and you have enough in your 401 to withdraw the $20,000 you need. Right off the top, unless you qualify for a waiver, you can expect to pay a $2,000 early withdrawal penalty. Then, when you file your income tax return, that 401 distribution will most likely be counted as ordinary income, so it will cost you another 25% or so. If the added income bumps you into another tax bracket, your tax bill could be higher.

But taxes and penalties arent the only costs to consider when youre deciding whether to go the distribution route.

Compound interest creates the potential for your initial investment to grow significantly over time. So every dollar you take out now could mean several dollars less in retirement. Essentially, withdrawing from your 401 now is like borrowing money from your future self, because youre losing long-term growth.

Recommended: 401 Early Withdrawal Penalties Explained