Your Employer Can Help Fund Your Retirement Dreams

Theres a nice little perk that may come with a Roth 401, as well as with a traditional 401: matching contributions from the sponsoring company. This can turn into big bucks over time. Take note, though: Company matches are not taxed when contributed, so the contributions and gains will be included in your taxable income when you make a withdrawal.

Roth Ira Withdrawals Can Help Your Taxes In Retirement

When you decide to dip into your Roth IRA funds in retirement, withdrawals are tax-free. These tax-free withdrawals can help you to put off the need to take cash out of other accounts that could increase your AGI, income taxes or other costs.

Heres an example: Consider a retiree who needs $10,000 to pay for a big vacation or $30,000 for a new car. They might decide the best way to avoid debt is to take the cash out of a retirement account. A retiree who withdrew the sum from a traditional IRA would owe income taxes on the entire amount, starting a negative chain reaction. They might bump themselves into a new tax bracket or even trigger an increase in Medicare premiums. But a retiree who withdrew that amount from a Roth IRA would face no such problems.

Donât Miss: Should You Roll Your 401k Into An Ira

Roth 401 Vs : How Are They Different

The biggest difference between a Roth 401 and a traditional 401 is how the money you put in is taxed. Taxes are already super confusing , so lets start with a simple definition, and then well dive into the details.

A Roth 401 is a post-tax retirement savings account. That means your contributions have already been taxed before they go into your Roth account.

On the other hand, a traditional 401 is a pretax savings account. When you invest in a traditional 401, your contributions go in before theyre taxed, which makes your taxable income lower.

Also Check: How To Take Money From 401k Without Penalty

Should I Do Before Tax Or Roth

You may save by lowering your taxable income now and paying taxes on your savings after you retire. You’d rather save for retirement with a smaller hit to your take-home pay. You pay less in taxes now when you make pretax contributions, while Roth contributions lower your paycheck even more after taxes are paid.

Max Out Your Roth Ira

If you have a traditional 401or if youre not super happy with the investments offered through your companys planthen you can move on to the Roth IRA and invest there.

Remember, you can only put up to $6,500 into your IRA in 2023. So, its very possible you could invest up to the match at work, max out your IRA, and still not hit 15%. In that case . . .

Also Check: How Can I Look At My 401k

Learn About Health Savings Accounts

If you are looking for a great place to put your money after you max out a 401K, a health savings account might be the right way to go. After you retire, you will probably have to spend a lot of money on medical expenses. You can easily pay hundreds of thousands of dollars in total lifetime medical bills after you retire.

Health savings accounts are excellent tax-wise. At best, none of the money you put into your account, none of the interest you earn on your account, and none of the money you withdraw from your account will be taxed. You can also use a health savings account before you retire.

Another advantage is that you can even take money out of your health savings account for non-medical purposes if you are over 65. If that sounds too good to be true, the catch is that you will have to pay income taxes if you withdraw it for non-medical reasons.

Too many people donât bother with a medical savings account. Donât miss out on one of the best ways to save tax-free money for retirement.

Another drawback is that the maximum contributions are low compared to what you can put into a 401K each year. Health savings accounts are, nonetheless, a great choice. They might be your first choice after you max out your 401Ks.

Recommended Reading: Can I Open A Roth Ira And A 401k

Roth 401k Vs Roth Ira: How Are They Different

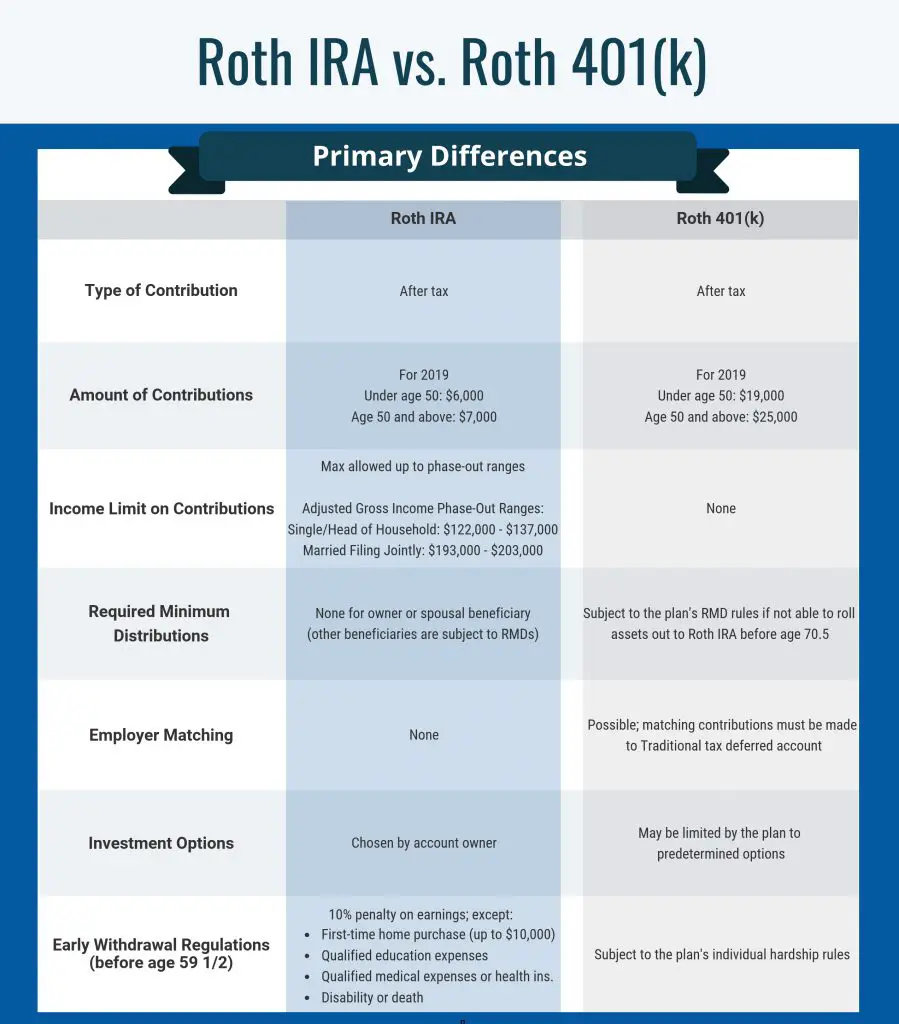

The biggest differences between a Roth 401k and a Roth IRA are their different annual contribution limits, eligibility criteria, and whether or not you will need to take required minimum distributions .

Lets start with the annual contribution limits.

In 2022, you can contribute up to $20,500 per year and a catch-up contribution of $6,500 per year if youre age 50 or over to a Roth 401k. However, the annual contribution limit for Roth IRAs is much lower: just $6,000 per year, or $7,000 if youre 50 years of age or over.

Another big difference between the Roth 401k and the Roth IRA is the eligibility criteria. If you make too much money, you cant open or contribute to a Roth IRA. More specifically, for tax year 2022, you are not eligible for a Roth IRA if your modified adjusted gross income is:

- $144,000 or more if you are single or head of household

- $214,000 or more for married couples filing jointly

With Roth 401ks, the only eligibility criteria is that your employer offers this option.

Another big difference is that you dont need to take Required Minimum Distributions from Roth IRAs. But with Roth 401ks, you must start taking RMDs when you turn 70½ years old.

You May Like: How To Roll Old 401k Into Ira

When A Traditional 401 Makes More Sense

I generally recommend that clients contribute to a traditional 401 because a Roth doesnt have the same conversion option. Especially if youre a parent with kids at home, you may want to take the tax deduction now to help you save on taxes and increase your cash flow.

With a traditional 401, you have more control over when and where you pay your taxes since you may be living in a different state when you retire. If you experience a period of lower income, it may present a great opportunity to convert a traditional 401 into a Roth individual retirement account at a lower tax rate.

For example, individuals who stop working prior to their full retirement age and dont start taking Social Security immediately may see a significant drop in their tax rate. This can be a tax-efficient time to convert. The same holds true for changing your retirement address to avoid cities and states that impose larger income taxes. Therefore, it doesnt make sense to contribute to a Roth 401 while living in New York City unless you know that you are going to retire in an area with a similarly high tax rate. For many of us, the added flexibility associated with a traditional 401 is what, in my opinion, makes it the employer-sponsored retirement plan of choice.

How Do Iras Work

You can open an IRA through a bank, brokerage firm, or with help from a financial advisor. Then you add money to your account to be invested in a wide range of different investmentsfrom simple savings at a bank to mutual funds and exchange-traded funds . And since IRAs arent limited to the small menu of options offered by your 401 plan administrator, you have more control over what investments go inside your IRA.

Investing with an IRA is like having a fast pass at your favorite theme park because you get to skip the tax line in several ways. You can change your investments inside your IRA without paying taxes. Plus, you either wont owe any taxes until you take your money out in retirement , or you wont owe taxes at all so long as you wait until age 59 1/2!

And since an IRA is meant to help you save for retirement, dont even think about taking your money out early. If you take money out before youre age 59 1/2, youll get hit by a 10% early withdrawal penalty .3 Plus, youll miss out on the tax-deferred or tax-free growth of that moneyand youll end up way behind on your retirement savings goals.

You May Like: Is It Worth Rolling Over A 401k

Enter The Roth 401k/403b

Almost 80% of these qualified plans now offer a Roth option for employee contributions. The main difference between Roth 401k contributions and Traditional 401k contributions is when you owe federal income tax on the money. When making Traditional contributions, you get an upfront tax benefit because your taxable income is reduced by the amount you contribute. For example, if youre in the 32% marginal tax bracket and you contribute the maximum $19,500 contribution for 2020, you would reduce your 2020 income tax bill by $6,240 which is significant savings to be sure. It isnt until you begin withdrawing your money that your withdrawals are taxed to you as regular income at whatever your marginal tax rate is for that year.

When you contribute to a Roth 401k/403b the money is taxed in reverse. Youll owe federal income tax on the amount you contribute for the year the contribution was made. However, assuming some basic conditions are met, youll wont owe any taxes on that money when its withdrawn. If youre in the 32% marginal tax bracket and you contribute $19,500 to your Roth account in 2020, youd owe $6,240 in federal income tax however, the IRS will never be able to tax that money, or the decades of compounded growth that it generates over the years, again! This benefit cannot be overstated!

How Much Should I Invest In A Roth 401

No matter what your income is, you should be investing 15% of your income into retirement savingsas long as youre debt-free and have a fully funded emergency fund . Lets say you make $60,000 a year. That means you would invest $750 a month in your Roth 401. See? Investing for the future is easier than you thought!

If you have a Roth 401 at work with good mutual fund options, you can invest your entire 15% there. Boom, youre done! But if youre not happy with your 401s investment options, then invest up to the match and max out a Roth IRA on your own.

Also Check: How To Grow My 401k Faster

The Difference In Roth 401 And Pre

The Roth contributions, its very important that you understand theyre made with after-tax dollars. So whether its a Roth IRA that you fund on your own out of your own savings or checking account, or its a Roth 401, its made with after-tax dollars. This means that you dont get the tax break up front, but it has a whole lot of other amazing tax advantages that youre going to get later on, which Im going to discuss.

Now the pre-tax contributions, theyre going to be made before your tax is actually paid. So whether its a regular IRA, where youre going to make a contribution and take a deduction on your tax return, so the effect is, its before your taxes are paid. Or, its your pre-tax contributions into your 401 plan, those contributions are going to go in before your tax is paid.

So thats the biggest difference between Roth, which is an after-tax contribution, youve already paid your taxes. And pre-tax, and we also call pre-tax traditional contributions, thats the traditional way that 401 contributions were made. And those are made before your taxes are paid. So thats the real big difference. Theres a lot of other differences, but thats the big one that you need to be focused on today.

Create Your Roth Ira Game Plan For 2023

Whether you have a Roth IRA or plan to open one, now is a good time to set some goals or review your prior ones. Ask yourself the following questions to help you develop a Roth IRA contribution game plan.

- How much income do you expect to earn in 2023?

- Does your income fall below the annual Roth IRA limits?

- Do you qualify to contribute the maximum amount to a Roth IRA in 2023?

- How much did you contribute to your Roth IRA in 2022? Do you want to increase your contributions in 2023?

- Do you have a sufficiently robust emergency fund and money set aside to handle your day-to-day expenses?

- Are you expecting to get a bonus in 2023 that could help you beef up your Roth IRA?

- Do you plan to contribute to other retirement accounts in 2023?

Don’t Miss: Can You Use 401k To Pay Taxes

No Loans Without Rollover

Unlike Roth 401s, Roth IRAs dont allow loans. However, there is a way around this: Initiate a Roth IRA rollover. During this period, you have 60 days to move your money from one account to another. As long as you return that money to it or another Roth IRA in that time frame, you are effectively getting a 0% interest loan for 60 days.

Which Is Best For You

This decision mainly comes down to how you want to put money into the account and how you want to take money out.

Lets start with today putting money in. If youd prefer to pay taxes now and get them out of the way, or you think your tax rate will be higher in retirement than it is now, choose a Roth 401.

Youre also giving yourself access to a more valuable pot of money in retirement: $100,000 in a Roth 401 is $100,000, while $100,000 in a traditional 401 is $100,000 less the taxes youll owe on each distribution.

In exchange, each Roth 401 contribution will reduce your paycheck by more than a traditional 401 contribution, since it’s made after taxes rather than before. If your primary goal is to reduce your taxable income now or to put off taxes until retirement because you think your tax rate will go down, you will do that with a traditional 401.

Just know that:

-

Youre kicking those taxes down the road, to a time when your income and tax rates are both relatively unknown and might be higher if you advance in your career and start earning more

-

If you want the after-tax value of your traditional 401 to equal what you could accumulate in a Roth 401, you need to invest the tax savings from each years traditional 401 contribution. For more on this, see our study on the Roth IRA advantage, which also applies here.

Don’t Miss: How To Withdraw Fidelity 401k

Why You Should Invest In An Ira

We love IRAs for retirement investing. Not only do they offer tax advantages for your retirement savings that are simply too good to pass up, but they also come with benefits that make them ideal for just about anyone who wants to invest for the future.

- You get tax-free or tax-deferred growth. With a traditional IRA, you get a tax break now. With a Roth IRA, you get a tax break later. Either way, you win!

- You have more investing options. When you invest with an IRA, you can pick and choose from thousands of different mutual funds. The more options you have, the more likely you are to find great funds to include in your investing portfolio.

- Theyre not tied to your employer. Unlike a workplace retirement plan, you can open a Roth IRA at any time. And no matter what your employment situation is, it doesnt affect your IRA at all. Theres no need to roll over any funds or worry about keeping track of a dozen 401s from old jobs.

- Theyre accessible and easy to set up. Like we mentioned, anyone with an earned income can take advantage of an IRA, and theres no age limit for opening or contributing to an IRA. Plus, it can take as little as a few minutes to set up your account.

K Vs Roth 401k A Comparison

401s are retirement accounts that offer tax-deferred growth and distributions. Roth 401s works similarly, but the contributions are not deductible, and qualified distributions of earnings can be made tax-free. Which is better? The answer depends on your situation. Its important to consider how much you earn now, what kind of investment options each account offers, and whether or not youll have other sources of income in retirement, such as pensions or Social Security benefitsthe list goes on! This guide will help break down some critical points for each type so you can decide which route is best.

Recommended Reading: Can You Take A Loan From 401k For Home Purchase

Both The Roth 401 And The Roth Ira Can Help You Reach Your Retirement Goals Each Has Its Advantages And Disadvantages

Roth 401s and Roth IRAs are retirement savings accounts that allow you to contribute with after-tax dollars and take tax-free withdrawals in retirement. They are an alternative to traditional 401s and traditional IRAs, both of which allow pre-tax contributions but require you to pay tax on withdrawals.

While both Roth accounts make it possible to defer taxes until retirement, there are some important differences between a Roth 401 and a Roth IRA:

- Required minimum distributions: Roth 401s require you to begin taking money out at age 72, while Roth IRAs do not have required minimum distributions .

- Eligibility: Because of income limits, higher earners cannot contribute to Roth IRAs.

- Individual/employer accounts: Roth 401s are administered by employers, while Roth IRAs are opened by individuals.

- Contribution limits: Roth 401s have higher contribution limits than Roth IRAs.

What About A Traditional Ira

The 401 and Roth IRA are two of the most popular choices available for retirement savings, but wed be remiss if we didnt also mention the traditional IRA.

This account combines some benefits of a 401 with a Roth IRA. Traditional IRA contributions are pre-tax, meaning they allow you to reduce your tax burden in the current year and defer the taxes until retirement. And like a Roth IRA, a traditional IRA offers a wider selection of investments than a 401.

Of course, a traditional IRA also has the downsides of a Roth IRA. Theres a low contribution limit of $6,000. Additionally, while anyone can contribute to a traditional IRA, not everyone can deduct their contributions. If you are eligible for an employer-sponsored retirement plan or your spouse is then youre subject to income limitations on your traditional IRA deduction.

Traditional IRAs can be deductible or non-deductible, so I would also caution you to check to see if you are even eligible to deduct your IRA contribution, Elise said.

So who is a traditional IRA right for? First, a traditional IRA is a great option for anyone who doesnt have access to a retirement plan through work, since you wont be subject to the income limits on your contribution deductions.

You May Like: How To Borrow Money From My 401k