Boost Savings With Each Pay Raise

Avoiding lifestyle inflation with each pay raise was key to Gilberts ability to save $1 million. Ive seen almost everybody as they make more money spend more money, he said. To avoid falling into that trap, he increased his 401k contribution with each pay raise.

For example, if he got a 3 percent pay increase, he would increase his 401k contribution by 2 percent and take home an extra 1 percent. So he got a slight boost in take-home pay but a bigger boost in his savings rate. Its a really good way to ramp up your 401k without sacrificing your lifestyle, Gilbert said.

If you dont think you can afford to contribute to your 401k now, start with your next pay raise, he said. You wont miss the extra money youre setting aside in savings because youre already used to living on your pre-raise income.

Recommended Reading: How To Transfer 401k From Vanguard To Fidelity

Stash Some Money In A Roth 401

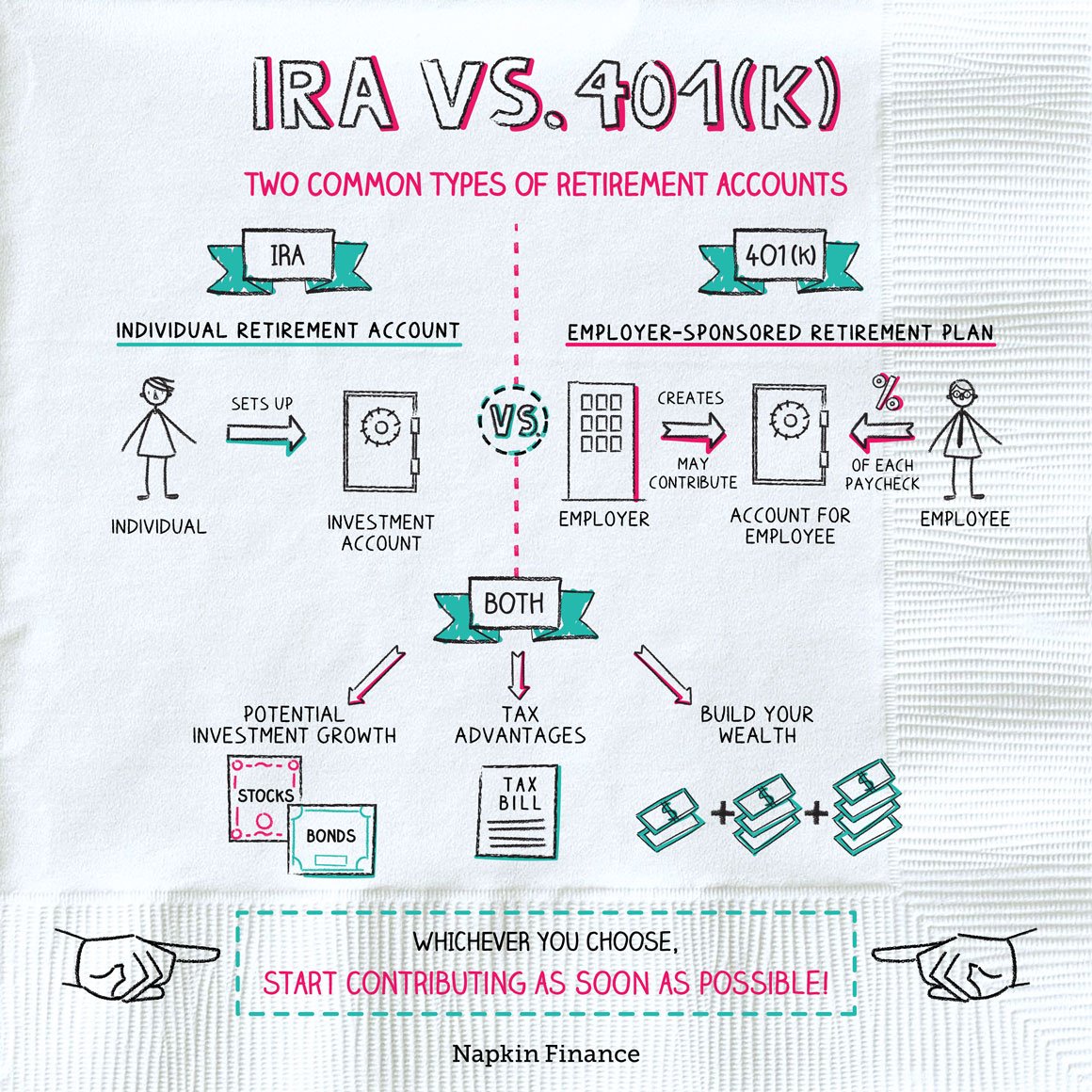

About 75 percent of plans now offer a Roth 401, along with a regular pretax account. With a Roth, you dont get an upfront tax break, but your money grows tax-free. Unlike a Roth IRA, there is no income limit to a Roth 401. And you can contribute to both pretax and Roth accounts. Unfortunately, few people opt for a Roth 401, when its offered.

Thats probably a mistake. A Roth 401 is an especially good deal for younger people, who are most likely to be in a lower tax bracket now than in the future, says Fredrickson.

A Roth 401 also offers advantages for middle-aged and older savers who typically have most of their savings in pretax accounts. When that money is withdrawn at retirement, it will be taxed, which may trigger higher Medicare premiums and Social Security taxes. Thats when having tax-free savings to tap can be particularly valuable, Fredrickson says.

Leverage All The Resources At Your Disposal

There are many tools available to help you understand your financial life in more detail, and when these tools are so readily available, not leveraging them can result in a huge blind spot when it comes to your finances. Simply having this information will help you understand if you are on the right track, and how to accelerate your progress on your retirement goals. If working with a financial advisor is an option for you, this can be an invaluable resource, especially as you get closer to retirement. A financial advisor who has your best interest in mind can help you strategize and address potential gaps in your savings and retirement income plans.

Read More: 7 Essential Steps for Retirement Planning

Read Also: How To Transfer My 401k To Fidelity

Have A Realistic Understanding Of When You Want To Retire

Having clearly defined goals will help you determine how much you should have saved based on your personal goals. Your savings objectives will be different if you plan to retire at 50 than if you plan to continue working past 70. Additionally, its important to determine as accurately as you can what your cost of living will be in retirement. How much do you need to spend per year to maintain the lifestyle that you want for the rest of your life? Have a good sense of what your costs will be so you can factor that into your overall retirement strategy. Really evaluate how long you want to continue working, and what retirement age is realistic for you based on your income and your current level of savings.

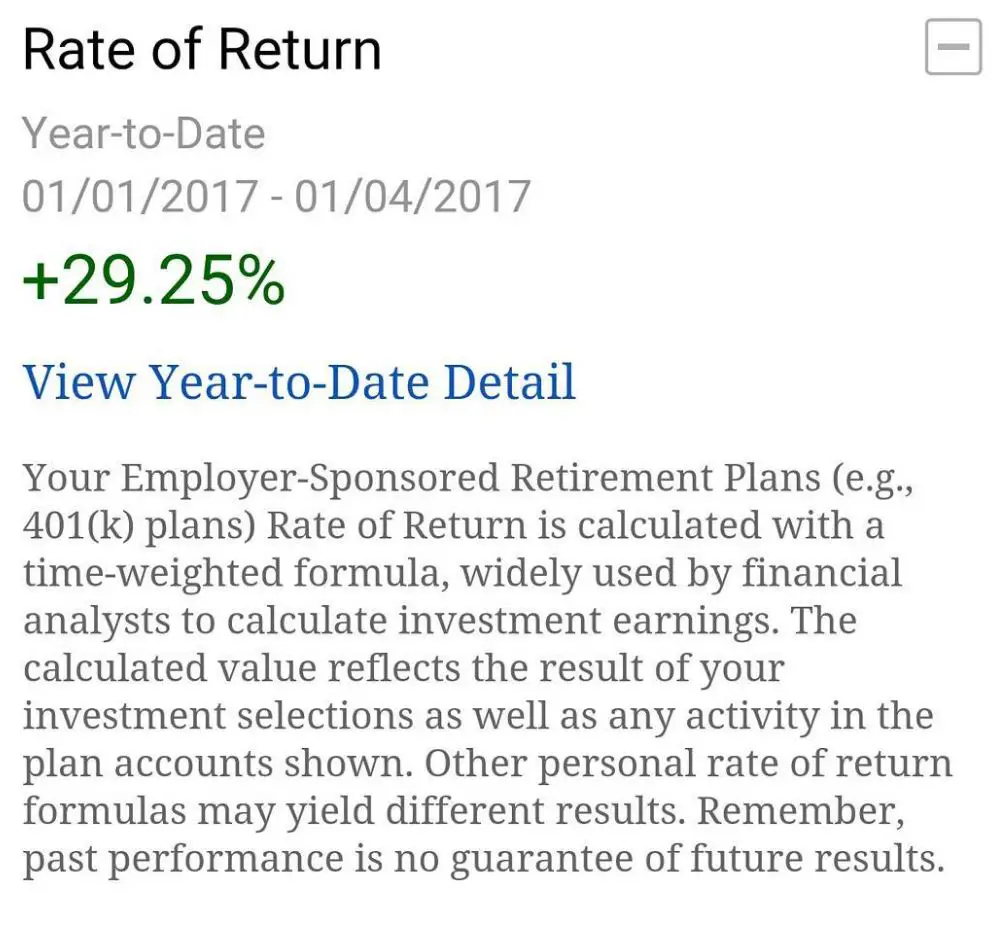

The More Money Your Retirement Savings Earn For You The Less Youll Need To Contribute To Hit Your Goals

Whether youre just opening your first retirement savings account or youve had one for decades, you need to make sure your 401 is set up to bring in as much money as possible. The higher your investment returns are, the less money youll need to save out of your paycheck in order to have enough money once you retire.

Lets go through the steps of priming your retirement savings for impressive long-term gains.

Recommended Reading: How Do I Roll A 401k Into An Ira

Should You Max Out Your 401

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks, securities or other investments.

Its in the air: Americans feel they arent saving enough for retirement. And in the wake of a global pandemic, war, record-breaking inflation and stock market volatility, it can be hard to know where to start.

If youve read any personal finance advice, you probably believe the best bet is to save, save, save. The maximum 401 contribution is $20,500 in 2022 and $22,500 in 2023.

But depending on your financial situation, putting that much into an employer-sponsored retirement account each year may not make sense. Rather, you may want to fund other accounts first. Here are four things to consider before you max out 401 contributions.

How To Stop 401s From A Previous Employer From Losing Money

If you have 401s from previous employers, you can do a few things to stop them from losing money.

First, you can roll them over into an IRA. This will give you more control over your investments and may help reduce fees.

Second, you can consolidate your accounts. This will help you track your investments and ensure theyre properly diversified.

Third, you can consider investing in a target date fund. This fund automatically becomes more conservative as you get closer to retirement.

Finally, consider rolling the old 401 into an IRA fixed index annuity. Fixed index annuities offer bonuses to offset and protection from market downturnswhile allowing you to participate in market gains. Additionally, FIAs can guarantee a stream of income for life, no matter how long you live or what happens in the markets.

Recommended Reading: Can I Move My 401k

Average 401k Balance At Age 22

The average 401k balance at ages 22-24 is actually pretty impressive, and indicates that young people using the Personal Capital Dashboard are taking their retirement savings seriously. When youre in your early 20s, if youve paid down any high-interest debt, endeavor to save as much as you can into your 401k. The earlier you start, the better. As you can see from the potential savings chart , compounding interest is no joke.

Save Early Often And Aggressively

Yes, saving is hard. Its hard when you are young and not making a large salary, and its hard when youre older and big life expenses get in the way. However, the biggest threat to your retirement is inaction. Even if its uncomfortable to max out your 401k, do it if you can. If you get a salary raise, immediately put 50% of it towards savings if youre able. The earlier and more aggressively you can save, the better off you will be, and you may even surprise yourself with how much you are able to put away. Compounding can do wonders when there is a positive annual return as you can see from the high end of the potential savings chart, so the earlier you can save more, the farther your money will go.

You May Like: How Much Can I Put In A 401k A Year

Are Retirement Savers Actually Changing Course

To answer this question, we looked at the behavior of 401 participants during the first half of 2022 from T. Rowe Prices recordkeeping data. Using collective and anonymized data, we analyzed their exchange activity and changes in their deferral rates during this volatile period.

In general, 401 participants have been staying the course. Based on our research, over 95% of 401 participants have not made any investment exchanges during the first half of 2022. But underlying that, there are some noticeable trends.

Apart from exchanges, 401 participants can also change their deferral rates in response to market conditions, but other factors may also be at work. For most of the first half of 2022, average deferral rates stayed relatively stable. More recently, though, the average has trended downward, suggesting that cutting back on contributions is one way workers may be coping with inflation at fourdecade highs. If high inflation persists and the downward trend in deferral rates is prolonged, then it could become problematic because retirement savings might fall.

Average Deferral Rate Has Remained Stable

Weekly average deferral rate during the first and second quarter of 2022

As of July 1, 2022.401 participants of plans with approximate assets> $25m. during the first half of 2022 from T. Rowe Prices record-keeping data.Source: T. Rowe Price.

Do Retirement Savers Need To Change Course

To track the progress of retirement savers, T. Rowe Price publishes age and incomespecific savings benchmarks.1 These are approximations of how much someone should have saved by a given age and level of income to have sustainable replacement income in retirement. For the calculation of these savings benchmarks, we assume an average annual return of 7%. This assumption is based on historical returns of different asset classes and agebased portfolio allocations.

But in lower expected return environments, should those saving for retirement assume lower returns and save more? To answer this question, we explored a hypothetical alternative retirement savings benchmark.

The hypothetical alternative savings benchmark assumes 4% returns for fiveyears, which we consider the midterm, and then reverts to 7% after that.

Under the lower midterm return assumptions, our agespecific savings benchmarks are unchanged for workers under age 50. In our view, these workers have enough time left to recover from any short-term to midterm market turmoil and need not focus on shortterm market returns if they are on track to reach these benchmarks.

Our Retirement Savings Benchmarks Remain Mostly Unchanged

Savings benchmarks by ageas a multiple of income

A good rule of thumb is that workers save at least 15% of their annual salary for retirement. This is a rule of thumb in practice, the suggested savings rate will vary from person to person, usually increasing for people with higher incomes.

Recommended Reading: Should I Put My 401k Into An Ira

How Do I Start A 401

If you work for a company that offers a 401 plan, contact the human resources or payroll specialist responsible for employee benefits. You’ll likely be asked to create a brokerage account through the brokerage firm your employee has selected to manage your funds. During the setup process, you’ll get to choose how much you want to invest as well as which types of investments you want your 401 funds invested in.

Invest Outside Your 401

The fees you pay to your 401 plan may also be limiting the growth of your retirement savings. Check your 401 statements or ask your benefits administrator to clarify your plan administration fees.

While its not unusual for a small company to charge 401 administration fees of 1.5% or more, those fees do limit your growth potential particularly when theyre on top of high mutual fund fees. If youre absorbing mutual fund fees of 1% and plan fees of 1.5%, youll have a hard time achieving market-level growth no matter how youre invested.

Your alternative is to invest some of your money elsewhere. Contribute enough to your workplace plan to max out any employer matching contributions, but consider saving additional amounts to an IRA or a taxable brokerage account. In a standard brokerage account, you will incur taxes annually on interest, dividends, and realized capital gains. But you can manage around that somewhat by holding tax-efficient funds and stock in companies that dont pay dividends.

Recommended Reading: How Can I Find Out If I Have 401k Money

Home Equity Line Of Credit

Instead of fixed-term repayment, you get a variable repayment and interest rate. You may opt for an interest-only repayment, but most often that comes loaded with a balloon payment, Poorman says, and may be tough to afford. Keep in mind that with a variable interest rate loan, you could see your rates go up over time.

The More Money Your Retirement Savings Earn For You The Less You’ll Need To Contribute To Hit Your Goals

Whether you’re just opening your first retirement savings account or you’ve had one for decades, you need to make sure your 401 is set up to bring in as much money as possible. The higher your investment returns are, the less money you’ll need to save out of your paycheck in order to have enough money once you retire.

Let’s go through the steps of priming your retirement savings for impressive long-term gains.

Recommended Reading: Do I Have A 401k Out There

Pay Attention To Costs

In recent years plan sponsors have focused on reducing fees, Callans data show, with more than half of employers saying they have reviewed the costs of their plans, or are likely to do so.

All of which is great, because the less you pay in fees, the more investment returns you can keep. But that may not happen if youre opting for high-cost investment options. So take a close look at the expenses charged by your fundsthey will be detailed on your 401 statement or the plans website.

If youre paying, say, 1 percent for a fund, look for a cheaper alternative on the plan menu. The typical 401 stock fund charges 0.5 percent, and index options may cost just 0.05 percent.

Seek Expert Investment Advice

No matter how much you read and learn about the stock market, itll be very difficult to cover all the angles to minimize the risk of losing money. This is why its still a good idea to seek counseling either from a financial advisor who specializes in 401 or from experienced traders who can provide investment recommendations to help you make your savings grow.

Many of these experts offer investment newsletters to analyze the markets, the economy, and more to come up with custom-tailored suggestions about where it is best to invest your 401 contributions.

Recommended Reading: Why Is A 401k Good

These Seven Steps Will Help You Build Your Retirement Nest Egg

Ah, for the days when employers worried enough about your old age to set aside and invest money on your behalf, assuring you of a secureor at least sustainableretirement.

Actually, employers still worry about your old age, but now they mostly use your money, plus the power of inertia, to get you where you need to be. Companies are not only automatically enrolling employees in 401sthe pretax accounts that have mostly supplanted pensionsbut they are also choosing employees investments and boosting contributions on an annual timetable. You can decline to participate, but most people dont, either because they dont get around to it or because they like the results.

The approach seems to be working. Over the past five years, the percentage of employees participating in a 401 or similar defined-contribution plan has held steady at 77%, according to the Transamerica Center for Retirement Studies, despite the bear market of 200709. And account balances have risen, from a median of $74,781 in 2007 for the baby-boom generation to $99,320 in 2012.

If youre like most people, you still need to save harder and longer to accumulate enough for a secure retirementsay, for an annual income that replaces 75% to 85% of your final pay. And 401s keep evolving Standard). So, rather than letting your employer make all the decisions, get the retirement you want by following these seven steps.

Average 401k Balance At Age 65+ $458563 Median $132101

The most common age to retire in the U.S. is 62, so its not surprising to see the average and median 401k balance figures start to decline after age 65. Once you reach age 65, there are still several considerations for your retirement, even if you are no longer working and accumulating wealth. Some of these include making decisions about Medicare, creating a plan around withdrawing money from your retirement accounts, and evaluating any additional insurance needs.

Read Also: How Does A 401k Work When You Change Jobs

Make Sure Your Old 401s Are Still Working For You In The Meantime

While youâre working on paying back your 401 loans, make sure you donât have any old 401s still with former employers.

Rollover your old 401s into your current account. You can monitor its investment performance and reallocate your funds to match your risk tolerance. This will help you better manage your retirement savings to ensure your meeting your retirement goals.

Tags

Recommended Reading: How To Pull Out Of 401k

Think About Opening A Roth 401

If youre looking ahead a few years, you may also want to consider opening a specific type of 401 called a Roth 401. With the Roth version, you fund with after-tax money, but youre able to enjoy tax-free withdrawals at retirement. .)

Tax rates are relatively low, so now could be a good time to fund a Roth 401 rather than a traditional 401.

With the Trump tax law due to sunset in 2025, we are facing higher rates in the future, says Kinder. It could be an excellent time to utilize the Roth 401 option and take advantage of the lower rates now. This is especially true for folks under 40 or folks in the 10 percent or 12 percent tax bracket.

Lower tax rates mean that the cost to take advantage of the Roth plan is lower, since you fund it with after-tax money. Taxpayers in higher brackets may find their break on current taxes is more advantageous, however, and stick to the traditional 401 plan.

This Bankrate calculator can help you decide whether the traditional 401 or Roth 401 is better for you.

You May Like: How Much Interest Does 401k Earn