Make Sure You Understand These Rules Before Converting Your 401 Funds To A Roth Ira

A 401 is a smart place to keep your retirement savings, especially if your company offers a matching contribution. But as some people look toward retirement, they find the Roth IRAs tax-free distributions more appealing. Contributing funds to a Roth IRA is always an option, but you could also do a 401 to Roth IRA conversion with your existing savings.

This lets you reclassify your 401 funds as Roth savings by paying taxes on the amount youd like to convert. Heres a closer look at how 401 to Roth IRA conversions work and how to decide if theyre right for you.

You Might Want A Roth Account

If your 401 plan doesnt provide a Roth 401 option, you might choose to roll your retirement savings into a Roth IRA. Advantages of a 401-to-Roth IRA rollover include:

Avoiding Roth IRA income restrictions. Even if your annual income is above the thresholds for Roth IRA contributions, youre still allowed to roll your 401 savings into a Roth IRA. This move is commonly referred to as a backdoor Roth IRA conversion, and it can grant you the benefits of tax-free withdrawals in retirement.

No required minimum distributions . With a 401or even a traditional IRAyoure subject to RMDs, or the mandated annual withdrawals from your retirement savings once you reach age 72. Roth IRAs are free of RMDs, providing you with more control over your retirement savings.

Tax-free withdrawals in retirement. When you roll over a traditional 401 into a Roth IRA, youll probably end up paying some taxes on the amount youre converting. But these taxes may be less than what youd pay if you took regular withdrawals from a traditional 401 in retirement.

Access to additional death benefits. Because there are no lifetime distribution requirements, you can pass down your Roth IRA to your heirsalthough beneficiaries need to draw down the account within 10 years.

Henderson cautions that you must be aware of the immediate tax consequences when you roll your money from a 401 to a Roth account, however.

How Do You Pay Taxes On A Roth Conversion

The conversion will place $20,000 of ordinary income on line 4b of your 2022 Form 1040. If you hold 15%, $17,000 goes to your Roth IRA account and $3,000 goes to Uncle Sam. Instead you can choose not to withhold taxes and pay $3,000 directly to the Treasury from a taxable account.

How do I avoid taxes on a Roth IRA conversion? If you start a Roth IRA with a conversion and earn a substantial investment return and then decide to empty your account within five years of setting up your first Roth IRA, you will not owe ordinary income tax on the converted money because you already paid it in the conversion.

Don’t Miss: Why Move 401k To Ira

How To Transfer From Your 401 To An Ira

When youre ready to make the transfer, you need to do three things:

I often help clients prepare these requests and do a three-way call with them , making it quick and easy to get things done. But if you prefer, you can probably figure this out on your own.

Unfortunately, you typically have to go through your former employer or a vendor they use. With many 401 plans, you cannot request a transfer using paperwork from the receiving IRA custodian.

Who to Contact

If you work for a large company, you can most likely contact your 401 provider directly. For example, contact Fidelity, Vanguard, or whatever website you use to manage your account. Alternatively, call whoever prints your 401 statements. If you work for a small company, you may need to contact the human resources department, which might just be the person who hired you. Either way, you eventually need one of the following:

What to Say

Roth Conversions: When Should You Convert Your Ira Or 401 To Roth

Roth conversions remain popular as many fear that tax rates will only increase in the next few years, so why not convert now at lower tax rates and let the account grow and come out tax-free at retirement. Remember, if you have a traditional IRA or 401, then that money grows tax-deferred, but you pay tax on the money as it is drawn out at retirement. If you have traditional dollars where you obtained tax deductions for those contributions, you then have to pay tax on the amount you want to convert to Roth.

When you are contributing you get zero tax deductions on Roth IRA and Roth 401 contributions but they grow and come out tax-free at retirement. Whats better? Well, in the end, the Roth account is a much better deal as youre pulling out what you put in AND the growth of the account after years of investing and saving. Thats likely a larger amount than what you put in so youd typically be a better-paying tax on what you put in rather than paying tax on the larger sum that you will take out later. The trade-off, of course, is youre playing the long game. Youre skipping a tax deduction or paying tax now to convert in return for tax-free growth and tax-free distributions at retirement. The Roth seems to be the better deal. Yet, most Americans have been sucked into traditional IRAs and 401s because we get a tax deduction when we put the money in a traditional account, saving us money on taxes now.

You May Like: How To Open 401k Solo

You Want Lower Fees And More Investment Options

Because a 401 account is tied to an employer, it likely has a limited number of investment options, especially if the plan is administered by a small company.

For example, you might have access to only a small group of mutual funds with relatively high expense ratios, or fees. Many discount brokerages, on the other hand, offer index funds with expense ratios close to zero within self-directed IRA accounts.

In a 401, a lot of people feel like theyre handcuffed in terms of what they can own, says Hernandez. In most cases, in an IRA you have a lot more flexibility in what you can own.

You Expect To Earn More Money In The Future

If you plan to earn lots of money in the future or earn a high income now you should consider rolling your funds into a Roth IRA instead of a traditional IRA. For single filers in 2016, the maximum income allowable for contributions to a Roth IRA starts at $117,000 and ends at $133,000. Learn more about Roth IRA rules and contribution limits here. For married filers, on the other hand, the ability to contribute to a Roth IRA begins phasing out at $184,000 and halts completely at $194,000 for 2016. The more you earn in the future, the harder it will become to contribute to a Roth IRA and secure the benefits that come with it.

Also Check: How Does A 401k Work When You Change Jobs

Read Also: How To Start A 401k For Myself

Roth 401 To Roth Ira Conversions

If your 401 plan was a Roth account, then it can only be rolled over to a Roth IRA. The rollover process is straightforward. The transferred funds have the same tax basis, composed of after-tax dollars. This is not, to use IRS parlance, a taxable event.

However, you should check how to handle any employer matching contributions, because those will be in a companion regular 401 account and taxes may be due on them. You can establish a new Roth IRA for your 401 funds or roll them over into an existing Roth.

You May Be Charged Lower Fees

Even if your company covers fees charged by your plan now, it may not once youve parted ways. And you have no guarantee your future companys 401 will be fee-free. Make sure you have a handle on potential costs your employer-sponsored retirement plan has just for managing your money.

While youll probably never be able to escape fund expense ratios, you can minimize or completely eliminate most administrative fees by moving from a 401 to an IRA. An IRA may also afford you better access to more low-cost funds, like index funds.

Recommended Reading: How Is My 401k Doing

What Other Types Of Retirement Accounts Can I Roll Over To An Ira

In addition to 401 accounts, you can roll over other qualified plans to IRAs, including pension plans, SIMPLE IRAs, 403s, 457s, and thrift savings plans .

The Oxford Gold Group helps investors protect and grow their wealth by purchasing physical gold and silver for their IRAs and for home delivery as effortlessly and securely as buying bonds or stocks. Thats why investors have turned to the security of gold and silver and the Oxford Gold Group. Call 833-600-GOLD or visit OxfordGoldGroup.com to receive a complimentary copy of Your Precious Metals Investment Guide.

Third-party advertisements and links to other sites where goods or services are advertised arent endorsements or recommendations by The Epoch Times of the third-party sites, goods, or services. The Epoch Times takes no responsibility for the content of the ads, promises made, or the quality/reliability of the products or services offered in all advertisements.

Be Sure To Understand The Tax Consequences Before Making The Change

If you are considering leaving a job and have a 401 plan, then you need to stay on top of the various rollover options for your workplace retirement account. One of those options is rolling over a traditional 401 into a Roth individual retirement account . This can be a very attractive option, especially if your future earnings will be high enough to knock into the ceiling placed on Roth account contributions by the Internal Revenue Service .

Regardless of the size of your earnings, you need to do the rollover strictly by the rules to avoid an unexpected tax burden. Since you havent paid income taxes on that money in your traditional 401 account, you will owe taxes on the money for the year when you roll it over into a Roth IRA. Read on to see how it works and how you can minimize the tax bite.

Recommended Reading: Can I Pull My 401k To Buy A House

You Want To Relax Early

Proponents of the FIRE movement invest aggressively so they can become work-optional in their 50s or even earlier.

If thats your plan, youll want at least a portion of your investments to be in an account thats more accessible than a 401, which you cannot tap without penalty before the age of 59 ½. A strategy known as a Roth conversion ladder involves converting 401 funds into a Roth IRA over a period of years.

Its a bit complex, says Hernandez. Theres a small number of people that it could make sense for. Its important to understand the tax impact.

Can You Withdraw Contributions From A Backdoor Roth Ira

And you can withdraw both your contributions and earnings from a Roth IRA with no taxes or penalties after you turn 59 and a half, as long as the account is at least five years old. Otherwise, you will be subject to the 10% tax penalty unless an exception applies .

How do you remove a backdoor from a Roth IRA?

To reverse a conversion by returning an account to traditional IRA status, you must submit the required form to the Roth IRA trustee or custodian by October 15 of the year following the conversion.

Can I withdraw my contributions from a Roth IRA conversion without a penalty?

As a general rule, you can withdraw your contributions from a Roth IRA at any time without paying any taxes or penalties. If you withdraw money from a conversion too soon after that event and before the age of 59 and a half, you could incur a penalty.

Also Check: How To Move 401k Into Ira

Roth 401s As An Alternative

A Roth 401 combines the employer-sponsored nature of the traditional 401 with the tax structure of the Roth IRA. If your employer offers this type of plan, youll contribute after-tax money to your account and you wont owe taxes when you start receiving distributions. If your employer offers a match, though, that money is in a traditional 401 plan. So if you choose to convert it, you will owe taxes on it the year you do so.

If youre looking to do a rollover from a Roth 401 to a Roth IRA , the process is quite simple. All youll have to do is follow the same steps as if you were rolling over a traditional 401 to a traditional IRA. The tax structure is staying the same. If youre looking to convert your Roth 401 into a traditional IRA, youre out of luck. Unfortunately, this isnt possible, since you cant un-pay taxes on the money in your Roth 401.

You May Like: How To Find Your 401k

Guaranteed Retirement Income For Life

You can choose to annuitize your annuity to receive annuity payments over a period of time or for life or add an optional income rider to generate a paycheck you can never outlive. Sometimes the insurance company will provide a paycheck that increases to help with inflation and the cost of living. Annuities automate withdrawing from a 401k or IRA.

Recommended Reading: What Reasons Can You Withdraw From 401k Without Penalty

Read Also: Can I Use My 401k To Buy Investment Property

How To Roll Over A Roth 401 To A Roth Ira

Saving through a Roth 401 can help you grow a nest egg that you can then tap into in retirement without having to pay taxes. If you leave your job or youre ready to retire, you may be wondering what to do with the funds in your 401. Rolling your Roth 401 over to a Roth IRA is just one possibility. But make sure you know how this process works to avoid triggering an IRS tax penalty. A financial advisor can walk you through a rollover if youre new to it.

When You Don’t Roll Over

Cashing out your account is a simple but costly option. You can ask your plan administrator for a checkbut your employer will withhold 20 percent of your account balance to prepay the tax youll owe. Plus, the IRS will consider your payout an early distribution, meaning you could owe the 10 percent early withdrawal penalty on top of combined federal, state and local taxes. That could total more than 50 percent of your account value.

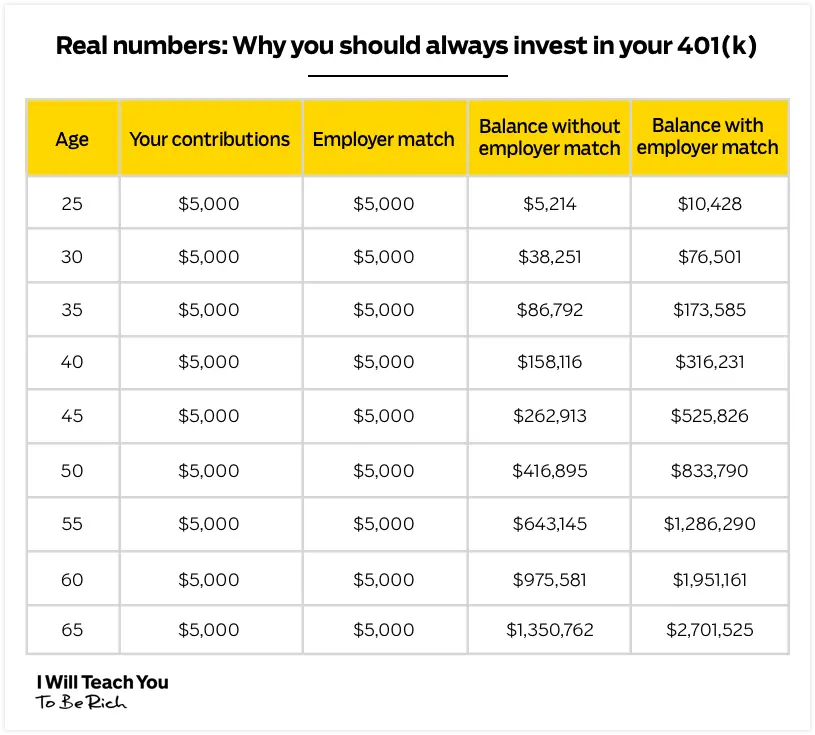

Think TwiceThe repercussions of taking money out now could be enormous: If you took $10,000 out of your 401 instead of rolling it over into an account earning 8 percent tax-deferred earnings, your retirement fund could end up more than $100,000 short after 30 years.

If your former employers plan has provided strong returns with reasonable fees, you might consider leaving your account behind. You dont give up the right to move your account to your new 401 or an IRA at any time. While your money remains in your former employers 401 plan, you wont be able to make additional contributions to the account, and you may not be able to take a loan from the plan. In addition, some employers might charge higher fees if youre not an active employee.

Further, you might not qualify to stay in your old 401 account: Your employer has the option of cashing out your account if the balance is less than $1,000 though it must provide for the automatic rolling over of your assets out of the plan and into an IRA if your plan balance is more than$1,000.

Recommended Reading: What Do 401k Invest In

Rolling Your Old 401 Over To A New Employer

To keep your money in one place, you may want to transfer assets from your old 401 to your new employers 401 plan. Doing this will make it easier to see how your assets are performing and make it easier to communicate with your employer about your retirement account.

To roll over from one 401 to another, contact the plan administrator at your old job and ask them if they can do a direct rollover. These two words “direct rollover” are important: They mean the 401 plan cuts a check directly to your new 401 account, not to you personally.

Generally, there aren’t any tax penalties associated with a 401 rollover, as long as the money goes straight from the old account to the new account.

Although this route may help you stay organized with fewer accounts to keep track of, make sure your new 401 has investment options that are right for you and that you aren’t incurring higher account fees.

A Roth Conversion Could Trigger Other Taxes

Look at the big picture if you plan a conversion. The added taxable income could boost you into a higher tax bracket, at least temporarily. A big jump in income could trigger one-time taxes, too, such as the 3.8% net investment income tax, or also called the Medicare surtax.

A series of small conversions over several years could keep the tax bill in check. For instance, you may want to convert just enough to take you to the top of your current tax bracket.

Recommended Reading: How Much Do They Tax Your 401k