How Can I Avoid Paying Taxes On My 401k Withdrawal

Heres how to minimize 401 and IRA withdrawal taxes in retirement:Avoid the early withdrawal penalty.Roll over your 401 without tax withholding.Remember required minimum distributions.Avoid two distributions in the same year.Start withdrawals before you have to.Donate your IRA distribution to charity.More items

Read Also: Is A 401k A Defined Contribution Plan

K Hardship Withdrawal Rules

Jeff Rose, CFP® | July 11, 2022

For many Americans struggling to make ends meet, a 401k hardship withdrawal appears to be a viable option.

When job loss, unexpected health issues, or recession hit, you may find yourself in dire need of help.

House or rent payment. Utility bills. Late credit cards notices. Debt collectors calling you every hour on the hour.

Read on to decide whether or not to pursue a 401k hardship withdrawal to alleviate the burden.

Hardships Early Withdrawals And Loans

Generally, a retirement plan can distribute benefits only when certain events occur. Your summary plan description should clearly state when a distribution can be made. The plan document and summary description must also state whether the plan allows hardship distributions, early withdrawals or loans from your plan account.

You May Like: Should I Transfer My 401k To A Roth Ira

How 401 Hardship Withdrawals Work

A hardship withdrawal is an emergency removal of funds from a retirement plan, sought in response to what the IRS terms “an immediate and heavy financial need.” It’s actually up to the individual plan administrator whether to allow such withdrawals or not.

Manythough not allmajor employers do this, provided that employees meet specific guidelines and present evidence of the hardship to them.

Dividing Your 401 Assets

If you divorce, your former spouse may be entitled to some of the assets in your 401 account or to a portion of the actual account. That depends on where you live, as the laws governing marital property differ from state to state.

In community property states, you and your former spouse generally divide the value of your accounts equally. In the other states, assets are typically divided equitably rather than equally. That means that the division of your assets might not necessarily be a 50/50 split. In some cases, the partner who has the larger income will receive a larger share.

For your former spouse to get a share of your 401, his or her attorney will ask the court to issue a Qualified Domestic Relations Order . It instructs your plan administrator to create two subaccounts, one that you control and the other that your former spouse controls. In effect, that makes you both participants in the plan. Though your spouse cant make additional contributions, he or she may be able to change the way the assets are allocated.

Your plan administrator has 18 months to rule on the validity of the QDRO, and your spouses attorney may ask that you not be allowed to borrow from your plan, withdraw the assets or roll them into an IRA before that ruling is final. Once the division is final, your former spouse may choose to take the money in cash, roll it into an IRA or leave the assets in the plan.

Don’t Miss: Can I Withdraw Money From 401k

Hardship Withdrawal Rules 2022

Siân Killingsworth / 5 May 2022 / 401 Resources

The CARES Act of 2020 allowed up to $100,000 in early hardship withdrawal distributions from 401 and IRA retirement savings plans without the usual 10% penalty. However, the IRS discontinued the early pandemic program on December 20, 2020, and it is no longer available in 2022. If you are currently experiencing financial hardship, options still exist, but borrowing from your retirement should be treated as a last resort.

Does Social Security Count As Income

Since 1935, the U.S. Social Security Administration has provided benefits to retired or disabled individuals and their family members. … While Social Security benefits are not counted as part of gross income, they are included in combined income, which the IRS uses to determine if benefits are taxable.

Don’t Miss: What To Do With Your 401k After Leaving A Job

Living With A Disability

If you become totally and permanently disabled, getting access to your retirement account early becomes easier. In this case, the government allows you to withdraw funds before age 59½ without penalty. Be prepared to prove that youre truly unable to work. Disability payments from either Social Security or an insurance carrier usually suffice, though a doctor’s confirmation of your disability is frequently required.

Keep in mind that if you are permanently disabled, you may need your 401 even more than most investors. Therefore, tapping your account should be a last resort, even if you lose the ability to work.

Drawbacks Of Making Hardship Withdrawals

Keep in mind, however, that just because you are facing one of these financial hardships doesnt mean that taking out a hardship withdrawal is a smart financial move. There are several potential drawbacks to making hardship withdrawals.

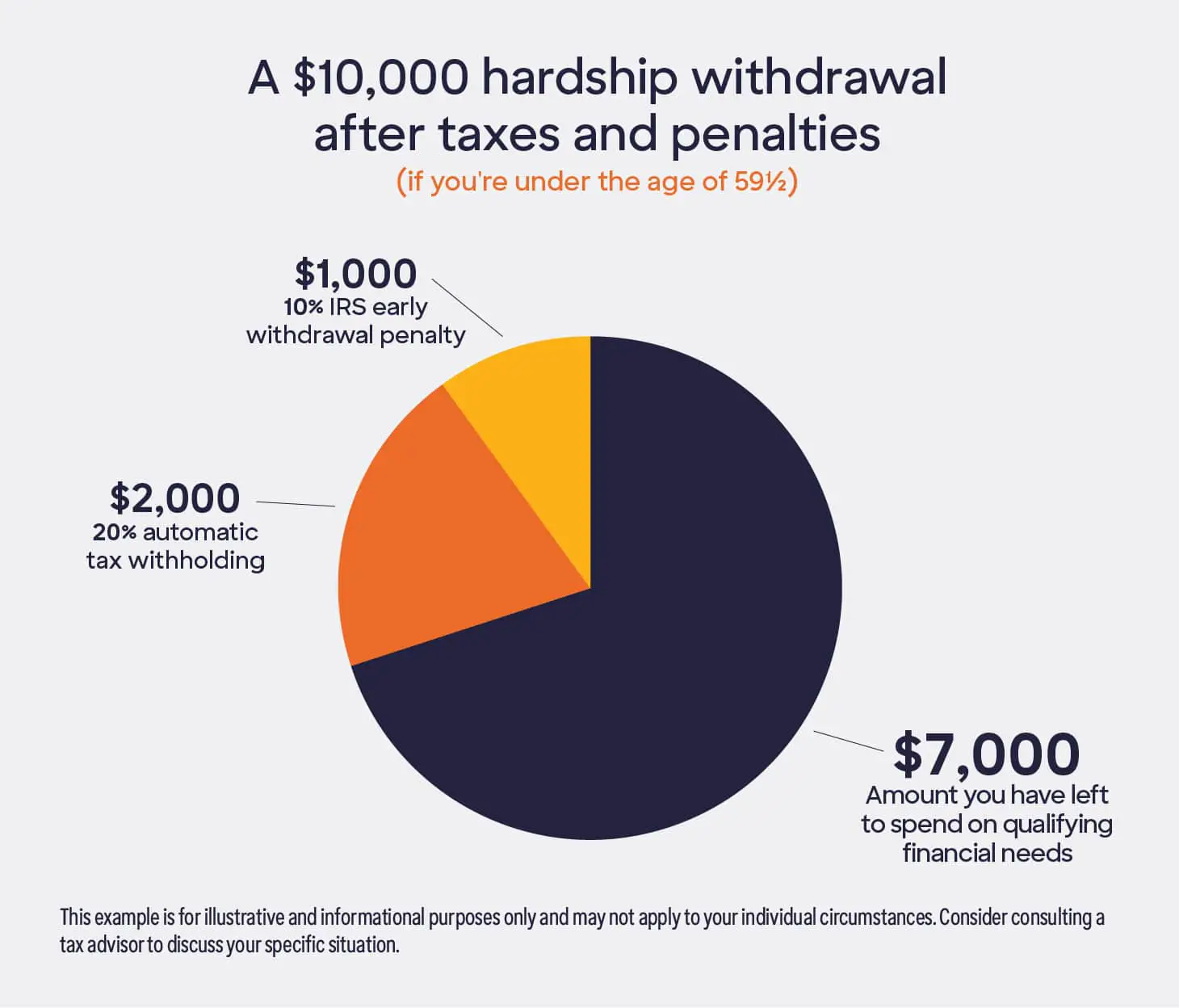

Perhaps the biggest disadvantage is that regular income taxes will be due on the funds taken out during the year in which theyre withdrawn. And if youre under age 59½, a 10% early withdrawal penalty may also apply. There are a few exceptions to the early withdrawal penalty, including disability, medical debt that exceeds 7.5%t of adjusted gross income , and a court order to give money to a divorced spouse, child or dependent.

If you dont qualify for one of these exceptions and you are under 59½ years old, you could receive significantly less money than the amount you take out via a hardship withdrawal. For example, if youre in the 22% tax bracket and make a hardship withdrawal of $10,000, youll only put $6,800 cash in your pocket after subtracting $3,200 in taxes and penalties.

Another big drawback to making hardship withdrawals is that this could jeopardize your ability to enjoy a financially comfortable retirement. Every dollar withdrawn from your 401k early is a dollar that isnt there for retirement. In addition, you lose the opportunity for these funds to grow on a tax-deferred basis over the long term, which could potentially grow your nest egg even more.

Read Also: Can You Pull From Your 401k To Buy A House

When A Problem Occurs

The vast majority of 401 plans operate fairly, efficiently and in a manner that satisfies everyone involved. But problems can arise. The Department of Labor lists signs that might alert you to potential problems with your plan including:

- consistently late or irregular account statements

- late or irregular investment of your contributions

- inaccurate account balance

Vesting Implications On 401 Hardship Withdrawals

If your employer offers a 401 match, the match can increase the value of your 401 assets exponentially. However, the employerââ¬â¢s contributions do not fully belong to you until after the end of the vesting period. For example, if your employer has a three-year vesting period, you must have been working for the employer for at least three years to claim 100% of the employerââ¬â¢s contributions.

If you take a hardship withdrawal before you have completed the vested period, you will only access the vested portion of your contributions. For example, if you want to withdraw $20,000, and only $18,000 is vested, you may be forced to take a lower distribution i.e. $18,000 to meet your needs than what you need. Otherwise, you may be forced to wait longer for the employerââ¬â¢s contributions to be vested, depending on the companyââ¬â¢s vesting schedule.

You May Like: How Do I Rollover My 401k Into An Ira

How To Avoid Penalties

In the most basic sense, 10% penalties are given to individuals who take out hardship withdrawals if they are under the age of 59.5. In some conditions, the penalties can be bypassed through specific rules and criteria.

The specified rules and criteria apply to different aspects of a financial burden and will cover medical expenses, university expenses, health insurance, and first-time homebuyers.

1. Medical expenses

If an individual is taking out a hardship withdrawal to cover medical expenses, they may avoid the penalty if the unreimbursed qualified medical expense does not exceed 10% of your adjusted gross income.

2. University expenses

Hardship withdrawal penalties can be avoided by allocating the money to qualified university expenses such as tuition, books, and board. Additionally, the withdrawal can be used for non-arms length university expenses only if they are attending school half time.

3. Health insurance

In terms of health insurance, an individual may avoid the hardship withdrawal penalty if theyve been unemployed for at least 12 weeks and use the compensation to pay for health insurance premiums.

4. First-time homebuyers

First-time homeowners are able to evade the hardship withdrawal penalty only if they have not owned another home in the last two years. Additionally, the withdrawal cannot exceed $10,000 and must only be allocated to the down payment.

Can You Be Denied A Hardship Withdrawal

Most 401 plans provide loans to participants who are facing financial hardship or have an immediate emergency need such as medical expenses or college education. If the reason for the 401 loan is a luxury expense that does not meet the financial hardship criteria, the loan application could be denied.

Read Also: How Can I Find My Lost 401k

What Is The Rule Of 55

The Rule of 55 allows early distribution as early as age 55, penalty-free, so long as youre retiring from the workforce and not simply changing employers. If youre 59.5 or older, you can take regular 401 distributions without penalty, though theyll be taxed as income unless your distribution is from a Roth source.

What Are The Tax Implications Of A 401k Hardship Withdrawal

If you must make a hardship withdrawal from your 401k before you reach the age of 59 and a half years old, your withdrawal will be subject to income tax and a 10% withdrawal penalty.

You dont have to pay back the money withdrawn like you would a loan from a 401k, which means your retirement account balance is permanently reduced by the amount of your hardship withdrawal.

Don’t Miss: Can I Invest In A 401k On My Own

Withdrawal Penalty Before Age 59

If you’re under age 59½, you may have to pay an additional 10% when you file your tax return. If you are still working when you are 59 ½, you can take money out of your 401.

You can take money from your 401 account if you are age 59½ or older. You will not have a penalty. Twenty percent is withheld for federal income taxes. You can also roll money from your 401 to IRA or other qualified plan. Funds that are rolled over are not subject to tax at that time.

Why Employers Operate Under Safe Harbor Rules

These rules create a safe harbor under IRS regulations so that the employer or other plan sponsor may permit these distributions without a plan audit questioning the validity of the distribution so long as the employer diligently received evidence of the employees hardship and reviewed the evidence for conformity with IRS regulations.

The less a plan sponsor goes outside of safe harbor rules with an ERISA retirement plan the less liability it creates for itself. Along with operating outside of safe harbor rules also comes paying for more guidance from employment law attorneys who specialize in retirement plans and other compensation issues.

If the IRS audits the retirement plan and finds regulatory violations then the plan sponsor may face penalties and may further attorneys fees to deal with defending against the IRS and fixing plan problems.

Read Also: Should I Take A 401k Loan To Pay Off Debt

Weighing Pros And Cons

Before you determine whether to borrow from your 401 account, consider the following advantages and drawbacks to this decision.

On the plus side:

- You usually dont have to explain why you need the money or how you intend to spend it.

- You may qualify for a lower interest rate than you would at a bank or other lender, especially if you have a low credit score.

- The interest you repay is paid back into your account.

- Since youre borrowing rather than withdrawing money, no income tax or potential early withdrawal penalty is due.

On the negative side:

- The money you withdraw will not grow if it isnt invested.

- Repayments are made with after-tax dollars that will be taxed again when you eventually withdraw them from your account.

- The fees you pay to arrange the loan may be higher than on a conventional loan, depending on the way they are calculated.

- The interest is never deductible even if you use the money to buy or renovate your home.

CAUTION: Perhaps the biggest risk you run is leaving your job while you have an outstanding loan balance. If thats the case, youll probably have to repay the entire balance within 90 days of your departure. If you dont repay, youre in default, and the remaining loan balance is considered a withdrawal. Income taxes are due on the full amount. And if youre younger than 59½, you may owe the 10 percent early withdrawal penalty as well. If this should happen, you could find your retirement savings substantially drained.

I Need Emergency Funds

Removing funds from your 401 before you retire because of an immediate and heavy financial need is called a hardship withdrawal. People do this for many reasons, including:

- Unexpected medical expenses or treatments that are not covered by insurance.

- Costs related to the purchase or repair of a home, or eviction prevention.

- Tuition, educational fees and related expenses.

- Burial or funeral expenses.

The IRS is making it easier to access the funds in your 401 by amending the rules around hardship withdrawals. But hardship withdrawals are a drain on your hard-earned retirement savings, and they stunt all the growth youve previously achieved. They can even impact your ability to retire when you want.

Recommended Reading: How Can I Access My 401k Money

What Changes Did The 2019 Final Hardship Rule Make

On Sept. 23, 2019 the IRS released a final hardship rule that relaxed several hardship distribution restrictions. Some of these changes are mandatory, requiring employers to make the changes by Jan. 1, 2020, while others are optional. Below are the key changes.

401 plans that permit hardship distributions must be formally amended to reflect the changes.

Do You Have To Pay Back A Hardship Withdrawal From A 401

Qualified hardship withdrawals from a 401 do not need to be repaid. However, you must pay any deferred taxes due on the amount of the withdrawal. You may also be subject to an early withdrawal penalty if the hardship withdrawal is not deemed qualified or if you withdraw more than needed to exactly cover the specific hardship.

Recommended Reading: How To Check How Much You Have In Your 401k

Hardship Withdrawals Vs 401 Loans

Taking a hardship withdrawal from your 401 is an alternative to taking a 401 loan. While you wont have to pay the money back when you take a hardship withdrawal, the aforementioned 10% IRS tax penalty will apply. Remember that this is in addition to your standard income tax rate, meaning the IRS will hit you hard come tax time.

The flip side is that a 401 loan is just that: a loan. Just like any other form of debt, youll need to pay it back, in this case, to your own account. Failure to make on-time payments will result in not only a default, but a 10% withdrawal penalty as well. Thats because the IRS will consequently view your loan as income if you dont pay it back. Should this happen, youll essentially incur the disadvantages of both hardship withdrawals and 401 loans.

Eligibility for a hardship withdrawal is dependent upon whether or not you meet the requirements above. On the other hand, your purpose for needing a 401 loan is completely irrelevant in the eyes of the IRS. So as long as you can pay the money back on time, you wont run into trouble.

Hardship Distributions Frequently Asked Questions

A 401 plan may, but is not required to, allow participants to take a hardship distribution in times of financial stress. This type of 401 distribution can be a financial lifeline when someone has nowhere else to turn for cash. In 2019, the IRS released a final hardship rule that made several changes to the 401 hardship rules, generally relaxing how and when these distributions may be taken. Both employers and 401 participants should understand how the regulation will affect their retirement plan.

Employers dont really have a choice. After all, they have a fiduciary responsibility to administer their 401 plan in accordance with the law. Meeting this responsibility is important because severe consequences including plan disqualification or fiduciary liability are possible when its not. To stay out of trouble, employers must be ready to administer the new hardship rules.

We receive a lot of questions from clients about hardship distributions which is hardly surprising when you consider how complicated these rules can appear. Below is a FAQ with answers to the most common questions we receive.

You May Like: Can You Roll Over A 403b Into A 401k

Sending The Hardship Withdrawalform To The Program

Once you receive the participants completedform, and Form W-4P , you must review and sign it as theAuthorized Plan Representative. Submit the completed Hardship Withdrawal Formto the Program via mail or email.

Once the Program receives the properly completed and signed Hardship Withdrawal Form, the hardship withdrawal is processed and a check is issued within two business days. Hardship withdrawal checks are sent via US Mail to the participant at the address of record. In January of the next calendar year, the Program will mail the participant an IRS Form 1099-R regarding any taxable withdrawals for the prior tax year.

Any withdrawals processed by the close ofbusiness on the last business day of the quarter will be reflected on theparticipants quarterly statement. Quarterly statements are mailed no laterthan 10 business days after the end of each quarter.