A Wide Array Of Unbiased Investment Choices

Making the best possible investment decisions for your plan is critical to its success. Whether your advisor is providing investment advisory services or you are considering hiring a third party for this support, ADP offers two distinct options for selecting investments:

- Our open-fund architecture provides access to over 13,000 nonproprietary investment options from 300+ investment managers. You and your advisor can compare and evaluate funds to find the right candidates for consideration.

- Our screened investment tiers put simplicity at the forefront by offering fund tiers that have been evaluated and are organized based on ADPs underwriting criteria.2

In both options, as an independent record keeper, ADP is able to provide investment options without any bias or agenda.

A separate, indirect subsidiary of ADP, Inc., ADP Strategic Plan Services, LLC provides fiduciary investment management services. including the analysis, selection, monitoring, and if necessary, replacement of investment options on behalf of employer-sponsored retirement plans.

Sentinel Benefits & Financial Group

Sentinel Benefits & Financial Group is headquartered in Wakefield, Massachusetts, and it provides investment advisory, retirement plan administration, actuarial consulting, and other wealth planning and life planning services.

As a recordkeeper, Sentinel Benefits & Financial Group administers more than $9.25 in assets, and it serves more than 175,000 individuals. Notable employers who use Sentinel Benefits & Financial Group include Compass Medical, Harvard Management, Wood Mackenzie, Select Equity Group, and Village Care of New York.

Provide Competent Qualified Financial Advisors

Its very beneficial for your employees to have someone to consult when they have questions about how to invest in their account and how much they should contribute. An advisor takes the burden of providing financial advice to your employees off of you. Be sure to properly vet your applicants for the financial advisor position, because poor financial advice can have serious financial and legal consequences.

Don’t Miss: Can Roth 401k Be Converted To Roth Ira

Can A Company Move Your 401k Without Your Permission

Yes, your former employer may inadvertently remove you from their 401k plan when your balance is $ 5,000 or less. They dont need your consent. They need to let you know in advance, but this is not always the case. It is up to you to prepare.

Can my employer transfer my 401k? You can leave the 401 to your former employer or include it in your new employers plan. You can also transfer your 401 to an Individual Retirement Account . Another option is a 401 withdrawal, but this may result in a penalty for early withdrawal and you will have to pay tax on the full amount.

Who Are Considered The Best 401 Providers

According toFit Small Business, the 10 best small business 401 providers include:

- Ubiquity perfect for those who want easy setup and the freedom to choose their own broker

- Vanguard ideal for a low-cost, easy-to-setup Solo 401 with a well-known name

- Charles Schwab offers additional banking and investment brokerage services

- Fidelity helpful if you want a large network of offices and in-person guidance

- E-Trade a DIY source for active trading

- TD Ameritrade a traditional provider and alternative to Vanguard

- IRA Financial for businesses who want alternative investment options

- Merrill Edge offers business and investment services under one roof

- Rocket Dollar offers self-directed Solo 401 with checkbook control

Read Also: Where Is The Best Place To Rollover My 401k

The Federal Thrift Savings Plan

The Thrift Savings Plan is a lot like a 401 plan on steroids, and its available to government workers and members of the uniformed services.

Participants choose from five low-cost investment options, including a bond fund, an S& P 500 index fund, a small-cap fund and an international stock fund plus a fund that invests in specially issued Treasury securities.

On top of that, federal workers can choose from among several lifecycle funds with different target retirement dates that invest in those core funds, making investment decisions relatively easy.

Pros: Federal employees can get a 5 percent employer contribution to the TSP, which includes a 1 percent non-elective contribution, a dollar-for-dollar match for the next 3 percent and a 50 percent match for the next 2 percent contributed.

The formula is a bit complicated, but if you put in 5 percent, they put in 5 percent, says Littell. Another positive is that the investment fees are shockingly low four hundredths of a percentage point. That translates to 40 cents annually per $1,000 invested much lower than youll find elsewhere.

Cons: As with all defined contribution plans, theres always uncertainty about what your account balance might be when you retire.

What it means to you: You still need to decide how much to contribute, how to invest, and whether to make the Roth election. However, it makes a lot of sense to contribute at least 5 percent of your salary to get the maximum employer contribution.

What Happens When My Employer Changes 401k Provider

If the plan changes the supplier of the investment, the assets are sold and the proceeds are sent to the new supplier, where they are usually reinvested in similar funds, in a process called mapping. The old supplier issues final statements based on the liquidation balance.

How long does an employer have to transfer 401k contributions?

Department of Labor regulations require an employer to pay deferrals to the trust fund as soon as possible however, under no circumstances may payment be made later than the 15th working day of the following month.

Also Check: What Age Can You Collect 401k

Great Benefits Help You Build A Great Team

Your team is essential to your success help them build a strong financial foundation for the future.

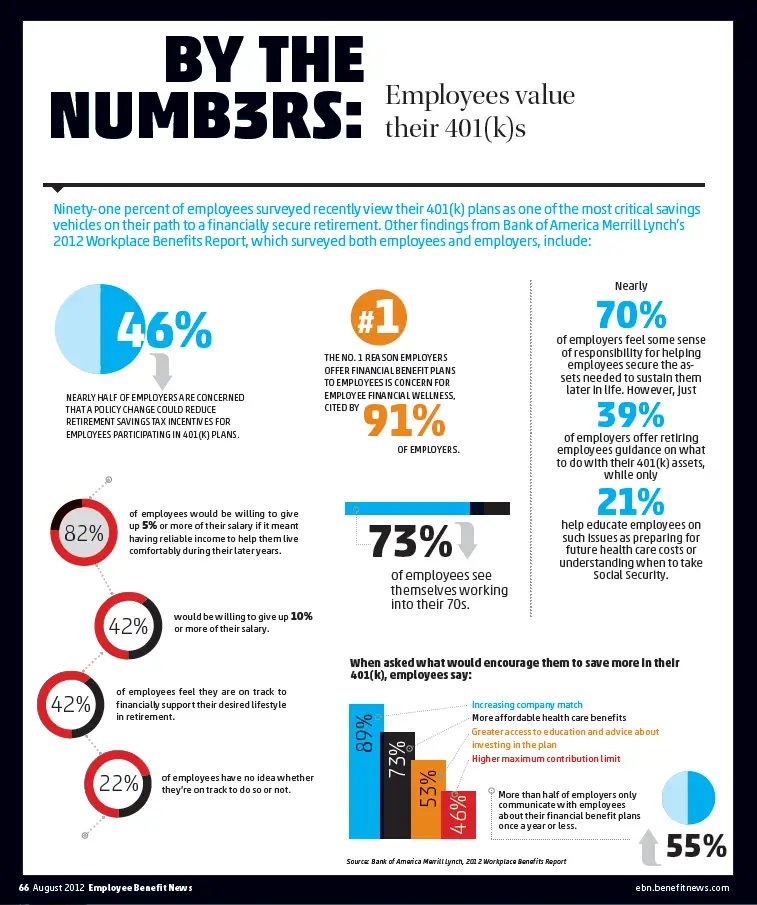

Did you know?Nearly 70 million Americans dont have a retirement savings plan at work, but workers are 15 times more likely to save when their employers offer one.Source: National Conference of State Legislators

Third Party Solo 401k Providers

If you need or want a solo 401k that is a little more robust that the free prototype plans these five brokerage firms offer, then you need to find a third party service that will create the plan documentation for you.

Some of the common reasons why you’d consider using a third-party service to create your solo 401k documentation:

- You want a choice in brokerage

- You want to invest in alternative assets such as real estate, startups, cryptocurrency, promissory notes, tax liens, precious metals, and more.

- You want checkbook control over your 401k

- None of the prototype providers matches exactly what you’re looking for with options

Remember, just because you go with a third party provider also doesn’t mean you can’t invest at your favorite firm. For example, you can create a third party solo 401k and then have that 401k held at Fidelity. This gives you access to all of Fidelity’s investment choices, but your options are created by the plan, and NOT Fidelity.

How is this possible? Your plan provider simply creates your plan documents that govern your 401k plan. You can then take those documents to your favorite broker , and you open a non-prototype account. These are equity-holding accounts that simply manage your equity investments. What they don’t do is any of the paperwork associated with your plan. Did you withdraw from your plan? You’re responsible for creating the 1099-R.

Some of the most popular online providers include:

Don’t Miss: What Is The Tax Rate On A 401k

Rules And Deadlines For Simple Ira

SIMPLE IRAs must be established by Oct. 1. All employees whom you have paid at least $5,000 during previous years, or expect to pay this year, are eligible to participate in this type of plan. Plan participants may begin withdrawing funds at age 59.5 without paying a 10% additional tax. However, participants must hold the account for at least two years before making withdrawals to avoid a higher 25% additional tax. Participants must begin withdrawals the year they turn 70.5 to avoid a 50% RMD excise tax.

Key Plan Benefits To Consider

Virtually all retirement plans offer a tax advantage, whether its available upfront during the savings phase or when youre taking withdrawals. For example, traditional 401 contributions are made with pre-tax dollars, reducing your taxable income. Roth 401 plans, in contrast, are funded with after-tax dollars but withdrawals are tax-free.

Some retirement savings plans also include matching contributions from your employer, such as 401 or 403 plans, while others dont. When trying to decide whether to invest in a 401 at work or an individual retirement account , go with the 401 if you get a company match or do both if you can afford it.

If you were automatically enrolled in your companys 401 plan, check to make sure youre taking full advantage of the company match if one is available.

And consider increasing your annual contribution, since many plans start you off at a paltry deferral level that is not enough to ensure retirement security. Roughly half of 401 plans that offer automatic enrollment, according to Vanguard, use a default savings deferral rate of just 3 percent. Yet T. Rowe Price says you should aim to save at least 15 percent of your income each year.

Also Check: What To Do With 401k When You Quit

Employee Retirement Provider Costs

Business owners can expect to pay $50 to $200 per month for their employee retirement plan, plus $5 to $15 per employee per month to cover the cost of administration and recordkeeping.

Additionally, when small business owners set up a retirement plan, there are usually annual fees for administration, recordkeeping and filing preparation. Providers may also charge fees for serving as a plan fiduciary, conducting onsite visits, or preparing educational materials or newsletters. Some companies may charge separate annual advisory fees for assisting with plan design and serving as a resource for employees who need assistance.

Key takeaway: Employee retirement plans typically charge a base rate ranging from $50 to $200 per month, plus $5 to $15 per employee per month.

Td Ameritrade Solo 401k

TD Ameritrade is another low cost brokerage that offers a prototype free solo 401k plan. Their plan is the hardest to dissect, however, after discussing their plan with them, here is what we found.

The TD Ameritrade solo 401k plan only allows traditional contributions after July 2022 .

As such, TD Ameritrade will also discontinue allowing loans from their solo 401k, and existing loans will need to be repaid.

Looking at their plan document, they only allow rollovers from 401, 401, 403, 403, 408, and 457 accounts.

They also offer a lot of investment choices within their 401k plan. For example, they offer Vanguard ETFs commission free.

There are no setup fees or annual account fees with TD Ameritrade’s plan. All regular trades within the 401k are subject to their standard commission which is $0 per stock, ETF, and option trade. However, even beyond the Vanguard ETFs, they offer other ETFs commission free as well.

Note: If you currently have a plan with TD Ameritrade, and you have a Roth Solo 401k, you’re going to need to rollover your plan to another provider by July 2022 . This is a little bit of a hassle, but very do-able. It could also be a good time to consider using a third-party firm to setup a non-prototype plan and give you more options for investing.

Learn more about in our TD Ameritrade Review.

Recommended Reading: Can You Move Money From Your 401k To An Ira

Employee Fiduciary: Best For Small Businesses Looking For Personalized Service

| $500 for solo 401 $1,500 for 401 plan | |

| Annual Custodial Fee | 0.08% |

Employee Fiduciary is a 401 plan administrator that caters to small businesses of all sizes. Every company that signs up for a 401 plan with Employee Fiduciary will go through a plan design consultation to create one that meets the companys goals and budget. Companies with existing 401 plans will also benefit from Employee Fiduciarys plan conversion services as they move to this new provider.

The company is a bundled 401 provider, meaning that it provides all the administration services needed, including asset custody, participant recordkeeping, and third-party administration. On its website, you can compare Employee Fiduciarys fees to more than 40 other leading 401 providers, or you can request a no-cost fee comparison for your current plan.

Employee Fiduciary offers a detailed fee schedule with startup fees and annual base and custodial fees listed on its website. Startup fees range from $250 to $500, with annual fees at $500 or $1,500, plus 0.08% annually in custodial fees.

You can reach the company through a web contact form or by phone at a toll-free number.

Employee Retirement Plan Pricing

When youre evaluating how much an employee retirement plan costs, you need to consider two sets of prices: your costs to sponsor the plan and your employees costs to participate in it. These costs vary by type of plan and provider. There are also tax incentives associated with some of these plans, which can lower your overall expenditures.

Don’t Miss: How Is A 401k Divided In A Divorce

Charles Schwab: Best 401 Low

Charles Schwab offers both a full-service 401 plan customized to your company and the option to add investment advisory services to an existing 401. Charles Schwab has both a broker-dealer and banking subsidiary, so it can provide a full range of financial services. It also offers its own proprietary mutual funds and ETFs to plan participants, along with other investment options.

With zero dollar trading fees, Charles Schwab gets our nod for the best low-to-no fee provider. This is extremely attractive for 401 owners who want to trade stocks or bonds in their accounts.

Best 401 Companies At A Glance

| Site Builder |

|---|

| One-time Setup Fee | Starting at $150 |

is our choice for the best overall 401 company due to its low-cost, digital-only retirement plans, making it easy for businesses of all sizes and locations to open an account. Whether you have just one employee or a whole corporation, it has a plan that can meet your needs.

It offers four different 401 plans: Solo 401, Safe Harbor 401, Traditional 401, and Tiered Profit-sharing 401. Administration fees start as low as $25 for Solo 401 plans and $190 for Tiered Profit-sharing plans. ShareBuilder 401k is an excellent option for small businesses looking to get started with 401 as they grow.

Its offerings include the lowest-cost, best-in-class investment options available. With it, small business owners can set up a plan online for a flat fee and start investing immediately.

The companys customer service can be reached via the toll-free phone number from 9 a.m. to 8 p.m. Eastern time Monday through Friday or via email.

Recommended Reading: How To Transfer Your 401k To Another Company

What Does A Financial Advisor Do For A 401k Plan

401 counselors help employers develop and maintain a plan that meets their needs, and help participants make important retirement saving decisions.

How often should I meet with my financial advisor?

You should meet with your advisor at least once a year to reassess basics such as your budget, taxes, and investment performance. Its time to talk about whether you feel you are on the right track and if there is anything you could do better to increase your net worth in the next 12 months.

Choosing Employee Retirement Providers

Selecting an employee retirement provider takes some research and careful consideration of your particular circumstances. Even after you settle on a platform, you should reassess it periodically to make sure youre getting everything you need. Follow these steps to choose the right employee retirement provider for your business:

Recommended Reading: How Do You Open A 401k Account

How To Find Affordable Small Company 401k Plans

Self-employed people have long been able to create low-cost solo 401k plans. However, small businesses with more than one employee havent always had similar affordable options.Setting up a 401k requires legal documentation to set up the plan. It also requires ongoing maintenance to manage employee and employer contributions, pay fees, and file tax-related paperwork. The companies listed in this article have all created technology that limits the amount of human intervention required to set up and maintain retirement plans for small businesses.

Theyve created boilerplate forms to simplify the setup process. Once the plans are set up, the companies integrate plan maintenance with payroll technology , so small business owners dont need a new HR person just to manage the new plan. Typically, the plan providers also have websites setup, so employees can manage their accounts and contributions online.These technologies offer massive benefits to small business owners who want a simple, straightforward 401k plan for their employees. Some of the companies offer a few different plan versions so business owners can decide which suits their needs. The pricing listed in this article reflects the current pricing for these standard plans.

The companies may be able to offer customizations , but those were not listed on the sites. Small business owners looking for a white glove experience should expect to pay higher prices than those listed below.

Best For Flexibility: American Funds

The great thing about a 401 plan from American Funds is that you can tailor it to fit almost any type of business. Start-ups, mergers, and well-established firms can create retirement plans using its services.

It also has several retirement plans available, including growth funds and growth-and-income funds .

Other funds available are equity-income funds and balanced funds that look to conserve capital and create current and long-term growth. You can also invest in stocks, bonds, and other fixed-income securities.

The firm also offers access to bond funds, which seek to create fixed income with capital growth as a secondary goal.

Also Check: What Is The Minimum Withdrawal From 401k At Age 70.5

Read Also: Is It A Good Idea To Borrow From Your 401k