You Think Your Tax Rate Is Going To Go Up

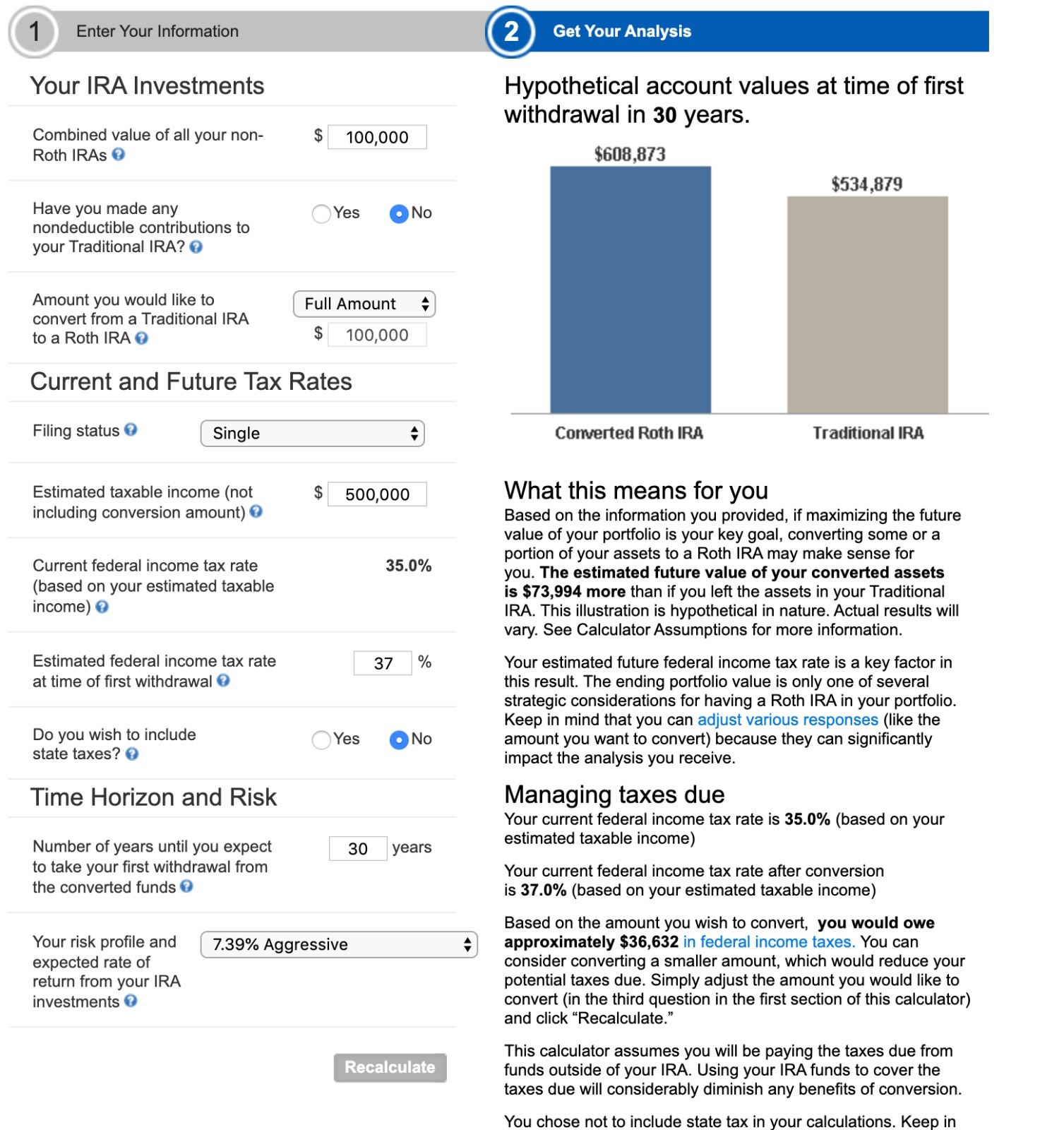

If you believe your current tax rate is lower than it might be in the future, you may want to convert your investments into a Roth IRA, pay your fair share of taxes now, and then let that money grow tax-free until you need it.

Converting a pre-tax 401 into a post-tax Roth IRA will trigger a tax bill, but a financial professional might recommend it anyway. Its a way to hedge against the risk of taxes going up in the future, says Hernandez. In a general sense, if youre still in the early stages of your earning career, it makes sense to go ahead and pay the taxes upfront and do the Roth contributions.

Of course, no one knows for sure what their tax rate will look like in the future. Thats why many experts recommend diversifying your long-term investments into different buckets: some in a tax-deferred account like a 401, and others in a post-tax account like a Roth IRA. If all your money is one bucket, a conversion could make sense.

How To Convert To A Roth 401

Here’s a general overview of the process of converting your traditional 401 to a Roth 401:

Not every company allows employees to convert an existing 401 balance to a Roth 401. If you can’t convert, consider making your future 401 contributions to a Roth account rather than a traditional one. You are allowed to have both types.

As mentioned, you’ll owe income tax on the amount you convert. So after you calculate the tax cost of converting, figure out how you can set aside enough cash from outside your retirement accountto cover it. Remember that you have until the date you file your taxes to pay the bill. For example, if you convert in January, you’ll have until April of the following year to save up the money.

Don’t rob your retirement account to pay the tax bill for converting. Try to save up for it or find the cash elsewhere.

Watch Out For The Five

The IRS requires any conversion to have occurred at least five years before you access the money.

If you have not kept assets in your Roth IRA for five or more years, you may be charged taxes and/or penalties on withdrawals, says Keihn. If you think youre going to need to withdraw the assets in less than five years from opening a Roth IRA, you may want to reconsider a conversion or have a conversation with a CPA to see if its still the best path for you.

Recommended Reading: How Much Tax To Convert 401k To Roth Ira

How Does A Roth Ira Grow

A Roth IRA grows like every other investment accountthrough the magic of compounding. Your contributions in a Roth IRA are invested to earn interest and that interest helps to increase your overall portfolio balance, thereby helping earn more interest. The more time your money has in the market, the better the opportunity for greater returns over time. The money in a Roth IRA can continue to grow even after you stop making contributions as the ongoing returns continue to add to the balance and get reinvested. The financial institutions reviewed for this article all provide resources and guidance on diversifying a portfolio to ensure the right balance of risk and reward to intelligently grow your retirement savings in a Roth IRA.

Tips For Saving For Retirement

- Having trouble figuring out how taxes fit into your retirement plan? It may be smart to work with a financial advisor on such decisions. Finding a qualified financial advisor doesnt have to be hard. SmartAssets free tool matches you with up to three financial advisors in your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- As you plan for your retirement income, you should also consider how Social Security benefits fit into the equation. Our Social Security calculator can help in this regard. Fill in your age, income and target retirement date and well calculate what you can expect in annual benefits.

Recommended Reading: How Do I Know How Much Is In My 401k

Heres What To Expect:

Step 1 Contact a Wells Fargo retirement professional at 1-877-493-4727 to initiate your conversion request and get an overview of the process.

Step 2 Our team will help you open a new Roth IRA account if you dont already have one, fill out the appropriate paperwork, and answer any questions you may have.

Step 3 An account form will be sent to you to initiate your conversion.

- Whether youre converting a Wells Fargo Traditional IRA, an IRA from another financial institution, or a qualified employer sponsored retirement plan such as 401, 403, or governmental 457, well walk you through the process to make sure all of your questions are answered.

Step 4 Return the paperwork to complete your request.

Can I Take Money Out Of My Ira Before I Reach Retirement

Yes. And you don’t have to pay it back like you would with a loan from your employer-sponsored plan.

However, withdrawals you make before age 59½ may have consequences:

- Roth IRA: There’s a 10% federal penalty tax on withdrawals of earnings before age 59½. Withdrawals of your contributions are always penalty-free.

- Traditional IRA: There’s a 10% federal penalty tax on withdrawals of contributions and earnings before age 59½.

There are some exceptions** to the 10% penalty, so be sure to check the IRS website for details.

Also Check: Can I Contribute To Traditional Ira And 401k

Roth Conversion: Things To Be Aware Of

Roth IRAs have a 5-year aging rule which requires you to wait 5 years after your first Roth IRA contribution before you can withdraw earnings tax-free in retirement or qualify for an exception to the 10% penalty.

There’s also a 5-year waiting period for conversions money). In this case, if you are under the age of 59½, you’ll need to wait 5 years before you can withdraw that money without incurring a 10% penalty. Note that this only applies to taxable money that was converted it does not apply to any balances that were not taxable when converted.

Another important fact to understandthere’s no way to undo a Roth conversion.

Before the Tax Cuts and Jobs Act was enacted in December 2017, you could undo a Roth conversion. That option is no longer available.

Finally, investors should be aware that taxes are not the only factor when it comes to rolling funds from a 401 plan to an IRA, of any type. There may be considerations related to fees, investment choices, creditor protection, RMDs, and other factors that need to be weighed in deciding whether a rollover is appropriate for you. Consider consulting a financial advisor before making any decisions.

Should I Convert My 401 To A Roth

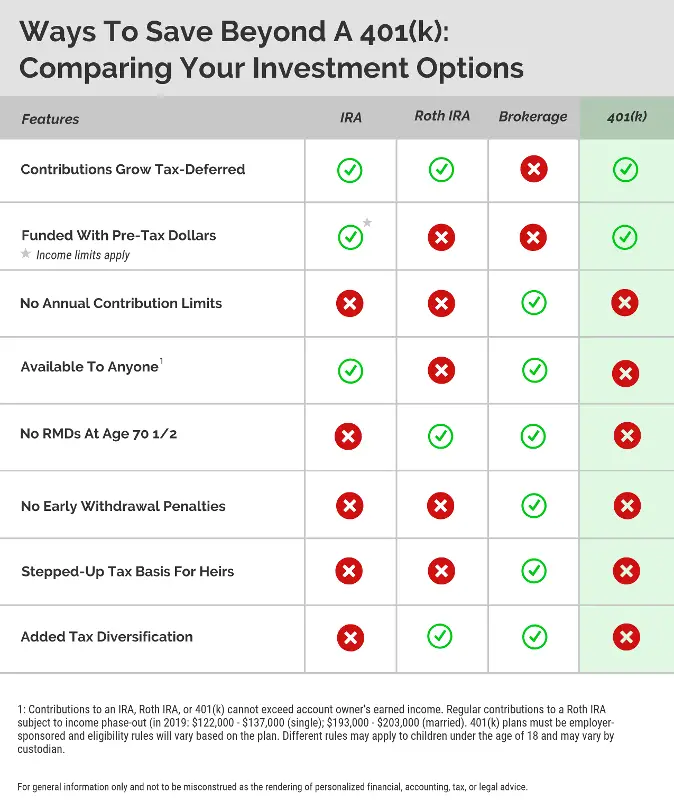

You might consider converting your 401 account into a Roth IRA in the following situations:

-

If your tax liabilities are likely to increase in the future: You might want to make Roth contributions and pay taxes now, so you can make tax-free withdrawals later.

-

If you want to make withdrawals at any time: Roth IRAs give you the flexibility to withdraw money whenever you want. They do not bind you with RMDs when you reach 70 ½ years.

-

If you want to diversify your taxation: If you are not sure how your tax liability will impact your income in the future, you might want to set up a Roth IRA in addition to a traditional retirement account, so you can make both taxable and tax-free withdrawals after.

Recommended Reading: How To Check How Much 401k I Have

Transfers To Simple Iras

Previously, a SIMPLE IRA could only accept transfers from another SIMPLE IRA plan. A new law in 2015 now allows a SIMPLE IRA to also accept transfers from traditional and SEP IRAs, as well as from employer-sponsored retirement plans, such as a 401, 403, or 457 plan. However, the following restrictions apply:

- SIMPLE IRAs may not accept rollovers from Roth IRAs or designated Roth accounts of employer-sponsored plans.

- The change applies only to rollovers made after the two-year period beginning on the date the participant first participated in their employers SIMPLE IRA plan.

- The new law only applies to transfers to SIMPLE IRAs made after December 18, 2015, the date of enactment.

- The one-per-year limitation that applies to IRA-to-IRA rollovers also applies to rollovers from a traditional IRA, SIMPLE IRA, or SEP IRA into a SIMPLE IRA.

Dont Miss: How Much Can We Contribute To 401k

Confusion Of The Roths

Unlike the similarly named Roth IRA, the Roth 401 is different. A Roth IRA is an individual retirement account whereas a Roth 401 is part of and offered through an employer sponsored retirement plan.

This minor confusion might be an invisible obstacle for some employees, especially high-income earners who have been told they cannot contribute to a Roth.

High-income earners may be pleasantly surprised to hear they can contribute because a Roth 401 does not have income limits like a Roth IRA does. This means they now have access to a savings vehicle that can grow tax-free.

Additionally, since Roth 401 accounts follow traditional 401 contribution guidelines, the amount that can be saved per year is subject to 401 maximums. For example, in 2020, employees can contribute up to $19,500 in a Roth 401 and if the employee is 50 years old or older, they may make a catch-up contribution of up to $6,500, for a potential total annual contribution of $26,000.5

Read Also: How Do You Take Money Out Of 401k

Read Also: Can You Get Your Own 401k

Do I Have To Convert The Entire Amount In My Traditional Ira Or Qrp

No. You may convert just a portion of your assets, and there is no limit to the number of conversions. To help manage the taxes due on each conversion, you may convert smaller amounts over several years. Keep in mind, if you want to take a distribution, each conversion has its own five-year waiting period to avoid the 10% additional tax if you are under age 59 1/2.

How Long Before I Can Withdraw Rollover Funds From A Roth

You will be subject to a 10% early withdrawal penalty if you do not wait five years from the rollover. Note that the rollover is considered to have been made at the beginning of the calendar year in which the rollover is complete. For example, if you roll $5,000 from your traditional IRA to your Roth IRA on Feb. 15, 2022, you will be eligible for tax and penalty-free withdrawal of the funds as early as Jan. 1, 2027.

You May Like: How Can I See My 401k

I Am Over Age 70 Must I Receive Required Minimum Distributions From A Sep

Both business owners and employees over age 70 1/2 must take required minimum distributions from a SEP-IRA or SIMPLE-IRA. There is no exception for non-owners who have not retired.

The SECURE Act made major changes to the RMD rules. For plan participants and IRA owners who reach the age of 70 ½ in 2019, the prior rule applies and the first RMD must start by April 1, 2020. For plan participants and IRA owners who reach age 70 ½ in 2020, the first RMD must start by April 1 of the year after the plan participant or IRA owner reaches 72.

Roth 401 To Roth Ira Conversion

Roth 401s are essentially the same as traditional 401s, except they’re funded with after-tax dollars, like the Roth IRA, instead of pre-tax dollars. The exception to this rule is employer-matched funds. These are considered pre-tax dollars even in a Roth IRA.

Because the government taxes Roth 401 and Roth IRA contributions the same way, you can roll over Roth 401 savings to a Roth IRA without paying any taxes on your Roth 401 contributions. But if the amount you’re rolling over includes employer-matched funds, these will affect your tax bill for the year.

Also Check: What Is A Hardship Loan From 401k

Savings Plan To Roth Ira

Welcome to the official Fidelity subreddit, . Happy to help with your questions.

A 401 is a retirement plan through your employer funded through payroll contributions, while an Individual Retirement Account is a personal account that you can open and contribute to on your own. Some plans will let you rollover 401 assets into an IRA while you are still employed, but many do not. Instead, you may be referring to Roth 401 contributions, or an in-plan conversion.

Some plans will let you mark future contributions as Roth dollars, rather than pre-tax, into your 401 plan. If your plan allows this, you can make the change on NetBenefits.com :

Navigate to your plans “Quick Links” and select “Contribution Amount”

Adjust your percentages to both pre-tax and Roth

Another possibility is to complete an in-plan Roth Conversion, which is where you move pre-tax assets to Roth assets. Keep in mind, this is a taxable event and you may owe taxes on the amount converted. If you have questions about how a Roth Conversion may affect your tax situation, I recommend consulting with a qualified tax advisor.

If you’re considering moving your 401 to a Roth IRA, the process would look a bit different.

Taxpayers Can Now Take Tax Free Jump From 401k To Roth Ira

Moving your retirement money around is now easier than ever. In a conciliatory move for taxpayers, the IRS has issued new rules that allow you to minimize your tax liability when you move 401 funds into a Roth IRA or into another qualified employer plan. The situation arises when you have a retirement account through your employer that includes both pre-tax and after-tax funds. However, allocating your retirement funds to new plans becomes tricky upon leaving the company.

The new allocation rules took effect in 2015, but taxpayers chose to apply them to distributions as early as September 18, 2014, the date the new rules were released by the IRS.

Under the old rules, you would have to pro-rate distributions and rollovers separately between pre-tax and after-tax amounts according to a set formula, resulting in payment of tax on a pro rata share of pre-tax funds. The new rules allow you to do the allocations yourself within certain limits. You can now choose to move pre-tax money into a traditional IRA and after-tax money into a Roth IRA. If you moved pre-tax amounts into a Roth IRA, you would have to pay tax on the rollover because Roths can only be funded with after-tax money. Now you can direct pre-tax dollars to one account and after-tax dollars to another to avoid tax liability.

Lets look at an example.

Smart Planning

You May Like: What Is 401k Roth Ira

What Is A Roth Ira Conversion

A Roth IRA conversion shifts money from a traditional IRA or a qualified employer sponsored retirement plan such as a 401 or 403 into a Roth IRA. It is also sometimes called a backdoor IRA conversion.

There are many reasons to consider a Roth IRA conversion tax-free investment earnings, lowering taxable income in retirement and not having to bother with required minimum distributions, to name a few. Here’s how to convert an existing retirement account into a Roth, along with guidance on whether it makes sense for you.

Roth 401 With A Match

Theres one important thing to remember about the Roth 401: Only your contributions grow tax-free. If your company offers a match, youll have to pay taxes on retirement income from the match side of the account.

Still, the Roth 401 is an amazing deal. It could literally save you hundreds of thousands of dollars in retirement. And yet, only 26% of workers are making contributions to their company plans Roth option.5

If youre just starting out with a company and they give you this option, take the ball and run with it!

But if you still have debt to pay off and dont have a fully funded emergency fund, pump the brakes. You need to get your financial house in order before you start saving for retirement.

If youd like a specific, step-by-step plan to becoming a millionaire by the time you retire, weve got one. Theres a whole group of millionaires called Baby Steps Millionaires whove followed Ramseys 7 Baby Steps to hit the million-dollar mark. By following the Baby Steps, they were able to pay off all their debt and reach a million-dollar net worth in about 20 years.

Read Also: What Is Ira And 401k

A Conversion May Affect Government Programs

If you participated in government healthcare programs or others that depend on your income, its vital to note that a conversion could affect your eligibility in those programs or their cost.

The Roth conversion is viewed as taxable income in the year it occurs, says Keihn. This means that it could affect your eligibility for Obamacare or financial aid or your childrens financial aid. If you are on Obamacare or completing a FAFSA application, it is important to factor that into the decision of how much to convert, if any.

People who are two years from receiving or are receiving Medicare benefits need to know that their Medicare premium most likely will go up two years after they convert to a Roth IRA, says Gilbert. Medicare has a two-year look-back to determine premiums and in the year you convert, your income will be higher than other years. But this is a one-year spike that will then decrease the following year.