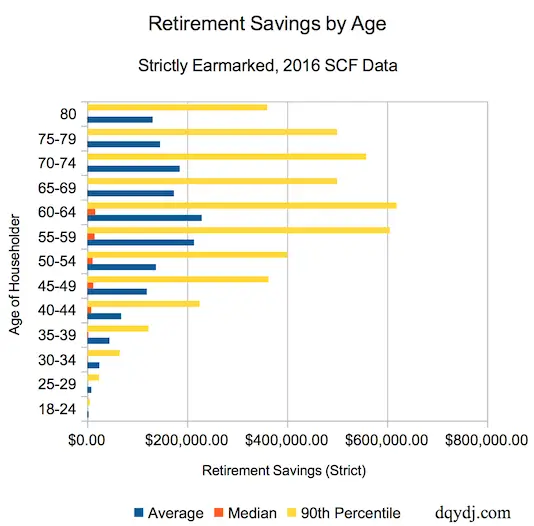

Average 401k Balance At Age 65+ $458563 Median $132101

The most common age to retire in the U.S. is 62, so its not surprising to see the average and median 401k balance figures start to decline after age 65. Once you reach age 65, there are still several considerations for your retirement, even if you are no longer working and accumulating wealth. Some of these include making decisions about Medicare, creating a plan around withdrawing money from your retirement accounts, and evaluating any additional insurance needs.

Locate An Old 401 Statement

If youâre having trouble getting a hold of your former employerâs HR department, refer to an account statement of your old 401.

If youâre still living at the same address, you should have yearly or quarterly statements mailed to you. Check your statement for information on where your account is held and any contact information.

The information on your statements will come in handy in identifying how much money youâll be transferring over to make sure nothing is left behind.

Personal Capital Average 401k Balance By Age

| AGE | |

|---|---|

| $458,563 | $132,101 |

*Note: Averages are rounded up to the nearest dollar. Numbers are based on aggregated and anonymous data from the Personal Capital Dashboard. Accounts included are the following: 401k, former employer, Roth 401k. Excludes test and invalid accounts. Excludes any account value greater than $100,000,000 or less than -$100,000,000. Excludes spouse accounts. Snapshotted balance as of 9/7/2022.

Dont Miss: Can I Rollover My 401k To A Mutual Fund

Recommended Reading: How To Get My 401k Statement

A Special Note For Pennsylvania Residents

If you live in Pennsylvania, you should start your search sooner rather than later.

In most states, lost or abandoned money, including checking and savings accounts, must be turned over to the states unclaimed property fund. Every state has unclaimed property programs that are meant to protect consumers by ensuring that money owed to them is returned to the consumer rather than remaining with financial institutions and other companies. Typically, retirement accounts have been excluded from unclaimed property laws.

However, Pennsylvania recently changed their laws to require that unclaimed IRAs and Roth IRAs be handed over to the states fund if the account has been dormant for three years or more.

If your account is liquidated and turned over to the state before the age of 59.5, you could only learn about the account when you receive a notice from the IRS saying you owe tax on a distribution!

Company 401k plans are excluded from the law unless theyve been converted to an IRA. If you know you have an account in Pennsylvania, be sure to log onto your account online periodically. You can also check the states website at patreasury.gov to see if you have any unclaimed property.

Contact Your Hr Department

If you dont know where to check your 401 balance, your HR department can at least direct you to the entity that manages your companys 401 plan. Then, you can contact the 401 plan administer by phone or over the internet to check the balance of your 401 plan. You can also check how the money is invested and whether its time for you to rebalance your portfolio.

Video of the Day

Dont Miss: How To Transfer 403b To 401k

Read Also: What Are Terms Of Withdrawal 401k

How To Check My Account Balance

To check your bank account balance, you must keep in mind the following things.

- Firstly, your mobile number should be registered with the bank.

- The mobile number should be active to receive and send SMS and call.

- Having a smartphone is preferable. The reason is, with an active internet connection, you can use different apps like banking apps or UPI apps.

- You should also have your ATM or debit card activated with your bank account

- Also, internet banking should be activated by your bank.

Keeping these things in place, you can check your bank account balance anywhere and anytime. The various ways to check bank account balance are as follows

You May Like: What Is The Best Fund To Invest In 401k

Search For Unclaimed Retirement Benefits

When all else fails, search for yourself in the National Registry of Unclaimed Retirement Benefits. Not all employers participate in this service, but many do because it provides benefits that help them meet their legal requirements. It’s a free service, and it only requires your Social Security number.

Also Check: How To Find A 401k From Previous Employer

What Kind Of Investments Are In A 401

401 accounts often offer a small, curated selection of mutual funds. Thats a good thing and a bad thing: On the plus side, you may have access to lower-cost versions of those specific funds, especially at very large companies that qualify for reduced pricing.

The negative is that even with discounted costs, that small selection narrows your investment options, and some of the funds offered may still have higher expense ratios than what youd pay if you could shop among a longer list of options. That can make it harder to build a low-cost, diversified portfolio.

Some plans also charge administrative fees on top of fund expenses, which can add up. If your 401 is expensive, contribute enough to earn your company match, and then direct any additional retirement savings contributions for the year into an IRA.

Is It Possible To Lose Your 401

Its possible to lose money from your 401 if youre cashing it out and taking a big tax hit or your investments suffer losses. But simply changing jobs doesnt mean your old 401 is gone for good. It does, however, mean that you may need to spend time locating it if its been a while since you changed jobs.

Dont Miss: How Can I Invest My 401k

Read Also: When You Leave An Employer What Happens To Your 401k

Look For Contact Information

If you dont know how to contact your former employer perhaps the company no longer exists or it was acquired or merged with another company see if you have any old 401 statements. These should have contact information to help put you in touch with the plan administrator.

If you dont have an old 401 statement handy or yours doesnt tell you what you need to know, visit the U.S. Department of Labor website and look up your employer. There you should find your old retirement accounts tax return, known as Form 5500. That will most likely have contact information for your 401s plan administrator.

Why You Should Roll Over Your Old 401 Accounts

Once you find forgotten retirement funds, you can make it easier to keep track of your money by simply rolling over your old 401 accounts into an IRA at a brokerage you already have an account with. This way you can manage your nest egg easier since all of your money is in one place.

“It’s beneficial to consolidate your accounts to reduce oversight obligations,” Cavazos says. “Having all of your funds consolidated in one account allows you to keep track of your balance and account performance.”

If you already have an existing IRA, you can roll your 401 balance into that account. Otherwise, it’s easy to open a new IRA at the big-name brokers like Charles Schwab, Fidelity, Vanguard, Betterment or E*TRADE. Rolling over your old 401 plan into an IRA gives you more control over how you invest your retirement funds since you won’t be limited to just the funds that were offered by your former employer. These large brokerages give you thousands of investment options, including mutual funds, index funds and individual stocks.

Don’t Miss: How Much Can You Rollover From 401k To Roth Ira

Why Does The Calculator Ask About My Highest Level Of Education

All questions in the calculator help us make more informed predictions about your future. Knowing your level of education lets us determine a more realistic estimate of how much youll earn in the future and in turn provide an estimate of what you may need in retirement. And although this information helps us provide you with a more personalized calculation, it is optional.

S To Find Your Old 401

Its not all that uncommon to lose a 401 especially if you didnt have much invested to begin with. Its possible you were automatically enrolled in a 401 by your old employer and didnt know the account existed. Or maybe you got caught up in the process of switching jobs and forgot to tie up loose ends.

Whatever the case, you can rest assured that your retirement funds arent gone, and youre entitled to them. Its a simple matter of tracking them down and you can start by contacting your old employer.

1. Contact your old employer

Start your search by reaching out to the human resources department of your previous employer. If you dont have HRs email address or phone number on hand, reach out to any company employees youre still in touch with to request the information.

In most cases, it shouldnt be too hard to reconnect with your old employer, but if your company merged with another firm or went out of business, you may need to move on to step two.

2. Speak to the plan administrator

Now lets say you havent had much luck reaching your old company. The next point of contact will be the plan administrator, which is the investment company responsible for managing the investments in your old 401 account.

3. Search national databases

If you follow these steps and still come up short, try a national database. There are numerous sites and services designed to connect former employees with lost retirement savings.

Also Check: How Do I Find My Fidelity 401k Account Number

Don’t Miss: How Much Can I Borrow From 401k

What Is A Social Security Statement

A Social Security Statement is a statement that is available through the Social Security Administration . It shows you the benefits that youll be entitled to when you retire, or if you need to file a claim for disability.

The purpose of the form is to let you know what your benefits will be. Its important to remember that the information provided is just an estimate.

For example, your Social Security retirement benefit is based on your earnings history. Since youre still working, the information that will be needed to determine that benefit is not complete.

The SSA has a record of your earnings and taxes paid up to this point. But what they dont know is what your future earnings will be. The estimate makes the assumption that your earnings will continue at the same level as it was for the most recent earnings year.

So lets say that in 2016 you earned $50,000. Now this is earned income only, so investment earnings, retirement plan liquidations, unemployment insurance, and other unearned sources will not count toward your benefits calculation. Only your earned income wages, self-employment income, contract revenues, and the like are used to calculate your benefits.

The SSA will make the assumption that youll continue to earn $50,000 per year between now and the time you collect benefits.

Also Check: How To Check 401k Balance Fidelity

Search The Abandoned Plan Database

If you cant find your lost money by contacting your old employer, searching the National Registry of Unclaimed Retirement Benefits, or the FreeERISA website, you have one last place to check, the Abandoned Plan Database offered by the U.S. Department of Labor.

Searching is simple, you can search their database by Plan Name or Employer name, and locate the Qualified Termination Administrator responsible for directing the shutdown of the plan.

Recommended Reading: How To Search For An Old 401k

What Is Actual Deferred Percentage

Actual deferral percentage is the percentage of wages deferred by employees under a 401 retirement plan.

An employers ADP helps to ensure that employee 401 benefits are compliant with IRS and ERISA rules that require such plans to be non-discriminatory against lower-paid employees or in favor of higher-earning employees.

The IRS states that traditional 401 plans must ensure that the contributions made by and for rank-and-file employees ) are proportional to contributions made for owners and managers ).

Recommended Reading: How To Withdraw My 401k

Why Does My Income In Retirement Need To Be So Much Higher Than It Is Now

My Retirement Plan uses an estimate of what your income will be in the year before you retire to estimate what you may need in retirement. This preretirement income is adjusted based on the income replacement rate, which is defaulted on 80% and can be changed on the Calculator Assumptions tab. We use government demographic income data to estimate how your current income may grow between now and retirement. The further from retirement you are, the more likely this number will grow.

Read Also: Can I Retire With 500k In My 401k

What To Do When You Find Your Old 401 Plan

If find your lost 401, congratulations! However, its not time to celebrate by blowing it all on a fancy vacation or a shopping spree. You invested that money to build a retirement nest egg and thats exactly where those funds should stay.

To invest your old 401, you can do whats known as a rollover to avoid early withdrawal penalties. You can roll over the funds into an individual retirement account or into another retirement plan, such as your current employers 401.

In both cases, you can avoid withholding taxes if you roll over the funds directly via the plan administrator. If a distribution is made directly to you, you have 60 days to deposit it into your new retirement account in order to avoid taxes and penalties.

What To Do When You Find An Old 401

Once youve reconnected with your old 401, its time to decide what to do with it:

- Leave it with your old employer. If you contributed at least $5,000 to your old 401, you might consider leaving it where it is. But this may only be worthwhile if the account has competitive fees or offers access to unique investments. Otherwise, itll be yet another account to keep track of come retirement, and you may be better off rolling it over.

- New 401 rollover. Has your new employer offered you a 401? Consider consolidating your retirement funds by rolling your old retirement account into a new 401.

- IRA rollover. If you dont have a new 401 to move your old retirement funds into, consider rolling over into an individual retirement account. That way, your funds retain their tax-advantaged status.

- Cash it out. Consider this a last resort because cashing out a 401 ahead of schedule can result in major penalties.

- If youre older than 59 ½, you can access funds without penalty.

- If youre under 59 ½, withdrawals are subject to a 10% tax penalty and other fees.

Also Check: Is 401k A Good Investment

How To Access My 401k Online

Although youll have set up your 401K through your employer, your funds will be managed through a custodian or brokerage firm, for example, the likes of Charles Schwab, Robinhood or Vanguard. You should be able to log into your 401K account online through the website of the broker or trading app your 401K is with.

If you cant remember your login details, youll need to contact your 401K provider to get your password reset, or failing that you may be able to check your balance over the phone.

If youre not sure which custodian your 401K is set up with, speak to your human resources department at work. They wont be able to tell you your 401K balance, but theyll be able to direct you to the relevant 401K broker.

Check The National Registry Of Unclaimed Retirement Benefits

The National Registry is a nationwide, secure database listing of retirement plan account balances that have been left unclaimed by former participants of retirement plans.

It is essentially a search engine of lost 401 plans.

The only thing you need to search the database is your social security number. No additional information is needed, and there is no cost to search the database.

You May Like: Should I Do Roth Or Traditional 401k

Us Department Of Labor

Even if your former employer abandoned its retirement plan, your money isnt lost forever. The U.S. Department of Labor maintains records for plans that have been abandoned or are in the process of being terminated. Search their database to find the Qualified Termination Administrator responsible for directing the shutdown of the plan.

Recommended Reading: How Do I Withdraw Money From My 401k

What Is My Vested Balance

posted on

When you participate in a retirement plan at your job, you might have a vested balance in your retirement account. Those different buckets of money are typically a result of contributions that your employer makes for you. For example, you might receive matching funds on your contributions to a 403 plan, profit-sharing money in a 401, or other funds from your employer.

Recommended Reading: How To Figure Out 401k Contribution

Read Also: What Is Ira And 401k

How To Check 401k Balance

Knowing how to check how much is your 401 can help calculate your net worth. Additionally, checking your 401 balance ensures your investments are performing, helping you reach your retirement goals.

Monitoring your finances should be cemented in your overall personal finance strategy. Whether it be your budget, credit profile, or retirement accounts, knowing where you stand is essential in determining your financial health. Some, like your bank accounts and credit, are relatively easy to monitor. However, figuring out how to check 401 balances can be more difficult.

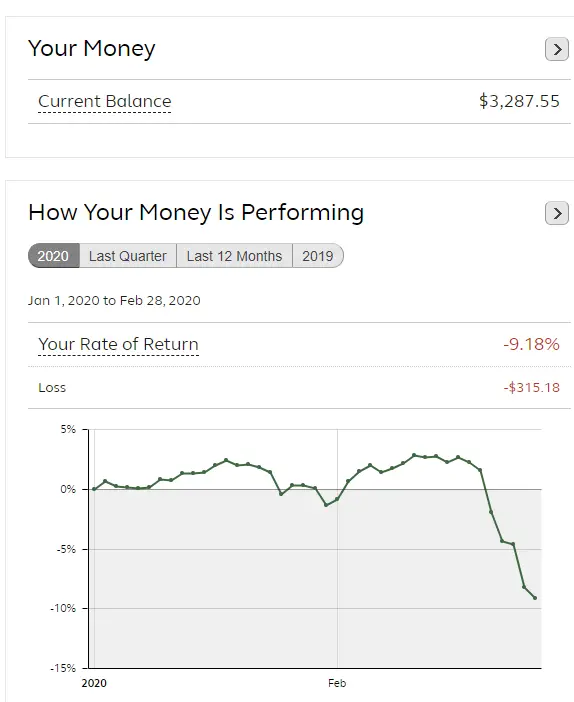

Like your car, your 401 needs regular maintenance. Without it, it may not perform as well or will no longer fit your overall investment strategy anymore.

You can find your 401 balance by logging into your 401 plans online portal and check how your 401 is performing. If you donât have access to your account online, contact your HR department and make sure your quarterly statements are being sent to the correct address.

Checking your 401 too frequently can cause overwhelm and panic when the market isn’t performing well. Dips and peaks are typical for any long-term retirement investment. Checking your 401 balances at least once a year will help you gauge how it fits in your retirement strategy.

Letâs look into how to check how much is in your 401, what to look for, and how often you should be checking.